Current Report Filing (8-k)

October 16 2017 - 4:29PM

Edgar (US Regulatory)

SECURITIES

AND EXCHANGE COMMISSION

FORM 8-K

CURRENT REPORT

Pursuant to Section

13 or 15(d) of

the Securities Exchange

Act of 1934

Date of Report (Date

of earliest event reported):

October 10, 2017

MARIJUANA COMPANY OF AMERICA, INC.

(Exact

Name of Registrant as Specified in its Charter)

|

Utah

(State or other jurisdiction of incorporation

or organization)

|

Commission File Number

000-27039

|

87-0406858

(I.R.S. Employer

Identification Number)

|

1340 West Valley Parkway Suite #205

Escondido, California 92029

(Address of Principal Executive Offices

and Zip Code)

(888) 777-4362

(Issuer's telephone number)

5256 S. Mission Road, 703 #314, Bonsall,

CA 92003

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is

intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

¨

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

¨

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

¨

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

¨

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933

(17 CFR §230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2).

Emerging

growth company

☒

If an emerging growth company, indicate

by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial

accounting standards provided pursuant to Section 13(a) of the Exchange Act.

☒

Section 1 - Registrant’s Business and Operations

Item 1.02 Termination of a Material

Definitive Agreement.

(a)(1) On October 10, 2017, Marijuana

Company of America, Inc. (the “Registrant”) entered into a “Settlement and Mutual Release of All Claims Agreement”

(“Agreement”) with Tangiers Global, LLC (“Tangiers”) terminating the Registrant’s previously announced

material definitive agreement with Tangiers reported on Form 8-K on July 31, 2017. The parties to the Agreement are the Registrant

and Tangiers Global, LLC, (“Tangiers”). With the exception of the entry into the previously disclosed material definitive

agreement, no material relationship exists between the Registrant, or any of the Registrant’s affiliates or control persons

on the one hand, and Tangiers, and any of its affiliates or control persons on the other hand.

(a)(2)(3) The Agreement terminated an

Investment Agreement between the Registrant and Tangiers, wherein Tangiers previously agreed to invest up to five million dollars

($5,000,000) to purchase the Registrant’s Common Stock, par value $0.001 per share, based upon an exemption from registration

provided under Section 4(a)(2) of the 1933 Securities Act, and Section 506 of Regulation D promulgated thereunder. Further, the

Agreement, terminated a Registration Rights Agreement entered into between the Registrant and Tangiers, which was an inducement

to Tangiers to execute and deliver the Investment Agreement, whereby the Registrant agreed to provide certain registration rights

under the Securities Act of 1933, as amended, and the rules and regulations thereunder, and applicable state securities laws, with

respect to the shares of Common Stock issuable for Tangiers’s investment pursuant to the Investment Agreement.

Further, the Agreement settled two outstanding

fixed convertible promissory notes the Registrant executed in favor of Tangiers: one in the amount of two hundred and fifty thousand

dollars ($250,000.00), of which Tangiers had advanced eighty-five thousand dollars ($85,000.00) to the Registrant, with total principal

and interest due in the amount of ninety-three thousand, five hundred dollars ($93,500.00); and one in the amount of fifty thousand

dollars ($50,000.00), with total principal and interest due in the amount of fifty-five thousand dollars ($55,000.00).

(a)(4) The Agreement further provided

that in order to affect a prepayment of the fixed convertible promissory note in the amount of two hundred and fifty thousand dollars

($250,000.00), the Registrant agreed to pay a prepayment penalty of eighteen thousand, five hundred dollars ($18,500.00), resulting

in a total payable on this note in the amount of one hundred and twelve thousand, two hundred dollars ($112,200.00).

The Registrant agreed to settle the

notes by paying Tangiers one hundred and sixty-seven thousand, two hundred dollars ($167,200.00) and issuing Tangiers three million

shares of the Registrant’s restricted common stock. The Registrant and Tangiers agreed to mutual releases of all claims.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934,

the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Dated October 16, 2017

MARIJUANA COMPANY OF AMERICA, INC.

By: /s/

Donald Steinberg

Donald Steinberg

Chief Executive Officer

(Principal Executive Officer)

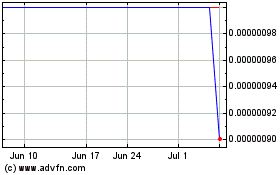

Marijuana Company of Ame... (PK) (USOTC:MCOA)

Historical Stock Chart

From Mar 2024 to Apr 2024

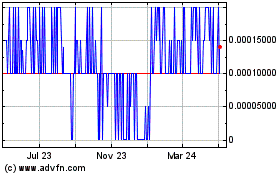

Marijuana Company of Ame... (PK) (USOTC:MCOA)

Historical Stock Chart

From Apr 2023 to Apr 2024