Kenmare Resources - Interim Results

October 08 1999 - 12:45PM

UK Regulatory

RNS No 8027q

KENMARE RESOURCES PLC

8 October 1999

KENMARE RESOURCES PLC ("Kenmare")

Interim Results for the Six Months Ended 30 June, 1999

MOMA-CONGOLONE TITANIUM PROJECT

Kenmare has now taken over all the assets owned by the BHP Joint Venture;

these included circa $400,000 worth of field vehicles, trucks, laboratory

equipment, camp equipment, etc. This has allowed us to smoothly take over the

operation of the project. BHP's chief field geologist is now working for

Kenmare in the same capacity and their laboratory manager is now running our

analytical laboratory. Drilling was restarted 3 weeks after we took over

control of the assets. The licences have been formally handed back from the

JV to Kenmare.

We are concentrating on drilling a high-grade zone which the BHP field team

discovered immediately prior to their departure. Our drilling in this zone is

continuing and has demonstrated to date a resource containing 3 million tonnes

of ilmenite at 7% Total Heavy Minerals. This grade is twice the grade of the

main deposit in Moma, known as Namalope. While there is already sufficient

mineral to justify a 30-year mine at Namalope, the presence of a high-grade

zone has a significant effect on the economics.

We are in discussion with interested parties concerning an entry into the

project and are hopeful of a positive outcome.

ANCUABE GRAPHITE MINE

Superior Graphite Inc. has been the distributor of the graphite products from

the Ancuabe Graphite mine for 5 years. Last year they injected $1.2 million

into the project, in addition to the provision of working capital. However,

this year they have been experiencing problems in their core businesses and

have reviewed their involvement in the natural flake graphite market. As a

consequence of this review, they informed us recently that they would be

terminating their European distribution contract and withdrawing the provision

of working capital to the project. Negotiations with Superior have not been

successful in getting them to alter their programme.

While GDAS is now capable of performing its own distribution function, the

withdrawal of working capital leaves the project with a requirement for circa

$2.0 million to fund ongoing operations. The Government which is an equity

partner in the project, has been informed of the situation and is considering

providing the required capital. In the meantime, it is necessary to put the

plant on a care and maintenance basis. It is not yet possible to quantify the

effect, but this development may have an impact on the Group Balance Sheet.

Before we received the news from Superior, Kenmare, working with the European

Investment Bank, was well advanced in the preparations for a possible

expansion of the production facility, as customer demand remains strong.

However this cannot be considered without the prior injection of the necessary

working capital.

EXPLORATION

The recent increase in the price of gold has had a positive effect on our gold

exploration properties. We have experienced a direct increase in the interest

of potential joint venture partners with one major mining company already

signing a confidentiality agreement.

CORPORATE

Our unaudited Profit and Loss Account for the six months ending 30th June 1999

is set out as part of this statement. The increased output from the graphite

project resulted in an increase in turnover. However, as a result of the BHP

withdrawal, no fee was paid to Kenmare during 1999 in respect of the Mineral

Sands Joint Venture Agreement. This contributed to the increased loss for the

period.

Charles Carvill

Chairman

INTERIM REPORT

The Group's unaudited Consolidated Profit & Loss Account

for the six months ended 30th June 1999 is as follows :

6 months to 6 months to

30 June 99 30 June 98

IR# IR#

Turnover 1,429,920 1,076,028

------------------------------

Loss before Taxation (1,037,313) (888,854)

Taxation - -

------------------------------

Loss Attributable to the Group (1,037,313) (888,854)

==============================

Loss per Share (0.95p) (0.81p)

==============================

The Interim Statement is posted to all shareholders and is available for

inspection at Chatham House, Chatham Street, Dublin 2, Ireland.

END

IR CCFCDADDDCKK

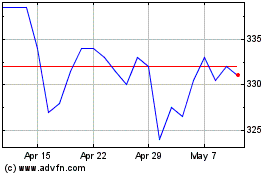

Kenmare Resources (LSE:KMR)

Historical Stock Chart

From May 2024 to Jun 2024

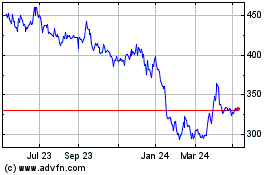

Kenmare Resources (LSE:KMR)

Historical Stock Chart

From Jun 2023 to Jun 2024