Use these links to rapidly review the document

TABLE OF CONTENTS

TABLE OF CONTENTS

Table of Contents

Filed Pursuant to Rule 424(b)(3)

Registration Number 333-221986

The information in this preliminary prospectus supplement is not complete and may be changed. This preliminary prospectus supplement and the accompanying

prospectus are not an offer to sell these securities and are not soliciting an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

SUBJECT TO COMPLETION. DATED DECEMBER 11, 2017

PRELIMINARY PROSPECTUS SUPPLEMENT

(TO PROSPECTUS DATED DECEMBER 11, 2017)

5,000,000 Shares

GMS Inc.

Common Stock

The selling stockholders identified in this prospectus supplement are offering 5,000,000 shares of common stock of GMS Inc. We are not

selling any shares of common stock of GMS Inc. in this offering, and we will not receive any of the proceeds from the sale of shares of our common stock by the selling stockholders.

Our

common stock is listed on the New York Stock Exchange under the symbol "GMS". The last reported sale price of our common stock on December 8, 2017 was $38.57 per share.

Investing in our common stock involves risk. See "Risk Factors" on page S-3 of this prospectus supplement, in the accompanying prospectus

and in the documents incorporated by reference in this prospectus supplement and the accompanying prospectus to read about factors you should consider before buying shares of our common stock.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Price to Public

|

|

Underwriting

Discounts and

Commissions(1)

|

|

Proceeds to

Selling

Stockholders

|

|

|

|

Per Share

|

|

$

|

|

$

|

|

$

|

|

|

|

Total

|

|

$

|

|

$

|

|

$

|

|

|

-

(1)

-

We

have agreed to reimburse the underwriter for certain expenses in connection with this offering. See "Underwriting."

Delivery

of the shares of common stock will be made on or about , 2017.

Neither the Securities and Exchange Commission nor any other regulatory body has approved or disapproved of these securities or determined if this prospectus

supplement or the accompanying prospectus are truthful or complete. Any representation to the contrary is a criminal offense.

Morgan Stanley

The date of this prospectus supplement is , 2017.

Table of Contents

TABLE OF CONTENTS

Prospectus Supplement

Prospectus

You

should rely only on the information contained or incorporated by reference in this prospectus supplement, the accompanying prospectus and any free writing prospectus prepared by us

or on our behalf that we have referred you to. We have not, the selling stockholders have not and the underwriter has not authorized anyone to provide you with additional information or information

different from that contained or incorporated by reference in this prospectus supplement, the accompanying prospectus or any free writing prospectus prepared by us or on our behalf that we have

referred you to. If anyone provides you with additional, different or inconsistent information, you should not rely on it. Offers to sell, and solicitations of offers to buy, shares of our common

stock are being made only in jurisdictions where offers and sales are permitted.

The

information contained or incorporated by reference in this prospectus supplement or the accompanying prospectus is accurate only as of their respective dates or on the date or dates

which are specified in such documents, regardless of the time of delivery of this prospectus supplement or of any sale of our common stock. Our business and financial condition may have changed since

such date.

S-i

Table of Contents

No

action is being taken in any jurisdiction outside the United States to permit a public offering of common stock or possession or distribution of this prospectus supplement and the

accompanying prospectus in that jurisdiction. Persons who come into possession of this prospectus supplement and the accompanying prospectus in jurisdictions outside the United States are required to

inform themselves about and to observe any restriction as to this offering and the distribution of this prospectus supplement and the accompanying prospectus applicable to those jurisdictions.

S-ii

Table of Contents

ABOUT THIS PROSPECTUS SUPPLEMENT

This document is in two parts. The first part, the prospectus supplement, is part of a registration statement on Form S-3 that we have

filed with the Securities and Exchange Commission (the "SEC") using a "shelf" registration process. Pursuant to the accompanying prospectus dated December 11, 2017, the selling stockholders

may, from time to time, offer and sell our common stock in one or more offerings or resales. This prospectus supplement describes the specific terms of this offering and also adds to and updates or

supersedes information contained in the accompanying prospectus and the documents incorporated by reference in the accompanying prospectus. The second part, the accompanying prospectus, gives more

general information, some of which may not apply to this offering. You should read both this prospectus supplement, the accompanying prospectus and any free writing prospectus relating to this

offering before deciding to invest in our common stock. In making your investment decision, you should also rely only on the information contained or incorporated by reference in this prospectus

supplement, in the accompanying prospectus and in any free writing prospectus with respect to this offering filed by us with the SEC. See "Incorporation of Certain Information by Reference" and "Where

You Can Find More Information" in this prospectus supplement.

The

information incorporated by reference is deemed to be part of this prospectus supplement, and information that we file with the SEC will automatically update and supersede the

previously filed information. In the case of a conflict or inconsistency between information in this prospectus supplement and/or information incorporated by reference in this prospectus supplement,

you should rely on the information contained in the document that was filed later.

Unless otherwise indicated or the context otherwise requires, all references to "the Company," \"GMS," "we," "us," "our" and other similar terms refer to

GMS Inc. and its subsidiaries.

S-iii

Table of Contents

PROSPECTUS SUPPLEMENT SUMMARY

Our Company

Founded in 1971, we are the leading North American distributor of wallboard and suspended ceilings systems, or ceilings. Our core customer is

the interior contractor, who typically installs wallboard, ceilings and our other interior construction products in commercial and residential buildings. As a leading specialty distributor, we serve

as a critical link between our suppliers and a highly fragmented customer base of over 20,000 contractors. Our operating model combines a national platform with a local go-to-market strategy through

over 210 branches across the country. We believe this combination enables us to generate economies of scale while maintaining the high service levels, entrepreneurial culture and customer intimacy of

a local business.

Our Corporate Information

GMS Inc. is a Delaware corporation. Our principal executive office is located at 100 Crescent Centre Parkway, Suite 800, Tucker,

Georgia 30084, and our telephone number at that address is (800) 392-4619. We maintain a website at

www.gms.com

. The information contained

on, or that can be accessed through, our website is not a part of, and should not be considered as being incorporated by reference in, this prospectus supplement.

S-1

Table of Contents

The Offering

|

|

|

|

|

Common stock offered by the selling stockholders

|

|

5,000,000 shares.

|

|

Common stock to be outstanding after this offering

|

|

41,030,800 shares.

|

|

Use of proceeds

|

|

The selling stockholders will receive all of the net proceeds from this offering. We will not receive any of the proceeds from the sale of

shares of common stock offered by the selling stockholders. See "Use of Proceeds."

|

|

Dividend policy

|

|

We do not expect to pay any dividends on our common stock for the foreseeable future. See "Dividend Policy."

|

|

New York Stock Exchange symbol

|

|

"GMS"

|

|

Risk factors

|

|

Investing in our common stock involves a high degree of risk. See "Risk Factors" beginning on page S-3 of this prospectus supplement,

in the accompanying prospectus and in the documents incorporated by reference in this prospectus supplement and the accompanying prospectus for a discussion of factors you should carefully consider before investing in our common stock.

|

The

41,030,800 shares of common stock to be outstanding after this offering is based on the number of shares outstanding as of December 1, 2017 and

excludes:

-

•

-

1,990,409 shares of common stock issuable upon the exercise of options outstanding under our existing equity plans as of December 1,

2017 at a weighted average exercise price of $14.33 per share;

-

•

-

21,766 shares of common stock issuable upon the settlement of restricted stock units outstanding under our existing equity plans as of

December 1, 2017;

-

•

-

2,414,484 shares of common stock reserved for future issuance under our existing equity plans; and

-

•

-

2,000,000 shares of common stock reserved for future issuance under our employee stock purchase plan.

S-2

Table of Contents

RISK FACTORS

Investing in our common stock involves a high degree of risk. Before deciding to invest in shares of our common stock,

you should carefully consider the risks described below as well as other factors and information contained or incorporated by reference in this prospectus supplement and the accompanying prospectus,

including the risks set forth under "Risk Factors" in our Annual Report on Form 10-K for the fiscal year ended April 30, 2017, filed with the SEC on June 30, 2017 (which document

is incorporated by reference herein), as well as other risk factors described under the caption "Risk Factors" in any of our filings with the SEC pursuant to Sections 13(a), 13(c), 14 or 15(d)

of the Securities Exchange Act of 1934, as amended (the "Exchange Act"), which are incorporated by reference in this prospectus supplement and the accompanying prospectus. See "Incorporation by

Reference" and "Where You Can Find More Information." The trading price of our common stock could decline due to any of these risks, and you may lose all or part of your

investment.

Risks Relating to this Offering and Ownership of Our Common Stock

The market price of our common stock may be highly volatile, and you may not be able to resell your shares at

or above the public offering price.

The trading price of our common stock could be volatile, and you can lose all or part of your investment. We cannot assure you that an active

public market for our common stock will be sustained. The following factors, in addition to other factors described in this "Risk Factors" section and elsewhere in this prospectus and the documents

incorporated by reference herein, may have a significant impact on the market price of our common stock:

-

•

-

announcements of innovations or new products or services by us or our competitors;

-

•

-

any adverse changes to our relationship with our customers, manufacturers or suppliers;

-

•

-

variations in the costs of products that we distribute;

-

•

-

any legal actions in which we may become involved;

-

•

-

announcements concerning our competitors or the building supply industry in general;

-

•

-

achievement of expected product sales and profitability;

-

•

-

manufacture, supply or distribution shortages;

-

•

-

adverse actions taken by regulatory agencies with respect to our services or the products we distribute;

-

•

-

actual or anticipated fluctuations in our quarterly or annual operating results;

-

•

-

changes in financial estimates or recommendations by securities analysts;

-

•

-

trading volume of our common stock;

-

•

-

sales of our common stock by us, our executive officers and directors or our stockholders (including affiliates of AEA Investors LP,

which we refer to as "AEA") in the future;

-

•

-

general economic and market conditions and overall fluctuations in the U.S. equity markets;

-

•

-

changes in accounting principles; and

-

•

-

the loss of any of our management or key personnel.

In

addition, broad market and industry factors may negatively affect the market price of our common stock, regardless of our actual operating performance, and factors beyond our control

may cause our stock price to decline rapidly and unexpectedly.

S-3

Table of Contents

We may be subject to securities litigation, which is expensive and could divert management attention.

Our share price may be volatile and, in the past, companies that have experienced volatility in the market price of their stock have been

subject to securities class action litigation. We may be the target of this type of litigation in the future. Litigation of this type could result in substantial costs and diversion of management's

attention and resources, which could adversely impact our business. Any adverse determination in litigation could also subject us to significant liabilities.

Because AEA owns a significant percentage of our common stock, it may influence major corporate decisions and

its interests may conflict with the interests of other holders of our common stock.

Upon completion of this offering, certain affiliates of AEA will beneficially own approximately 16.6% of the voting power of our outstanding

common stock. As a result, AEA will be able to influence matters requiring approval by our stockholders and/or our board of directors, including the election of directors and the approval of business

combinations or dispositions and other extraordinary transactions. AEA may also have interests that differ from yours and may vote in a way with which you disagree and which may be adverse to your

interests. The concentration of ownership may have the effect of delaying, preventing or deterring a change of control of our Company, could deprive our stockholders of an opportunity to receive a

premium for their common stock as part of a sale of our Company and may materially and adversely affect the market price of our common stock. In addition, AEA may in the future own businesses that

directly compete with ours. See Item 13, "Certain Relationships and Related Party Transactions and Director Independence" in our Proxy Statement for the 2017 Annual Meeting of Stockholders

filed with the SEC on August 22, 2017, which is incorporated by reference herein.

Sales of a substantial number of shares of our common stock in the public market by us or our existing

stockholders could cause our stock price to fall.

Sales of a substantial number of shares of our common stock in the public market or the perception that these sales might occur, could depress

the market price of our common stock and could impair our ability to raise capital through the sale of additional equity securities. In connection with this offering, we, our directors and executive

officers and the selling stockholders will agree with the underwriter of this offering to enter into lock-up agreements that restrict the stockholders' ability to transfer shares of our common stock,

other than in connection with this offering, for 30 days from the date of this prospectus supplement, subject to certain exceptions. As of December 1, 2017, we had 41,030,800 shares of

our common stock outstanding. Of these shares, all of the 8,050,000 shares sold in our initial public offering, the 7,992,500 shares sold in the secondary offering of our common stock in February 2017

and the 5,750,000 shares sold in the secondary offering of our common stock in June 2017 are, and the 5,000,000 shares to be sold in this offering will be, immediately tradable without restriction

under the Securities Act of 1933, as amended (the "Securities Act"), except that any shares held by our "affiliates," as that term is defined under Rule 144 of the Securities Act, may be sold

only in compliance with the limitations of Rule 144 under the Securities Act. Approximately 7,948,913 shares are subject to the lock-up agreements described above and, subject to limitations,

will become eligible for sale upon expiration of the lock-up period.

In

addition, shares issued or issuable upon exercise of options vested as of the expiration of the lock-up period will be eligible for sale at that time or, if not subject to the lock-up

agreements described above, will be eligible for sale immediately following exercise of such options, except that any shares held by our "affiliates," as that term is defined under Rule 144 of

the Securities Act, may be sold only in compliance with the limitations of Rule 144 under the Securities Act. As of December 1, 2017, we had

outstanding options to purchase an aggregate of 1,990,409 shares of our common stock at a weighted average exercise price of $14.33 per share and 21,766 restricted stock units outstanding. The

S-4

Table of Contents

exercise

of such outstanding options and settlement of such restricted stock units will result in dilution of the value of our common stock and could further depress the market price of our common

stock.

Moreover,

after this offering, the selling stockholders and certain other holders of our common stock will have rights, subject to certain conditions such as the 30-day lock-up

arrangement described above, to require us to file registration statements covering their shares or to include their shares in the registration statement of which this prospectus supplement

forms a part. Registration of these shares under the Securities Act would result in the shares becoming freely tradable without restriction under the Securities Act, except for shares held by

our "affiliates" as defined in Rule 144 under the Securities Act.

If

our existing stockholders sell substantial amounts of our common stock in the public market, or if the public perceives that such sales could occur, this could have an adverse impact

on the market price of our common stock, even if there is no relationship between such sales and the performance of our business. Sales of stock by these stockholders could have a material adverse

effect on the trading price of our common stock.

If securities or industry analysts do not publish or cease publishing research or reports about us, our

business or our markets, or if they adversely change their recommendations or publish negative reports regarding our business or our stock, our stock price and trading volume could decline.

The trading market for our common stock will be influenced by the research and reports that industry or securities analysts may publish about

us, our business, our markets or our competitors. We do not have any control over these analysts and we cannot provide any assurance that analysts will cover us or provide favorable coverage. If any

of the analysts who may cover us adversely change their recommendation regarding our stock, or provide more favorable relative recommendations about our competitors, our stock price could decline. If

any analyst who may cover us were to cease coverage of our Company or fail to regularly publish reports on us, we could lose visibility in the financial markets, which in turn could cause our stock

price or trading volume to decline.

Because we do not intend to declare cash dividends on our shares of common stock in the foreseeable future,

stockholders must rely on appreciation of the value of our common stock for any return on their investment.

We currently anticipate that we will retain future earnings for the development, operation and expansion of our business and do not anticipate

declaring or paying any cash dividends in the foreseeable future. In addition, the terms of the ABL Facility, the First Lien Facility and any future debt agreements may preclude our subsidiaries from

paying dividends to us which, in turn, may preclude us from paying dividends to our stockholders. As a result, we expect that only appreciation of the price of our common stock, if any, will provide a

return to investors in this offering for the foreseeable future.

The requirements of being a public company, including compliance with the reporting requirements of the

Exchange Act and the requirements of the Sarbanes-Oxley Act and the New York Stock Exchange, may strain our resources, increase our costs and distract management, and we may be unable to comply with

these requirements in a timely or cost-effective manner.

As a public company, we are subject to the reporting requirements of the Securities Exchange Act of 1934, as amended, or the Exchange Act, and

the corporate governance standards of the Sarbanes-Oxley Act of 2002, or the Sarbanes-Oxley Act, and the New York Stock Exchange. These requirements place a strain on our management, systems and

resources and we will continue to incur significant legal, accounting, insurance and other expenses. The Exchange Act requires us to file annual, quarterly and current reports with respect to our

business and financial condition within specified time periods and to prepare a proxy statement with respect to our annual meeting of

S-5

Table of Contents

shareholders.

The Sarbanes-Oxley Act requires that we maintain effective disclosure controls and procedures and internal controls over financial reporting. The New York Stock Exchange requires that we

comply with various corporate governance requirements. To maintain and improve the effectiveness of our disclosure controls and procedures and internal controls over financial reporting and comply

with the Exchange Act and the New York Stock Exchange requirements, significant resources and management oversight will be required. This may divert management's attention from other business concerns

and lead to significant costs associated with compliance, which could have a material adverse effect on us and the price of our common stock.

These

requirements and standards could make it significantly more expensive to obtain directors' and officers' liability insurance, and we may be required to accept reduced policy limits

and coverage or incur substantially higher costs to obtain the same or similar coverage available to a non-public company. As a result, it may be more difficult for us to attract and retain qualified

persons to serve on our board of directors or as executive officers. Advocacy efforts by shareholders and third parties may also prompt even more changes in governance and reporting requirements. We

cannot predict or estimate the amount of additional costs we may incur or the timing of these costs.

We have identified material weaknesses in our internal control over financial reporting. If our remediation

of these material weaknesses is not effective, or if we experience additional material weaknesses in the future or otherwise fail to maintain an effective system of internal controls in the future, we

may not be able to accurately or timely report our financial condition or results of operations, which may adversely affect investor confidence in us and, as a result, the value of our common stock.

As a public company, we are required to comply with the SEC's rules implementing Section 302 and 404 of the Sarbanes-Oxley Act, which

require management to certify financial and other information in our quarterly and annual reports and provide an annual management report on the effectiveness of internal control over financial

reporting. In addition, our independent registered public accounting firm is required to provide an annual attestation report on the effectiveness of internal control over financial reporting pursuant

to Section 404(b) of the Sarbanes-Oxley Act of 2002.

During

the course of preparing for our initial public offering, we identified material weaknesses in our internal control over financial reporting. A material weakness is a deficiency,

or a combination of deficiencies, in internal control over financial reporting, such that there is a reasonable possibility that a material misstatement of a company's annual or interim financial

statements will not be prevented or detected on a timely basis. The material weaknesses included an insufficient complement of personnel with a level of U.S. GAAP accounting knowledge

commensurate with our financial reporting requirements, a lack of formal accounting policies and procedures, ineffective IT general computer controls and a lack of controls over the preparation and

review of manual journal entries.

As

of April 30, 2017, we had remediated the material weaknesses associated with personnel and manual journal entries, and we are in the process of remediating the material

weaknesses related to accounting policies and procedures and IT general controls. The material weaknesses related to our accounting policies and procedures and IT general controls could result in our

inability to prevent or detect material misstatements in our financial statement accounts or disclosures. These deficiencies previously resulted in material adjustments to correct the consolidated

financial statements of our wholly owned subsidiary, GYP Holdings III Corp., that were issued for fiscal 2013 and 2014 and could result in material misstatements to our consolidated financial

statements that may not be prevented or detected.

Our

current efforts to design and implement an effective control environment may not be sufficient to remediate the material weaknesses related to accounting policies and procedures and

IT general controls or to prevent future material weaknesses or control deficiencies from occurring. There

S-6

Table of Contents

can

be no assurance that we will not identify additional material weaknesses in our internal control over financial reporting in the future.

If

we fail to effectively remediate the material weaknesses in our control environment, if we identify future material weaknesses in our internal controls over financial reporting or if

we are unable to comply with the demands that we face as a public company, including the requirements of Section 404 of the Sarbanes-Oxley Act, in a timely manner, we may be unable to

accurately report our financial results, or report them within the timeframes required by the SEC. We also could become subject to sanctions or investigations by the New York Stock Exchange, the SEC

or other regulatory authorities. In addition, if we are unable to assert that our internal control over financial reporting is effective, or if our independent registered public accounting firm is

unable to express an opinion as to the effectiveness of our internal control over financial reporting, investors may lose confidence in the accuracy and completeness of our financial reports, we may

face restricted access to the capital markets and our stock price may be adversely affected.

Upon completion of the secondary offering of our common stock on June 7, 2017, we are no longer a

"controlled company" within the meaning of the rules of the New York Stock Exchange. However, we may continue to rely on exemptions from certain corporate governance requirements during the one-year

transition periods.

Following the completion of the secondary offering of our common stock on June 7, 2017, the control group consisting of certain

affiliates of AEA and certain other of our stockholders no longer controls a majority of the voting power of our outstanding common stock. Accordingly, we are no longer a "controlled company" within

the meaning of the New York Stock Exchange corporate governance standards. Consequently, the New York Stock Exchange rules require that we (i) have a majority of independent directors on our

board of directors within one year of the date we no longer qualified as a "controlled company"; (ii) have at least one independent director on each of the compensation and nominating/corporate

governance committees on the date we no longer qualified as a "controlled company," at least a majority of independent directors on each of the compensation and nominating/corporate governance

committees within 90 days of such date and the compensation and nominating/corporate governance committees composed entirely of independent directors within one year of such date and

(iii) perform an annual performance evaluation of the compensation and nominating/corporate governance committees. During this transition period, we may continue to utilize the available

exemptions from certain corporate governance requirements as permitted by the New York Stock Exchange rules. Accordingly, during the transition period you will not

have the same protections afforded to stockholders of companies that are subject to all of the corporate governance requirements of the New York Stock Exchange.

As

of the date of this prospectus supplement, the audit committee of the board of directors consists entirely of independent directors and is in compliance with the rules and regulations

of the SEC and the New York Stock Exchange, and we have at least a majority of independent directors on each of the compensation and nominating/corporate governance committees.

Some provisions of our charter documents and Delaware law may have anti-takeover effects that could

discourage an acquisition of us by others, even if an acquisition would be beneficial to our stockholders, and may prevent attempts by our stockholders to replace or remove our current management.

Provisions in our second amended and restated certificate of incorporation and our amended and restated bylaws, as well as provisions of the

Delaware General Corporation Law, or DGCL, could make it more difficult for a third party to acquire us or increase the cost of acquiring us, even if doing so

S-7

Table of Contents

would

benefit our stockholders, including transactions in which stockholders might otherwise receive a premium for their shares. These provisions include:

-

•

-

establishing a classified board of directors such that not all members of the board are elected at one time;

-

•

-

allowing the total number of directors to be determined exclusively (subject to the rights of holders of any series of preferred stock to elect

additional directors) by resolution of our board of directors and granting to our board the sole power (subject to the rights of holders of any series of preferred stock or rights granted pursuant to

the stockholders' agreement) to fill any vacancy on the board;

-

•

-

limiting the ability of stockholders to remove directors without cause;

-

•

-

authorizing the issuance of "blank check" preferred stock by our board of directors, without further shareholder approval, to thwart a takeover

attempt;

-

•

-

prohibiting stockholder action by written consent (and, thus, requiring that all stockholder actions be taken at a meeting of our

stockholders);

-

•

-

eliminating the ability of stockholders to call a special meeting of stockholders;

-

•

-

establishing advance notice requirements for nominations for election to the board of directors or for proposing matters that can be acted upon

at annual stockholder meetings; and

-

•

-

requiring the approval of the holders of at least two-thirds of the voting power of all outstanding stock entitled to vote thereon, voting

together as a single class, to amend or repeal our amended and restated certificate of incorporation or bylaws.

In

addition, while we have opted out of Section 203 of the DGCL, our second amended and restated certificate of incorporation contains similar provisions providing that we may not

engage in certain "business combinations" with any "interested stockholder" for a three-year period following the time that the stockholder became an interested stockholder,

unless:

-

•

-

prior to such time, our board of directors approved either the business combination or the transaction that resulted in the stockholder

becoming an interested stockholder;

-

•

-

upon consummation of the transaction that resulted in the stockholder becoming an interested stockholder, the interested stockholder owned at

least 85% of our voting stock outstanding at the time the transaction commenced, excluding certain shares; or

-

•

-

at or subsequent to that time, the business combination is approved by our board of directors and by the affirmative vote of holders of at

least two-thirds of our outstanding voting stock that is not owned by the interested stockholder.

Generally,

a "business combination" includes a merger, asset or stock sale or other transaction provided for or through our Company resulting in a financial benefit to the interested

stockholder. Subject to certain exceptions, an "interested stockholder" is a person who owns 15% or more of our outstanding voting stock and the affiliates and associates of such person. For purposes

of this provision, "voting stock" means any class or series of stock entitled to vote generally in the election of directors.

Under

certain circumstances, this provision will make it more difficult for a person who would be an "interested stockholder" to effect certain business combinations with our Company for

a three year period. This provision may encourage companies interested in acquiring us to negotiate in advance with our board of directors in order to avoid the stockholder approval requirement if our

board of directors approves either the business combination or the transaction that results in the stockholder becoming an interested stockholder. These provisions also may have the effect of

preventing changes in our board of

S-8

Table of Contents

directors

and may make it more difficult to accomplish transactions that stockholders may otherwise deem to be in their best interests. See "Description of Capital Stock" in the accompanying

prospectus.

These

anti-takeover defenses could discourage, delay or prevent a transaction involving a change in control of our Company. These provisions could also discourage proxy contests and make

it more difficult for you and other stockholders to elect directors of your choosing and cause us to take corporate actions other than those you desire.

Our second amended and restated certificate of incorporation designates the Court of Chancery of the State of

Delaware as the exclusive forum for certain litigation that may be initiated by our stockholders, which could limit our stockholders' ability to obtain a favorable judicial forum for disputes with us.

Our second amended and restated certificate of incorporation provides that the Court of Chancery of the State of Delaware will be the sole and

exclusive forum for (i) any derivative action or proceeding brought on our behalf, (ii) any action asserting a claim of breach of a fiduciary duty owed to us or our stockholders by any

of our directors, officers, employees or agents, (iii) any action asserting a claim against us arising under the DGCL or (iv) any action asserting a claim against us that is governed by

the internal affairs doctrine. By becoming a stockholder in our Company, you will be deemed to have notice of and have consented to the provisions of our second amended and restated certificate of

incorporation related to choice of forum. The choice of forum provision in our second amended and restated certificate of incorporation may limit our stockholders' ability to obtain a favorable

judicial forum for disputes with us.

S-9

Table of Contents

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This prospectus supplement, the accompanying prospectus and the documents incorporated by reference herein contain "forward-looking statements"

within the meaning of the Private Securities Litigation Reform Act of 1995, Section 27A of the Securities Act and Section 21E of the Exchange Act. You can generally identify

forward-looking statements by our use of forward-looking terminology such as "anticipate," "believe," "continue," "could," "estimate," "expect," "intend," "may," "might," "plan," "potential,"

"predict," "seek," or "should," or the negative thereof or other variations thereon or comparable terminology. In particular, statements about the markets in which we operate, including growth of our

various markets, and statements about our expectations, beliefs, plans, strategies, objectives, prospects, assumptions or future events or performance contained or incorporated by reference in this

prospectus supplement and the accompanying prospectus are forward-looking statements.

We

have based these forward-looking statements on our current expectations, assumptions, estimates and projections. While we believe these expectations, assumptions, estimates and

projections are reasonable, such forward-looking statements are only predictions and involve known and unknown risks and uncertainties, many of which are beyond our control. These and other important

factors, including those discussed or incorporated by reference in this prospectus supplement and the accompanying prospectus may cause our actual results, performance or achievements to differ

materially from any future results, performance or achievements expressed or implied by these forward-looking statements. Some of the factors that could cause actual results to differ materially from

those expressed or implied by the forward-looking statements include:

-

•

-

general economic and financial conditions;

-

•

-

our dependency upon the commercial and residential construction and residential repair and remodeling markets;

-

•

-

competition in our highly fragmented industry and the markets in which we operate;

-

•

-

the fluctuations in prices of the products we distribute;

-

•

-

the consolidation of our industry;

-

•

-

our inability to pursue strategic transactions and open new branches;

-

•

-

our inability to expand into new geographic markets;

-

•

-

product shortages and potential loss of relationships with key suppliers;

-

•

-

the seasonality of the commercial and residential construction markets;

-

•

-

the potential loss of any significant customers;

-

•

-

exposure to product liability and various other claims and litigation;

-

•

-

our inability to attract key employees;

-

•

-

rising health care costs;

-

•

-

the reduction of the quantity of products our customers purchase;

-

•

-

the credit risk from our customers;

-

•

-

our inability to renew leases for our facilities;

-

•

-

our inability to effectively manage our inventory as our sales volume increases or the prices of the products we distribute fluctuate;

S-10

Table of Contents

-

•

-

our inability to engage in activities that may be in our best long-term interests because of restrictions in our debt agreements;

-

•

-

our current level of indebtedness and our potential to incur additional indebtedness;

-

•

-

our inability to obtain additional financing on acceptable terms, if at all;

-

•

-

our holding company structure;

-

•

-

an impairment of our goodwill;

-

•

-

the impact of federal, state and local regulations;

-

•

-

the cost of compliance with environmental, health and safety laws and other regulations;

-

•

-

significant increases in fuel costs or shortages in the supply of fuel;

-

•

-

a disruption or breach in our IT systems;

-

•

-

natural or man-made disruptions to our facilities; and

-

•

-

other risks and uncertainties, including those listed under "Risk Factors" in this prospectus supplement, in the accompanying prospectus and in

the documents incorporated by reference in this prospectus supplement and the accompanying prospectus.

Given

these risks and uncertainties, you are cautioned not to place undue reliance on such forward-looking statements. The forward-looking statements contained or incorporated by

reference in this prospectus supplement and the accompanying prospectus are not guarantees of future performance and our actual results of operations, financial condition and liquidity, and the

development of the industry in which we operate, may differ materially from the forward-looking statements contained or incorporate by reference in this prospectus supplement and the accompanying

prospectus. In addition, even if our results of operations, financial condition and liquidity, and events in the industry in which

we operate, are consistent with the forward-looking statements contained or incorporated by reference in this prospectus supplement and the accompanying prospectus, they may not be predictive of

results or developments in future periods.

Any

forward-looking statement included or incorporated by reference in this prospectus supplement and the accompanying prospectus speaks only as of the date of such statement. Except as

required by law, we do not undertake any obligation to update or revise, or to publicly announce any update or revision to, any of the forward-looking statements, whether as a result of new

information, future events or otherwise, after the date of this prospectus supplement. You should, however, review the factors and risks we describe in the reports we will file from time to time with

the SEC after the date of this prospectus supplement.

S-11

Table of Contents

USE OF PROCEEDS

The selling stockholders will receive all of the net proceeds from the sale of shares of our common stock in this offering.

We

will not receive any proceeds from the sale of shares of our common stock offered by the selling stockholders. We will, however, bear the costs associated with the sale of shares by

the selling stockholders, other than any underwriting discounts and commissions, which will be borne by the selling stockholders.

S-12

Table of Contents

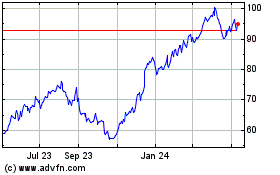

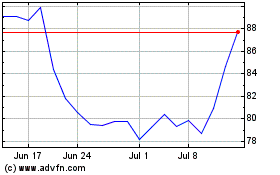

PRICE RANGE OF COMMON STOCK

Our common stock has been listed on the New York Stock Exchange since May 26, 2016. Our initial public offering was priced at $21.00 per

share on May 25, 2016. Prior to that date, there was no public market for our stock. The following table sets forth, for the indicated periods, the high and low sales prices per share for our

common stock on the New York Stock Exchange.

|

|

|

|

|

|

|

|

|

|

|

High

|

|

Low

|

|

|

Fiscal 2017:

|

|

|

|

|

|

|

|

|

First quarter (starting May 26, 2016)

|

|

$

|

26.42

|

|

$

|

19.28

|

|

|

Second quarter

|

|

$

|

25.25

|

|

$

|

20.23

|

|

|

Third quarter

|

|

$

|

31.62

|

|

$

|

20.51

|

|

|

Fourth quarter

|

|

$

|

36.76

|

|

$

|

28.22

|

|

|

Fiscal 2018:

|

|

|

|

|

|

|

|

|

First quarter

|

|

$

|

36.99

|

|

$

|

27.20

|

|

|

Second quarter

|

|

$

|

36.08

|

|

$

|

27.83

|

|

|

Third quarter (through December 8, 2017)

|

|

$

|

39.98

|

|

$

|

32.97

|

|

On

December 8, 2017, the last reported sale price of our common stock on the New York Stock Exchange was $38.57 per share. As of December 1, 2017, we had 35 holders of

record of our common stock. The actual number of stockholders is greater than this number of record holders, and includes stockholders who are beneficial owners, but whose shares are held in street

name by brokers and other nominees. This number of holders of record also does not include stockholders whose shares may be held in trust by other entities.

S-13

Table of Contents

DIVIDEND POLICY

We do not currently expect to pay any cash dividends on our common stock for the foreseeable future. Instead, we intend to retain future

earnings, if any, for the future operation and expansion of our business and the repayment of debt. Any determination to pay dividends in the future will be at the discretion of our board of directors

and will depend upon our results of operations, cash requirements, financial condition, contractual restrictions, restrictions imposed by applicable laws and other factors that our board of directors

may deem relevant. Our business is conducted through our subsidiaries. Dividends, distributions and other payments from, and cash generated by, our subsidiaries will be our principal sources of cash

to repay indebtedness, fund operations and pay dividends. Accordingly, our ability to pay dividends to our stockholders is dependent on the earnings and distributions of funds from our subsidiaries.

In addition, the covenants in the agreements governing our existing indebtedness significantly restrict the ability of our subsidiaries to pay dividends or otherwise transfer assets to us. See "Risk

Factors—Risks Relating to Our Business and Industry—Because we are a holding company with no operations of our own, we are financially dependent on receiving distributions from

our subsidiaries and we could be harmed if such distributions could not be made in the future" in our Annual Report on Form 10-K for the fiscal year ended April 30, 2017, which is

incorporated by reference herein, and "Risk Factors—Risks Relating to this Offering and Ownership of Our Common Stock—Because we do not intend to declare cash dividends on our

shares of common stock in the foreseeable future, stockholders must rely on appreciation of the value of our common stock for any return on their investment" in this prospectus supplement.

S-14

Table of Contents

SELLING STOCKHOLDERS

The following table sets forth information regarding the beneficial ownership of our common stock held by the selling stockholders as of

December 1, 2017, before and after giving effect to this offering by the selling stockholders.

Information

with respect to beneficial ownership has been furnished to us by the selling stockholders listed in the table below. The amounts and percentages of our common stock

beneficially owned are reported on the basis of rules of the SEC governing the determination of beneficial ownership of securities. Under these rules, a person is deemed to be a "beneficial owner" of

a security if that person has or shares "voting power", which includes the power to vote or direct the voting of such security, or "investment power", which includes the power to dispose of or to

direct the disposition of such security. A person is also deemed to be a beneficial owner of any securities of which that person has a right to acquire beneficial ownership within 60 days after

December 1, 2017, including any shares of our common stock subject to an option that has vested or will vest within 60 days after December 1, 2017. More than one person may be

deemed to be a beneficial owner of the same securities.

The

percentage of beneficial ownership is based on 41,030,800 shares of common stock outstanding as of December 1, 2017.

Unless

otherwise indicated below, to our knowledge, all persons listed below have sole voting and investment power with respect to the shares beneficially owned by them. In addition,

based on the information provided to us by the selling stockholders, none of the selling stockholders is a broker-dealer or an affiliate of a broker-dealer. Each of the selling stockholders listed

below acquired the shares of common stock offered hereby on April 1, 2014 in connection with the acquisition of our company by AEA, including Richard K. Mueller, who was previously a

stockholder of Gypsum Management and Supply, Inc., and rolled a portion of such equity interests into shares of our common stock in connection with such acquisition. Addresses for the beneficial

owners are set forth in the footnotes to the table.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Name of Selling Stockholder

|

|

Number of

Shares

Beneficially

Owned Before

this Offering

|

|

Percentage of

Shares

Beneficially

Owned Before

this Offering

|

|

Number of Shares

to be Sold

in this Offering

|

|

Number of Shares

Beneficially

Owned After

this Offering

|

|

Percentage of

Shares

Beneficially

Owned After

this Offering

|

|

|

AEA(1)(2)

|

|

|

11,325,058

|

|

|

27.6

|

%

|

|

4,500,000

|

|

|

6,825,058

|

|

|

16.6

|

%

|

|

Richard K. Mueller(3)

|

|

|

562,355

|

|

|

1.4

|

%

|

|

500,000

|

|

|

62,355

|

|

|

*

|

|

-

*

-

Represents

beneficial ownership of less than 1% of our outstanding common stock.

-

(1)

-

For

purposes of this beneficial ownership table, we have excluded shares of common stock held of record by other parties to the stockholders' agreement or voting

proxies with which AEA may be deemed to share beneficial ownership by virtue of voting provisions of such agreement or proxies. All of our stockholders prior to our initial public offering were

parties to the stockholders' agreement. See "Certain Relationships and Related Party Transactions—Stockholders' Agreement" in our Proxy Statement for the 2017 Annual Meeting of

Stockholders filed with the SEC on August 22, 2017, which is incorporated by reference herein.

-

(2)

-

Represents

shares of our common stock held of record by AEA GMS Holdings LP ("AEA GMS Holdings"), whose general partner is AEA GMS

Holdings GP LLC ("AEA GMS Holdings GP"). The managing member of AEA GMS Holdings GP is AEA Investors Fund V LP and its other members are (i) AEA Investors

Participant Fund V LP, (ii) AEA Investors QP Participant Fund V LP, (iii) AEA Investors Fund V-A LP and (iv) AEA Investors Fund V-B LP (AEA

Investors Fund V LP and the entities named in clauses (i) through (iv), collectively, the "AEA

S-15

Table of Contents

Funds").

The AEA Funds are also limited partners of AEA GMS Holdings. The general partner of each of AEA Investors Participant Fund V LP and AEA Investors QP Participant Fund V LP is AEA

Investors PF V LLC, whose sole member is AEA Investors LP. The general partner of each of AEA Investors Fund V LP, AEA Investors Fund V-A LP and AEA Investors Fund

V-B LP is AEA Investors Partners V LP, whose general partner is AEA Management (Cayman) Ltd. Each of AEA GMS Holdings GP, the AEA Funds, AEA Investors PF V LLC, AEA

Investors Partners V LP, AEA Investors LP and AEA Management (Cayman) Ltd. may be deemed to share beneficial ownership of the shares of our common stock held of record by

AEA GMS Holdings, but each disclaims beneficial ownership of such shares. John L. Garcia, the Chairman and Chief Executive Officer of AEA Investors LP and the sole stockholder and director of

AEA Management (Cayman) Ltd., may also be deemed to share beneficial ownership of the shares of our common stock held of record by AEA GMS Holdings, but Mr. Garcia disclaims beneficial

ownership of such shares.

The

address for each of AEA GMS Holdings, AEA GMS Holdings GP, AEA Investors Participant Fund V LP, AEA Investors QP Participant Fund V LP, AEA Investors PF V LLC, AEA

Investors LP and

Mr. Garcia is c/o AEA Investors LP, 666 Fifth Avenue, 36th Floor, New York, NY 10103. The address for each of AEA Investors Fund V LP, AEA Investors Fund V-A LP, AEA

Investors Fund V-B LP, AEA Investors Partners V LP and AEA Management (Cayman) Ltd. is P.O. Box 309, Ugland House, Grand Cayman KY1-1104, Cayman Islands.

Justin

de La Chapelle is a principal of AEA, and Brian R. Hoesterey and J. Louis Sharpe are partners of AEA. Each of Messrs. de La Chapelle, Hoesterey and Sharpe serves on our board of

directors as a representative of AEA, but each disclaims beneficial ownership of the shares of our common stock held of record by AEA GMS Holdings. For a description of our relationship with AEA,

please see "Certain Relationships and Related Party Transactions" in our Proxy Statement for the 2017 Annual Meeting of Stockholders filed with the SEC on August 22, 2017, which is incorporated

by reference herein.

-

(3)

-

Represents

(i) 22,855 shares of common stock issuable upon exercise of options that have vested or will vest within 60 days after December 1,

2017 and (ii) 539,500 shares of our common stock held of record by Second Bite Investments, LLC, of which Richard K. Mueller is the Chief Executive Officer. Mr. Mueller may be

deemed to share beneficial ownership of the shares of our common stock held of record by Second Bite Investments, LLC, but Mr. Mueller disclaims beneficial ownership of such shares.

Mr. Mueller is the Chairman of our board of directors and co-founded our Company in 1971. Mr. Mueller served as our Chief Executive Officer from 1990 until May 2015, and as our President

from 1990 until 2013. For a description of our relationship with Mr. Mueller, please see "Certain Relationships and Related Party Transactions" in our Proxy Statement for the 2017 Annual

Meeting of Stockholders filed with the SEC on August 22, 2017, which is incorporated by reference herein.

The

address for Mr. Mueller is c/o GMS Inc., 100 Crescent Centre Parkway, Suite 800, Tucker, Georgia 30084.

S-16

Table of Contents

MATERIAL U.S. FEDERAL TAX CONSIDERATIONS FOR NON-U.S. HOLDERS OF OUR COMMON STOCK

The following is a summary of the material U.S. federal income and estate tax consequences of the ownership and disposition of our common stock

that is being issued pursuant to this offering. This summary is limited to Non-U.S. Holders (as defined below) that hold our common stock as a capital asset (generally, property held for investment)

for U.S. federal income tax purposes. This summary does not discuss all of the aspects of U.S. federal income and estate taxation that may be relevant to a Non-U.S. Holder in light of the Non-U.S.

Holder's particular investment or other circumstances. Accordingly, all prospective Non-U.S. Holders should consult their own tax advisors with respect to the U.S. federal, state, local and non-U.S.

tax consequences of the ownership and disposition of our common stock.

This

summary is based on provisions of the U.S. Internal Revenue Code of 1986, as amended (which we refer to as the "Code"), applicable U.S. Treasury regulations and administrative and

judicial

interpretations, all as in effect or in existence on the date of this prospectus. Subsequent developments in U.S. federal income or estate tax law, including changes in law or differing

interpretations, which may be applied retroactively, could alter the U.S. federal income and estate tax consequences of owning and disposing of our common stock as described in this summary. There can

be no assurance that the Internal Revenue Service (the "IRS") will not take a contrary position with respect to one or more of the tax consequences described herein and we have not obtained, nor do we

intend to obtain, a ruling from the IRS with respect to the U.S. federal income or estate tax consequences of the ownership or disposition of our common stock.

As

used in this summary, the term "Non-U.S. Holder" means a beneficial owner of our common stock that is not, for U.S. federal income tax

purposes:

-

•

-

an individual who is a citizen or resident of the United States;

-

•

-

a corporation (or other entity treated as a corporation for U.S. federal income tax purposes) created or organized in or under the laws of the

United States, any state thereof, or the District of Columbia;

-

•

-

an entity or arrangement treated as a partnership;

-

•

-

an estate whose income is includible in gross income for U.S. federal income tax purposes regardless of its source; or

-

•

-

a trust, if (1) a U.S. court is able to exercise primary supervision over the trust's administration and one or more "United States

persons" (within the meaning of the Code) has the authority to control all of the trust's substantial decisions, or (2) the trust has a valid election in effect under applicable U.S. Treasury

regulations to be treated as a United States person.

If

an entity or arrangement treated as a partnership for U.S. federal income tax purposes holds our common stock, the tax treatment of a partner in such a partnership generally will

depend upon the status of the partner, the activities of the partnership and certain determinations made at the partner level. Partnerships, and partners in partnerships, that hold our common stock

should consult their own tax advisors as to the particular U.S. federal income and estate tax consequences of owning and disposing of our common stock that are applicable to them.

S-17

Table of Contents

This

summary does not consider any specific facts or circumstances that may apply to a Non-U.S. Holder and does not address any special tax rules that may apply to particular Non-U.S.

Holders, such as:

-

•

-

a Non-U.S. Holder that is a financial institution, insurance company, tax-exempt organization, pension plan, broker, dealer or trader in

stocks, securities or currencies, U.S. expatriate, controlled foreign corporation or passive foreign investment company;

-

•

-

a Non-U.S. Holder holding our common stock as part of a conversion, constructive sale, wash sale or other integrated transaction or a hedge,

straddle or synthetic security;

-

•

-

a Non-U.S. Holder that holds or receives our common stock pursuant to the exercise of any employee stock option or otherwise as compensation;

or

-

•

-

a Non-U.S. Holder that at any time owns, directly, indirectly or constructively, 5% or more of our outstanding common stock.

In

addition, this summary does not address any U.S. state or local, or non-U.S. or other tax consequences, or any U.S. federal income or estate tax consequences for beneficial owners of

a Non-U.S. Holder, including shareholders of a controlled foreign corporation or passive foreign investment company that hold our common stock.

Each Non-U.S. Holder should consult its own tax advisor regarding the U.S. federal, state, local and non-U.S. income and other tax consequences of owning and

disposing of our common stock.

Distributions on Our Common Stock

We do not intend to pay cash dividends on our common stock for the foreseeable future. If we make distributions of cash or property (other than

certain pro rata distributions of our common stock) with respect to our common stock, any such distributions generally will constitute dividends for U.S. federal income tax purposes to the extent paid

from our current or accumulated earnings and profits, as determined under U.S. federal income tax principles. If a distribution exceeds our current and accumulated earnings and profits, the excess

will be treated as a nontaxable return of capital to the extent of the Non-U.S. Holder's adjusted tax basis in its common stock and will reduce (but not below zero) such Non-U.S. Holder's adjusted tax

basis in its common stock. Any remaining excess will be treated as gain from a disposition of our common stock subject to the tax treatment described below in "Sales or Other Dispositions of Our

Common Stock."

Distributions

on our common stock that are treated as dividends, and that are not effectively connected with a Non-U.S. Holder's conduct of a trade or business in the United States,

generally will be subject to withholding of U.S. federal income tax at a rate of 30%. A Non-U.S. Holder may be eligible for a lower rate under an applicable income tax treaty between the United States

and its jurisdiction of tax residence. In order to claim the benefit of an applicable income tax treaty, a Non-U.S. Holder will be required to provide to the applicable withholding agent a properly

executed IRS Form W-8BEN or W-8BEN-E (or other applicable form) in accordance with the applicable certification and disclosure requirements. Special rules apply to partnerships and other

pass-through entities and these certification and disclosure requirements also may apply to beneficial owners of partnerships and other pass-through entities that hold our common stock.

Distributions

on our common stock that are treated as dividends, and that are effectively connected with a Non-U.S. Holder's conduct of a trade or business in the United States will be

taxed on a net income basis at the regular graduated rates and in the manner applicable to United States persons (unless the Non-U.S. Holder is eligible for and properly claims the benefit of an

applicable income tax treaty and the dividends are not attributable to a permanent establishment or fixed base maintained by the Non-U.S. Holder in the United States, in which case the Non-U.S. Holder

may be

S-18

Table of Contents

eligible

for a lower rate under an applicable income tax treaty between the United States and its jurisdiction of tax residence). Dividends that are effectively connected with a Non-U.S. Holder's

conduct of a trade or business in the United States will not be subject to the withholding of U.S. federal income tax discussed above if the Non-U.S. Holder provides to the applicable withholding

agent a properly executed IRS Form W-8ECI (or other applicable form) in accordance with the applicable certification and disclosure requirements. A Non-U.S. Holder that is treated as a

corporation for U.S. federal income tax purposes may also be subject to a "branch profits" tax at a 30% rate (or a lower rate if the Non-U.S. Holder is eligible for a lower rate under an applicable

income tax treaty) on the Non-U.S. Holder's earnings and profits (attributable to dividends on our common stock or otherwise) that are effectively connected with the Non-U.S. Holder's conduct of a

trade or business within the United States, subject to certain adjustments.

The

certifications described above must be provided to the applicable withholding agent prior to the payment of dividends and must be updated periodically. A Non-U.S. Holder may obtain a

refund or credit of any excess amounts withheld by timely filing an appropriate claim for a refund with the IRS. Non-U.S. Holders should consult their own tax advisors regarding their eligibility for

benefits under a relevant income tax treaty and the manner of claiming such benefits.

The

foregoing discussion is subject to the discussion below under "Backup Withholding and Information Reporting" and "FATCA Withholding."

Sales or Other Dispositions of Our Common Stock

A Non-U.S. Holder generally will not be subject to U.S. federal income tax (including withholding thereof) on any gain recognized on sales or

other dispositions of our common stock unless:

-

•

-

the gain is effectively connected with the Non-U.S. Holder's conduct of a trade or business in the United States (and, if required by an

applicable income tax treaty, is attributable to a permanent establishment or fixed base maintained by the Non-U.S. Holder in the United States); in this case, the gain will be subject to U.S. federal

income tax on a net income basis at the regular graduated rates and in the manner applicable to United States persons (unless an applicable income tax treaty provides otherwise) and, if the Non-U.S.

Holder is treated as a corporation for U.S. federal income tax purposes, the "branch profits tax" described above may also apply;

-

•

-

the Non-U.S. Holder is an individual who is present in the United States for more than 182 days in the taxable year of the disposition

and meets certain other requirements; in this case, except as otherwise provided by an applicable income tax treaty, the gain, which may be offset by certain U.S. source capital losses, generally will

be subject to a flat 30% U.S. federal income tax, even though the Non-U.S. Holder is not considered a resident of the United States under the Code; or

-

•

-

we are or have been a "United States real property holding corporation" for U.S. federal income tax purposes at any time during the shorter of

(i) the five-year period ending on the date of disposition and (ii) the period that the Non-U.S. Holder held our common stock.

Generally,

a corporation is a "United States real property holding corporation" if the fair market value of its "United States real property interests" equals or exceeds 50% of the sum

of the fair market value of its worldwide real property interests plus its other assets used or held for use in a trade or business. We believe that we are not currently, and we do not anticipate

becoming in the future, a United States real property holding corporation. However, because the determination of whether we are a United States real property holding corporation is made from time to

time and depends on the relative fair market values of our assets, there can be no assurance in this regard. If we were a United States real property holding corporation, the tax relating to

disposition of stock in a United States real

S-19

Table of Contents

property

holding corporation generally will not apply to a Non-U.S. Holder whose holdings, direct, indirect and constructive, constituted 5% or less of our common stock at all times during the

applicable period, provided that our common stock is "regularly traded on an established securities market" (as provided in applicable U.S. Treasury regulations) at any time during the calendar year

in which the disposition occurs. However, no assurance can be provided that our common stock will be regularly

traded on an established securities market for purposes of the rules described above. Non-U.S. Holders should consult their own tax advisors regarding the possible adverse U.S. federal income tax

consequences to them if we are, or were to become, a United States real property holding corporation.

The

foregoing discussion is subject to the discussion below under "Backup Withholding and Information Reporting" and "FATCA Withholding."

Federal Estate Tax

Our common stock that is owned (or treated as owned) by an individual who is not a U.S. citizen or resident of the United States (as specially

defined for U.S. federal estate tax purposes) at the time of death will be included in the individual's gross estate for U.S. federal estate tax purposes, unless an applicable estate tax or other

treaty provides otherwise and, therefore, may be subject to U.S. federal estate tax.

Backup Withholding and Information Reporting

Backup withholding (currently at a rate of 28%) will not apply to payments of dividends on our common stock to a Non-U.S. Holder if the Non-U.S.

Holder provides to the applicable withholding agent a properly executed IRS Form W-8BEN or W-8BEN-E (or other applicable form) certifying under penalties of perjury that the Non-U.S. Holder is

not a United States person, or otherwise qualifies for an exemption. However, the applicable withholding agent generally will be required to report to the IRS and to such Non-U.S. Holder payments of

dividends on our common stock and the amount of U.S. federal income tax, if any, withheld with respect to those payments. Copies of the information returns reporting such dividends and any withholding

may also be made available to the tax authorities in the country in which the Non-U.S. Holder resides under the provisions of a treaty or agreement.

The

gross proceeds from sales or other dispositions of our common stock may be subject, in certain circumstances discussed below, to U.S. backup withholding and information reporting. If

a Non-U.S. Holder sells or otherwise disposes of our common stock outside the United States through a non-U.S. office of a non-U.S. broker and the sale or disposition proceeds are paid to the Non-U.S.

Holder outside the United States, then the U.S. backup withholding and information reporting requirements generally will not apply to that payment. However, U.S. information reporting, but not U.S.

backup withholding, will apply to a payment of sale or disposition proceeds, even if that payment is made outside the United States, if a Non-U.S. Holder sells our common stock through a non-U.S.

office of a

broker that is a United States person or has certain enumerated connections with the United States, unless the broker has documentary evidence in its files that the Non-U.S. Holder is not a United

States person and certain other conditions are met or the Non-U.S. Holder otherwise qualifies for an exemption.

If

a Non-U.S. Holder receives payments of the proceeds of sales or other dispositions of our common stock to or through a U.S. office of a broker, the payment will be subject to both

U.S. backup withholding and information reporting unless the Non-U.S. Holder provides to the broker a properly executed IRS Form W-8BEN or W-8BEN-E (or other applicable form) certifying under

penalties of perjury that the Non-U.S. Holder is not a United States person, or otherwise qualifies for an exemption.

S-20

Table of Contents

Backup

withholding is not an additional tax. Any amounts withheld under the backup withholding rules may be credited against the Non-U.S. Holder's U.S. federal income tax liability

(which may result in the Non-U.S. Holder being entitled to a refund), provided that the required information is timely furnished to the IRS.

FATCA Withholding

The Foreign Account Tax Compliance Act and related Treasury guidance (commonly referred to as "FATCA") impose U.S. federal withholding tax at a

rate of 30% on payments to certain foreign entities of (i) U.S.-source dividends (including dividends paid on our common stock) and (ii) the gross proceeds from the sale or other

disposition after December 31, 2018 of property that produces U.S.-source dividends (including sales or other dispositions of our common stock). This withholding tax applies to a foreign

entity, whether acting as a beneficial owner or an intermediary, unless such foreign entity complies with (i) certain information reporting requirements regarding its U.S. account holders and

its U.S. owners and (ii) certain withholding obligations regarding certain payments to its account holders and certain other persons. Accordingly, the entity through which a Non-U.S. Holder

holds its common stock will affect the determination of whether such withholding is required. Non-U.S. Holders are encouraged to consult their tax advisors regarding FATCA.

S-21

Table of Contents

UNDERWRITING

Morgan Stanley & Co. LLC is acting as the underwriter for this offering. The selling stockholders will enter into an underwriting

agreement with the underwriter. Subject to the terms and conditions of the underwriting agreement, the selling stockholders have agreed to sell to the underwriter, and the underwriter has agreed to

purchase, the number of shares of common stock listed next to its name in the following table:

|

|

|

|

|

|

|

Underwriter

|

|

Number of

Shares

|

|

|

Morgan Stanley & Co. LLC

|

|

|

5,000,000

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

The

underwriting agreement provides that the underwriter is obligated to purchase all the shares of common stock in the offering if any are purchased.

The

underwriter proposes to offer the common stock directly to the public at the public offering price set forth on the cover page of this prospectus supplement and to certain dealers at

that price less a selling concession not in excess of $ per share. After the public offering of the shares, the offering price and other selling terms may be changed by the underwriter.

The offering of the shares by the underwriter is subject to receipt and acceptance and subject to the underwriter's right to reject any order in whole or in part. Sales of shares made outside of the

United States may be made by affiliates of the underwriter.

The

following table summarizes the compensation to be paid to the underwriter:

|

|

|

|

|

|

|

|

|

|

|

Per Share

|

|

Total

|

|

|

Underwriting Discounts and Commissions paid by the selling stockholders

|

|

$

|

|

|

$

|

|

|

We

estimate that our out-of-pocket expenses for this offering will be approximately $ . We have agreed to reimburse the underwriter for expenses of approximately $25,000

related to clearance of this offering with the Financial Industry Regulatory Authority, Inc., or FINRA.

We

have agreed that we will not offer, sell, contract to sell, pledge or otherwise dispose of, directly or indirectly, or file with the SEC a registration statement under the Securities

Act relating to, any shares of our common stock or securities convertible into or exchangeable or exercisable for any shares of our common stock, or publicly disclose the intention to make any offer,

sale, pledge, disposition or filing, without the prior written consent of the underwriter for a period of 30 days after the date of this prospectus supplement, except grants of employee stock

options pursuant to the terms of our existing equity plans and issuances pursuant to the exercise of employee stock options outstanding on the date hereof. The foregoing restriction, however, will not

apply to issuances by us of up to 10% of our common stock issued and outstanding on the closing date of this offering in connection with an acquisition, business combination or joint venture

formation, provided that each recipient of such common stock shall execute and deliver an agreement, substantially in the form described in the following paragraph, restricting the sale or other

disposition of such common stock.

Our