Bond Insurer's Appetite for Puerto Rico Debt Hasn't Waned

May 16 2017 - 5:10PM

Dow Jones News

By Andrew Scurria

While some investors flee Puerto Rico securities, a major bond

insurer is still a buyer.

Ambac Assurance Corp. has been aggressive this year in

repurchasing distressed bonds that the company has guaranteed,

Chief Executive Claude LeBlanc said on an earnings call last week.

The buybacks include municipal debt issued by Puerto Rico, the

struggling U.S. territory now under bankruptcy protection.

Repurchasing bonds in the open market allows bond insurers to

chip away at problematic exposures, provided the debt is cheap

enough. Both Ambac and MBIA Inc. bought back Puerto Rico sales-tax

bonds, known as Cofinas, after prices fell when the island's former

governor declared its debt unpayable in 2015.

Now Ambac is accelerating its buyback strategy, doubling down

last quarter on investments in its own securities, said Odeon

Capital Group research analyst Andrew Gadlin.

The company owns 16% of the $7.3 billion in Cofinas it

guarantees, Mr. LeBlanc said, up from the $233 million it reported

owning last year. The bonds are trading at pennies on the dollar

because they pay no interest until their balloon maturity in 2054.

Ambac also bought $114 million of its own surplus notes in the

first quarter.

Ambac and other insurers made large bets that Puerto Rico would

repay its obligations, writing insurance policies in the 2000s

promising to cover shortfalls in scheduled debt-service payments.

The federal oversight board managing Puerto Rico's finances is now

asking a judge to slash its $73 billion debt load, heightening the

likelihood of claims on those policies.

Ambac's $9.6 billion exposure to Puerto Rico is one reason the

insurer remains under a court-supervised rehabilitation process.

Insurance regulators broke up Ambac into a good bank and a bad bank

in 2010 to contain the damage from policies written on toxic

real-estate securities and credit derivatives.

Seven years later, Ambac's regulator is developing a plan to end

the rehabilitation. The more insured debt that Ambac buys back, the

easier it will be for the regulator to justify releasing the bad

bank from court supervision, and the less likely policyholders at

the good bank will object, according to people familiar with the

matter.

"The company looks at cash as a strategic resource, and right

now the focus of the strategy is to exit rehabilitation," Mr.

Gadlin said.

Ending the rehabilitation is a worthy goal, but not if it costs

too much, said Evermore Global Advisors LLC CEO David Marcus. Bond

buybacks make the most sense during periods of volatility when

prices fluctuate and sellers are motivated, but Ambac appears to

have bought Puerto Rico bonds at fairly steep prices, Mr. Marcus

said, in the months before the U.S. territory's entry into

court-supervised restructuring proceedings.

The repurchased Cofina bonds yielded less than 6.1% in the first

quarter, according to Electronic Municipal Market Access. Yields

and prices move in opposite directions.

Meanwhile, volatility in benchmark Puerto Rico bonds has

increased since the May 3 bankruptcy as investors unload them.

Ambac bought ahead of the bad news, when insurers are typically

more restrained in deploying capital, said Mr. Marcus, whose firm

owns Ambac shares.

"You have to wonder if they were paying too much," he said.

"Getting to the finish line is one thing, but not if they're

throwing gold bars out of their pockets to lighten the load along

the way."

Investors with claims against the bad bank have been agitating

for accelerated settlement payments, arguing that Ambac can pay

them off with new debt and the proceeds from pending lawsuits

against Bank of America, people familiar with the matter said. A

New York appeals court on Tuesday allowed some of the claims

against Bank of America to proceed.

Puerto Rico, its creditors and the oversight board are scheduled

to meet in court for the first time Wednesday before U.S. District

Judge Laura Taylor Swain, who is handling the bankruptcy

proceedings. While no Puerto Rico bonds have been restructured yet,

Ambac has paid out $78 million in claims for missed payments so far

and has set aside reserves as a cushion against further losses.

Complicating matters, it may be harder for the insurer to reach

consensual settlements than for other creditors with more narrow

interests. Hedge funds bought uninsured Puerto Rico bonds to bet on

specific tranches of debt, but Ambac, MBIA and Assured Guaranty

Ltd. are jointly liable with Puerto Rico on a variety of competing

bonds.

Write to Andrew Scurria at Andrew.Scurria@wsj.com

(END) Dow Jones Newswires

May 16, 2017 16:55 ET (20:55 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

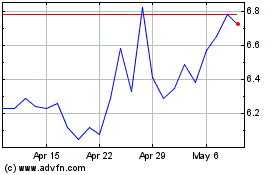

MBIA (NYSE:MBI)

Historical Stock Chart

From Mar 2024 to Apr 2024

MBIA (NYSE:MBI)

Historical Stock Chart

From Apr 2023 to Apr 2024