UNITED

STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE

14C

Information

Statement Pursuant to Section 14(c) of

the

Securities Exchange Act of 1934

Check

the appropriate box:

|

[X]

|

Preliminary

Information Statement

|

|

[ ]

|

Confidential,

for Use of the Commission Only (as permitted by Rule 14c-5(d)(2))

|

|

[ ]

|

Definitive

Information Statement

|

DUO

WORLD, INC.

(Name

of Registrant as Specified In Its Charter)

Payment

of Filing Fee (Check the appropriate box):

|

[X]

|

None

required

|

|

[ ]

|

Fee

computed on table below per Exchange Act Rules 14c-5(g) and 0-11.

|

|

|

1)

|

Title

of each class of securities to which transaction applies:

|

|

|

|

|

|

|

2)

|

Aggregate

number of securities to which transaction applies:

|

|

|

|

|

|

|

3)

|

Per

unit price of other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth amount on which

filing fee is calculated and state how it was determined):

|

|

|

|

|

|

|

4)

|

Proposed

maximum aggregate value of transaction:

|

|

|

|

|

|

|

5)

|

Total

fee paid:

|

|

[ ]

|

Fee

paid previously with preliminary materials.

|

|

|

|

|

[ ]

|

Check

box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting

fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date

of the filing.

|

|

|

1)

|

Amount

previously paid:

|

|

|

|

|

|

|

2)

|

Form,

Schedule or Registration Statement No.:

|

|

|

|

|

|

|

3)

|

Filing

Party:

|

|

|

|

|

|

|

4)

|

Date

Filed:

|

THIS

INFORMATION STATEMENT IS BEING PROVIDED TO

YOU

BY THE BOARD OF DIRECTORS OF THE COMPANY

WE

ARE NOT ASKING YOU FOR A PROXY

AND

YOU ARE REQUESTED NOT TO SEND US A PROXY

DUO

WORLD, INC.

170 S Green Valley Parkway, Suite 300

Henderson, Nevada 89012

INFORMATION

STATEMENT

(Preliminary)

November

9, 2017

GENERAL

INFORMATION

This

Information Statement of DUO WORLD, INC., a Nevada corporation (“Company”), has been filed with the Securities and

Exchange Commission and is being furnished, pursuant to Section 14 (c) of the Securities Exchange Act of 1934, as amended (“Exchange

Act”) on or about November 20, 2017, to our shareholders of record as of the close of business on November 1, 2017

(“Record Date”), to notify such shareholders that on November 2, 2017 (i) the Company’s Board of Directors approved

an amendment to our Articles of Incorporation to increase the authorized shares of our Common Stock from 90,000,000 shares to

400,000,000 shares, subject to shareholder approval; (ii) our Board of Directors set November 1, 2017, as the record date for

shareholders entitled to vote on the amendment; and (iii) the Company received the written consent in lieu of a special meeting

of shareholders from shareholders holding 28,000,000 shares of our Common Stock and 5,000,000 shares of our Series A Preferred

Stock representing approximately 70.8% of our total voting stock (“Majority Shareholders”), approving of the Company

amending the Articles of Incorporation to increase the number of authorized shares of Common Stock to 400,000,000 described above.

While

the above actions have been approved by a majority of our outstanding shares in accordance with Nevada Corporate Law, the rules

of the Securities and Exchange Commission provide that the above actions cannot take effect until at least 20 days after this

information statement has first been sent to our shareholders. We anticipate that the actions contemplated hereby will be effected

on or about the close of business on December 12, 2017.

WE

ARE NOT ASKING YOU FOR A PROXY AND YOU ARE REQUESTED NOT TO SEND A PROXY

The

entire cost of furnishing this Information Statement will be borne by us. We will request brokerage houses, nominees, custodians,

fiduciaries and other similar persons to forward this Information Statement to the beneficial owners of our voting securities,

and we will reimburse such persons for out-of-pocket expenses incurred in forwarding such material.

You

are being provided with this Information Statement pursuant to Section 14 (c) of the Exchange Act and Regulation 14C promulgated

thereunder, and, in accordance therewith, the amendment to our Articles of Incorporation and the forward stock split will not

become effective until at least 20 calendar days after the mailing of this Information Statement.

ADDITIONAL

INFORMATION

The

Company is subject to the informational requirements of the Securities Exchange Act of 1934, as amended. Accordingly, we file

annual, quarterly and special reports, proxy statements and other information with the SEC. You may read and copy any document

we file at the SEC’s public reference room at 100 F Street,, N.E., Washington, D.C. 20549. You should call the SEC at 1-800-SEC-0330

for further information on the public reference rooms. Our SEC filings will also be available to the public at the SEC’s

web site at

http://www.sec.gov.

You

may request, and we will voluntarily provide, a copy of our filings, including our annual report, which will contain audited financial

statements, at no cost to you, by writing or telephoning us at the following address and telephone number:

DUO

WORLD, INC.

170 S Green Valley Parkway, Suite 300

Henderson, Nevada 89012

Telephone:

(870) 505-6540

You may also contact

our securities counsel, David E. Wise, Attorney at Law, by calling (210) 323-6074.

The

following documents as filed with the Commission by the Company are incorporated herein by reference:

|

|

1.

|

Annual

Report on Form 10-K for the fiscal year ended March 31, 2017;

|

|

|

2.

|

Form

10-Q for the quarter ended December 31, 2016;

|

|

|

3.

|

Form

10-Q for the quarter ended June 30, 2017; and

|

|

|

4.

|

Form

10-Q for the quarter ended September 30, 2017.

|

OUTSTANDING

VOTING SECURITIES

The

holders of our Common Stock are entitled to one vote per share. As of November 2, 2017, we had 41,116,654 shares of Common Stock

issued and outstanding. The holders of our Series “A” Preferred Stock are entitled to one vote per share, and vote

alongside our Common Stock and not as a separate class. As of November 2, 2017, we had 5,500,000 shares of Series “A”

Preferred Stock issued and outstanding, which entitled the holders of our Series A Preferred Stock to 5,500,000 votes.

On November 2, 2017,

persons entitled to cast 33,000,000 votes (or 70.8% of total votes entitled to be cast) voted to approve the above described corporate

actions.

Security

Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters.

The

following tables set forth the ownership of our common stock and preferred stock by (a) each person known by us to be the beneficial

owner of more than 5% of our outstanding common stock and preferred stock; and (b) by all of named officers and our directors

and by all of our named executive officers and directors as a group. To the best of our knowledge, the persons named have sole

voting and investment power with respect to such shares and are beneficial owners of the shares indicated in the tables, except

as otherwise noted by footnote.

The

information presented below regarding beneficial ownership of our voting securities has been presented in accordance with the

rules of the U.S. Securities and Exchange Commission and is not necessarily indicative of ownership for any other purpose. Under

these rules, a person is deemed to be a “beneficial owner” of a security if that person has or shares the power to

vote or direct the voting of the security or the power to dispose or direct the disposition of the security. A person is deemed

to own beneficially any security as to which such person has the right to acquire sole or shared voting or investment power within

60 days through the conversion or exercise of any convertible security, warrant, option or other right. More than one person may

be deemed to be a beneficial owner of the same securities. The percentage of beneficial ownership by any person as of a particular

date is calculated by dividing the number of shares beneficially owned by such person, which includes the number of shares as

to which such person has the right to acquire voting or investment power within 60 days, by the sum of the number of shares outstanding

as of such date plus the number of shares as to which such person has the right to acquire voting or investment power within 60

days. Consequently, the denominator used for calculating such percentage may be different for each beneficial owner. Except as

otherwise indicated below, we believe that the beneficial owners of our common stock listed below have sole voting and investment

power with respect to the shares shown.

(a)

Security ownership of certain beneficial owners of our Common Stock by our named executive officers and persons who own 5%

or more of our Common Stock:

|

|

|

Number

of

|

|

|

Percentage

of

|

|

|

Name

and Address of Beneficial Owner

|

|

Shares

(1)

|

|

|

Ownership

(1)

|

|

|

|

|

|

|

|

|

|

|

Muhunthan

Canagasooryam

|

|

|

|

|

|

|

|

|

|

(President,

Director and 5% or more beneficial owner)

|

|

|

78,000,000

|

(2)

|

|

|

85.60

|

%

|

|

No.

12, Palm Grove

|

|

|

|

|

|

|

|

|

|

Colombo

03, Sri Lanka

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Dr.

Gnaga Kosala Bandara Heengama

|

|

|

7,494,000

|

(3)

|

|

|

16.75

|

%

|

(5%

or more beneficial owner)

532/3C Sirikotha Lane

|

|

|

|

|

|

|

|

|

|

Galle

Road

|

|

|

|

|

|

|

|

|

|

Colombo

02, Sri Lanka

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Global

Equity International, Inc.

|

|

|

4,703,559

|

(4)

|

|

|

11.07%

|

|

Peter

J. Smith

(5% or more beneficial owner)

|

|

|

|

|

|

|

|

|

|

X3

Jumeirah Bay, Office 3305

|

|

|

|

|

|

|

|

|

|

Jumeirah

Lake Towers

|

|

|

|

|

|

|

|

|

|

Dubai,

UAE

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Gregory

Scott Newsome

(5% or more beneficial owner)

|

|

|

3,654,000

|

(5)

|

|

|

8.17

|

%

|

|

14A

Cambridge Terrace

|

|

|

|

|

|

|

|

|

|

Colombo

07, Sri Lanka

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

All

officers and directors as a group (one person)

|

|

|

78,000,000

|

(2)

|

|

|

85.60

|

%

|

(1)

The numbers and percentages set forth in these columns are based on 41,116,654 shares of Common Stock outstanding and the shareholder’s

respective beneficial ownership of 5,500,000 shares of Series “A” Preferred Stock outstanding. The number and percentage

of shares beneficially owned is determined in accordance with Rule 13d-3 of the Securities Exchange Act of 1934, and the information

is not necessarily indicative of beneficial ownership for any other purpose. Under such rule, beneficial ownership includes any

shares as to which the security holder has sole or shared voting power or investment power and also any shares, which the security

holder has the right to acquire within 60 days.

(2)

Includes 5,000,000 shares of Series “A” Preferred Stock, each share of which is convertible into 10 shares of Common

Stock. In accordance with Rule 13d-3, these 5,000,000 shares of Series “A” Preferred Stock equate to 50,000,000 shares

of Common Stock. These 50,000,000 shares are included in both the numerator and denominator for purposes of calculating Mr. Canagasooryam’s

beneficial ownership in the Company’s voting securities.

(3)

Includes 3,840,000 shares of common stock registered in the name of Spearfish Capital Group Limited, and 20,000 shares of common

stock registered in the name of Yenom (Pvt.) Limited, which are beneficially owned by Dr. Gnaga Kosala Bandara Heengama and Gregory

Scott Newsome, who share voting and dispositive power over such 20,000 shares. This total number also includes 363,400 shares

of Series “A” Preferred Stock, registered in the name of Yenom (Pvt.) Limited, which are also beneficially owned by

Dr. Gnaga Kosala Bandara Heengama and Gregory Scott Newsome, who share voting and dispositive power over such 363,400 shares of

Series A Preferred Stock, each share of which is convertible into 10 shares of Common Stock. In accordance with Rule 13d-3, these

363,400 shares of Series “A” Preferred Stock equate to 3,634,000 shares of Common Stock. These 3,634,000 shares are

included in both the numerator and denominator for purposes of calculating Dr. Gnaga Kosala Bandara Heengama’s beneficial

ownership in the Company’s voting securities.

(4)

Includes 136,600 shares of Series “A” Preferred Stock, each share of which is convertible into 10 shares of Common

Stock. In accordance with Rule 13d-3, these 136,600 shares of Series “A” Preferred Stock equate to 1,366,000 shares

of Common Stock. These 1,366,000 shares are included in both the numerator and denominator for purposes of calculating GEP Equity

Holdings Limited’s and Peter J. Smith’s beneficial ownership in the Company’s voting securities.

(5)

Includes 20,000 shares of common stock registered in the name of Yenom (Pvt.) Limited, which are beneficially owned by Dr. Gnaga

Kosala Bandara Heengama and Gregory Scott Newsome, who share voting and dispositive power over such 20,000 shares of common stock.

This total number also includes 363,400 shares of Series “A” Preferred Stock, registered in the name of Yenom (Pvt.)

Limited, which are also beneficially owned by Dr. Gnaga Kosala Bandara Heengama and Gregory Scott Newsome, who share voting and

dispositive power over such 363,400 shares of Series A Preferred Stock, each share of which is convertible into 10 shares of Common

Stock. In accordance with Rule 13d-3, these 363,400 shares of Series “A” Preferred Stock equate to 3,634,000 shares

of Common Stock. These 3,634,000 shares are included in both the numerator and denominator for purposes of calculating Gregory

Scott Newsome’s beneficial ownership in the Company’s voting securities.

(b)

Security ownership of certain beneficial owners of our Series A Preferred Stock by our named executive officers and all other

persons who own our Series A Preferred Stock:

|

|

|

Number

of

|

|

|

Percentage

of

|

|

|

Name

and Address of Beneficial Owner

|

|

Shares

(1)

|

|

|

Ownership

(1)

|

|

|

|

|

|

|

|

|

|

|

Muhunthan

Canagasooryam

|

|

|

|

|

|

|

|

|

|

(President,

Director and 5% or more beneficial owner)

|

|

|

5,000,000

|

(2)

|

|

|

90.9

|

%

|

|

No.

12, Palm Grove

|

|

|

|

|

|

|

|

|

|

Colombo

03, Sri Lanka

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Dr.

Gnaga Kosala Bandara Heengama

|

|

|

363,400

|

(3)

|

|

|

6.61

|

%

|

(5%

or more beneficial owner)

532/3C Sirikotha Lane

|

|

|

|

|

|

|

|

|

|

Galle

Road

|

|

|

|

|

|

|

|

|

|

Colombo

02, Sri Lanka

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

GEP

Equity Holdings Limited

|

|

|

136,600

|

(4)

|

|

|

2.48

|

%

|

Peter

J. Smith

(5% or more beneficial owner)

|

|

|

|

|

|

|

|

|

|

X3

Jumeirah Bay, Office 3305

|

|

|

|

|

|

|

|

|

|

Jumeirah

Lake Towers

|

|

|

|

|

|

|

|

|

|

Dubai,

UAE

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Gregory

Scott Newsome

(5% or more beneficial owner)

|

|

|

363,400

|

(5)

|

|

|

6.61

|

%

|

|

14A

Cambridge Terrace

|

|

|

|

|

|

|

|

|

|

Colombo

07, Sri Lanka

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

All

officers and directors as a group (one person)

|

|

|

5,000,000

|

(2)

|

|

|

90.9

|

%

|

|

|

(1)

|

The

numbers and percentages set forth in these columns are based on 5,500,000 shares of Series “A” Preferred Stock

outstanding and the shareholder’s respective beneficial ownership of 5,500,000 shares of Series “A” Preferred

Stock outstanding.

|

|

|

(2)

|

Mr.

Canagasooryam is the direct beneficial owner of, and has sole dispositive and voting power over, these shares,

|

|

|

(3)

|

These

shares are registered in the name of Yenom (Pvt.) Limited, which shares are beneficially owned by Dr. Gnaga Kosala Bandara

Heengama and Gregory Scott Newsome, who share voting and dispositive power over such 363,400 shares of Series A Preferred

Stock,

|

|

|

(4)

|

These

shares are registered in the name of Global Equity Holdings Limited, which shares are beneficially owned by its Chief Executive

Officer, Peter Smith, who has sole voting and dispositive power over such 136,600 shares of Series A Preferred Stock,

|

|

|

(5)

|

These

shares are registered in the name of Yenom (Pvt.) Limited, which shares are beneficially owned by Dr. Gnaga Kosala Bandara

Heengama and Gregory Scott Newsome, who share voting and dispositive power over such 363,400 shares of Series A Preferred

Stock,

|

There

are no arrangements or understandings among the entities and individuals referenced above or their respective associates concerning

election of directors or other any other matters which may require shareholder approval.

THE

APPROVAL OF AN AMENDMENT TO OUR ARTICLES

OF

INCORPORATION TO INCREASE THE NUMBER OF AUTHORIZED SHARES OF OUR COMMON STOCK

ACTION

NO. 1

Overview

The

Company currently has authorized 90,000,000 shares of Common Stock. On November 2, 2017, our Board of Directors and the shareholders

holding a majority of the voting rights in the Company, approved an amendment to the Articles of Incorporation to increase the

number of outstanding shares of our Common Stock to 400,000,000.

REASONS

FOR ACTION NO. 1

The

Company believes that it needs to have the additional authorized shares of Common Stock in order to allow conversion of debt and

equity securities into shares of Common Stock and for rewarding management, advisors and personnel for their efforts on behalf

of the Company.

DILUTIVE

EFFECT OF INCREASING OUR AUTHORIZED SHARES OF COMMON STOCK AND ISSUING A SUBSTANTIAL NUMBER OF SHARES UPON CONVERSION OF DEBT

AND EQUITY SECURITIES AND AS REWARDS TO THE COMPANY’S MANAGEMENT, ADVISORS AND PERSONNEL

By

increasing our authorized shares of Common Stock and issuing a substantial number of shares of our Common Stock upon conversion

of debt and equity securities and as rewards to the Company’s management, advisors and personnel, our shareholders will

suffer from substantial percentage dilution to their shareholdings in our Company.

AUTHORIZED

SHARES OF COMMON STOCK AVAILABLE FOR FUTURE ISSUANCE

Since

the Company is increasing the authorized shares of Common Stock, the Company will have more authorized (but unissued) shares to

issue in the future. The additional shares of Common Stock that will become available for issuance could be used by our management

to oppose a hostile takeover attempt or delay or prevent changes of control or changes in or removal of management, including

transactions that are favored by a majority of the shareholders or in which the shareholders might otherwise receive a premium

for their shares over then-current market prices or benefit in some other manner. Although the increase in our authorized Common

Stock has been prompted by business and financial considerations, shareholders nevertheless should be aware that approval of the

proposal could facilitate future efforts by our management to deter or prevent a change in control of the Company.

NO

APPRAISAL OR DISSENTER’S RIGHTS

Under

Nevada Law, shareholders are not entitled to appraisal or dissenter’s rights with respect to the proposed amendment to the

Articles of Incorporation to effect an increase in our authorized Common Stock and we will not independently provide shareholders

with any such right.

POTENTIAL

ANTI-TAKEOVER EFFECT

Although

the increased proportion of authorized but unissued shares to issued shares could, under certain circumstances, have an anti-takeover

effect (for example, by permitting issuances that could dilute the stock ownership of a person seeking to effect a change in the

composition of the Board of Directors or contemplating a tender offer or other transaction for the combination of the Company

with another company, the increase in our authorized Common Stock is not being undertaken in response to any effort of which the

Board of Directors is aware to accumulate shares of the Common Stock or obtain control of the Company. The Board of Directors

does not currently contemplate the adoption of any other amendments to the Articles of Incorporation that could be construed to

affect the ability of third parties to take over or change the control of the Company.

Release

No. 34-15230 of the Staff of the Securities and Exchange Commission requires disclosure and discussion of the effects of any shareholder

proposal that may be used as an anti-takeover device. However, the purpose of the increase in our authorized Common Stock is to

have additional shares available for issuance upon conversion of debt and equity securities into shares of Common Stock and as

compensation to reward the Company’s management, advisors and personnel, and not to construct or enable any anti-takeover

defense or mechanism on behalf of the Company. While it is possible that management could use the additional shares to resist

or frustrate a third-party transaction providing an above-market premium that could favored by a majority of the independent shareholders,

the Company has no intent or plan to employ the resulting additional unissued authorized shares as an anti-takeover device.

Approval

of Action No. 1

The

Majority Shareholders have approved the amendment to our Articles of Incorporation to effect an increase of our authorized shares

of Common Stock to 400,000,000 shares. The number of shares voted to approve the plan was sufficient under Nevada corporate law.

|

|

By

Order of the Board of Directors

|

|

|

|

|

|

/s/

Suzannah Jennifer Samuel Perera

|

|

Date:

November __, 2017

|

Suzannah

Jennifer Samuel Perera,

|

|

|

Director

and Chief Financial Officer

|

Appendix

A

Exhibit

“A”

To

Articles

of Amendment

To

Articles

of Incorporation

of

DUO

WORLD, INC.

Article

3 of the Articles of Incorporation is hereby amended to read in its entirety as follows:

“Article

3.

Number

of Shares with Par Value. The aggregate number of shares which this Corporation shall have authority to issue is 410,000,000)

shares, including 400,000,000 shares of Common Stock, par value $0.001 per share, and 10,000,000 shares of Preferred Stock, par

value $0.001 per share.”

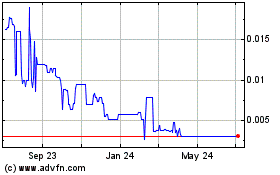

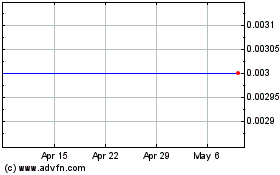

Duo World (CE) (USOTC:DUUO)

Historical Stock Chart

From Mar 2024 to Apr 2024

Duo World (CE) (USOTC:DUUO)

Historical Stock Chart

From Apr 2023 to Apr 2024