Current Report Filing (8-k)

December 04 2017 - 4:24PM

Edgar (US Regulatory)

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date

of Report (Date of earliest event reported):

November 28, 2017

AURA

SYSTEMS, INC.

(Exact

name of registrant as specified in its charter)

|

Delaware

|

0-17249

|

95-4106894

|

|

(State

or other jurisdiction of incorporation or organization)

|

(Commission

File

Number)

|

(IRS

Employer

Identification

No.)

|

10541

Ashdale St.

Stanton,

CA 90680

(Address

of principal executive offices)

(310)

643-5300

(Registrant’s

telephone number, including area code)

Not

Applicable

(Former

name or former address, if changed since last report)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant

under any of the following provisions:

|

☐

|

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

|

|

|

☐

|

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

|

|

|

☐

|

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

|

|

☐

|

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR

230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR 240.12b-2).

☐

Emerging growth company

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for

complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

|

|

Item

5.02

|

Departure

of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers;

Compensatory Arrangements of Certain Officers

.

|

(d) On

November 28, 2017, the Board of Directors of Aura Systems, Inc. (the “Company”) appointed David Mann and Robert T.

Lempert to fill two vacancies on the Board of Directors of the Company. It was not determined on which if any committee(s) of

the Board of Directors Mr. Mann or Mr. Lempert would serve.

Mr.

Mann, age 46, has been Vice President of Marketing for his family’s manufactured and imported houseware products company

since 1990, and the Vice President of Sales of the company since 2007. From 2000 until 2007, Mr. Mann also served as Vice President

of Operations. As such he has extensive experience dealing with all aspects of marketing and sales, as well as, suppliers in both

North America and China. He has a degree in Business Administrations. His marketing and sales experience, particularly in China,

provides the Board with important knowledge and insight in a key target market of the Company. Mr. Mann has been an investor in

the Company since 2007. In 2017, Mr. Mann and his family loaned the Company $213,620 at an annual interest rate of 5%. The note

is convertible into 435,959 shares of common stock upon the approval by shareholders, at the Company’s annual meeting of

shareholders, of the approval, and subsequent effectiveness of, an amendment to the Company’s Amended and Restated Certificate

of Incorporation to effect a reverse stock split of all of the outstanding shares of the Company’s common stock, whereby

each seven (7) shares would be combined and changed into one (1) share of common stock (the “Reverse Stock Split”).

In exchange for the convertible note, Mr. Mann also received warrants to purchase 170,896 shares of the Company’s common

stock at a strike price of $1.40 per share. The warrants are exercisable over a five-year period. The warrants are also contingent

on the approval and effectiveness of the Reverse Stock Split.

Dr.

Lempert, age 75, is a retired dentist with many years of experience investing in numerous high technology companies and running

his own business. He graduated from University of Pennsylvania and did his residency at the Albert Einstein Medical Center in

Philadelphia. Dr. Lempert served two as a Captain in the U.S. Army for two years. He was a member of the American Dental Association

and the Academy of General Dentistry. Dr. Lempert has been a significant investor, shareholder and an active advocate of Aura’s

technology for more than 20 years. In 2017, Dr. Lempert guaranteed $250,000 of a $500,000 loan that was made to the Company by

a third party. In exchange for this guarantee, Dr. Lempert received warrants to purchase 100,000 shares of the Company’s

common stock at a strike of $1.40 per share. The warrants are exercisable over a five-year period.

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf

by the undersigned hereunto duly authorized.

|

Dated:

December 4, 2017

|

By:

|

/s/

Melvin Gagerman

|

|

|

|

Melvin

Gagerman

|

|

|

|

Chief

Executive Officer

|

3

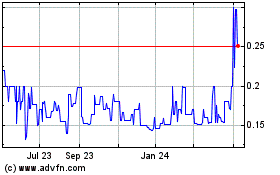

Aura Systems (PK) (USOTC:AUSI)

Historical Stock Chart

From Mar 2024 to Apr 2024

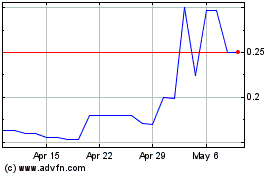

Aura Systems (PK) (USOTC:AUSI)

Historical Stock Chart

From Apr 2023 to Apr 2024