Liberty Media Corporation (“Liberty Media” or “Liberty”)

(NASDAQ: LSXMA, LSXMB, LSXMK, BATRA, BATRK, FWONA, FWONK) today

reported third quarter 2017 results. Highlights include(1):

- Attributed to Liberty SiriusXM Group

- SiriusXM reported strong third quarter

2017 results

- Third quarter revenue climbed 8% to

$1.4 billion

- Quarterly net income increased 42% to

$276 million; diluted EPS grew 49% to $0.06

- Adjusted EBITDA(2) grew 12% to a

quarterly record of $551 million and margin of 39.9%

- Quarterly operating cash flow rose 24%

to $521 million

- Free cash flow(2) grew 22% to a

quarterly record $434 million

- Self-pay net subscribers increased

311,000 to reach approximately 27 million

- SiriusXM increased 2017 guidance for

revenue, adjusted EBITDA and free cash flow

- SiriusXM closed second stage of $480

million investment in Pandora, representing approximately 19%

interest or approximately 16% on as converted basis

- Liberty Media’s ownership of SiriusXM

stood at 68.8% as of October 23rd

- Attributed to Formula One Group

- Announced several broadcast agreements,

including TF1 free-to-air agreement in France, FOX SPORTS in

Australia, ESPN multimedia agreement in the US and satellite radio

agreement with SiriusXM

- Completed multi-year extensions for

Grands Prix in China and Singapore

- Proposed, jointly with the FIA, overall

framework for 2021 power unit definition

- Attributed to Braves Group

- Finished successful first season at

SunTrust Park with meaningful increases in ticket sales,

concessions and retail revenue

- Remaining Battery Atlanta development

on-time and on-budget

“Formula 1 delivered exciting racing, with five different

drivers standing atop the podium so far this season, and Lewis

Hamilton securing his fourth World Championship in Mexico City,”

said Greg Maffei, Liberty Media President and CEO. “The Atlanta

Braves new SunTrust Park is living up to its potential, and we saw

meaningful increases across the board in revenue. SiriusXM again

posted strong results and completed its investment in Pandora.”

Unless otherwise noted, the following discussion compares

financial information for the three months ended September 30, 2017

to the same period in 2016.

LIBERTY SIRIUSXM GROUP – The following table provides the

financial results attributed to Liberty SiriusXM Group for the

third quarter of 2017. In the third quarter, approximately $13

million of corporate level selling, general and administrative

expense (including stock-based compensation expense) was allocated

to the Liberty SiriusXM Group.

3Q16 3Q17 % Change amounts in millions

Liberty SiriusXM Group Revenue SiriusXM $ 1,276

$ 1,379 8 % Total Liberty SiriusXM Group $

1,276 $ 1,379 8 %

Operating Income

(Loss) SiriusXM 381 421 10 % Corporate and other (14 )

(13 ) 7 % Total Liberty SiriusXM Group $ 367 $

408 11 %

Adjusted OIBDA SiriusXM 490 549 12 %

Corporate and other (8 ) (6 ) 25 % Total

Liberty SiriusXM Group $ 482 $ 543 13 %

The increases in Liberty SiriusXM Group revenue, operating

income and adjusted OIBDA(2) were primarily attributable to an

increase in SiriusXM’s daily weighted average number of subscribers

and an increase in SiriusXM’s average monthly revenue per

subscriber due to certain rate increases.

SiriusXM is a separate publicly traded company and additional

information about SiriusXM can be obtained through its website and

filings with the Securities and Exchange Commission. SiriusXM

reported its stand-alone third quarter results on October 25, 2017.

For additional detail on SiriusXM’s financial results for the third

quarter, please see SiriusXM’s earnings release posted to their

Investor Relations website. For presentation purposes on page one

of this release, we include the results of SiriusXM, as reported by

SiriusXM, without regard to the purchase accounting adjustments

applied by us for purposes of our financial statements. Liberty

Media believes the presentation of financial results as reported by

SiriusXM is useful to investors as the comparability of those

results is best understood in the context of SiriusXM's historical

financial presentation. For a reconciliation of revenue, adjusted

OIBDA (as defined by Liberty Media) and operating income for

SiriusXM's stand-alone operating results as reported by SiriusXM to

those results as reported by Liberty Media, see Liberty Media's

Form 10-Q for the quarter ended September 30, 2017.

The businesses and assets attributed to Liberty SiriusXM Group

consist primarily of Liberty Media’s interest in SiriusXM.

FORMULA ONE GROUP – The following table provides the

financial results attributed to the Formula One Group for the third

quarter of 2017. In the third quarter, the Formula One Group

incurred approximately $7 million of corporate level selling,

general and administrative expense (including stock-based

compensation expense).

“We are looking forward to the final Grands Prix of the season

in Sao Paulo and Abu Dhabi,” said Chase Carey, Formula 1 Chairman

and CEO. “We are focused on making the sport even greater through

fan engagement to produce long term results.”

3Q16 3Q17 amounts in millions

Formula One Group

Revenue Formula 1 $

N/A

$ 501 Corporate and other — — Total

Formula One Group $ — $ 501

Operating Income

(Loss) Formula 1 $

N/A

$ (10 ) Corporate and other (16 ) (7 ) Total Formula

One Group $ (16 ) $ (17 )

Adjusted OIBDA Formula 1 $

N/A

$ 106 Corporate and other (13 ) (2 ) Total Formula

One Group $ (13 ) $ 104

Liberty completed the acquisition of F1 on January 23, 2017.

Liberty maintained an investment in F1 from September 7, 2016 until

January 23, 2017, which was accounted for as a cost investment. For

comparison and discussion purposes, the pro forma results of F1 are

presented below for the full three months ended September 30, 2017

and 2016, inclusive of purchase accounting adjustments, as if the

acquisition of F1 occurred on January 1, 2016. The purchase price

allocation related to the F1 business combination and pro forma

adjustments are preliminary and have been made available solely for

the purpose of providing comparative pro forma condensed

consolidated financial information. The financial information below

is presented for illustrative purposes only and does not purport to

represent the actual results of F1 had the business combination

occurred on January 1, 2016, or to project the results of

operations of Liberty for any future periods.

Pro Forma F1 Operating Results

3Q16 3Q17 % Change amounts in millions Primary

Formula 1 revenue $ 453 $ 430 (5 ) % Other Formula 1 revenue

67 71 6 % Total Formula 1 revenue $ 520

$ 501 (4 ) % Operating expenses (excluding stock-based compensation

included below): Team payments (316 ) (273 ) 14 % Other cost of

Formula 1 revenue (86 ) (81 ) 6 % Cost of

Formula 1 revenue $ (402 ) $ (354 ) 12 % Selling, general and

administrative expenses (31 ) (36 ) (16 ) % Adjusted

OIBDA

$

87

$

111(1)

28 % Stock-based compensation — (7 ) — % Depreciation and

Amortization (113 ) (114 ) (1 ) % Operating loss $

(26 ) $ (10 ) 61 % Number of races in period 7

6 (1) Pro forma adjusted

OIBDA for the third quarter is net of $5 million of transaction

expenses related to the F1 acquisition recognized during the

quarter.

Primary F1 revenue represents the majority of F1’s revenue and

is derived from (i) race promotion fees, (ii) broadcasting fees and

(iii) advertising and sponsorship fees. Broadcast revenue decreased

due to the impact of slightly lower proportionate recognition of

season-based income during the quarter (6/20 races in the third

quarter of 2017 compared to 7/21 races in the third quarter of

2016) and the adverse impact of weaker prevailing foreign currency

exchange rates used to translate a small number of Pound and

Euro-denominated contracts into US dollars, partially offset by

higher contractual rates. Race promotion and advertising and

sponsorship revenue decreased due to one less event being held in

the third quarter of 2017 compared to the same period in 2016.

Other F1 revenue increased modestly during the third quarter

primarily due to higher logistics and digital media revenue,

partially offset by lower spend by GP3 series’ competing teams due

to it being the second year of the GP3 vehicle cycle.

Operating loss decreased and adjusted OIBDA increased in the

third quarter. Cost of F1 revenue decreased primarily driven by

lower team payments due to the pro rata recognition of such

payments during the season and a decrease in other costs primarily

due to lower circuit fees at one race, partially offset by

increased costs related to spend on fan engagement, filming in

Ultra High-Definition and higher freight costs. Selling, general

and administrative expense increased as a result of additional

headcount and new corporate offices, and stock-based compensation

increased related to awards granted to members of F1

management.

The businesses and assets attributed to the Formula One Group

consist of all of Liberty Media’s businesses and assets other than

those attributed to the Liberty SiriusXM Group and the Braves

Group, including Liberty Media’s subsidiary F1, its interest in

Live Nation, minority equity investments in Time Warner and Viacom

and an intergroup interest in the Braves Group. There are

approximately 9.1 million notional shares of the Braves Group

underlying the Formula One Group’s 15.5% intergroup interest as of

October 31, 2017.

BRAVES GROUP – The following table provides the financial

results attributed to the Braves Group for the third quarter of

2017. In the third quarter, approximately $1 million of corporate

level selling, general and administrative expense (including

stock-based compensation expense) was allocated to the Braves

Group.

3Q16 3Q17 amounts in millions

Braves Group

Revenue Corporate and other $ 109 $ 185 Total Braves

Group $ 109 $ 185

Operating Income (Loss) Corporate

and other 1 (9 ) Total Braves Group $ 1 $ (9 )

Adjusted OIBDA Corporate and other 16 48

Total Braves Group $ 16 $ 48

The following table provides the operating results of Braves

Holdings, LLC (“Braves”).

Braves Operating Results

3Q16 3Q17 % Change amounts in millions Total

revenue $ 109 $ 185 70 % Operating expenses (excluding stock-based

compensation included below): Other operating expenses (78 ) (109 )

(40 ) % Selling, general and administrative expenses (15 )

(27 ) (80 ) % Adjusted OIBDA $ 16 $ 49 206 % Stock-based

compensation (2 ) (33 ) (1,550 ) % Depreciation and Amortization

(12 ) (24 ) (100 ) % Operating income (loss) $ 2

$ (8 ) (500 ) % Number of home game openings in

period 35 41

The increase in Braves revenue in the quarter was primarily

attributable to an increase in ballpark operations revenue driven

by the Braves move to their new ballpark, SunTrust Park. Ticket

sales, concessions, corporate sales, suites and premium seat fees

all increased during the third quarter.

Operating loss increased compared to the prior year primarily as

a result of increased stock-based compensation expense due to an

increase in the estimated value of the Braves, combined with the

continued vesting of outstanding awards, which resulted in a higher

accrual for Braves’ equity compensation. Increased depreciation and

amortization expense due to the depreciation of assets associated

with the Braves mixed-use facility and SunTrust Park also impacted

the operating loss. Adjusted OIBDA increased primarily due to the

increase in ballpark operations revenue as discussed above,

partially offset by increased costs associated with baseball and

ballpark operations and the mixed-use facility.

The Formula One Group holds an approximate 15.5% intergroup

interest in the Braves Group as of October 31, 2017. Assuming the

issuance of the shares underlying the intergroup interest held by

the Formula One Group, the Braves Group outstanding share count as

of October 31, 2017 would have been 58.6 million.

The businesses and assets attributed to the Braves Group consist

primarily of Liberty Media’s subsidiary the Braves, which

indirectly owns the Atlanta Braves major league baseball team, five

minor league baseball clubs and certain assets and liabilities

associated with its ballpark and mixed-use development project.

Share Repurchases

There were no repurchases of Series A or Series C Liberty

SiriusXM common stock, Series A or Series C Liberty Braves common

stock or Series A or Series C Liberty Formula One common stock from

August 1, 2017 through October 31, 2017. The total remaining

repurchase authorization for Liberty Media is approximately $1.3

billion and can be applied to repurchases of Series A and Series C

shares of any of the Liberty Media Corporation tracking stocks.

FOOTNOTES

1) Liberty Media's President and CEO, Greg Maffei,

will discuss these highlights and other matters on Liberty Media's

earnings conference call which will begin at 12:15 p.m. (E.S.T.) on

November 9, 2017. For information regarding how to access the call,

please see “Important Notice” later in this document. 2) For

definitions of adjusted OIBDA (as defined by Liberty Media) and

adjusted EBITDA and free cash flow (as defined by SiriusXM) and

applicable reconciliations see the accompanying schedules.

NOTES

The following financial information with respect to Liberty

Media's equity affiliates and available for sale securities is

intended to supplement Liberty Media's condensed consolidated

balance sheet and statement of operations to be included in its

Form 10-Q for the period ended September 30, 2017.

Fair Value of Corporate Public

Holdings

(amounts in millions)

6/30/2017

9/30/2017 Liberty SiriusXM Group(1) $ N/A $ N/A Formula One Group

Live Nation Equity Method Investment(2) $ 2,427 3,033 Other Public

Holdings(3) 509 502 Total Formula One Group $ 2,936 $

3,535 Braves Group N/A N/A

Total Liberty Media

$ 2,936 $ 3,535 (1)

SiriusXM's investment in Pandora excluded

from public holdings presented above.

(2) Represents the fair value of the equity investment attributed

to Formula One Group. In accordance with GAAP, Liberty Media

accounts for its investment in the equity of Live Nation using the

equity method of accounting and includes it in its condensed

consolidated balance sheet at its historical carrying value of $755

million and $805 million as of June 30, 2017 and September 30,

2017, respectively. (3) Represents the carrying value of other

public holdings which are accounted for at fair value.

Cash and Debt

The following presentation is provided to separately identify

cash and liquid investments and debt information.

(amounts in millions)

6/30/2017

9/30/2017

Cash and Cash Equivalents Attributable to: Liberty

SiriusXM Group(1) $ 173 $ 234 Formula One Group(2) 443 420 Braves

Group 128 129

Total Liberty Consolidated Cash and

Cash Equivalents (GAAP) $ 744 $ 783

Debt: SiriusXM senior notes(3) $ 5,500 $ 6,500 Margin loans

250 250 Other subsidiary debt(4) 1,011 299

Total Attributed Liberty SiriusXM Group Debt $

6,761 $ 7,049 Unamortized

discount, fair market value adjustment and deferred loan costs

(44 ) (67 )

Total Attributed Liberty SiriusXM

Group Debt (GAAP) $ 6,717 $

6,982 1.375% cash convertible notes due

2023(5) 1,000 1,000 1% cash convertible notes due 2023(5) 450 450

2.25% exchangeable senior debentures due 2046(5) 445 445 Live

Nation margin loan 350 350 Formula 1 bank loans 3,402 3,302 Delta

Topco exchangeable notes(5) 351 27 Other corporate level debt

35 35

Total Attributed Formula One

Group Debt $ 6,033 $ 5,609

Fair market value adjustment 272 325

Total Attributed Formula One Group Debt (GAAP)

$ 6,305 $ 5,934

Atlanta Braves debt(6) 511 585

Total

Attributed Braves Group Debt $ 511

$ 585 Deferred loan costs (9 )

(9 )

Total Attributed Braves Group Debt (GAAP) $

502 $ 576

Total Liberty Media Corporation Debt (GAAP) $

13,524 $ 13,492 (1)

Includes $43 million and $74 million of cash and

liquid investments held at SiriusXM as of June 30, 2017 and

September 30, 2017, respectively. (2) Includes $297 million and

$274 million of cash and liquid investments held at Formula 1 as of

June 30, 2017 and September 30, 2017, respectively. (3) Outstanding

principal amount of Senior Notes with no reduction for the net

unamortized discount. (4) Includes SiriusXM capital leases and

borrowings under the SiriusXM revolving credit facility. (5) Face

amount of the cash convertible notes and exchangeable debentures

with no fair market value adjustment. (6) Includes Atlanta National

League Baseball Club, LLC borrowings, Braves Stadium Company, LLC

debt to fund the construction of the new ballpark and drawdowns

under various credit facilities to fund development costs for the

mixed-use development.

Total cash and liquid investments attributed to Liberty SiriusXM

Group increased $61 million during the quarter as cash from

operations and net debt borrowings more than offset approximately

$308 million spent to complete the second stage of SiriusXM’s

investment in Pandora as well as stock repurchases, dividends paid

to shareholders and capital expenditures at SiriusXM. Included in

the cash and liquid investments balance attributed to Liberty

SiriusXM Group at September 30, 2017 is $74 million held at

SiriusXM. Although SiriusXM is a consolidated subsidiary, it is a

separate public company with a significant non-controlling

interest, therefore Liberty Media does not have ready access to

SiriusXM’s cash balance.

Total debt attributed to Liberty SiriusXM Group increased $288

million during the quarter primarily due to net borrowings at

SiriusXM. During the third quarter, SiriusXM issued $1.0 billion

aggregate principal amount of 3.875% Senior Notes due 2022 and $1.5

billion aggregate principal amount of 5.00% Senior Notes due 2027,

which was partially offset by the redemption of $1.5 billion across

various tranches of Senior Notes and net repayments under

SiriusXM’s credit facility.

Total cash and liquid investments attributed to the Formula One

Group decreased $23 million during the quarter, primarily as a

result of debt repayments, partially offset by cash from operations

and working capital swings due to the seasonality of the

business.

Total debt attributed to Formula One Group decreased

approximately $424 million primarily as a result of the repayment

of debt at F1 and the Exchangeable Notes (described below). On

August 3, 2017, Liberty closed a $200 million add-on to F1’s $3.1

billion first lien term loan. The add-on is on the same terms as

the existing first lien term loan and has a rate of 3.25%, which

was further reduced to 3.00% after September 2, 2017 due to certain

upgraded credit ratings. F1 used the proceeds from the $200 million

term loan, together with cash on hand, to repay the remaining $300

million of F1’s second lien term loan. Liberty also amended the

first lien term loan agreement to, among other things, increase

F1’s available revolving credit facility capacity from $75 million

to $500 million, which was undrawn as of September 30, 2017. The

term loan and revolving credit facility remain non-recourse to

Liberty.

On September 22, 2017, Liberty closed a secondary offering on

behalf of certain F1 selling shareholders of 17.7 million shares of

Series C Liberty Formula One common stock ("FWONK") at a price of

$37.40 per share. The offering included approximately 14.5 million

shares of FWONK that were issued to the selling shareholders in

exchange for approximately $323.2 million aggregate principal

amount of Exchangeable Notes, and accrued interest thereon, issued

to the F1 selling shareholders in connection with the F1

acquisition. Liberty did not receive any proceeds from the

offering.

On October 27, 2017, Liberty launched an exchange offer to

exchange all, but not less than all, of the remaining outstanding

Exchangeable Notes issued to the F1 selling shareholders in

connection with the F1 acquisition. Upon exchange, noteholders will

receive (i) a number of FWONK shares equal to the principal amount

owned divided by the $22.323 conversion price, rounded up to the

nearest whole share, and (ii) cash equal to all unpaid interest had

the Exchangeable Notes been held until maturity on July 23, 2019.

The exchange offer expires at midnight, New York City time, at the

end of Friday, November 24, 2017, unless extended or earlier

terminated.

As of October 31, 2017, there are approximately 230.8 million

shares of Formula One Group common stock outstanding, pro forma for

the approximately 1.2 million shares of FWONK issuable upon

exchange of the remaining Exchangeable Notes. Based on this share

count, the original selling shareholders of F1 who acquired shares

of FWONK in January 2017 in connection with the Formula 1

acquisition own approximately 3% of the equity of the Formula One

Group, assuming no prior or subsequent acquisitions of Liberty

Formula One common stock.

Total cash and liquid investments attributed to the Braves Group

was flat in the quarter as capital expenditures related to the

construction of the new ballpark and adjacent mixed-use development

were offset by cash from operations and additional borrowings.

As of September 30, 2017, approximately $718 million had been

spent on the new ballpark, of which approximately $390 million of

funding was provided by Cobb County and related entities and $328

million provided by the Braves. As of September 30, 2017,

approximately $398 million had been spent on the mixed-use

development (including $7 million of cost towards future

development phases, including purchased land cost, not reflected in

the currently forecasted equity contribution towards the mixed-use

development). The Braves have provided $364 million of this

funding, of which approximately $188 million was contributed in

equity and approximately $176 million in debt.

Total debt attributed to the Braves Group increased by $74

million primarily as a result of additional borrowings for funding

the ballpark and mixed-use development.

Important Notice: Liberty Media Corporation (NASDAQ:

LSXMA, LSXMB, LSXMK, FWONA, FWONK, BATRA, BATRK) President and CEO,

Greg Maffei, will discuss Liberty Media's earnings release on a

conference call which will begin at 12:15 p.m. (E.S.T.) on November

9, 2017. The call can be accessed by dialing (844) 838-8043 or

(678) 509-7480 at least 10 minutes prior to the start time. The

call will also be broadcast live across the Internet and archived

on our website. To access the webcast go to

http://www.libertymedia.com/events. Links to this press release

will also be available on the Liberty Media website.

This press release includes certain forward-looking statements

within the meaning of the Private Securities Litigation Reform Act

of 1995, including statements about business strategies, market

potential, future financial prospects, the future financial

performance of F1’s business, the new ballpark for the Atlanta

Braves and completion of the associated mixed-use development,

expansion of the Formula 1 brand, completion of the exchange offer

for the Exchangeable Notes, the continuation of our stock

repurchase plan and other matters that are not historical facts.

These forward-looking statements involve many risks and

uncertainties that could cause actual results to differ materially

from those expressed or implied by such statements, including,

without limitation, possible changes in market acceptance of new

products or services, regulatory matters affecting our businesses,

the unfavorable outcome of pending or future litigation, the

failure to realize benefits of acquisitions, rapid technological

and industry change, failure of third parties to perform, changes

in consumer protection laws and their enforcement, continued access

to capital on terms acceptable to Liberty Media, satisfaction of

the conditions to completing the exchange offer for the

Exchangeable Notes and changes in law and market conditions

conducive to stock repurchases. These forward-looking statements

speak only as of the date of this press release, and Liberty Media

expressly disclaims any obligation or undertaking to disseminate

any updates or revisions to any forward-looking statement contained

herein to reflect any change in Liberty Media's expectations with

regard thereto or any change in events, conditions or circumstances

on which any such statement is based. Please refer to the publicly

filed documents of Liberty Media, including the most recent Forms

10-K and 10-Q, for additional information about Liberty Media and

about the risks and uncertainties related to Liberty Media's

business which may affect the statements made in this press

release.

LIBERTY MEDIA CORPORATION

BALANCE SHEET INFORMATION

September 30, 2017 (unaudited)

Attributed Liberty Formula

SiriusXM Braves One Intergroup

Consolidated Group Group Group

Eliminations Liberty amounts in millions Assets

Current assets: Cash and cash equivalents $ 234 129 420 — 783 Trade

and other receivables, net 225 51 77 — 353 Other current assets

198 23 78 — 299 Total

current assets 657 203 575 —

1,435 Intergroup interest in the Braves Group — — 230 (230 )

— Investments in available-for-sale securities and other cost

investments 552 8 560 — 1,120 Investments in affiliates, accounted

for using the equity method 680 111 981 — 1,772 Property and

equipment, at cost 2,191 1,120 174 — 3,485 Accumulated depreciation

(859 ) (36 ) (76 ) — (971 ) 1,332 1,084

98 — 2,514 Intangible assets not

subject to amortization Goodwill 14,247 180 3,968 — 18,395 FCC

licenses 8,600 — — — 8,600 Other 931 143 —

— 1,074 23,778 323 3,968

— 28,069 Intangible assets subject to

amortization, net 971 59 5,212 — 6,242 Other assets 147

15 569 (30 ) 701 Total assets $ 28,117

1,803 12,193 (260 ) 41,853

Liabilities and Equity Current liabilities: Intergroup payable

(receivable) $ (9 ) (21 ) 30 — — Accounts payable and accrued

liabilities 838 108 154 — 1,100 Current portion of debt 4 43 — — 47

Deferred revenue 1,846 27 306 — 2,179 Other current liabilities

8 — 20 — 28 Total current

liabilities 2,687 157 510 —

3,354 Long-term debt 6,978 533 5,934 — 13,445 Deferred

income tax liabilities 2,292 75 477 (30 ) 2,814 Redeemable

intergroup interest — 230 — (230 ) — Other liabilities 285

438 63 — 786 Total liabilities

12,242 1,433 6,984 (260 ) 20,399

Equity / Attributed net assets 10,277 355 5,207 — 15,839

Noncontrolling interests in equity of subsidiaries 5,598

15 2 — 5,615 Total liabilities

and equity $ 28,117 1,803 12,193 (260 ) 41,853

LIBERTY MEDIA CORPORATION

STATEMENT OF OPERATIONS

Three months ended September 30, 2017

(unaudited)

Attributed Liberty Formula

SiriusXM Braves One Consolidated

Group Group Group Liberty amounts in

millions Revenue: Subscriber revenue $ 1,136 — — 1,136 Formula 1

revenue — — 501 501 Other revenue 243 185 —

428 Total revenue 1,379 185 501 2,065 Operating costs

and expenses, including stock-based compensation: Cost of

subscriber services (exclusive of depreciation shown separately

below): Revenue share and royalties 297 — — 297 Programming and

content 98 — — 98 Customer service and billing 95 — — 95 Other 29 —

— 29 Cost of Formula 1 revenue — — 354 354 Subscriber acquisition

costs 119 — — 119 Other operating expenses 30 109 — 139 Selling,

general and administrative 210 61 53 324 Depreciation and

amortization 93 24 111 228

971 194 518 1,683 Operating

income (loss) 408 (9 ) (17 ) 382 Other income (expense): Interest

expense (95 ) (7 ) (57 ) (159 ) Share of earnings (losses) of

affiliates, net 34 68 53 155 Realized and unrealized gains (losses)

on financial instruments, net 62 — (44 ) 18 Unrealized gains

(losses) on intergroup interest — (12 ) 12 — Other, net (19

) 1 7 (11 ) (18 ) 50 (29 ) 3

Earnings (loss) from continuing operations before income taxes 390

41 (46 ) 385 Income tax (expense) benefit (116 ) (19 ) 11

(124 ) Net earnings (loss) 274 22 (35 ) 261 Less net

earnings (loss) attributable to the noncontrolling interests

91 — 2 93 Net earnings (loss)

attributable to Liberty stockholders $ 183 22 (37 )

168 Programming and content 7 — — 7 Customer

service and billing 1 — — 1 Other 2 — — 2 Other operating expenses

4 — — 4 Selling, general and administrative 28 33

10 71 Stock compensation expense $ 42

33 10 85

LIBERTY MEDIA CORPORATION

STATEMENT OF OPERATIONS

Three months ended September 30, 2016

(unaudited)

Attributed Liberty Formula

SiriusXM Braves One Consolidated

Group Group Group Liberty amounts in

millions Revenue: Subscriber revenue $ 1,069 — — 1,069 Other

revenue 207 109 — 316 Total

revenue 1,276 109 — 1,385 Operating costs and expenses, including

stock-based compensation: Cost of subscriber services (exclusive of

depreciation shown separately below): Revenue share and royalties

273 — — 273 Programming and content 90 — — 90 Customer service and

billing 95 — — 95 Other 31 — — 31 Subscriber acquisition costs 121

— — 121 Other operating expenses 18 78 — 96 Selling, general and

administrative 202 18 15 235 Depreciation and amortization

79 12 1 92 909 108

16 1,033 Operating income (loss) 367 1 (16 ) 352

Other income (expense): Interest expense (93 ) — (5 ) (98 ) Share

of earnings (losses) of affiliates, net 2 2 33 37 Realized and

unrealized gains (losses) on financial instruments, net — — 7 7

Unrealized gains (losses) on intergroup interest — (25 ) 25 —

Other, net 1 1 3 5 (90 )

(22 ) 63 (49 ) Earnings (loss) from continuing operations

before income taxes 277 (21 ) 47 303 Income tax (expense) benefit

(127 ) (1 ) (6 ) (134 ) Net earnings (loss) 150 (22 ) 41 169

Less net earnings (loss) attributable to the noncontrolling

interests 54 — — 54 Net earnings

(loss) attributable to Liberty stockholders $ 96 (22 ) 41

115 Programming and content 6 — — 6

Customer service and billing 1 — — 1 Other 1 — — 1 Other operating

expenses 3 — — 3 Selling, general and administrative 25

3 2 30 Stock compensation expense $ 36

3 2 41

LIBERTY MEDIA CORPORATION

STATEMENT OF CASH FLOWS

INFORMATION

Nine months ended September 30, 2017

(unaudited)

Attributed Liberty Formula

SiriusXM Braves One Consolidated

Group Group Group Liberty amounts in

millions Cash flows from operating activities: Net earnings (loss)

$ 648 (29 ) (158 ) 461 Adjustments to reconcile net earnings to net

cash provided by operating activities: Depreciation and

amortization 270 50 295 615 Stock-based compensation 113 41 28 182

Share of (earnings) loss of affiliates, net (32 ) (72 ) (63 ) (167

) Unrealized (gains) losses on intergroup interest, net — 43 (43 )

— Realized and unrealized (gains) losses on financial instruments,

net (62 ) — 105 43 Noncash interest expense 4 1 4 9 Losses (gains)

on dilution of investment in affiliate — — (4 ) (4 ) Deferred

income tax expense (benefit) 321 28 (63 ) 286 Intergroup tax

allocation (11 ) (18 ) 29 — Intergroup tax (payments) receipts 4 15

(19 ) — Other charges (credits), net 36 — 10 46 Changes in

operating assets and liabilities Current and other assets 18 (41 )

28 5 Payables and other liabilities 1 (59 ) (105 )

(163 ) Net cash provided (used) by operating activities

1,310 (41 ) 44 1,313 Cash flows from investing

activities: Investments in and loans to cost and equity investees

(750 ) (2 ) (8 ) (760 ) Cash proceeds from sale of investments — 5

15 20 Net cash paid for the acquisition of Formula 1 — — (1,647 )

(1,647 ) Capital expended for property and equipment (207 ) (190 )

(10 ) (407 ) Other investing activities, net (115 ) 4

(9 ) (120 ) Net cash provided (used) by investing activities

(1,072 ) (183 ) (1,659 ) (2,914 ) Cash flows from financing

activities: Borrowings of debt 3,933 288 1,599 5,820 Repayments of

debt (3,103 ) (42 ) (1,674 ) (4,819 ) Proceeds from issuance of

Series C Formula One common stock — — 1,938 1,938 Subsidiary shares

repurchased by subsidiary (996 ) — — (996 ) Cash dividends paid by

subsidiary (45 ) — — (45 ) Taxes paid in lieu of shares issued for

stock-based compensation (91 ) — (4 ) (95 ) Other financing

activities, net 11 — 1 12 Net

cash provided (used) by financing activities (291 ) 246

1,860 1,815 Effect of foreign exchange rate

changes on cash and cash equivalents — — 7 7 Net increase

(decrease) in cash and cash equivalents (53 ) 22 252 221 Cash and

cash equivalents at beginning of period 287 107

168 562 Cash and cash equivalents at end of

period $ 234 129 420 783

LIBERTY MEDIA CORPORATION

STATEMENT OF CASH FLOWS

INFORMATION

Nine months ended September 30, 2016

(unaudited)

Attributed Liberty Formula

SiriusXM Braves One Consolidated

Group Group Group Liberty amounts in

millions Cash flows from operating activities: Net earnings (loss)

$ 471 (22 ) 289 738 Adjustments to reconcile net earnings to net

cash provided by operating activities: Depreciation and

amortization 235 30 7 272 Stock-based compensation 90 7 12 109

Share of (earnings) loss of affiliates, net (11 ) (6 ) (26 ) (43 )

Unrealized (gains) losses on intergroup interest, net — (2 ) 2 —

Realized and unrealized (gains) losses on financial instruments,

net — — 33 33 Noncash interest expense (benefit) 5 (2 ) 6 9 Losses

(gains) on dilution of investment in affiliate — — 2 2 Deferred

income tax expense (benefit) 319 (10 ) 98 407 Intergroup tax

allocation (9 ) (4 ) 13 — Intergroup tax (payments) receipts 2 7 (9

) — Other charges (credits), net 22 5 (3 ) 24 Changes in operating

assets and liabilities Current and other assets 6 (39 ) 4 (29 )

Payables and other liabilities 67 55 7

129 Net cash provided (used) by operating activities

1,197 19 435 1,651 Cash flows from

investing activities: Investments in and loans to cost and equity

investees — (13 ) (749 ) (762 ) Cash proceeds from sale of

investments — — 61 61 Capital expended for property and equipment

(132 ) (185 ) (1 ) (318 ) Purchases of short term investments and

other marketable securities — — (258 ) (258 ) Sales of short term

investments and other marketable securities — — 273 273 Other

investing activities, net (4 ) (27 ) 25 (6 ) Net cash

provided (used) by investing activities (136 ) (225 ) (649 )

(1,010 ) Cash flows from financing activities: Borrowings of debt

1,387 194 438 2,019 Repayments of debt (749 ) (126 ) (1 ) (876 )

Intergroup (payments) receipts 8 (34 ) 26 — Subsidiary shares

repurchased by subsidiary (1,225 ) — — (1,225 ) Proceeds from

Liberty Braves common stock rights offering — 203 — 203 Taxes paid

in lieu of shares issued for stock-based compensation (34 ) — (9 )

(43 ) Other financing activities, net 51 65

(96 ) 20 Net cash provided (used) by financing activities

(562 ) 302 358 98 Net increase

(decrease) in cash and cash equivalents 499 96 144 739 Cash and

cash equivalents at beginning of period 112 13

76 201 Cash and cash equivalents at end of period $

611 109 220 940

NON-GAAP FINANCIAL MEASURES

SCHEDULE 1

This press release includes a presentation of adjusted OIBDA,

which is a non-GAAP financial measure, for the Liberty SiriusXM

Group, the Braves Group and the Formula One Group, together with

reconciliations to operating income, as determined under GAAP.

Liberty Media defines adjusted OIBDA as revenue less operating

expenses, and selling, general and administrative expenses,

excluding all stock-based compensation, and excludes from that

definition depreciation and amortization, restructuring and

impairment charges and separately reported legal settlements that

are included in the measurement of operating income pursuant to

GAAP.

Liberty Media believes adjusted OIBDA is an important indicator

of the operational strength and performance of its businesses,

including each business' ability to service debt and fund capital

expenditures. In addition, this measure allows management to view

operating results and perform analytical comparisons and

benchmarking between businesses and identify strategies to improve

performance. Because adjusted OIBDA is used as a measure of

operating performance, Liberty Media views operating income as the

most directly comparable GAAP measure. Adjusted OIBDA is not meant

to replace or supersede operating income or any other GAAP measure,

but rather to supplement such GAAP measures in order to present

investors with the same information that Liberty Media's management

considers in assessing the results of operations and performance of

its assets.

The following table provides a reconciliation of adjusted OIBDA

for Liberty Media to operating income calculated in accordance with

GAAP for the three months ended September 30, 2016 and September

30, 2017, respectively.

QUARTERLY SUMMARY

(amounts in millions)

3Q16 3Q17

Liberty SiriusXM Group Revenue $ 1,276 $ 1,379

Adjusted OIBDA 482 543 Depreciation and amortization (79 ) (93 )

Stock compensation expense (36 ) (42 )

Operating

Income $ 367 $ 408

Formula One

Group Revenue $ — $ 501 Adjusted OIBDA (13 ) 104

Depreciation and amortization (1 ) (111 ) Stock compensation

expense (2 ) (10 )

Operating Income (Loss) $

(16 ) $ (17 )

Braves Group Revenue $ 109 $ 185

Adjusted OIBDA 16 48 Depreciation and amortization (12 ) (24 )

Stock compensation expense (3 ) (33 )

Operating

Income (Loss) $ 1 $ (9 )

Liberty Media

Corporation (Consolidated) Revenue $ 1,385 $ 2,065

Adjusted OIBDA 485 695 Depreciation and amortization (92 ) (228 )

Stock compensation expense (41 ) (85 )

Operating

Income $ 352 $ 382

SCHEDULE 2

This press release also includes a presentation of adjusted

EBITDA of SiriusXM, which is a non-GAAP financial measure used by

SiriusXM, together with a reconciliation to SiriusXM's stand-alone

net income, as determined under GAAP. SiriusXM defines adjusted

EBITDA as follows: EBITDA is defined as net income before interest

expense, income tax expense and depreciation and amortization.

SiriusXM adjusts EBITDA to exclude the impact of other income as

well as certain other charges discussed below. Adjusted EBITDA is

one of the primary Non-GAAP financial measures SiriusXM uses to (i)

evaluate the performance of its on-going core operating results

period over period, (ii) base its internal budgets and (iii)

compensate management. Adjusted EBITDA is a Non-GAAP financial

measure that excludes (if applicable): (i) certain adjustments as a

result of the purchase price accounting for the merger of Sirius

and XM, (ii) share-based payment expense and (iii) other

significant operating expense (income) that do not relate to the

on-going performance of SiriusXM’s business. SiriusXM believes

adjusted EBITDA is a useful measure of the underlying trend of its

operating performance, which provides useful information about its

business apart from the costs associated with its capital structure

and purchase price accounting. SiriusXM believes investors find

this Non-GAAP financial measure useful when analyzing past

operating performance with current performance and comparing

operating performance to the performance of other communications,

entertainment and media companies. SiriusXM believes investors use

adjusted EBITDA to estimate its current enterprise value and to

make investment decisions. Because of large capital investments in

SiriusXM’s satellite radio system, its results of operations

reflect significant charges for depreciation expense. SiriusXM

believes the exclusion of share-based payment expense is useful as

it is not directly related to the operational conditions of the

business. SiriusXM also believes the exclusion of the legal

settlements and reserves related to the historical use of sound

recordings, loss on extinguishment of debt and loss on disposal of

assets, to the extent they occur during the period, is useful as

they are significant expenses not incurred as part of normal

operations for the period.

Adjusted EBITDA has certain limitations in that it does not take

into account the impact to SiriusXM’s statements of comprehensive

income of certain expenses, including share-based payment expense

and certain purchase price accounting for the merger of Sirius and

XM. SiriusXM endeavors to compensate for the limitations of the

Non-GAAP measure presented by also providing the comparable GAAP

measure with equal or greater prominence and descriptions of the

reconciling items, including quantifying such items, to derive the

Non-GAAP measure. Investors that wish to compare and evaluate

operating results after giving effect for these costs, should refer

to net income as disclosed in SiriusXM’s unaudited consolidated

statements of comprehensive income. Since adjusted EBITDA is a

Non-GAAP financial performance measure, SiriusXM’s calculation of

adjusted EBITDA may be susceptible to varying calculations; may not

be comparable to other similarly titled measures of other

companies; and should not be considered in isolation, as a

substitute for, or superior to measures of financial performance

prepared in accordance with GAAP. The reconciliation of net income

to the adjusted EBITDA is calculated as follows:

Unaudited

For the Three Months Ended September 30, 2016

2017 ($ in thousands) Net income: $ 193,901 $ 275,722

Add back items excluded from Adjusted EBITDA: Purchase price

accounting adjustments: Revenues 1,813 1,813 Share-based payment

expense(1) 30,020 34,891 Depreciation and amortization 67,880

79,913 Interest expense 89,092 92,634 Loss on extinguishment of

debt — 43,679 Other income (2,370 ) (86,971 ) Income tax expense

111,556 108,901 Adjusted EBITDA $

491,892 $ 550,582 (1) Allocation

of share-based payment expense.

SCHEDULE 3

SiriusXM’s free cash flow is derived from cash flow provided by

operating activities, net of additions to property and equipment,

restricted and other investment activity and the return of capital

from investment in unconsolidated entity. Free cash flow is a

metric that SiriusXM’s management and board of directors use to

evaluate the cash generated by operations, net of capital

expenditures and other investment activity. In a capital intensive

business, with significant investments in satellites, SiriusXM

looks at operating cash flow, net of these investing cash outflows,

to determine cash available for future subscriber acquisition and

capital expenditures, to repurchase or retire debt, to acquire

other companies and to evaluate SiriusXM’s ability to return

capital to stockholders. SiriusXM excludes from free cash flow

certain items that do not relate to the on-going performance of the

business such as cash outflows for acquisitions, strategic

investments and loans to related parties. SiriusXM believes free

cash flow is an indicator of the long-term financial stability of

the business. Free cash flow, which is reconciled to "Net cash

provided by operating activities," is a Non-GAAP financial measure.

This measure can be calculated by deducting amounts under the

captions "Additions to property and equipment" and deducting or

adding Restricted and other investment activity from "Net cash

provided by operating activities" from the consolidated statements

of cash flows, adjusted for any significant legal settlements. Free

cash flow should be used in conjunction with other GAAP financial

performance measures and may not be comparable to free cash flow

measures presented by other companies. Free cash flow should be

viewed as a supplemental measure rather than an alternative measure

of cash flows from operating activities, as determined in

accordance with GAAP. Free cash flow is limited and does not

represent remaining cash flows available for discretionary

expenditures due to the fact that the measure does not deduct the

payments required for debt maturities. SiriusXM believes free cash

flow provides useful supplemental information to investors

regarding its current cash flow, along with other GAAP measures

(such as cash flows from operating and investing activities), to

determine SiriusXM’s financial condition, and to compare its

operating performance to other communications, entertainment and

media companies. Free cash flow is calculated as follows:

Unaudited

For the Three Months Ended September 30, 2016

2017 ($ in thousands)

Cash flow information

Net cash provided by operating activities $ 421,816 $ 521,228 Net

cash used in investing activities $ (65,289 ) $ (391,367 ) Net cash

used in financing activities $ (260,598 ) $ (93,046 )

Free cash

flow Net cash provided by operating activities $ 421,816 $

521,228 Additions to property and equipment (65,074 ) (87,200 )

Purchases of restricted and other investments (215 )

(240 ) Free cash flow $ 356,527 $ 433,788

View source

version on businesswire.com: http://www.businesswire.com/news/home/20171109005504/en/

Liberty Media CorporationCourtnee Chun, (720) 875-5420

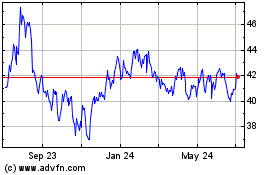

Atlanta Braves (NASDAQ:BATRA)

Historical Stock Chart

From Mar 2024 to Apr 2024

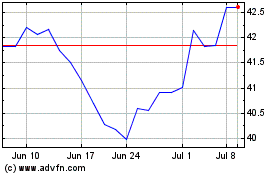

Atlanta Braves (NASDAQ:BATRA)

Historical Stock Chart

From Apr 2023 to Apr 2024