Report of Foreign Issuer (6-k)

October 11 2017 - 10:12AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 6-K

REPORT OF FOREIGN PRIVATE ISSUER PURSUANT TO RULE 13a-16 OR 15d-16 UNDER THE

SECURITIES EXCHANGE ACT OF 1934

Report on Form 6-K for October 11, 2017

Commission File Number 1-31615

Sasol Limited

50 Katherine Street

Sandton 2196

South Africa

(Name and address of registrant's principal executive office)

Indicate by check mark whether the registrant files or will file annual

reports under cover of Form 20-F or Form 40-F.

Form 20-F __X__ Form 40-F _____

Indicate by check mark if the registrant is submitting the Form 6-K in paper

as permitted by Regulation S-T Rule 101(b)(1): ____

Note: Regulation S-T Rule 101(b)(1) only permits the submission in paper of a

Form 6-K if submitted solely to provide an attached annual report to security

holders.

Indicate by check mark if the registrant is submitting the Form 6-K in paper

as permitted by Regulation S-T Rule 101(b)(7): ____

Note: Regulation S-T Rule 101(b)(7) only permits the submission in paper of a

Form 6-K if submitted to furnish a report or other document that the

registrant foreign private issuer must furnish and make public under the laws

of the jurisdiction in which the registrant is incorporated, domiciled or

legally organized (the registrant's "home country"), or under the rules of

the home country exchange on which the registrant's securities are traded, as

long as the report or other document is not a press release, is not required

to be and has not been distributed to the registrant's security holders, and,

if discussing a material event, has already been the subject of a Form 6-K

submission or other Commission filing on EDGAR.

Indicate by check mark whether the registrant by furnishing the information

contained in this Form is also thereby furnishing the information to the

Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of

1934.

Yes _____ No __X__

If "Yes" is marked, indicate below the file number assigned to the registrant

in connection with Rule 12g3-2(b):

82-_______________.d

Enclosures: SASOL AMENDS PLAN TO ISSUE ADDITIONAL SHARES TO SETTLE EXPECTED

OUTSTANDING SASOL INZALO DEBT

Sasol Limited

(Incorporated in the Republic of South Africa)

(Registration number 1979/003231/06)

Sasol Ordinary Share codes: JSE: SOL NYSE: SSL

Sasol Ordinary ISIN codes: ZAE000006896 US8038663006

Sasol BEE Ordinary Share code: JSE: SOLBE1

Sasol BEE Ordinary ISIN code: ZAE000151817

("Sasol" or "the Company")

|

Sasol Inzalo Public (RF) Limited (Incorporated in the Republic of South

Africa)

(Registration number 2007/030646/06)

Sasol Inzalo Public Ordinary Share code: JSE: SIPBEE

Sasol Inzalo Public Ordinary ISIN: ZAE000210050

SASOL AMENDS PLAN TO ISSUE ADDITIONAL SHARES TO SETTLE EXPECTED OUTSTANDING

SASOL INZALO DEBT

Sasol shareholders are referred to the Company's announcement on 20 September

2017 (the "First Announcement") regarding Sasol's broad-based black economic

empowerment ownership transaction, incorporating information relating to the

termination of the Sasol Inzalo black economic empowerment transaction

("Sasol Inzalo transaction").

The Sasol Inzalo transaction was a landmark, broad-based black economic

empowerment initiative that received shareholder approval in 2008. A

significant amount of the funding to facilitate this transaction was obtained

through the issue of preference shares to external banks to facilitate the

acquisition of Sasol preferred ordinary shares by Sasol Inzalo Groups Funding

(Pty) Ltd and Sasol Inzalo Public Funding (Pty) Ltd (collectively "the Inzalo

FundCos").

Under the terms approved in 2008, 25 547 081 Sasol preferred ordinary shares

are due to be re-designated to Sasol ordinary shares during June and

September 2018. This would result in dilution for existing ordinary

shareholders of approximately 4%. These shares would then need to be sold in

the market by the Inzalo FundCos in order to fund the redemption of the

preference shares and cumulative dividends. Based on the recent trading range

of Sasol's share price, however, this would not be sufficient to satisfy

these obligations and creates a funding shortfall of between R2 billion and

R3 billion. This shortfall will be made good by Sasol in terms of a guarantee

granted in respect of a portion of the preference share funding at the outset

of the transaction.

In the First Announcement Sasol indicated that its preferred funding option

would be to undertake an accelerated book-build of up to 43 million Sasol

ordinary shares to enable the funding of the minimum amount sufficient to

repurchase the relevant Sasol preferred ordinary shares and settle the

relevant obligations and associated costs of the Inzalo FundCos. The

rationale for this option was to achieve rapid resolution of Sasol and the

Inzalo FundCos' respective financing obligations with a structure designed to

help protect Sasol's investment grade credit rating with limited incremental

dilution for shareholders of approximately 1% incremental dilution pursuant

to the issue by Sasol of new ordinary shares.

Following extensive engagement with shareholders, Sasol is now undertaking to

explore, in consultation with the external banks and Inzalo FundCos,

different funding options to settle the relevant financing obligations. Sasol

will therefore no longer pursue the preferred funding option, as described in

the First Announcement, of issuing up to 43 million ordinary shares through

an accelerated book-build process. Sasol's intention is to mitigate the

amount of shareholder dilution whilst still maintaining Sasol's investment

grade credit rating. Sasol will communicate its final plan for settling the

Inzalo FundCos' debt in February 2018.

The terms of Sasol Khanyisa relating to Sasol Inzalo participants, SOLBE1

shareholders and qualifying employees as set out the First Announcement are

in no way affected by this announcement.

09 October 2017

Johannesburg

Sponsor: Deutsche Securities (SA) Proprietary Limited

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the

registrant, Sasol Limited, has duly caused this report to be signed on its

behalf by the undersigned, thereunto duly authorized.

Date: October 11, 2017 By: /s/ V D Kahla

Name: Vuyo Dominic Kahla

Title: Company Secretary

0

|

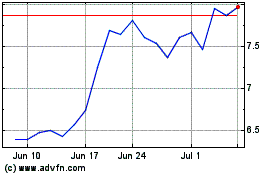

Sasol (NYSE:SSL)

Historical Stock Chart

From Mar 2024 to Apr 2024

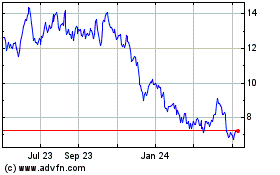

Sasol (NYSE:SSL)

Historical Stock Chart

From Apr 2023 to Apr 2024