Zurich Insurance Ends Takeover Talks With RSA -- Update

September 21 2015 - 5:40AM

Dow Jones News

By John Letzing and Ian Walker

ZURICH-- Zurich Insurance Group AG has called off a planned

acquisition of U.K.-based RSA Insurance Group PLC potentially worth

$8.8 billion, as the Swiss firm focuses instead on repairing a

business affected by a massive disaster in China last month.

Zurich Insurance said on Monday it expects losses of about $275

million as a result of the deadly explosions at a port in Tianjin,

China. That will compound other difficulties at the company's

largest unit, general insurance, leading to an operating loss for

that unit in the third quarter of roughly $200 million, the

Zurich-based company said. The deterioration prompted Zurich

Insurance to end its talks with RSA, the company said, adding that

an "in-depth review" of the general insurance business is now under

way.

A spokesman for Zurich Insurance said the company found nothing

during its due diligence that caused it to halt its pursuit of RSA,

though that process hadn't been completed.

In its own statement, RSA confirmed that talks with Zurich

Insurance had ended, but said it has made recent progress in

strengthening its position as a stand-alone company. Still, shares

of RSA tumbled 22% in morning trading. Shares of Zurich Insurance

fell more than 2%.

The scuttling of Zurich Insurance's pursuit of its U.K. peer is

the latest effect felt by businesses as a result of the massive

explosions roughly one month ago at the Tianjin port, which were

caused by the improper storage of hazardous chemicals. The

explosions killed more than 100 people, and created logistical

glitches and supply chain issues that are expected to hinder

companies using the facility for months to come.

Insured losses resulting from the disaster could top $1.5

billion, according to an estimate from Fitch Ratings.

The disaster comes at an inopportune time for Zurich Insurance,

which had disclosed in July that it was interested in buying RSA.

Last month, the Swiss firm proposed making an $8.8 billion

acquisition offer, just hours before a deadline imposed by U.K.

regulators. RSA said at that time that it was willing to recommend

the bid to its shareholders.

The deal was intended to help bolster Zurich Insurance, at a

time of low investment returns and flagging profits. Zurich

Insurance and RSA both sell insurance to corporations, and had

business units including those in the U.K. that were potentially

complementary.

Vontobel analyst Stefan Schürmann said in a research note that

Zurich Insurance's decision to end its pursuit of RSA was "not

highly surprising," though it underlines the significant challenges

facing the Swiss firm. In addition to losses stemming from the

Tianjin port disaster, Zurich Insurance said it expects a $300

million impact on its reserves in the third quarter primarily

related to its U.S. auto liability business.

RSA said on Monday that Zurich's acquisition interest was

unsolicited, and that the U.K. firm has made "good progress" on its

continuing overhaul.

That overhaul began after it appointed former Royal Bank of

Scotland Group PLC Chief Executive Stephen Hester as CEO early last

year. The firm has raised fresh capital, and earlier this month

agreed to sell its operations in Latin America to Suramericana SA,

the insurance subsidiary of Grupo de Inversiones Suramericana.

Mr. Hester was appointed after his predecessor, Simon Lee,

abruptly left the company at the end of 2013 amid difficulties at

RSA's Irish unit. Earlier that year, RSA opened an investigation of

the Irish unit's claims and finance functions after a routine audit

discovered a number of issues.

Write to John Letzing at john.letzing@wsj.com and Ian Walker at

ian.walker@wsj.com

Subscribe to WSJ: http://online.wsj.com?mod=djnwires

(END) Dow Jones Newswires

September 21, 2015 05:25 ET (09:25 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

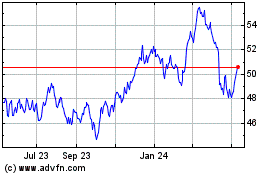

Zurich Insurance (QX) (USOTC:ZURVY)

Historical Stock Chart

From May 2024 to Jun 2024

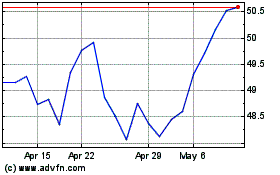

Zurich Insurance (QX) (USOTC:ZURVY)

Historical Stock Chart

From Jun 2023 to Jun 2024