KWG Property Prices $400 Million 13.25% Bond Maturing 2017

March 15 2012 - 12:59PM

Dow Jones News

Chinese property developer KWG Property Holding Ltd. (1813.HK)

priced a $400 million, five-year bond, one of the banks running the

deal said Thursday.

Barclays Capital, HSBC Holdings PLC and Standard Chartered Bank

PLC were the lead managers on the sale, which has the following

terms:

Amount: $400 million

Maturity: March 22, 2017

Coupon: 13.25%

Reoffer Price: 99.112

Payment Date: March 22, 2012

Yield: 13.5%

Issue Ratings: B1 (Moody's)

B+ (Standard & Poor's)

Denominations: $1,000; $200,000

Listing: Singapore

-By Ben Edwards, Dow Jones Newswires, 44 20 7842 9287;

ben.edwards@dowjones.com

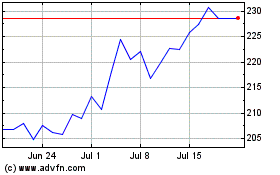

Barclays (LSE:BARC)

Historical Stock Chart

From Jun 2024 to Jul 2024

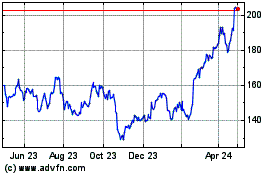

Barclays (LSE:BARC)

Historical Stock Chart

From Jul 2023 to Jul 2024