- Initial Statement of Beneficial Ownership (3)

May 25 2012 - 4:34PM

Edgar (US Regulatory)

|

FORM 3

|

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

INITIAL STATEMENT OF BENEFICIAL OWNERSHIP OF SECURITIES

|

OMB APPROVAL

OMB Number:

3235-0104

Estimated average burden

hours per response...

0.5

|

|

Filed pursuant to Section 16(a) of the Securities Exchange Act of 1934, Section 17(a) of the Public Utility Holding Company Act of 1935 or Section 30(h) of the Investment Company Act of 1940

|

|

|

1. Name and Address of Reporting Person

*

Friedman Kenneth T

|

2. Date of Event Requiring Statement (MM/DD/YYYY)

5/15/2012

|

3. Issuer Name

and

Ticker or Trading Symbol

JBI, INC. [JBII.PK]

|

|

(Last)

(First)

(Middle)

27800 PACIFIC COAST HIGHWAY,

|

4. Relationship of Reporting Person(s) to Issuer (Check all applicable)

_____ Director

___

X

___ 10% Owner

_____ Officer (give title below)

_____ Other (specify below)

|

|

(Street)

MALIBU, CA 90265

(City)

(State)

(Zip)

|

5. If Amendment, Date Original Filed

(MM/DD/YYYY)

|

6. Individual or Joint/Group Filing

(Check Applicable Line)

___ Form filed by One Reporting Person

_

X

_ Form filed by More than One Reporting Person

|

Table I - Non-Derivative Securities Beneficially Owned

|

1.Title of Security

(Instr. 4)

|

2. Amount of Securities Beneficially Owned

(Instr. 4)

|

3. Ownership Form: Direct (D) or Indirect (I)

(Instr. 5)

|

4. Nature of Indirect Beneficial Ownership

(Instr. 5)

|

|

Common Stock

(1)

(2)

|

1511803

|

D

|

|

|

Common Stock

(1)

(2)

|

5500

|

I

|

By daughter

(2)

|

|

Common Stock

(1)

(3)

|

1397297

|

D

|

|

|

Common Stock

(1)

(3)

|

1397297

|

D

|

|

|

Common Stock

(1)

(4)

|

425000

|

D

|

|

|

Common Stock

(1)

(5)

|

650000

|

D

|

|

|

Common Stock

(1)

(6)

|

650000

|

D

|

|

|

Common Stock

(1)

(7)

|

597571

|

D

|

|

|

Common Stock

(1)

(8)

|

125000

|

D

|

|

|

Common Stock

(1)

(9)

|

1000000

|

D

|

|

|

Common Stock

(1)

(10)

|

1000000

|

D

|

|

Table II - Derivative Securities Beneficially Owned (

e.g.

, puts, calls, warrants, options, convertible securities)

|

1. Title of Derivate Security

(Instr. 4)

|

2. Date Exercisable and Expiration Date

(MM/DD/YYYY)

|

3. Title and Amount of Securities Underlying Derivative Security

(Instr. 4)

|

4. Conversion or Exercise Price of Derivative Security

|

5. Ownership Form of Derivative Security: Direct (D) or Indirect (I)

(Instr. 5)

|

6. Nature of Indirect Beneficial Ownership

(Instr. 5)

|

|

Date Exercisable

|

Expiration Date

|

Title

|

Amount or Number of Shares

|

|

Explanation of Responses:

|

|

(

1)

|

For the purposes of this Form 3, each Reporting Person disclaims beneficial ownership of the shares of common stock owned by the other Reporting Persons except to the extent of their pecuniary interest therein. This Initial Statement of Beneficial Ownership of Securities on Form 3 should be read in conjunction with the additional Form 3 filed by Michael B. Dorrell and certain other Purchasers on May 25, 2012.

|

|

(

2)

|

Consists of 1,517,303 shares held by Mr. Friedman consisting of (i) 1,511,803 shares held directly by Mr. Friedman and (ii) 5,500 shares held by Mr. Friedman's adult daughter.

|

|

(

3)

|

Consists of 1,397,297 shares held directly by Ms. Ishimaru and Mr. Linden, as joint tenants with rights of survivorship.

|

|

(

4)

|

Consists of 425,000 shares held directly by Mr. May.

|

|

(

5)

|

Consists of 650,000 shares held directly by Moreno Energy, Inc.

|

|

(

6)

|

Consists of 125,000 shares held directly by Mr. Murdoch.

|

|

(

7)

|

Consists of 597,571 shares held directly by Mr. Scott.

|

|

(

8)

|

Consists of 125,000 shares held directly by Mr. Taylor.

|

|

(

9)

|

Consists of 1,000,000 shares held directly by Mr. Vichie.

|

|

(

10)

|

Consists of 1,000,000 shares held directly by Mr. Weinstein.

|

Remarks:

Please see Exhibits 24.1 through 24.8 and Exhibit 99 for powers of attorney for each Reporting Person.

Between May 15, 2012 and May 18, 2012, JBI, Inc.(the "Issuer") entered into Subscription Agreements(the "Purchase Agreements") with several accredited investors (collectively, the "Purchasers"), including the Reporting Persons in connection with a private placement of shares (the "Shares") of common stock. As a condition to the closing of the transactions contemplated by the Purchase Agreements, the Purchasers required John W. Bordynuik to enter into a letter agreement, dated as of May 15, 2012("Letter Agreement"),pursuant to which Mr. Bordynuik made certain agreements regarding the voting of his shares of Common Stock and his one million shares of the Issuer's Series A super majority voting preferred stock, $0.01 par value per share. Mr. Bordynuik is the current Chief of Technology of the Issuer and the former President and Chief Executive Officer of the Issuer.

As a result of agreements related to the private placement, including but not limited to the Letter Agreement, the Reporting Persons and the other parties to the Letter Agreement (other than Mr. Bordynuik and the Waiving Purchasers)may be deemed to comprise a "group" within the meaning of Section 13(d)(3)of the Exchange Act and may be deemed to beneficially own in excess of 10% of the outstanding shares of common stock of the Issuer, although neither the fact of this filing nor any information contained herein shall be deemed to be an admission by the Reporting Persons that a "group" exists.

The foregoing summary of the private placement and the Letter Agreement is qualified in its entirety by reference to the Issuer's Current Reports on Form 8-K filed on May 17, 2012 and May 22, 2012, and the Schedule 13D filed by the Reporting Persons regarding ownership of shares the Issuer's common stock on May 25, 2012.

|

Reporting Owners

|

|

Reporting Owner Name / Address

|

Relationships

|

|

Director

|

10% Owner

|

Officer

|

Other

|

Friedman Kenneth T

27800 PACIFIC COAST HIGHWAY

MALIBU, CA 90265

|

|

X

|

|

|

Ishimaru Asami

1049 FIFTH AVENUE

NEW YORK, NY 10028

|

|

X

|

|

|

Linden Craig

1049 FIFTH AVENUE

NEW YORK, NY 10028

|

|

X

|

|

|

May Samuel

350 SOUTH GRANDE AVENUE

LOS ANGELES, CA 90071

|

|

X

|

|

|

Moreno Energy, Inc.

8818 STABLE CREST BLVD

HOUSTON, TX 77024

|

|

X

|

|

|

Murdoch Duncan D

125 W. 55TH STREET

NEW YORK, NY 10019

|

|

X

|

|

|

Scott Sherwin N

21090 NORTH PIMA ROAD

SCOTTSDALE, AZ 85255

|

|

X

|

|

|

Taylor Luke R

717 FIFTH AVENUE

FLOOR 14

NEW YORK, NY 10022

|

|

X

|

|

|

Vichie Trent D

717 FIFTH AVENUE

FLOOR 14

NEW YORK, NY 10022

|

|

X

|

|

|

Weinstein Lawrence A

919 SOUTH GRAND AVENUE

LOS ANGELES, CA 90015

|

|

X

|

|

|

Signatures

|

|

/s/ David I. Meyers, attorney-in-fact for Kenneth T. Friedman

|

|

5/25/2012

|

|

**

Signature of Reporting Person

|

Date

|

|

/s/ David I. Meyers, attorney-in-fact for Asami Ishimaru

|

|

5/25/2012

|

|

**

Signature of Reporting Person

|

Date

|

|

/s/ David I. Meyers, attorney-in-fact for Craig Linden

|

|

5/25/2012

|

|

**

Signature of Reporting Person

|

Date

|

|

/s/ David I. Meyers, attorney-in-fact for Samuel May

|

|

5/25/2012

|

|

**

Signature of Reporting Person

|

Date

|

|

/s/ David I. Meyers, attorney-in-fact for Moreno Energy, Inc.

|

|

5/25/2012

|

|

**

Signature of Reporting Person

|

Date

|

|

/s/ David I. Meyers, attorney-in-fact for Duncan D. Murdoch

|

|

5/25/2012

|

|

**

Signature of Reporting Person

|

Date

|

|

/s/ David I. Meyers, attorney-in-fact for Sherwin N. Scott

|

|

5/25/2012

|

|

**

Signature of Reporting Person

|

Date

|

|

/s/ David I. Meyers, attorney-in-fact for Luke R. Taylor

|

|

5/25/2012

|

|

**

Signature of Reporting Person

|

Date

|

|

/s/ David I. Meyers, attorney-in-fact for Trent D. Vichie

|

|

5/25/2012

|

|

**

Signature of Reporting Person

|

Date

|

|

/s/ David I. Meyers, attorney-in-fact for Lawrence A. Weinstein

|

|

5/25/2012

|

|

**

Signature of Reporting Person

|

Date

|

|

Reminder: Report on a separate line for each class of securities beneficially owned directly or indirectly.

|

|

*

|

If the form is filed by more than one reporting person,

see

Instruction 5(b)(v).

|

|

**

|

Intentional misstatements or omissions of facts constitute Federal Criminal Violations.

See

18 U.S.C. 1001 and 15 U.S.C. 78ff(a).

|

|

Note:

|

File three copies of this Form, one of which must be manually signed. If space is insufficient,

see

Instruction 6 for procedure.

|

|

Persons who respond to the collection of information contained in this form are not required to respond unless the form displays a currently valid OMB control number.

|

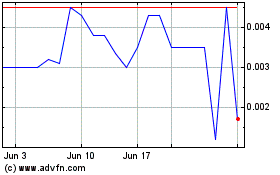

Plastic2Oil (PK) (USOTC:PTOI)

Historical Stock Chart

From May 2024 to Jun 2024

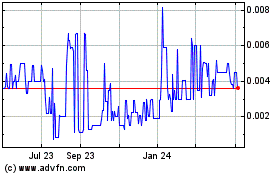

Plastic2Oil (PK) (USOTC:PTOI)

Historical Stock Chart

From Jun 2023 to Jun 2024