TIDMCAM

RNS Number : 6608M

Camellia PLC

29 August 2013

Camellia Plc

Half yearly report for period ended 30 June

2013

Highlights from the

results

Six months Six months

ended ended

30 June 30 June

2013 2012

GBP'000 GBP'000

restated

- see note

2

Revenue 113,753 110,389

Trading profit 8,741 6,694

Profit before tax 11,930 28,555

Headline profit before

tax 12,466 11,739

Profit for the period 6,565 19,782

Earnings per share 156.9 p 514.5 p

Interim dividend 34 p 32 p

Chairman's statement

The headline profit before tax was GBP12,466,000 for the six

months to 30 June 2013 compared with GBP11,739,000 in the same

period last year. Headline profit is a measure of underlying

performance which is not impacted by exceptional and other items.

In the comparative period for the six months to 30 June 2012,

biological asset gains were GBP16,079,000 of which GBP15,751,000

were attributable to our Malawi operations following the

devaluation of the Malawian Kwacha in that period. After taking

account of this and exceptional items the profit before tax for the

six month period to 30 June 2013 amounted to GBP11,930,000 (2012:

GBP28,555,000).

The board has declared an interim dividend of 34p per ordinary

share payable on 4 October 2013 to shareholders registered on 6

September 2013.

Tea

India

Weather in Assam has been erratic with periods of drought mixed

with prolonged wet spells in different gardens. The impact on the

crop has been mixed. Overall it is behind budget despite being

ahead of the same period last year in some gardens. Tea prices in

Assam have been higher than in the same period last year.

Growing conditions in the Dooars and Darjeeling have been more

favourable with crops to date ahead of last year but tea prices

have been similar to the same period last year.

Bangladesh

Crops recovered from the drought conditions earlier in the year

following a period of plentiful rainfall. Prices have remained high

throughout the period but have recently softened following the

withdrawal of the supplemental import tax on tea of 20% leaving the

import duty on black tea at 62%.

Africa

Production in Kenya has continued to be well ahead of the same

period last year following the high levels of rainfall earlier in

the year. Prices have declined at auction but the higher volumes

have reduced the cost of production resulting in profits similar to

the previous period.

Yields in Malawi have recovered significantly following recent

rainfall and production is slightly ahead of budget and ahead of

the same period last year. The rebuilding of the Makwasa factory,

following the fire in August 2011, has been completed two months

ahead of schedule and good quality tea is now being produced.

Edible nuts

The production of macadamia nuts in Malawi is down on budget

following the dry period at the time of flowering. However, the

quality of the nuts at cracking has been good. In South Africa the

macadamia harvest is underway with volumes expected to be down on

budget following poor climatic conditions at the end of last year.

Prices remain firm.

In California, 2013 is an "off" year for pistachio production

and the volume of crop will be minimal.

Other horticulture

The avocado harvest in Kenya has commenced but volumes are

expected to be lower than last year and prices have also been lower

following the high volumes of fruit from Peru and South Africa

available in Europe.

Citrus production in California is well ahead of budget and

prices remain higher than last year.

The arable harvest to date in Brazil has been ahead of

expectations. The costs of production and sale prices have both

increased over those of 2012.

The volume of wine sales from South Africa has started to

increase following a sustained marketing campaign.

Food storage and distribution

Storage levels at ACS&T have continued to improve but

pressures on margins remain with sustained competition in the

industry.

Our operations in the Netherlands have seen an increase in

demand but there is a shortage of supply for certain products.

Conditions remain challenging.

Engineering

The UK businesses of AJT Engineering servicing the oil and the

gas sector have seen an increase in demand and profits are in line

with budget.

Production at the new factory in Hinkley for Abbey Metal has

started to increase with strong performance in the civil aviation

sector. Earlier in the year, Atfin GmbH was incorporated, 51% owned

by Abbey Metal and 49% by Aerotech. This company will operate an

etching line in Peissenberg, Germany and will service their major

German aviation customers. The company is expected to be

operational by the beginning of next year.

Our other engineering companies have had mixed results but the

level of orders has recently started to increase.

Banking

The Duncan Lawrie marketing campaign has resulted in an increase

in new accounts but the lack of any realistic margin on depositors'

funds continues to adversely affect the results. A newly

refurbished office has been opened in Bristol which provides

services to targeted niche clients in the West Country. Lending

opportunities are increasing and further capital has been made

available to increase our share of the lending market. The asset

management operation has performed well during the period,

particularly with the increase in the equity market.

Prospects

Our agricultural operations are continuing to make a positive

contribution to profits. The increasing costs of production remain

a concern for the future. The continuation of this contribution is

of course dependent on benign climatic conditions, reasonable sale

prices and the continued political stability in the countries in

which we operate, none of which can be guaranteed. The group has no

net debt and remains in a strong financial position but, as usual,

it is not possible to give any indication of the likely outcome for

the full year.

M C Perkins

Chairman

29 August 2013

Interim management report

The chairman's statement forms part of this report and includes

important events that have occurred during the six months ended 30

June 2013 and their impact on the financial statements set out

herein.

Principal risks and uncertainties

The directors' report in the statutory financial statements for

the year ended 31 December 2012 (the accounts are available on the

company's website: www.camellia.plc.uk) highlighted risks and

uncertainties that could have an impact on the group's businesses.

As these businesses are widely spread both in terms of activity and

location, it is unlikely that any one single factor could have a

material impact on the group's performance. These risks and

uncertainties continue to be relevant for the remainder of the

year. In addition, the chairman's statement included in this report

refers to certain specific risks and uncertainties that the group

is presently facing.

Statement of directors' responsibilities

The directors confirm that these condensed financial statements

have been prepared in accordance with IAS 34 'Interim Financial

Reporting' as adopted by the European Union, and that the interim

management report herein includes a fair review of the information

required by sections 4.2.7 and 4.2.8 of the Disclosure and

Transparency Rules of the United Kingdom's Financial Services

Authority.

The directors of Camellia Plc are listed in the Camellia Plc

statutory financial statements for the year ended 31 December 2012.

Mr D A Reeves did not seek re-election at the annual general

meeting. There have been no other subsequent changes of directors

and a list of current directors is maintained on the group's

website at www.camellia.plc.uk.

By order of the board

M C Perkins

Chairman

29 August 2013

Consolidated income statement

for the six months ended 30 June 2013

Six months Six months Year

ended ended ended

30 June 30 June 31 December

2013 2012 2012

Notes GBP'000 GBP'000 GBP'000

restated - see note 2 restated - see note 2

Revenue 4 113,753 110,389 261,529

Cost of sales (79,367) (78,753) (166,859)

---------- --------------------- ---------------------

Gross profit 34,386 31,636 94,670

Other operating income 1,134 1,059 1,699

Distribution costs (4,980) (4,314) (12,201)

Administrative expenses (21,799) (21,687) (44,370)

---------- --------------------- ---------------------

Trading profit 4 8,741 6,694 39,798

Share of associates' results 6 445 2,229 4,269

Profit on non-current assets 7 - 994 1,538

Profit on disposal of available-for-sale investments 57 246 271

Profit on disposal of a subsidiary - - 396

Loss on transfer of an associate 6 - - (10,045)

(Loss)/gain arising from changes in fair value of

biological assets:

---------- --------------------- ---------------------

Excluding Malawi Kwacha exceptional gain 8 (23) 328 8,690

Malawi Kwacha exceptional gain 8 - 15,751 21,353

(23) 16,079 30,043

---------- --------------------- ---------------------

Profit from operations 9,220 26,242 66,270

Investment income 1,159 578 1,186

Finance income 1,937 1,984 3,517

Finance costs (424) (304) (825)

Net exchange gain 608 558 1,030

Net interest expense on employee benefit obligations (570) (503) (1,468)

Net finance income 9 1,551 1,735 2,254

---------- --------------------- ---------------------

Profit before tax 11,930 28,555 69,710

Comprising

- headline profit before tax 5 12,466 11,739 48,975

- exceptional items, (loss)/gain arising from

changes in

fair value of biological assets and other

financing gains and losses 5 (536) 16,816 20,735

---------- --------------------- ---------------------

11,930 28,555 69,710

Taxation 10 (5,365) (8,773) (25,662)

---------- --------------------- ---------------------

Profit for the period 6,565 19,782 44,048

---------- --------------------- ---------------------

Profit attributable to:

Owners of the parent 4,359 14,300 31,210

Non-controlling interests 2,206 5,482 12,838

---------- --------------------- ---------------------

6,565 19,782 44,048

---------- --------------------- ---------------------

Earnings per share - basic and diluted 12 156.9p 514.5p 1,122.9p

Statement of comprehensive income

for the six months ended 30 June 2013

Six months Six months Year

ended ended ended

30 June 30 June 31 December

2013 2012 2012

GBP'000 GBP'000 GBP'000

restated - see note 2 restated - see note 2

Profit for the period 6,565 19,782 44,048

---------- --------------------- ---------------------

Other comprehensive income/(expense):

Items that will not be reclassified subsequently to profit

or

loss:

Remeasurements of post employment benefit obligations (note

17) 12,287 (4,390) (6,085)

---------- --------------------- ---------------------

12,287 (4,390) (6,085)

---------- --------------------- ---------------------

Items that may be reclassified subsequently to profit or

loss:

Foreign exchange translation differences 14,227 (21,320) (36,155)

Release of exchange translation difference on transfer of

associate - - (3,998)

Release of other reserve movements on transfer of associate - - 2,817

Release of exchange translation difference on disposal of

subsidiary - - 5

Available-for-sale investments:

Valuation gains/(losses) taken to equity 2,277 (13) 674

Transferred to income statement on sale (31) (5) (4)

Share of other comprehensive expense of associates - (811) (769)

Tax relating to components of other comprehensive income - - (48)

---------- --------------------- ---------------------

16,473 (22,149) (37,478)

---------- --------------------- ---------------------

Other comprehensive income/(expense) for the period, net

of tax 28,760 (26,539) (43,563)

---------- --------------------- ---------------------

Total comprehensive income/(expense) for the period 35,325 (6,757) 485

---------- --------------------- ---------------------

Total comprehensive income/(expense) attributable to:

Owners of the parent 30,957 (7,413) (4,356)

Non-controlling interests 4,368 656 4,841

---------- --------------------- ---------------------

35,325 (6,757) 485

---------- --------------------- ---------------------

Consolidated balance sheet

at 30 June 2013

30 June 30 June 31 December

2013 2012 2012

Notes GBP'000 GBP'000 GBP'000

Non-current assets

Intangible assets 7,300 7,549 7,413

Property, plant and equipment 13 97,865 93,438 93,483

Biological assets 128,246 115,767 119,693

Prepaid operating leases 977 965 910

Investments in associates 6 7,448 38,392 6,549

Deferred tax assets 332 154 314

Financial assets 6 56,768 29,716 50,501

Other investments 8,700 8,548 8,598

Retirement benefit surplus 740 427 678

Trade and other receivables 17,303 9,231 15,174

--------- --------- -----------

Total non-current assets 325,679 304,187 303,313

--------- --------- -----------

Current assets

Inventories 40,471 36,485 37,575

Trade and other receivables 74,840 69,867 72,257

Other investments 1,004 4,001 3,993

Current income tax assets 1,452 2,946 822

Cash and cash equivalents 14 266,688 273,903 262,174

--------- --------- -----------

384,455 387,202 376,821

Assets classified as held

for sale 15 - 5,037 -

--------- --------- -----------

Total current assets 384,455 392,239 376,821

--------- --------- -----------

Current liabilities

Borrowings 16 (11,740) (11,059) (5,590)

Trade and other payables (238,097) (257,638) (235,636)

Current income tax liabilities (8,248) (5,455) (5,542)

Employee benefit obligations 17 (1,187) (335) (409)

Provisions (458) (214) (456)

--------- --------- -----------

(259,730) (274,701) (247,633)

Liabilities classified

as held for sale 15 - (2,110) -

--------- --------- -----------

Total current liabilities (259,730) (276,811) (247,633)

--------- --------- -----------

Net current assets 124,725 115,428 129,188

--------- --------- -----------

Total assets less current

liabilities 450,404 419,615 432,501

--------- --------- -----------

Non-current liabilities

Borrowings 16 (102) (133) (116)

Trade and other payables (9,787) (6,001) (9,015)

Deferred tax liabilities (36,923) (32,723) (36,225)

Employee benefit obligations 17 (19,626) (30,476) (32,866)

Other non-current liabilities (105) (108) (107)

Provisions (375) (525) (671)

--------- --------- -----------

Total non-current liabilities (66,918) (69,966) (79,000)

--------- --------- -----------

Net assets 383,486 349,649 353,501

--------- --------- -----------

Equity

Called up share capital 18 283 284 284

Share premium 15,298 15,298 15,298

Reserves 325,823 296,110 298,228

--------- --------- -----------

Total shareholders' funds 341,404 311,692 313,810

Non-controlling interests 42,082 37,957 39,691

--------- --------- -----------

Total equity 383,486 349,649 353,501

--------- --------- -----------

Consolidated cash flow statement

for the six months ended 30 June 2013

Six months Six months Year

ended ended ended

30 June 30 June 31 December

2013 2012 2012

Notes GBP'000 GBP'000 GBP'000

Cash generated from operations

Cash flows from operating activities 19 (171) 6,251 41,162

Interest paid (423) (337) (822)

Income taxes paid (5,526) (4,369) (12,407)

Interest received 1,814 2,039 3,411

Dividends received from associates 206 750 1,275

---------- ---------- -----------

Net cash flow from operating activities (4,100) 4,334 32,619

Cash flows from investing activities

Purchase of intangible assets (88) (116) (180)

Purchase of property, plant and equipment (7,618) (9,059) (16,557)

Insurance proceeds for non-current assets - 994 1,538

Proceeds from sale of non-current assets 352 400 429

Biological assets - new planting (1,585) (1,507) (2,499)

Part disposal of a subsidiary 49 123 262

Disposal of a subsidiary - - 1,264

Purchase of non-controlling interests - (215) (223)

Purchase of own shares (925) - -

Proceeds from sale of investments 5,272 7,623 7,863

Purchase of investments (2,864) (7,213) (8,339)

Income from investments 1,159 578 1,186

---------- ---------- -----------

Net cash flow from investing activities (6,248) (8,392) (15,256)

Cash flows from financing activities

Equity dividends paid - - (3,224)

Dividends paid to non-controlling interests (2,017) (2,855) (4,106)

New loans 39 370 154

Loans repaid (55) (282) (230)

Finance lease payments (27) (114) (190)

---------- ---------- -----------

Net cash flow from financing activities (2,060) (2,881) (7,596)

---------- ---------- -----------

Net (decrease)/increase in cash and cash equivalents (12,408) (6,939) 9,767

Cash and cash equivalents at beginning of period 81,373 72,626 72,626

Exchange gains/(losses) on cash 2,976 236 (1,020)

---------- ---------- -----------

Cash and cash equivalents at end of period 71,941 65,923 81,373

---------- ---------- -----------

For the purposes of the cash flow statement, cash and cash equivalents are included net of

overdrafts repayable on demand. These overdrafts are excluded from the definition of cash

and cash equivalents disclosed on the balance sheet.

For the purposes of the cash flow statement cash and cash equivalents comprise:

Cash and cash equivalents 266,688 273,903 262,174

Less banking operation funds (183,087) (197,651) (175,302)

Overdrafts repayable on demand (included in current

liabilities - borrowings) (11,660) (10,741) (5,499)

Cash and cash equivalents included in assets held for sale - 412 -

--------- --------- ---------

71,941 65,923 81,373

--------- --------- ---------

Statement of changes in equity

for the six months ended 30 June 2013

Non-

Share Share Treasury Retained Other controlling Total

capital premium shares earnings reserves Total interests equity

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

At 1 January 2012 284 15,298 (400) 264,659 41,751 321,592 40,115 361,707

Total comprehensive income/(expense)

for

the period - - - 9,094 (16,507) (7,413) 656 (6,757)

Dividends - - - (2,335) - (2,335) (2,855) (5,190)

Non-controlling interest subscription - - - 29 - 29 93 122

Acquisition of non-controlling interest - - - (162) - (162) (52) (214)

Share of associates' other equity

movements - - - 21 - 21 - 21

Loss on dilution of interest in

associate - - - (40) - (40) - (40)

------- ------- -------- -------- -------- ------- ----------- -------

At 30 June 2012 284 15,298 (400) 271,266 25,244 311,692 37,957 349,649

------- ------- -------- -------- -------- ------- ----------- -------

At 1 January 2012 284 15,298 (400) 264,659 41,751 321,592 40,115 361,707

Total comprehensive income/(expense)

for

the period - - - 27,129 (31,485) (4,356) 4,841 485

Dividends - - - (3,224) - (3,224) (4,106) (7,330)

Disposal of subsidiary - - - - - - (1,333) (1,333)

Non-controlling interest subscription - - - 71 - 71 226 297

Acquisition of non-controlling interest - - - (171) - (171) (52) (223)

Share of associates' other equity

movements - - - 221 - 221 - 221

Loss on dilution of interest in

associate - - - (323) - (323) - (323)

------- ------- -------- -------- -------- ------- ----------- -------

At 31 December 2012 284 15,298 (400) 288,362 10,266 313,810 39,691 353,501

Total comprehensive income/(expense)

for

the period - - - 16,616 14,341 30,957 4,368 35,325

Dividends - - - (2,446) - (2,446) (2,017) (4,463)

Own shares acquired in the period (1) - - (925) 1 (925) - (925)

Non-controlling interest subscription - - - 8 - 8 40 48

------- ------- -------- -------- -------- ------- ----------- -------

At 30 June 2013 283 15,298 (400) 301,615 24,608 341,404 42,082 383,486

------- ------- -------- -------- -------- ------- ----------- -------

Notes to the accounts

1 Basis of preparation

These financial statements are the interim condensed

consolidated financial statements of Camellia Plc, a company

registered in England, and its subsidiaries (the "group") for the

six month period ended 30 June 2013 (the "Interim Report"). They

should be read in conjunction with the Report and Accounts (the

"Annual Report") for the year ended 31 December 2012.

The financial information contained in this interim report has

not been audited and does not constitute statutory accounts within

the meaning of Section 435 of the Companies Act 2006. A copy of the

statutory accounts for the year ended 31 December 2012 has been

delivered to the Registrar of Companies. The auditors' opinion on

these accounts was unqualified and does not contain an emphasis of

matter paragraph or a statement made under Section 498(2) and

Section 498(3) of the Companies Act 2006.

The interim condensed financial statements have been prepared in

accordance with International Financial Reporting Standards

("IFRS") including IAS 34 "Interim Financial Reporting". For these

purposes, IFRS comprise the Standards issued by the International

Accounting Standards Board ("IASB") and Interpretations issued by

the International Financial Reporting Interpretations Committee

("IFRIC") that have been adopted by the European Union.

Where necessary, the comparatives have been reclassified from

the previously reported interim results to take into account any

presentational changes made in the Annual Report.

These interim condensed financial statements were approved by

the board of directors on 29 August 2013. At the time of approving

these financial statements, the directors have a reasonable

expectation that the company and the group have adequate resources

to continue to operate for the foreseeable future. They therefore

continue to adopt the going concern basis of accounting in

preparing the financial statements.

2 Accounting policies

These interim condensed financial statements have been prepared

on the basis of accounting policies consistent with those applied

in the financial statements for the year ended 31 December 2012. In

addition, the group has implemented the following new and revised

standards and interpretations:

IAS 1 (amendment) Financial statement presentation

IAS 19 (revised) Employee benefits

IFRS 13 Fair value measurement

A summary of each of the above standards and interpretations was

provided on page 35 of the 2012 Annual Report. The adoption of IAS

1 and IFRS 13 has had no material impact on the group's results,

assets and liabilities.

IAS 19 (revised) amends the accounting for employment benefits.

The group has applied the standard retrospectively in accordance

with the transition provisions of the standard and the comparative

figures have been restated. The impact on the group has been in the

following areas:

The standard requires that only administrative costs relating to

the cost of managing plan assets can be deducted from the actual

return on assets. This has no effect on total comprehensive income

as the increased charge in profit or loss is offset by a credit in

other comprehensive income. The effect has been that the income

statement charge for the period to 30 June 2012 has increased by

GBP91,000 and for the year to 31 December 2012 has increased by

GBP171,000.

The standard replaces the interest cost on the defined benefit

obligation and the expected return on plan assets with a net

interest cost based on the net defined benefit asset or liability

and the discount rate, measured at the beginning of the year. There

is no change to determining the discount rate, this continues to

reflect the yield on high-quality corporate bonds. This has

increased the income statement charge as the discount rate applied

to assets is lower than the expected return on assets. This has no

effect on total comprehensive income as the increased charge in the

income statement is offset by a credit in other comprehensive

income. The effect has been that the income statement charge for

the period to 30 June 2012 has increased by GBP429,000 and for the

year to 31 December 2012 has increased by GBP853,000.

The effect of the change in accounting policy is to decrease

earnings per share from 533.2p to 514.5p for the period 30 June

2012 and from 1,190.4p to 1,122.9p for the year to 31 December

2012, the effect on the cash flow statement is immaterial.

3 Cyclical and seasonal factors

Due to climatic conditions the group's tea operations in India

and Bangladesh produce most of their crop during the second half of

the year. Tea production in Kenya remains at consistent levels

throughout the year but in Malawi the majority of tea is produced

in the first six months.

Soya and maize in Brazil are generally harvested in the first

half of the year. In California the pistachio crop occurs in the

second half of the year and has 'on' and 'off' years. Avocados in

Kenya are mostly harvested in the second half of the year.

There are no other cyclical or seasonal factors which have a

material impact on the trading results.

4 Segment reporting

Six months Six months Year

ended ended ended

30 June 30 June 31 December

2013 2012 2012

Revenue Trading profit Revenue Trading profit Revenue Trading profit

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

restated restated

Agriculture and horticulture 75,851 11,827 73,620 8,616 187,538 45,495

Engineering 14,568 (976) 13,990 (165) 27,675 (6)

Food storage and distribution 15,264 365 15,806 203 32,195 127

Banking and financial services 7,026 (24) 6,216 249 12,551 253

Other operations 1,044 32 757 (12) 1,570 62

------- -------------- ------- -------------- ------- --------------

113,753 11,224 110,389 8,891 261,529 45,931

------- ------- ------- --------------

Unallocated corporate

expenses* (2,483) (2,197) (6,133)

-------------- -------------- --------------

Trading profit 8,741 6,694 39,798

Share of associates' results 445 2,229 4,269

Profit on non-current assets - 994 1,538

Profit on disposal of available

for-sale investments 57 246 271

Profit on disposal of a

subsidiary - - 396

Loss on transfer of an

associate - - (10,045)

(Loss)/gain arising from

changes in fair value of

biological assets (23) 16,079 30,043

Investment income 1,159 578 1,186

Net finance income 1,551 1,735 2,254

-------------- -------------- --------------

Profit before tax 11,930 28,555 69,710

Taxation (5,365) (8,773) (25,662)

-------------- -------------- --------------

Profit after tax 6,565 19,782 44,048

-------------- -------------- --------------

Agriculture and horticulture trading profit includes exchange

gains of GBPnil (2012: six months GBP1,756,000 - year GBP2,289,000)

following the devaluation of the Malawian Kwacha.

*Unallocated corporate expenses include group marketing expenses

of GBP487,000 (2012: six months GBP303,000 - year GBP1,162,000)

incurred on behalf of the banking and financial services and

agriculture and horticulture segments.

5 Headline profit

The group seeks to present an indication of the underlying

performance which is not impacted by exceptional items or items

considered non-operational in nature. This measure of profit is

described as 'headline' and is used by management to measure and

monitor performance.

The following items have been excluded from the headline

measure:

- Exceptional items, including profit and losses from disposal

of non-current assets and available-for-sale investments.

- Gains and losses arising from changes in fair value of

biological assets, which are a non-cash item, and the

directors believe should be excluded to give a better

understanding of the group's underlying performance.

- Net interest expense on employee benefit obligations.

Six months Six months Year

ended ended ended

30 June 30 June 31 December

2013 2012 2012

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

restated restated restated restated

Trading profit 8,741 6,694 39,798

Share of associates' results 445 2,229 4,269

Investment income 1,159 578 1,186

Net finance income 1,551 1,735 2,254

Exclude

- Net interest expense on employee

benefit obligations 570 503 1,468

------- -------- --------

Headline finance costs 2,121 2,238 3,722

------- -------- --------

Headline profit before tax 12,466 11,739 48,975

------- -------- --------

Non-headline items in profit before

tax comprise:

Exceptional items

Profit on non-current assets - 994 1,538

Profit on disposal of available-for-sale

investments 57 246 271

Profit on disposal of a subsidiary - - 396

Loss on transfer of an associate - - (10,045)

------- -------- --------

57 1,240 (7,840)

(Loss)/gain arising from changes in

fair value of biological assets (23) 16,079 30,043

Net interest expense on employee

benefit obligations (570) (503) (1,468)

------- -------- --------

Non-headline items in profit before

tax (536) 16,816 20,735

------- -------- --------

6 Share of associates' results

The group's share of the results of associates is analysed

below:

Six months Six months Year

ended ended ended

30 June 30 June 31 December

2013 2012 2012

GBP'000 GBP'000 GBP'000

Operating profit 793 2,622 4,857

Net finance costs - (25) (114)

---------- ---------- -----------

Profit before tax 793 2,597 4,743

Taxation (348) (368) (474)

---------- ---------- -----------

Profit after tax 445 2,229 4,269

---------- ---------- -----------

At 31 December 2012, the group re-evaluated its relationship

with BF&M Limited. Although the group's holding is in excess of

20%, the directors concluded that the group is no longer able to

exercise significant influence due to the cumulative result of,

inter alia, the composition of the board of BF&M and the

inability of the group to be a party to important strategic

decisions concerning the operations and development of BF&M.

Accordingly the group's holding has been accounted for as an

available-for-sale financial asset with effect from 1 January 2013.

In conjunction with the reclassification the investment was written

down to current market value at 31 December 2012 giving rise to an

exceptional charge in the Income Statement for the year ended 31

December 2012 of GBP10,045,000.

7 Profit on non-current assets

In 2012 a profit of GBP1,538,000 (six months to 30 June 2012:

GBP944,000) was realised following part recovery of insurance

claims received in relation to the property, plant and equipment

destroyed by the fire in 2011 at one of the tea processing

factories owned by Eastern Produce Malawi Limited.

8 Gain arising from changes in fair value of biological assets

In 2012 the Malawian kwacha depreciated in value from 254.49 to

the pound sterling at 1 January 2012 to 544.05 to the pound

sterling at 31 December 2012 (30 June 2012: 423.39). The functional

currency of our Malawian subsidiaries is the kwacha. Our principal

assets in Malawi are our agricultural assets. As they generate

revenues in currencies other than the kwacha their value in hard

currency has not fallen in the year. Accordingly, the revaluation

of the agricultural assets in kwacha under IAS 41 at 31 December

2012 generated a credit of GBP21,353,000 (six months to 30 June

2012: GBP15,751,000) due to the currency devaluation which is

included in the overall gain of GBP30,043,000 (six months to 30

June 2012: GBP16,079,000) credited to the income statement. This

has been largely offset by a foreign exchange translation loss

charged to reserves. No such amounts occurred in the period ending

30 June 2013.

9 Finance income and costs

Six months Six months Year

ended ended ended

30 June 30 June 31 December

2013 2012 2012

GBP'000 GBP'000 GBP'000

restated restated

Interest payable on loans and bank overdrafts (424) (292) (808)

Interest payable on obligations under finance leases - (12) (17)

---------- ---------- -----------

Finance costs (424) (304) (825)

Finance income - interest income on short-term bank deposits 1,937 1,984 3,517

Net exchange gain on foreign currency balances 608 558 1,030

Net interest expense on employee benefit obligations (570) (503) (1,468)

---------- ---------- -----------

Net finance income 1,551 1,735 2,254

---------- ---------- -----------

The above figures do not include any amounts relating to the

banking subsidiaries.

10 Taxation on profit on ordinary activities

Six months Six months Year

ended ended ended

30 June 30 June 31 December

2013 2012 2012

GBP'000 GBP'000 GBP'000

Current tax

Overseas corporation tax 7,005 5,104 15,505

Deferred tax

Origination and reversal of timing differences

Overseas deferred tax (1,640) 3,669 10,157

---------- ---------- -----------

Tax on profit on ordinary activities 5,365 8,773 25,662

---------- ---------- -----------

Tax on profit on ordinary activities for the six months to 30

June 2013 has been calculated on the basis of the estimated annual

effective rate for the year ending 31 December 2013.

11 Equity dividends

Six months Six months Year

ended ended ended

30 June 30 June 31 December

2013 2012 2012

GBP'000 GBP'000 GBP'000

Amounts recognised as distributions to equity holders in the

period:

Final dividend for the year ended 31 December 2012 of

88.00p (2011: 84.00p) per share 2,446 2,335 2,335

---------- ----------

Interim dividend for the year ended 31 December 2012 of

32.00p per share 889

-----------

3,224

-----------

Dividends amounting to GBP55,000 (2012: six months GBP52,000 - year GBP73,000) have not been

included as group companies hold 62,500 issued shares in the company. These are classified

as treasury shares.

Proposed interim dividend for the year ended 31 December

2013 of 34.00p (2012: 32.00p) per share 942 889

---------- ----------

The proposed interim dividend was approved by the board of

directors on 29 August 2013 and has not been included as a

liability in these financial statements.

12 Earnings per share (EPS)

Six months Six months Year

ended ended ended

30 June 30 June 31 December

2013 2012 2012

Earnings EPS Earnings EPS Earnings EPS

GBP'000 Pence GBP'000 Pence GBP'000 Pence

restated restated restated restated

Basic and diluted EPS

Attributable to ordinary shareholders 4,359 156.9 14,300 514.5 31,210 1,122.9

-------- ----- -------- -------- -------- --------

Basic and diluted earnings per share are calculated by dividing

the earnings attributable to ordinary shareholders by the weighted

average number of ordinary shares in issue of 2,778,775 (2012: six

months 2,779,500 - year 2,779,500), which excludes 62,500 (2012:

six months 62,500 - year 62,500) shares held by the group as

treasury shares.

13 Property plant and equipment

During the six months ended 30 June 2013 the group acquired

assets with a cost of GBP7,618,000 (2012: six months GBP9,059,000 -

year GBP16,557,000). Assets with a carrying amount of GBP212,000

were disposed of during the six months ended 30 June 2013 (2012:

six months GBP66,000 - year GBP182,000).

14 Cash and cash equivalents

Included in cash and cash equivalents of GBP266,688,000 (2012:

six months GBP273,903,000 - year GBP262,174,000) are cash and

short-term funds, time deposits with banks and building societies

and certificates of deposit amounting to GBP183,087,000 (2012: six

months GBP197,651,000 - year GBP175,302,000), which are held by

banking subsidiaries and which are an integral part of the banking

operations of the group.

15 Assets/liabilities held for sale

The assets and liabilities held for sale at 30 June 2012 related

to the assets and liabilities of Siret Tea Company Limited, which

was disposed of by the group on 31 August 2012.

16 Borrowings

Borrowings (current and non-current) include loans and finance

leases of GBP182,000 (2012: six months GBP451,000 - year

GBP207,000) and bank overdrafts of GBP11,660,000 (2012: six months

GBP10,741,000 - year GBP5,499,000). The following loans and finance

leases were issued and repaid during the six months ended 30 June

2013:

GBP'000

Balance at 1 January 2013 207

Exchange differences 18

New issues

Loans 39

Repayments

Loans (55)

Finance lease liabilities (27)

-------

Balance at 30 June 2013 182

-------

17 Retirement benefit schemes

The UK defined benefit pension scheme for the purpose of IAS 19

has been updated to 30 June 2013 from the valuation as at 31

December 2012 by the actuary and the movements have been reflected

in this interim statement. Overseas schemes have not been updated

from 31 December 2012 valuations as it is considered that there

have been no significant changes.

An actuarial gain of GBP12,287,000 was realised in the period,

of which a gain of GBP7,205,000 was realised in relation to the

scheme assets and a gain of GBP5,082,000 was realised in relation

to changes in the underlying actuarial assumptions. The assumed

discount rate has increased to 4.60% (31 December 2012: 4.20%), the

assumed rate of inflation (CPI) has increased to 2.30% (31 December

2012: 2.00%) and the assumed rate of increases for salaries to

2.30% (31 December 2012: 2.00%). There has been no change in the

mortality assumptions used.

18 Share Capital

30 June 30 June 31 December

2013 2012 2012

GBP'000 GBP'000 GBP'000

Authorised: 2,842,000 (2012: 30 June 2,842,000

- 31 December 2,842,000) ordinary shares of 10p each 284 284 284

------- ------- -----------

Allotted, called up and fully paid: ordinary shares of 10p each:

At 1 January - 2,842,000 (2012: 2,842,000) shares 284 284 284

Purchase of own shares - 10,192 (2012: nil) shares (1) - -

------- ------- -----------

At 30 June - 2,831,808 (2012: 30 June 2,842,000

- 31 December 2,842,000) shares 283 284 284

------- ------- -----------

Group companies hold 62,500 issued shares in the company. These

are classified as treasury shares.

On 6 June 2013 the directors were authorised to purchase up to a

maximum of 277,950 ordinary shares and during the period 10,192

shares were purchased. Upon cancellation of the shares purchased, a

capital redemption reserve is created representing the nominal

value of the shares cancelled.

19 Reconciliation of profit from operations to cash flow

Six months Six months Year

ended ended ended

30 June 30 June 31 December

2013 2012 2012

GBP'000 GBP'000 GBP'000

restated restated

Profit from operations 9,220 26,242 66,270

Share of associates' results (445) (2,229) (4,269)

Depreciation and amortisation 4,890 4,951 9,646

Impairment of non-current assets - - 440

Loss/(gain) arising from changes in fair value of biological

assets 23 (16,079) (30,043)

Profit on non-current assets (141) (1,124) (1,786)

Loss on transfer of an associate - - 10,045

Profit on disposal of a subsidiary - - (396)

Profit on disposal of investments (57) (246) (271)

Pensions and similar provisions less payments (871) (981) (1,294)

Biological assets capitalised cultivation costs (4,378) (4,131) (6,917)

Biological assets decreases due to harvesting 4,682 5,032 9,158

Decrease/(increase) in working capital 502 (2,071) (10,336)

Net (increase)/decrease in funds of banking subsidiaries (13,596) (3,113) 915

---------- ---------- -----------

(171) 6,251 41,162

---------- ---------- -----------

20 Reconciliation of net cash flow to movement in net cash

Six months Six months Year

ended ended ended

30 June 30 June 31 December

2013 2012 2012

GBP'000 GBP'000 GBP'000

(Decrease)/increase in cash and cash equivalents in the period (12,408) (6,939) 9,767

Net cash outflow from decrease in debt 43 26 266

---------- ---------- -----------

(Decrease)/increase in net cash resulting from cash flows (12,365) (6,913) 10,033

Exchange rate movements 2,958 238 (1,014)

---------- ---------- -----------

(Decrease)/increase in net cash in the period (9,407) (6,675) 9,019

Net cash at beginning of period 81,166 72,147 72,147

---------- ---------- -----------

Net cash at end of period 71,759 65,472 81,166

---------- ---------- -----------

21 Related party transactions

There have been no related party transactions that had a

material effect on the financial position or performance of the

group in the first six months of the financial year.

Further enquiries please contact Camellia Plc

Malcolm Perkins

01622 746655

29 August 2013

This information is provided by RNS

The company news service from the London Stock Exchange

END

IR PPMJTMBBTBTJ

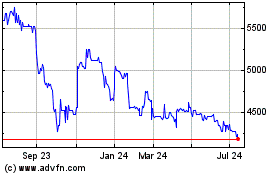

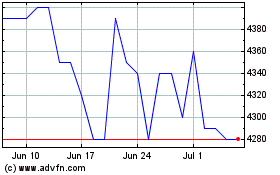

Camellia (LSE:CAM)

Historical Stock Chart

From Jun 2024 to Jul 2024

Camellia (LSE:CAM)

Historical Stock Chart

From Jul 2023 to Jul 2024