$454,000 related to our sponsorship and advertising package with

The Mirage and $295,000 related to our contract with Pocket Kings, Ltd.

Sponsorship and advertising revenue in the three and six months ended June 30,

2007 primarily represented the fair value of our sponsorship and advertising

package with The Mirage, which we recorded at $405,000, $188,000 for our

sponsorship package with Mitchum (through Van Wagner, a sales agent), and

$134,000 in additional barter revenue recorded in trade for vendor credits.

Licensing

revenue.

During the

first half of 2008, we recorded revenue related to our licensing contract with

the Custom Group. There was no licensing revenue recorded during 2007.

Player

entry fees revenue.

Player entry fees revenue is comprised of the tournament entry fees paid by the

amateur players in our live events, which were $10,000 per player for our 2007

and 2008 events. We record player entry fees revenue on a net basis, in that we

do not record gifted or sponsored buy-ins to player entry fees revenue with an

offset to expense. Revenue from player entry fees increased in the three and

six months ended June 30, 2008 compared to the three and six months ended June

30, 2007. In 2008, we had 80 playing positions, with 54 players paying the full

entry fee and 23 sponsored players. In 2007, the year in which we held our

inaugural event, we had 60 players, with 26 players paying the full entry fee

and 28 sponsored players.

Cost

of revenue

. Cost

of revenue primarily consists of barter transactions, player payout (tournament

prizes), media production costs and other event costs. Cost of revenue

decreased slightly in the three and six months ended June 30, 2008 compared to

the three and six months ended June 30, 2007. Our inaugural event was held in

2007, which resulted in costs being higher for the tournament.

Sales

and marketing

.

Sales and marketing expense consists primarily of consulting, public relations,

sales materials and advertising. Sales and marketing increased in the three and

six months ended June 30, 2008 compared to the three and six months ended June

30, 2007 resulting primarily from the inclusion in the three and six months

ended June 30, 2008 of $150,000 and $300,000, respectively, of fair value of

shares of our common stock issued to a consulting group which provided public

relations and promotional services. This was offset by higher sales and

marketing expenses in 2007 related to promotional activities related to the

inaugural event.

General

and administrative

.

General and administrative expense consists primarily of salaries and other

personnel-related expenses to support our tournament operations, non-cash

stock-based compensation for general and administrative personnel, professional

fees, such as accounting and legal, corporate insurance and facilities costs.

The significant increase in general and administrative expenses in the three

and six months ended June 30, 2008 compared to the three and six months ended

June 30, 2007 resulted primarily from an overall increase in 2008 as compared

to 2007 in consulting fees and salaries paid to administrative personnel in

support of tournament operations.

Interest

Expense

.

In 2007,

we borrowed a total of $985,000 pursuant to a promissory note with the chairman

of our board of directors. The note bore interest at a rate of 12% per annum

and matured on November 9, 2007. An origination fee of $10,000 was recorded as

debt discount and amortized over the life of the debt, and 197,000 shares of

common stock were also issued as an origination fee and recorded at their fair

value of $1.00 per share as determined by our board of directors after taking

into account recent stock sales and amortized to interest expense during 2007.

In

January 2008, the note was replaced by a second promissory note in the principal

amount of $961,000, bearing interest at a rate of 12% per annum. This new note

was due on January 1, 2009. During the three and six months ended June 30,

2008, we recorded interest expense of approximately $29,000 and $58,000 related

to this note.

In

addition, in the second quarter of 2008, we borrowed an aggregate of $1,135,000

pursuant to convertible promissory notes, bearing interest at 6% per annum,

with a discount of $1.1 million that was recorded and is being amortized to

interest expense during 2008. We recognized interest expense related to the

amortization of the discount of $285,000 during the three and six months ended

June 30, 2008.

Off-Balance Sheet Arrangements

As

of June 30, 2008, we did not have any off-balance sheet arrangements, as

defined in Item 303(a)(4)(ii) of SEC Regulation S-K.

I

TEM 4T. CONTROLS AND PROCEDURES.

(a)

Disclosure Controls and Procedures. As described above in the “Explanatory

Note” to this Amendment No. 1 to our Quarterly Report on Form 10-Q/A for the

quarter ended June 30, 2008 and Note 9 to our unaudited consolidated financial

statements,

17

our management determined it

was necessary to restate our unaudited interim financial statements as of and

for the three and six months ended June 30, 2008 and 2007.

As

stated in our Quarterly Report on Form 10-Q for the period ended June 30, 2008

as originally filed, our management evaluated, under the supervision and with

the participation of our then Chief Executive Officer/Chief Financial Officer

(“CEO/CFO”), the effectiveness of our disclosure controls and procedures as of

June 30, 2008. Based on that initial evaluation, our then CEO/CFO concluded

that, as of June 30, 2008, our disclosure controls and procedures (as defined in

Rules 13a-15(e) and 15d-15(e) under the Securities Exchange Act of 1934), were

effective.

Subsequent

to that evaluation and in connection with the restatement and filing of this

Amendment No. 1 to our Quarterly Report on Form 10-Q/A for the quarter ended

June 30, 2008, our management, under the supervision and with the participation

of our current CEO/CFO, reevaluated the effectiveness of our disclosure

controls and procedures and concluded that our disclosure controls and

procedures were not effective as of June 30, 2008 in light of the need for the

restatements reported herein. Under Item 9A(T) of our Annual Report on Form

10-K for the year ended December 31, 2008 (the “Annual Report”), we described

the remediation efforts we are undertaking in order to correct the deficiencies

in our disclosure controls.

(b)

Internal Control over Financial Reporting. There were no changes in our

internal controls over financial reporting or in other factors during the

fiscal quarter ended June 30, 2008 that materially affected, or are reasonably

likely to materially affect, our internal control over financial reporting. As

previously reported in Item 9A(T) of the Annual Report, we still had numerous

material weaknesses in our internal control over financial reporting as of

December 31, 2008. In the Annual Report we described the remediation efforts we

have begun to undertake in order to correct such material weaknesses.

P

ART II – OTHER INFORMATION

I

TEM 2. UNREGISTERED SALES OF EQUITY

SECURITIES AND USE OF PROCEEDS

The

following sets forth certain information for all securities we sold during the

quarter ended June 30, 2008 without registration under the Securities Act of

1933, as amended (the “Securities Act”), other than those sales previously

reported in a Current Report on Form 8-K:

In

May and June 2008, we issued convertible promissory notes to six investors in

an aggregate principal amount of $1,135,000. These notes were convertible into

shares of common stock at a conversion price of $1.00 per share. The

convertible notes provide that the conversion price of the notes will be

reduced in the event of subsequent financings at an effective price per share

less than the conversion price of the convertible notes, subject to certain

exceptions. The convertible promissory notes were issued together with warrants

to purchase an aggregate of 1,135,000 shares of common stock at an exercise

price of $1.05 per share. Copies of the form of Convertible Promissory Note and

form of Warrant issued to the investors are filed as Exhibits 10.5 and 10.6,

respectively, to our Annual Report on Form 10-K for the year ended December 31,

2008. This offering was exempt from registration provided by Rule 506

promulgated under the Securities Act, and each of the investors was an

“accredited investor” as defined in Rule 501promulgated under the Securities

Act.

In

May 2008, we issued 150,000 shares of our common stock to a financial

consultant in payment of services rendered. This transaction was exempt from

registration provided by Section 4(2) of the Securities Act.

I

TEM 6. EXHIBITS

The

exhibits required by this item are listed on the Exhibit Index attached hereto.

18

S

IGNATURES

In

accordance with the requirements of the Exchange Act, the registrant has caused

this report to be signed on its behalf by the undersigned, thereunto duly

authorized.

|

|

|

|

|

Dated: August 5, 2009

|

WORLD SERIES OF GOLF, INC.

|

|

|

|

|

|

|

By:

|

/s/ Joseph F. Martinez

|

|

|

|

|

|

|

|

Joseph F. Martinez

|

|

|

|

Chief Executive Officer,

Chief Financial Officer,

|

|

|

|

and Principal Accounting

Officer

|

19

EXHIBIT INDEX

|

|

|

|

|

|

Exhibit No.

|

|

Description

of Exhibit

|

|

|

|

|

|

|

|

|

|

|

|

31.1

|

|

Certification of our Chief

Executive Officer and Chief Financial Officer pursuant to Section 302 of the

Sarbanes-Oxley Act of 2002.

|

|

|

|

|

|

|

32.1

|

|

Certification of our Chief

Executive Officer and Chief Financial Officer pursuant to Section 906 of the

Sarbanes-Oxley Act of 2002.

|

20

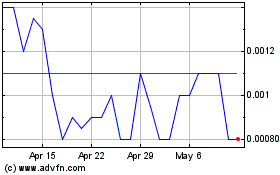

Vaycaychella (PK) (USOTC:VAYK)

Historical Stock Chart

From Jun 2024 to Jul 2024

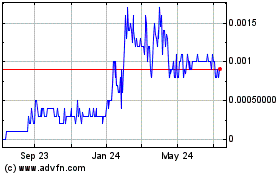

Vaycaychella (PK) (USOTC:VAYK)

Historical Stock Chart

From Jul 2023 to Jul 2024