UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

SCHEDULE

14C INFORMATION

Information

Statement Pursuant to Section 14(c) of the Securities Exchange Act of 1934

|

Check

the appropriate box:

|

|

|

|

[ ]

|

Preliminary

Information Statement

|

|

|

|

|

[ ]

|

Confidential,

for Use of the Commission Only (as permitted by Rule 14c-5(d)(2))

|

|

|

|

|

[X]

|

Definitive

Information Statement

|

|

|

|

|

[ ]

|

Definitive

Additional Materials

|

|

|

|

|

[ ]

|

Soliciting

Material Under §240.14(a)(12)

|

Social

Life Network, Inc.

(Name

of Registrant as Specified in Its Charter)

|

Payment

of Filing Fee (Check the appropriate box):

|

|

|

|

[X]

|

No

fee required.

|

|

|

|

|

[ ]

|

Fee

computed on table below per Exchange Act Rules 14c-5(g) and 0-11.

|

|

|

|

|

|

1)

|

Title

of each class of securities to which transaction applies:

|

|

|

|

|

|

|

2)

|

Aggregate

number of securities to which transaction applies:

|

|

|

|

|

|

|

3)

|

Per

unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which

the filing fee is calculated and state how it was determined):

|

|

|

|

|

|

|

4)

|

Proposed

maximum aggregate value of the transaction:

|

|

|

|

|

|

|

5)

|

Total

fee paid:

|

|

|

|

|

|

[ ]

|

Fee

paid previously with preliminary materials.

|

|

|

|

|

[ ]

|

Check

box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting

fee was paid previously. Identify the previous filing by information statement number, or the Form or Schedule and the

date of its filing.

|

|

|

|

|

|

1)

|

Amount

Previously Paid:

|

|

|

|

|

|

|

2)

|

Form,

Schedule or Information statement No.:

|

|

|

|

|

|

|

3)

|

Filing

Party:

|

|

|

|

|

|

|

4)

|

Date

Filed:

|

SOCIAL

LIFE NETWORK, INC.

3465

S Gaylord Ct., Suite A509

Englewood

Colorado 80113

(855)

933-3277

NOTICE

LETTER TO SHAREHOLDERS

INTRODUCTION

This

notice/information statement (the “Information Statement”) will be mailed on or about June 14, 2019 to the

stockholders of record of Social Life Network, Inc. (“we”, “our”, “us” or the “Company”),

a Nevada corporation pursuant to Section 14(c) of the Securities Exchange Act of 1934, as amended (“Exchange

Act”). This Information Statement is circulated to advise the Company’s shareholders of actions already approved and

taken on May 15, 2019 without a meeting by written consent of a holder of a majority of our outstanding voting

common and outstanding voting stock, representing 98,798,334 capital shares or 77.1% of the Company’s issued

and outstanding voting stock as of May 15, 2019.

The purpose of this letter is to inform

you of the following actions approved by our Board of Directors and by an over 75% stockholder vote by consent as

required by our bylaws:

|

|

1)

|

The

re-election of the Company’s Board of Directors, consisting of Kenneth S. Tapp,

George Jage

,

Leslie Bockor, Kenneth Granville, and Vincent Keber as our Board members, to hold

office until our next annual meeting of shareholders or until their successors have

been duly elected and qualified

|

|

|

2)

|

The

appointment of BF Borgers CPA PC as the Company’s independent certified public accountant for the fiscal year ending

December 31, 2019.

|

The

corporate actions referred to immediately above in 1) and 2) are hereafter referred to as the “Corporate Actions.”

The Corporate Actions have been duly authorized

and approved by the written consent of the holders of 77.1% of our outstanding voting securities and unanimously by our

Board of Directors. As such, your vote or consent is not requested or required. The accompanying Information Statement is

provided solely for your information and serves as the notice as required by Nevada Revised Statues and our bylaws. Our bylaws

provide that the Corporate Actions may be approved without an annual meeting by unanimous written consent of our Board of

Directors and over 75% vote of the Company’s stockholders.

The

elimination of the need for a meeting of stockholders to approve this action is made possible by our bylaws and the Nevada Statutes,

which provides that the written consent of the holders of outstanding shares of voting capital stock, having not less than the

minimum number of votes which would be necessary to authorize or take such action at a meeting at which all shares entitled to

vote thereon were present and voted, may be substituted for such a meeting. In order to eliminate the costs involved in holding

a special meeting of our stockholders, our Board of Directors voted to utilize the written consent of the holders of a majority

in interest of our voting securities.

THIS

INFORMATION STATEMENT IS CIRCULATED TO ADVISE THE SHAREHOLDERS OF ACTION ALREADY APPROVED BY WRITTEN CONSENT OF THE SHAREHOLDERS

WHO COLLECTIVELY HOLD A MAJORITY OF THE VOTING POWER OF OUR CAPITAL STOCK.

Please

review the Information Statement included with this Notice for a more complete description of this matter. This Information Statement

is being sent to you for informational purposes only.

WE

ARE NOT ASKING YOU FOR A PROXY AND YOU ARE REQUESTED NOT TO SEND US A PROXY.

The

actions that we wish to advise you of are:

|

|

●

|

The

re-election of the Company’s Board of Directors, consisting of Kenneth S. Tapp,

George Jage

,

Leslie Bockor, Kenneth Granville, and Vincent Keber as the Company’s Board members,

to hold office until our next annual meeting of shareholders or until their successors

have been duly elected and qualified

|

|

|

●

|

The

reappointment of BF Borgers CPA PC as the Company’s independent certified public accountant for the fiscal year ending

December 31, 2019.

|

SPECIAL

NOTE REGARDING FORWARD-LOOKING STATEMENTS

This Information Statement contains certain

forward-looking statements regarding management’s plans and objectives for the future. These statements may be found under

“Management’s Discussion and Analysis of Financial Condition and Results of Operations” and “Description

of Business,” included in our Form 10-K for the period ending December 31, 2018 and our Form 10-Q for the period ending

March 31, 2019, which reports are available at sec.gov. Actual events or results may differ materially from those discussed

in forward-looking statements as a result of various factors, including, without limitation, the risks outlined under “Risk

Factors” and matters described in the information statement generally. In light of these risks and uncertainties, there

can be no assurance that the forward-looking statements contained in the information statement will in fact occur.

The

forward-looking statements herein are based on current expectations that involve a number of risks and uncertainties. Such forward-looking

statements are based on assumptions described herein. The assumptions are based on judgments with respect to, among other things,

future economic, competitive and market conditions, and future business decisions, all of which are difficult or impossible to

predict accurately and many of which are beyond our control. Accordingly, although we believe that the assumptions underlying

the forward-looking statements are reasonable, any such assumption could prove to be inaccurate and therefore there can be no

assurance that the results contemplated in forward-looking statements will be realized. In addition, there are a number of other

risks inherent in our business and operations, which could cause our operating results to vary markedly, and adversely from prior

results or the results contemplated by the forward-looking statements. Management decisions, including budgeting, are subjective

in many respects and periodic revisions must be made to reflect actual conditions and business developments, the impact of which

may cause us to alter marketing, capital investment and other expenditures, which may also materially adversely affect our results

of operations. In light of significant uncertainties inherent in the forward-looking information the inclusion of such information should not be regarded as a representation by us or any other person that our objectives

or plans will be achieved.

Any statement in the information statement

that is not a statement of an historical fact constitutes a “forward-looking statement”. Further, when we use the

words “may”, “expect”, “anticipate”, “plan”, “believe”, “seek”,

“estimate”, “internal”, and similar words, we intend to identify statements and expressions that may be

forward- looking statements. We believe it is important to communicate certain of our expectations to our investors. Forward-looking

statements are not a guarantee of future performance. They involve risks, uncertainties and assumptions that could cause

our future results to differ materially from those expressed in any forward-looking statements. Many factors are beyond our ability

to control or predict. You are accordingly cautioned not to place undue reliance on such forward-looking statements. Important

factors that may cause our actual results to differ from such forward-looking statements include, but are not limited to, the

risks outlined under “Risk Factors” herein. The reader is cautioned that our company does not have a policy of updating

or revising forward-looking statements and thus the reader should not assume that silence by management of our company over time

means that actual events are bearing out as estimated in such forward-looking statements.

This Information Statement, which describes

the Corporate Actions in more detail, is being furnished to our shareholders for informational purposes only pursuant

to Section 14(c) of the Exchange Act, and the rules and regulations prescribed thereunder. Pursuant to Rule 14c-2 under the Exchange

Act, the corporate actions will not be effective until no fewer than twenty (20) calendar days after the initial mailing of the

Information Statement to our shareholders, on or about July 5, 2019.

I

encourage you to read the enclosed Information, which is being provided to all of our shareholders and describes the Corporate

Actions in detail.

|

|

For

the Board of Directors of

|

|

|

Social

Life Network, Inc.

|

|

|

|

|

|

|

By:

|

/s/

Ken Tapp

|

|

|

|

Ken

Tapp, Chairman of the Board/Chief

Executive Officer

|

The Definitive Information will be mailed

on or about June 14, 2019 to our shareholders of record.

SOCIAL

LIFE NETWORK, INC.

3465 S Gaylord Ct. Suite A509

Englewood

,

Colorado 80113

Telephone:

(855) 933-3277

INFORMATION

STATEMENT PURSUANT TO SECTION 14(C) OF THE SECURITIES EXCHANGE ACT OF 1934 AND RULE 14C-2 THEREUNDER

WE

ARE NOT ASKING YOU FOR A PROXY,

AND

YOU ARE REQUESTED NOT TO SEND US A PROXY.

GENERAL

Social

Life Network, Inc. is referred to herein as “we”, “our” or “us” or the “Company”

We

are distributing this Information Statement to shareholders of Social Life Network, Inc. in full satisfaction of any notice requirements

we may have under the Securities Exchange Act of 1934, as amended (the “Exchange Act”), and the Nevada Statutes (referred

to herein as the “Nevada Statutes”). We will undertake no additional action with respect to the receipt of Board of

Directors and shareholder written consents, and no appraisal rights under the Nevada Statutes or otherwise are afforded to our

shareholders as a result of the Corporate Actions described in this Information Statement.

This

Information Statement is being furnished by us in connection with action taken by the holders of a majority of the voting power

of our issued and outstanding voting securities. By written consent dated May 15, 2019, the holders of over 75% of

the voting power voted to approve the Corporate Actions detailed below. We will be sending or giving this Information Statement

to our stockholders on or about June 14, 2019. Our principal executive offices are located at 3465 S. Gaylord Court,

Suite A509, Denver, Colorado and our telephone number is (855) 933-3277.

Board

Approval of the Corporate Actions.

On

May 15, 2019, our Board of Directors approved of the Corporate Actions.

The

Action by Written Consent

As

of May 15, 2019, the holders of over 75% of our outstanding voting securities approved of the Corporate Actions,

specifically representing 98,798,334 voting capital shares or 77.1% of our issued and outstanding voting stock executed

a written consent approving the Corporate Actions.

No

Further Voting Required

All necessary corporate and stockholder

approvals have been obtained to elect the Board of Directors and appoint BF Borgers CPA PC as the Company’s independent

certified public accountant for the fiscal year ending December 31, 2019. We are not seeking consent, authorizations, or proxies

from you. The Nevada statutes and our bylaws provide that actions requiring a vote of the stockholders may be approved by written

consent of the holders of outstanding shares of voting capital stock having not less than the minimum number of votes which would

be necessary to authorize or take such action at a meeting at which all shares entitled to vote thereon were present and voted.

Notice

Pursuant to the Nevada Statutes

Pursuant

to the Nevada Statutes, we are required to provide prompt notice of the Corporate Actions by written consent to our stockholders

who have not consented in writing to such action. This Information Statement serves as the notice required by the Nevada Statutes

in addition to which, we will be mailing this notice to our shareholders of record.

Dissenters’

Rights of Appraisal

The

Nevada statutes does not provide dissenters’ rights of appraisal to our stockholders in connection with the matters approved

by the Written Consent.

OUTSTANDING

VOTING SECURITIES

As of May 15, 2019, we had issued and

outstanding shares of Common Stock of 128,108,943 shares of Common Stock, par value $0.001 per share, such shares

constituting all of our issued and outstanding Common Stock.

The

Nevada Revised Statutes and our bylaws permit the holders of a majority of the shares of our outstanding Common Stock to approve

and authorize actions by written consent as if the action were undertaken at a duly constituted meeting of our shareholders. On

May 15, 2019, our Board of Directors consented in writing without a meeting to the matters described herein, and recommended

that the matters described herein be presented for approval to the holders of approximately 77.1% of our issued and outstanding

shares. On May 15, 2019, the holders of an aggregate of 98,798,334 shares of Common Stock (the “Consenting

Shareholders”), representing 77.1% of the total shares of our Common Stock entitled to vote on the matters set forth

herein, consented in writing without a meeting to the matters described herein and approved of the Corporate Actions summarized

below.

CORPORATE

ACTIONS

The

Corporate Actions described in this Information Statement will not afford shareholders the opportunity to dissent from the actions

described herein or to receive an agreed or judicially appraised value for their shares.

Our

Board of Directors and the Consenting Shareholders have consented to, approved, authorized and directed:

|

|

●

|

The re-election of the Company’s Board

of Directors, consisting of Kenneth S. Tapp, George Jage, Leslie Bockor, Kenneth Granville, and Vincent Keber as the Company’s

Board members, to hold office until our next annual meeting of shareholders or until their successors have been duly elected

and qualified

|

|

|

●

|

The

reappointment of BF Borgers CPA PC as the Company’s independent certified public accountant for the fiscal year ending

December 31, 2019.

|

This Information Statement is being furnished

to our shareholders in connection with the Corporate Actions by written consent of our Board of Directors and the holders of an

over 75% vote of our issued and outstanding common stock in lieu of a special meeting. On May 15, 2019, our Board of

Directors and our Consenting Shareholders approved the Corporate Actions.

The Consenting Shareholders own approximately

77.1% of our outstanding voting stock and they have executed a written consent approving the corporate actions.

The

elimination of the need for a meeting of shareholders to approve these actions is made possible by the Nevada Statutes and our

bylaws.

In

order to eliminate the costs involved in holding a special meeting, our Board of Directors determined to utilize the written consent

of the holders of a majority in interest of our voting securities.

Pursuant to Rule 14c-2 under the Securities

Exchange Act of 1934, as amended, the Corporate Actions will not be effective until 20 days after the mailing of this Information

Statement to our stockholders. The nominees for election as directors are willing to be elected as our directors. If as a result

of circumstances know now known or foreseen, a nominee shall be unavailable or unwilling to serve as a director, the majority

of stockholders may elect by written consent such other person as they deem advisable.

Pursuant

to Nevada Statute Section 607.0704, we are required to provide notice of the taking of the corporate action without a meeting

of shareholders to all shareholders who did not consent in writing to such action. This Information Statement serves as

this notice. This Information Statement will be mailed on or about June 14, 2019 to our shareholders who did not

consent to the Corporate Actions, and is being delivered to inform you of the corporate actions described herein, before

it takes effect in accordance with Rule 14c-2 of the Securities Exchange Act of 1934.

We

will bear the entire cost of furnishing this Information Statement. We will request brokerage houses, nominees, custodians, fiduciaries

and other like parties to forward this Information Statement to the beneficial owners of our voting securities held of record

by them.

BACKGROUND

– BUSINESS

We

license our Social Life Network SaaS (Software as a Service) Internet Platform (hereafter referred to as the

“Platform”) to niche industries for an annual license fee and/or a percentage of profits. Our Platform is a

cloud-based social network and E-Commerce system that can be accessed by a web browser or mobile application that allows

end-users to socially connect with one another and their customers to market and advertise their products and services. The

Platform can be customized to suit virtually any international niche industry or sub-culture, such as hunting and fishing,

tennis, real estate professionals, health and fitness, and charity causes. Our wholly owned subsidiary, MjLink.com, Inc.

(“MjLink”) owns and operates cannabis and hemp industry Platforms through MjLink from which we generate

advertising and digital subscription revenue. MjLink also includes an event division that will provide many industry

tradeshows and conferences to its vast audience of platform members, the majority of which use MjLink.com and

WeedLife.com year-round.

We

have filed our Form 10-K for our fiscal year 2018 and our latest quarterly report for our quarter ending March 31, 2019, both

of which may be accessed at sec.gov.

Interests

of Certain Parties in the Matters to be Acted Upon

Our

Consenting Shareholders are:

|

Shareholder

|

|

Number of Common Shares

Represented

|

|

|

Percentage

Ownership

|

|

LVC Consulting, LLC

(Kenneth Tapp)

|

|

|

59,736,667

|

|

|

|

46.6

|

%

|

Rodosevich Investments, LLC

(Andrew Rodosevich)

|

|

|

14,736,667

|

|

|

|

11.5

|

%

|

Electrum Partners

(Leslie Bocskor, President)

|

|

|

3,000,000

|

|

|

|

2.3

|

%

|

Rightside Advisors, LLC

(Vincent Keber, CEO)

|

|

|

1,000,000

|

|

|

|

0.8

|

%

|

Vincent “Tripp” Keber

|

|

|

2,000,000

|

|

|

|

1.6

|

%

|

D. Scott Karnedy

|

|

|

1,000,000

|

|

|

|

0.8

|

%

|

Mark DiSiena

|

|

|

1,000,000

|

|

|

|

0.8

|

%

|

Mike Fuller

|

|

|

1,000,000

|

|

|

|

0.8

|

%

|

Scott Anderson & Melissa Anderson, Jt Tenant

|

|

|

2,500,000

|

|

|

|

2.0

|

%

|

Brian Lazarus & Carin Lazaus, Jt Tenant

|

|

|

2,500,000

|

|

|

|

2.0

|

%

|

OBI Consulting Inc

Quincy Amarikwa, CEO)

|

|

|

2,183,334

|

|

|

|

1.7

|

%

|

Emerging Markets Consulting, LLC

(James S. Painter, III, Managing Member)

|

|

|

1,750,000

|

|

|

|

1.4

|

%

|

Britt Glassburn

|

|

|

1,283,333

|

|

|

|

1.0

|

%

|

Luke Boland

|

|

|

1,000,000

|

|

|

|

0.8

|

%

|

|

Lonnie Klaess

|

|

|

1,000,000

|

|

|

|

0.8

|

%

|

MD Global Partners, LLC

(Owen May, CEO)

|

|

|

1,000,000

|

|

|

|

0.8

|

%

|

Trang Pham

|

|

|

1,000,000

|

|

|

|

0.8

|

%

|

Lynn S. Murphy

|

|

|

608,333

|

|

|

|

0.5

|

%

|

Bruce Kennedy

|

|

|

500,000

|

|

|

|

0.4

|

%

|

|

Total

|

|

|

98,798,334

|

|

|

|

77.1

|

%

|

DIRECTORS

AND EXECUTIVE OFFICERS

Directors

and Executive Officers

All

directors of our company hold office until the next annual meeting of our stockholders or until their successors have been elected

and qualified, or until their death, resignation or removal. The executive officers of our company are appointed by our board

of directors and hold office until their death, resignation or removal from office.

Our

directors and executive officers, their ages, positions held, and duration of such, are as follows:

|

Name

|

|

Position

Held with Our Company

|

|

Age

|

|

Date

First Elected or Appointed

|

|

|

|

|

|

|

|

|

|

Kenneth

S. Tapp

|

|

Chairman,

Chief Executive Officer & Chief Technology Officer

|

|

49

|

|

June

6, 2016

|

|

Mark

DiSiena

|

|

Chief

Financial Officer & Chief Accounting Officer

|

|

53

|

|

November

1, 2018

|

|

D.

Scott Karnedy *

|

|

Former-

Chief

Operating Officer and Former-Board Member

|

|

56

|

|

August

1, 2018

|

|

Leslie

Bocskor

|

|

Board

Member

|

|

55

|

|

August

1, 2018

|

|

Kenneth

Granville

|

|

Board

Member

|

|

59

|

|

August

1, 2018

|

|

Vincent

(Tripp) Keber

|

|

Board

Member

|

|

50

|

|

August

1, 2018

|

|

Andrew

Rodoevich

|

|

Former

-Chief

Financial Officer and Former-Board Member

|

|

34

|

|

June

6, 2016

|

|

George Jage

|

|

Chief Operating Officer & Board

Member

|

|

48

|

|

May

10, 2019

|

* Resigned as Chief Operating

Officer and Board Member on May 10, 2019.

Business

Experience

The

following is a brief account of the education and business experience of directors and executive officers during at least the

past five years, indicating their principal occupation during the period, and the name and principal business of the organization

by which they were employed:

Kenneth

S. Tapp, Chairman of the Board, Chief Executive Officer, Chief Technology Officer

Kenneth

Shawn Tapp has served as our Chief Executive Officer, Chief Technology Officer and Chairman since June 6, 2016. In addition to

his responsibilities as our CEO, Mr. Tapp oversees the ongoing development, data architecture and cloud security of our social

network platform. Mr. Tapp has served as an officer of Internet companies since 1999, including from January 2013 to June 2016,

as Chief Operating Officer of Life Marketing, Inc., the forerunner of the then private company, Social Life Network, Inc. Mr.

Tapp, from January of 2000 to August of 2009, was the founder, Chief Executive Officer and Chief Technology Officer of Cherry

Creek Internet Group, a SaaS company, and the Co-founder and Chief Executive Officer of CCMG, a digital advertising company. In

August of 2009, Mr. Tapp merged the two companies and sold them to BRIMS-RES Australia, Pty Ltd., a real estate SaaS company headquartered

in Brisbane Australia. Mr. Tapp was the tech division Vice President, and lead database engineer at Move.com,

the parent company of Realtor.com, from January 1996 through their IPO in August 1999, and left Move.com in January of 2000.

Mark

DiSiena, Chief Financial Officer & Chief Accounting Officer

Mark

DiSiena joined the executive team on August 1, 2018 and effective November 1, 2018 was appointed as our Chief Financial Officer

and Chief Accounting Officer. Prior joining Social Life Network, Mr. DiSiena was a consultant at Cresset Advisors from January

2016 to October 2018. Previously, Mr. DiSiena served in related leadership roles, including: Chief Financial Officer of Cherokee,

Inc (NASDAQ: CHKE) from November 2010 to March 2013; and Chief Financial Officer at 4Medica, a privately-held software company,

between March 2004 to November 2008. He was an Account Executive at Oracle-NetSuite from January 2014 to December 2015. Mr. DiSiena

has held senior management positions at LVMH from 1999 to 2000 and at Lucent Technologies from 1995 to 1999. Mr. DiSiena, has

consulted at various companies, notably: Cetera Financial Group, Countrywide Bank, American Apparel, Dreamworks, Paramount Pictures,

and HauteLook. He began his career as an auditor at Coopers & Lybrand, from 1988 to 1990. Mr. DiSiena holds a B.S. in Accounting

with honors from New York University, a J.D. from Vanderbilt University, and an M.B.A. from Stanford University; and is both an

attorney and a CPA.

D. Scott Karnedy, Former Chief Operating

Officer & Former Board Member

D. Scott Karnedy was our Chief Operating

Officer from October 12, 2017 to May 10, 2019 and our Director from August 1, 2018 to May 10, 2019. On

May 10, 2019, D. Scott Karnedy resigned as our Chief Operating Officer/Director. Mr. Karnedy has served as an officer or Vice

President of sales and marketing for digital media and Internet companies since 1998, including: Vice President of Sales of AOL

from June of 2001 to December of 2003; Senior Vice President of Sales and Marketing of SiriusXM, from September of 2003 to October

of 2008; Chief Revenue Officer of Technicolor, a Digital Film company from November of 2008 to February of 2012; Chief Revenue

Officer of Indiewire Snag Films, a film production company, from February of 2012 to August of 2014; and Senior Vice President

of Global Sales of Myspace from January of 2014 to August of 2014. Mr. Karnedy has served as the founder and Chief Executive Officer

of Valhalla Advisors, a Revenue Acceleration Company consultant for digital media companies from October of 2014 to October of

2017.

Lesli

Bocskor, Board Member

Leslie

Bockskor has been our Director since August 1, 2018. Leslie Bocskor is the President and Founder of Electrum Partners. Electrum

Partners is known as a pioneer in the cannabis industry as a global cannabis business advisory and services firm. He is also the

Vice Chairman of GB Science, Inc., one of the leading publicly traded life science companies in the legal cannabis industry. Mr.

Bocskor was one of the first investment bankers to focus exclusively on the internet and new media in the mid to late seventies.

Mr. Bocskor has extensive experience working in cannabis space, even being dubbed the “Warren Buffet of Cannabis”

on CNBC.

Kenneth

Granville, Board Member

Kenneth

Granville has been our Director since August 1, 2018. Kenneth Granville is the Cofounder and CEO of MindAptiv. established in

2011, which enables machines to adapt to humans through semantic intelligence, the next generation of machine learning that translates

human meanings for generating functional code on-the-fly. He has also held various operations and engineering positions at the

USAF, Lockeed Martin and then L-3 Communications from 1980 to 1992, 1992 to 2003 and 2003 through 2008 respectively. Mr. Granville

has an extensive knowledge background in signal intelligence, cyber security, systems networking, enterprise architecture, computing

platforms, as well as artificial and semantic intelligence.

Vincent

(Tripp) Keber III, Board Member

Vincent

(Tripp) Keber has been our Director since August 1, 2018. Vincent Tripp Keber is widely considered one of the most prominent and

well-known business leaders in the cannabis industry. Additionally, Mr. Keber is recognized as a branding expert in the adult

use and medical cannabis spaces. He is the co-founder and Former CEO of Dixie Brands, Inc. (DIXI-U.CN), a cannabis centric

branding company, known worldwide for its namesake cannabis-infused beverages, Dixie Elixirs, Aceso and Therabis, Dixie’s

human and pet CBD wellness brand platforms respectively, as well as hundreds of other cannabis products. Mr. Keber has served

as a Director for several cannabis industry organizations, including the National Cannabis Industry Association, the Marijuana

Policy Project, and the National Association of Cannabis Businesses. He has also held many senior and C-level positions in realty,

communications and other industries.

George

Jage

, Chief Operating Officer & Board Member

George Jage has

been our Chief Operating Officer/Board Member since May 10, 2019.

George

Jage has been the President of MjLink.com,Inc., our wholly owned subsidiary, since January 2, 2019. George Jage has more than

25 years of experience as an owner, founder, and fast-growth specialist in the publishing, events, and media industries. He has

received awards and recognitions including Gourmet News Top 20 under 40 (2006); InBusiness magazine’s Nevada Entrepreneur

Award (2008); UNLV Jerry Valen Award of Distinction (2010); Tradeshow Executive’s Tradeshow Elite (2013) and was featured

on the cover of Tradeshow Executive in May 2017. He served on the Board of Directors for the Society of Independent Show Organizers

(SISO) from 2009 through 2014 and chaired the SISO Executive Conference in 2010, 2011, and 2013.

George

Jage built, owned and operated two business media companies with successful exits with the Off-Price Specialist Show and World

Tea Media from 1993 through 2012. World Tea Media included World Tea Expo, World Tea East, North American Tea Championship, World

Tea News, and World Tea Academy. World Tea Expo was named as a Fastest 50 growing events by Tradeshow Week in 2006, 2008, and

2009.

In

2014, George Jage joined an emerging start-up publisher in the hyper-competitive cannabis markets as President of Marijuana Business

Daily. In 3 years, he grew the businesses revenue, profitability and its flagship event, Marijuana Business Conference and Expo,

which was named the fastest-growing Tradeshow in the entire U.S. in 2015 and the fastest-growing Semiannual Tradeshow in the U.S.

in 2016 by Tradeshow Executive Magazine. The Company was named as #304 to Inc.’s 500 fastest growing company list in 2016.

In

mid-2017, George Jage joined Dope Media as the Chief Executive Officer at the bequest of the investors to recapitalize the business

from Dope’s early fast-growth trajectory. Within 6 months, George secured 3 parties to tender offers for the acquisition

of the business and following the completion of a PCAOB-compliance audit, sold the assets of Dope Media to Trans High Corporations

(High Times) in October 2018.

Andrew

Rodosevich, Former Chief Financial Officer & Former Board Member

Andrew

Rodosevich served as our Chief Financial Officer/Director from June 6, 2016 to July 31, 2018, at which time he resigned as our

CFO/Director. From January 2013 to June 2016, he was the Chief Financial Officer of Life Marketing, Inc., the forerunner of the

then private company, Social Life Network, Inc. Andrew Rodosevich was the Chief Executive Officer and founder of Elevated Medical,

a licensed medical cannabis dispensary company in Colorado, from October 2009 to January of 2011.

SECURITY

OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT AND RELATED STOCKHOLDER MATTERS

The

following table sets forth, as of May 15, 2019 certain information with respect to the beneficial ownership of our common

stock by each stockholder known by us to be the beneficial owner of more than 5% of any class of our voting securities and by

each of our current directors, our named executive officers and by our current executive officers and directors as a group.

|

Name of Beneficial Owner

|

|

Title of Class

|

|

Amount and Nature of Beneficial

Ownership(1)

|

|

|

Percentage of

Class(2)

|

|

LVC Consulting, LLC

c/o Kenneth Tapp

8100 E. Union Ave., Suite 1809

Denver, Colorado 80237

|

|

Common Stock

|

|

|

59,736,667

|

(3)

|

|

|

46.6

|

|

Rodosevich Investments, LLC

c/o Andrew Rodosevich

8100 E. Union Ave., Suite 1809

Denver, Colorado 80237

|

|

Common Stock

|

|

|

14,736,667

|

(4)

|

|

|

11.5

|

|

Somerset Private Fund, Ltd.

387 Corona Street, Suite 55

Denver, CO 80218

|

|

Common Stock

|

|

|

13,320,000

|

(5)

|

|

|

10.4

|

|

Electrum Partners

c/o Leslie Bocskor

3571 E Sunset Road, Suite 300

Las Vegas, NV 89120

|

|

Common Stock

|

|

|

3,000,000

|

(6)

|

|

|

2.4

|

|

|

Rightside Advisors, Inc

c/oVincent “Tripp” Keber III

8100 E. Union Ave., Suite 1809

Denver, Colorado 80237

|

|

Common Stock

|

|

|

3

,000,000

|

(7)

|

|

|

2.4

|

|

|

D. Scott Karnedy

|

|

|

|

|

|

|

|

|

|

|

|

c/o 8100 E. Union Ave., Suite 1809

|

|

|

|

|

|

|

|

|

|

|

|

Denver, Colorado 80237

|

|

Common Stock

|

|

|

1,000,000

|

(8)

|

|

|

0.8

|

|

|

Mark DiSiena

|

|

|

|

|

|

|

|

|

|

|

|

c/o 8100 E. Union Ave., Suite 1809

|

|

|

|

|

|

|

|

|

|

|

|

Denver, Colorado 80237

|

|

Common Stock

|

|

|

1,000,000

|

(9)

|

|

|

0.8

|

|

|

George Jage

c/o 8100 E. Union Avenue, Suite 1809

Denver, Colorado 80237

|

|

Common Stock

|

|

|

0

|

(10)

|

|

|

0.0

|

|

|

All executive officers and directors as a group (7 persons)

|

|

Common Stock

|

|

|

95,793,334

|

|

|

|

74.9

|

|

|

(1)

|

Except

as otherwise indicated, we believe that the beneficial owners of the common stock listed above, based on information furnished

by such owners, have sole investment and voting power with respect to such shares, subject to community property laws where

applicable. Beneficial ownership is determined in accordance with the rules of the SEC and generally includes voting or investment

power with respect to securities. Common stock subject to options or warrants currently exercisable or exercisable within

60 days, are deemed outstanding for purposes of computing the percentage ownership of the person holding such option or warrants

but are not deemed outstanding for purposes of computing the percentage ownership of any other person.

|

|

(2)

|

Percentage of common stock

is based on 128,108,943 shares of our common stock issued and outstanding as of May 15, 2019

|

|

(3)

|

Mr.

Tapp was appointed as Chief Executive Officer, Chief Technology Officer, and Chairman on June 6, 2016. He was Chief Financial

Officer from August 1, 2018 thru October 31, 2018.

|

|

|

|

|

(4)

|

Mr.

Rodosevich was appointed as Chief Financial Officer since June 6, 2016, which he resigned from that position effective July

31, 2018.

|

|

|

|

|

(5)

|

Somerset

Private Fund, Ltd. (“Somerset”) is registered in the state of Colorado. There are 6 limited partners of Somerset.

Robert Stevens, Somerset’s President holds a 90% interest in Somerset. Somerset’s Board of Directors has sole

dispositive and transfer power over the shares. Robert Stevens was appointed as the receiver in 2014 when we were placed into

Receivership in Nevada’s 8th Judicial District (White Tiger Partners, LLC et al v. Sew Cal Logo, Inc.et al, Case No

A-14-697251-C) (Dept. No.: XIII).

|

|

|

|

|

(6)

|

We

granted 3,000,000 shares of common stock to Electrum Partners for their professional services. Our Director, Mr. Bocskor is

the President/Founder of Electrum Partners; and he has been a Director since August 1, 2018.

|

|

|

|

|

(7)

|

Mr.

Keber has been a Director since August 1, 2018 and was granted 2,000.000 common shares to date; and with his indirect holdings

of 1,000,000 common shares through Rightside Advisors, controls 3,000,000 common shares or 2.4%

|

|

|

|

|

(8)

|

Mr.

Karnedy became our Chief Operating Officer in October 2017 and was appointed a director of our Company on August 1, 2018:

he resigned as our Chief Operating Officer/Director on May 10, 2019.

|

|

|

|

|

(9)

|

Mr.

DiSiena was appointed as Chief Financial Officer on November 1, 2018, after being our consulting from August 1, 2018 through

October 31, 2018.

|

|

|

|

|

(10)

|

George Jage was appointed

as our Chief Operating Officer on May 10, 2019.

|

Changes

in Control

We

are unaware of any contract or other arrangement the operation of which may at a subsequent date result in a change in control

of our company.

CERTAIN

RELATIONSHIPS AND RELATED TRANSACTIONS, AND DIRECTOR INDEPENDENCE

Other

than as disclosed below, there has been no transaction, since January 1, 2019, or currently proposed transaction, in which our

company was or is to be a participant and the amount involved exceeds $5,000, being the lesser of $120,000 or one percent of our

total assets at December 31, 2018, and in which any of the following persons had or will have a direct or indirect material interest:

|

|

(a)

|

any

director or executive officer of our company;

|

|

|

|

|

|

|

(b)

|

any

person who beneficially owns, directly or indirectly, more than 5% of any class of our voting securities;

|

|

|

|

|

|

|

(c)

|

any

person who acquired control of our company when it was a shell company or any person that is part of a group, consisting of

two or more persons that agreed to act together for the purpose of acquiring, holding, voting or disposing of our common stock,

that acquired control of our company when it was a shell company; and

|

|

|

|

|

|

|

(d)

|

any

member of the immediate family (including spouse, parents, children, siblings and in- laws) of any of the foregoing persons.

|

We have software

license agreements with Real Estate Social Network, Inc. and Sports Social Network, which provides that our licensees pay us a

license fee of $125,000 per year or a period of two years and thereafter receive a 20% percentage of profits. Our Chief Executive

Office, Kenneth Tapp owns 46.6% of our outstanding shares and is also the Chief Technology Officer of Real Estate Social

Network and Sports Social Network and owns approximately 40% each of those entities through LVC Consulting, LLC, of which he is

the only member. Our Chief Financial Officer, Andrew Rodosevich, owns 11.5% of our outstanding shares and is a Managing

Member of Real Estate Social Network and Sports Social Network and owns approximately 10% of those entities through Rodosevich

Investments, LLC, of which Andrew Rodosevich is the sole member. During our Fiscal Year 2018, our largest source of our revenues

was $215,000 in social network platform licensing revenues, which constituted 97.5% of our total revenues, which were derived

solely from the only 2 licensees we have agreements with, the Real Estate Social Network and Sports Social Network, which revenues

are related party revenues.

Pricing

for the license agreements were negotiated with the Chief Executive Officers of Real Estate Social Network and Sports Social Network

using a “Royalty Flex-Rate” method per network end-user. Our Chief Executive Officer and prior-Chief Financial Officer

represented us in the negotiations with Real Estate Social Network and Sports Social Network in our negotiations involving the

license agreements.

This

type of licensing is the standard when licensing intellectual property per users. The rates were determined by existing users

in the Sports Social Network, and future predicted users in the Real Estate Social Network. We researched competing Social Network

licensing platforms for pricing and features, and determined that the most similar to our Network Platform was SocialShared.com

(https://www.socialshared.com/plans.html), which currently provides the United States Tennis Association with their own social

network (Setteo.com) for $2.25 per month per end-user, a competitor to the Sports Social Network, Inc. website, RacketStar.com

Our

related party revenue for Fiscal Year 2018 was $215,000 or 97.5% of gross revenue. As of March 31, 2019, our largest source

of our revenues was $25,000 for the first quarter in social network platform licensing revenues, which constituted 90.9% of our

total revenues.

On

June 6, 2016, we issued 59,736,667 common stock shares to LVC Consulting, LLC. The shares are valued at $0.15, the closing stock

price on the date of grant, for total non-cash expense of $8,960,500. The Managing Member of LVC Consulting is our Chief Executive

Officer, Kenneth Tapp.

On

June 6, 2016, we issued 59,736,667 common stock shares to Rodosevich Investments, LLC. The shares are valued at $0.15, the closing

stock price on the date of grant, for total non-cash expense of $8,960,500. 50,000,000 of these shares were returned to

the Company on December 7, 2017. On December 14, we issued 5,000,000 restricted common stock shares to Rodosevich Investments,

LLC. The shares are valued at $0.13, the closing stock price on the date of grant, for total non-cash expense of $650,000. The

Managing Member of Rodosevich Investments is our prior-Chief Financial Officer, Andrew Rodosevich.

On

July 18, 2016, we executed a Note Payable with Andrew Rodosevich, the Company’s CFO, for $26,400 to pay for public company

expenses. The note is unsecured, non-interest bearing and due December 31, 2019. As of December 31, 2018, the balance is zero

dollars due.

On

September 1, 2016, we executed a Note Payable with Like RE, Inc. for $53,000. Kenneth Tapp, our Chief Executive Officer also an

officer with Like RE, Inc. The note is unsecured, non-interest bearing and due December 31, 2018. As of December 31, 2018, the

balance is zero dollars due.

On

January 3, 2019, we completed an employment agreement with George Jage, President of MjLink, providing that effective on the 91st

day after the start date of the agreement (the “Grant Date”) and subject to the approval of our Board of Directors,

George Jage will be granted the equivalent in shares to equal 2.5% of the outstanding shares of MjLink that will vest on a monthly

basis after 90 days of employment in equal parts in months 4 through 12. Additionally, the employment agreement provides George

Jage with the opportunity to earn an additional 2.5% of MjLink’s equity during the first year of this employment contract

based on performance goals met. All stock issuances to Mr. Jage are subject to applicable holdings periods and volume limitations

under Securities Act Rule 144. If Mr. Jage resigns as MjLink’s President during the first 24 months of the employment agreement,

all stock previously issued to him are required to be returned to MjLink’s treasury. For fiscal year ending 2019, Mr. Jage

is expected to earn $180,000 of executive compensation and $1,500 per month for healthcare benefits.

On

November 1, 2018, the Company authorized the issuance of 500,000 restricted common stock shares to Mark DiSiena, Chief Financial

Officer, for his CFO services. The shares are valued at $0.10 the closing stock price on the date of grant, for total non-cash

expense of $50,000. On February 6, 2019, we authorized an additional 500,000 restricted common stock shares to Mark DiSiena, our

Chief Financial Officer valued at $50,000. The 1,000,000 shares were issued during the three months ended March 31, 2019. For

fiscal year ending 2019, Mr. DiSiena is expected to earn $120,000 of executive compensation.

EXECUTIVE

COMPENSATION

The

particulars of compensation paid to the following persons:

|

|

(a)

|

all

individuals serving as our principal executive officer during the year ended December 31, 2018;

|

|

|

|

|

|

|

(b)

|

each

of our two most highly compensated executive officers who were serving as executive officers at the end of the year ended

December 31, 2018; and

|

who

we will collectively refer to as the named executive officers, for all services rendered in all capacities to our company and

subsidiaries for the years ended December 31, 2018 and December 31, 2017 are set out in the following summary compensation table:

|

Summary

Compensation Table

|

|

Name

and Principal Position

|

|

Year

|

|

|

Salary

($)

|

|

|

Bonus

($)

|

|

|

Stock

Awards

($)

|

|

|

Option

Awards

($)

|

|

|

Non-Equity

Incentive

Plan

Compensation

($)

|

|

|

Nonqualified

Deferred

Compensation

Earnings

($)

|

|

|

All

Other

Compensation

($)

|

|

|

Total

($)

|

|

|

Kenneth

Tapp

(1)

|

|

2018

|

(5)

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

Chairman,

Chief Executive Officer, and Chief Technology Office

|

|

2017

|

(6)

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

Mark

DiSiena

(2)

|

|

2018

|

(5)

|

|

|

26,500

|

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

26,500

|

|

|

Chief

Financial Officer

|

|

2017

|

(6)

|

|

|

|

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

Andrew

Rodosevich

(3)

|

|

2018

|

(5)

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

Chief

Financial Officer/Director

|

|

2017

|

(6)

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

D.

Scott Karnedy

(4)

|

|

2018

|

(5)

|

|

|

60,000

|

|

|

|

-

|

|

|

|

75,000

|

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

135,000

|

|

|

Former-

Chief

Operating Officer/Director

|

|

2017

|

(6)

|

|

|

-

|

|

|

|

-

|

|

|

|

75,000

|

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

75,000

|

|

|

George

Jage

|

|

2017

|

(5)(7)

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

Chief

Operating Officer/ Director

|

|

2018

|

(6)(7)

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

(1)

|

Mr.

Tapp was appointed as Chief Executive Officer, Chief Technology Officer, and Chairman since June 6, 2016. And was Chief Financial

Officer from August 1, 2018 thru October 31, 2018. For fiscal year ending 2019, Mr. Tapp is expected to earn zero dollars

of executive compensation.

|

|

|

|

|

(2)

|

Mr.

DiSiena was appointed as Chief Financial Officer on November 1, 2018, after being our consult from August 1, 2018 through

October 31, 2018. For fiscal year ending 2019, Mr. DiSiena is expected to earn $120,000 of executive compensation.

|

|

|

|

|

(3)

|

Mr.

Rodosevich was appointed as Chief Financial Officer since June 6, 2016, which he resigned from that position effective July

31, 2018.

|

|

|

|

|

(4)

|

Mr.

Karnedy became our Chief Operating Officer in October 2017 and was appointed a director of our Company on August 1, 2018;

he resigned as our Chief Operating Officer/Director on May 10, 2019.

|

|

|

|

|

(5)

|

Year

ended December 31, 2017.

|

|

|

|

|

(6)

|

Year

ended December 31, 2018.

|

|

|

|

|

(7)

|

Mr. Jage did not commence his employment

until January 2019. For fiscal year ending 2019, Mr. Jage is expected to earn $180,000 of executive compensation and $1,500

per month for healthcare benefits.

|

Retirement

or Similar Benefit Plans

There

are no arrangements or plans in which we provide retirement or similar benefits for our directors or executive officers.

Resignation,

Retirement, Other Termination, or Change in Control Arrangements

Other

than the employment agreement with Mr. DiSiena and Mr. Karnedy, we have no contract, agreement, plan or arrangement, whether written

or unwritten, that provides for payments to our directors or executive officers at, following, or in connection with the resignation,

retirement or other termination of our directors or executive officers, or a change in control of our company or a change in our

directors’ or executive officers’ responsibilities following a change in control.

Compensation

of Directors

The

table below shows the compensation of our directors who were not our named executive officers for the fiscal year ended December

31, 2018:

|

Name

|

|

Fees

earned or paid in cash

($)

|

|

|

Stock

awards

($)

|

|

|

Option

awards

($)

|

|

|

Non-equity

incentive plan compensation

($)

|

|

|

Nonqualified

deferred compensation earnings

($)

|

|

|

All

other compensation

($)

|

|

|

Total

($)

|

|

|

Leslie

Bocskor

(1) (2)

|

|

|

25,000

|

|

|

|

360,000

|

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

385,000

|

|

|

Kenneth

Granville

(1)

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

Vincent

(Tripp) Keber

(1)

|

|

|

80,000

|

|

|

|

450,000

|

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

530,000

|

|

|

George Jage

(1) (3)

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

(1)

|

Mr.

Bocskor, Mr. Granville, and Mr. Keber were all appointed as our directors of our company on August 1, 2018. Mr. Jage was

appointed as our director of our company on May 10, 2019.

|

|

|

|

|

(2)

|

We

granted 3,000,000 shares of common stock to Electrum Partners, LLC for their professional services. Our Director, Mr. Bocksor

is the President/Founder of Electrum Partners; his firm received $25,000 in consulting fees for fiscal year 2018.

|

|

|

|

|

(3)

|

Mr. Jage did not commence

his employment until January 2019. For fiscal year ending 2019, Mr. Jage is expected

to earn $180,000 of executive compensation and $1,500 per month for healthcare benefits.

|

Golden

Parachute Compensation

For

a description of the terms of any agreement or understanding, whether written or unwritten, between our company and any officer

or director concerning any type of compensation, whether present, deferred or contingent, that will be based on or otherwise will

relate to an acquisition, merger, consolidation, sale or other type of disposition of all or substantially all assets of our company,

see above under the heading “Compensation Discussion and Analysis”.

We

have no formal plan for compensating our directors for their services in their capacity as directors. Our directors are entitled

to reimbursement for reasonable travel and other out-of-pocket expenses incurred in connection with attendance at meetings of

our board of directors. Our board of directors may award special remuneration to any director undertaking any special services

on their behalf other than services ordinarily required of a director.

Section

16(a) Beneficial Ownership Reporting Compliance

Section

16(a) of the Securities Exchange Act of 1934 requires our officers and directors and persons who own more than 10% of the outstanding

Shares to file reports of ownership and changes in ownership concerning their Shares with the SEC and to furnish us with copies

of all Section 16(a) forms they file. We are required to disclose delinquent filings of reports by such persons.

Based

solely on the copies of such reports and amendments thereto received by us, or written representations that no filings were required,

we believe that all Section 16(a) filing requirements applicable to our executive officers and directors and 10% stockholders

were met for the year ended December 31, 2018.

Code

of Ethics

We

have adopted a formal code of ethics within the meaning of Item 406 of Regulation S-K promulgated under the Securities Act, that

applies to our principal executive officer, principal financial officer, principal accounting officer or controller, or persons

performing similar functions that establishes, among other things, procedures for handling actual or apparent conflicts of interest.

Committees

of Board of Directors

Audit

We

do not have an audit committee that provides independent review and oversight of a company’s financial reporting processes,

internal controls, and independent auditors. Management is responsible for establishing and maintaining adequate internal control

over our financial reporting. Our internal control over financial reporting was not subject to attestation by our independent

registered public accounting firm pursuant to rules of the SEC that permit us to provide only management’s report in this

annual report.

Governance

We

do not have any defined policy or procedure requirements for our stockholders to submit recommendations or nominations for directors.

We do not currently have any specific or minimum criteria for the election of nominees to our board of directors and we do not

have any specific process or procedure for evaluating such nominees. Our board of directors assesses all candidates, whether submitted

by management or stockholders, and makes recommendations for election or appointment.

Compensation

Our

board of directors is responsible for determining compensation for the directors of our company to ensure it reflects the responsibilities

and risks of being a director of a public company.

Other

Board Committees

We

have no committees of our board of directors.

Corporate

Governance

General

Our

board of directors believes that good corporate governance improves corporate performance and benefits all stockholders. Canadian

National Policy 58-201 Corporate Governance Guidelines provides non-prescriptive guidelines on corporate governance practices

for reporting issuers such as the Company. In addition, Canadian National Instrument 58-101 Disclosure of Corporate Governance

Practices prescribes certain disclosure by our company of its corporate governance practices. This disclosure is presented below.

Orientation

and Continuing Education

We

have an informal process to orient and educate new recruits to the board regarding their role on the board, our committees and

our directors, as well as the nature and operations of our business. This process provides for an orientation with key members

of the management staff, and further provides access to materials necessary to inform them of the information required to carry

out their responsibilities as a board member. This information includes the most recent board approved budget, the most recent

annual report, the audited financial statements and copies of the interim quarterly financial statements.

The

board does not provide continuing education for its directors. Each director is responsible to maintain the skills and knowledge

necessary to meet his obligations as director.

Ethical

Business Conduct

We

have adopted a formal code of ethics within the meaning of Item 406 of Regulation S-K promulgated under the Securities Act of

1933, as amended, that applies to our principal executive officer, principal financial officer, principal accounting officer or

controller, or persons performing similar functions that establishes, among other things, procedures for handling actual or apparent

conflicts of interest.

We

have found that the fiduciary duties placed on individual directors by our governing corporate legislation and the common law

and the restrictions placed by applicable corporate legislation on an individual director’s participation in decisions of

the board of directors in which the director has an interest have been sufficient to ensure that the board of directors operates

in the best interests of our company.

Nomination

of Directors

As

of May 2, 2019, we had not affected any material changes to the procedures by which our stockholders may recommend nominees to

our board of directors. Our board of directors does not have a policy with regards to the consideration of any director candidates

recommended by our stockholders. Our board of directors has determined that it is in the best position to evaluate our company’s

requirements as well as the qualifications of each candidate when the board considers a nominee for a position on our board of

directors. If stockholders wish to recommend candidates directly to our board, they may do so by sending communications to the

president of our company at the address on the cover of this annual report.

Compensation

Our

board of directors is responsible for determining compensation for the directors of our company to ensure it reflects the responsibilities

and risks of being a director of a public company.

Other

Board Committees

We

do not have an audit committee that provides independent review and oversight of a company’s financial reporting processes,

internal controls, and independent auditors

We

have no committees of our board of directors. We do not have any defined policy or procedure requirements for our stockholders

to submit recommendations or nominations for directors. We do not currently have any specific or minimum criteria for the election

of nominees to our board of directors and we do not have any specific process or procedure for evaluating such nominees. Our board

of directors assesses all candidates, whether submitted by management or stockholders, and makes recommendations for election

or appointment.

A

stockholder who wishes to communicate with our board of directors may do so by directing a written request to the address appearing

on the first page of this annual report.

Assessments

The

board intends that individual director assessments be conducted by other directors, taking into account each director’s

contributions at board meetings, service on committees, experience base, and their general ability to contribute to one or more

of our company’s major needs. However, due to our stage of development and our need to deal with other urgent priorities,

the board has not yet implemented such a process of assessment.

Director

Independence

We

are not currently listed on the Nasdaq Stock Market, which requires independent directors. In evaluating the independence of our

members and the composition of the committees of our board of directors, we utilize the definition of “independence”

as that term is defined by applicable listing standards of the Nasdaq Stock Market and Securities and Exchange Commission rules,

including the rules relating to the independence standards of an audit committee and the non-employee director definition of Rule

16b-3 promulgated under the Securities Exchange Act of 1934, as amended.

According

to the Nasdaq definition, we believe Kenneth Granville is an independent director because he is not an officer of our company

and not a beneficial owner of a material amount of shares of our common stock and has not received compensation from us in excess

of the relevant limits. We have determined that Kenneth Tapp and D. Scott Karnedy are not independent due to the fact that they

are our employees and determined that Leslie Bocskor and Vincent (Tripp) Keber are not independent because they receive compensation

directly or indirectly from us for consulting services.

Our

board of directors expects to continue to evaluate its independence standards and whether and to what extent the composition of

our board of directors and its committees meets those standards. We ultimately intend to appoint such persons to our board and

committees of our board as are expected to be required to meet the corporate governance requirements imposed by a national securities

exchange. Therefore, we intend that a majority of our directors will be independent directors of which at least one director will

qualify as an “audit committee financial expert,” within the meaning of Item 407(d)(5) of Regulation S-K, as promulgated

under the Securities Act of 1933, as amended.

WHERE

YOU CAN OBTAIN ADDITIONAL INFORMATION

WHERE

YOU CAN FIND MORE INFORMATION

This

Information Statement refers to certain documents that are not presented herein or delivered herewith. Such documents are

available to any person, including any beneficial owner of our shares, to whom this Information Statement is delivered upon oral

or written request, without charge.

We

file annual and special reports and other information with the SEC. Certain of our SEC filings are available over the Internet

at the SEC’s web site at http://www.sec.gov. You may also read and copy any document we file with the SEC at its public

reference facilities:

Public

Reference Room Office

100

F Street, N.E.

Room

1580

Washington,

D.C. 20549

You

may also obtain copies of the documents at prescribed rates by writing to the Public Reference Section of the SEC at 100 F Street,

N.E., Room 1580, Washington, D.C. 20549. Callers in the United States can also call 1-202-551-8090 for further information on

the operations of the public reference facilities.

Pursuant

to the requirements of the Securities Exchange Act of 1934, as amended, the Registrant has duly caused this Information Statement

to be signed on its behalf by the undersigned on May 16, 2019.

|

|

SOCIAL

LIFE NETWORK, INC.

|

|

|

|

|

|

|

By:

|

/s/

Ken Tapp

|

|

|

|

Ken

Tapp, CEO

|

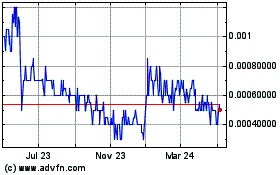

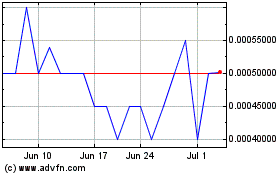

Decentral Life (PK) (USOTC:WDLF)

Historical Stock Chart

From Mar 2024 to Apr 2024

Decentral Life (PK) (USOTC:WDLF)

Historical Stock Chart

From Apr 2023 to Apr 2024