Visa Raises Outlook as Results Beat Views

July 20 2017 - 5:02PM

Dow Jones News

By Maria Armental

Visa Inc. raised its financial targets for the year as quarterly

results beat Wall Street expectations, driven by a higher number of

transactions.

Shares rose 1.3% to $99.37 in extended trading and have been

trading at all-time highs.

Visa, like other payment networks, processes credit- and

debit-card transactions and makes most of its money from

transaction fees. Like MasterCard Inc., which is scheduled to

report next week, Visa doesn't extend credit directly to

cardholders. Rather, banks and others issue Visa-branded cards.

On Wednesday, American Express Co. also reported quarterly

earnings above analysts' expectations, but higher expenses to keep

apace of competition continued to pressure the company's bottom

line.

San Francisco-based Visa, which has delivered a string of

earnings beats fueled by a growing credit-card market, is the

network for many in-demand credit cards, including the J.P. Morgan

Chase Sapphire Reserve card, and has also benefited from Costco

Wholesale Corp. cards' switch to the Visa network from American

Express.

Visa accounted for 59% of purchase volume on U.S. general

purpose credit and debit cards last year, compared with

Mastercard's 25% market share, according to the Nilson Report, a

trade publication.

Now, the company is taking on cash, offering up to 50

restaurants and food vendors $10,000 apiece to switch to what Visa

executive Jack Forestell calls a "journey to cashless."

In the latest period, client incentives--long-term contracts

with banks, merchants and others to expand business--were $1.1

billion, 20% of gross revenue.

Over all, profit surged to $2.06 billion, or 86 cents a Class A

share, from $412 million, or 17 cents a share, a year earlier.

Net operating revenue rose 26% to $4.6 billion.

Analysts surveyed by Thomson Reuters had expected profit of 81

cents a share on $4.36 billion in net operating revenue.

The year-ago results had been weighed down by the acquisition of

Visa's European acquisitions.

Payments volume for the quarter rose 38% on a constant-dollar

basis to $1.9 trillion, while total processed transactions rose 44%

to 28.5 billion.

But operating expenses also rose by 31% after adjustments,

largely tied to the Visa Europe acquisition.

With one quarter to go, Visa again raised financial targets for

the current business year, saying it now expects adjusted profit to

increase about 20%, compared with its earlier view of an increase

at the high end of the midteens. It also expects net revenue to

increase about 20%, up from its previous view of an increase at the

high end of 16% to 18%.

AnnaMaria Andriotis contributed to this article.

Write to Maria Armental at maria.armental@wsj.com

(END) Dow Jones Newswires

July 20, 2017 16:47 ET (20:47 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

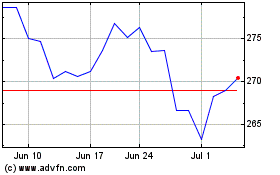

Visa (NYSE:V)

Historical Stock Chart

From Mar 2024 to Apr 2024

Visa (NYSE:V)

Historical Stock Chart

From Apr 2023 to Apr 2024