Current Report Filing (8-k)

December 06 2017 - 4:07PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): November 30, 2017

HERITAGE INSURANCE HOLDINGS, INC.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

|

Delaware

|

|

001-36462

|

|

45-5338504

|

|

(State or other jurisdiction

of incorporation)

|

|

(Commission

File Number)

|

|

(I.R.S. Employer

Identification No.)

|

|

|

|

|

|

|

|

Heritage Insurance Holdings, Inc.

2600 McCormick Drive, Suite 300

Clearwater, Florida

|

|

33759

|

|

(Address of principal executive offices)

|

|

(Zip Code)

|

(727)

362-7202

(Registrant’s telephone number, including area code)

N/A

(Former name or

former address, if changed since last report)

Check the appropriate box below

if the Form

8-K

filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

|

☐

|

Soliciting material pursuant to Rule

14a-12

under the Exchange Act (17 CFR

240.14a-12)

|

|

|

☐

|

Pre-commencement

communications pursuant to Rule

14d-2(b)

under the Exchange Act (17 CFR

240.14d-2(b))

|

|

|

☐

|

Pre-commencement

communications pursuant to Rule

13e-4(c)

under the Exchange Act (17 CFR

240.13e-4(c))

|

Indicate by check mark whether the registrant is an emerging growth company as

defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule

12b-2

of the Securities Exchange Act of 1934

(§240.12b-2

of this chapter).

Emerging growth company ☒

If an emerging

growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange

Act. ☒

|

Item 2.01

|

Completion of Acquisition or Disposition of Assets.

|

On November 30, 2017, Heritage

Insurance Holdings, Inc. (the “Company”) completed the acquisition of all of the outstanding capital stock of NBIC Holdings, Inc. (“NBIC”), the parent company of Narragansett Bay Insurance Company, a leading specialty underwriter

of personal residential insurance products and services in several states along the Eastern seaboard. The acquisition resulted in NBIC becoming a wholly-owned subsidiary of the Company (the “NBIC Acquisition”). The Company completed the

NBIC Acquisition pursuant to the previously disclosed Agreement and Plan of Merger, dated as of August 8, 2017, by and among the Company, Gator Acquisition Merger Sub, Inc., NBIC and PBRA, LLC, in its capacity as Stockholder Representative (the

“Merger Agreement”).

The purchase price for the NBIC Acquisition consisted of $210 million in cash, plus 2,222,215 shares

of the Company’s common stock (the “Stock Consideration”), subject to a post-closing book value adjustment. The value of each share of the Company’s common stock was based on the volume-weighted average price of the

Company’s common stock during the five

business-day

period ending on November 29, 2017. The Stock Consideration was issued at closing in an exempt private placement pursuant to Section 4(a)(2)

of the Securities Act of 1933, as amended. On December 1, 2017, the Company filed a shelf registration statement on Form

S-3

with the Securities and Exchange Commission (the “SEC”) providing for

the registered resale of the Stock Consideration. In accordance with the Merger Agreement, 687,802 shares from the Stock Consideration were placed into an escrow account to secure any amounts payable pursuant to the post-closing book value

adjustment provisions.

The cash portion of the purchase price for the NBIC Acquisition was financed in part through the proceeds of its

previously announced offering of its 5.875% Convertible Senior Notes due 2037.

On November 30, 2017, the Company issued a press

release announcing the closing of the NBIC Acquisition. A copy of the press release is attached hereto as Exhibit 99.1.

|

Item 3.02

|

Unregistered Sales of Equity Securities.

|

The information set forth in Item 2.01 is

hereby incorporated by reference into this Item 3.02.

|

Item 5.07

|

Submission of Matters to a Vote of Security Holders.

|

The Company held a Special Meeting

of Stockholders (the “Special Meeting”) on December 1, 2017. The matter that was voted on at the Special Meeting and the final voting results as to such matter are set forth below.

Proposal No. 1: To approve, as Required by Rule 312 of the New York Stock Exchange Listed Company Manual, the Issuance of the Company’s Common

Stock Upon Conversion of the Company’s 5.875% Convertible Senior Notes due 2017.

The issuance of the Company’s common stock upon conversion

of the Company’s 5.875% Convertible Senior Notes due 2017 was approved as follows:

|

|

|

|

|

|

|

FOR

|

|

AGAINST

|

|

ABSTAIN

|

|

15,663,828

|

|

89,635

|

|

243,243

|

|

Item 9.01

|

Financial Statements and Exhibits.

|

(a)

Financial

statements of businesses acquired.

The Company intends to file with the SEC the financial statements required by Item 9.01(a) within 71 days of the date on which this Current Report on Form

8-K

was

required to be filed with the SEC.

(

b)

Pro forma

financial information.

The Company intends to file

with the SEC the pro forma information required by Item 9.01(b) within 71 days of the date on which this Current Report on Form

8-K

was required to be filed with the SEC.

(d) Exhibits:

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Company has duly caused this report to be signed on its behalf by the undersigned

hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

|

HERITAGE INSURANCE HOLDINGS, INC.

|

|

|

|

|

|

|

Date: December 6, 2017

|

|

|

|

By:

|

|

/s/ Bruce Lucas

|

|

|

|

|

|

|

|

Bruce Lucas

|

|

|

|

|

|

|

|

Chairman & Chief Executive Officer

|

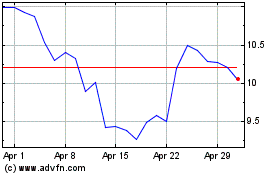

Heritage Insurance (NYSE:HRTG)

Historical Stock Chart

From Mar 2024 to Apr 2024

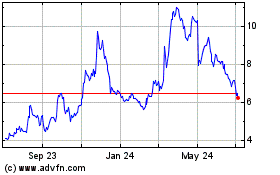

Heritage Insurance (NYSE:HRTG)

Historical Stock Chart

From Apr 2023 to Apr 2024