Current Report Filing (8-k)

November 22 2022 - 4:26PM

Edgar (US Regulatory)

false

0000770460

0000770460

2022-11-22

2022-11-22

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

|

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

|

|

Date of Report (Date of earliest event reported) November 22, 2022

|

|

PEOPLES FINANCIAL CORPORATION

(Exact Name of Registrant as Specified in its Charter)

|

| |

|

|

|

Mississippi

(State or Other Jurisdiction of Incorporation)

|

|

001-12103

(Commission File Number)

|

64-0709834

(IRS Employer Identification No.)

|

|

152 Lameuse Street Biloxi, MS

(Address of Principal Executive Offices)

|

39530

(Zip Code)

|

|

(228) 435-5511

(Registrant’s Telephone Number, Including Area Code)

|

| |

| |

|

|

(Former Name or Former Address, if Changed Since Last Report)

|

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

Trading

Symbol(s)

|

Name of each exchange on which registered |

| None |

PFBX |

None |

|

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instructions A.2 below):

|

|

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

| |

|

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

| |

|

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

| |

|

☐ Pre-commencement communications pursuant to Rule 13e-4( c) under the Exchange Act (17 CFR 240.13e-4( c))

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933(§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter). Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

--12-31

Item 5.03 Amendments to Articles of Incorporation or Bylaws; Change in Fiscal Year.

On November 22, 2022, the Board of Directors of Peoples Financial Corporation (the “Company”) approved and adopted amended and restated bylaws (the “Amended and Restated Bylaws”) which became effective the same day. Among other things, amendments effected by the Amended and Restated Bylaws include:

| |

●

|

Insert a new Section 1.03 which defines several terms important for compliance with new requirements under Rule 14a-19 and application of the new Bylaw provisions, including definitions for “Acting in Concert,” “Director Questionnaire,” “Nominating Person,” and “Solicitation Statement.” Article I, Section 1.03.

|

| |

●

|

Require that any stockholder directly or indirectly soliciting proxies from other stockholders must use a proxy card other than white, which shall be reserved for exclusive use by the Board of Directors. Article II, Section 2.09.

|

| |

●

|

Revising procedures for bringing business before a stockholder meeting to further define the qualifications of stockholders allowed to do so, limit the subject of such business to those allowed to be brought by stockholders under Mississippi law, supplement requirements for the description of business to be brought before the meeting that must be included in the notice of the proposing stockholder, and require the notice of the proposing stockholder to include information about others supporting the proposal or acting in concert with the proposing stockholder. Article II, Section 2.14.

|

| |

●

|

Require director nominations to comply with SEC requirements and the Bylaws, including new SEC Rule 14a-19 which establishes requirements for the universal proxy. Article III, Sections 3.02.

|

| |

●

|

Confirm that the Board of Directors, a designated committee or an authorized PFBX executive shall determine if the Bylaw requirements have been satisfied. Article III, Section 3.02(g).

|

| |

●

|

Provide that a stockholder’s nominees cannot exceed the number of directors to be elected, and clarify the proper use of alternate nominees. Article III, Section 3.02(f).

|

| |

●

|

Require disclosure of all agreements, arrangements, or understandings between the stockholder or beneficial owner and any other person. Article III, Section 3.02(d).

|

| |

●

|

Require a person who has an agreement, arrangement or understanding with, or is otherwise acting in concert (as defined) with, a nominating stockholder to disclose the same types of information that a “participant” in a proxy solicitation would have to disclose in SEC filings. Article I, Section 1.03(a) and Article III, Section 3.02(d).

|

| |

●

|

Require more detailed disclosure regarding a nominee, including the completion of a Director Questionnaire and the provision of all information required to be disclosed by applicable SEC rules. Section 3.02(d).

|

| |

●

|

Require a written “Solicitation Agreement” that the stockholder or beneficial owner will deliver proxy solicitation materials in compliance with SEC filing requirements, including the requirement of Rule 14a-19 that a definitive proxy statement be delivered to at least 67% of the voting power of the common stock, and comply with all requirements of the Exchange Act and regulations related thereto. Article 1, Section 1.03(m) and Article III, Section 3.02(d).

|

| |

●

|

Require a written undertaking and agreement that the stockholder will update the Company in writing promptly if necessary or if the stockholder fails to satisfy the requirements of Rule 14a-19 for any reason. Otherwise, the stockholder shall prior to the meeting provide the Company evidence that the SEC requirements have been fully satisfied. Article III, Sections 3.02(e) and 3.02(h).

|

| |

●

|

Require disclosure of such other information as may be reasonably requested by the Company to determine compliance with the Bylaws and qualifications of the stockholder’s nominee. Article I, Sections 1.03(c) and 1.03(m) and Article III, Sections 3.02(d) and 3.02(e).

|

| |

●

|

Make a limited number of other clerical revisions to correct an internal reference and ensure consistent use of “stockholders” through the bylaws.

|

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits:

|

Exhibit

Number

|

|

Exhibit Description

|

| |

|

|

|

3.1

|

|

|

|

104

|

|

Inline XBRL Document for the cover page of this Current Report on Form 8-K

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Dated: November 22, 2022

PEOPLES FINANCIAL CORPORATION

By: /s/ Chevis C. Swetman

Chevis C. Swetman

Chairman, President and CEO

Peoples Financial (QX) (USOTC:PFBX)

Historical Stock Chart

From Oct 2024 to Nov 2024

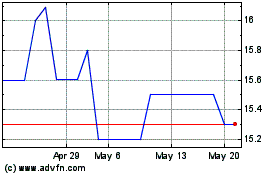

Peoples Financial (QX) (USOTC:PFBX)

Historical Stock Chart

From Nov 2023 to Nov 2024