BP's 3Q Earnings Beat Expectations -- Earnings Review

October 29 2019 - 5:47AM

Dow Jones News

By Giulia Petroni

BP PLC (BP.LN) reported results for the third quarter on

Tuesday. Here is how the results came in:

UNDERLYING REPLACEMENT COST PROFIT: BP's underlying replacement

cost profit--a figure similar to the net profit figure U.S. oil

companies use, but excluding one-off items--came in at $2.25

billion. While below the $3.84 billion reported in the third

quarter of 2018, it beat forecasts. A company-compiled consensus of

24 brokers' estimates projected underlying replacement cost profit

at $1.73 billion.

UPSTREAM PRODUCTION: Upstream was weaker than expected despite a

rise in production, Bernstein says. Upstream production for the

quarter rose 4.4% to 2.57 million barrels of oil equivalent a day.

However, underlying replacement cost profit before interest and tax

in the business fell to $2.14 billion from $4 billion. BP said

earnings were hit by weaker oil prices, maintenance activities in

some of the highest-margin regions and weather in the Gulf of

Mexico.

WHAT WE WATCHED:

STRONG DOWNSTREAM: BP delivered better-than-expected downstream

revenues, according to CMC Markets, with underlying replacement

cost profit before interest and tax at $1.88 million. The

outperfomance was helped by record output at the Whiting and Cherry

Point refineries in the U.S, analysts say, and helped offset weaker

upstream performance.

NET DEBT ON THE RISE: Net debt in the quarter rose to $46.5

billion compared with $38.5 billion the year-earlier period.

Gearing ticked higher to 31.7% from 27.1% the previous

year----above BP's target of 20%-30%--following guided

divestment-related impairments. In a note, CMC Markets analysts

said they believe management has already taken steps to address

debt levels with the sale of BP's Alaska business to Hilcorp for

$5.6 billion.

DIVESTMENTS AHEAD OF SCHEDULE: Following the agreement to sell

all BP's interests in Alaska, divestment transactions announced in

2019 totaled $7.2 billion at the end of the third quarter. BP

expects to complete its $10 billion divestment program by the end

of 2019, earlier than previously expected.

Write to Giulia Petroni at giulia.petroni@wsj.com

(END) Dow Jones Newswires

October 29, 2019 05:32 ET (09:32 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

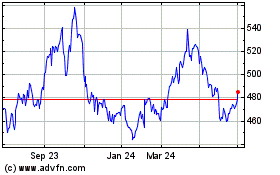

Bp (LSE:BP.)

Historical Stock Chart

From Mar 2024 to Apr 2024

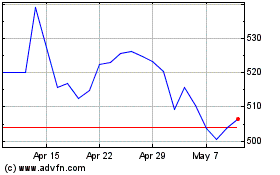

Bp (LSE:BP.)

Historical Stock Chart

From Apr 2023 to Apr 2024