Current Report Filing (8-k)

December 29 2017 - 4:40PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM

8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): December 28, 2017

RAMACO RESOURCES, INC.

(Exact name of Registrant as specified in its charter)

|

|

|

|

|

|

|

Delaware

|

|

001-38003

|

|

38-4018838

|

|

(State or other jurisdiction of

incorporation or organization)

|

|

(Commission

File Number)

|

|

(I.R.S. Employer

Identification No.)

|

250 West Main Street, Suite 1800

Lexington, Kentucky 40507

(Address of principal executive offices)

(Zip Code)

Registrant’s Telephone Number, including area code: (859)

244-7455

Not Applicable

(Former

name, former address and former fiscal year, if changed since last report)

Check the appropriate box below if the Form

8-K

filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2.):

|

☐

|

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

|

Soliciting material pursuant to Rule

14a-12

under the Exchange Act (17 CFR

240.14a-12)

|

|

☐

|

|

Pre-commencement

communications pursuant to Rule

14d-2(b)

under the Exchange Act (17 CFR

240.14d-2(b))

|

|

☐

|

|

Pre-commencement

communications pursuant to Rule

13e-4(c)

under the Exchange Act (17 CFR

240.13e-4(c))

|

Indicate by check mark whether the registrant is an emerging growth company as defined

in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule

12b-2

of the Securities Exchange Act of 1934

(§ 240.12b-2

of this

chapter).

Emerging growth company

☒

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended

transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange

Act.

☒

|

Item 5.02.

|

Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements or Certain Officers.

|

On December 28, 2017, the Board of Directors of Ramaco Resources, Inc. (the “

Company

”) determined to, effective as of January 1,

2018, move Mark Clemens from the position of Chief Operating Officer of the Company and appoint him to the title of Executive Vice President and Chief Commercial Officer of the Company.

On December 28, 2017, the Board of Directors of the Company also determined to appoint Christopher L. Blanchard as the Senior Vice President and Chief

Operating Officer of the Company, effective as of January 1, 2018 and immediately following the removal of Mark Clemens from the position of Chief Operating Officer of the Company.

Mr. Blanchard, age 43, has served as an independent contractor to the Company through his company, Carbon Ventures, LLC, and has provided project

management and operational oversight services to the Company and its affiliates since 2013 through the expiration of his consulting agreement on December 31, 2017. From 2015 to 2016, Mr. Blanchard served as Vice President – Operations and

Development for Cutlass Collieries, LLC, a Cline Group Company, where among other duties he was in charge of developing, designing and building a greenfield

sub-sea

coal operation in Nova Scotia, Canada.

Mr. Blanchard previously served as the Director of Operations Support for Alpha Appalachia Services, an Alpha Natural Resources subsidiary, from 2011 to 2012. Mr. Blanchard was President of a subsidiary of Massey Energy Company operating

the Upper Big Branch mine in April 2010 at the time of an explosion. Mr. Blanchard was not charged in connection with the incident. Mr. Blanchard received his Bachelor of Science in Mining Engineering from Virginia Polytechnic Institute

and State University. Mr. Blanchard also holds a Masters of Business Administration from the University of Charleston and a Master of Science in Systems Engineering from Missouri University of Science and Technology.

There are no arrangements or understandings between Mr. Blanchard and any other person pursuant to which he was selected as an officer of the Company.

Mr. Blanchard does not have any family relationship with any director or executive officer of the Company or any person nominated or chosen by the Company to be a director or executive officer.

As described above, Mr. Blanchard is the owner and president of Carbon Ventures, LLC. Carbon Ventures, LLC and Ramaco Resources, LLC, a subsidiary of the

Company, are parties to a consulting agreement which terminates December 31, 2017 whereby Mr. Blanchard provided project management and development services for the Company and its affiliates (the “

Consulting Agreement

”) for a

period that began on September 16, 2016. The Consulting Agreement provides for a monthly retainer of $22,916.67, along with additional specified project-related compensation.

Pursuant to the terms of his offer letter, Mr. Blanchard will receive a base salary of $275,000 per annum and he is eligible to receive an annual

performance-based bonus with a target value equal to fifty percent (50%) of his base salary. Mr. Blanchard will also be eligible for incentive compensation under the Company’s Long-Term Incentive Plan with a value of 100% of his base

salary at the time of grant. Any such award will be subject to the terms and conditions of the Company’s Long-Term Incentive Plan and applicable award agreement, which may include both performance and time-based vesting. Mr. Blanchard is

eligible to participate in the Company’s benefit programs as made generally available to other senior executives.

In connection with

Mr. Blanchard’s appointment as an officer, the Company has entered into an indemnification agreement effective as of January 1, 2018 (the “

Indemnification Agreement

”) with Mr. Blanchard that requires the Company

to indemnify Mr. Blanchard to the fullest extent permitted under Delaware law against liability that may arise by reason of his service to the Company, and to advance certain expenses incurred as a result of any proceeding against him as to

which he could be indemnified. The foregoing description of the Indemnification Agreement is not complete and is qualified in its entirety by reference to the full text of the Indemnification Agreement, which is attached as Exhibit 10.1 to this

Current Report on Form

8-K

and incorporated into this Item 5.02 by reference.

1

|

Item 9.01.

|

Financial Statements and Exhibits.

|

2

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has caused this report to be signed on its behalf by the

undersigned hereunto duly authorized.

|

|

|

|

|

RAMACO RESOURCES, INC.

|

|

|

|

|

By:

|

|

/s/ Randall W. Atkins

|

|

|

|

|

|

Name:

|

|

Randall W. Atkins

|

|

Title:

|

|

Executive Chairman

|

Date: December 29, 2017

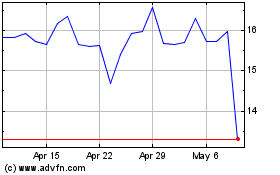

Ramaco Resources (NASDAQ:METC)

Historical Stock Chart

From Mar 2024 to Apr 2024

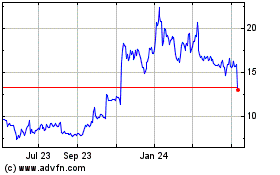

Ramaco Resources (NASDAQ:METC)

Historical Stock Chart

From Apr 2023 to Apr 2024