UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the

Registrant ☒ Filed by a Party other than the

Registrant ☐

Check the appropriate box:

|

|

|

|

|

☐

|

|

Preliminary Proxy Statement

|

|

|

|

|

☐

|

|

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

|

|

|

|

|

☐

|

|

Definitive Proxy Statement

|

|

|

|

|

☒

|

|

Definitive Additional Materials

|

|

|

|

|

☐

|

|

Soliciting Material Pursuant to §240.14a-12

|

Clear

Channel Outdoor Holdings, Inc.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

|

|

|

|

|

|

|

|

|

|

☒

|

|

No fee required.

|

|

|

|

|

☐

|

|

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

|

|

|

|

|

|

|

|

(1)

|

|

Title of each class of securities to which the transaction applies:

|

|

|

|

(2)

|

|

Aggregate number of securities to which the transaction applies:

|

|

|

|

(3)

|

|

Per unit price or other underlying value of the transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the

filing fee is calculated and state how it was determined):

|

|

|

|

(4)

|

|

Proposed maximum aggregate value of the transaction:

|

|

|

|

(5)

|

|

Total fee paid:

|

|

|

|

|

☐

|

|

Fee paid previously with preliminary materials.

|

|

|

|

|

☐

|

|

Check box if any part of the fee is offset as provided by Exchange Act Rule

0-11(a)(2)

and identify the filing for which the offsetting fee was paid previously. Identify the

previous filing by registration statement number, or the Form or Schedule and the date of its filing.

|

|

|

|

|

|

|

|

(1)

|

|

Amount Previously Paid:

|

|

|

|

(2)

|

|

Form, Schedule or Registration Statement No.:

|

|

|

|

(3)

|

|

Filing Party:

|

|

|

|

(4)

|

|

Date Filed:

|

CLEAR CHANNEL OUTDOOR HOLDINGS, INC.

200 E. Basse Road, Suite 100

San Antonio, Texas 78209

May 16,

2017

We are pleased to announce that our Board of Directors (the “Board”) has nominated Paul Keglevic for election to the Board

at the 2017 Annual Meeting of Stockholders to be held on May 26, 2017 (the “Annual Meeting”). Mr. Keglevic has been nominated to fill the Board seat currently held by Christopher M. Temple, who has not been nominated for

re-election to our Board at the Annual Meeting and whose term will expire on the date of the Annual Meeting. Mr. Keglevic has been nominated as a Class II director to serve a three year term expiring at the Annual Meeting of Stockholders in

2020.

Because this change adds Mr. Keglevic to the slate of directors proposed to be elected at the Annual Meeting, we are providing

you with additional information in the enclosed Supplement to Proxy Statement and an amended proxy card to allow stockholders to vote on the election of Mr. Keglevic as a Class II director. For technical purposes, the election of

Mr. Keglevic as director is being considered as a separate proposal (Proposal No. 6).

You should resubmit your vote on all six

proposals in your proxy or voting instructions by one of the alternatives described in the Supplement. The receipt of your new proxy or voting instructions will revoke and supersede any proxy or voting instructions previously submitted. If you have

already voted and do not submit new voting instructions, your previously submitted proxy or voting instructions will be voted at the Annual Meeting with respect to all other proposals but will not be counted in determining the outcome of the

election of Mr. Keglevic to our Board.

Please read the Proxy Statement that was previously made available to stockholders and the

attached Supplement in their entirety, as together they contain all of the information that is important to your decisions in voting at the Annual Meeting.

|

|

|

|

|

|

|

|

|

|

|

By Order of the Board of Directors

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Robert H. Walls, Jr.

|

|

|

|

|

|

Executive Vice President, General Counsel and Secretary

|

CLEAR CHANNEL OUTDOOR HOLDINGS, INC.

200 E. Basse Road, Suite 100

San Antonio, Texas 78209

AMENDED NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD MAY 26, 2017

The 2017 Annual Meeting of Stockholders (the “Annual Meeting”) of Clear Channel Outdoor Holdings, Inc. (“we”,

“us”, “our” or the “Company”) will be held in the Texas A Ballroom at the Hilton San Antonio Airport, located at 611 NW Loop 410, San Antonio, Texas 78216, on Friday, May 26, 2017 at 9:00 a.m., local time, for the

following purposes:

|

|

Proposal 1:

|

to elect Olivia Sabine to serve as a director for a three year term;

|

|

|

Proposal 2:

|

to approve an advisory resolution on executive compensation;

|

|

|

Proposal 3:

|

to conduct an advisory vote on the frequency of future advisory votes on executive compensation;

|

|

|

Proposal 4:

|

to approve the adoption of the 2012 Amended and Restated Stock Incentive Plan;

|

|

|

Proposal 5:

|

to ratify the selection of Ernst & Young LLP as the independent registered public accounting firm of Clear Channel Outdoor for the year ending December 31, 2017;

|

|

|

Proposal 6:

|

to elect Paul Keglevic to serve as a director for a three year term;

|

and to transact any other business which

may properly come before the Annual Meeting or at any adjournments or postponements thereof.

The Proxy Statement first sent to

stockholders on April 21, 2017 provides information about the matters you will be asked to consider and vote on at the Annual Meeting, except that information with respect to Proposal 6 listed above is set forth in the accompanying

Supplement to Proxy Statement.

Stockholders of record at the close of business on April 6, 2017 (the “Record Date”) are

entitled to notice of, and to vote at, the Annual Meeting or at any adjournments or postponements thereof. We previously mailed the Proxy Statement to our stockholders on or about April 21, 2017.

You are cordially invited to attend the Annual Meeting. Whether or not you plan to attend the Annual Meeting, our Board of Directors asks that

you vote as soon as possible. Your attention is directed to the previously provided Proxy Statement. In addition, although mere attendance at the Annual Meeting will not revoke your proxy, if you attend the Annual Meeting you may revoke your proxy

and vote in person. To ensure that your shares are represented at the Annual Meeting, please complete, date, sign and mail the amended proxy card in the return envelope provided for that purpose.

Your vote is important and all stockholders are encouraged to attend the Annual Meeting and vote in person or by proxy.

|

|

|

|

|

|

|

May 16, 2017

|

|

|

|

By Order of the Board of Directors

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Robert H. Walls, Jr.

|

|

|

|

|

|

Executive Vice President, General Counsel and Secretary

|

|

|

|

IMPORTANT NOTICE REGARDING AVAILABILITY OF PROXY

MATERIALS FOR THE

ANNUAL MEETING OF STOCKHOLDERS TO BE HELD ON MAY 26, 2017

The Proxy, Supplement to Proxy and Annual Report Materials

are available at:

www.envisionreports.com/cco

|

SUPPLEMENT TO PROXY STATEMENT

FOR THE ANNUAL MEETING OF STOCKHOLDERS

To Be Held May 26, 2017

May 16, 2017

This

Supplement to Proxy Statement (this “Supplement”) is furnished to the stockholders of Clear Channel Outdoor Holdings, Inc. (“we”, “us”, “our” or the “Company”) in connection with the solicitation of

proxies for use at the Annual Meeting of Stockholders to be held on May 26, 2017 (the “Annual Meeting”), or at any adjournments or postponements thereof, pursuant to the accompanying Amended Notice of Annual Meeting of Stockholders.

This Supplement and the Amended Notice of Annual Meeting of Stockholders supplement and amend the Notice of Annual Meeting of Stockholders and the Proxy Statement, each dated April 19, 2017.

This Supplement is being furnished to provide information related to Proposal No. 6, which has been newly added to the agenda for the

Annual Meeting. This Supplement does not provide all of the information that is important to your decisions in voting at the Annual Meeting. Additional information is contained in the Proxy Statement for our Annual Meeting that was previously sent

to our stockholders.

On April 19, 2017, the Company filed its proxy statement (the “Proxy Statement”) relating to the

Annual Meeting with the Securities and Exchange Commission and began mailing the Proxy Statement to its stockholders on or about April 21, 2017. Subsequent to that date, the Board of Directors of the Company (the “Board”) nominated

Paul Keglevic as a Class II director. These additional materials have been prepared to provide the Company’s stockholders with information regarding the new nominee for director that would have been included in the Proxy Statement had the

nominee been nominated prior to the filing of the Proxy Statement.

Nomination of Class II Director

Paul Keglevic has been nominated to fill the Board seat currently held by Christopher M. Temple, who has not been nominated for re-election to

our Board at the Annual Meeting and whose term will expire on the date of the Annual Meeting. Mr. Keglevic has been nominated as a Class II director to serve a three year term expiring at the Annual Meeting of Stockholders in 2020. Based on

information provided by Mr. Keglevic, the Board has affirmatively determined that Mr. Keglevic is independent under the listing standards of the NYSE, as well as the Company’s independence standards set forth in the Proxy Statement.

In addition, the Board has determined that Mr. Keglevic is independent under the heightened independence standards required for audit committee members by the listing standards of the NYSE and the rules and regulations of the SEC. The Board has

determined that, if elected, Mr. Keglevic will serve on the audit committee of the Board.

The amended proxy card enclosed with

this Supplement differs from the proxy card previously furnished to you with the Proxy Statement dated April 19, 2017, in that the enclosed amended proxy card includes the additional Proposal No. 6. You should resubmit your vote on all six

proposals by submitting the amended proxy card enclosed with this Supplement. If you have already voted and do not submit a new proxy card or new voting instructions, your previously submitted proxy or voting instructions will be voted at the Annual

Meeting with respect to all other proposals but will not be counted in determining the outcome of the election of Mr. Keglevic to our Board.

1

PROPOSAL NO. 6

ELECTION OF ADDITIONAL DIRECTOR

Paul Keglevic has been nominated to fill the Board seat currently held by Christopher M. Temple, who has not been nominated for re-election to

our Board at the Annual Meeting and whose term will expire on the date of the Annual Meeting. Mr. Keglevic has been nominated as a Class II director to serve a three year term expiring at the Annual Meeting of Stockholders in 2020. Based on

information provided by Mr. Keglevic, the Board has affirmatively determined that Mr. Keglevic is independent under the listing standards of the NYSE, as well as the Company’s independence standards set forth in the Proxy Statement.

In addition, the Board has determined that Mr. Keglevic is independent under the heightened independence standards required for audit committee members by the listing standards of the NYSE and the rules and regulations of the SEC. The Board has

determined that, if elected, Mr. Keglevic will serve on the audit committee of the Board.

If elected at the annual meeting,

Mr. Keglevic will serve a three year term, or until his successor shall have been elected and qualified, subject to earlier death, resignation or removal. Mr. Keglevic has indicated a willingness to serve as director if elected. Should

Mr. Keglevic become unavailable for election, discretionary authority is conferred on the proxies to vote for a substitute. Management has no reason to believe that Mr. Keglevic will be unable or unwilling to serve if elected.

Business Experience of Mr. Keglevic

Mr. Keglevic, age 63, has served as the Chief Executive Officer of Energy Future Holdings Corp., (“EFH”), since October 2016 and

as Chief Restructuring Officer of EFH since December 2013. Previously Mr. Keglevic served as Executive Vice President and Chief Financial Officer for EFH from June 2008 to October 2016. EFH filed for Chapter 11 bankruptcy protection in April

2014 while Mr. Keglevic served as its Chief Financial Officer and Chief Restructuring Officer. Mr. Keglevic was a partner at PricewaterhouseCoopers (“PWC”), an accounting firm, where he worked from July 2002 to July 2008. At PWC

he was the U.S. utility sector leader for six years and the clients and sector assurance leader for one year. Prior to PWC, Mr. Keglevic led the utilities practice for Arthur Andersen, where he was a partner for 15 years. Mr. Keglevic

serves on the board of directors of Stellus Capital Investment Corp. and Bonzanza Creek Energy, Inc. and has served as a member of the board of directors of several subsidiaries of EFH and the Dallas and State of California Chambers of Commerce and

several other charitable and advisory boards. Mr. Keglevic received his B.S. in accounting from Northern Illinois University and is a certified public accountant. Mr. Keglevic was selected to serve as a member of our Board for his

extensive experience with public companies and knowledge of accounting and regulatory issues.

Stock Ownership of Mr. Keglevic

Mr. Keglevic does not beneficially own any shares of the Company’s common stock as of the date of this Supplement.

THE BOARD OF DIRECTORS RECOMMENDS YOU VOTE

FOR

MR. KEGLEVIC. A PROPERLY SUBMITTED AMENDED PROXY CARD WILL BE SO VOTED

UNLESS THE STOCKHOLDER SPECIFIES OTHERWISE.

Required Vote

Our Bylaws provide that for the election of this nominee to our Board, the holders of Class A common stock and Class B common stock will

vote together as a single class. Each share of Class A common stock is entitled to one vote at the Annual Meeting, and each share of Class B common stock is entitled to 20 votes at the Annual Meeting. The directors will be elected by a

plurality of the votes cast by stockholders present in person or represented by proxy voting together as a single class at the Annual Meeting.

If you withhold your vote on the election of this nominee to our Board, it will have no effect on the outcome of the vote on Proposal 6.

Abstentions and broker non-votes are counted as present for purposes of determining a quorum.

2

VOTING; REVOCABILITY OF PROXIES

With regard to the election of the nominee for director named in Proposal 1, you may vote “FOR” the nominee or “WITHHOLD”

your vote for the nominee. With regard to the election of the nominee for director named in Proposal 6, you may vote “FOR” the nominee or “WITHHOLD” your vote for the nominee. The Company’s Bylaws provide for the election of

directors by a plurality of the votes cast by stockholders present in person or represented by proxy voting together as a single class at the Annual Meeting. This means that the individuals nominated for election to the Board who receive the most

“FOR” votes (among votes properly cast in person or by proxy) will be elected.

If you sign and return the amended proxy card,

it will revoke and replace any previous proxy you have submitted. If you do not sign and return the amended proxy card, your previous proxy will remain in effect, but it will not include any vote on Mr. Keglevic as a nominee for director. In

order to vote on Mr. Keglevic as a nominee for director you must submit a vote on Proposal No. 6 and mail the amended proxy card, or attend the Annual Meeting and vote in person. If you hold the Company’s common stock in “street

name,” you must either instruct your bank, broker or other nominee as to how to vote such shares or obtain a proxy, executed in your favor by your bank, broker or other nominee, to be able to vote at the Annual Meeting.

If the amended proxy card or original proxy card is properly signed, dated and returned and is not revoked, the proxy will be voted at the

Annual Meeting in accordance with the stockholder’s instructions indicated on the most recently dated proxy. If no instructions are indicated on the amended proxy card, the proxy will be voted “FOR” Mr. Sabine as Board nominee

for director; “FOR” the approval of an advisory resolution on executive compensation; “FOR” holding an advisory vote on executive compensation once every three years; “FOR” the approval of the adoption of the 2012

Amended and Restated Stock Incentive Plan; “FOR” the ratification of the selection of Ernst & Young LLP as the independent registered public accounting firm of Clear Channel Outdoor for the year ending December 31, 2017; and

“FOR” Mr. Keglevic as an additional director.

You may revoke your proxy and change your vote at any time before your vote

is due. You may vote again on a later date by signing and returning a new proxy card or voting instruction form with a later date, or by attending the Annual Meeting and voting in person if you have the right to vote in person. Mere attendance at

the Annual Meeting will not automatically revoke your proxy unless you vote in person at the Annual Meeting or specifically request in writing that your prior proxy be revoked.

OTHER MATTERS COMING BEFORE THE MEETING

As of the date of this Supplement, the Board of Directors does not know of any matters to be presented to the meeting other than the matters

set forth in the attached Amended Notice of Annual Meeting of Stockholders. If any other matter properly comes before the meeting, it is intended that the holders of the proxies will vote thereon in their discretion.

3

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Clear Channel Outdoor Holdings, Inc.

|

|

|

|

|

|

|

|

|

|

|

|

I

MPORTANT ANNUAL MEETING INFORMATION

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

To vote by mail, sign and date your proxy card and return it

in the enclosed postage-paid envelope.

All votes by 401(k) Plan participants must be

received by 11:59 p.m. Eastern Time on May 23, 2017.

|

|

|

|

|

|

|

|

|

|

Using a

black ink

pen, mark your votes with an

X

as shown in this example. Please do not write outside the designated areas.

|

|

☒

|

|

|

|

|

|

|

|

|

|

|

|

Annual Meeting Proxy Card

|

|

|

|

|

|

|

|

q

PLEASE FOLD ALONG THE PERFORATION, DETACH AND RETURN THE BOTTOM PORTION IN THE ENCLOSED ENVELOPE.

q

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1.

|

|

Election of Directors (Please vote for a total of only one Nominee)

The Board recommends that you vote “FOR” the Nominee listed below:

01 - Olivia

Sabine

|

|

|

|

+

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

☐

|

|

Mark here to vote

FOR

the nominee

|

|

☐

|

|

Mark here to

WITHHOLD

vote from the nominee

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

For

|

|

Against

|

|

Abstain

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1 year

|

|

|

|

2 years

|

|

3 years

|

|

Abstain

|

|

2.

|

|

Approval of the advisory (non-binding) resolution on executive compensation.

|

|

|

|

|

|

☐

|

|

☐

|

|

☐

|

|

|

|

3.

|

|

Advisory (non-binding) vote on the frequency of future advisory votes on executive compensation.

|

|

|

|

☐

|

|

|

|

☐

|

|

☐

|

|

☐

|

|

|

|

|

|

|

|

|

|

The

Board recommends

that

you

vote

“FOR”

approval

of

the

advisory

resolution.

|

|

|

|

|

|

The

Board recommends

a

vote

to

hold

future advisory

votes

once

every

3

years.

|

|

|

|

|

|

|

|

|

|

For

|

|

Against

|

|

Abstain

|

|

|

|

|

|

|

|

For

|

|

Against

|

|

Abstain

|

|

4.

|

|

Approval of the adoption of the 2012 Amended and Restated Stock Incentive Plan.

|

|

|

|

|

|

☐

|

|

☐

|

|

☐

|

|

|

|

5.

|

|

Ratification of the selection of Ernst & Young LLP as the independent registered public accounting firm for the year ending December 31, 2017.

|

|

|

|

☐

|

|

☐

|

|

☐

|

|

|

|

Th

e

Boar

d

recommend

s

tha

t

yo

u

vot

e

“FOR

”

approva

l

o

f

th

e

adoptio

n

o

f

the

201

2

Amende

d

an

d

Restate

d

Stoc

k

Incentiv

e

Plan.

|

|

|

|

|

|

The

Board recommends

that

you

vote

“FOR”

ratification.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

6.

|

|

Election of Additional Director (Please vote for a total of only one Nominee)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

The

Board recommends

that

you

vote

“FOR”

the

Nominee

listed

below:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

01 - Paul Keglevic

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

☐

|

|

Mark here to vote

FOR

the nominee

|

|

☐

|

|

Mark here to

WITHHOLD

vote from the nominee

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

In their discretion, the proxies are authorized to vote upon such other business as may properly come before the Annual Meeting

or any adjournment or postponement thereof.

If any other matters properly come before the meeting, the proxies will vote as recommended by our Board or,

if there is no recommendation, in their discretion.

|

|

|

Important Notice Regarding the Availability of Proxy Materials

for the Stockholder Meeting to be held on May 26, 2017.

The Proxy Statement and the Annual Report Materials are available at:

www.envisionreports.com/cco

|

|

|

q

PLEASE FOLD ALONG THE PERFORATION, DETACH AND RETURN THE BOTTOM PORTION IN THE ENCLOSED ENVELOPE.

q

|

|

|

|

|

|

Proxy — Clear Channel Outdoor Holdings, Inc.

|

|

+

|

2017 Meeting of Stockholders – May 26, 2017

THIS PROXY IS SOLICITED ON BEHALF OF THE BOARD OF DIRECTORS

The undersigned hereby appoints Robert W. Pittman, Richard J. Bressler and Robert H. Walls, Jr., and each of them, proxies of the undersigned

with full power of substitution for and in the name, place and stead of the undersigned to appear and act for and to vote all shares of Clear Channel Outdoor Holdings, Inc. standing in the name of the undersigned or with respect to which the

undersigned is entitled to vote and act at the Annual Meeting of Stockholders of said company to be held in San Antonio, Texas on May 26, 2017 at 9:00 a.m. local time, or at any adjournments or postponements thereof, with all powers the undersigned

would possess if then personally present, as indicated on the reverse side.

If shares of Clear Channel Outdoor Holdings, Inc. are issued

to or held for the account of the undersigned under the 401(k) Plan, then the undersigned hereby directs the trustee of the plan to vote all such shares in the undersigned’s name and/or account under such plan in accordance with the

instructions given herein, at the Annual Meeting and at any adjournments or postponements thereof, on all matters properly coming before the Annual Meeting, including but not limited to the matters set forth on the reverse side.

Th

e

truste

e

wil

l

vot

e

share

s

a

s

t

o

whic

h

n

o

instruction

s

ar

e

receive

d

i

n

proportio

n

t

o

votin

g

direction

s

received b

y

th

e

truste

e

fro

m

al

l

pla

n

participant

s

wh

o

vote.

THI

S

PROX

Y

WIL

L

B

E

VOTE

D

A

S

DIRECTED

.

I

F

N

O

DIRECTIO

N

I

S

INDIC

A

TED

,

THI

S

PROX

Y

WIL

L

B

E

VOTE

D

“FOR

”

TH

E

ELECTIO

N

O

F

TH

E

NOMINE

E

NAME

D

I

N

PROPOSA

L

1

,

“FOR

”

THE ELECTIO

N

O

F

TH

E

NOMINE

E

NAME

D

I

N

PROPOSA

L

6

,

“FOR

”

PROPOSAL

S

2

,

4

AN

D

5

AN

D

“

3

YEARS

”

FO

R

PROPOSA

L

3

(othe

r

tha

n

401(k

)

Pla

n

p

a

rticipant

s

discusse

d

above).

|

|

|

|

|

|

|

Change of Address

— Please print new address below.

|

|

Comments

— Please print your comments below.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

C

|

|

Authorized Signatures — This section must be completed for your vote to be counted. — Date and Sign Below

|

NOTE: Please sign as name appears hereon. Joint owners should each sign. When signing as attorney, executor, administrator,

trustee or guardian, please give full title as such.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Date (mm/dd/yyyy) — Please print date below.

|

|

|

|

|

|

Signature 1 — Please keep signature within the box.

|

|

|

|

|

|

Signature 2 — Please keep signature within the box.

|

|

/ /

|

|

|

|

|

|

|

|

|

|

|

|

|

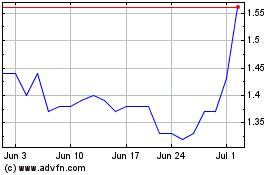

Clear Channel Outdoor (NYSE:CCO)

Historical Stock Chart

From Mar 2024 to Apr 2024

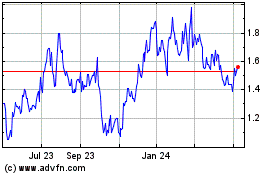

Clear Channel Outdoor (NYSE:CCO)

Historical Stock Chart

From Apr 2023 to Apr 2024