Baidu Emphasizes Artificial Intelligence as It Files for Video Unit's IPO

February 28 2018 - 6:03AM

Dow Jones News

By Alyssa Abkowitz

BEIJING--The iQiyi Inc. video-streaming unit of search-engine

giant Baidu Inc. has filed for an initial public offering in the

U.S., promoting its ability to use artificial intelligence and user

data to deliver videos that generate billions of views.

In a U.S. regulatory filing, Baidu said it would list iQiyi on

the Nasdaq exchange and is seeking to raise around $1.5 billion.

Analysts at Jefferies have valued iQiyi at $17 billion.

The move comes as Baidu looks to raise money for the loss-making

unit to stay ahead in the fiercely competitive video-streaming

sector where tech titans Tencent Holdings Ltd. and Alibaba Group

Holding Ltd. also have strong plays. Baidu told investors in its

most recent earnings call that it would remain iQiyi's controlling

shareholder.

IQiyi, which was founded in 2010 will list under the ticker IQ,

said it is China's largest video-streaming service by amount of

time spent watching, with more than 50 million paid

subscribers.

Two of its original series, "The Mystic Nine" and "Burning Ice,"

have together garnered more than 13 billion views, the company said

in its filing with the U.S. Securities and Exchange Commission.

"We distinguish ourselves in the online entertainment industry

by our leading technology platform powered by advanced AI, big data

analytics and other core proprietary technologies," the company

said in its filing. "Our core proprietary technologies are critical

to producing content that caters to user tastes, delivering

superior entertainment experience to our users."

In China, people spend the majority of their

online-entertainment time on video, and the market overall is

expected to grow to 688 billion yuan ($109 billion) by 2022, up

from about 51 billion yuan in 2012, iQiyi said, citing a report by

iResearch Consulting Group.

But a tough competitive environment and the costs of providing

content have made streaming a money-losing proposition for Baidu,

as well as for its internet rivals Tencent and Alibaba.

"We incurred net losses since our inception," iQiyi said in its

filing, including losses of 3.7 billion yuan in 2017.

Junwen Woo, a senior analyst at IHS Markit who tracks online

video in Asia, said iQiyi has potential because of its use of AI,

which helps the company differentiate from competing Chinese video

platforms operated by much bigger rivals Alibaba and Tencent.

"They can know what is the most popular content and what are the

most favorite things viewers like--and what is coming up next," she

said.

In fundraising last year, iQiyi raised $1.53 billion, an

investment that came months after investors balked at a $2.3

billion buyout bid from a group led by Baidu Chief Executive Robin

Li, saying the proposal undervalued the unit.

Goldman Sachs, Credit Suisse and Bank of America Merrill Lynch

are the lead underwriters of the IPO.

Wayne Ma in Hong Kong contributed to this article.

Write to Alyssa Abkowitz at alyssa.abkowitz@wsj.com

(END) Dow Jones Newswires

February 28, 2018 05:48 ET (10:48 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

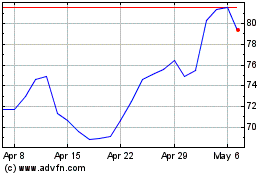

Alibaba (NYSE:BABA)

Historical Stock Chart

From Mar 2024 to Apr 2024

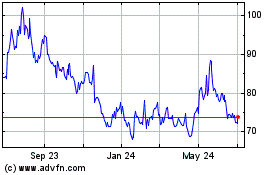

Alibaba (NYSE:BABA)

Historical Stock Chart

From Apr 2023 to Apr 2024