Report of Foreign Issuer (6-k)

December 26 2017 - 6:41AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

__________________________________

FORM 6-K

__________________________________

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16 under

the Securities Exchange Act of 1934

For the month period ended December 31, 2017

Commission File Number 0-28564

__________________________________

QIAGEN N.V.

__________________________________

Hulsterweg 82

5912 PL Venlo

The Netherlands

__________________________________

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F

x

Form 40-F

o

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1):

o

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7):

o

QIAGEN N.V.

Form 6-K

TABLE OF CONTENTS

|

|

|

|

|

|

|

|

|

Item

|

Page

|

|

Other Information

|

|

|

Signatures

|

|

|

Exhibit Index

|

|

OTHER INFORMATION

On December 22, 2017, QIAGEN N.V. (Nasdaq: QGEN; Frankfurt, Prime Standard: QIA) issued a press release announcing consequences of new U.S. tax legislation. The press release is furnished herewith as Exhibit 99.1 and is incorporated by reference herein.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

QIAGEN N.V.

|

|

|

|

|

|

|

By:

|

/s/ Roland Sackers

|

|

|

|

Roland Sackers

|

|

|

|

Chief Financial Officer

|

|

|

|

|

|

|

Date:

|

December 22, 2017

|

EXHIBIT INDEX

|

|

|

|

|

|

|

|

|

|

|

Exhibit

No.

|

|

Exhibit

|

|

99.1

|

|

Press Release dated December 22, 2017

|

Exhibit 99.1

QIAGEN to take impairment on deferred tax assets, informs on expected impacts of new U.S. tax law and other changes in global tax environment

Germantown, Maryland, and Hilden, Germany, December 22, 2017 -

QIAGEN N.V. (NASDAQ: QGEN; Frankfurt Prime Standard: QIA) announces that, mainly as a consequence of the new U.S. tax legislation, it will take an after-tax charge on net income of approximately $110-120 million (or about $0.47-$0.52 per share) in the fourth quarter of 2017, and an additional after-tax charge in 2018 of approximately $7 million (or about $0.03 per share).

These charges, the vast majority of which involve non-cash items, do not affect QIAGEN’s adjusted EPS forecast for the fourth quarter and full-year 2017, nor the forecast to be provided for full-year 2018 in January 2018, since these charges will be excluded from adjusted results.

For the charge in the fourth quarter of 2017, approximately $100-110 million of the write-off involve non-cash items related to deferred tax assets, revaluation of deferred tax liabilities and other tax provisions. QIAGEN has proactively initiated additional restructuring initiatives that will mitigate some of the impact of the new U.S. tax law. As a result, a new after-tax charge of approximately $10 million is planned to be taken in the fourth quarter of 2017. An additional after-tax charge of approximately $7 million is planned to be taken during 2018 related to these specific measures. QIAGEN notes that it has now completed its previously announced efficiency programs with these measures and does not expect any additional material non-M&A related restructuring charges in 2018.

Based on an initial review of the new U.S. legislation, as well as the current global tax environment, QIAGEN currently expects a preliminary adjusted tax rate for full-year 2018 of approximately 20-21%, mainly due to the new U.S. limitations on interest deductions. This preliminary outlook for 2018 compares to an adjusted tax rate of approximately 17-18% expected for full-year 2017, and to a mid-term outlook provided at QIAGEN’s analyst and investor day in November 2016 for an adjusted tax rate of approximately 19-20% in the period from 2018 to 2020.

QIAGEN plans to release further details when it reports results for the fourth quarter and full-year 2017, which is scheduled for January 31, 2018.

About QIAGEN

QIAGEN N.V., a Netherlands-based holding company, is the leading global provider of Sample to Insight solutions that enable customers to gain valuable molecular insights from samples containing the building blocks of life. Our sample technologies isolate and process DNA, RNA and proteins from blood, tissue and other materials. Assay technologies make these biomolecules visible and ready for analysis. Bioinformatics software and knowledge bases interpret data to report relevant, actionable insights. Automation solutions tie these together in seamless and cost-effective workflows. QIAGEN provides solutions to more than 500,000 customers around the world in Molecular Diagnostics (human healthcare), Applied Testing (forensics, veterinary testing and food safety), Pharma (pharma and biotech companies) and Academia (life sciences research). As of September 30, 2017, QIAGEN employed approximately 4,600 people in over 35 locations worldwide. Further information can be found at

http://www.qiagen.com.

Certain statements contained in this press release may be considered forward-looking statements within the meaning of Section 27A of the U.S. Securities Act of 1933, as amended, and Section 21E of the U.S. Securities Exchange Act of 1934, as amended, including statements regarding the amount of an anticipated charge in the fourth quarter of 2017, the anticipated after-tax impact that charge on 2017 net income, the amount and non-cash nature of anticipated write-offs related to deferred tax assets, revaluation of deferred tax liabilities and other tax provisions, the amount of pre-tax and after-tax restructuring charges expected to be taken in the fourth quarter of 2017 and 2018 and QIAGEN’s expected adjusted tax rate of approximately 17-18% for full-year 2017. These statements are forward-looking and are based on current expectations and assumptions that involve a number of uncertainties and risks. Such uncertainties and risks include, but are not limited to, risks associated with the content and consequences of the recently signed U.S. tax legislation, management of growth and international operations (including the effects of currency fluctuations, regulatory processes and dependence on logistics), variability of operating results and allocations between customer classes, the commercial development of markets for our products to customers in academia, pharma, applied testing and molecular diagnostics; changing relationships with customers, suppliers and strategic partners; competition; rapid or unexpected changes in technologies; fluctuations in demand for QIAGEN's products (including fluctuations due to general economic conditions, the level and timing of customers' funding, budgets and other factors); our ability to obtain regulatory approval of our products; difficulties in successfully adapting QIAGEN's products to integrated solutions and producing such products; the ability of QIAGEN to identify and develop new products and to differentiate and protect our products from competitors' products; market acceptance of QIAGEN's new products and the integration of acquired technologies and businesses. For further information, please refer to the discussions in reports that QIAGEN has filed with, or furnished to, the U.S. Securities and Exchange Commission (SEC).

###

Contacts:

QIAGEN

|

|

|

|

|

|

|

|

Investor Relations

|

|

Public Relations

|

|

|

John Gilardi

|

+49 2103 29 11711

|

Dr. Thomas Theuringer

|

+49 2103 29 11826

|

|

e-mail: ir@QIAGEN.com

|

|

e-mail: pr@QIAGEN.com

|

|

|

|

|

|

|

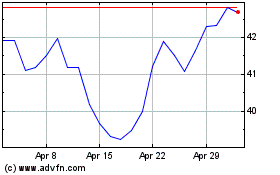

Qiagen NV (NYSE:QGEN)

Historical Stock Chart

From Mar 2024 to Apr 2024

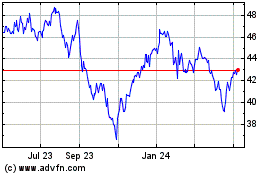

Qiagen NV (NYSE:QGEN)

Historical Stock Chart

From Apr 2023 to Apr 2024