Vornado Announces Fourth Quarter 2017 Financial Results

February 12 2018 - 6:03PM

VORNADO REALTY TRUST (NYSE:VNO) filed its Form 10-K for the year

ended December 31, 2017 today and reported its financial results

below. The financial results treat as "discontinued

operations" the Company's former Washington, DC segment, which was

spun off to shareholders on July 17, 2017.

Quarter Ended December 31, 2017

Financial Results

- NET INCOME attributable to common shareholders for the quarter

ended December 31, 2017 was $27.3 million, or $0.14 per diluted

share, compared to $651.2 million, or $3.43 per diluted share, for

the prior year's quarter. Adjusting net income attributable

to common shareholders (non-GAAP) for the items listed in the table

on the following page, net income attributable to common

shareholders for the quarters ended December 31, 2017 and 2016 was

$65.5 million and $77.8 million, or $0.34 and $0.41 per diluted

share, respectively.

- FUNDS FROM OPERATIONS attributable to common shareholders plus

assumed conversions (non-GAAP) ("FFO") for the quarter ended

December 31, 2017 was $153.2 million, or $0.80 per diluted share,

compared to $797.7 million, or $4.20 per diluted share, for the

prior year's quarter. Adjusting FFO for the items listed in

the table on page 3, FFO for the quarters ended December 31, 2017

and 2016 was $187.6 million and $193.2 million, or $0.98 and $1.02

per diluted share, respectively.

Year Ended December 31, 2017 Financial

Results

- NET INCOME attributable to common shareholders for the year

ended December 31, 2017 was $162.0 million, or $0.85 per

diluted share, compared to $823.6 million, or $4.34 per diluted

share, for the prior year. Adjusting net income attributable

to common shareholders (non-GAAP) for the items listed in the table

on the following page, net income attributable to common

shareholders for the years ended December 31, 2017 and 2016 was

$251.0 million and $229.2 million, or $1.31 and $1.21 per diluted

share, respectively.

- FFO (non-GAAP) for the year ended December 31, 2017 was $717.8

million, or $3.75 per diluted share, compared to $1,457.6 million,

or $7.66 per diluted share, for the prior year. Adjusting FFO

for the items listed in the table on page 3, FFO for the years

ended December 31, 2017 and 2016 was $713.8 million and $683.4

million, or $3.73 and $3.59 per diluted share, respectively.

Supplemental Financial

Information

Further details regarding results of operations,

properties and tenants can be accessed at the Company's website

www.vno.com. Vornado Realty Trust is a fully – integrated

equity real estate investment trust.

Certain statements contained herein may

constitute "forward-looking statements" within the meaning of the

Private Securities Litigation Reform Act of 1995. Such

forward-looking statements involve known and unknown risks,

uncertainties and other factors which may cause the actual results,

performance or achievements of the Company to be materially

different from any future results, performance or achievements

expressed or implied by such forward-looking statements. For

a discussion of factors that could materially affect the outcome of

our forward-looking statements and our future results and financial

condition, see "Risk Factors" in Part I, Item 1A, of our Annual

Report on Form 10-K for the year ended December 31, 2017.

Such factors include, among others, risks associated with the

timing of and costs associated with property improvements,

financing commitments and general competitive factors.

(tables to follow)

The following table reconciles our net income

attributable to common shareholders to net income attributable to

common shareholders, as adjusted (non-GAAP):

| |

|

|

|

|

|

|

|

| (Amounts in thousands,

except per share amounts) |

For the Quarters Ended |

|

For the Years Ended |

| |

December 31, |

|

December 31, |

| |

2017 |

|

2016 |

|

2017 |

|

2016 |

| Net income attributable

to common shareholders |

$ |

27,319 |

|

|

$ |

651,181 |

|

|

$ |

162,017 |

|

$ |

823,606 |

| Per

diluted share |

$ |

0.14 |

|

|

$ |

3.43 |

|

|

$ |

0.85 |

|

$ |

4.34 |

| |

|

|

|

|

|

|

|

| Certain items that

impact net income attributable to common shareholders: |

|

|

|

|

|

|

|

| JBG SMITH

Properties which is treated as a discontinued operation: |

|

|

|

|

|

|

|

|

Transaction costs |

$ |

(1,617 |

) |

|

|

$ |

(11,989 |

|

) |

|

$ |

(68,662 |

) |

|

$ |

(16,586 |

) |

| Operating

results through July 17, 2017 spin-off |

— |

|

|

|

20,523 |

|

|

47,752 |

|

|

87,237 |

|

| |

(1,617 |

) |

|

|

8,534 |

|

|

(20,910 |

) |

|

70,651 |

|

| |

|

|

|

|

|

|

|

| Tax

expense related to the reduction of our taxable REIT subsidiaries

deferred tax assets |

(34,800 |

) |

|

|

— |

|

|

(34,800 |

) |

|

— |

|

| Expense

related to the prepayment of our 2.50% senior unsecured notes due

2019 |

(4,836 |

) |

|

|

— |

|

|

(4,836 |

) |

|

— |

|

| 666 Fifth

Avenue Office Condominium (49.5% interest) |

(3,042 |

) |

|

|

(7,869 |

) |

|

(25,414 |

) |

|

(41,532 |

) |

| Income

(loss) from real estate fund investments, net |

529 |

|

|

|

(34,704 |

) |

|

(10,804 |

) |

|

(21,042 |

) |

| Net gain

on extinguishment of Skyline properties debt |

— |

|

|

|

487,877 |

|

|

— |

|

|

487,877 |

|

| Income

from the repayment of our investments in 85 Tenth Avenue loans and

preferred equity |

— |

|

|

|

160,843 |

|

|

— |

|

|

160,843 |

|

| Net gain

on sale on our 20% interest in Fairfax Square |

— |

|

|

|

15,302 |

|

|

— |

|

|

15,302 |

|

| Our share

of impairment on India non-depreciable real estate |

— |

|

|

|

(13,962 |

) |

|

— |

|

|

(13,962 |

) |

| Default

interest on Skyline properties mortgage loan |

— |

|

|

|

(2,480 |

) |

|

— |

|

|

(7,823 |

) |

|

Impairment loss on our investment in Pennsylvania REIT |

— |

|

|

|

— |

|

|

(44,465 |

) |

|

— |

|

| Net gain

resulting from Urban Edge Properties operating partnership unit

issuances |

— |

|

|

|

— |

|

|

21,100 |

|

|

— |

|

| Our share

of net gain on sale of property of Suffolk Downs JV |

— |

|

|

|

— |

|

|

15,314 |

|

|

— |

|

| Net gain

on repayment of Suffolk Downs JV debt investments |

— |

|

|

|

— |

|

|

11,373 |

|

|

— |

|

| Our share

of write-off of deferred financing costs |

— |

|

|

|

— |

|

|

(3,819 |

) |

|

— |

|

| Skyline

properties impairment loss |

— |

|

|

|

— |

|

|

— |

|

|

(160,700 |

) |

| Net gain

on sale of 47% ownership interest in 7 West 34th Street |

— |

|

|

|

— |

|

|

— |

|

|

159,511 |

|

| Preferred

share issuance costs (Series J redemption) |

— |

|

|

|

— |

|

|

— |

|

|

(7,408 |

) |

|

Other |

3,084 |

|

|

|

(2,942 |

) |

|

2,060 |

|

|

(8,298 |

) |

| |

(40,682 |

) |

|

|

610,599 |

|

|

(95,201 |

) |

|

633,419 |

|

| Noncontrolling

interests' share of above adjustments |

2,522 |

|

|

|

(37,185 |

) |

|

6,267 |

|

|

(38,972 |

) |

| Total of certain items

that impact net income attributable to common shareholders,

net |

$ |

(38,160 |

) |

|

|

$ |

573,414 |

|

|

$ |

(88,934 |

) |

|

$ |

594,447 |

|

| |

|

|

|

|

|

|

|

| Net income attributable

to common shareholders, as adjusted (non-GAAP) |

$ |

65,479 |

|

|

|

$ |

77,767 |

|

|

$ |

250,951 |

|

|

$ |

229,159 |

|

| Per

diluted share (non-GAAP) |

$ |

0.34 |

|

|

|

$ |

0.41 |

|

|

$ |

1.31 |

|

|

$ |

1.21 |

|

| |

| |

| |

The following table reconciles our FFO (non-GAAP) to FFO, as

adjusted (non-GAAP):

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| (Amounts in thousands,

except per share amounts) |

|

For the Quarters Ended |

|

For the Years Ended |

| |

|

December 31, |

|

December 31, |

| |

|

2017 |

|

2016 |

|

2017 |

|

2016 |

| FFO (non-GAAP)

(1) |

|

$ |

153,151 |

|

|

$ |

797,734 |

|

|

$ |

717,805 |

|

|

$ |

1,457,583 |

|

| Per

diluted share (non-GAAP) |

|

$ |

0.80 |

|

|

$ |

4.20 |

|

|

$ |

3.75 |

|

|

$ |

7.66 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Certain items that

impact FFO: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| JBG SMITH

Properties which is treated as a discontinued operation: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Transaction costs |

|

$ |

(1,617 |

) |

|

$ |

(11,989 |

) |

|

$ |

(68,662 |

) |

|

$ |

(16,586 |

) |

| Operating

results through July 17, 2017 spin-off |

|

— |

|

|

57,147 |

|

|

122,201 |

|

|

226,288 |

|

| |

|

(1,617 |

) |

|

45,158 |

|

|

53,539 |

|

|

209,702 |

|

| |

|

|

|

|

|

|

|

|

| Tax

expense related to the reduction of our taxable REIT subsidiaries

deferred tax assets |

|

(34,800 |

) |

|

— |

|

|

(34,800 |

) |

|

— |

|

| Expense

related to the prepayment of our 2.50% senior unsecured notes due

2019 |

|

(4,836 |

) |

|

— |

|

|

(4,836 |

) |

|

— |

|

| 666 Fifth

Avenue Office Condominium (49.5% interest) |

|

1,103 |

|

|

808 |

|

|

13,164 |

|

|

10,925 |

|

| Income

(loss) from real estate fund investments, net |

|

529 |

|

|

(34,704 |

) |

|

(10,804 |

) |

|

(21,042 |

) |

| Net gain

on extinguishment of Skyline properties debt |

|

— |

|

|

487,877 |

|

|

— |

|

|

487,877 |

|

| Income

from the repayment of our investments in 85 Tenth Avenue loans and

preferred equity |

|

— |

|

|

160,843 |

|

|

— |

|

|

160,843 |

|

| Our share

of impairment on India non-depreciable real estate |

|

— |

|

|

(13,962 |

) |

|

— |

|

|

(13,962 |

) |

|

Impairment loss on our investment in Pennsylvania REIT |

|

— |

|

|

— |

|

|

(44,465 |

) |

|

— |

|

| Net gain

resulting from Urban Edge Properties operating partnership unit

issuances |

|

— |

|

|

— |

|

|

21,100 |

|

|

— |

|

| Net gain

on repayment of our Suffolk Downs JV debt investments |

|

— |

|

|

— |

|

|

11,373 |

|

|

— |

|

| Our share

of write-off of deferred financing costs |

|

— |

|

|

— |

|

|

(3,819 |

) |

|

— |

|

| Preferred

share issuance costs (Series J redemption) |

|

— |

|

|

— |

|

|

— |

|

|

(7,408 |

) |

|

Other |

|

2,945 |

|

|

(2,324 |

) |

|

3,801 |

|

|

(2,454 |

) |

| |

|

(36,676 |

) |

|

643,696 |

|

|

4,253 |

|

|

824,481 |

|

| Noncontrolling

interests' share of above adjustments |

|

2,274 |

|

|

(39,201 |

) |

|

(264 |

) |

|

(50,293 |

) |

| Total of certain items

that impact FFO, net |

|

$ |

(34,402 |

) |

|

$ |

604,495 |

|

|

$ |

3,989 |

|

|

$ |

774,188 |

|

| |

|

|

|

|

|

|

|

|

| FFO, as adjusted

(non-GAAP) |

|

$ |

187,553 |

|

|

$ |

193,239 |

|

|

$ |

713,816 |

|

|

$ |

683,395 |

|

| Per

diluted share (non-GAAP) |

|

$ |

0.98 |

|

|

$ |

1.02 |

|

|

$ |

3.73 |

|

|

$ |

3.59 |

|

|

|

|

(1) See page 5 for a reconciliation of our net

income attributable to common shareholders to FFO (non-GAAP) for

the quarters and years ended December 31, 2017 and 2016.

VORNADO REALTY

TRUSTOPERATING RESULTS FOR THE QUARTERS AND YEARS

ENDEDDECEMBER 31, 2017 AND 2016

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| (Amounts in thousands,

except per share amounts) |

For the Quarters Ended |

|

For the Years Ended |

| |

December 31, |

|

December 31, |

| |

2017 |

|

2016 |

|

2017 |

|

2016 |

| Revenues |

$ |

536,226 |

|

|

$ |

513,974 |

|

|

$ |

2,084,126 |

|

|

$ |

2,003,742 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Income from continuing

operations |

$ |

52,278 |

|

|

$ |

195,428 |

|

|

$ |

277,356 |

|

|

$ |

577,010 |

|

| Income (loss) from

discontinued operations |

1,273 |

|

|

509,116 |

|

|

(13,228 |

) |

|

404,912 |

|

| Net income |

53,551 |

|

|

704,544 |

|

|

264,128 |

|

|

981,922 |

|

| Less net (income) loss

attributable to noncontrolling interests in: |

|

|

|

|

|

|

|

|

Consolidated subsidiaries |

(7,366 |

) |

|

5,010 |

|

|

(25,802 |

) |

|

(21,351 |

) |

| Operating

Partnership |

(1,853 |

) |

|

(42,244 |

) |

|

(10,910 |

) |

|

(53,654 |

) |

| Net income attributable

to Vornado |

44,332 |

|

|

667,310 |

|

|

227,416 |

|

|

906,917 |

|

| Preferred share

dividends |

(17,013 |

) |

|

(16,129 |

) |

|

(65,399 |

) |

|

(75,903 |

) |

| Preferred share

issuance costs (Series J redemption) |

— |

|

|

— |

|

|

— |

|

|

(7,408 |

) |

| Net income attributable

to common shareholders |

$ |

27,319 |

|

|

$ |

651,181 |

|

|

$ |

162,017 |

|

|

$ |

823,606 |

|

| |

|

|

|

|

|

|

|

| Income per common share

- Basic: |

|

|

|

|

|

|

|

| Income

from continuing operations, net |

$ |

0.14 |

|

|

$ |

0.91 |

|

|

$ |

0.92 |

|

|

$ |

2.35 |

|

| Income

(loss) from discontinued operations, net |

— |

|

|

2.53 |

|

|

(0.07 |

) |

|

2.01 |

|

| Net

income per common share |

$ |

0.14 |

|

|

$ |

3.44 |

|

|

$ |

0.85 |

|

|

$ |

4.36 |

|

| Weighted

average shares outstanding |

189,898 |

|

|

189,013 |

|

|

189,526 |

|

|

188,837 |

|

| |

|

|

|

|

|

|

|

| Income per common share

- Diluted: |

|

|

|

|

|

|

|

| Income

from continuing operations, net |

$ |

0.14 |

|

|

$ |

0.91 |

|

|

$ |

0.91 |

|

|

$ |

2.34 |

|

| Income

(loss) from discontinued operations, net |

— |

|

|

2.52 |

|

|

(0.06 |

) |

|

2.00 |

|

| Net

income per common share |

$ |

0.14 |

|

|

$ |

3.43 |

|

|

$ |

0.85 |

|

|

$ |

4.34 |

|

| Weighted

average shares outstanding |

191,020 |

|

|

190,108 |

|

|

191,258 |

|

|

190,173 |

|

| |

|

|

|

|

|

|

|

| FFO (non-GAAP) |

$ |

153,151 |

|

|

$ |

797,734 |

|

|

$ |

717,805 |

|

|

$ |

1,457,583 |

|

| Per

diluted share (non-GAAP) |

$ |

0.80 |

|

|

$ |

4.20 |

|

|

$ |

3.75 |

|

|

$ |

7.66 |

|

| |

|

|

|

|

|

|

|

| FFO, as adjusted

(non-GAAP) |

$ |

187,553 |

|

|

$ |

193,239 |

|

|

$ |

713,816 |

|

|

$ |

683,395 |

|

| Per

diluted share (non-GAAP) |

$ |

0.98 |

|

|

$ |

1.02 |

|

|

$ |

3.73 |

|

|

$ |

3.59 |

|

| |

|

|

|

|

|

|

|

| Weighted average shares

used in determining FFO per diluted share |

191,063 |

|

|

190,108 |

|

|

191,304 |

|

|

190,173 |

|

|

|

|

|

|

|

The following table reconciles net income attributable to common

shareholders to FFO (non-GAAP):

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| (Amounts in thousands,

except per share amounts) |

For the Quarters Ended |

|

For the Years Ended |

| |

December 31, |

|

December 31, |

| |

2017 |

|

2016 |

|

2017 |

|

2016 |

| Net income attributable

to common shareholders |

$ |

27,319 |

|

|

$ |

651,181 |

|

|

$ |

162,017 |

|

|

$ |

823,606 |

|

| Per

diluted share |

$ |

0.14 |

|

|

$ |

3.43 |

|

|

$ |

0.85 |

|

|

$ |

4.34 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| FFO adjustments: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Depreciation and

amortization of real property |

$ |

106,017 |

|

|

$ |

133,389 |

|

|

$ |

467,966 |

|

|

$ |

531,620 |

|

| Net gains on sale of

real estate |

308 |

|

|

(15,302 |

) |

|

(3,489 |

) |

|

(177,023 |

) |

| Real estate impairment

losses |

— |

|

|

— |

|

|

— |

|

|

160,700 |

|

| Proportionate share of

adjustments to equity in net income of partially owned entities to

arrive at FFO: |

|

|

|

|

|

|

|

|

Depreciation and amortization of real property |

28,247 |

|

|

37,160 |

|

|

137,000 |

|

|

154,795 |

|

| Net gains

on sale of real estate |

(593 |

) |

|

(12 |

) |

|

(17,777 |

) |

|

(2,853 |

) |

| Real

estate impairment losses |

145 |

|

|

792 |

|

|

7,692 |

|

|

6,328 |

|

| |

134,124 |

|

|

156,027 |

|

|

591,392 |

|

|

673,567 |

|

| Noncontrolling

interests' share of above adjustments |

(8,310 |

) |

|

(9,495 |

) |

|

(36,728 |

) |

|

(41,267 |

) |

| FFO adjustments,

net |

$ |

125,814 |

|

|

$ |

146,532 |

|

|

$ |

554,664 |

|

|

$ |

632,300 |

|

| |

|

|

|

|

|

|

|

| FFO attributable to

common shareholders (non-GAAP) |

$ |

153,133 |

|

|

$ |

797,713 |

|

|

$ |

716,681 |

|

|

$ |

1,455,906 |

|

| Convertible preferred

share dividends |

18 |

|

|

21 |

|

|

77 |

|

|

86 |

|

| Earnings allocated to

Out-Performance Plan units |

— |

|

|

— |

|

|

1,047 |

|

|

1,591 |

|

| FFO attributable to

common shareholders plus assumed conversions (non-GAAP) |

$ |

153,151 |

|

|

$ |

797,734 |

|

|

$ |

717,805 |

|

|

$ |

1,457,583 |

|

| Per

diluted share (non-GAAP) |

$ |

0.80 |

|

|

$ |

4.20 |

|

|

$ |

3.75 |

|

|

$ |

7.66 |

|

| |

| |

| |

FFO is computed in accordance with the

definition adopted by the Board of Governors of the National

Association of Real Estate Investment Trusts ("NAREIT"). NAREIT

defines FFO as GAAP net income or loss adjusted to exclude net

gains from sales of depreciated real estate assets, real estate

impairment losses, depreciation and amortization expense from real

estate assets and other specified non-cash items, including the pro

rata share of such adjustments of unconsolidated

subsidiaries. FFO and FFO per diluted share are non-GAAP

financial measures used by management, investors and analysts to

facilitate meaningful comparisons of operating performance between

periods and among our peers because it excludes the effect of real

estate depreciation and amortization and net gains on sales, which

are based on historical costs and implicitly assume that the value

of real estate diminishes predictably over time, rather than

fluctuating based on existing market conditions. FFO does not

represent cash generated from operating activities and is not

necessarily indicative of cash available to fund cash requirements

and should not be considered as an alternative to net income as a

performance measure or cash flow as a liquidity measure. FFO

may not be comparable to similarly titled measures employed by

other companies. A reconciliation of our net income to FFO is

provided above. In addition to FFO, we also disclose FFO, as

adjusted. Although this non-GAAP measure clearly differs from

NAREIT's definition of FFO, we believe it provides a meaningful

presentation of operating performance. Reconciliations of FFO

to FFO, as adjusted are provided on page 3 of this press

release.

Conference Call and Audio

Webcast

As previously announced, the Company will host a

quarterly earnings conference call and an audio webcast on Tuesday,

February 13, 2018 at 10:00 a.m. Eastern Time (ET). The

conference call can be accessed by dialing 800-708-4540 (domestic)

or 847-619-6397 (international) and indicating to the operator the

passcode 46251598. A telephonic replay of the

conference call will be available from 1:00 p.m. ET on

February 13, 2018 through March 15, 2018. To access the

replay, please dial 888-843-7419 and enter the passcode

46251598#. A live webcast of the conference call will be

available on the Company's website at www.vno.com and an online

playback of the webcast will be available on the website for 90

days following the conference call.

CONTACT:

JOSEPH MACNOW(212) 894-7000

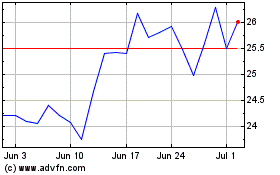

Vornado Realty (NYSE:VNO)

Historical Stock Chart

From Mar 2024 to Apr 2024

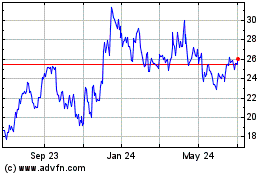

Vornado Realty (NYSE:VNO)

Historical Stock Chart

From Apr 2023 to Apr 2024