UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM

6-K

REPORT OF

FOREIGN PRIVATE ISSUER

PURSUANT TO RULE

13a-16

OR

15d-16

OF THE SECURITIES EXCHANGE ACT OF 1934

For the month of December 2017

Commission File Number

001-36866

SUMMIT THERAPEUTICS PLC

(Translation of registrant’s name into English)

136a Eastern

Avenue

Milton Park, Abingdon

Oxfordshire OX14 4SB

United Kingdom

(Address

of principal executive office)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form

20-F

or Form

40-F:

FORM

20-F ☒ FORM

40-F ☐

Indicate by check mark if the registrant is submitting the Form

6-K

in paper as permitted by Regulation

S-T

Rule 101(b)(1): ☐

Indicate by check mark if the registrant is submitting the Form

6-K

in paper as permitted by Regulation

S-T

Rule 101(b)(7): ☐

Indicate by check mark whether the registrant by furnishing the information contained in this form is also thereby furnishing the information to the

Commission pursuant to Rule

12g3-2(b)

under the Securities Exchange Act of 1934:

YES ☐ NO ☒

If “Yes” is marked, indicate below the file number assigned to the registrant in connection with Rule

12g3-2(b):

On December 23, 2017, Summit Therapeutics plc (the “Company”) entered into a Share Purchase

Agreement (the “Share Purchase Agreement”) with the shareholders (the “Sellers”) of Discuva Limited, a private limited company organized under the laws of England and Wales (“Discuva”), pursuant to which the Company

acquired all of the outstanding share capital of Discuva (the “Transaction”). The Transaction closed on the same day. Discuva is a discovery stage company with a bacterial genetics-based platform that facilitates the discovery and

development of differentiated antibiotics (the “Platform”). With this acquisition, the Company believes it is now better placed to advance additional potential drug treatments for patients with serious bacterial infections where there is a

substantial unmet need, while in parallel continuing to advance its clinical and research program in Duchenne muscular dystrophy.

Under the terms of the

Share Purchase Agreement, the Company has agreed to pay the Sellers total upfront consideration comprised of (A) £5.0 million in cash plus an amount equal to the cash and cash equivalents of Discuva minus (i) indebtedness, (ii) any

other liabilities of Discuva at the closing of the Transaction that had arisen outside of the ordinary course of business and (iii) funds to be held in escrow and (B) £5.0 million of the Company’s ordinary shares, satisfied by

the issue of 2,934,272 fully-paid, new ordinary shares of the Company at a price per share of £1.704.

In addition, the Sellers will be entitled to

receive contingent payments from the Company based on (i) the receipt of potential research and development tax credits to which Discuva may be entitled for the period from April 1, 2015 to the date of the Share Purchase Agreement and

(ii) approximately

one-half

of the economic benefit from any amounts received in connection with certain payments made to the Company under an existing collaboration agreement between Discuva and F.

Hoffman – La Roche Limited (the “Roche Agreement”). Separately, certain employees, former employees and former directors of Discuva are eligible for further payments from Discuva of up to £7.9 million based on specified

development and clinical milestones related to proprietary product candidates developed under the Platform.

In connection with the Transaction, the

ordinary shares issued as consideration were issued pursuant to an exemption from registration under Regulation S of the Securities Act of 1933, as amended (the “Securities Act”), based in part on the Sellers’ representations to the

Company that none of the Sellers are “U.S. persons” as defined under the Securities Act. The ordinary shares are expected to be admitted to trading on AIM on or about December 29, 2017. Under the Share Purchase Agreement, the Sellers

have agreed not to sell, transfer or otherwise dispose of, or create any encumbrance over any of, the ordinary shares received as consideration until September 23, 2018 (the

“Lock-up

Period”),

subject to certain limited exceptions. Following the

Lock-up

Period, each of the Sellers has agreed for a period of twelve months to only dispose of their ordinary shares in accordance with certain orderly

market undertaking provisions specified in the Share Purchase Agreement, which, among other things, limit the number of ordinary shares each Seller may dispose of during such twelve-month period.

The Share Purchase Agreement also prohibits the Sellers from engaging in certain business activities which are competitive with the business of Discuva at the

time of the Transaction and from soliciting customers or hiring employees of Discuva, subject to certain limited exceptions as set forth in the Share Purchase Agreement, for a period of two years following the date of the Share Purchase Agreement.

The Share Purchase Agreement contains customary representations and warranties that the Company and the Sellers made to each other as of specific dates.

The assertions embodied in those representations and warranties were made solely for purposes of the Share Purchase Agreement and may be subject to important qualifications and limitations agreed to by the Company and the Sellers in connection with

negotiating its terms. Moreover, the representations and warranties may be subject to a contractual standard of materiality that may be different from what may be viewed as material to stockholders or may have been used for the purpose of allocating

risk between the Company and Sellers rather than establishing matters as facts. For the foregoing reasons, no person should rely on such representations and warranties as statements of factual information at the time they were made or otherwise.

The foregoing description of certain terms of the Share Purchase Agreement does not purport to be complete and is

qualified in its entirety by reference to the Share Purchase Agreement that the Company intends to file as an exhibit to its annual report on Form

20-F

for the fiscal year ending January 31, 2018. The

press release announcing the Share Purchase Agreement is attached hereto as Exhibit 99.1.

Forward-looking Statements

Any statements in this report about the Company’s future expectations, plans and prospects, including but not limited to, statements about the potential

benefits and future operation of the acquired Platform or Discuva, including any potential future payments to or from the Company related thereto, clinical and preclinical development of the Company’s product candidates and the potential for

their commercialization, the therapeutic potential of the Company’s product candidates, the potential submission of applications for regulatory approvals, the sufficiency of the Company’s cash resources, and the timing of initiation,

completion and availability of data from clinical trials, and other statements containing the words “anticipate,” “believe,” “continue,” “could,” “estimate,” “expect,” “intend,”

“may,” “plan,” “potential,” “predict,” “project,” “should,” “target,” “would,” and similar expressions, constitute forward looking statements within the meaning of The

Private Securities Litigation Reform Act of 1995. The Company’s actual results, performance or achievements could differ materially from those expressed or implied by forward-looking statements it makes as a result of a variety of risks and

uncertainties, including those related to: the Company’s ability to effectively use the Platform to identify new potential drug development candidates; the Company’s ability to realize the anticipated benefits of the Transaction, including

the possibility that the expected benefits from the Transaction will not be realized or will not be realized within the expected time period; negative effects of the announcement of the Transaction on the market price of the Company’s ordinary

shares and/or American Depository Shares; significant transaction costs, unknown liabilities, the risk of litigation related to the Transaction, as well as other business effects, including the effects of industry, market, economic, political or

regulatory conditions; changes in tax and other laws, regulations, rates and policies; the sufficiency of the Company’s cash resources and its ability to obtain adequate financing in the future for its foreseeable and unforeseeable operating

expenses and capital requirements and expenditures other factors discussed in the “Risk Factors” section of filings that the Company makes with the Securities and Exchange Commission including the Company’s Annual Report on Form

20-F

for the fiscal year ended January 31, 2017. Accordingly, readers should not place undue reliance on forward-looking statements or information. In addition, any forward-looking statements included in this

report represent the Company’s views only as of the date of this report and should not be relied upon as representing the Company’s views as of any subsequent date. The Company specifically disclaims any obligation to update any

forward-looking statements included in this Report on Form

6-K.

The information in this Report on Form

6-K,

including Exhibit 99.1, shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “

Exchange Act

”), or incorporated by

reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as expressly set forth by specific reference in such a filing.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned,

thereunto duly authorized.

|

|

|

|

|

|

|

SUMMIT THERAPEUTICS PLC

|

|

|

|

|

By:

|

|

/s/ Erik Ostrowski

|

|

|

|

Erik Ostrowski

|

|

|

|

Chief Financial Officer

|

Date: December 26, 2017

EXHIBIT INDEX

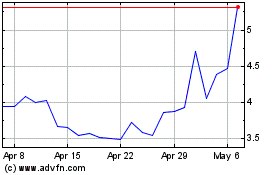

Summit Therapeutics (NASDAQ:SMMT)

Historical Stock Chart

From Mar 2024 to Apr 2024

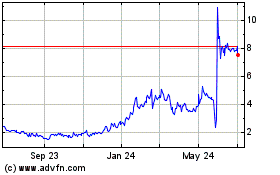

Summit Therapeutics (NASDAQ:SMMT)

Historical Stock Chart

From Apr 2023 to Apr 2024