UNITED

STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(Rule 14a-101)

Information Required in Proxy Statement

Schedule 14a Information

Proxy Statement Pursuant to Section 14(a)

of the Securities Exchange Act of 1934

(Amendment No. 1)

Filed by the Registrant ¨

Filed by a Party other than the Registrant x

Check the appropriate box:

|

|

x

|

Preliminary Proxy Statement

|

|

|

¨

|

Confidential, for Use of the Commission Only (as permitted

by Rule 14a-6(e)(2))

|

|

|

¨

|

Definitive Proxy Statement

|

|

|

¨

|

Definitive Additional Materials

|

|

|

¨

|

Soliciting Material Under Rule 14a-12

|

|

PEOPLES

FINANCIAL CORPORATION

|

|

(Name of Registrant as Specified in Its Charter)

|

|

|

|

STILWELL ACTIVIST INVESTMENTS, L.P.

STILWELL VALUE PARTNERS VII, L.P.

STILWELL ACTIVIST FUND, L.P.

STILWELL VALUE LLC

JOSEPH STILWELL

PETER PRICKETT

|

|

(Name of Persons(s) Filing Proxy Statement, if Other Than the Registrant)

|

Payment of Filing Fee (Check the appropriate box):

|

|

¨

|

Fee computed on table below per Exchange Act Rules 14a-6(i)(1)

and 0-11.

|

|

|

(1)

|

Title of each class of securities to which transaction

applies:

|

|

|

(2)

|

Aggregate number of securities to which transaction

applies:

|

|

|

(3)

|

Per unit price or other underlying value of transaction

computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

|

|

|

(4)

|

Proposed maximum aggregate value of transaction:

|

|

|

¨

|

Fee paid previously with preliminary materials:

|

¨ Check

box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting

fee was paid previously. Identify the previous filing by registration statement number, or the form or schedule and the date of

its filing.

|

|

(1)

|

Amount previously paid:

|

|

|

(2)

|

Form, Schedule or Registration Statement No.:

|

PRELIMINARY COPY SUBJECT TO COMPLETION

DATED MARCH 24, 2021

___________________________

The

Stilwell Group

111

Broadway, 12th Floor

New

York, NY 10006

(212)

269-1551

INFO@STILWELLGROUP.COM

March [__], 2021

Dear Fellow Stockholder,

The Stilwell Group

(as defined in the attached Proxy Statement), beneficially owns an aggregate of 484,645 shares of Common Stock, par value $1.00

per share, of Peoples Financial Corporation (the “Corporation”). We are seeking proxies to vote at the Corporation’s

2021 Annual Meeting of Stockholders, including any adjournments, postponements, continuations or reschedulings thereof (the “Annual

Meeting”), in connection with our bid to elect Peter Prickett to the Corporation’s Board of Directors at the Annual

Meeting.

The attached Proxy

Statement and the enclosed GREEN proxy card are first being furnished to the stockholders on or about March [__], 2021.

Please submit the GREEN

proxy voting card FOR Peter Prickett TODAY. We appreciate your support.

|

|

Sincerely,

/s/

Megan Parisi

Megan

Parisi

(917)

881-8076

mparisi@stilwellgroup.com

|

PRELIMINARY COPY SUBJECT TO COMPLETION

DATED MARCH 24, 2021

PEOPLES FINANCIAL CORPORATION

------------------------------------------------------

2021 ANNUAL MEETING OF STOCKHOLDERS

------------------------------------------------------

PROXY STATEMENT OF THE STILWELL GROUP

IN OPPOSITION TO

THE BOARD OF DIRECTORS OF PEOPLES FINANCIAL

CORPORATION

------------------------------------------------------

WHY YOU WERE SENT THIS PROXY STATEMENT

The Stilwell Group (as defined below) is

one of the largest stockholders of Peoples Financial Corporation (the “Corporation” or “Peoples Financial”),

beneficially owning an aggregate of 484,645 shares of Common Stock, par value $1.00 per share (the “Common Stock”),

of the Corporation. The Stilwell Group is furnishing this Proxy Statement and accompanying GREEN proxy card to the holders of the

Common Stock. We are seeking proxies to vote at the Corporation’s 2021 Annual Meeting of Stockholders (including any adjournments,

postponements, continuations or reschedulings thereof, the “Annual Meeting”) in connection with our bid to elect Peter

Prickett (the “Nominee”) to the Corporation’s Board of Directors (the “Board”) at the Annual Meeting.

The Corporation has not yet announced the

date, time and location of the Annual Meeting. Similarly, the Corporation has not yet set the record date for determining stockholders

entitled to notice of and to vote at the Annual Meeting. Once the Corporation announces such information, the Stilwell Group will

supplement this Proxy Statement to include such information. Stockholders who own shares of Common Stock as of the close of business

on the record date will be entitled to vote at the Annual Meeting.

As there are five directors up for re-election,

we are “rounding out” our slate of one candidate by permitting stockholders to also vote for the Corporation’s

expected nominees other than [__].We also expect the Corporation to include a proposal

for the ratification of the selection of the Corporation’s independent registered public accounting firm as an item on the

agenda to be voted upon by stockholders at the Annual Meeting. To the extent the foregoing proposal is included on the agenda for

the Annual Meeting, unless instructed otherwise, proxies will be voted in favor of ratification of the selection of the Corporation’s

independent registered public accounting firm. To the extent any other proposals are included on the agenda or presented at the

Annual Meeting, for which we may exercise discretionary voting, proxies will be voted in accordance with the best judgment of the

persons named as proxies on the attached proxy card. Additional voting instructions are stated below. This Proxy Statement and

GREEN proxy card are first being mailed or furnished to stockholders on or about March [__], 2021.

As of the date of this Proxy Statement,

the following members of the Stilwell Group who beneficially own an aggregate of 484,645 shares of Common Stock are:

|

|

·

|

Stilwell Activist Investments, L.P., a Delaware limited partnership (“Stilwell Activist Investments”);

|

|

|

·

|

Stilwell Activist Fund, L.P., a Delaware limited partnership (“Stilwell Activist Fund”);

|

|

|

·

|

Stilwell Value Partners VII, L.P., a Delaware limited partnership (“Stilwell Value Partners VII”);

|

|

|

·

|

Stilwell Value LLC, a Delaware limited liability company, which is the general partner of Stilwell Activist Investments, Stilwell Activist Fund and Stilwell Value Partners VII; and

|

|

|

·

|

Joseph Stilwell, individually and as the beneficial owner of Stilwell Value LLC (collectively, “the Stilwell Group”).

|

Additional information concerning the Stilwell

Group is set forth under the headings “Proposal Number 1: Election of Directors” and “Certain Information Regarding

the Participants” and in Appendix A.

IT IS IMPORTANT THAT YOU RETURN YOUR

PROXY PROMPTLY. IF YOU ARE A RECORD HOLDER (NAMELY, YOU OWN YOUR CORPORATION STOCK IN CERTIFICATE FORM), PLEASE SIGN AND DATE YOUR

GREEN PROXY CARD PROMPTLY AND RETURN IT IN THE ENCLOSED ENVELOPE. NO POSTAGE IS REQUIRED. IF YOUR SHARES ARE HELD IN “STREET

NAME” BY A BROKER, NOMINEE, FIDUCIARY OR OTHER CUSTODIAN, PLEASE CONTACT THE PERSON RESPONSIBLE FOR YOUR ACCOUNT AND INSTRUCT

HIM TO VOTE THE GREEN PROXY CARD ON YOUR BEHALF (YOUR BROKER, NOMINEE, FIDUCIARY OR OTHER CUSTODIAN MAY PERMIT YOU TO VOTE VIA

THE INTERNET OR BY TELEPHONE).

We urge you not to return any white

proxy card sent to you by the Corporation. Your last dated proxy is the only one that counts. If you are a registered holder, return

the GREEN proxy card as explained in the instructions on the GREEN proxy card, even if you previously delivered a white proxy card

to the Corporation. If your shares are held in street name, contact the person responsible for your account and instruct that person

to execute and return the GREEN proxy card on your behalf.

Please refer to the Corporation’s

definitive proxy statement when it becomes available for a full description of management’s candidates for election as directors.

Holders of record of shares of the Common

Stock on the record date for the Annual Meeting are urged to vote even if you sold your shares of Common Stock after that date.

If you have any questions or need assistance

in voting your shares, please call the Stilwell Group:

The Stilwell Group

Attn: Ms. Megan Parisi

111 Broadway, 12th Floor

New York, NY 10006

Direct: 212-269-1551

info@stilwellgroup.com

Also, please feel free to call our proxy

solicitor:

Okapi Partners LLC

Attn: Ms. Teresa Huang

1212 Avenue of the Americas, 24th Floor

New York, NY 10036

Main: 212-297-0720

Stockholders Call Toll-Free: 855-305-0856

PROPOSAL NUMBER 1: ELECTION OF DIRECTORS

The Board currently consists of five members.

Based on publicly available information, we believe the terms of all five current directors will expire at the Annual Meeting and

all five seats on the Board will be up for election at the Annual Meeting. At the Annual Meeting, the Stilwell Group will seek

to elect Peter Prickett, who has consented to being named in this Proxy Statement and to serving as a director on the Board if

elected. The election of Mr. Prickett requires the affirmative vote of a plurality of the votes cast. If elected and seated, the

Nominee will be entitled to serve a one-year term. Mr. Prickett has previously served as a senior executive of, including Chief

Executive Officer, and has served on the Board of Directors of, over five community banks and their holding companies. We therefore

believe he would be a valuable addition to the Board. As there are five directors up for re-election, we are “rounding out”

our slate of one candidate by permitting stockholders to also vote for the Corporation’s nominee(s) other than [___].There

is no assurance that the candidates nominated by the Corporation will serve as directors if the Stilwell Group’s Nominee

is elected. For additional information regarding the Corporation’s nominees for election as directors, please refer to the

Corporation’s proxy statement when it becomes available.

Each director is elected to hold office

until the next Annual Meeting of Stockholders and until his successor is elected and qualified.

The election of Mr. Prickett requires the

affirmative vote of a plurality of the votes cast in person or by proxy at the Annual Meeting. Only the five nominees for election

as directors who receive the highest numbers of “For” votes actually cast will be elected. See “Voting and Proxy

Procedures” below.

If you sign and return the Stilwell Group’s

GREEN proxy card, you will be deemed to have voted FOR Mr. Prickett unless you instruct otherwise.

Peter Prickett (age 64): Peter

Prickett’s principal occupation is serving as a consultant for Dynamic Insights, LLC, a business consulting firm, since

January 2018. Previously, Mr. Prickett served as Senior Vice President, Commercial Banking for Nicolet National Bank, a Midwestern

bank and subsidiary of Nicolet Bankshares, Inc. (NASDAQ: NCBS), from May 2017 to December 2017. Prior to that, from 2007 to May

2017, Mr. Prickett served as Chief Executive Officer of First National Bank-Fox Valley and Chairman of First Menasha Bancshares

(the holding company for First National Bank-Fox Valley), a Wisconsin bank that was acquired by Nicolet Bankshares, Inc. Prior

to that, Mr. Prickett served as a Senior Vice President, Commercial Banking for Associated Bank, N.A., a Midwestern bank, from

2005 to 2007 and he served as Vice President, Commercial Banking from 1995 to 2002. Earlier in his career, Mr. Prickett served

as Senior Vice President at Valley Bank-Oshkosh, a Midwest bank that was acquired by Marshall & Ilsley Corporation that was

subsequently acquired by BMO Harris Bank, N.A. (NYSE: BMO), as Vice President, Commercial Banking, and also served as a Vice President,

Commercial Banking with State Bank and Trust Co., an Iowa bank. Mr. Prickett has served on the Board of Directors of Fortifi Bank

and its holding company, First Berlin Bancorp Inc., a Wisconsin bank, since November 2018. Mr. Prickett has served as the President

and Director of The Council for Sound Tax Policy, a non-profit organization seeking to promote sound tax policy, since July 2016.

Previously, Mr. Prickett served on the Board of Directors of the Wisconsin Bankers Association, an advocate for Wisconsin’s

banking industry, from 2013 to 2017, and as Board Chair from June 2015 to June 2016. Mr. Prickett attended both Cardinal Stritch

and Marion College. He is not employed by any parent, subsidiary or other affiliate of the Corporation.

Specific Qualities: Mr. Prickett’s

extensive senior level executive experience at a number of community banks and board service at two bank-holding companies would

make him a valuable asset to the Board.

The Nominee is independent under the independence

standards previously and/or currently applicable to the Corporation, as the case may be, under (i) paragraph (a)(1) of Item 407

of Regulation S-K, (ii) Section 301 of the Sarbanes-Oxley Act of 2002, and (iii) Sections 2.5(a) and 7 of the OTCQX Rules for U.S.

Companies.

On or about March 12, 2021, the Stilwell

Group provided the Corporation with notice, of the Stilwell Group’s intention to nominate Mr. Prickett for election to the

Board. We reserve the right to solicit proxies for the election of any substitute nominee if the Corporation makes or announces

any changes to its Articles of Incorporation, as amended, or Bylaws, as amended (the “Bylaws”, and together with the

Articles of Incorporation, the “Organizational Documents”) or takes or announces any other action that has, or if

consummated would have, the effect of disqualifying the Nominee, to the extent this is not prohibited under the Organizational

Documents and applicable law. In any such case, shares represented by the enclosed GREEN proxy card will be voted for such

substitute nominee. We reserve the right to nominate additional persons, to the extent this is not prohibited under the Organizational

Documents and applicable law, if the Corporation increases the size of the Board above its existing size or increases the number

of directors whose terms expire at the Annual Meeting. Additional nominations made pursuant to the preceding sentence are without

prejudice to the position of the Stilwell Group that any attempt to increase the size of the current Board or to classify the

Board, constitutes an unlawful manipulation of the Corporation’s corporate machinery. In the event the Stilwell Group nominates

a substitute and/or additional nominee, as applicable, prior to the Annual Meeting, it will file an amended proxy statement identifying

such nominee, disclosing whether such nominee has consented to being named in the revised proxy statement and to serve as a director

of the Corporation if elected, and otherwise disclose such other information required by applicable law.

PROPOSAL NUMBER 2: RATIFICATION OF APPOINTMENT

OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

We expect that the Corporation will also

submit to a vote of stockholders ratification of the appointment of Wipfli LLP as the Corporation’s independent registered

public accounting firm. If this proposal is included on the agenda for the Annual Meeting, we intend to vote, and recommend that

you vote, FOR Proposal 2.

Proposal 2 will be approved if the votes

cast in favor of Proposal 2 exceed the votes cast against it at the Annual Meeting. Abstentions, which include broker non-votes,

are counted for purposes of determining a quorum, but are otherwise not counted and have no effect on the outcome of the matters

to be voted upon. See “Voting and Proxy Procedures” below.

CERTAIN INFORMATION REGARDING THE PARTICIPANTS

Except as described herein, there are no

material proceedings in which any Stilwell Group member, or any associate of any Stilwell Group member, is a party adverse to the

Corporation or any of its subsidiaries or has a material interest adverse to the Corporation or any of its subsidiaries. Except

as described in Appendix A, no Stilwell Group member or any associate of any Stilwell Group member has any interest in the matters

to be voted upon at the Annual Meeting, other than an interest, if any, as a stockholder of the Corporation.

Except as described in Appendix A, no Stilwell

Group member or any associate of any Stilwell Group member (1) has engaged in or has a direct or indirect interest in any

transaction or series of transactions since the beginning of the Corporation’s last fiscal year, or in any currently proposed

transaction, to which the Corporation or any of its subsidiaries is a party where the amount involved was in excess of $120,000;

(2) has been indebted to the Corporation or any of its subsidiaries; (3) has borrowed any funds for the purpose of acquiring or

holding any securities of the Corporation; (4) is presently, or has been within the past year, a party to any contract, arrangement

or understanding with any person with respect to any securities of the Corporation, any future employment by the Corporation or

its affiliates, or any future transaction to which the Corporation or any of its affiliates will or may be a party; or (5) is the

beneficial or record owner of any securities of the Corporation or any parent or subsidiary thereof.

No Stilwell Group member or any associate

of any Stilwell Group member, during the past 10 years, has been convicted in a criminal proceeding (excluding traffic violations

or similar misdemeanors).

Additional information concerning the Stilwell

Group, including, but not limited to, beneficial ownership of and transactions in the Common Stock, is set forth in Appendix A.

OTHER MATTERS

The Stilwell Group anticipates that the

Corporation’s proxy statement, when it becomes available, will contain information regarding (1) the securities ownership

of certain beneficial owners and management; (2) the committees of the Board; (3) the meetings of the Board and all Board committees;

(4) the background of the Corporation’s nominees for election as directors; (5) the compensation of the Corporation’s

directors and executive officers; and (6) the services and fees of the Corporation’s independent registered public accounting

firm. The Stilwell Group has no knowledge of the accuracy of the Corporation’s disclosures in its proxy materials.

STOCKHOLDER PROPOSALS

In order for a stockholder proposal to

be included in the Corporation’s proxy statement and form of proxy prepared by the Board under Rule 14a-8 of the Securities

Exchange Act of 1934, it must be received at the principal executive offices of the Corporation not less than 120 days in advance

of the first anniversary of the date the previous year’s proxy statement and form of proxy were mailed by the Corporation

to stockholders.

In accordance with the Bylaws, stockholders

may make proposals for consideration at the 2022 annual meeting of stockholders (the “2022 Annual Meeting”) by giving

timely notice thereof in writing to the Secretary of the Corporation. To be timely, a stockholder’s notice must be delivered

to or mailed and received at the principal executive offices of the Corporation not less than 90 days nor more than 120 days prior

to the date of the 2022 Annual Meeting; provided, however, that if fewer than 100 days’ notice or prior public disclosure

of the date of the meeting is given or made to stockholders, notice by such stockholder to be timely must be so delivered or received

not later than the close of business on the 10th day following the earlier of (i) the day on which such notice of the date of such

meeting was mailed or (ii) the day on which prior public disclosure was made.

SOLICITATION; EXPENSES

Proxies may be solicited by the Stilwell

Group by mail, e-mail, advertisement, telephone, facsimile, and personal solicitation. Phone calls will be made to stockholders

by employees of the Stilwell Group and certain of its personnel, as well as employees of Okapi Partners LLC. Ms. Megan Parisi will

be principally responsible for soliciting proxies for the Stilwell Group and certain of its personnel will perform additional work

in connection with the solicitation of proxies, for which no additional compensation will be paid. Banks, brokerage houses, and

other custodians, nominees, and fiduciaries will be requested to forward the Stilwell Group’s solicitation material to their

customers for whom they hold shares and the Stilwell Group will reimburse them for their reasonable out-of-pocket expenses. The

Stilwell Group has retained Okapi Partners LLC to assist in the solicitation of proxies and for related services. The Stilwell

Group will pay Okapi Partners LLC a base fee of up to $40,000 and has agreed to reimburse it for its reasonable out-of-pocket expenses.

In addition, the Stilwell Group has agreed to indemnify Okapi Partners LLC against certain liabilities and expenses. Approximately

25 persons will be used by Okapi Partners LLC in its solicitation efforts.

Although a precise estimate cannot be made

at the present time, the Stilwell Group currently estimates that the total expenditures relating to the proxy solicitation to

be incurred by it will be approximately [___] of which approximately [___] has been incurred to date. The entire expense of preparing,

assembling, printing, and mailing this Proxy Statement and related materials and the cost of soliciting proxies will be borne

by the Stilwell Group. The Stilwell Group does not intend to seek reimbursement of its expenses from the Corporation.

WHO CAN VOTE AT THE ANNUAL MEETING

Stockholders who own shares as of the close

of business on the record date will be entitled to vote at the Annual Meeting. The Corporation has not yet set the record date

for determining stockholders entitled to notice of and to vote at the Annual Meeting. Once the Corporation announces the record

date and the number of shares of Common Stock outstanding as of such record date, the Stilwell Group will supplement this Proxy

Statement to include such information. Stockholders of the Corporation as of the close of business on the record date are entitled

to one vote at the Annual Meeting for each share of Common Stock held on the record date.

HOW TO VOTE BY PROXY

To elect the Stilwell Group’s Nominee

to the Board, if you are a record holder (namely, you own your Corporation stock in certificate form), you can vote by marking

your vote on the GREEN proxy card we have enclosed, signing and dating it, and mailing it in the postage-paid envelope we

have provided. If your shares are held in “street name,” follow the directions given by the broker, nominee, fiduciary

or other custodian regarding how to instruct them to vote your shares. Your broker, nominee, fiduciary or other custodian may permit

you to vote via the Internet or by telephone. Whether you plan to attend the Annual Meeting or not, we urge you to vote your shares

now. Please contact our proxy solicitor Okapi Partners LLC at 855-208-8903 if you require assistance in voting your shares. This

Proxy Statement and the accompanying form of GREEN proxy card are available at [_____].

Properly executed proxies will be voted

in accordance with the directions indicated thereon. If you sign the GREEN proxy card but do not make any specific choices,

your shares will be voted: (a) “FOR” the election of our Nominee to the Board of Directors and (b) “FOR”

the ratification of the appointment of Wipfli LLP as the Corporation’s independent registered public accounting firm, assuming

with respect to the foregoing item (b), that the Corporation includes such item on the agenda for the Annual Meeting. If any other

matters are presented at the Annual Meeting for which we may exercise discretionary voting, your proxy will be voted in accordance

with the best judgment of the persons named as proxies on the attached proxy card. At the time this Proxy Statement was mailed,

we knew of no matters which needed to be acted on at the Annual Meeting, other than those discussed in this Proxy Statement.

You should refer to the Corporation’s

proxy statement and form of proxy distributed by the Corporation for the names, backgrounds, qualifications and other information

concerning the Corporation’s nominees for election as directors. The Stilwell Group is NOT seeking authority to vote for

and will NOT exercise any authority to vote for [_____], one of the Corporation’s expected nominees.

If any of your shares are held in the name

of a brokerage firm, bank, bank nominee or other institution on the record date, only that entity can vote your shares and only

upon its receipt of your specific instructions. Accordingly, please contact the person responsible for your account at such entity

and instruct that person to execute and return the GREEN proxy card on your behalf. You should also sign, date and mail

the voting instruction form your broker or banker sends you when you receive it (or, if applicable, vote by following the instructions

supplied to you by your bank or brokerage firm, including voting by telephone or via the Internet). Please do this for each account

you maintain to ensure that all of your shares are voted.

Many banks and brokerage firms are participating

in programs that allow eligible stockholders to vote by telephone or via the Internet. If your bank or brokerage firm is participating

in a telephone or Internet voting program, then such bank or brokerage firm will provide you with instructions for voting by telephone

or the Internet on the voting form. Telephone and Internet voting procedures, if available through your bank or brokerage firm,

are designed to authenticate your identity to allow you to give your voting instructions and to confirm that your instructions

have been properly recorded. Stockholders voting via the Internet should understand that there might be costs that they must bear

associated with electronic access, such as usage charges from Internet access providers and telephone companies. If your bank or

brokerage firm does not provide you with a voting form, but instead you receive our GREEN proxy card, then you should mark

our proxy card, date it and sign it, and return it in the enclosed postage-paid envelope.

VOTING AND PROXY PROCEDURES

The Board is elected annually. Each director

is elected to hold office until the next Annual Meeting of Stockholders and until his successor is elected and qualified. If elected

and seated, Peter Prickett would serve until the 2022 Annual Meeting. Directors are elected by a plurality of the votes cast.

A majority of the outstanding shares of

Common Stock constitutes a quorum. Each share of Common Stock entitles the holder thereof to one vote on each matter presented

at the Annual Meeting for stockholder approval. Except in the election of directors, action on a matter is approved if the votes

cast in favor of the action exceed the votes cast opposing the action. Abstentions, which include broker non-votes, are counted

for purposes of determining a quorum, but are otherwise not counted and have no effect on the outcome of the matters to be voted

upon.

THE STILWELL GROUP URGES YOU TO VOTE

FOR THE ELECTION OF THE NOMINEE AS A DIRECTOR OF THE CORPORATION AS SOON AS POSSIBLE. PROXIES SOLICITED BY THIS PROXY STATEMENT

MAY BE EXERCISED ONLY AT THE ANNUAL MEETING (AND ANY ADJOURNMENT OR POSTPONEMENT THEREOF) IN ACCORDANCE WITH YOUR INSTRUCTIONS

AND WILL NOT BE USED FOR ANY OTHER MEETING.

A proxy given pursuant to this solicitation

may be revoked at any time before it is voted. If you are a record holder, you may revoke your proxy and change your vote by: (1)

the timely delivery of a duly executed proxy bearing a later date, (2) providing timely written notice of revocation to the Corporation’s

Corporate Secretary at the Corporation’s principal executive offices at P.O. Box 529, Biloxi, Mississippi 39533-0529, or

(3) attending the Annual Meeting and giving oral notice of your intention to vote in person. If you are the beneficial owner of

shares held in street name, you may revoke your proxy and change your vote: (1) by submitting new voting instructions to your broker,

bank or other nominee in accordance with their voting instructions, or (2) if you have obtained a legal proxy from your bank, broker

or other nominee giving you the right to vote your shares in person, by attending the Annual Meeting, presenting the completed

legal proxy to the Corporation and voting in person. You should be aware that simply attending the Annual Meeting will not in and

of itself constitute a revocation of your proxy. If you have already sent a white proxy to management of the Corporation,

you can revoke that proxy by signing, dating and mailing the GREEN proxy card or by voting in person at the Annual Meeting.

Only holders of record as of the close

of business on the record date for the Annual Meeting will be entitled to vote at the Annual Meeting. The Corporation has not yet

set the record date for the Annual Meeting. Stockholders who own shares as of the close of business on the record date will be

entitled to vote at the Annual Meeting. If you were a stockholder of record on the record date, you will retain your voting rights

for the Annual Meeting even if you sell your shares after the record date. Accordingly, it is important that you vote the shares

held by you on the record date, or grant a proxy to vote such shares, even if you sell your shares after the record date.

IMPORTANT: If you wish to support Mr.

Prickett, please sign, date and return only the Stilwell Group’s GREEN proxy card. If you later vote on management’s

white proxy (even if it is to withhold authority to vote for management’s nominees), you will revoke your previous vote for

Mr. Prickett. PLEASE DISCARD THE CORPORATION’S WHITE PROXY CARD.

ALTHOUGH YOU MAY VOTE MORE THAN ONCE,

ONLY ONE PROXY WILL BE COUNTED AT THE ANNUAL MEETING, AND THAT WILL BE YOUR LATEST-DATED, VALIDLY EXECUTED PROXY.

IF YOU SIGN THE GREEN PROXY CARD AND

NO MARKING IS MADE, YOU WILL BE DEEMED TO HAVE GIVEN A DIRECTION TO VOTE THE PEOPLES FINANCIAL CORPORATION COMMON STOCK REPRESENTED

BY THE GREEN PROXY CARD FOR THE ELECTION OF PETER PRICKETT AND THE PERSON(S) WHO HAS BEEN NOMINATED BY THE CORPORATION TO SERVE

AS A DIRECTOR, OTHER THAN [______] AND IF ON THE AGENDA FOR THE ANNUAL MEETING, FOR THE RATIFICATION OF WIPFLI LLP AS THE CORPORATION’S

INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM.

ADDITIONAL INFORMATION

The information concerning the Corporation

contained in this Proxy Statement has been taken from, or is based upon, publicly available information. Although we have no knowledge

that would indicate that statements relating to the Corporation contained in this Proxy Statement, in reliance upon publicly available

information, are inaccurate or incomplete, to date we have not had access to the books and records of the Corporation, were not

involved in the preparation of such information and statements and are not in a position to verify such information and statements.

The Corporation previously filed annual,

quarterly and current reports, proxy statements and other information with the SEC. You may read and copy any reports, statements

or other information that the Corporation filed with the SEC at the SEC’s public reference room at 100 F Street, N.E., Washington,

D.C. 20549. Please call the SEC at 1-800-SEC-0330 for further information on the public reference room. These SEC filings are also

available to the public from commercial document retrieval services and at the Internet website maintained by the SEC at www.sec.gov.

YOUR VOTE IS IMPORTANT

NO MATTER HOW MANY OR HOW FEW SHARES

YOU OWN, WE ARE SEEKING YOUR SUPPORT. PLEASE VOTE FOR MR. PRICKETT. ONLY YOUR LATEST-DATED PROXY COUNTS. EVEN IF YOU HAVE ALREADY

RETURNED A WHITE PROXY TO THE BOARD, YOU HAVE EVERY LEGAL RIGHT TO REVOKE IT BY RETURNING A GREEN PROXY TO US AS PROVIDED BELOW.

IF YOU ARE A RECORD HOLDER, PLEASE VOTE

BY SIGNING, DATING, AND MAILING (IN THE ENCLOSED POSTAGE-PAID ENVELOPE) THE ENCLOSED GREEN PROXY CARD AS SOON AS POSSIBLE. IF YOUR

SHARES ARE HELD IN “STREET NAME” BY A BROKER, NOMINEE, FIDUCIARY OR OTHER CUSTODIAN, FOLLOW THE DIRECTIONS GIVEN BY

THE BROKER, NOMINEE, FIDUCIARY OR OTHER CUSTODIAN REGARDING HOW TO INSTRUCT THEM TO VOTE YOUR SHARES.

This Proxy Statement and the accompanying form of GREEN proxy card are available at [_____]. If

you have any questions or require any assistance, please contact the Stilwell Group:

|

|

The Stilwell Group

|

|

|

111 Broadway, 12th Floor

|

|

|

New York, NY 10006

|

|

|

Direct: (212) 269-1551

|

|

|

Attn: Ms. Megan Parisi

|

|

|

info@stilwellgroup.com

|

Please feel free to contact Okapi Partners LLC, proxy solicitors

for the Stilwell Group, as follows:

|

|

Okapi Partners LLC

|

|

|

Attn: Ms. Teresa Huang

|

|

|

1212 Avenue of the Americas, 24th Floor

|

|

|

New York, NY 10036

|

|

|

Main: 212-297-0720

Stockholders Call Toll-Free: 855-305-0856

|

|

Sincerely,

|

|

|

|

|

|

|

|

|

/s/ Megan Parisi

|

|

|

Megan Parisi

|

|

|

The Stilwell Group

|

|

March [__], 2021

APPENDIX A

IDENTITY OF PARTICIPANTS

The participants in

this solicitation are anticipated to include Stilwell Activist Investments, L.P., a Delaware limited partnership (“Stilwell

Activist Investments”); Stilwell Activist Fund, L.P., a Delaware limited partnership (“Stilwell Activist Fund”);

Stilwell Value Partners VII, L.P., a Delaware limited partnership (“Stilwell Value Partners VII”); Stilwell Value LLC,

a Delaware limited liability company; and Joseph D. Stilwell (collectively, the “Stilwell Group” or the “Beneficial

Owners”); and Peter Prickett (the “Nominee” and, together with the Beneficial Owners, the “Participants”

and each a “Participant”).

With respect to each

Participant, other than as disclosed herein, such Participant is not and, within the past year, was not a party to any contract,

arrangement or understanding with any person with respect to any securities of Peoples Financial Corporation (the “Corporation”),

including, but not limited to, joint ventures, loan or option arrangements, puts or calls, guarantees against loss or guarantees

of profit, division of losses or profits, or the giving or withholding of proxies, except for sharing of profits. Stilwell Value

LLC, in its capacity as general partner of Stilwell Activist Investments, Stilwell Activist Fund, Stilwell Value Partners VII,

and Joseph Stilwell, in his capacity as the managing member and sole owner of Stilwell Value LLC, are entitled to an allocation

of a portion of profits. With respect to each Participant, other than as disclosed below, neither such Participant nor any of such

Participant’s associates has any arrangement or understanding with any person with respect to (i) any future employment by

the Corporation or its affiliates or (ii) any future transactions to which the Corporation or any of its affiliates will or may

be a party.

Except as otherwise

set forth herein, (i) during the past 10 years, no Participant has been convicted in a criminal proceeding (excluding traffic violations

or similar misdemeanors); (ii) no Participant directly or indirectly beneficially owns any securities of the Corporation; (iii)

no Participant owns any securities of the Corporation which are owned of record but not beneficially; (iv) no Participant has purchased

or sold any securities of the Corporation during the past two years; (v) no part of the purchase price or market value of the securities

of the Corporation owned by any Participant is represented by funds borrowed or otherwise obtained for the purpose of acquiring

or holding such securities; (vi) no Participant is, or within the past year was, a party to any contract, arrangements or understandings

with any person with respect to any securities of the Corporation, including, but not limited to, joint ventures, loan or option

arrangements, puts or calls, guarantees against loss or guarantees of profit, division of losses or profits, or the giving or withholding

of proxies; (vii) no associate of any Participant owns beneficially, directly or indirectly, any securities of the Corporation;

(viii) no Participant owns beneficially, directly or indirectly, any securities of any parent or subsidiary of the Corporation;

(ix) no Participant or any of his, her or its associates was a party to any transaction, or series of similar transactions, since

the beginning of the Corporation’s last fiscal year, or is a party to any currently proposed transaction, or series of similar

transactions, to which the Corporation or any of its subsidiaries was or is to be a party, in which the amount involved exceeds

$120,000; (x) no Participant or any of his, her or its associates has any arrangement or understanding with any person with respect

to any future employment by the Corporation or its affiliates, or with respect to any future transactions to which the Corporation

or any of its affiliates will or may be a party; (xi) no Participant has a substantial interest, direct or indirect, by securities

holdings or otherwise in any matter to be acted on at the Corporation’s 2021 Annual Meeting of Stockholders (including any

adjournments, postponements, continuations and reschedulings thereof, the “Annual Meeting”); (xii) no Participant holds

any positions or offices with the Corporation; (xiii) no Participant has a family relationship with any director, executive officer,

or person nominated or chosen by the Corporation to become a director or executive officer; and (xiv) no companies or organizations,

with which any of the Participants has been employed in the past five years, is a parent, subsidiary or other affiliate of the

Corporation. There are no material proceedings to which any Participant or any of his, her or its associates is a party adverse

to the Corporation or any of its subsidiaries or has a material interest adverse to the Corporation or any of its subsidiaries.

With respect to the Nominee, none of the events enumerated in Item 401(f)(1)-(8) of Regulation S-K of the Exchange Act occurred

during the past ten years.

SECURITY OWNERSHIP OF BENEFICIAL OWNERS

The table below shows the number of shares of common stock, $1.00 par value per share

(“Common Stock”), in accounts of the listed entities or individuals.

|

Title of Class

|

|

Name of Owner

|

|

Direct Beneficial

Ownership

|

|

Percent of Class (1)

|

|

|

|

|

|

|

|

|

|

Common Stock

|

|

Stilwell Activist Investments

|

|

|

354,206

|

|

|

|

7.26

|

%

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Common Stock

|

|

Stilwell Activist Fund

|

|

|

47,122

|

|

|

|

0.97

|

%

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Common Stock

|

|

Stilwell Value Partners VII

|

|

|

83,317

|

|

|

|

1.71

|

%

|

(1) The percentages are calculated based

on 4,878,557 shares of Common Stock outstanding as of February 3, 2021, as reported in the Corporation’s Proxy Statement

on Form DEF 14A, filed with the Securities and Exchange Commission on February 11, 2021.

Stilwell Value LLC,

as the general partner of each of Stilwell Activist Investments, Stilwell Activist Fund and Stilwell Value Partners VII, may be

deemed the beneficial owner of the 484,645 shares of Common Stock owned in the aggregate by Stilwell Activist Investments, Stilwell

Activist Fund and Stilwell Value Partners VII. Mr. Stilwell, as the managing member and sole owner of Stilwell Value LLC, may be

deemed the beneficial owner of the 484,645 shares of Common Stock owned in the aggregate by Stilwell Activist Investments, Stilwell

Activist Fund and Stilwell Value Partners VII.

Each of the Participants

disclaims beneficial ownership with respect to the shares of Common Stock reported owned in this notice except to the extent of

its, his or his pecuniary interest therein.

DESCRIPTION OF BENEFICIAL OWNERSHIP AND

BENEFICIAL OWNERS

Joseph Stilwell is

the managing member and sole owner of Stilwell Value LLC, which is the general partner of Stilwell Activist Investments, Stilwell

Activist Fund and Stilwell Value Partners VII. The business address of the Beneficial Owners is 111 Broadway, 12th Floor, New York,

New York 10006.

The principal employment

of Joseph Stilwell is investment management, and he serves as the managing member and sole owner of Stilwell Value LLC. Stilwell

Activist Investments, Stilwell Activist Fund and Stilwell Value Partners VII are private investment partnerships engaged in the

purchase and sale of securities for their own accounts. Stilwell Value LLC is in the business of serving as the general partner

of Stilwell Activist Investments, Stilwell Activist Fund, Stilwell Value Partners VII, and related partnerships.

Because he is the managing

member and sole owner of Stilwell Value LLC, which is the general partner of Stilwell Activist Investments, Stilwell Activist Fund

and Stilwell Value Partners VII, Joseph Stilwell has the power to direct the affairs of Stilwell Activist Investments, Stilwell

Activist Fund and Stilwell Value Partners VII, including the voting and disposition of shares of Common Stock held in the name

of Stilwell Activist Investments, Stilwell Activist Fund and Stilwell Value Partners VII. Therefore, Joseph Stilwell is deemed

to share voting and disposition power with Stilwell Activist Investments, Stilwell Activist Fund and Stilwell Value Partners VII

with regard to those shares of Common Stock.

The Beneficial Owners

may be deemed to beneficially own, in the aggregate, 484,645 shares of Common Stock, representing approximately 9.9% of the Corporation’s

outstanding shares of Common Stock (based upon the 4,878,557 shares of Common Stock outstanding as of February 3, 2021). The Beneficial

Owners have an interest in the election of directors at the Annual Meeting in their capacities as stockholders of the Corporation.

TWO YEAR SUMMARY TABLE

The following table indicates the date

of each purchase and sale of shares of Common Stock by each Participant within the past two years and the number of shares of Common

Stock in each purchase and sale.

|

Name

|

Date

|

Shares of Common Stock

Purchased/(Sold)1

|

|

Stilwell Value Partners VII

|

07/10/2020

|

17,200

|

|

Stilwell Value Partners VII

|

07/22/2020

|

5,515

|

|

Stilwell Value Partners VII

|

07/30/2020

|

1,280

|

|

Stilwell Value Partners VII

|

08/10/2020

|

1,073

|

|

Stilwell Value Partners VII

|

09/09/2020

|

1,120

|

|

Stilwell Value Partners VII

|

09/11/2020

|

3,328

|

|

Stilwell Value Partners VII

|

10/26/2020

|

740

|

|

Stilwell Value Partners VII

|

11/02/2020

|

30,457

|

|

Stilwell Value Partners VII

|

11/23/2020

|

3,915

|

|

Stilwell Value Partners VII

|

11/25/2020

|

3,886

|

|

Stilwell Value Partners VII

|

12/07/2020

|

510

|

|

Stilwell Value Partners VII

|

12/08/2020

|

8,000

|

|

Stilwell Value Partners VII

|

12/09/2020

|

4,985

|

|

Stilwell Value Partners VII

|

12/11/2020

|

1,308

|

|

|

|

|

|

Stilwell Activist Fund

|

10/21/2019

|

500

|

|

Stilwell Activist Fund

|

10/23/2019

|

571

|

|

Stilwell Activist Fund

|

12/03/2019

|

1,134

|

|

Stilwell Activist Fund

|

12/20/2019

|

894

|

|

Stilwell Activist Fund

|

01/10/2020

|

567

|

|

Stilwell Activist Fund

|

01/17/2020

|

1,260

|

|

Stilwell Activist Fund

|

01/23/2020

|

542

|

|

Stilwell Activist Fund

|

02/05/2020

|

680

|

|

Stilwell Activist Fund

|

03/06/2020

|

757

|

|

Stilwell Activist Fund

|

06/30/2020

|

2,904

|

|

Stilwell Activist Fund

|

07/01/2020

|

1,925

|

|

Stilwell Activist Fund

|

07/07/2020

|

1,023

|

|

Stilwell Activist Fund

|

07/22/2020

|

910

|

|

Stilwell Activist Fund

|

07/30/2020

|

800

|

|

Stilwell Activist Fund

|

08/10/2020

|

670

|

|

Stilwell Activist Fund

|

09/09/2020

|

700

|

|

Stilwell Activist Fund

|

09/11/2020

|

2,080

|

|

Stilwell Activist Fund

|

10/06/2020

|

517

|

|

Stilwell Activist Fund

|

10/23/2020

|

1,283

|

|

Stilwell Activist Fund

|

10/26/2020

|

900

|

|

Stilwell Activist Fund

|

11/12/2020

|

4,602

|

|

Stilwell Activist Fund

|

11/16/2020

|

820

|

|

Stilwell Activist Fund

|

11/17/2020

|

660

|

|

Stilwell Activist Fund

|

11/18/2020

|

3,500

|

|

Stilwell Activist Fund

|

11/19/2020

|

2,686

|

|

Stilwell Activist Fund

|

11/23/2020

|

10,647

|

|

Stilwell Activist Fund

|

11/25/2020

|

2,590

|

|

Stilwell Activist Fund

|

12/16/2020

|

500

|

|

Stilwell Activist Fund

|

12/18/2020

|

500

|

|

|

|

|

|

Stilwell Activist Investments

|

10/21/2019

|

2,400

|

|

Stilwell Activist Investments

|

10/22/2019

|

3,000

|

|

Stilwell Activist Investments

|

10/23/2019

|

2,029

|

|

Stilwell Activist Investments

|

12/03/2019

|

7,866

|

|

Stilwell Activist Investments

|

12/18/2019

|

1,415

|

|

Stilwell Activist Investments

|

12/20/2019

|

4,786

|

|

Stilwell Activist Investments

|

01/10/2020

|

3,933

|

|

Stilwell Activist Investments

|

01/17/2020

|

8,740

|

|

Stilwell Activist Investments

|

01/21/2020

|

3,100

|

|

Stilwell Activist Investments

|

01/23/2020

|

658

|

|

Stilwell Activist Investments

|

01/24/2020

|

3,200

|

|

Stilwell Activist Investments

|

01/31/2020

|

2,000

|

|

Stilwell Activist Investments

|

02/05/2020

|

1,120

|

|

Stilwell Activist Investments

|

02/27/2020

|

1,100

|

|

Stilwell Activist Investments

|

03/06/2020

|

4,343

|

|

Stilwell Activist Investments

|

05/01/2020

|

3,300

|

|

Stilwell Activist Investments

|

06/30/2020

|

22,996

|

|

Stilwell Activist Investments

|

07/01/2020

|

15,575

|

|

Stilwell Activist Investments

|

07/07/2020

|

8,277

|

|

Stilwell Activist Investments

|

07/22/2020

|

2,675

|

|

Stilwell Activist Investments

|

07/30/2020

|

5,920

|

|

Stilwell Activist Investments

|

08/10/2020

|

4,960

|

|

Stilwell Activist Investments

|

09/09/2020

|

5,180

|

|

Stilwell Activist Investments

|

09/11/2020

|

15,392

|

|

Stilwell Activist Investments

|

10/06/2020

|

3,483

|

|

Stilwell Activist Investments

|

10/22/2020

|

5,000

|

|

Stilwell Activist Investments

|

10/23/2020

|

3,717

|

|

Stilwell Activist Investments

|

10/26/2020

|

7,360

|

|

Stilwell Activist Investments

|

11/12/2020

|

10,963

|

|

Stilwell Activist Investments

|

11/16/2020

|

7,380

|

|

Stilwell Activist Investments

|

11/17/2020

|

5,940

|

|

Stilwell Activist Investments

|

11/18/2020

|

31,500

|

|

Stilwell Activist Investments

|

11/19/2020

|

24,171

|

|

Stilwell Activist Investments

|

11/20/2020

|

1,400

|

|

Stilwell Activist Investments

|

11/23/2020

|

90,508

|

|

Stilwell Activist Investments

|

11/25/2020

|

19,429

|

|

Stilwell Activist Investments

|

12/07/2020

|

2,890

|

|

Stilwell Activist Investments

|

12/16/2020

|

3,000

|

|

Stilwell Activist Investments

|

12/18/2020

|

3,500

|

____________________________

1 The shares of Common

Stock owned directly by each of Stilwell Activist Investments, Stilwell Activist Fund and Stilwell Value Partners VII were

purchased with working capital. The purchases effected by each of Stilwell Activist Investments, Stilwell Activist Fund and

Stilwell Value Partners VII were effected through margin accounts maintained with prime brokers, which extend margin credit

as and when required to open or carry positions in their margin accounts, subject to applicable federal margin regulations,

stock exchange rules and such firms’ credit policies. Positions in the shares of Common Stock held in such margin

accounts may be pledged as collateral security for the repayment of debit balances in such accounts. Since other securities

are held in such margin accounts in addition to the Common Stock, it may not be possible to determine the amounts, if any, of

margin used to purchase the shares of Common Stock held by each of Stilwell Activist Investments, Stilwell Activist Fund and

Stilwell Value Partners VII at any one time. Nevertheless, to the best of the Nominating Stockholders’ knowledge, no

shares of Common Stock held by any of Stilwell Activist Investments, Stilwell Activist Fund and Stilwell Value Partners VII

were acquired or are currently held on margin.

INFORMATION

ABOUT THE NOMINEE

The Beneficial Owners

believe that the Nominee presently is, and if elected as a director of the Corporation, would be, an “independent director”

within the meaning of (i) paragraph (a)(1) of Item 407 of Regulation S-K, (ii) Section 301 of the Sarbanes-Oxley Act of 2002, and

(iii) Sections 2.5(a) and 7 of the OTCQX Rules for U.S. Companies.

Name, Age, and Business Address

|

Name

|

Age

|

Business Address

|

|

|

Peter Prickett

|

64

|

87110 Highpoint Dr.

Diamondhead, MS 39525

|

|

Stilwell Activist Investments,

Stilwell Activist Fund, Stilwell Value Partners VII, Stilwell Value LLC, and the Nominee are parties to an agreement whereby, among

other things, the Nominee has agreed to be nominated for election to the Board of Directors of the Corporation at the Annual Meeting,

and the Beneficial Owners have agreed to reimburse Nominee for his expenses incurred in connection with his nomination for election

to the Board of Directors and to indemnify and hold him harmless from and against all damages and claims that may arise in connection

with being nominated for election to the Board of Directors. For the avoidance of doubt, such indemnification does not apply to

any claims made against the Nominee in his capacity as a director of the Corporation, if so elected. In addition, pursuant to such

agreement, the Nominee has agreed that he will not acquire, directly or indirectly, any Common Stock from the date of the agreement

until the conclusion of the Annual Meeting, except as otherwise required under the Corporation’s Bylaws, as amended (the

“Bylaws”).

In addition, in accordance

with recently adopted director qualification provisions set forth in the newly amended Bylaws, the Nominee: (a) will own in his

own right unencumbered stock in the Corporation in the amount of at least Two Hundred Dollars ($200.00) par value at the time of

his election to the Board of Directors and continue to own such par value amount throughout his term; (b) has not been subject

to a cease and desist order, consent, or other formal order by a state or federal regulatory agency which has been publicly disclosed

within the past ten (10) years; (c) has not been convicted of a crime involving dishonesty or breach of trust; (d) is not be currently

charged with the commission of a crime; (e) maintains a principal residence within fifty (50) miles of the main office or a branch

office of the Corporation or its bank subsidiary; (f) is not a director, officer or 10% stockholder of a financial institution

that has a main office or branch offices within fifty (50) miles of the main office or a branch office of the Corporation; (g)

will comply with all of the Corporation’s policies and procedures applicable to directors, including a requirement to maintain

confidentiality of all matters discussed by the Board of Directors at its meeting; (h) is not a party to any agreement that materially

limits his voting discretion as a director or his ability to discharge fiduciary duties to all directors; and (i) will take and

subscribe an annual oath that he will faithfully and diligently perform the duties of his office and will not knowingly violate

or permit to be violated any provision of law or any requirements or qualifications of directors listed in the Bylaws.

SECURITY OWNERSHIP OF THE NOMINEE

As of the date hereof,

the Nominee does not currently directly or indirectly own any securities of the Corporation, and has not transacted in securities

of the Corporation during the past two years. Notwithstanding the foregoing, the Nominee intends to comply with any Common Stock

ownership requirements set forth in the Bylaws as of his appointment or election to the Board.

|

▼ DETACH PROXY CARD HERE ▼

|

PRELIMINARY COPY SUBJECT TO COMPLETION

DATED MARCH 24, 2021

PROXY

THIS PROXY IS SOLICITED BY THE STILWELL

GROUP IN OPPOSITION TO

THE BOARD OF DIRECTORS OF PEOPLES FINANCIAL

CORPORATION

FOR THE 2021 ANNUAL MEETING OF STOCKHOLDERS

THIS SOLICITATION IS NOT BEING MADE BY

THE BOARD OF DIRECTORS OF PEOPLES FINANCIAL CORPORATION

The undersigned hereby appoints Mses. E.J.

Borrack, Teresa Huang and Megan Parisi, and each of them, attorneys and agents with full power of substitution, as Proxy for the

undersigned, to vote all shares of common stock, no par value per share, of Peoples Financial Corporation (“Peoples Financial”

or the “Corporation”), which the undersigned is entitled to vote at the Corporation’s 2021 Annual Meeting of

Stockholders, or any adjournments, postponements, continuations and reschedulesings thereof and at any meeting called in lieu thereof

(the “Annual Meeting”). The Corporation has not yet announced the date, time and location of the Annual Meeting. Once

the Corporation announces such information, the Stilwell Group will supplement this Proxy Card to include such information.

This proxy, when properly executed will

be voted in the manner directed herein by the undersigned stockholder. Unless otherwise specified, this proxy will be voted

“FOR” the election of the Stilwell Group’s Nominee as a director as noted on the reverse and if on the agenda

for the Annual Meeting and “FOR” the ratification of the appointment of Wipfli LLP as the Corporation’s independent

registered public accounting firm. This proxy revokes all prior proxies given by the undersigned.

Important Notice Regarding the Availability

of Proxy Materials for the Annual Meeting. The Stilwell Group’s Proxy Statement and form of GREEN proxy card are available

at [_____].

For registered shares, your proxy must

be received by 11:59 p.m. Eastern Time the day before the Annual Meeting date.

IMPORTANT: PLEASE SIGN AND DATE ON THE

REVERSE SIDE.

|

▼ DETACH PROXY CARD HERE ▼

|

The Stilwell Group recommends that you

vote “FOR” the election of the Stilwell Group’s Nominee, Peter Prickett, as a director and “FOR”

the ratification of the appointment of Wipfli LLP as the Corporation’s independent registered public accounting firm for

2021.

|

1.

|

ELECTION OF DIRECTORS

– To elect Mr. Peter Prickett

|

The Stilwell Group intends to use this

proxy to vote for the person who has been nominated by the Corporation for election as a director, other than the Corporation’s

nominee noted below. There is no assurance that the other candidates nominated by the Corporation will serve as directors if the

Stilwell Group’s Nominee is elected. You should refer to the Corporation’s proxy statement and form of proxy distributed

by the Corporation for the name, background, qualifications and other information concerning the Corporation’s nominees.

The Stilwell Group is NOT seeking authority to vote for and will NOT exercise any authority for [___].

Note: If you do not wish for your shares to be voted “FOR”

a person who has been nominated by the Corporation for election as a director, other than [___], write the name of the Corporation’s

nominee in the following space:

|

2.

|

RATIFICATION OF THE APPOINTMENT OF WIPFLI LLP AS THE INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM FOR PEOPLES FINANCIAL CORPORATION

|

|

|

¨ FOR

|

¨ AGAINST

|

¨ ABSTAIN

|

Each Proxy is authorized to vote, in his

or her discretion, upon any other matters as may properly come before the Annual Meeting that are unknown to such Proxy a reasonable

time before this solicitation as provided in the Proxy Statement provided herewith.

Please sign exactly as your name(s) appear

on the proxy card(s) previously sent to you. When shares are held by joint tenants, both should sign. When signing as an attorney,

executor, administrator, trustee, or guardian, please give full title as such. If a corporation, please sign in full corporation

name by the President or other duly authorized officer. If a partnership, please sign in partnership name by authorized person.

This proxy card votes all shares held in all capacities.

PLEASE SIGN, DATE, AND MAIL THIS PROXY

CARD TODAY.

|

Dated:

|

|

|

Signature

|

|

|

|

|

|

Title:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Dated:

|

|

|

Signature (if held jointly)

|

|

|

|

|

|

Title:

|

|

18

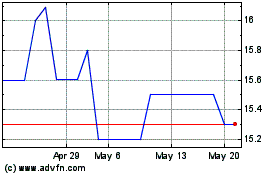

Peoples Financial (QX) (USOTC:PFBX)

Historical Stock Chart

From Oct 2024 to Nov 2024

Peoples Financial (QX) (USOTC:PFBX)

Historical Stock Chart

From Nov 2023 to Nov 2024