Overseas Shipholding Group, Inc. (NYSE:OSG) (the “Company” or

“OSG”) a provider of energy transportation services for crude oil

and petroleum products in the U.S. Flag markets, today reported

results for the fourth quarter and full year 2017.

Highlights

- Income from continuing operations for

the fourth quarter was $53.6 million, or $0.61 per diluted share,

compared with income from continuing operations of $64.7 million,

or $0.74 per diluted share for the fourth quarter 2016.

- Income from continuing operations for

the full year 2017 was $56.0 million, or $0.64 per diluted share,

compared with a loss of $1.1 million, or $0.01 per diluted share

for the full year 2016.

- Shipping revenues for the fourth

quarter and full year 2017 were $92.8 million and $390.4 million,

down 19% and 16%, respectively, compared with the same periods in

2016. Time charter equivalent (TCE) revenues(A), a non-GAAP

measure, for the fourth quarter and full year 2017 were $82.8

million and $361.0 million, down 24% and 19%, respectively,

compared with the same periods in 2016.

- Fourth quarter and full year 2017

Adjusted EBITDA(B), a non-GAAP measure, was $22.7 million and

$111.1 million, down 54% and 37%, respectively, from $49.9 million

and $176.2 million in the same periods in 2016.

- Total cash(C), was $166.3 million as of

December 31, 2017.

- Principal payment of $26.4 million plus

accrued and unpaid interest of $514 thousand was made on December

27, 2017, on all of the outstanding 8.125% Notes in the fourth

quarter, and as a result, the Company's obligations under the

indenture was canceled and discharged.

Mr. Norton stated, “We witnessed a robust recovery of spot

market rates during the fourth quarter. While still early days, we

consider realized reduction in available supply and the emergence

of the demand catalysts that we have been looking for - in

particular in respect to demand for domestic crude oil

transportation - as supportive of increased confidence in a

progression towards a more balanced and normalized market

environment.”

Fourth Quarter 2017

Results

Shipping revenues were $92.8 million for the quarter, down 19%

compared with the fourth quarter of 2016. TCE revenues for the

fourth quarter of 2017 were $82.8 million, a decrease of $26.8

million, or 24%, compared with the fourth quarter of 2016,

primarily due to lower average daily rates earned, which accounted

for a $22.8 million decrease in TCE revenues and a 138-day decrease

in revenue days for its fleet, excluding its modern lightering

ATBs, driven by additional drydock and repair days resulting in a

$4.0 million decrease in TCE revenues.

A, B, C Reconciliations of these non-GAAP financial measures are

included in the financial tables attached to this press release

starting on Page 8.

Operating income for the fourth quarter of 2017 was $3.9

million, compared to operating income of $4.1 million in the fourth

quarter of 2016.

Net income for the fourth quarter was $53.6 million, compared

with net loss of $275.5 million for the fourth quarter 2016. Net

income from continuing operations for the fourth quarter was $53.6

million, or $0.61 per diluted share, compared with a net income

from continuing operations of $64.7 million, or $0.74 per diluted

share for the fourth quarter 2016. The increase reflects the income

tax benefit primarily as a result of the remeasurement of the net

deferred tax liability to the newly enacted statutory rate of

21%.

Adjusted EBITDA was $22.7 million for the quarter, a decrease of

$27.1 million compared with the fourth quarter of 2016, driven

primarily by the decline in TCE revenues.

Full Year 2017 Results

Shipping revenues were $390.4 million for the full year 2017,

down 16% compared with the full year 2016. TCE revenues for the

full year 2017 were $361.0 million, a decrease of $85.1 million, or

19%, compared with the full year 2016, primarily due to lower

average daily rates, which accounted for a $75.2 million decrease

in TCE revenues and a 278-day decrease in revenue days for its

Jones Act fleet, excluding its modern lightering ATBs, driven by an

increase in drydock days resulting in a $9.8 million decrease in

TCE revenues.

Operating income for the full year 2017 was $37.8 million,

compared to operating loss of $31.5 million for the full year

2016.

Net income for the full year 2017 was $56.0 million, compared

with net loss of $293.6 million for the full year 2016. Income from

continuing operations for the full year 2017 was $56.0 million, or

$0.64 per diluted share, compared with a loss from continuing

operations of $1.1 million, or $0.01 per diluted share for the full

year 2016. The increase reflects the income tax benefit primarily

as a result of the remeasurement of the net deferred tax liability

to the newly enacted statutory rate of 21%.

Adjusted EBITDA was $111.1 million for the full year 2017, a

decrease of $65.1 million compared with the full year 2016, driven

primarily by the decline in TCE revenues.

Conference Call

The Company will host a conference call to discuss its fourth

quarter and full year 2017 results at 9:00 a.m. Eastern Time (“ET”)

on Friday, March 9, 2018.

To access the call, participants should dial (844) 850-0546 for

domestic callers and (412) 317-5203 for international callers.

Please dial in ten minutes prior to the start of the call.

A live webcast of the conference call will be available from the

Investor Relations section of the Company’s website at

http://www.osg.com/.

An audio replay of the conference call will be available

starting at 11:00 a.m. ET on Friday, March 9, 2018, through 10:59

p.m. ET on Friday, March 16, 2018, by dialing (877) 344-7529 for

domestic callers and (412) 317-0088 for international callers, and

entering Access Code 10117595.

About Overseas Shipholding Group, Inc.

Overseas Shipholding Group, Inc. (NYSE:OSG) is a publicly traded

tanker company providing energy transportation services for crude

oil and petroleum products in the U.S. Flag markets. OSG is a major

operator of tankers and ATBs in the Jones Act industry. OSG’s

23-vessel U.S. Flag fleet consists of seven ATBs, two lightering

ATBs, three shuttle tankers, nine MR tankers, and two non-Jones Act

MR tankers that participate in the U.S. MSP. OSG is committed to

setting high standards of excellence for its quality, safety and

environmental programs. OSG is recognized as one of the world’s

most customer-focused marine transportation companies and is

headquartered in Tampa, FL. More information is available

at www.osg.com.

Forward-Looking Statements

This release contains forward-looking statements. In addition,

the Company may make or approve certain statements in future

filings with the Securities and Exchange Commission (SEC), in press

releases, or in oral or written presentations by representatives of

the Company. All statements other than statements of historical

facts should be considered forward-looking statements. These

matters or statements may relate to the Company’s prospects, its

ability to retain and effectively integrate new members of

management and the effect of the Company’s spin-off of

International Seaways, Inc. Forward-looking statements are based

the Company’s current plans, estimates and projections, and are

subject to change based on a number of factors. Investors should

carefully consider the risk factors outlined in more detail in the

Annual Report on Form 10-K for OSG and in similar sections of other

filings made by the Company with the SEC from time to time. The

Company assumes no obligation to update or revise any

forward-looking statements. Forward-looking statements and written

and oral forward-looking statements attributable to the Company or

its representatives after the date of this release are qualified in

their entirety by the cautionary statements contained in this

paragraph and in other reports previously or hereafter filed by the

Company with the SEC.

Consolidated Statements of

Operations

($ in thousands, except per share

amounts)

Three Months Ended December 31, Fiscal Year Ended

December 31, 2017 2016 2017 2016

(unaudited) (unaudited) Shipping Revenues:

Time and bareboat charter revenues 57,400 85,539 266,193 372,149

Voyage charter revenues 35,415 29,237

124,233 90,271 Total shipping revenues

92,815 114,776 390,426

462,420

Operating Expenses: Voyage expenses

10,061 5,219 29,390 16,260 Vessel expenses 34,658 33,343 135,991

140,696 Charter hire expenses 23,101 23,138 91,587 91,947

Depreciation and amortization 12,573 20,862 58,673 89,563 General

and administrative 6,413 7,013 27,493 41,608 Severance costs —

10,758 16 12,996 Loss on disposal of vessels and other property,

including impairments 5,847 6,623

13,200 104,532 Total operating expenses

92,653 106,956 356,350

497,602 Income/(loss) from vessel operations 162

7,821 34,076 (35,182 ) Equity in income of affiliated companies

3,747 3,656 3,747

3,642 Operating income/(loss) 3,909 11,476 37,823 (31,540 )

Other expense (826 ) (295 ) (1,881 )

(2,391 ) Income/(loss) before interest expense, reorganization

items and income taxes and income taxes 3,083 11,181 35,942 (33,931

) Interest expense (9,125 ) (9,765 ) (37,401 )

(43,151 ) (Loss)/income before reorganization items and

income taxes and income taxes (6,042 ) 1,416 (1,459 ) (77,082 )

Reorganization items, net 8 (393 ) (190

) 10,925 (Loss)/income from continuing operations

before income taxes (6,034 ) 1,023 (1,649 ) (66,157 ) Income tax

benefit from continuing operations 59,679

63,653 57,627 65,098 Net

income/(loss) from continuing operations 53,645 64,678 55,978

(1,059 ) Net income/(loss) from discontinued operations —

(340,153 ) — (292,555 )

Net

income/(loss) $ 53,645 $ (275,475 ) $ 55,978 $

(293,614 )

Weighted Average Number of Common Shares

Outstanding: Basic - Class A 87,840,169 87,497,273 87,834,769

90,949,577 Diluted - Class A 88,108,079 87,721,704 88,082,978

90,949,577 Basic and diluted - Class B — — — 533,758

Per

Share Amounts from Continuing Operations: Basic and diluted net

income/(loss) – Class A $ 0.61 $ 0.74 $ 0.64 $ (0.01 ) Basic and

diluted net income/(loss) – Class B — — — $ (0.11 )

Per Share

Amounts from Discontinued Operations: Basic and diluted net

income/(loss) – Class A — $ (3.89 ) — $ (3.24 ) Basic and diluted

net income/(loss) – Class B — — — $ 4.54

On June 2, 2016, the Board approved the Reverse Split Amendment

to the Company’s Amended and Restated Certificate of Incorporation.

The Reverse Split Amendment effected the Reverse Split. The Reverse

Split Amendment became effective on June 13, 2016. In accordance

with Financial Accounting Standards Board (“FASB”) Accounting

Standards Codification (“ASC”) ASC 260, Earnings Per Share, the

Company adjusted the computations of basic and diluted earnings per

share retroactively for all periods presented to reflect that

change in its capital structure.

Consolidated Balance Sheets

($ in thousands)

December 31, December 31, 2017

2016 ASSETS Current Assets: Cash and cash

equivalents $ 165,994 $ 191,089 Restricted cash 58 7,272 Voyage

receivables, including unbilled of $9,919 and $12,593 24,209 23,456

Income tax recoverable 1,122 877 Receivable from INSW 372 683 Other

receivables 2,184 2,696 Inventories, prepaid expenses and other

current assets 13,356 12,243 Total

Current Assets 207,295 238,316 Restricted cash 217 8,572 Vessels

and other property, less accumulated depreciation 632,509 684,468

Deferred drydock expenditures, net 23,914

31,172 Total Vessels, Deferred Drydock and Other Property

656,423 715,640 Investments in and

advances to affiliated companies 3,785 3,694 Intangible assets,

less accumulated amortization 41,017 45,617 Other assets

23,150 18,658 Total Assets $ 931,887 $

1,030,497

LIABILITIES AND EQUITY Current

Liabilities: Accounts payable, accrued expenses and other

current liabilities $ 34,220 $ 57,222 Income taxes payable 151 306

Current installments of long-term debt 28,160

— Total Current Liabilities 62,531 57,528 Reserve for

uncertain tax positions 3,205 3,129 Long-term debt 420,776 525,082

Deferred income taxes 83,671 141,457 Other liabilities

48,466 48,969 Total Liabilities 618,649

776,165 Commitments and contingencies

Equity: Common stock - Class A ($0.01 par value;

166,666,666 shares authorized; 78,277,669 and 70,271,172 shares

issued and outstanding) 783 702 Paid-in additional capital 584,675

583,526 Accumulated deficit (265,758 ) (321,736 )

319,700 262,492 Accumulated other comprehensive loss (6,462

) (8,160 ) Total Equity 313,238 254,332

Total Liabilities and Equity $ 931,887 $ 1,030,497

Consolidated Statements of

Cash Flows

($ in thousands)

Years Ended December 31, 2017 2016

2015 Cash Flows from Operating Activities: Net income/(loss)

$ 55,978 $ (293,614 ) $ 283,960 (Loss)/income from discontinued

operations — (292,555 ) 203,395

Net income/(loss) from continuing operations 55,978 (1,059 ) 80,565

Items included in net income/(loss) from continuing operations not

affecting cash flows: Depreciation and amortization 58,673 89,563

76,851 Vessel impairment charges 5,878 104,405 — Amortization of

debt discount and other deferred financing costs 5,167 6,005 5,154

Compensation relating to restricted stock, stock unit and stock

option grants 2,388 7,441 3,580 Deferred income tax benefit (59,047

) (67,394 ) (69,564 ) Undistributed earnings of affiliated

companies (91 ) 132 (399 ) Deferred payment obligations on

charters-in — — 590 Reorganization items, non-cash (105 ) 5,198 (50

) Other – net 3,282 2,268 1,971 Items included in net income/(loss)

related to investing and financing activities: Loss on repurchases

and extinguishment of debt 3,237 2,988 — Loss on disposal of

vessels and other property, net 7,322 127 207 Distributions from

INSW — 202,000 200,000 Payments for drydocking (8,390 ) (6,844 )

(41,323 ) SEC payment, bankruptcy and IRS claim payments (5,000 )

(7,136 ) (8,343 ) Deferred financing costs paid for loan

modification — — (4,220 ) Changes in operating assets and

liabilities: (Increase)/decrease in receivables (753 ) (16,794 )

6,502 (Increase)/decrease in income tax recoverable (246 ) 323

54,637 (Decrease)/increase in deferred revenue (4,639 ) 63 (3,034 )

Net change in prepaid items and accounts payable, accrued expenses

and other current and long-term liabilities (20,035 )

7,574 (26,791 ) Net cash provided by operating

activities 43,619 328,860

276,333 Cash Flows from Investing Activities: Change in

restricted cash 15,569 (5,261 ) 42,502 Expenditures for other

property (11 ) (666 ) (75 ) Proceeds from disposal of vessels and

other property 1,055 — — Other – net — —

(54 ) Net cash provided by/(used in) investing

activities 16,613 (5,927 ) 42,373

Cash Flows from Financing Activities: Cash dividends paid —

(31,910 ) — Payments on debt, including adequate protection

payments — (54,345 ) (6,030 ) Repurchases and extinguishment of

debt (84,170 ) (120,224 ) (326,051 ) Repurchases of common stock

and common stock warrants — (119,343 ) (3,633 ) Tax withholding on

share-based awards (1,157 ) — —

Net cash used in financing activities (85,327 )

(325,822 ) (335,714 ) Net decrease in cash and cash

equivalents (25,095 ) (2,889 ) (17,008 ) Cash and cash equivalents

at beginning of year 191,089 193,978

210,986 Cash and cash equivalents at end of year $

165,994 $ 191,089 $ 193,978 Cash flows

from discontinued operations: Cash flows provided by operating

activities $ — $ 111,768 $ 222,739 Cash flows provided by investing

activities — 25,202 114,163 Cash flows used in financing activities

— (355,687 ) (206,284 ) Net

(decrease)/increase in cash and cash equivalents from discontinued

operations $ — $ (218,717 ) $ 130,618

Spot and Fixed TCE Rates Achieved and Revenue Days

The following tables provides a breakdown of TCE rates achieved

for spot and fixed charters and the related revenue days for the

three months and fiscal year ended December 31, 2017, and the

comparable periods of 2016. Revenue days in the quarter ended

December 31, 2017, totaled 2,029 compared with 2,167 in the prior

year quarter. Revenue days in the fiscal year ended December 31,

2017, totaled 8,378 compared with 8,658 in the prior year. A

summary fleet list by vessel class can be found later in this press

release.

For the three months ended December

31, 2017 2016 Spot Fixed

Spot Fixed Earnings Earnings

Earnings Earnings Jones Act Handysize Product

Carriers: Average rate $ 31,397 $ 63,163 $ 29,742 $ 65,060 Revenue

days 284 790 92 972 Non-Jones Act Handysize Product Carriers:

Average rate $ 28,334 $ — $ 24,311 $ 9,628 Revenue days 184 — 147

37 ATBs: Average rate $ 12,644 $ 25,363 $ 26,473 $ 32,029 Revenue

days 317 270 83 652 Lightering: Average rate $ 42,802 $ — $ 91,052

$ — Revenue days 184 — 184 —

For the years ended

December 31, 2017 2016 Spot Fixed

Spot Fixed Earnings Earnings

Earnings Earnings Jones Act Handysize Product

Carriers: Average rate $ 27,179 $ 63,604 $ 27,989 $ 64,919 Revenue

days 896 3,411 208 4,103 Non-Jones Act Handysize Product Carriers:

Average rate $ 31,174 $ 14,031 $ 31,422 $ 16,141 Revenue days 566

159 544 186 ATBs: Average rate $ 11,111 $ 26,863 $ 26,473 $ 35,269

Revenue days 979 1,637 83 2,802 Lightering: Average rate $ 61,648 $

— $ 72,271 $ — Revenue days 730 — 732 —

Fleet Information

As of December 31, 2017, OSG’s operating fleet consisted of 23

vessels, 13 of which were owned, with the remaining vessels

chartered-in. Vessels chartered-in are on Bareboat Charters.

Vessels Owned Vessels

Chartered-in Total at December 31, 2017 Vessel

Type Number Weighted by

Ownership

Number Weighted by

Ownership

Total Vessels Vessels

Weighted by

Ownership

Total dwt (2) Handysize Product Carriers (1) 4

4.0 10 10.0 14 14.0 664,490 Refined Product ATBs 7 7.0 — — 7 7.0

195,131 Lightering ATBs 2 2.0 — — 2 2.0 91,112 Total Operating

Fleet 13 13.0 10 10.0 23 23.0 950,733

(1) Includes two owned shuttle tankers,

one chartered-in shuttle tanker and two owned U.S. Flag Product

Carriers that trade internationally.

(2) Total dwt is defined as total deadweight tons for all vessels

of that type.

Reconciliation to Non-GAAP Financial Information

The Company believes that, in addition to conventional measures

prepared in accordance with GAAP, the following non-GAAP measures

may provide certain investors with additional information that will

better enable them to evaluate the Company’s performance.

Accordingly, these non-GAAP measures are intended to provide

supplemental information, and should not be considered in isolation

or as a substitute for measures of performance prepared with

GAAP.

(A) Time Charter Equivalent (TCE) Revenues

Consistent with general practice in the shipping industry, the

Company uses TCE revenues, which represents shipping revenues less

voyage expenses, as a measure to compare revenue generated from a

voyage charter to revenue generated from a time charter. Time

charter equivalent revenues, a non-GAAP measure, provides

additional meaningful information in conjunction with shipping

revenues, the most directly comparable GAAP measure, because it

assists Company management in making decisions regarding the

deployment and use of its vessels and in evaluating their financial

performance. Reconciliation of TCE revenues of the segments to

shipping revenues as reported in the consolidated statements of

operations follow:

Three Months Ended Fiscal Year Ended

December 31, December 31, ($ in thousands)

2017 2016 2017 2016 TCE

revenues $ 82,754 $ 109,557 $ 361,036 $ 446,160 Add: Voyage

Expenses 10,061 5,219 29,390 16,260

Shipping revenues $ 92,815 $ 114,776 $ 390,426 $ 462,420

Vessel Operating Contribution

Vessel operating contribution, a non-GAAP measure, is TCE

revenues minus vessel expenses and charter hire expenses.

Our “niche market activities,” which includes Delaware Bay

lightering, MSP vessels and shuttle tankers, continue to provide a

stable operating platform underlying our total US Flag operations.

These vessels’ operations are insulated from the forces affecting

the broader Jones Act market.

The following table sets forth the contribution of our

vessels:

Years Ended December 31, 2017

2016 2015 Niche Market Activities $ 101,405 $

106,410 $ 97,890 Jones Act Handysize Tankers 6,083 36,648 46,539

ATBs 26,057 69,928 74,678 Vessel Operating

Contribution $ 133,545 $ 212,986 $ 219,107

(B) EBITDA and Adjusted EBITDA

EBITDA represents net (loss)/income from continuing operations

before interest expense, income taxes and depreciation and

amortization expense. Adjusted EBITDA consists of EBITDA adjusted

for the impact of certain items that we do not consider indicative

of our ongoing operating performance. EBITDA and Adjusted EBITDA do

not represent, and should not be a substitute for, net

(loss)/income or cash flows from operations as determined in

accordance with GAAP. Some of the limitations are: (i) EBITDA and

Adjusted EBITDA do not reflect our cash expenditures, or future

requirements for capital expenditures or contractual commitments;

(ii) EBITDA and Adjusted EBITDA do not reflect changes in, or cash

requirements for, our working capital needs; and (iii) EBITDA and

Adjusted EBITDA do not reflect the significant interest expense, or

the cash requirements necessary to service interest or principal

payments, on our debt. While EBITDA and Adjusted EBITDA are

frequently used as a measure of operating results and performance,

neither of them is necessarily comparable to other similarly titled

captions of other companies due to differences in methods of

calculation. The following table reconciles net income/(loss) from

continuing operations as reflected in the consolidated statements

of operations, to EBITDA and Adjusted EBITDA:

Three Months Ended Fiscal Year Ended

December 31, December 31, ($ in thousands)

2017 2016 2017 2016 Net

Income/(loss) from continuing operations $ 53,645 $ 64,678 $ 55,978

$ (1,059 ) Income tax benefit from continuing operations (59,679 )

(63,653 ) (57,627 ) (65,098 ) Interest expense 9,125 9,765 37,401

43,151 Depreciation and amortization 12,573

20,862 58,673 89,563 EBITDA

15,664 31,652 94,425 66,557 Severance costs — 10,758 16 12,996 Loss

on disposal of vessels and other property, including impairments

5,847 6,623 13,200 104,532 Loss on repurchase of debt 1,238 456

3,237 2,988 Reorganization items, net (8 ) 393

190 (10,925 ) Adjusted EBITDA $ 22,741

$ 49,882 $ 111,068 $ 176,225

(C) Total Cash

December 31, December 31, ($ in

thousands)

2017 2016 Cash and cash equivalents $

165,994 $ 191,089 Restricted cash - current 58 7,272 Restricted

cash – non-current 217 8,572 Total Cash $ 166,269 $

206,933

View source

version on businesswire.com: http://www.businesswire.com/news/home/20180309005347/en/

Overseas Shipholding Group, Inc.Susan Allan,

813-209-0620sallan@osg.com

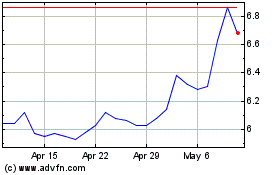

Overseas Shipholding (NYSE:OSG)

Historical Stock Chart

From Mar 2024 to Apr 2024

Overseas Shipholding (NYSE:OSG)

Historical Stock Chart

From Apr 2023 to Apr 2024