NOTE REGARDING FORWARD-LOOKING STATEMENTS

This prospectus supplement, the accompanying prospectus and the documents incorporated by reference herein or therein may contain and refer to

certain forward-looking statements with respect to our financial condition, results of operations and business. These statements constitute forward-looking statements within the meaning of Section 27A of the Securities Act and Section 21E

of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). Forward-looking statements are statements of future expectations that are based on management’s current expectations and assumptions and involve known and

unknown risks and uncertainties that could cause actual results, performance or events to differ materially from those expressed or implied in these statements. Forward-looking statements include, among others, statements concerning the potential

exposure to market risks, statements expressing management’s expectations, beliefs, estimates, forecasts, projections and assumptions and statements that are not limited to statements of historical or present facts or conditions.

Forward-looking statements are typically identified by words such as “anticipate,” “believe,” “could,”

“estimate,” “expect,” “intend,” “may,” “plan,” “objectives,” “outlook,” “probably,” “project,” “will,” “seek,” “target” and other

words of similar meaning. These forward-looking statements include, without limitation, statements about the following matters:

|

|

•

|

|

our strategies for (i) strengthening our position in specialty carbon blacks and rubber carbon blacks, (ii) increasing our rubber carbon black margins and (iii) strengthening the competitiveness of our

operations;

|

|

|

•

|

|

the outcome of any pending or possible litigation or regulatory proceedings, including the U.S. Environmental Protection Agency (the “EPA”) enforcement action described in our Annual Report on Form

20-F

for the year ended December 31, 2016; and

|

|

|

•

|

|

our expectation that the markets we serve will continue to grow.

|

All these forward-looking

statements are based on estimates and assumptions that, although believed to be reasonable, are inherently uncertain. Therefore, undue reliance should not be placed upon any forward-looking statements.

There are important factors that could cause actual results to differ materially from those contemplated by such forward-looking statements.

These factors include, among others:

|

|

•

|

|

negative or uncertain worldwide economic conditions;

|

|

|

•

|

|

volatility and cyclicality in the industries in which we operate;

|

|

|

•

|

|

operational risks inherent in chemicals manufacturing, including disruptions as a result of severe weather conditions and natural disasters;

|

|

|

•

|

|

our dependence on major customers;

|

|

|

•

|

|

our ability to compete in the industries in which we operate;

|

|

|

•

|

|

our ability to develop new products and technologies successfully and the availability of substitutes for our products;

|

|

|

•

|

|

our ability to implement our business strategies;

|

|

|

•

|

|

volatility in the costs and availability of raw materials and energy;

|

|

|

•

|

|

our ability to realize benefits from investments, joint ventures, acquisitions or alliances;

|

|

|

•

|

|

our ability to realize benefits from planned plant capacity expansions and site development projects and the potential delays to such expansions and projects;

|

S-iv

|

|

•

|

|

information technology systems failures, network disruptions and breaches of data security;

|

|

|

•

|

|

our relationships with our workforce, including negotiations with labor unions, strikes and work stoppages;

|

|

|

•

|

|

our ability to recruit or retain key management and personnel;

|

|

|

•

|

|

our exposure to political or country risks inherent in doing business in some countries;

|

|

|

•

|

|

environmental, health and safety regulations, including nanomaterial and greenhouse gas emissions regulations, and the related costs of maintaining compliance and addressing liabilities;

|

|

|

•

|

|

current and potentially future investigations and enforcement actions by the EPA or other governmental or supranational agencies;

|

|

|

•

|

|

our operations as a company in the chemical sector, including the related risks of leaks, fires and toxic releases;

|

|

|

•

|

|

market and regulatory changes that may affect our ability to sell or otherwise benefit from

co-generated

energy;

|

|

|

•

|

|

tax audits, litigation or legal proceedings, including product liability and environmental claims;

|

|

|

•

|

|

our ability to protect our intellectual property rights and

know-how;

|

|

|

•

|

|

our ability to generate the funds required to service our debt and finance our operations;

|

|

|

•

|

|

fluctuations in foreign currency exchange and interest rates;

|

|

|

•

|

|

the availability and efficiency of hedging;

|

|

|

•

|

|

changes in international and local economic conditions, including with regard to the Euro, dislocations in credit and capital markets and inflation or deflation;

|

|

|

•

|

|

potential impairments or write-offs of certain assets;

|

|

|

•

|

|

required increases in our pension fund contributions;

|

|

|

•

|

|

the adequacy of our insurance coverage;

|

|

|

•

|

|

changes in our jurisdictional earnings mix or in the tax laws or accepted interpretations of tax laws in those jurisdictions;

|

|

|

•

|

|

our indemnities to and from Evonik Industries AG (“Evonik”);

|

|

|

•

|

|

challenges to our decisions and assumptions in assessing and complying with our tax obligations;

|

|

|

•

|

|

potential conflicts of interests with our principal shareholders;

|

|

|

•

|

|

effect of exchange rate fluctuations on U.S. Dollar amounts received in dividends;

|

|

|

•

|

|

our status as a foreign private issuer; and

|

|

|

•

|

|

potential difficulty in obtaining or enforcing judgments or bringing actions against us in the United States.

|

In light of these risks, our results could differ materially from the forward-looking statements contained in this prospectus supplement, the

accompanying prospectus and the documents incorporated by reference. For further information regarding factors that could affect our business and financial results and the related forward-looking statements, see “Risk Factors.”

S-v

All subsequent forward-looking statements are expressly qualified in their entirety by the

cautionary statements contained or referred to in this section. You should not place undue reliance on forward-looking statements. Each forward-looking statement speaks only as of the date of the particular statement. New risk factors and

uncertainties emerge from time to time and it is not possible for our management to predict all risk factors and uncertainties, nor can we assess the impact of all factors on our business or the extent to which any factor, or combination of factors,

may cause actual results to differ materially from those contained in any forward-looking statements. We undertake no obligation to publicly update or revise any forward-looking statement as a result of new information, future events or other

information, other than as required by applicable law.

S-vi

SUMMARY

The following summary is qualified in its entirety by, and should be read in conjunction with, the more detailed information appearing

elsewhere in this prospectus supplement, the accompanying prospectus and the documents incorporated by reference herein and therein, including the “Risk Factors” sections of this prospectus supplement and our Annual Report on Form

20-F

for the year ended December 31, 2016. The documents incorporated by reference are described under “Where You Can Find More Information; Incorporation by Reference” in this prospectus supplement.

OVERVIEW

We are

a leading global producer of carbon black. Carbon black is a form of carbon used to improve certain properties of materials into which it is added. It is used as a pigment and as a performance additive in coatings, polymers, printing and special

applications (specialty carbon black) and in the reinforcement of rubber in tires and mechanical rubber goods (rubber carbon black). We operate a diversified carbon black business with more than 280 specialty carbon black grades and approximately 80

rubber carbon black grades. Our product portfolio is one of the broadest in the industry and is divided into the following segments:

Specialty Carbon Black

. We are one of the largest global producers of specialty carbon black with an estimated share of global industry

sales of approximately 26% in 2016 measured by volume in kmt. Our estimated share of global industry specialty carbon black sales remained relatively stable in the past three years (25.0% in 2015 and 25.0% in 2014). We believe that our share of

global industry sales measured by revenue is higher, since our product portfolio is weighted towards higher priced premium grades. We manufacture specialty carbon black at multiple sites for a broad range of specialized applications. Specialty

carbon black imparts specific characteristics, such as high-quality pigmentation, UV light protection, viscosity control and electrical conductivity.

Rubber Carbon Black

. We are one of the largest global producers of rubber carbon black. We have a global supply network and an

estimated share of global industry sales of approximately 8% in 2016 measured by volume in kmt, with industry sales shares by volume equal to or exceeding 16% in each of our major operating regions. Our estimated market share for this segment

increased in 2016 to 8% from 7% during the prior two years as a result of consolidation of our Chinese plant for the full fiscal year ended December 31, 2016.

We have over 75 years of experience and enjoy a long-standing reputation for technical capability in the carbon black industry and its

served applications. We provide consistent product quality, reliability, technical expertise and innovation, built upon continually improving processes and

know-how

through our advanced Innovation Group and

through supply chain execution.

Our Innovation Group works closely with our clients to develop innovative products and applications,

while strengthening customer relationships and improving communication. Long-term R&D alliances and sophisticated technical interfaces with customers allow us to develop solutions to meet specific customer requirements. As a result, we have been

able to generate attractive margins for our specialized carbon black products. Additionally, our Innovation Group works closely with our operations group to improve process economics with new process equipment designs, operating techniques and raw

material selection.

We operate a modern global supply chain network comprising 13 wholly-owned production facilities in Europe, North and

South America, Asia and South Africa and three sales companies, as well as a jointly-owned production plant in Germany.

S-1

Corporate History and Information

Historically, our business operated as a business line of Evonik. On July 29, 2011, the Rhône Investors and the Triton Investors

indirectly acquired from Evonik the entities operating its carbon black business (the “Acquisition”). Currently, we operate on a fully stand-alone basis, through a number of direct and indirect subsidiaries.

The Company is a Luxembourg joint stock corporation (

société anonyme

or S.A.). The Company was incorporated on

April 13, 2011 as a Luxembourg limited liability company (

société à responsabilité limitée

) under the name Kinove Luxembourg Holdings 2 S.à r.l. (later changed to Orion Engineered Carbons

S.à r.l.). On July 28, 2014, the Company changed its legal form to become a Luxembourg joint stock corporation (

société anonyme

). On July 30, 2014, we completed the initial public offering of 19.5 million

of our common shares. Our common shares are listed on the NYSE under the symbol “OEC”.

The Company’s registered office is

located at 6, Route de Trèves,

L-2633

Senningerberg (Municipality of Niederanven Grand Duchy of Luxembourg, and our telephone number is +352 27 04 80 60. The Company is registered with the Luxembourg

Trade and Companies Register (

Registre de Commerce et des Sociétés

) under registration number B 160.558. Our website address is www.orioncarbons.com. The information on, or that can be accessed through, the Company’s

website is not part of, and is not incorporated into, this prospectus. The Company’s agent for service of process in the United States is Corporation Service Company, located at 1180 Avenue of the Americas, New York, NY 10036, telephone number

(800)

927-9800.

You can find a more detailed description of our business and recent transactions

in our Annual Report on

Form 20-F

for the year ended December 31, 2016, which is incorporated by reference in this prospectus supplement.

PRINCIPAL SHAREHOLDERS AND SELLING SHAREHOLDERS

Approximately 33.07% of our outstanding common shares are currently held by Kinove Holdings. Kinove Holdings is currently owned primarily by

the Rhône Investors and the Triton Investors. The remaining ownership interests in Kinove Holdings are held by Luxinva S.A. (the “ADIA Investor”), a wholly-owned subsidiary of the Abu Dhabi Investment Authority, a public institution

wholly-owned by the Government of the Emirate of Abu Dhabi.

Approximately 7.66% of our outstanding common shares are currently held by

Kinove Luxembourg Coinvestment S.C.A. (“Luxco Coinvest”), an investment vehicle that is owned by current and former members of our management (the “Luxco

Co-Investors”),

including our

current executive officers, and by Kinove Holdings. In this offering, certain Luxco

Co-Investors,

who are named in this prospectus supplement, are selling some of the common shares in which they have an

interest, and we refer to them as the “Luxco Sellers.” On March 23, 2017, an extraordinary general meeting of shareholders of Luxco Coinvest resolved to dissolve Luxco Coinvest and put it into liquidation, and appointed Kinove

Services SARL as liquidator (in its capacity as such, the “Liquidator”). The liquidation is currently in process. The Liquidator will pay

in-kind

advances on the liquidation proceeds to the Luxco

Sellers by transferring to them the common shares they are selling in this offering. Following the completion of this offering, the Liquidator will from time to time pay

in-kind

advances on the liquidation

proceeds to the Luxco

Co-Investors

who have not yet received all outstanding common shares to which they are entitled, by transferring the remaining common shares to them. Following the transfer to the Luxco

Co-Investors

by the Liquidator of all common shares held by Luxco Coinvest, either as

in-kind

advances on the liquidation proceeds or

in-kind

boni

of liquidation, and after payment of the liabilities of Luxco Coinvest and setting aside the necessary funds for the payment of any liabilities of Luxco Coinvest, the Liquidator will

proceed with the closing of the liquidation.

S-2

Approximately 90.77% of the common shares to be sold in this offering will be sold by Kinove

Holdings and 9.23% will be sold by the Luxco Sellers. Immediately following this offering, approximately 17.77% of our outstanding common shares (15.47%, assuming full exercise of the underwriter’s option to purchase additional common shares)

will be held by Kinove Holdings and 6.10% (5.87%, assuming full exercise of the underwriter’s option to purchase additional common shares) will be held by Luxco Coinvest.

Immediately following this offering, the Rhône Investors, the Triton Investors and the ADIA Investor will own, indirectly, 9.83%, 9.83%

and 2.40%, respectively, of our common shares (8.81%, 8.81% and 2.15%, respectively, assuming full exercise of the underwriter’s option to purchase additional common shares). The Luxco

Co-Investors

will

own, indirectly through Luxco Coinvest, 1.81% of our common shares (1.57% assuming full exercise of the underwriter’s option to purchase additional common shares).

Subject to the

30-day

lock-up

described below in

“Underwriting,” the common shares held by Kinove Holdings and by Luxco Coinvest after this offering may be resold publicly by the holders from time to time pursuant to the Registration Statement or Rule 144. In addition, in connection with

the liquidation of Luxco Coinvest, we and Kinove Holdings entered into an amendment to the registration rights agreement on March 22, 2017, with respect to common shares that Luxco

Co-Investors

may

receive from the Liquidator as payment

in-kind

of advances on the liquidation proceeds or

in-kind

boni

of liquidation. Pursuant to the amendment and subject to

the

30-day

lock-up,

Luxco

Co-Investors

will be permitted to sell such shares in underwritten offerings pursuant to the

registration rights agreement that are initiated by Kinove Holdings or the Company and, with the prior written consent of the Company, in offerings under the Registration Statement other than underwritten offerings.

THE OFFERING

|

|

|

|

|

|

|

|

Common shares offered by Kinove Holdings

|

|

9,076,696 common shares

|

|

|

|

|

Common shares offered by Luxco Sellers

|

|

923,304 common shares

|

|

|

|

|

Option to purchase additional common shares

|

|

The Selling Shareholders have granted the underwriter an option for a period of 30 days from the

date of this prospectus supplement to purchase up to 1,500,000 additional common shares at the public offering price less the underwriting discount.

|

|

|

|

|

Common shares outstanding as of the date of this prospectus supplement and immediately after

this offering

|

|

59,320,214 common shares, reflecting 59,635,126 issued common shares of which 314,912 common shares are held in

treasury.

|

|

|

|

|

Use of proceeds

|

|

We will not receive any proceeds from the sale of common shares by the Selling Shareholders in

this offering.

|

|

|

|

|

Lock-up

|

|

We, our directors, our executive officers, the Principal Shareholders, the ADIA Investor, Kinove

Holdings, Luxco Coinvest and the Luxco Sellers have agreed, subject to certain exceptions, for a period of 30 days after the date of this prospectus supplement, not to dispose of any common shares or similar securities without the prior written

consent of Morgan Stanley & Co. LLC.

|

S-3

|

|

|

|

|

|

|

|

NYSE symbol

|

|

OEC

|

|

|

|

|

Transfer agent and registrar

|

|

American Stock Transfer and Trust Company LLC

|

|

|

|

|

Risk factors

|

|

Investing in our common shares involves risks. See “Risk Factors” beginning on page

S-5

of this prospectus supplement and in our most recent Annual Report on Form

20-F

for factors you should consider before investing in the common shares.

|

|

|

|

|

Dividend policy

|

|

In accordance with the Luxembourg Company Law, the general meeting of shareholders has the power to

make a resolution on the payment of dividends upon the recommendation of the Board of Directors. In deciding whether to recommend any future dividend, the Board of Directors would take into account any legal or contractual limitation, our actual and

anticipated future earnings, cash flows, debt service and capital requirements, our business plans and such other matters as the Board of Directors believes appropriate, in its discretion. Generally, any dividend approved by a general meeting of

shareholders would be paid out shortly after the meeting.

Our ability to pay dividends depends on the existence of

legally distributable amounts, which include available profit, distributable reserves and share premium, as determined in accordance with the Luxembourg Company Law and on the basis of the Company’s unconsolidated balance sheet. In order to

determine the distributable amounts, the financial profit or loss for the relevant financial period must be adjusted by the profit/loss carried forward from the previous financial years as well as any withdrawals or contributions made to the

distributable reserves and share premium. Certain reserves must be established by law (e.g., the Company’s legal reserve, equal to 10% of the Company’s share capital or, in the case of a buy back of its own shares by the Company, a reserve

equal to the value of the shares bought back) and deducted when calculating the amount available for distribution. Because the Company is a holding company, it does not generate any distributable profits of its own and is dependent on the transfer

of distributable profits by its operating subsidiaries. Luxembourg withholding tax at a rate of 15% is deducted from the dividends, subject to certain exemptions and reductions in certain circumstances.

|

S-4

RISK FACTORS

Investing in our common shares involves risks. You should carefully consider each of the risk factors below and in our Annual Report on

Form

20-F

for the year ended December 31, 2016, as well as other information included or incorporated by reference in this prospectus supplement and the accompanying prospectus, before you decide to

purchase our common shares. Additional risks and uncertainties of which we are not presently aware or that we currently deem immaterial could also affect our business operations and financial condition. If any of these risks actually occur, our

business, financial condition and results of operations could be materially affected. As a result, the trading price of our common shares could decline and you could lose part or all of your investment.

Risks Related to This Offering and Ownership of Our Common Shares

The price of our common shares may be affected by market conditions beyond our control.

Some factors that may cause the market price of our common shares to fluctuate, in addition to the other risks below or those incorporated by

reference in this prospectus supplement, are:

|

|

•

|

|

our operating and financial performance and prospects;

|

|

|

•

|

|

our announcements or our competitors’ announcements regarding new products, enhancements, significant contracts, acquisitions or strategic investments;

|

|

|

•

|

|

changes in earnings estimates or recommendations by securities analysts who cover our securities;

|

|

|

•

|

|

fluctuations in our quarterly financial results or the quarterly financial results of companies perceived to be similar to us;

|

|

|

•

|

|

changes in our capital structure, such as future issuances of securities, sales of large blocks of common shares by our shareholders, or the incurrence of additional debt;

|

|

|

•

|

|

departure of key personnel;

|

|

|

•

|

|

changes in general economic and market conditions;

|

|

|

•

|

|

changes in industry conditions or perceptions or changes in the market outlook for the chemical and automotive industries; and

|

|

|

•

|

|

changes in applicable laws, rules or regulations, regulatory actions affecting us and other dynamics.

|

In addition, the stock market in general has experienced substantial price and volume fluctuations that have often been unrelated or

disproportionate to the operating performance of particular companies affected. These broad market and industry factors may materially affect the market price of our common shares, regardless of our operating performance. In the past, following

periods of volatility in the market price of certain companies’ securities, securities class action litigation has been instituted against these companies. If any such litigation is instituted against us, it could materially adversely affect

our business, results of operations, financial condition and cash flows.

Future sales of our common shares or the anticipation of

future sales in the public market may adversely affect the trading price of our common shares.

If our shareholders sell a large

number of common shares or if we issue a large number of common shares, the market price of our common shares and our ability to raise capital through subsequent offerings of equity or equity-related securities could be adversely affected. Moreover,

the perception in the public market that our shareholders might sell shares of our common stock could depress the market price of those shares.

S-5

Immediately after this offering, the public market for our common shares will include the

10,000,000 shares of common stock that are being sold in this offering plus 35,162,415 common shares (representing 19,500,000 common shares sold in our initial public offering, plus 5,750,000 shares sold in a registered offering in March 2017, plus

10,227,327 shares sold in a registered offering in July 2017, less 314,912 common shares that have been repurchased by us and are currently held in treasury). Immediately following this offering, Kinove Holdings and Luxco Coinvest will own

10,538,560 and 3,619,239 common shares, respectively (assuming no exercise of the option to purchase additional shares). Subject to the

30-day

lock-up

described below

and to the limitations set forth in the registration rights agreement among the Company, Kinove Holdings and Luxco Coinvest, all common shares beneficially owned by Kinove Holdings and Luxco Coinvest may be publicly resold by the holders from time

to time pursuant to the Registration Statement of which this prospectus supplement and the accompanying prospectus form a part. Subject to the

lock-up,

such shares may also be publicly resold by the holders

from time to time pursuant to Rule 144.

Pursuant to the registration rights agreement, Kinove Holdings may require us, subject to certain

limitations, to facilitate one or more underwritten registered offerings of common shares beneficially owned by Kinove Holdings and Luxco Coinvest may join in such offerings. Kinove Holdings and Luxco Coinvest also have certain “piggyback”

registration rights, pursuant to which they are entitled to register the resale of common shares alongside any offering of securities that we may undertake. Kinove Holdings and Luxco Coinvest may also offer common shares beneficially owned by them

from time to time in separate sales to or through brokers or dealers pursuant to the Registration Statement or any successor shelf registration statement. In connection with the liquidation of Luxco Coinvest, we and Kinove Holdings entered into an

amendment to the registration rights agreement on March 22, 2017, with respect to common shares that Luxco

Co-Investors

may receive from the Liquidator as payment

in-kind

of advances on the liquidation proceeds or

in-kind

boni

of liquidation. Pursuant to the amendment, Luxco

Co-Investors

will be permitted to sell such shares in underwritten offerings pursuant to the Registration Statement that are initiated by Kinove Holdings or the Company. In addition, with the prior written

consent of the Company, Luxco

Co-Investors

will be permitted to sell such common shares in offerings under the Registration Statement other than underwritten offerings. See “Selling

Shareholders—Shares Available for Future Sale.”

In addition, we have registered common shares that are reserved for issuance

under our employee benefit plans. The shares under our employee benefit plans can be sold in the public market upon issuance, subject to restrictions under the securities laws applicable to resales by affiliates.

We, our directors, our executive officers, the Principal Shareholders, the ADIA Investor, Kinove Holdings, Luxco Coinvest and the Luxco

Sellers have agreed, subject to certain exceptions, for a period of 30 days after the date of this prospectus supplement, not to dispose of any common shares or similar securities without the prior written consent of Morgan Stanley & Co.

LLC. See “Underwriting”.

Exchange rate fluctuations may reduce the amount of U.S. Dollars you receive in respect of any

dividends or other distributions we may pay in the future in connection with your common shares.

Our common shares are quoted in

U.S. Dollars on the NYSE. Our financial statements are prepared in Euros. Under Luxembourg law, the determination of whether we have sufficient distributable profits or retained earnings to pay dividends is made on the basis of our unconsolidated

annual financial statements prepared under the Luxembourg Company Law in accordance with accounting principles generally accepted in Luxembourg. Exchange rate fluctuations may affect the amount in Euro that we are able to distribute, and the amount

in U.S. Dollars that our shareholders receive upon the payment of cash dividends or other distributions we declare and pay in Euro, if any. Such fluctuations could adversely affect the value of our common shares, and, in turn, the U.S. Dollar

proceeds that holders receive from the sale of our common shares.

S-6

Risks Related to Investment in a Luxembourg Company and Our Status as a Foreign Private Issuer

We may lose our foreign private issuer status in the future, which could result in significant additional costs and expenses.

We could cease to be a foreign private issuer if a majority of our outstanding voting securities are directly or indirectly held

of record by U.S. residents and we fail to meet alternative requirements necessary to avoid loss of foreign private issuer status. The regulatory and compliance costs to us under U.S. securities laws as a U.S. domestic issuer may be significantly

higher than costs we incur as a foreign private issuer, which could have a material adverse effect on our business and financial results.

The rights of our shareholders may differ from the rights they would have as shareholders of a U.S. corporation, which could

adversely affect trading in our common shares and our ability to conduct equity financings.

Our corporate affairs are governed by

our Articles of Association and the laws of Luxembourg, including the Luxembourg Company Law (

loi du 10 août 1915 concernant les sociétés commerciales, telle quelle a été modifiée

). The rights of our

shareholders and the responsibilities of our directors and officers under Luxembourg law are different from those applicable to a corporation incorporated in the United States. In addition, Luxembourg law governing the securities of Luxembourg

companies may not be as extensive as those in effect in the United States, and Luxembourg law and regulations in respect of corporate governance matters might not be as protective of minority shareholders as state corporation laws in the United

States. As a result, our shareholders may have more difficulty in protecting their interests in connection with actions taken by our directors and officers or our Principal Shareholders than they would as shareholders of a corporation incorporated

in the United States.

On August 23, 2016, certain amendments to the Luxembourg Company Law entered into force. The purpose of the

amendments was to increase the flexibility and legal certainty of certain Luxembourg corporate law concepts. The amendments are therefore rather technical and cover a wide range of areas, including the creation of new type of companies,

clarifications on

non-voting

agreements and

non-voting

shares and the creation of a new liquidation regime. Companies incorporated before the entry into force of the

amendments, including the Company, remain subject to the existing regime of the Luxembourg Company Law for a transitional period of 24 months (i.e., until August 23, 2018). The Company has not yet taken any actions to amend its articles of

association to reflect the changes effected by the amendments. Such adjustments will need to be submitted to the general meeting of shareholders for approval before August 23, 2018. In the absence of shareholder resolutions to amend the

articles of association of the Company, the mandatory provisions of the amended Luxembourg Company Law will apply to the Company by default.

We are organized under the laws of the Grand Duchy of Luxembourg and it may be difficult to obtain or enforce judgments or bring

original actions against us or the members of our Board of Directors in the United States.

We are organized under the laws of the

Grand Duchy of Luxembourg and the majority of our assets are located outside the United States. Furthermore, the majority of the members of our Board of Directors and officers and certain experts named in this prospectus supplement reside outside

the United States and a substantial portion of their assets are located outside the United States. Investors may not be able to effect service of process within the United States upon us or these persons or to enforce judgments obtained against us

or these persons in U.S. courts, including judgments in actions predicated upon the civil liability provisions of the U.S. federal securities laws. Likewise, it may also be difficult for an investor to enforce in U.S. courts judgments obtained

against us or these persons in courts located in jurisdictions outside the United States, including judgments predicated upon the civil liability provisions of the U.S. federal securities laws. Awards of punitive damages in actions brought in the

United States or elsewhere are generally not enforceable in Luxembourg.

S-7

As there is no treaty in force on the reciprocal recognition and enforcement of judgments in

civil and commercial matters between the United States and the Grand Duchy of Luxembourg, courts in Luxembourg will not automatically recognize and enforce a final judgment rendered by a U.S. court. The enforceability in Luxembourg courts of

judgments rendered by U.S. courts will be subject, prior to any enforcement in Luxembourg, to the procedure and the conditions set forth in the Luxembourg procedural code, which conditions may include the following as of the date of this prospectus

supplement (and may change):

|

|

•

|

|

the judgment of the U.S. court is final and enforceable (

exécutoire

) in the United States;

|

|

|

•

|

|

the U.S. court had jurisdiction over the subject matter leading to the judgment (that is, its jurisdiction was in compliance both with Luxembourg private international law rules and with the applicable domestic U.S.

federal or state jurisdictional rules);

|

|

|

•

|

|

the U.S. court applied to the dispute the substantive law that would have been applied by Luxembourg courts(based on recent case law and legal doctrine, it is not certain that this condition would still be required for

enforcement (

exequatur

) to be granted by a Luxembourg court);

|

|

|

•

|

|

the judgment was granted following proceedings where the counterparty had the opportunity to appear and, if it appeared, to present a defense, and the decision of the foreign court must not have been obtained by fraud,

but in compliance with the rights of the defendant;

|

|

|

•

|

|

the U.S. court acted in accordance with its own procedural laws; and

|

|

|

•

|

|

the decisions and the considerations of the U.S. court must not be contrary to Luxembourg international public policy rules or have been given in proceedings of a tax or criminal nature or rendered subsequent to an

evasion of Luxembourg law (

fraude à la loi

). Awards of damages made under civil liability provisions of the U.S. federal securities laws, or other laws, which are classified by Luxembourg courts as being of a penal or punitive nature

(for example, fines or punitive damages), might not be recognized by Luxembourg courts. Ordinarily, an award of monetary damages would not be considered as a penalty, but if the monetary damages include punitive damages, such punitive damages may be

considered as a penalty.

|

In addition, actions brought in a Luxembourg court against us or the members of our Board of

Directors, our officers and the experts named herein to enforce liabilities based on U.S. federal securities laws may be subject to certain restrictions. In particular, Luxembourg courts generally do not award punitive damages. Litigation in

Luxembourg is also subject to rules of procedure that differ from the U.S. rules, including with respect to the taking and admissibility of evidence, the conduct of the proceedings and the allocation of costs. Proceedings in Luxembourg would have to

be conducted in the French or German language, and all documents submitted to the court would, in principle, have to be translated into French or German. For these reasons, it may be difficult for a U.S. investor to bring an original action in a

Luxembourg court predicated upon the civil liability provisions of the U.S. federal securities laws against us, the members of our Board of Directors and officers and the experts named in this prospectus supplement. In addition, even if a judgment

against our company, the

non-U.S.

members of our Board of Directors, officers or the experts named in this prospectus supplement based on the civil liability provisions of the U.S. federal securities laws is

obtained, a U.S. investor may not be able to enforce it in U.S. or Luxembourg courts.

Under our Articles of Association, we may indemnify

our directors for and hold them harmless against all claims, actions, suits or proceedings brought against them, subject to limited exceptions. The right to indemnification does not exist in the case of gross negligence, fraud or wrongful

misconduct. The rights and obligations among or between us and any of our current or former directors and officers are generally governed by the laws of the Grand Duchy of Luxembourg and subject to the jurisdiction of the Luxembourg courts, unless

such rights or obligations do not relate to or arise out of such persons’ capacities listed above. Although there is doubt as to whether U.S. courts would enforce this indemnification provision in an action brought in the United States under

U.S. federal or state securities laws, this provision could make judgments obtained outside Luxembourg more difficult to enforce against our assets in Luxembourg or in jurisdictions that would apply Luxembourg law.

S-8

Luxembourg and European insolvency and bankruptcy laws are substantially different from

U.S. insolvency laws and may offer our shareholders less protection than they would have under U.S. insolvency and bankruptcy laws.

As a joint stock corporation organized under the laws of Luxembourg and with its registered office in Luxembourg, we are subject to Luxembourg

insolvency and bankruptcy laws in the event any insolvency proceedings are initiated against us including, among other things, Council Regulation (EC) No. 1346/2000 of May 29, 2000 on insolvency proceedings and the Regulation (EU) 2015/848

of the European Parliament and of the Council of 20 May 2015 on insolvency proceedings. Should courts in another European country determine that the insolvency and bankruptcy laws of that country apply to us in accordance with and subject to

such EU regulations, the courts in that country could have jurisdiction over the insolvency proceedings initiated against us. Insolvency and bankruptcy laws in Luxembourg or the relevant other European country, if any, may offer our shareholders

less protection than they would have under U.S. insolvency and bankruptcy laws and make it more difficult for them to recover the amount they could expect to recover in a liquidation under U.S. insolvency and bankruptcy laws.

Legal and Regulatory Risks

We

could experience a material adverse effect on our financial condition if the tax authorities were to successfully challenge decisions and assumptions we have made in assessing and complying with our tax obligations.

We make, and have in the past made, numerous decisions and assumptions in assessing and complying with our tax obligations, including in

respect of the tax treatment of the separation of our business from Evonik, the Acquisition, assumptions regarding the tax deductibility of certain interest expenses under German tax regulations, the upholding and recognition of our German tax group

and the applicability of the regulations to our business as a group headquartered by a Luxembourg company. Many of the tax laws that apply to us, including tax laws that apply to the separation of our business from Evonik and the Acquisition, are

complex and often require judgments to be made when the law is unclear or the facts are uncertain. While we believe the decisions we have made and the assumptions and practices we have applied are reasonable and accurate, we cannot guarantee that

these decisions, assumptions and practices will not be questioned or rejected by the tax authorities. In particular, we are subject to tax audits for the period in which the Acquisition occurred by tax authorities in multiple jurisdictions

worldwide, and in many cases these audits have not yet begun or have not been completed and could give rise to issues of this kind. If such tax authorities were to successfully challenge such decisions or assumptions, we could be required to pay

additional amounts to such authorities to satisfy our tax obligations, which could have a material adverse effect on our business, financial condition, results of operations and cash flows. In particular, the German tax authorities are conducting

their first audit of Orion Engineered Carbons GmbH following the Acquisition. Currently, we are unable to assess when this audit will be completed or the possible outcome of this audit. While currently we do not believe this audit will have a

material adverse impact on our financial position, it could raise one or more issues of the kind referenced above.

S-9

USE OF PROCEEDS

We will not receive any of the proceeds from the sale of common shares by the Selling Shareholders.

S-10

CAPITALIZATION AND INDEBTEDNESS

The following table sets forth our capitalization and indebtedness as of September 30, 2017. You should read this table in conjunction

with “Item 5. Operating and Financial Review and Prospects,” our consolidated financial statements, the related notes and the other financial information in our Annual Report on Form

20-F

for the

year ended December 31, 2016 and our unaudited interim condensed consolidated financial statements for the quarter ended September 30, 2017, filed with the SEC on a Form

6-K

on November 3, 2017,

which are incorporated by reference in this prospectus supplement.

|

|

|

|

|

|

|

|

|

As of September 30, 2017

|

|

|

|

|

(in EUR thousands)

|

|

|

Cash and cash equivalents

|

|

|

55,763

|

|

|

Long-term debt:

|

|

|

|

|

|

Revolving Credit Facility

(1)

|

|

|

—

|

|

|

Term Loan

(2)

|

|

|

576,093

|

|

|

|

|

|

|

|

|

Total long-term debt

|

|

|

576,093

|

|

|

Shareholders’ Equity:

|

|

|

|

|

|

Subscribed capital, 59,635,126 common shares with no par value

issued, 29,817,500 common shares with no par value authorized and unissued

|

|

|

59,635

|

|

|

Treasury shares, at cost, 314,912 common shares

|

|

|

(3,415

|

)

|

|

Reserves

|

|

|

(38,047

|

)

|

|

Profit for the period

|

|

|

45,680

|

|

|

|

|

|

|

|

|

Total Equity

|

|

|

63,853

|

|

|

Total capitalization

(does not include cash and cash equivalents)

|

|

|

639,946

|

|

|

|

|

|

|

|

|

(1)

|

As of September 30, 2017, there were no cash amounts drawn under our Revolving Credit Facility. The aggregate amount of the revolving credit commitments as of September 30, 2017 was €175 million.

|

|

(2)

|

Represents the outstanding principal amount of Term Loan, of which the principal amount of $289.3 million is denominated in U.S. Dollars and has been translated at an assumed exchange rate at the maturity date of

$1.1806 per €1.00.

|

S-11

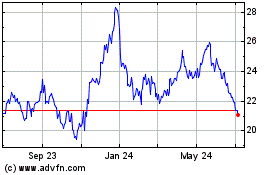

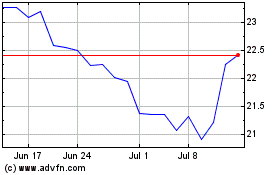

PRICE RANGE OF COMMON SHARES

Our common shares are listed on the NYSE under the symbol “OEC”. Trading on the NYSE began on July 25, 2014. On

November 7, 2017, the last reported sales price of our common shares was $24.25 per share. The following tables set forth, for the periods indicated, the high and low prices of our common shares as reported by the NYSE.

|

|

|

|

|

|

|

|

|

|

|

Fiscal year ended December 31,

|

|

High

|

|

|

Low

|

|

|

2016

|

|

$

|

20.85

|

|

|

$

|

10.33

|

|

|

2015

|

|

$

|

21.06

|

|

|

$

|

9.69

|

|

|

2014

(1)

|

|

$

|

18.40

|

|

|

$

|

12.60

|

|

|

|

|

|

|

|

|

|

|

|

|

Fiscal quarter ended

|

|

|

|

|

|

|

|

December 31, 2017 (through November 7, 2017)

|

|

$

|

25.45

|

|

|

$

|

22.45

|

|

|

September 30, 2017

|

|

$

|

24.55

|

|

|

$

|

19.70

|

|

|

June 30, 2017

|

|

$

|

20.85

|

|

|

$

|

17.15

|

|

|

March 31, 2017

|

|

$

|

22.20

|

|

|

$

|

18.50

|

|

|

December 31, 2016

|

|

$

|

20.85

|

|

|

$

|

17.70

|

|

|

September 30, 2016

|

|

$

|

19.51

|

|

|

$

|

15.13

|

|

|

June 30, 2016

|

|

$

|

17.01

|

|

|

$

|

13.52

|

|

|

March 31, 2016

|

|

$

|

14.95

|

|

|

$

|

10.33

|

|

|

December 31, 2015

|

|

$

|

15.51

|

|

|

$

|

9.69

|

|

|

September 30, 2015

|

|

$

|

19.68

|

|

|

$

|

13.47

|

|

|

June 30, 2015

|

|

$

|

21.06

|

|

|

$

|

17.66

|

|

|

March 31, 2015

|

|

$

|

19.20

|

|

|

$

|

15.79

|

|

|

December 31, 2014

|

|

$

|

18.09

|

|

|

$

|

12.60

|

|

|

September 30, 2014

(1)

|

|

$

|

18.40

|

|

|

$

|

15.87

|

|

|

|

|

|

|

|

|

|

|

|

|

Most recent six months

|

|

|

|

|

|

|

|

November 2017 (through November 7, 2017)

|

|

$

|

25.45

|

|

|

$

|

22.90

|

|

|

October 2017

|

|

$

|

23.95

|

|

|

$

|

22.45

|

|

|

September 2017

|

|

$

|

22.60

|

|

|

$

|

21.10

|

|

|

August 2017

|

|

$

|

21.95

|

|

|

$

|

19.90

|

|

|

July 2017

|

|

$

|

24.55

|

|

|

$

|

19.70

|

|

|

June 2017

|

|

$

|

20.00

|

|

|

$

|

17.15

|

|

|

May 2017

|

|

$

|

20.30

|

|

|

$

|

17.35

|

|

|

(1)

|

Since beginning of trading on July 25, 2014.

|

S-12

SELLING SHAREHOLDERS

Immediately following the offering, Kinove Holdings will hold approximately 17.77% of our outstanding common shares and Luxco Coinvest will

hold approximately 6.10% (assuming no exercise of the option to purchase additional shares). Kinove Holdings is currently owned primarily by the Rhône Investors and the Triton Investors. The remaining ownership interests in Kinove Holdings are

held by the ADIA Investor. Luxco Coinvest is an investment vehicle that is owned by the Luxco

Co-Investors

and Kinove Holdings. On March 23, 2017, an extraordinary general meeting of shareholders of Luxco

Coinvest resolved to dissolve Luxco Coinvest and put it into liquidation, and appointed Kinove Services SARL as liquidator. The liquidation is currently in process. The Liquidator will pay

in-kind

advances on

the liquidation proceeds to the Luxco Sellers listed in the table below as Selling Shareholders by transferring to them the common shares they are selling in this offering.

The following tables set forth information regarding holdings of our common shares (1) by the Selling Shareholders and (2) by the

Principal Shareholders, the ADIA Investor and the Luxco

Co-Investors,

as well as our directors and executive officers, in each case as applicable through their respective ownership interests in Kinove Holdings

or Luxco Coinvest, and both immediately prior to this offering and after giving effect to this offering (excluding any exercise of the underwriter’s option to purchase up to an additional 1,500,000 common shares). Percentage ownership

calculations in this section are based on 59,320,214 common shares outstanding as of the date of this prospectus supplement (reflecting 59,635,126 issued common shares of which 314,912 common shares are held in treasury).

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Selling Shareholders

|

|

Common Shares

Owned Prior to the Offering

|

|

|

Common Shares to

be Sold

in the Offering

|

|

|

Common Shares

Owned After the Offering

|

|

|

|

|

Number

|

|

|

Percent

|

|

|

Number

|

|

|

Number

|

|

|

Percent

|

|

|

|

|

|

|

|

|

|

Kinove Holdings

(1)

|

|

|

19,615,256

|

|

|

|

33.07%

|

|

|

|

9,076,696

|

|

|

|

10,538,560

|

|

|

|

17.77%

|

|

|

Luxco Sellers

(2)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Jack

Clem

†

|

|

|

*

|

|

|

|

*

|

|

|

|

*

|

|

|

|

*

|

|

|

|

*

|

|

|

Charles

Herlinger

†

|

|

|

*

|

|

|

|

*

|

|

|

|

*

|

|

|

|

*

|

|

|

|

*

|

|

|

Diane Herlinger

(3)

|

|

|

*

|

|

|

|

*

|

|

|

|

*

|

|

|

|

*

|

|

|

|

*

|

|

|

Jeff

Malenky

†

|

|

|

*

|

|

|

|

*

|

|

|

|

*

|

|

|

|

*

|

|

|

|

*

|

|

|

Claudine

Mollenkopf

†

|

|

|

*

|

|

|

|

*

|

|

|

|

*

|

|

|

|

*

|

|

|

|

*

|

|

|

Dirk

Rechenbach

†

|

|

|

*

|

|

|

|

*

|

|

|

|

*

|

|

|

|

*

|

|

|

|

*

|

|

|

Georg

Hohn

†

|

|

|

*

|

|

|

|

*

|

|

|

|

*

|

|

|

|

*

|

|

|

|

*

|

|

|

Mark

Leigh

‡

|

|

|

*

|

|

|

|

*

|

|

|

|

*

|

|

|

|

*

|

|

|

|

*

|

|

|

Dietmar

Balschukat

‡

|

|

|

*

|

|

|

|

*

|

|

|

|

*

|

|

|

|

*

|

|

|

|

*

|

|

|

Bernhard

Schwaiger

‡

|

|

|

*

|

|

|

|

*

|

|

|

|

*

|

|

|

|

*

|

|

|

|

*

|

|

|

Tony

Vaccarelli

‡

|

|

|

*

|

|

|

|

*

|

|

|

|

*

|

|

|

|

*

|

|

|

|

*

|

|

|

Udo

Wieschnowsky

†

|

|

|

*

|

|

|

|

*

|

|

|

|

*

|

|

|

|

*

|

|

|

|

*

|

|

|

Werner

Niedemeier

†

|

|

|

*

|

|

|

|

*

|

|

|

|

*

|

|

|

|

*

|

|

|

|

*

|

|

|

Chris

Erickson

†

|

|

|

*

|

|

|

|

*

|

|

|

|

*

|

|

|

|

*

|

|

|

|

*

|

|

|

Andre Schulze

Isfort

†

|

|

|

*

|

|

|

|

*

|

|

|

|

*

|

|

|

|

*

|

|

|

|

*

|

|

|

Marco

Gruss

†

|

|

|

*

|

|

|

|

*

|

|

|

|

*

|

|

|

|

*

|

|

|

|

*

|

|

|

Jeff

Shelton

†

|

|

|

*

|

|

|

|

*

|

|

|

|

*

|

|

|

|

*

|

|

|

|

*

|

|

|

Tilo

Lindner

†

|

|

|

*

|

|

|

|

*

|

|

|

|

*

|

|

|

|

*

|

|

|

|

*

|

|

|

Joerg

Schuhoff

†

|

|

|

*

|

|

|

|

*

|

|

|

|

*

|

|

|

|

*

|

|

|

|

*

|

|

|

Thomas

Ochs

†

|

|

|

*

|

|

|

|

*

|

|

|

|

*

|

|

|

|

*

|

|

|

|

*

|

|

|

Donnie

Loubiere

†

|

|

|

*

|

|

|

|

*

|

|

|

|

*

|

|

|

|

*

|

|

|

|

*

|

|

|

Tsutomu

Nakano

†

|

|

|

*

|

|

|

|

*

|

|

|

|

*

|

|

|

|

*

|

|

|

|

*

|

|

|

Dave

Andrews

†

|

|

|

*

|

|

|

|

*

|

|

|

|

*

|

|

|

|

*

|

|

|

|

*

|

|

|

Don

Kronenberger

†

|

|

|

*

|

|

|

|

*

|

|

|

|

*

|

|

|

|

*

|

|

|

|

*

|

|

|

Erik

Thiry

†

|

|

|

*

|

|

|

|

*

|

|

|

|

*

|

|

|

|

*

|

|

|

|

*

|

|

S-13

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Selling Shareholders

|

|

Common Shares

Owned Prior to the Offering

|

|

|

Common Shares to

be Sold

in the Offering

|

|

|

Common Shares

Owned After the Offering

|

|

|

|

|

Number

|

|

|

Percent

|

|

|

Number

|

|

|

Number

|

|

|

Percent

|

|

|

Jörg

Krüger

‡

|

|

|

*

|

|

|

|

*

|

|

|

|

*

|

|

|

|

*

|

|

|

|

*

|

|

|

Michael

O’Brien

†

|

|

|

*

|

|

|

|

*

|

|

|

|

*

|

|

|

|

*

|

|

|

|

*

|

|

|

Enzo

Pezzolla

†

|

|

|

*

|

|

|

|

*

|

|

|

|

*

|

|

|

|

*

|

|

|

|

*

|

|

|

Russell

Webb

†

|

|

|

*

|

|

|

|

*

|

|

|

|

*

|

|

|

|

*

|

|

|

|

*

|

|

|

Two Pillar GmbH

(4)

|

|

|

*

|

|

|

|

*

|

|

|

|

*

|

|

|

|

*

|

|

|

|

*

|

|

|

Rory

Pollard

†

|

|

|

*

|

|

|

|

*

|

|

|

|

*

|

|

|

|

*

|

|

|

|

*

|

|

|

Christian

Eggert

†

|

|

|

*

|

|

|

|

*

|

|

|

|

*

|

|

|

|

*

|

|

|

|

*

|

|

|

Michael

Warrikoff

†

|

|

|

*

|

|

|

|

*

|

|

|

|

*

|

|

|

|

*

|

|

|

|

*

|

|

|

Sascha

Link

†

|

|

|

*

|

|

|

|

*

|

|

|

|

*

|

|

|

|

*

|

|

|

|

*

|

|

|

Barry

Snyder

‡

|

|

|

*

|

|

|

|

*

|

|

|

|

*

|

|

|

|

*

|

|

|

|

*

|

|

|

Michael

Reers

†

|

|

|

*

|

|

|

|

*

|

|

|

|

*

|

|

|

|

*

|

|

|

|

*

|

|

|

Christian

Werner

‡

|

|

|

*

|

|

|

|

*

|

|

|

|

*

|

|

|

|

*

|

|

|

|

*

|

|

|

Diana

Downey

†

|

|

|

*

|

|

|

|

*

|

|

|

|

*

|

|

|

|

*

|

|

|

|

*

|

|

|

Lixing Ping

(Min)

†

|

|

|

*

|

|

|

|

*

|

|

|

|

*

|

|

|

|

*

|

|

|

|

*

|

|

|

Arndt

Schinkel

†

|

|

|

*

|

|

|

|

*

|

|

|

|

*

|

|

|

|

*

|

|

|

|

*

|

|

|

Lester

Tyra

‡

|

|

|

*

|

|

|

|

*

|

|

|

|

*

|

|

|

|

*

|

|

|

|

*

|

|

|

Henry

Brooks

†

|

|

|

*

|

|

|

|

*

|

|

|

|

*

|

|

|

|

*

|

|

|

|

*

|

|

|

Anthony Zhitong

Su

†

|

|

|

*

|

|

|

|

*

|

|

|

|

*

|

|

|

|

*

|

|

|

|

*

|

|

|

Romeo Kreinberg

(5)

|

|

|

*

|

|

|

|

*

|

|

|

|

*

|

|

|

|

*

|

|

|

|

*

|

|

|

Weigelia

(6)

|

|

|

*

|

|

|

|

*

|

|

|

|

*

|

|

|

|

*

|

|

|

|

*

|

|

|

Total Luxco Sellers

|

|

|

1,966,241

|

|

|

|

3.31

|

%

|

|

|

923,304

|

|

|

|

1,042,937

|

|

|

|

1.76

|

%

|

|

Total

|

|

|

21,581,497

|

|

|

|

36.38

|

%

|

|

|

10,000,000

|

|

|

|

11,581,497

|

|

|

|

19.52

|

%

|

Totals may

not sum due to rounding.

|

*

|

Represents beneficial ownership of less than one percent (1%) of our outstanding equity interests.

|

|

†

|

Current employee of the Company

|

|

‡

|

Former employee of the Company

|

|

(1)

|

Kinove Holdings is a limited liability company (

société à responsabilité limitée

) organized under the laws of the Grand Duchy of Luxembourg and registered under registration

number B 160655 with the Luxembourg Register of Commerce and Companies (

Registre de Commerce et des Sociétés

). Kinove Holdings’ principal registered office is located at 14 rue Edward Steichen,

L-2540

Luxembourg, Grand Duchy of Luxembourg. If the underwriter fully exercises its option to purchase additional shares, following this offering Kinove Holding will own 9,177,056 common shares, or 15.47% of common

shares currently outstanding. In addition, 2,547,230 common shares (4.29% of common shares currently outstanding) owned by Luxco Coinvest (both before and after the offering) are attributable to shares of Luxco Coinvest held by Kinove Holdings, but

are not reflected in the table above.

|

|

(2)

|

Unless otherwise indicated, the address for all Luxco Sellers is c/o Kinove Luxembourg Coinvestment S.C.A., 2C, rue Albert Borschette,

L-1246

Luxembourg. Luxco Coinvest is a

partnership limited by shares (

société en commandite par actions

) organized under the laws of the Grand Duchy of Luxembourg and registered with the Luxembourg Register of Commerce and Companies under registration number B

166469. Luxco Coinvest’s principal registered office is located at 2C, rue Albert Borschette,

L-1246

Luxembourg, Grand Duchy of Luxembourg. Luxco Coinvest owns 4,542,543 common shares, representing 7.66%

of common shares currently outstanding. Immediately following this offering, Luxco Coinvest will own 3,619,239 common shares, representing 6.10% of common shares currently outstanding (3,480,743 common shares and 5.87%, assuming full exercise of the

underwriter’s option to purchase additional common shares).

|

|

(3)

|

Diane Herlinger is the wife of Charles Herlinger, our Chief Financial Officer.

|

|

(4)

|

Two Pillar GmbH is a private limited liability company organized under the laws of Germany and registered with at

Amtsgericht Freiburg i.Br. under number HRB 709572. Two Pillar’s registered office is located at 2,

|

S-14

|

|

Im Dorfli,

D-79692

Kleines Wiesental, Germany. Daniel Meier, an employee of the Company, has voting and investment power over the common shares owned by

Two Pillar.

|

|

(5)

|

Mr. Kreinberg is a member of our Board of Directors.

|

|

(6)

|

Weigelia is a limited liability company (

société à responsabilité limitée

) organized under the laws of France and registered under registration number 807 949 771 with the

Register of Commerce and Companies (

Registre de Commerce et des Sociétés

) in Castres. Weigelia’s principal registered office is located at Montaboulet Bas 81470 Maurens-Scopont, France. Didier Miraton, a member of our Board

of Directors, has voting and investment power over the common shares owned by Weigelia.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Indirect Owners

|

|

Common Shares Indirectly

Owned Prior to the

Offering

|

|

|

Common Shares to

be Sold

in the Offering

|

|

|

Common Shares

Indirectly Owned After the

Offering

|

|

|

|

|

Number

|

|

|

Percent

|

|

|

Number

|

|

|

Number

|

|

|

Percent

(1)

|

|

|

Rhône Investors

(2)

|

|

|

9,873,765

|

|

|

|

16.64

|

%

|

|

|

4,043,822

|

|

|

|

5,829,943

|

|

|

|

9.83

|

%

|

|

Triton Investors

(3)

|

|

|

9,873,765

|

|

|

|

16.64

|

%

|

|

|

4,043,822

|

|

|

|

5,829,943

|

|

|

|

9.83

|

%

|

|

ADIA Investor

(4)

|

|

|

2,414,956

|

|

|

|

4.07

|

%

|

|

|

989,052

|

|

|

|

1,425,904

|

|

|

|

2.40

|

%

|

|

Luxco

Co-Investors

(collectively)

(5)

|

|

|

1,995,313

|

|

|

|

3.36

|

%

|

|

|

923,304

|

(6)

|

|

|

1,072,009

|

|

|

|

1.81

|

%

|

|

Total

|

|

|

24,157,799

|

|

|

|

40.72

|

%

|

|

|

10,000,000

|

|

|

|

14,157,799

|

|

|

|

23.87

|

%

|

|

|

|

|

|

|

|

|

Directors:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Directors collectively (8 persons)

|

|

|

174,434

|

(7)

|

|

|

*

|

|

|

|

68,249

|

|

|

|

106,185

|

|

|

|

*

|

|

|

|

|

|

|

|

|

|

Executive Officers:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Jack Clem

|

|

|

*

|

|

|

|

*

|

|

|

|

*

|

|

|

|

*

|

|

|

|

*

|

|

|

Christian Eggert

|

|

|

*

|

|

|

|

*

|

|

|

|

*

|

|

|

|

*

|

|

|

|

*

|

|

|

Charles Herlinger

(8)

|

|

|

*

|

|

|

|

*

|

|

|

|

*

|

|

|

|

*

|

|

|

|

*

|

|

|

Jeffrey Malenky

|

|

|

*

|

|

|

|

*

|

|

|

|

*

|

|

|

|

*

|

|

|

|

*

|

|

|

Lixing Min

|

|

|

*

|

|

|

|

*

|

|

|

|

*

|

|

|

|

*

|

|

|

|

*

|

|

|

Claudine Mollenkopf

|

|

|

*

|

|

|

|

*

|

|

|

|

*

|

|

|

|

*

|

|

|

|

*

|

|

|

Michael Reers

|

|

|

*

|

|

|

|

*

|

|

|

|

*

|

|

|

|

*

|

|

|

|

*

|

|

|

André Schulze Isfort

|

|

|

*

|

|

|

|

*

|

|

|

|

*

|

|

|

|

*

|

|

|

|

*

|

|

|

Erik Thiry

|

|

|

*

|

|

|

|

*

|

|

|

|

*

|

|

|

|

*

|

|

|

|

*

|

|