Highlights of the third quarter

include:

HealthEquity, Inc. (NASDAQ:HQY) ("HealthEquity" or the "Company"),

the nation's largest health savings account ("HSA") non-bank

custodian, today announced financial results for its third quarter

ended October 31, 2017.

"HealthEquity has added more than 740,000 new HSAs and $1.3

billion in custodial assets since the end of the third quarter last

year as we added more than 123,000 HSAs in this year’s third

quarter, including 14,000 from First Interstate Bank,” said Jon

Kessler, President and CEO of HealthEquity. “The 27% third quarter

growth in HSAs helped us surpass 3 million total HSAs and drive our

custodial assets up 30% to $5.6 billion. Our fully integrated

investment platform continues to lead the industry with 73%

custodial investment growth in the third quarter and total invested

custodial assets at $1 billion at quarter end. With another strong

quarterly performance and record year-to-date results, we are

narrowing our guidance for fiscal 2018 financial expectations

around a higher revenue forecast and confirming our adjusted EBITDA

outlook."

Third quarter financial results

For the third quarter ended October 31, 2017, HealthEquity

reported revenue of $56.8 million, an increase of 31% compared to

$43.4 million for the third quarter ended October 31, 2016.

Revenue consisted of:

- Service revenue of $23.0 million, an increase of 22% compared

to Q3 FY17.

- Custodial revenue of $22.1 million, an increase of 48% compared

to Q3 FY17.

- Interchange revenue of $11.7 million, an increase of 22%

compared to Q3 FY17.

Net income was $10.5 million for the third quarter ended

October 31, 2017, compared to $6.0 million for the third

quarter ended October 31, 2016.

Net income per diluted share was $0.17 for the third quarter

ended October 31, 2017, compared to $0.10 for the third

quarter ended October 31, 2016.

Adjusted EBITDA was $21.2 million for the third quarter ended

October 31, 2017, an increase of 46% compared to $14.5 million

for the third quarter ended October 31, 2016.

HSA Member and Custodial Asset metrics

The total number of HSAs for which we serve as a non-bank

custodian ("HSA Members") as of October 31, 2017 was 3.0

million, an increase of 27% from 2.4 million as of October 31,

2016.

Total Custodial Assets as of October 31, 2017 was $5.6

billion, an increase of 30% year over year, consisting of:

- Custodial Cash Assets of $4.6 billion, an increase of 24%

compared to Q3 FY17; and

- Custodial Investment Assets of $1.0 billion, an increase of 73%

compared to Q3 FY17.

Business outlook

We are increasing our business outlook for the year

ended January 31, 2018. We are narrowing our revenue outlook from a

range between $223.0 million and $228.0 million to a range between

$225.0 million and $228.0 million, our net income from a range

between $41.0 million and $45.0 million to a range between $43.0

million and $45.0 million, our Adjusted EBITDA from a range between

$79.0 million and $84.0 million to a range between $80.0 million

and $83.0 million. We also expect our non-GAAP net income to be in

a range between $39.0 million and $41.0 million, narrowed from our

prior range between $39.0 million and $43.0 million. Our non-GAAP

net income is calculated by adding back to net income all non-cash

stock-based compensation expense, net of an estimated statutory tax

rate of 38%, and the impact of excess tax benefits due to the

adoption of Accounting Standards Update ("ASU") 2016-09. Our

non-GAAP net income outlook results in a non-GAAP net income per

diluted share range between $0.64 and $0.66 (based on an estimated

62.0 million diluted weighted-average shares outstanding), narrowed

from our prior range between $0.64 and $0.68.

A reconciliation of the non-GAAP financial measures

used throughout this release to the most comparable GAAP financial

measures is included with the financial tables at the end of this

release.

Conference call

HealthEquity management will host a conference call at 5:00 pm

(Eastern Time) on Tuesday, December 5, 2017 to discuss the fiscal

year 2018 third quarter results. The conference call will be

accessible by dialing 844-791-6252, or 661-378-9636 for

international callers, and referencing conference ID 2796618. A

live audio webcast of the call will also be available on the

investor relations section of our website at

http://ir.healthequity.com.

Non-GAAP financial Information

To supplement our financial information presented on a GAAP

basis, we disclose Adjusted EBITDA, non-GAAP net income and

non-GAAP net income per diluted share, which are non-GAAP financial

measures. We define Adjusted EBITDA as adjusted earnings before

interest, taxes, depreciation and amortization, stock-based

compensation expense, and other certain non-operating items.

Non-GAAP net income is calculated by adding back to net income all

non-cash stock-based compensation expense, net of an estimated

statutory tax rate of 38%, and the impact of excess tax benefits

due to the adoption of ASU 2016-09. Non-GAAP net income per diluted

share is calculated by dividing non-GAAP net income by diluted

weighted-average shares outstanding.

Non-GAAP financial measures should be considered in addition to

results prepared in accordance with GAAP and should not be

considered as a substitute for, or superior to, GAAP results. The

Company cautions investors that non-GAAP financial information, by

its nature, departs from GAAP; accordingly, its use can make it

difficult to compare current results with results from other

reporting periods and with the results of other companies. Whenever

we use these non-GAAP financial measures, we provide a

reconciliation of the applicable non-GAAP financial measure to the

most closely applicable GAAP financial measure. Investors are

encouraged to review the related GAAP financial measures and the

reconciliation of the non-GAAP financial measures to their most

directly comparable GAAP financial measure as detailed in the

tables below.

Forward-Looking Statements

This press release contains “forward-looking statements” within

the meaning of the “safe harbor” provisions of the Private

Securities Litigation Reform Act of 1995, including but not limited

to, statements regarding the Company’s industry, business strategy,

plans, goals and expectations concerning our market position,

product expansion, future operations, revenue, margins, business

outlook, profitability, future efficiencies, capital expenditures,

liquidity and capital resources and other financial and operating

information. When used in this discussion, the words “may,”

“believes,” “intends,” “seeks,” “anticipates,” “plans,”

“estimates,” “expects,” “should,” “assumes,” “continues,” “could,”

“will,” “future” and the negative of these or similar terms and

phrases are intended to identify forward-looking statements.

Forward-looking statements are subject to a number of risks and

uncertainties, many of which involve factors or circumstances that

are beyond the control of the Company. The Company’s actual results

could differ materially from those stated or implied in

forward-looking statements due to a number of factors, including

but not limited to, the continued availability of tax-advantaged,

consumer-directed benefits to employers and employees, the

Company’s ability to acquire and retain new network partners and to

cross-sell its products to existing network partners and members,

the Company’s ability to successfully identify, acquire and

integrate portfolio purchases or acquisition targets, the Company’s

ability to raise awareness among employers and employees about the

advantages of adopting and participating in consumer-directed

benefits programs, and the Company’s ability to identify and

execute on network partner opportunities. For a detailed discussion

of these and other risk factors, please refer to the risks detailed

in the Company’s filings with the Securities and Exchange

Commission, including, without limitation, our most recent Annual

Report on Form 10-K and subsequent periodic and current reports.

Past performance is not necessarily indicative of future results.

The Company undertakes no intention or obligation to update or

revise any forward-looking statements, whether as a result of new

information, future events or otherwise. These forward-looking

statements should not be relied upon as representing the Company’s

views as of any date subsequent to the date of this press

release.

| |

|

HealthEquity, Inc. and its subsidiaries |

|

Consolidated balance sheets (unaudited) |

| |

|

(in thousands, except par value) |

October 31, 2017 |

|

|

January 31, 2017 |

|

| Assets |

|

|

|

| Current assets |

|

|

|

| Cash and

cash equivalents |

$ |

184,367 |

|

|

$ |

139,954 |

|

|

Marketable securities, at fair value |

40,711 |

|

|

40,405 |

|

| Total

cash, cash equivalents and marketable securities |

225,078 |

|

|

180,359 |

|

| Accounts

receivable, net of allowance for doubtful accounts as of October

31, 2017 and January 31, 2017 were $100 and $75,

respectively |

21,458 |

|

|

17,001 |

|

|

Inventories |

169 |

|

|

592 |

|

| Other

current assets |

6,106 |

|

|

2,867 |

|

| Total

current assets |

252,811 |

|

|

200,819 |

|

| Property

and equipment, net |

6,789 |

|

|

5,170 |

|

|

Intangible assets, net |

85,450 |

|

|

65,020 |

|

|

Goodwill |

4,651 |

|

|

4,651 |

|

| Deferred

tax asset |

4,656 |

|

|

1,615 |

|

| Other

assets |

1,760 |

|

|

1,861 |

|

| Total

assets |

$ |

356,117 |

|

|

$ |

279,136 |

|

| Liabilities and

stockholders’ equity |

|

|

|

| Current

liabilities |

|

|

|

| Accounts

payable |

$ |

3,295 |

|

|

$ |

3,221 |

|

| Accrued

compensation |

6,503 |

|

|

8,722 |

|

| Accrued

liabilities |

9,680 |

|

|

3,760 |

|

| Total

current liabilities |

19,478 |

|

|

15,703 |

|

| Long-term

liabilities |

|

|

|

| Other

long-term liabilities |

2,226 |

|

|

1,456 |

|

| Deferred

tax liability |

— |

|

|

37 |

|

| Total

long-term liabilities |

2,226 |

|

|

1,493 |

|

| Total

liabilities |

21,704 |

|

|

17,196 |

|

| Commitments and

contingencies |

|

|

|

| Stockholders’

equity |

|

|

|

| Preferred

stock, $0.0001 par value, 100,000 shares authorized, no shares

issued and outstanding as of October 31, 2017 and January 31, 2017,

respectively |

— |

|

|

— |

|

| Common

stock, $0.0001 par value, 900,000 shares authorized, 60,652 and

59,538 shares issued and outstanding as of October 31, 2017 and

January 31, 2017, respectively |

6 |

|

|

6 |

|

| Additional paid-in

capital |

255,245 |

|

|

232,114 |

|

| Accumulated other

comprehensive loss |

(188 |

) |

|

(165 |

) |

| Accumulated

earnings |

79,350 |

|

|

29,985 |

|

| Total

stockholders’ equity |

334,413 |

|

|

261,940 |

|

|

Total liabilities and stockholders’ equity |

$ |

356,117 |

|

|

$ |

279,136 |

|

| |

|

|

|

|

|

|

|

|

|

|

HealthEquity, Inc. and its subsidiaries |

|

Consolidated statements of operations and comprehensive

income (unaudited) |

| |

|

|

|

| (in thousands, except per share

data) |

Three months ended October 31, |

|

|

Nine months ended October 31, |

|

| 2017 |

|

|

2016 |

|

|

2017 |

|

|

2016 |

|

| Revenue: |

|

|

|

|

|

|

|

| Service

revenue |

$ |

22,962 |

|

|

$ |

18,781 |

|

|

$ |

68,258 |

|

|

$ |

56,610 |

|

| Custodial

revenue |

22,105 |

|

|

14,967 |

|

|

62,709 |

|

|

43,557 |

|

|

Interchange revenue |

11,722 |

|

|

9,610 |

|

|

38,122 |

|

|

31,389 |

|

| Total

revenue |

56,789 |

|

|

43,358 |

|

|

169,089 |

|

|

131,556 |

|

| Cost of revenue: |

|

|

|

|

|

|

|

| Service

costs |

17,251 |

|

|

12,675 |

|

|

47,824 |

|

|

34,471 |

|

| Custodial

costs |

2,784 |

|

|

2,461 |

|

|

8,370 |

|

|

7,211 |

|

|

Interchange costs |

3,027 |

|

|

2,331 |

|

|

9,625 |

|

|

7,748 |

|

| Total

cost of revenue |

23,062 |

|

|

17,467 |

|

|

65,819 |

|

|

49,430 |

|

| Gross profit |

33,727 |

|

|

25,891 |

|

|

103,270 |

|

|

82,126 |

|

| Operating

expenses: |

|

|

|

|

|

|

|

| Sales and

marketing |

5,892 |

|

|

4,391 |

|

|

15,707 |

|

|

12,764 |

|

|

Technology and development |

6,866 |

|

|

6,209 |

|

|

19,905 |

|

|

15,827 |

|

| General

and administrative |

6,252 |

|

|

5,166 |

|

|

18,354 |

|

|

15,290 |

|

|

Amortization of acquired intangible assets |

1,155 |

|

|

1,083 |

|

|

3,320 |

|

|

3,214 |

|

| Total

operating expenses |

20,165 |

|

|

16,849 |

|

|

57,286 |

|

|

47,095 |

|

| Income from

operations |

13,562 |

|

|

9,042 |

|

|

45,984 |

|

|

35,031 |

|

| Other expense: |

|

|

|

|

|

|

|

| Other

expense, net |

(395 |

) |

|

(256 |

) |

|

(523 |

) |

|

(934 |

) |

| Total other

expense |

(395 |

) |

|

(256 |

) |

|

(523 |

) |

|

(934 |

) |

| Income before income

taxes |

13,167 |

|

|

8,786 |

|

|

45,461 |

|

|

34,097 |

|

| Income tax

provision |

2,685 |

|

|

2,778 |

|

|

4,004 |

|

|

11,783 |

|

| Net income |

$ |

10,482 |

|

|

$ |

6,008 |

|

|

$ |

41,457 |

|

|

$ |

22,314 |

|

| Net income per

share: |

|

|

|

|

|

|

|

|

Basic |

$ |

0.17 |

|

|

$ |

0.10 |

|

|

$ |

0.69 |

|

|

$ |

0.38 |

|

|

Diluted |

$ |

0.17 |

|

|

$ |

0.10 |

|

|

$ |

0.67 |

|

|

$ |

0.37 |

|

| Weighted-average number

of shares used in computing net income per share: |

|

|

|

|

|

|

|

|

Basic |

60,562 |

|

|

58,938 |

|

|

60,160 |

|

|

58,338 |

|

|

Diluted |

61,868 |

|

|

60,073 |

|

|

61,703 |

|

|

59,693 |

|

| Comprehensive

income: |

|

|

|

|

|

|

|

| Net

income |

$ |

10,482 |

|

|

$ |

6,008 |

|

|

$ |

41,457 |

|

|

$ |

22,314 |

|

| Other

comprehensive gain (loss): |

|

|

|

|

|

|

|

|

Unrealized gain (loss) on available-for-sale marketable securities,

net of tax |

7 |

|

|

(23 |

) |

|

(23 |

) |

|

(36 |

) |

|

Comprehensive income |

$ |

10,489 |

|

|

$ |

5,985 |

|

|

$ |

41,434 |

|

|

$ |

22,278 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

HealthEquity, Inc. and its subsidiaries |

|

Statement of Cash flows (unaudited) |

| |

|

|

|

Nine months ended October 31, |

|

|

(in thousands) |

2017 |

|

|

2016 |

|

| Cash flows from

operating activities: |

|

|

|

| Net income |

$ |

41,457 |

|

|

$ |

22,314 |

|

| Adjustments to

reconcile net income to net cash provided by operating

activities: |

|

|

|

|

Depreciation and amortization |

11,142 |

|

|

9,543 |

|

|

Amortization of deferred financing costs and other |

97 |

|

|

53 |

|

| Deferred

taxes |

5,093 |

|

|

(1,880 |

) |

|

Stock-based compensation |

10,468 |

|

|

6,399 |

|

| Changes in operating

assets and liabilities: |

|

|

|

| Accounts

receivable |

(4,482 |

) |

|

244 |

|

|

Inventories |

423 |

|

|

(324 |

) |

| Other

assets |

(3,027 |

) |

|

(3,955 |

) |

| Accounts

payable |

(425 |

) |

|

(973 |

) |

| Accrued

compensation |

(2,219 |

) |

|

(3,117 |

) |

| Accrued

liabilities |

2,586 |

|

|

1,666 |

|

| Other

long-term liabilities |

770 |

|

|

1,059 |

|

| Net cash provided by

operating activities |

61,883 |

|

|

31,029 |

|

| Cash flows from

investing activities: |

|

|

|

| Purchases

of intangible member assets |

(15,529 |

) |

|

— |

|

|

Acquisition of a business |

(2,882 |

) |

|

— |

|

| Purchases

of marketable securities |

(343 |

) |

|

(275 |

) |

| Purchase

of property and equipment |

(3,382 |

) |

|

(2,705 |

) |

| Purchase

of software and capitalized software development costs |

(7,654 |

) |

|

(6,799 |

) |

| Net cash used in

investing activities |

(29,790 |

) |

|

(9,779 |

) |

| Cash flows from

financing activities: |

|

|

|

| Proceeds

from exercise of common stock options |

12,320 |

|

|

4,546 |

|

| Tax

benefit from exercise of common stock options |

— |

|

|

15,909 |

|

| Net cash provided by

financing activities |

12,320 |

|

|

20,455 |

|

| Increase in cash and

cash equivalents |

44,413 |

|

|

41,705 |

|

| Beginning cash and cash

equivalents |

139,954 |

|

|

83,641 |

|

| Ending cash and cash

equivalents |

$ |

184,367 |

|

|

$ |

125,346 |

|

| Supplemental

disclosures of non-cash investing and financing activities: |

|

|

|

| Purchases

of property and equipment included in accounts payable or accrued

liabilities at period end |

$ |

238 |

|

|

$ |

569 |

|

| Purchases

of software and capitalized software development costs included in

accounts payable or accrued liabilities at period end |

501 |

|

|

185 |

|

| Purchases

of intangible member assets accrued at period end |

3,429 |

|

|

— |

|

|

|

|

|

|

|

|

|

|

|

Stock-based compensation expense (unaudited) |

|

|

| Total

stock-based compensation expense included in the consolidated

statements of operations and comprehensive income is as

follows: |

| |

|

|

|

|

|

|

|

Three months ended October 31, |

|

Nine months ended October 31, |

|

(in thousands) |

|

2017 |

|

2016 |

|

2017 |

|

2016 |

| Cost of revenue |

|

$ |

720 |

|

$ |

462 |

|

$ |

1,903 |

|

$ |

1,258 |

| Sales and

marketing |

|

561 |

|

364 |

|

1,403 |

|

930 |

| Technology and

development |

|

831 |

|

487 |

|

2,365 |

|

1,290 |

| General and

administrative |

|

1,553 |

|

755 |

|

4,797 |

|

2,921 |

|

Total stock-based compensation expense |

|

$ |

3,665 |

|

$ |

2,068 |

|

$ |

10,468 |

|

$ |

6,399 |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

HSA Members (unaudited) |

| |

|

|

|

|

|

|

|

|

|

|

|

October 31, 2017 |

|

October 31, 2016 |

|

% Change |

|

January 31, 2017 |

| HSA Members |

|

3,012,968 |

|

2,378,353 |

|

27% |

|

2,746,132 |

| Average HSA Members -

Year-to-date |

|

2,872,744 |

|

2,278,994 |

|

26% |

|

2,339,091 |

| Average HSA Members -

Quarter-to-date |

|

2,977,367 |

|

2,354,227 |

|

26% |

|

2,519,382 |

| HSA

Members with investments |

|

98,257 |

|

58,226 |

|

69% |

|

65,906 |

| |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

Custodial assets (unaudited) |

| |

|

|

|

|

|

|

|

|

|

(in thousands, except percentages) |

|

October 31, 2017 |

|

October 31, 2016 |

|

% Change |

|

January 31, 2017 |

| Custodial cash |

|

$ |

4,592,658 |

|

$ |

3,713,290 |

|

24% |

|

$ |

4,380,487 |

| Custodial

investments |

|

987,050 |

|

570,553 |

|

73% |

|

658,580 |

| Total custodial

assets |

|

$ |

5,579,708 |

|

$ |

4,283,843 |

|

30% |

|

$ |

5,039,067 |

| Average daily custodial

cash - Year-to-date |

|

$ |

4,469,641 |

|

$ |

3,596,571 |

|

24% |

|

$ |

3,661,058 |

| Average

daily custodial cash - Quarter-to-date |

|

$ |

4,550,327 |

|

$ |

3,669,480 |

|

24% |

|

$ |

3,854,518 |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net income reconciliation to Adjusted EBITDA

(unaudited) |

| |

|

|

|

|

|

|

|

Three months ended October 31, |

|

|

Nine months ended October 31, |

|

|

(in thousands) |

|

2017 |

|

|

2016 |

|

|

2017 |

|

|

2016 |

|

| Net income |

|

$ |

10,482 |

|

|

$ |

6,008 |

|

|

$ |

41,457 |

|

|

$ |

22,314 |

|

| Interest

income |

|

(185 |

) |

|

(137 |

) |

|

(521 |

) |

|

(385 |

) |

| Interest

expense |

|

69 |

|

|

69 |

|

|

205 |

|

|

206 |

|

| Income

tax provision |

|

2,685 |

|

|

2,778 |

|

|

4,004 |

|

|

11,783 |

|

|

Depreciation and amortization |

|

2,851 |

|

|

2,335 |

|

|

7,822 |

|

|

6,329 |

|

|

Amortization of acquired intangible assets |

|

1,155 |

|

|

1,083 |

|

|

3,320 |

|

|

3,214 |

|

|

Stock-based compensation expense |

|

3,665 |

|

|

2,068 |

|

|

10,468 |

|

|

6,399 |

|

| Other

(1) |

|

511 |

|

|

323 |

|

|

839 |

|

|

1,113 |

|

| Adjusted

EBITDA |

|

$ |

21,233 |

|

|

$ |

14,527 |

|

|

$ |

67,594 |

|

|

$ |

50,973 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(1) For the three months ended October 31, 2017 and 2016,

Other consisted of non-income-based taxes of $113 and $86,

acquisition-related costs of $398 and $10, and other costs of $0

and $237, respectively. For the nine months ended October 31,

2017 and 2016, Other consisted of non-income based taxes of $303

and $260, acquisition-related costs of $482 and $595, and other

costs of $54 and $258, respectively.

| |

|

|

Reconciliation of Adjusted EBITDA outlook

(unaudited) |

| |

|

|

|

Outlook for the year ending |

|

(in millions) |

January 31, 2018 |

| Net income |

$43 -

$45 |

| Income

tax provision |

5 -

6 |

|

Depreciation and amortization |

~

11 |

|

Amortization of acquired intangible assets |

~

4 |

|

Stock-based compensation expense |

~

14 |

|

Other |

~ 3 |

| Adjusted

EBITDA |

$80 - $83 |

| |

|

| |

|

|

|

|

Reconciliation of non-GAAP net income per diluted share

(unaudited) |

| |

|

|

|

|

|

Three months ended |

|

Nine months ended |

|

Outlook for the year ending |

|

(in millions, except per share data) |

October 31, 2017 |

|

October 31, 2017 |

|

January 31, 2018 |

| Net income |

$10 |

|

$41 |

|

$43 - $45 |

| Stock

compensation, net of tax (1) |

2 |

|

6 |

|

~ 9 |

| Excess

tax benefit due to adoption of ASU 2016-09 |

(2 |

) |

(12 |

) |

~ (13) |

| Non-GAAP net

income |

$10 |

|

$35 |

|

$39 - $41 |

| |

|

|

|

|

|

| Diluted

weighted-average shares used in computing GAAP and Non-GAAP per

share amounts |

62 |

|

62 |

|

62 |

| Non-GAAP

net income per diluted share (2) |

$0.17 |

|

$0.57 |

|

$0.64 - $0.66 |

| |

|

|

|

|

|

(1) The Company used an estimated statutory tax rate of 38% to

calculate the net impact stock-based compensation expense.(2)

Non-GAAP net income per diluted share does not calculate due to

rounding.

Investor Relations Contact:Richard

Putnam801-727-1209rputnam@healthequity.com

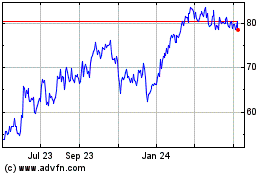

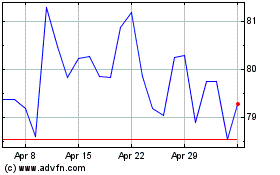

HealthEquity (NASDAQ:HQY)

Historical Stock Chart

From Mar 2024 to Apr 2024

HealthEquity (NASDAQ:HQY)

Historical Stock Chart

From Apr 2023 to Apr 2024