Cost Reduction and Increase Efficiencies

Efforts Have Yielded Improved Visibility and Optimized Performance

Ahead of Schedule; Management Provides Adjusted EBITDA Guidance for

2018

Perion Network Ltd. (NASDAQ: PERI), a global technology leader

in advertising solutions for brands and publishers, announced today

its financial results for the fourth quarter and 12 months ended

December 31, 2017.

Financial Highlights*(In millions, except per share

data)

Three months ended Twelve months ended

December 31, December 31, 2016

2017 2016 2017 Search and other

revenues $ 40.5 $ 34.3 $ 172.7 $ 139.5 Advertising revenues $ 44.1

$ 43.0 $ 140.1 $ 134.5 Total Revenues $ 84.5 $ 77.3 $ 312.8 $ 274.0

GAAP Net Income (Loss) $ 0.3 $ (37.3) $ 0.2 $ (72.8) Non-GAAP Net

Income $ 6.5 $ 6.4 $ 27.7 $ 17.4 Adjusted EBITDA $ 13.5 $ 11.9 $

45.4 $ 29.0 Impairment of Goodwill and Intangible assets $ 0.0 $

41.8 $ 0.0 $ 85.7 GAAP Diluted Earnings (Loss) Per Share $ 0.00 $

(0.48) $ 0.00 $ (0.94) Non-GAAP Diluted Earnings Per Share $ 0.08

$ 0.08 $ 0.36 $ 0.24

* Reconciliation of GAAP to Non-GAAP measures follows.

Doron Grestel, Perion’s CEO commented, “The turnaround strategy

we implemented earlier in 2017 is taking hold, providing Perion

with a stable base for profitable growth. During the fourth

quarter, we continued to advance targeted expense reductions while

reallocating resources to support the investment in new

technology. With these investments, we have streamlined

efficiencies through the automation of our platforms and operating

systems. Since I joined as CEO, Perion has secured more than

$7 million in corporate expense reductions. The steps we are

taking are necessary to position Perion for renewed growth and

enhanced profitability in the future.”

“The industry trends driven by our Fortune 500 clients and

agency partners are clear: digital media investments must protect

the safety of their brands,” continued Mr. Gerstel. “Their need for

engaging creative in transparent, quality environments plays

perfectly into Undertone’s offering. In a

recent Forbes article, Procter & Gamble's Chief Brand

Officer Marc Pritchard, one of the most outspoken CMOs on this

topic, called for more effective use of targeted creative to

protect brands. Mr. Pritchard emphasized ‘the importance of

consistency in brand building … focusing less on volume of

advertising [and] more on quality.’”

Mr. Gerstel added, “while advertisers look for better quality

and more engaging creative, agencies are reducing the number of

partners they work with. They are looking for partners like

Undertone who can offer a holistic end-to-end solution for their

digital ad-spend. In the past year, Undertone has expanded their

digital media offering, helping brands reach consumers on the

screens and platforms that matter most—with beautiful design and

innovative formats in safe and quality environments.”

“On the search side we extended our agreement with Bing through

2020, serving as a meaningful signal to the search ecosystem,

stability and trust,” continued Mr. Gerstel. “As a direct result,

this extension encouraged new partners to join our network and this

is reflected on our fourth quarter search revenue. After five

consecutive quarters, we are happy to bend the curve and report

quarter-over-quarter growth. We believe this trend will continue

due to the strong partnership we have with Bing.”

Financial Comparison for the Fourth Quarter of 2017:

Revenues: Revenues decreased by 9%, from $84.5 million in

the fourth quarter of 2016 to $77.3 million in the fourth quarter

of 2017.

Customer Acquisition Costs and Media Buy ("CAC"): CAC in

the fourth quarter of 2017 was $35.1 million, remain flat at 45% of

the revenues compare to $38.1 millions in the fourth quarter of

2016.

Impairment Charge: In the fourth quarter of 2017, the

company recorded a non-cash impairment charge of $41.8 million to

reduce the recorded value of goodwill and intangible assets related

to Undertone business and its fair value. The impairment charge is

primarily a result of the recent industry trends. We expect traffic

acquisition costs (TAC) as a percent of revenues to

increase in 2018 and beyond as industry budgets shift toward

automated channels. This trend is driven by higher TAC expectations

related to increased revenues in programmatic, and the effect of

header bidding and Chrome ad blocker.

Net Income: On a GAAP basis, and inclusive of the

non-cash impairment charge described above, net loss in the fourth

quarter of 2017 was $(37.3) million as compared to net income of

$0.3 million in the fourth quarter of 2016.

Non-GAAP Net Income: In the fourth quarter of 2017,

non-GAAP net income was $6.4 million, or 8% of revenues, compared

to $6.5 million, or 8% of revenues, in the fourth quarter of

2016.

Adjusted EBITDA: In the fourth quarter of 2017, Adjusted

EBITDA was $11.9 million, or 15% of revenues, compared to $13.5

million, or 16% of revenues, in the fourth quarter of 2016.

Cash and Cash Flow from Operations: As of December 31,

2017, cash, cash equivalents and short-term deposits were $37.5

million. Cash provided by continuing operations in the fourth

quarter of 2017 was $7.2 million compared to $12.1 million in the

fourth quarter of 2016.

Financial Comparison for the full year of 2017:

Revenues: Revenues decreased by 12%, from $312.8 million

in 2016 to $274.0 million in 2017.

Customer Acquisition Costs and Media Buy ("CAC"): CAC in

2017 were $130.9 million, or 48% of revenues, as compared to $140.2

million, or 45% of revenues, in 2016.

Impairment Charge: In 2017, the company recorded a

non-cash impairment charge of $85.7 million to reduce the recorded

value of goodwill and intangible assets related to Undertone

business and its fair value. The impairment charge is primarily a

result of the recent industry trends. We expect traffic acquisition

costs (TAC) as a percent of revenues to increase in 2018 and

beyond as industry budgets shift toward automated channels.

This trend is driven by higher TAC expectations related to

increased revenues in programmatic and the effect of header bidding

and Chrome ad blocker.

Net Income: On a GAAP basis, and inclusive of the

non-cash impairment charges described above, the full-year net loss

was $(72.8) million as compared to net income of $0.2 million in

2016.

Non-GAAP Net Income: In 2017, non-GAAP net income was

$17.4 million, or 6% of revenues, compared to $27.7 million, or 9%

of revenues, in 2016.

Adjusted EBITDA: In 2017, Adjusted EBITDA was $29

million, or 11% of revenues, compared to $45.4 million, or 15% of

revenues, in 2016.

Cash and Cash Flow from Operations: As of December 31,

2017, cash, cash equivalents and short-term deposits were $37.5

million. Cash provided by operations in 2017 increased by 18%, from

$30.5 million in 2016 to $36.0 million in 2017.

Debt: Short-term debt, long-term debt and convertible

debt decreased by 22%, from 77.7 million in 2016 to 60.7 million in

2017.

Perion satisfies all the financial covenants associated with its

public debt.

2018 Guidance

Management expects to generate Adjusted EBITDA of $28 million to

$32 million for the full year of 2018.

“The turnaround efforts during 2017, related both to cost

optimization and the stabilization of our Undertone and Search

businesses provide management with sufficient visibility to provide

2018 Adjusted EBITDA guidance,” noted Mr. Gerstel.

Conference Call

Perion will host a conference call to discuss the results today,

March 15, 2018, at 10 a.m. ET. Details are as follows:

- Conference ID: 4677454

- Dial-in number from within the United

States: 1-866-548-4713

- Dial-in number from Israel:

1-809-212-883

- Dial-in number (other international):

1-323-794-2093

- Playback available until March 22, 2018

by calling 1-844-512-2921 (United States) or 1-412-3176671

(international). Please use PIN code 4677454 for the replay.

- Link to the live webcast accessible at

https://www.perion.com/ir-info/

About Perion Network Ltd.

Perion is a global technology company that delivers advertising

solutions to brands and publishers. Perion is committed to

providing data-driven execution, from high-impact ad formats to

branded search and a unified social and mobile programmatic

platform. More information about Perion may be found at

www.perion.com, and follow Perion on Twitter @perionnetwork.

Non-GAAP measures

Non-GAAP financial measures consist of GAAP financial measures

adjusted to exclude acquisition related expenses, share-based

compensation expenses, restructuring costs, loss from discontinued

operations, accretion of acquisition related contingent

consideration, impairment of goodwill, amortization and impairment

of acquired intangible assets and the related taxes thereon,

non-recurring tax expenses, as well as certain accounting entries

under the business combination accounting rules that require us to

recognize a legal performance obligation related to revenue

arrangements of an acquired entity based on its fair value at the

date of acquisition. Additionally, in September 2014, the Company

issued convertible bonds denominated in New Israeli Shekels and at

the same time entered into a derivative arrangement (SWAP) that

economically exchanges the convertible bonds as if they were

denominated in US dollars when the bonds were issued. The Company

excludes from its GAAP financial measures the fair value

revaluations of both, the convertible bonds and the related

derivative instrument, and by doing so, the non-GAAP measures

reflect the Company’s results as if the convertible bonds were

originally issued and denominated in US dollars, which is the

Company’s functional currency. Adjusted Earnings Before Interest,

Taxes, Depreciation and Amortization ("Adjusted EBITDA") is defined

as operating income excluding stock-based compensation expenses,

depreciation, restructuring costs, acquisition related items

consisting of amortization of intangible assets and goodwill and

intangible asset impairments, acquisition related expenses, gains

and losses recognized on changes in the fair value of contingent

consideration arrangements and certain accounting entries under the

business combination accounting rules that require us to recognize

a legal performance obligation related to revenue arrangements of

an acquired entity based on its fair value at the date of

acquisition.

The purpose of such adjustments is to give an indication of our

performance exclusive of non-cash charges and other items that are

considered by management to be outside of our core operating

results. These non-GAAP measures are among the primary factors

management uses in planning for and forecasting future periods.

Furthermore, the non-GAAP measures are regularly used internally to

understand, manage and evaluate our business and make operating

decisions, and we believe that they are useful to investors as a

consistent and comparable measure of the ongoing performance of our

business. However, our non-GAAP financial measures are not meant to

be considered in isolation or as a substitute for comparable GAAP

measures, and should be read only in conjunction with our

consolidated financial statements prepared in accordance with GAAP.

Additionally, these non-GAAP financial measures may differ

materially from the non-GAAP financial measures used by other

companies. A reconciliation between results on a GAAP and non-GAAP

basis is provided in the last table of this press release.

Forward Looking Statements

This press release contains historical information and

forward-looking statements within the meaning of The Private

Securities Litigation Reform Act of 1995 with respect to the

business, financial condition and results of operations of Perion.

The words “will”, “believe,” “expect,” “intend,” “plan,” “should”

and similar expressions are intended to identify forward-looking

statements. Such statements reflect the current views, assumptions

and expectations of Perion with respect to future events and are

subject to risks and uncertainties. Many factors could cause the

actual results, performance or achievements of Perion to be

materially different from any future results, performance or

achievements that may be expressed or implied by such

forward-looking statements, or financial information, including,

among others, the failure to realize the anticipated benefits of

companies and businesses we acquired and may acquire in the future,

risks entailed in integrating the companies and businesses we

acquire, including employee retention and customer acceptance; the

risk that such transactions will divert management and other

resources from the ongoing operations of the business or otherwise

disrupt the conduct of those businesses, potential litigation

associated with such transactions, and general risks associated

with the business of Perion including intense and frequent changes

in the markets in which the businesses operate and in general

economic and business conditions, loss of key customers,

unpredictable sales cycles, competitive pressures, market

acceptance of new products, inability to meet efficiency and cost

reduction objectives, changes in business strategy and various

other factors, whether referenced or not referenced in this press

release. Various other risks and uncertainties may affect Perion

and its results of operations, as described in reports filed by the

Company with the Securities and Exchange Commission from time to

time, including its annual report on Form 20-F for the year ended

December 31, 2016 filed with the SEC on March 7, 2017. Perion does

not assume any obligation to update these forward-looking

statements.

Source: Perion Network Ltd.

PERION NETWORK LTD. AND ITS SUBSIDIARIES

CONSOLIDATED STATEMENTS OF OPERATIONS

In thousands (except share and per share data)

Three months ended Year ended December

31, December 31, 2016 2017

2016 2017 Audited Audited

Audited Audited Revenues: Search

and other $ 40,488 $ 34,251 $ 172,683 $ 139,505 Advertising

44,054 43,029 140,111 134,481

Total

Revenues 84,542 77,280

312,794 273,986 Costs and

Expenses: Cost of revenues 7,011 6,838 25,924 24,659 Customer

acquisition costs and media buy 38,145 35,092 140,210 130,885

Research and development 6,054 4,406 25,221 17,189 Selling and

marketing 14,364 14,309 54,559 52,742 General and administrative

7,303 5,369 28,827 21,911 Depreciation and amortization 6,174 3,294

25,977 16,591 Impairment charges - 41,820 - 85,667 Restructuring

costs - - 728 -

Total Costs and

Expenses 79,051 111,128

301,446 349,644 Income (Loss) from

Operations 5,491 (33,848) 11,348

(75,658) Financial expense, net 1,882 1,756

8,288 5,922

Income (Loss) before Taxes on

income 3,609 (35,604) 3,060

(81,580) Taxes on income 3,290 1,673

212 (8,826)

Net Income (loss) from continuing

operations 319 (37,277) 2,848

(72,754) Net Loss from discontinued operations -

- (2,647) -

Net Income (Loss)

$ 319 $ (37,277) $ 201

$ (72,754) Net Earnings (Loss) per Share -

Basic and Diluted: Continuing operations $ 0.00 $ (0.48) $ 0.04

$ (0.94) Discontinued operations $ - $ - $ (0.04) $ -

Weighted average number of shares continuing and

discontinued Basic 77,163,670 77,550,069

76,560,454 77,549,171 Diluted 77,540,690

77,550,069 76,673,803 77,549,171 *) less than

$0.01

CONDENSED CONSOLIDATED BALANCE SHEET

In thousands

December 31, December 31, 2016

2017 Audited Unaudited ASSETS

Current Assets: Cash and cash equivalents $ 23,962 $ 31,567

Short-term bank deposit 8,414 5,913 Accounts receivable, net 71,346

62,830 Prepaid expenses and other current assets 10,036

13,955

Total Current Assets 113,758 114,265

Property and equipment, net 14,205 17,476 Goodwill and intangible

assets, net 234,755 136,360 Deferred taxes 4,117 4,798 Other assets

1,617 1,128

Total Assets $

368,452 $

274,027 LIABILITIES AND

SHAREHOLDERS' EQUITY Current Liabilities: Accounts

payable $ 38,293 $ 39,180 Accrued expenses and other liabilities

17,466 17,784 Short-term loans and current maturities of long-term

and convertible debt 17,944 13,989 Deferred revenues 5,354 5,271

Payment obligation related to acquisitions 7,653

5,146

Total Current Liabilities 86,710 81,370

Long-Term Liabilities: Long-term debt, net of current

maturities 37,928 30,026 Convertible debt, net of current

maturities 21,862 16,693 Deferred taxes 8,087 - Other long-term

liabilities 5,721 7,606

Total Liabilities

160,308 135,695 Shareholders'

equity: Ordinary shares 210 211 Additional paid-in capital

234,831 236,975 Treasury shares at cost (1,002) (1,002) Accumulated

other comprehensive gain (loss) (265) 532 Accumulated deficit

(25,630) (98,384)

Total Shareholders' Equity

208,144 138,332 Total

Liabilities and Shareholders' Equity $

368,452 $

274,027

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

In thousands

Year ended December 31, 2016 2017

Unaudited Unaudited Operating

activities: Net Income (loss) $ 201 $ (72,754)

Loss from discontinued operations, net (2,647) - Net

Income (Loss) from continuing operations 2,848 (72,754)

Adjustments required to reconcile net income to net cash provided

by operating activities: Depreciation and amortization 25,977

16,591 Impairment of goodwill and intangible assets - 85,667

Restructuring costs related to impairment of property and equipment

254 - Stock based compensation expense 6,844 2,112 Accretion of

payment obligation related to acquisition 320 43 Foreign currency

translation 980 83 Accrued interest, net 406 475 Deferred taxes,

net (3,268) (8,877) Change in payment obligation related to

acquisition 983 - Fair value revaluation - convertible debt 1,350

3,785 Net changes in operating assets and liabilities

(2,910) 8,888 Net cash provided by continuing operating

activities

33,784 36,013 Net cash used in

discontinued activities (3,329) -

Net cash

provided by operating activities $ 30,455

$ 36,013 Investing activities:

Purchases of property and equipment $ (1,353) $ (1,596)

Capitalization of development costs (4,591) (5,756) Change in

restricted cash, net 647 - Short-term deposits, net 34,028

2,501

Net cash provided by investing activities $

28,731 $ (4,851) Financing

activities: Exercise of stock options and restricted

share units 2 1 Payment made in connection with acquisition

(29,537) (2,551) Proceeds from Short-term loans 40,000 - Proceeds

from Long-term loans - 5,000 Repayment of convertible debt (7,620)

(7,901) Repayment of short-term loans (46,000) (7,000) Repayment of

long-term loans (9,452) (11,389)

Net cash used in

financing activities $ (52,607) $

(23,840) Effect of exchange rate changes on cash and cash

equivalents (136) 283

Net increase in cash and

cash equivalents 9,772 7,605 Net cash used in

discontinued activities (3,329) - Cash and cash equivalents at

beginning of period 17,519 23,962

Cash and cash

equivalents at end of period $ 23,962 $

31,567

RECONCILIATION OF GAAP TO NON-GAAP RESULTS

In thousands (except share and per share data)

Three months ended Year ended

December 31, December 31, 2016

2017 2016 2017 Unaudited

Unaudited Unaudited Unaudited

GAAP Net Income from continuing operations $

319 $ (37,277) $ 2,848 $

(72,754) Acquisition related expenses - - 179 - Valuation

adjustment on acquired deferred revenues - - 359 - Share based

compensation 1,859 446 6,844 2,112 Amortization of acquired

intangible assets 5,173 2,416 21,974 13,024 Restructuring costs - -

728 - Legal fees - 206 - 206 Impairment of goodwill and intangible

assets - 41,820 - 85,667 Fair value revaluation of convertible debt

and related derivative 274 538 408 1,148 Accretion of payment

obligation related to acquisition 33 (18) 1,303 43 Taxes on the

above items (1,140) (1,763) (6,950)

(12,010)

Non-GAAP Net Income from continuing operations

$ 6,518 $ 6,368 $ 27,693

$ 17,436 Non-GAAP Net Income from

continuing operations $ 6,518 $

6,368 $ 27,693 $ 17,436 Taxes on

income 4,430 3,436 7,162 3,184 Financial expense, net 1,575 1,236

6,577 4,731 Depreciation 1,001 877 4,003

3,566

Adjusted EBITDA $ 13,524 $

11,917 $ 45,435 $ 28,917

Non-GAAP diluted earnings per share $ 0.08

$ 0.08 $ 0.36 $ 0.24

Shares used in computing non-GAAP diluted earnings per

share 77,540,690 77,567,040 76,673,803

79,122,597

View source

version on businesswire.com: http://www.businesswire.com/news/home/20180315005705/en/

Perion Network Ltd.Investor relationsHila Valdman+972

(73) 398-1000Perion.Investor.Relations@perion.com

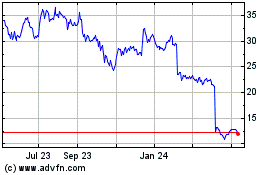

Perion Network (NASDAQ:PERI)

Historical Stock Chart

From Mar 2024 to Apr 2024

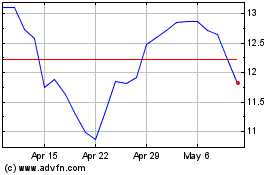

Perion Network (NASDAQ:PERI)

Historical Stock Chart

From Apr 2023 to Apr 2024