Total Gabon: 2017 Revenues

February 15 2018 - 12:08PM

Business Wire

Regulatory News:

As announced in the news release dated November 14, 2017, Total

Gabon (Paris:EC), which used to publish its accounts under the

OHADA accounting standard, will publish, as from its 2017 Annual

Financial Report and at the request of the French Financial Markets

Authority (Autorité des Marchés Financiers), its accounts in

accordance with IFRS (International Financial Reporting Standards).

The 2017 Annual Financial Report, which will be published on April

27, 2018, will include a note describing the impact of this change

of accounting standard. The impact on Revenues is described below

in footnote (5).

Main Financial Indicators

2017

2016

2017

vs

2016

Average Brent price $/b

54.2 43.7

+24% Average Total Gabon crude price (1) $/b

49.7 37.9 +31%

Crude oil production from fields

operatedby Total Gabon

kb/d (2)

48.5 55.0 -12%

Crude oil production from Total

Gaboninterests (3)

kb/d

44.6 47.4 -6% Sales volumes

(1) Mb (4)

15.9 17.6 -10%

Revenues (5) $M

914 784 +17%

(1) Excluding tax oil reverting to the Gabonese Republic as per

production sharing contracts, those barrels being delivered to the

Gabonese Republic in kind.(2) kb/d: Thousand barrels per day.(3)

Including tax oil reverting to the Gabonese Republic as per

production sharing contracts.(4) Mb: Million barrels.(5) Revenues

include hydrocarbon sales and services provided to third parties

(transportation, processing and storage). As from 2017, Total

Gabon’s accounts are established in accordance with IFRS. According

to the IAS 18 norm, revenues include the tax oil reverting to the

Gabonese Republic as per production sharing contracts. This

reclassification, also applied on 2016 revenues, has no impact on

net income.

2017 REVENUES

Selling prices

Reflecting the higher Brent price and strong Asian demand for

West African crude oil grades, the selling price of the Mandji and

Rabi Light crude oil grades marketed by Total Gabon averaged

49.7 $/b, up 31% compared to the previous year.

Production

Total Gabon’s equity share of operated and non-operated oil

production(1) averaged 44,600 barrels per day in 2017, down 6%

compared to the previous year. This decrease was mainly due to:

- The sale to Perenco of interests in

several mature fields on October 31, 2017.

- An increase of produced water content

and the presence of sulfide deposits in the Anguille sector.

- The natural decline in fields.

These factors were partially offset by:

- A better availability of

facilities.

- The acquisition of an additional 50%

interest in the Baudroie-Mérou license in June 2017.

Revenues

Revenues amounted to $914 million in 2017, up 17% from

$784 million in 2016. The increase was driven mainly by the

higher average selling price for Total Gabon’s crude oil grades,

partially offset by the 10% decrease in volumes sold, linked mainly

to the sale to Perenco of interests in several mature fields on

October 31, 2017 and to the lifting schedule. Revenues from third

parties also decreased (-20 M$) due essentially to the sale to

Perenco of the Rabi-Coucal-Cap Lopez pipeline network.

The 2017 results news release will be published on March 27,

2018, after markets close.

(1) Including tax oil reverting to the Gabonese Republic as per

production sharing contracts.

Société anonyme incorporated in Gabon

with a Board of Directors and share capital of

$76,500,000Headquarters: Boulevard Hourcq, Port-Gentil, BP

525, Gabonese Republicwww.total.gaRegistered in

Port-Gentil: 2000 B 00011

View source

version on businesswire.com: http://www.businesswire.com/news/home/20180215005938/en/

PresseTotal GabonFlorent

CAILLETflorent.caillet@total.com

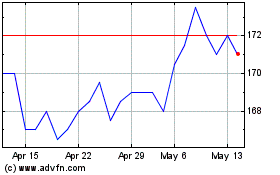

TotalEnergies EP Gabon (EU:EC)

Historical Stock Chart

From Mar 2024 to Apr 2024

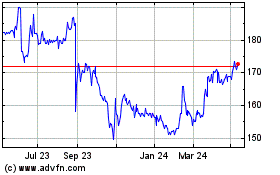

TotalEnergies EP Gabon (EU:EC)

Historical Stock Chart

From Apr 2023 to Apr 2024