Shell Sees 3Q Earnings Boost from Stronger Gas, Chemicals Trading

October 06 2023 - 2:54AM

Dow Jones News

By Christian Moess Laursen and Joe Hoppe

Shell said it expects its third-quarter earnings to be boosted

by stronger gas and chemical trading, while its production volumes

are on track to meet targets.

The British energy giant said Friday that it expects to report

production of 880,000-920,000 oil-equivalent barrels a day of

integrated gas for the third quarter, which would be in line with

its guided range of 870,000-930,000 BOE a day, but down from

924,000 BOE a day in the same quarter of 2022.

Meanwhile, third-quarter volumes of liquefied natural

gas--LNG--are expected to have fallen to 6.6 million-7.0 million

metric tons from 7.24 million tons a year earlier. This still

tightens guidance upward from Shell's previous expectations of 6.3

million-6.9 million tons.

On the corporate side, the company expects to post an adjusted

loss of around $400 million to $600 million. This compares with a

corporate adjusted loss of $654 million in the second quarter.

Shell said integrated gas production and the LNG liquefaction

outlook reflect scheduled maintenance, including Prelude and

Trinidad and Tobago assets.

The oil-and-gas major said both integrated gas trading and

chemicals and products trading are expected to be higher

on-quarter.

Write to Christian Moess Laursen at christian.moess@wsj.com and

Joe Hoppe at joseph.hoppe@wsj.com

(END) Dow Jones Newswires

October 06, 2023 02:39 ET (06:39 GMT)

Copyright (c) 2023 Dow Jones & Company, Inc.

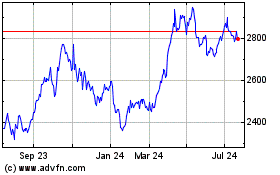

Shell (LSE:SHEL)

Historical Stock Chart

From Jun 2024 to Jul 2024

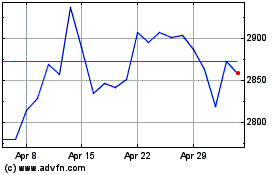

Shell (LSE:SHEL)

Historical Stock Chart

From Jul 2023 to Jul 2024