TIDMVLX

RNS Number : 0562F

Volex PLC

12 November 2020

12 November 2020

Volex plc

("Volex" or the "Company")

Acquisition of DEKA for EUR61.8 million

Accelerates growth strategy and provides increased presence in

Europe

Volex plc (AIM:VLX), the global supplier of integrated

manufacturing services and power products, is pleased to announce

it has signed a share purchase agreement for the proposed

acquisition of the entire issued share capital of De-Ka

Elektroteknik Sanayi ve Ticaret Anonim irketi ("DEKA"), for a total

consideration of up to EUR61.8 million, on a debt-free basis (the

"Acquisition").

The Acquisition is expected to close in January 2021, subject to

approval by the Turkish Competition Authority and admission of the

Consideration Shares (as defined below) to trading on AIM.

About DEKA

-- DEKA is a leading power cord manufacturer for the European white goods market

-- Headquartered in Kocaeli, Turkey, with three production

facilities and approximately 450 employees, it is strategically

located in a low-cost region close to Europe

-- Like Volex, DEKA has shown a resilient performance through

the period of the Covid-19 pandemic and reported unaudited sales of

EUR33 million for the nine months ended 30 September 2020

-- DEKA has best-in-class automation, full vertical integration

and a strong management team who are expected to remain with the

business

Strategic Rationale

-- DEKA offers exciting organic growth potential, providing

Volex with increased market share in attractive end market

segments

-- Expands Volex's presence in Europe, a key market for Volex's capabilities

-- Provides additional diversity to Volex's business in terms of customers and end-markets

-- Increased scale should allow the enlarged Volex group to

continue to improve our cost structure and realise procurement

savings and reductions in engineering and safety approval costs

Financial Highlights

-- Track record of consistent and long-term profit growth -

eight-year revenue and EBITDA CAGR of 9% and 28%, respectively

-- For the year ended 31 December 2019, DEKA generated audited

sales of EUR44.3 million and operating profit of EUR6.5 million

-- Acquisition multiple represents 6.9x DEKA's expected 2021 EBITDA

-- Acquisition is expected to be earnings enhancing after the first full year of ownership

-- Following the Acquisition, Volex's ROCE is expected to exceed 25%

Transaction Structure

-- Acquisition of DEKA for initial cash consideration of

EUR37million and EUR9.8 million to be satisfied by the issue of

3.32 million ordinary shares in Volex (the "Consideration Shares")

to the sellers on Completion

-- Deferred cash consideration of EUR2.0 million payable in January 2022

-- Deferred contingent cash consideration of up to EUR13.0

million in cash, which may be payable within two years of

Completion based on certain profit targets of DEKA being met

-- The Consideration Shares are subject to a six-month lock-up,

and an application will be made to the London Stock Exchange for

the admission of the Consideration Shares to trading on AIM

("Admission") on Completion

-- The initial and deferred cash consideration will be funded through new debt facilities

-- Completion of the Acquisition is expected to occur in January

2021, subject to approval by the Turkish Competition Authority

-- Leverage of enlarged Volex Group, defined as net

debt/pro-forma EBITDA (based on consensus forecasts for Volex), is

expected to be below 0.4x by the end of Volex's financial year

ending 4 April 2021. Conservative approach to leverage remains

unchanged with flexibility for dividends and future bolt-on

acquisitions

Commenting on the acquisition, Nat Rothschild Executive Chairman

of Volex said:

"The acquisition of DEKA is an exceptional opportunity for Volex

and is expected to be significantly earnings enhancing in the first

full year of ownership. As one of the two leading power cord

producers in Europe, with a strong management team and an

impressive customer list, DEKA is a perfect fit with our business

model. Furthermore, it accelerates our strategy of creating the

most efficient and lowest-cost producer in the industry, providing

an immediate and scalable European platform. The business has an

excellent track record and is positioned well in high structural

growth end-segments such as White Goods to deliver exciting growth

in the future."

The information contained within the announcement is deemed by

the Company to constitute inside information under the Market Abuse

Regulations (EU) No.596/2014. The person responsible for arranging

the release of this information is Mr Jon Boaden, CFO of the

Company.

-ENDS-

A presentation for analysts and investors will be held at 0800

this morning to discuss the acquisition of DEKA alongside the

Group's half-year results for the 26 weeks ended 4 October 2020.

Please contact Powerscourt via Volex@powerscourt-group.com for

dial-in details.

For further information please contact :

+44 (0)7747 488

Volex plc 785

Nat Rothschild, Executive Chairman

Jon Boaden, Chief Financial Officer

N+1 Singer - Nominated Adviser & Joint Broker +44 (0)20 7496 3000

Shaun Dobson

Iqra Amin

Panmure Gordon - Joint Broker +44 (0)20 7886 2500

Hugh Rich

Powerscourt - Media Enquiries + 44 (0)20 7250 1446

James White

Jack Holden

NOTES TO EDITORS :

Volex plc (AIM:VLX) is a leading integrated manufacturing specialist. The Group designs and

manufactures products that ensure a critical connection never fails and are used in everything

from defibrillators and ventilators through to data networking equipment and vehicle telematics.

Headquartered in the United Kingdom, Volex serves the needs of its blue-chip customer base

from its manufacturing sites located across nine countries and three continents, employing

over 6,000 people. Volex's products are sold through its own global sales force and through

distributors to Original Equipment Manufacturers ('OEMs') and Electronic Manufacturing Services

companies. For more information please visit www.volex.com

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

ACQGPGPGGUPUPPG

(END) Dow Jones Newswires

November 12, 2020 02:00 ET (07:00 GMT)

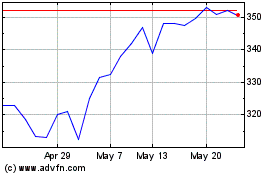

Volex (LSE:VLX)

Historical Stock Chart

From Oct 2024 to Nov 2024

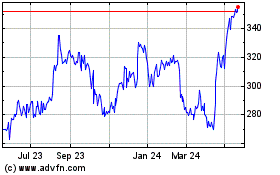

Volex (LSE:VLX)

Historical Stock Chart

From Nov 2023 to Nov 2024