RNS Number:2025E

Braemar Seascope Group PLC

25 November 2002

For immediate release 25 November 2002

Braemar Seascope announces Interim results for the six months ended 31 August

2002

Braemar Seascope Group plc (the "Group"), providers of specialised broking and

consultancy services to international ship owners and charterers in the sale &

purchase, tanker, offshore and dry bulk markets, today announced Interim results

for the six months ended 31 August 2002. The results for the first half of 2001

did not include a contribution from Braemar Tankers which joined the Group in

October 2001 and are not strictly comparable with the first half of 2002.

Highlights

* Turnover up to #14.23m (2001: #9.81m)

* Pre-tax profit up #2.01m to #2.14m (2001: #0.13m)

* Adjusted EPS before goodwill and exceptionals 8.24p (2001: 10.06p)

* Interim dividend unchanged at 5.0p per share

* Integration of Seascope, Braemar Shipbrokers and Braemar Tankers

completed successfully

Sir Peter Cazalet, Chairman, said:

"The global shipping market has been much weaker during 2002 especially compared

with the two previous years when freight rates were exceptionally high. Against

this backdrop most of the Group's broking departments performed well in

difficult trading conditions benefiting in particular from a higher level of

sale and purchase transactions."

"The outlook for shipping markets is difficult to foresee given the uncertain

global economic environment and the threat of war in the Middle East. In the

medium term a steady global recovery should be reflected in growth in sea-borne

trade which is a key driver for our business. However, political and economic

changes occurring in the short term may lead to high volatility in shipping

rates".

"As announced at the AGM Sir Graham Hearne is taking over as Chairman of the

Company from today. I am pleased to be handing over a company which has been

strengthened by the mergers of 2001 and is now well placed to become a major

force in providing shipping services to its worldwide client base."

Sir Graham Hearne, in-coming Chairman, said:

"Sir Peter Cazalet leaves the company a much stronger and more broadly-based

shipping services group than when he took over two years ago. The successful

mergers of Seascope with Braemar Shipbrokers and Braemar Tankers in 2001 offer

considerable possibilities for further business development. I am delighted to

be taking over the Chairmanship of Braemar Seascope Group plc at an exciting

time and to be working alongside a highly committed management and successful

broking team."

For further information, contact:

Alan Marsh, Chief Executive 020 7535 2600

James Kidwell, Finance Director 020 7535 2881

Braemar Seascope Group plc

Nick Boakes 020 7417 4170

Victoria Morris

Grandfield

BRAEMAR SEASCOPE GROUP PLC

Interim Results for the six months ended 31 August 2002

CHAIRMAN'S REVIEW

Results and Dividend

Turnover increased to #14.2m (2001: #9.8m) and operating profit before goodwill

amortisation and exceptional items increased to #2.6m compared with #1.9m in the

first half 2001. Pre-tax profits were #2.1m, up from #0.1m in 2001 and adjusted

earnings per share before exceptional items and goodwill amortisation were 8.24

pence compared with 10.06 pence in 2001. The results for the first half of 2001

did not include a contribution from Braemar Tankers which joined the Group in

October 2001 and are not strictly comparable with the first half of 2002.

It is the Directors' intention to pay an interim dividend of 5.0p per share

(Interim 2001: 5.0p).

Review of activities

The global shipping market has been much weaker during 2002 especially compared

with the two previous years when freight rates were exceptionally high. Against

this backdrop most of the Group's broking departments performed well in

difficult trading conditions benefiting in particular from a higher level of

sale and purchase transactions.

The performance of the sale and purchase department has been particularly strong

in all three sectors; new-building, second hand and demolition, and compares

very favourably with the previous two years when the freight markets were much

stronger. The new-building transactions also serve to underpin the company's

forward income over the next few years. Despite depressed freight rates the

second hand market continued to be active with a steady volume of business

concluded. Prices levelled off, buoyed by interest primarily from Greek buyers

and the support for prices has been maintained as freight rates improved. We

were also able to conclude some significant transactions with the company's

German partners in the container sector.

Tanker chartering freight levels in all sectors of crude transportation -

Aframax, Suezmax and VLCC - have been significantly lower in the first half of

2002, reflecting weaker market conditions caused by a higher oil price and

excess availability of shipping capacity. Global economies have not recovered as

was widely expected in 2002 thereby weakening oil demand and undermining the

long haul crude oil transportation business. The uncertainty surrounding crude

oil prices has also affected clean petroleum product shipping volumes which have

suffered due to lower refinery runs and lower margins as refiners have decreased

capacity in order to preserve stocks until prices stabilise. In other related

areas both the Chemical and Gas departments experienced a variable trading

market place but have both secured significant longer term contractual business

commencing in 2003 and the small tanker product shipping market has been weak

throughout the year with spot freight rates at their lowest point for many

years.

The Dry Cargo market has enjoyed a welcome improvement in the last month after

six months of extremely slow activity levels. Demand has been weak reflecting

tough commodity market conditions and there has been a significant number of

newly-built ships delivered into the market which has increased available

tonnage and depressed the rates achievable.

BRAEMAR SEASCOPE GROUP PLC

Interim Results for the six months ended 31 August 2002

Our Offshore business has experienced lower day rates and activity in the North

Sea during the first half despite a strong oil price. This is partly due to the

windfall tax levied by the UK government in the last budget which was received

with great disappointment in the industry, and also because of relatively low

exploration activity. However the department has concluded some substantial

project business, the benefits of which should come through in the second half.

Wavespec's half-year results fell slightly short of expectations due to a

reduction in the number of consultants supplied to the Oil Majors. There are

early indications that a recovery is underway in the second half, which should

yield a modest increase in profitability for the division.

The company concluded the divestment of Seascope Capital Services to its

management on the basis of a share of the work in progress.

Financial

The estimated full year tax rate on profits before non-deductible goodwill

amortisation has been applied at the half year. This rate is 40% compared to a

14 months to February 2002 tax rate of 38%. After charging goodwill amortisation

the estimated tax rate is 50% of pre-tax profits.

The average rate of exchange for the company's US$ income in the first half was

#/$1.44.

Net debt increased to #4.2m at 31 August 2002 from #3.1m at 28 February 2002.

The increase reflected a reduction in short term funds held on behalf of clients

and the payments of the final dividend and annual bonus relating to the prior

year. Underlying operating cash flow was strong at #2.1m.

The proposed interim dividend of 5.0 pence will be paid on 20 December 2002 to

shareholders on the register at close of business on 6 December 2002.

Outlook

The outlook for shipping markets is difficult to foresee given the uncertain

global economic environment and the threat of war in the Middle East. In the

medium term a steady global recovery should be reflected in growth in sea-borne

trade which is a key driver for our business. However, political and economic

changes occurring in the short term may lead to high volatility in shipping

rates.

Oil inventories are generally low at present and with the potential war threat

to oil movements, there has been a noticeable increase in volumes moved since

early October. Volumes are expected to continue increasing at a modest rate in

spite of OPEC's stated intention of maintaining production cuts. The high oil

price will serve to depress the major economies, especially in Asia. However, if

the recent trend of reducing oil prices continues, consumer demand in the major

economies should be stimulated thereby bringing about a recovery in

transportation rates. We would also expect some improvement in clean rates based

on the normal three-month lag from the recent crude rate increase.

BRAEMAR SEASCOPE GROUP PLC

Interim Results for the six months ended 31 August 2002

If the 20th Century was the oil age then it is possible that the 21st will

become the gas age. The company has already been actively involved in the

new-building of large LNG carriers, and Wavespec is one of the world's major

technical consulting companies covering maritime gas transportation. We expect

that our combined expertise in this area will enable us to take a growing share

of this market.

The sinking of the 1976 built PRESTIGE and subsequent oil spill has brought

international calls for much stricter laws and the possibility of an

acceleration of the 'phase-out' of older single hull tankers. This will almost

certainly result in an increase in both demolition and new-building activity.

The dry cargo fleet is largely dependent on the demand for steel, coal and

grain. Steel production in particular is driven by global economies. Despite the

worldwide economic uncertainties, demand is predicted to grow, albeit at a

slower rate than anticipated earlier in the year. China is a key driver in this

growth with the demand for steel and steel products forecast to rise at

double-digit rates in 2002 and 2003. The demand for steam coal is seasonal with

more coal being required for electricity consumption in winter months.

We have recently been experiencing an increase in business in China and as a

result of this we are now well advanced on plans to open at least one new office

there. The initial focus will be in the dry cargo and sale and purchase markets.

Board

John Denholm joined the Board as non-executive director on 26 July 2002 and

James Kidwell joined the Board as Finance Director and Company Secretary on 1

August 2002.

As announced at the AGM Sir Graham Hearne is taking over as Chairman of the

Company from today. I am pleased to be handing over a company which has been

strengthened by the mergers of 2001 and is now well placed to become a major

force in providing shipping services to its worldwide client base.

Sir Peter Cazalet

Chairman

25 November 2002

BRAEMAR SEASCOPE GROUP plc

CONSOLIDATED PROFIT AND LOSS ACCOUNT

FOR THE SIX MONTHS ENDED 31 AUGUST 2002

6 months to 6 months to 14 months to

31August 2002 30 June 2001 28 Feb 2002

Unaudited Unaudited Audited

#'000 #'000 #'000

Turnover 14,227 9,805 25,430

Net operating expenses before exceptional items and (11,668) (7,904) (21,719)

goodwill amortisation

Goodwill amortisation (517) (310) (3,403)

Exceptional items 250 (1,375) (3,310)

Total operating expenses (11,935) (9,589) (28,432)

Total operating profit/(loss) 2,292 216 (3,002)

Net interest payable and similar charges (154) (86) (324)

--------- --------- ---------

Profit/(loss) on ordinary activities before 2,138 130 (3,326)

taxation

Taxation on profit on ordinary activities (1,069) (288) (429)

---------- ----------- --------

Profit/(loss) on ordinary activities after taxation 1,069 (158) (3,755)

Dividends (856) (678) (1,725)

---------- ---------- --------

Retained profit/(loss) for the period 213 (836) (5,480)

Accumulated loss brought forward (6,607) (1,127) (1,127)

----------- ----------- --------

Retained loss carried forward (6,394) (1,963) (6,607)

====== ====== =====

Earnings per ordinary share - pence

- Basic 6.24p (1.43)p (27.45)p

- Adjusted EPS excluding goodwill

- amortisation and exceptional items 8.24p 10.06p 15.43p

- Diluted 6.24p (1.43)p (27.45)p

BRAEMAR SEASCOPE GROUP plc

CONSOLIDATED BALANCE SHEET AS AT 31 AUGUST 2002

As at As at As at

31 Aug 2002 30 June 2001 28 Feb 2002

Unaudited Unaudited Audited

#'000 #'000 #'000

Fixed assets

Goodwill 19,150 17,391 19,668

Tangible assets 4,520 1,876 4,666

Investments 1,087 1,387 1,087

---------- ---------- --------

24,757 20,654 25,421

Current assets

Debtors 4,885 4,572 5,680

Cash at bank and in hand 2,707 1,961 3,241

----------- ----------- --------

7,592 6,533 8,921

Creditors: amounts falling due

within one year (9,937) (7,650) (11,578)

---------- ------------ --------

Net current (liabilities)/assets (2,345) (1,117) (2,657)

----------- ---------- --------

Total assets less current liabilities 22,412 19,537 22,764

Creditors: amounts falling due after

More than one year (3,003) (3,459) (3,283)

Provisions (1,115) (124) (1,400)

----------- ---------- ---------

Net assets 18,294 15,954 18,081

====== ====== =====

Capital and reserves

Called up share capital 1,719 1,349 1,719

Capital redemption reserve 396 396 396

Share premium 4,271 4,421 4,271

Other reserves 18,302 11,443 18,302

Shares to be issued - 308 -

Profit and loss account (6,394) (1,963) (6,607)

----------- ---------- ---------

Total equity shareholders' funds 18,294 15,954 18,081

====== ====== =====

BRAEMAR SEASCOPE GROUP plc

CONSOLIDATED CASH FLOW STATEMENT

FOR THE SIX MONTHS ENDED 31 AUGUST 2002

6 months to 6 months to 14 months to

31 Aug 2002 30 June 2001 28 Feb 2002

Unaudited Unaudited Audited

#'000 #'000 #'000

Net cash inflow/(outflow) from operating activities 489 1,508 5,355

Returns on investments and servicing of finance

Net interest (paid) excluding finance leases (149) (1) (205)

Interest element of finance lease payments (4) (7) (16)

-------- --------- ---------

Net cash (outflow) from returns on investments and (153) (8) (221)

servicing of finance

Taxation

UK Corporation tax paid (149) (351) (1,961)

Capital expenditure and financial investment

Payments to acquire tangible fixed assets (40) (47) (133)

Receipts from investments - 143 924

-------- -------- --------

Net cash (outflow)/inflow from investing Activities (40) 96 791

Acquisitions and disposals

Purchase of subsidiary - (882) (2,019)

Cash acquired with subsidiary - 1,200 2,085

Deferred consideration (217) (75) (170)

------- -------- -------

Net cash (outflow)/inflow from acquisitions (217) 243 (104)

Equity dividends paid (1,045) (675) (1,354)

-------- --------- --------

Cash (outflow)/inflow before financing (1,115) 813 2,506

Financing

New loan 1,000 1,800 2,450

Loan repayment - (950) (950)

Loan acquired on acquisition - (562) (1,911)

Expenses on issue of equity shares - (307) -

Repayment of loan notes (375) - -

Payment of principal under finance leases (44) (22) (43)

-------- -------- ---------

Financing 581 (41) (454)

-------- --------- ---------

(Decrease)/increase in cash (534) 772 2,052

===== ===== =====

BRAEMAR SEASCOPE GROUP plc

NOTES TO THE ACCOUNTS

FOR THE SIX MONTHS ENDED 31 AUGUST 2002

1 Accounting policies

There have been no changes to the accounting policies set out in the 2002 Annual

Report and Accounts.

2 Financial Information

The financial information for the half-year ended 31 August 2002 is unaudited.

The financial information for the 14 months ended 28 February 2002 and half year

ended 31 August 2002 does not constitute full accounts and has been extracted

from the Company's accounts for the year/half year on which the auditors gave

unqualified reports. The accounts for the 14 months ended 28 February 2002 have

been delivered to the Registrar of Companies.

3. Exceptional Item

In the 6 months to 31 August 2002 there was exceptional income relating to the

successful outcome of litigation.

4. Dividends

The interim dividend of 5.00p per ordinary share (2001: 5.00p) will be paid on

20 December 2002 to shareholders on the register at the close of business on 6

December 2002.

5. Earnings per share

2002 2001 2002

6 months 6 months 14 months

to 31 Aug to 30 June to 28 Feb

#'000 #'000 #'000

Profit/(loss) after taxation 1,069 (158) (3,755)

Weighted av. no. of shares - basic 17,120,436 11,082,866 13,680,695

Basic EPS 6.24p (1.43)p (27.45p)

Goodwill amortisation 517 310 3,403

Exceptional (income)/ costs (250) 1,375 3,310

Related tax charge/(relief) 75 (412) (847)

--------- -------- --------

Adjusted PAT 1,411 1,115 2,111

Adjusted EPS excluding goodwill amort -isation and 8.24p 10.06p 15.43p

exceptional items

Fully diluted av. no. of shares 17,120,436 11,457,494 13,680,695

Diluted EPS 6.24p (1.43)p (27.45)p

6. Taxation

The taxation charge is based on the estimated effective tax rate

applicable for the full year.

BRAEMAR SEASCOPE GROUP plc

NOTES TO THE ACCOUNTS

FOR THE SIX MONTHS ENDED 31 AUGUST 2002

7. Reconciliation of Operating Profit to Net Cash Inflow from Operating

Activities

2002 2001 2002

31 Aug 30 June 28 Feb

#'000 #'000 #'000

Operating profit/(loss) after exceptional items 2,292 216 (3,002)

Depreciation charge 186 204 573

Goodwill amortisation and impairment 517 310 3,403

Decrease/(increase) in debtors 850 574 1,275

(Decrease)/Increase in creditors (3,071) 204 1,612

Exceptional write off of fixed assets - - 565

Profit on sale of investments - - (156)

(Decrease)/increase in provisions (285) - 1,085

------- ------- --------

489 1,508 5,355

===== ===== =====

The movement in creditors includes a reduction in short terms funds held on

behalf of clients of #1.6m (30 June 2001 reduction #0.2m; 28 February 2002

increase #1.3m). Net cash inflow from operating activities eliminating this

movement during the respective periods is #2.1m, #1.7m and #4.1m.

8. Reconciliation of Net Cash Flow to Movement in Net Debt

2002 2001 2002

31 Aug 30 June 28 Feb

#'000 #'000 #'000

(Decrease)/increase in cash (534) 772 2,052

Decrease in finance leases and bank loan 44 972 993

------- -------- --------

Change in net debt resulting from cash flows (490) 1,744 3,045

Non cash items

New finance leases - (31) (51)

Disposal of finance leases - 37 55

------- ------- --------

Movement in net debt (490) 1,750 3,049

Net funds at beginning of period (3,060) 91 91

New bank loan (1,000) (1,800) (2,450)

Issue of convertible unsecured loan stock - (3,000) (3,000)

Issue of loan notes in respect of deferred consideration - (750) (750)

Repayment of loan notes 375 - -

------ --------- ---------

Net (debt)/funds at end of period (4,175) (3,709) (3,060)

===== ===== =======

BRAEMAR SEASCOPE GROUP plc

NOTES TO THE ACCOUNTS

FOR THE SIX MONTHS ENDED 31 AUGUST 2002

9 Reconciliation of movement in shareholders' funds

2002 2001 2002

31 Aug 30 June 28 Feb

#'000 #'000 #'000

Retained profit/(loss) 213 (836) (5,480)

Issue of share capital at market value - 12,418 1,037

Other reserves arising on acquisition - - 18,302

Costs debited to share premium account - (307) (457)

-------- -------- --------

Net increase in shareholders' funds 213 11,275 13,402

Opening shareholders' funds 18,081 4,679 4,679

-------- -------- --------

Closing shareholders' funds 18,294 15,954 18,081

10 Profit and loss account

The negative cumulative profit and loss account balance is the result of a

goodwill write-off, in the amount of #5,599,794, which took place in the

financial year to 31 December 1998 upon the Company's adoption of FRS10.

Independent review report to Braemar Seascope Group plc

Introduction

We have been instructed by the company to review the financial information which

comprises a consolidated profit and loss account, consolidated balance sheet,

consolidated cash flow statement and related notes. We have read the other

information contained in the interim report and considered whether it contains

any apparent misstatements or material inconsistencies with the financial

information.

Directors' responsibilities

The interim report, including the financial information contained therein, is

the responsibility of, and has been approved by the directors. The directors are

responsible for preparing the interim report in accordance with the Listing

Rules of the Financial Services Authority which require that the accounting

policies and presentation applied to the interim figures should be consistent

with those applied in preparing the preceding annual accounts except where any

changes, and the reasons for them, are disclosed.

Review work performed

We conducted our review in accordance with guidance contained in Bulletin 1999/4

issued by the Auditing Practices Board for use in the United Kingdom. A review

consists principally of making enquiries of group management and applying

analytical procedures to the financial information and underlying financial data

and, based thereon, assessing whether the accounting policies and presentation

have been consistently applied unless otherwise disclosed. A review excludes

audit procedures such as tests of controls and verification of assets,

liabilities and transactions. It is substantially less in scope than an audit

performed in accordance with United Kingdom Auditing Standards and therefore

provides a lower level of assurance than an audit. Accordingly we do not express

an audit opinion on the financial information.

Review conclusion

On the basis of our review we are not aware of any material modifications that

should be made to the financial information as presented for the six months

ended 31 August 2002.

PricewaterhouseCoopers

Chartered Accountants

West London

25 November 2002

Notes:

a) The maintenance and integrity of the Braemar Seascope Group plc website

is the responsibility of the directors; the work carried out by the auditors

does not involve consideration of these matters and, accordingly, the auditors

accept no responsibility for any changes that may have occurred to the interim

report since it was initially presented on the website.

b) Legislation in the United Kingdom governing the preparation and

dissemination of financial information may differ from legislation in other

jurisdictions.

This information is provided by RNS

The company news service from the London Stock Exchange

END

IR UURKRUSRAUAA

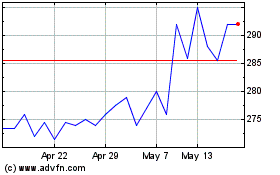

Braemar (LSE:BMS)

Historical Stock Chart

From Jun 2024 to Jul 2024

Braemar (LSE:BMS)

Historical Stock Chart

From Jul 2023 to Jul 2024