TIDMTOM

RNS Number : 6198C

TomCo Energy PLC

22 June 2021

22 June 2021

TOMCO ENERGY PLC

("TomCo", the "Company" or the "Group")

Unaudited interim results for the six-month period ended 31

March 2021

TomCo Energy plc (AIM: TOM), the US operating oil development

group focused on using innovative technology to unlock

unconventional hydrocarbon resources, announces its unaudited

interim results for the six-month period ended 31 March 2021.

CHAIRMAN'S STATEMENT

Operational

Our Greenfield joint venture with Valkor LLC has made progress

despite the COVID-19 pandemic. The oil sands plant at Asphalt Ridge

developed by Petroteq Energy Inc (the "POSP") and enhanced by

Greenfield has now been brought into sustained production,

extracting oil from sands in a manner that we believe could be

scaled up to be commercially viable in large, purpose-built plants,

with a target of being capable of producing 10,000 barrels of oil

per day. In late May 2021, we received a draft of the Front-End

Engineering and Design ("FEED") study that, whilst still being

reviewed, is encouraging. Taken together with the practical

demonstration of the process via the POSP test plant, such draft

report has led Greenfield to most recently move ahead with

investigating the possibility of acquiring up to a 100 per cent.

interest in a large oil sands site in Utah via Tar Sands Holdings

II LLC ("TSHII") believed to be suitable for the construction of a

potential initial commercial scale plant. Alongside the potential

acquisition, Greenfield is also in the early stages of exploring

possible financing opportunities for the potential project.

We have continued to postpone operations in respect of

TurboShale's RF Technology, pending a return to normality after the

COVID-19 pandemic abates.

Details of our progress during the reporting period, and more

recently, is outlined in the various regulatory announcements the

Company has issued. We will continue to provide regular updates as

matters progress and believe that Greenfield is well positioned to

achieve its goals.

Board changes

At the time of our last fund-raising, in the autumn of 2020,

Stephen West and Alexander Benger stepped down from the Board to

focus on commitments elsewhere, I became Chairman, and we appointed

two new non-executives, Richard Horsman and Robb Kirchner. In the

spring of 2021, Robb Kirchner left us to pursue other

opportunities, but I am delighted that we were able to attract

Louis Castro to join our Board. Louis is widely respected in our

sector and brings very valuable experience and judgment relevant to

the Company's future progression.

Funding

During the reporting period, we raised GBP3.5m (gross) via a

placing in November 2020, through the issue of 777,777,777 new

ordinary shares at a price of 0.45 pence per share, with the net

proceeds being used to provide general working capital and to fund

Greenfield's development.

As at 21June 2021, TomCo had approximately GBP1,390,000 of cash

reserves available to it. The Board believes that the Group has

sufficient funds to cover its expected and normal outgoings for the

next 12 months. However, we anticipate needing to raise additional

funds in the event a decision is made to exercise our option to

acquire the abovementioned site and commence work on our first

full-scale oil sands plant and related matters. The contractual

balance due if Greenfield was to assume full ownership of the site

via TSHII is up to approximately US$16 million (dependent on the

timing of the option exercise) and, at this stage, we envisage that

Greenfield would require funding in excess of US$110 million for

the construction of the first plant, the vast majority of which it

would seek to finance by way of debt. Should Greenfield proceed

with the acquisition, TomCo will work closely with its joint

venture partner to explore the most appropriate financing solutions

for the requisite funding.

I would like to thank shareholders for their continued support

and encouragement through recent challenging times. We remain

focused on meeting the further challenges that lie ahead.

Malcolm Groat

Non-Executive Chairman

Enquiries :

TomCo Energy plc

Malcolm Groat (Chairman) / John Potter (CEO) +44 (0)20 3823 3635

Strand Hanson Limited (Nominated Adviser)

James Harris / Matthew Chandler +44 (0)20 7409 3494

Novum Securities Limited (Broker)

Jon Belliss / Colin Rowbury +44 (0)20 7399 9402

IFC Advisory Limited (Financial PR)

Tim Metcalfe / Graham Herring +44 (0)20 3934 6630

For further information, please visit www.tomcoenergy.com .

The information contained within this announcement is deemed by

the Company to constitute inside information as stipulated under

the Market Abuse Regulation (EU) No. 596/2014 as it forms part of

United Kingdom domestic law by virtue of the European Union

(Withdrawal) Act 2018.

Condensed consolidated statement of comprehensive income

For the six-month period ended 31 March 2021

Unaudited Unaudited Audited

Six months Six months Year ended

ended ended 30 September

31 March 31 March

2021 2020 2020

Notes GBP'000 GBP'000 GBP'000

----------------------------------------- ----- ----------- ----------- -------------

Revenue - - -

----------------------------------------- ----- ----------- ----------- -------------

Cost of sales - - -

----------------------------------------- ----- ----------- ----------- -------------

Gross profit/(loss) - - -

Administrative expenses (738) (377) (1,031)

----------------------------------------- ----- ----------- ----------- -------------

Operating loss 3 (738) (377) (1,031)

Finance income/(costs) - 1 1

Share of loss of joint venture (39) - (40)

----------------------------------------- ----- ----------- ----------- -------------

Loss on ordinary activities before

taxation (777) (376) (1,070)

Taxation - - -

----------------------------------------- ----- ----------- ----------- -------------

Loss for the period (777) (376) (1,070)

Loss for the period/year attributable

to:

Equity shareholders of the parent (739) (355) (1,028)

Non-controlling interests (38) (21) (42)

----------------------------------------- ----- ----------- ----------- -------------

(777) (376) (1,070)

----------------------------------------- ----- ----------- ----------- -------------

Items that may be reclassified subsequently to

profit or loss

Exchange differences on translation

of foreign operations (585) (107) 350

Other comprehensive income for the year attributable

to :

Equity shareholders of the parent (598) (108) (356)

Non-controlling interests 13 1 6

Other comprehensive income (585) (107) (350)

Total comprehensive loss attributable

to :

Equity shareholders of the parent (1,337) (463) (1,384)

Non-controlling interests (25) (20) (36)

----------------------------------------- ----- ----------- ----------- -------------

(1,362) (483) (1,420)

----------------------------------------- ----- ----------- ----------- -------------

Loss per share attributable to the equity shareholders

of the parent

------------------------------------------------------------- ----------- -------------

Basic & Diluted Loss per share (pence) 4 (0.06) (0.16) (0.30)

----------------------------------------- ----- ----------- ----------- -------------

Condensed consolidated statement of financial position

As at 31 March 2021

Unaudited Unaudited

Six months Six months Audited

ended ended Year ended

31 March 31 March 30 September

2021 2020 2020

Note GBP'000 GBP'000 GBP'000

-------------------------------- ---- ----------- ------------ ---------------

Assets

Non-current assets

Intangible assets 5 8,192 9,221 8,834

Property, plant and equipment 382 425 411

Investment in joint venture 6 1,859 - 1,224

Other receivables 24 27 26

-------------------------------- ---- ----------- ------------ ---------------

10,457 9,673 10,495

-------------------------------- ---- ----------- ------------ ---------------

Current assets

Trade and other receivables 138 92 118

Cash and cash equivalents 2,250 751 334

-------------------------------- ---- ----------- ------------ ---------------

2,388 843 452

-------------------------------- ---- ----------- ------------ ---------------

Total Assets 12,845 10,516 10,947

-------------------------------- ---- ----------- ------------ ---------------

Liabilities

Current liabilities

Trade and other payables (228) (353) (215)

(228) (353) (215)

-------------------------------- ---- ----------- ------------ ---------------

Net current assets 2,160 490 237

-------------------------------- ---- ----------- ------------ ---------------

Total liabilities (228) (353) (215)

-------------------------------- ---- ----------- ------------ ---------------

Total Net Assets 12,617 10,163 10,732

-------------------------------- ---- ----------- ------------ ---------------

Shareholders' equity

Share capital - - -

Share premium 7 30,271 28,784 29,222

Warrant reserve 8 3,466 354 1,288

Translation reserve (316) 530 282

Retained deficit (20,606) (19,348) (19,887)

-------------------------------- ---- ----------- ------------ ---------------

Equity attributable to owners

of the parent 12,815 10,320 10,905

Non-controlling interests (198) (157) (173)

-------------------------------- ---- ----------- ------------ ---------------

Total Equity 12,617 10,163 10,732

-------------------------------- ---- ----------- ------------ ---------------

The financial information was approved and authorised for issue

by the Board of Directors on 21June 2021 and was signed on its

behalf by:

J Potter

Director

Condensed consolidated statement of changes in equity

For the six months ended 31 March 2021

Share Share Warrant Translation Retained Non-controlling Total

capital premium reserve reserve deficit Total interest equity

----------------------- -----

Note GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

----------------------- ----- -------- -------- -------- ----------- -------- ------- --------------- -------

At 30 September

2019 (audited) - 28,247 65 638 (19,012) 9,938 (137) 9,801

-------- -------- -------- ----------- -------- ------- --------------- -------

Loss for the period - - - - (355) (355) (21) (376)

Comprehensive loss

for the period - - - (108) - (108) 1 (107)

------------------------------ -------- -------- -------- ----------- -------- ------- --------------- -------

Total comprehensive

loss for the period - - - (108) (355) (463) (20) (483)

Issue of shares

(net of costs) - 537 327 - - 864 - 864

Expiry of warrants - - (42) - 42 - - -

Share based payment

credit - 4 - (23) (19) - (19)

------------------------------ -------- -------- -------- ----------- -------- ------- --------------- -------

At 31 March 2020

(unaudited) - 28,784 354 530 (19,348) 10,320 (157) 10,163

------------------------------ -------- -------- -------- ----------- -------- ------- --------------- -------

Loss for the period - - - - (673) (673) (21) (694)

Comprehensive loss

for the period - - - (248) - (248) 5 (243)

------------------------------ -------- -------- -------- ----------- -------- ------- --------------- -------

Total comprehensive

loss for the perio

d - - - (248) (673 ) (921) (16) (937)

Issue of shares

(net of costs) - 329 1,050 - - 1,379 - 1,379

Exercise of warrants - 109 (114) - 114 109 - 109

Expiry of warrants - - (1) - 1 - - -

Share based payment

charge - - (1) - 19 18 - 18

At 30 September

2020 (audited) - 29,222 1,288 282 (19,887) 10,905 (173) 10,732

------------------------------ -------- -------- -------- ----------- -------- ------- --------------- -------

Loss for the period - - - - (739) (739) (38) (777)

Comprehensive loss

for the period - - - (598) - (598) 13 (585)

------------------------------ -------- -------- -------- ----------- -------- ------- --------------- -------

Total comprehensive

loss for the period - - - (598) (739) (1,337) (25) (1,362)

Issue of shares

(net of costs) - 1,049 2,178 - - 3,227 - 3,227

Share-based payment

credit - - - - 20 20 - 20

------------------------------ -------- -------- -------- ----------- -------- ------- --------------- -------

At 31 March 2021

(unaudited) - 30,271 3,466 (316) (20,606) 12,815 (198) 12,617

------------------------------ -------- -------- -------- ----------- -------- ------- --------------- -------

The following describes the nature and purpose of each reserve

within owners' equity:

Reserve Descriptions and purpose

Share capital Amount subscribed for share capital at nominal value,

together with transfers to share premium upon redenomination

of the shares to nil par value.

Share premium Amount subscribed for share capital in excess of nominal

value, together with transfers from share capital

upon redenomination of the shares to nil par value.

Warrant reserve Amounts credited to equity in respect of warrants

to acquire ordinary shares in the Company.

Translation reserve Amounts debited or credited to equity arising from

translating the results of subsidiary entities whose

functional currency is not sterling.

Retained deficit Cumulative net gains and losses recognised in the

consolidated statement of comprehensive income.

Non-Controlling Amounts attributable to the non-controlling interest

Interests in TurboShale Inc.

Condensed consolidated statement of cash flows

For the period ended 31 March 2021

Unaudited Unaudited Audited

Six months Six months Year ended

ended 31 ended 31 30 September

March 2021 March 2020 2020

Note GBP'000 GBP'000 GBP'000

------------------------------------------- ---- ----------- --------------------- -------------

Cash flows from operating activities

Loss after tax (777) (376) (1,070)

Finance (income)/costs - (1) (1)

Amortisation of intangible fixed

assets 3 3 6

Share-based payment (credit)/charge 20 (19) (1)

Unrealised foreign exchange losses 172 - 81

Share of loss of joint venture 39 - 40

Decrease/(increase) in trade and

other receivables (20) 5 (21)

(Decrease)/increase in trade and

other payables 13 (239) (384)

------------------------------------------- ---- ----------- --------------------- -------------

Cash used in operations (550) (627) (1,350)

Interest received/(paid) - 1 (1)

Net cash outflows from operating

activities (550) (626) (1,349)

Cash flows from investing activities

Investment in intangibles 5 - (124) (29)

Investment in joint venture 6 (761) - (1,279)

Net cash used in investing activities (761) (124) (1,308)

------------------------------------------- ---- ----------- --------------------- -------------

Cash flows from financing activities

Issue of share capital 3,500 864 2,535

Costs of share issue (273) - (182)

Net cash generated from financing

activities 3,227 864 2,353

------------------------------------------- ---- ----------- --------------------- -------------

Net increase/(decrease) in cash

and cash equivalents 1,916 114 (304)

Cash and cash equivalents at beginning

of financial period 334 639 639

------------------------------------------- ---- ----------- --------------------- -------------

Foreign currency translation differences - (2) (1)

------------------------------------------- ---- ----------- --------------------- -------------

Cash and cash equivalents at end

of financial period 2,250 751 334

------------------------------------------- ---- ----------- --------------------- -------------

UNAUDITED NOTES FORMING PART OF THE CONDENSED CONSOLIDATED

INTERIM FINANCIAL STATEMENTS

For the six months ended 31 March 2021

1. Accounting Policies

Basis of Preparation

The unaudited condensed consolidated interim financial

statements of TomCo Energy plc ("TomCo" or the "Company") for the

six months ended 31 March 2021, incorporates the financial

information of the Company and its subsidiaries (together referred

to as the "Group").

The unaudited condensed interim financial information for the

Group has been prepared using the recognition and measurement

requirements of International Financial Reporting Standards (IFRS

and IFRIC interpretations) issued by the International Accounting

Standards Board ("IASB") as adopted for use in the EU, with the

exception of IAS 34 Interim Financial Reporting that is not

mandatory for companies quoted on the AIM market of the London

Stock Exchange. The unaudited condensed interim financial

information has been prepared using the accounting policies which

will be applied in the Group's statutory financial information for

the year ending 30 September 2021.

There were no new standards, interpretations and amendments to

published standards effective in the period which had a significant

impact on the Group.

Going concern

For the six months ended 31 March 2021, the Group recorded a

loss of approximately GBP777,000 and had net cash outflows from

operating and investing activities of approximately GBP1,311,000.

As at 21 June 2021, TomCo had approximately GBP1,390,000 of cash

available to it. Accordingly, the Board believes that the Group has

sufficient funds to cover its expected and normal outgoings for the

next 12 months and accordingly the unaudited condensed consolidated

interim financial statements have been prepared on the basis that

the entity is a going concern.

However, in the event a decision is made to exercise the Group's

option to acquire up to a 100% interest in Tar Sands Holdings II

LLC ("TSHII") or any additional unplanned expenditure is required

in respect of Greenfield, then it is anticipated that additional

funds would need to be raised to ensure that sufficient headroom is

maintained for the Group's working capital requirements.

Management has successfully raised funds in the past, but there

is no guarantee that adequate funds will be available when required

going forwards. Should the entity not be able to continue as a

going concern, it may be required to realise its assets and

discharge its liabilities other than in the ordinary course of

business, and at amounts that differ from those stated in the

financial statements. This interim financial report does not

include any adjustments relating to the recoverability and

classification of recorded asset amounts or liabilities that might

be necessary should the entity not continue as a going concern.

2. Financial reporting period

The unaudited condensed interim financial information

incorporates comparative figures for the unaudited six-month

interim period to 31 March 2020 and the audited financial year

ended 30 September 2020. The six-month financial information to 31

March 2021 is neither audited nor reviewed. In the opinion of the

Directors the unaudited condensed interim financial information for

the period presents fairly the financial position, results from

operations and cash flows for the period in conformity with the

generally accepted accounting principles consistently applied.

The financial information contained in this unaudited interim

report does not constitute statutory accounts as defined by the

Isle of Man Companies Act 2006. It does not include all disclosures

that would otherwise be required in a complete set of financial

statements and should be read in conjunction with the 2020 Annual

Report and Financial Statements. The comparatives for the full year

ended 30 September 2020 are not the Group's full statutory accounts

for that year. The auditors' report on those accounts was

unqualified.

3. Operating Loss

Unaudited Unaudited Audited

Six months Six months Year

ended ended ended

31 March 31 March 30 September

2021 2020 2020

GBP'000 GBP'000 GBP'000

------------------------------------------------ ----------- ----------- -------------

The following items have been charged in arriving at operating loss:

Directors' remuneration 160 264 360

Share-based payment (credit)/charges

for directors 20 (19) (1)

Auditors' remuneration 16 15 33

Operating leases for land and buildings-short

term assets 4 19 52

------------------------------------------------ ----------- ----------- -------------

Directors' remuneration for the period ended 31 March 2020

included GBP150,000 of compensation and ex gratia payments to

Andrew Jones (former Executive Chairman), which was settled post

that period end. Of the credit to profit and loss for share-based

payments in 2020, approximately GBP35,000 arose from the reversal

of charges previously recognised for unvested options awarded to Mr

Jones that lapsed, and the replacement of the lapsed options with a

similar number of warrants exercisable on similar terms.

4. Loss per share

Basic loss per share is calculated by dividing the losses

attributable to ordinary shareholders by the weighted average

number of ordinary shares outstanding during the year.

Reconciliations of the losses and weighted average number of shares

used in the calculations are set out below.

Weighted average Per share

Losses number of shares amount

Six months ended 31 March 2021 GBP'000 Pence

---------------------------------------- -------- ------------------ ----------

Basic and Diluted EPS

Losses attributable to ordinary

shareholders on continuing operations (739) 1,193,585,125 (0.06)

---------------------------------------- -------- ------------------ ----------

Weighted average Per share

Losses number of shares amount

Six months ended 31 March 202 GBP'000 Pence

0

---------------------------------------- -------- ------------------ ----------

Basic and Diluted EPS

Losses attributable to ordinary

shareholders on continuing operations (3 55 ) 221,025,507 (0.16)

---------------------------------------- -------- ------------------ ----------

Weighted average Per share

Losses number of shares amount

Year ended 30 September 202 0 GBP'000 Pence

---------------------------------------- -------- ------------------ ----------

Basic and Diluted EPS

Losses attributable to ordinary (1,0 28

shareholders on continuing operations ) 339,346,801 (0.30)

---------------------------------------- -------- ------------------ ----------

5. Intangible assets

Oil & Gas Exploration Oil & Gas Patents

and development and patent

licences applications Total

GBP'000 GBP'000 GBP'000

------------------------------------------- --------------------- ----------------- ---------

Cost, net of impairment and amortisation

At 30 September 2019 (audited) 9,200 22 9,222

Additions 124 - 124

Translation differences and amortisation (122) (3) (125)

------------------------------------------- --------------------- ----------------- ---------

At 31 March 2020 (unaudited) 9,202 19 9,221

Additions (87) - (87)

Translation differences and amortisation (296) (4) (300)

------------------------------------------- --------------------- ----------------- ---------

At 30 September 2020 (audited) 8,819 15 8,834

Additions - - -

Translation differences and amortisation (638) (4) (642)

------------------------------------------- --------------------- ----------------- ---------

At 31 March 2021 (unaudited) 8,181 11 8,192

------------------------------------------- --------------------- ----------------- ---------

Net book value

At 31 March 2021 (unaudited) 8,181 11 8,192

------------------------------------------- --------------------- ----------------- ---------

At 30 September 2020 (audited) 8,819 15 8,834

------------------------------------------- --------------------- ----------------- ---------

At 31 March 2020 (unaudited) 9,202 19 9,221

------------------------------------------- --------------------- ----------------- ---------

The exploration and development licences comprise nine Utah oil

shale leases covering approximately 15,488 acres. In respect of

leases ML 49570 and ML 49571, independent natural resources

consultants SRK Consulting (Australasia) Pty Ltd, part of the

internationally recognised SRK Group, reported in March 2019 best

estimate Contingent Resources (2C) of, in aggregate, 131.3 million

barrels ("MM bbl") of oil assessed under Petroleum Resources

Management System ("PRMS") guidelines, plus a best estimate

Prospective Resource (2U) of, in aggregate, 442.8 MM bbl oil across

the two leases. This included the Holliday A Block, where two field

tests have been undertaken to date, with 2C Contingent Resources of

57.3 MM bbl of oil and 2U Prospective Resources of 84.7 MM bbl of

oil. The Directors continue to consider the Holliday A Block to be

prospective and are seeking methods of extracting the shale oil

through development of TurboShale's RF technologies. The claim

areas and the Group's interest in them are:

Asset Per cent Licence Expiry Licence Area

Interest Status Date (Acres)

ML 49570 100 Prospect 31/12/2024 1,638.84

ML 49571 100 Prospect 31/12/2024 1,280.00

ML 48801 100 Prospect 01/10/2021 1,918.50

ML 48802 100 Prospect 01/10/2021 1,920.00

ML 48803 100 Prospect 01/10/2021 1,920.00

ML 48806 100 Prospect 01/12/2023 1,880.00

ML 49236 100 Prospect 01/12/2023 2,624.21

ML 49237 100 Prospect 01/12/2023 1,666.67

ML 50151 100 Prospect 30/11/2025 640.00

In performing an assessment of the carrying value of the

exploration licences at the reporting date, the Directors concluded

that it was not appropriate to book an impairment given the

measured resource, the licence term and the continued plans to

explore and develop the licence areas, including the new

technologies which TurboShale is seeking to develop.

The outcome of ongoing exploration, and therefore whether the

carrying value of the exploration licences will ultimately be

recovered, is inherently uncertain and is dependent upon successful

development of a commercially viable extraction technology. If

additional funding to develop TurboShale's RF Technology was not to

be made available to the Group when required or alternative

commercially viable extraction technologies cannot be developed,

the carrying value of the intangible assets might need to be

impaired.

The Group continues to renew the leases set out above as and

when they expire and has no reason to believe that the leases will

not continue to be capable of renewal in the future.

Further field tests of the TurboShale RF Technology were

postponed because of the COVID-19 pandemic. The Board plans to

review the position in Q3 2021, but currently intends to resume the

testing programme when conditions permit.

6. Investment in joint venture

Carrying value under equity method GBP'000

----------------------------------------- ------------------

At 31 March 2020 -

Cost 1,279

Share of loss of joint venture (40)

Other comprehensive income-translation

differences (15)

------------------------------------------- ------------------

At 30 September 2020 1,224

Share of loss of joint venture (39)

Other comprehensive income-translation

differences (87)

------------------------------------------- ------------------

At 31 March 2021 1,098

------------------------------------------- ------------------

L oans GBP'000

------------------------------------ ----------------------

At 31 March 2020 -

Cost -

------------------------------------ ----------------------

At 30 September 2020 -

Loans made 761

At 31 March 2021 761

-------------------------------------- ----------------------

Total investment in joint venture

at 31 March 2021 1,859

-------------------------------------- ----------------------

During the year ended 30 September 2020, the Group formed a

joint venture, Greenfield Energy LLC ("Greenfield"), with Valkor

LLC ("Valkor"). Greenfield is incorporated in Utah, USA. Its

initial purpose is the development of a plant utilising technology

licensed or assigned to it by third parties for Valkor to recover

oil from oil sands in Utah, which is considered strategic to the

Group's activities. Both the Group and Valkor hold 50% ownership

interests in Greenfield.

There is no quoted market price for the Group's investment in

Greenfield.

Loans made to Greenfield carry interest at 3% above the Bank of

England's base rate and are repayable after five years.

7. Share Capital

31 March 31 March 30 September

2021 2020 2020

unaudited Unaudited audited

Number of shares Number of shares Number of shares

--------------------------- ----------------- ----------------- -----------------

Issued and fully paid

Number of ordinary shares

of no par value 1,451,412,012 275,759,235 673,634,235

--------------------------- ----------------- ----------------- -----------------

8. Warrants

31 March 31 March 30 September

2021 2020 2020

unaudited Unaudited Audited

--------------------------- -------------- ----------- -------------

Outstanding (number) 1,041,457,112 82,341,515 269,791,515

Exercisable (number) 1,041,457,112 82,341,515 269,791,515

Weighted average exercise

price (pence) 1.0 1.5 1.0

--------------------------- -------------- ----------- -------------

9. Post balance sheet events

Greenfield entered into a membership interest purchase agreement

in June 2021 with Endeavour Capital Group LLC ("Endeavour") and Tar

Sands Holdings II LLC ("TSHII") with respect to the potential

acquisition by Greenfield of up to 100% of the ownership and

membership rights and interests in TSHII (the "Membership

Interests"). TSHII owns approximately 760 acres of land and certain

non-producing assets in Uintah County, Utah, USA.

Robert Kirchner resigned as a non-executive director on 4 June

2021. Louis Castro joined the board as a non-executive director on

19 April 2021.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR DKDBQCBKDPAB

(END) Dow Jones Newswires

June 22, 2021 02:00 ET (06:00 GMT)

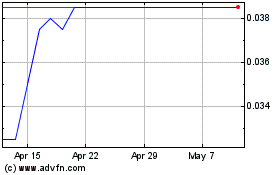

Tomco Energy (LSE:TOM)

Historical Stock Chart

From May 2024 to Jun 2024

Tomco Energy (LSE:TOM)

Historical Stock Chart

From Jun 2023 to Jun 2024