UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

Quarterly Report Pursuant to Section 13 OR 15(d) of the Securities Exchange

Act of 1934.

For the quarterly period ended December 31, 2008

Commission file number 0-10976

MICROWAVE FILTER COMPANY, INC.

(Exact name of registrant as specified in its charter.)

New York 16-0928443

(State of Incorporation) (I.R.S. Employer Identification Number)

|

6743 Kinne Street, East Syracuse, N.Y. 13057

(Address of Principal Executive Offices) (Zip Code)

Registrant's telephone number, including area code: (315) 438-4700

Indicate by check mark if the registrant is a well-known seasoned issuer, as

defined in Rule 405 of the Securities Act. YES ______ NO __X___

Indicate by check mark if the registrant is not required to file reports

pursuant to Section 13 or Section 15(d) of the Act. YES ______ NO ___X___

Indicate by check mark whether the registrant (1) has filed all reports

required to be filed by section 13 or 15(d) of the Securities Exchange Act of

1934 during the preceding 12 months (or for such shorter period that the

registrant was required to file such reports, and (2) has been subject to such

filing requirements for the past 90 days. YES __X__ NO____

Indicate by check mark whether the registrant is a large accelerated filer,

an accelerated filer, a non-accelerated filer or a smaller reporting company

(as defined in Rule 12b-2 of the Exchange Act).

Large accelerated filer ______ Accelerated filer ______ Non-accelerated filer

______ (Do not check if smaller reporting company) Smaller reporting company

____X____.

Indicate by check mark whether the registrant is a shell company (as defined

in Rule 12b-2 of the Exchange Act). YES ____ NO__X__

Common Stock, $.10 Par Value - 2,595,213 shares as of February 2, 2009.

PART I. - FINANCIAL INFORMATION

MICROWAVE FILTER COMPANY, INC.

CONSOLIDATED BALANCE SHEETS

(Amounts in thousands)

December 31, 2008 September 30, 2008

(Unaudited)

Assets

Current Assets:

Cash and cash equivalents $ 1,219 $ 1,417

Accounts receivable-trade, net 302 306

Inventories 614 601

Prepaid expenses and other

current assets 108 100

------- -------

Total current assets 2,243 2,424

Property, plant and equipment, net 437 393

------- -------

Total assets $ 2,680 $ 2,817

======= =======

Liabilities and Stockholders' Equity

Current liabilities:

Accounts payable $ 166 $ 152

Customer deposits 31 21

Accrued federal and state income

taxes 1 1

Accrued payroll and related

expenses 72 61

Accrued compensated absences 189 196

Other current liabilities 28 31

------- -------

Total current liabilities 487 462

------- -------

Total liabilities 487 462

------- -------

Stockholders' Equity:

Common stock,$.10 par value 432 432

Additional paid-in capital 3,249 3,249

Retained earnings 195 203

------- -------

3,876 3,884

Common stock in treasury,

at cost (1,683) (1,529)

------- -------

Total stockholders' equity 2,193 2,355

------- -------

Total liabilities and

stockholders' equity $ 2,680 $ 2,817

======= =======

|

See Accompanying Notes to Consolidated Financial Statements

MICROWAVE FILTER COMPANY, INC.

CONSOLIDATED STATEMENTS OF OPERATIONS

FOR THE THREE MONTHS

ENDED DECEMBER 31, 2008 AND 2007

(Unaudited)

(Amounts in thousands, except per share data)

Three months ended

December 31

2008 2007

Net sales $1,250 $1,343

Cost of goods sold 821 829

------ ------

Gross profit 429 514

Selling, general and

administrative expenses 442 490

------ ------

(Loss) income

from operations (13) 24

Other income (net),

principally interest 6 14

------ ------

(Loss) income before

income taxes (7) 38

Provision (benefit) for

income taxes 0 0

------ ------

NET (LOSS) INCOME ($7) $38

====== ======

Per share data:

Basic earnings (loss)

per share $0.00 $0.01

====== ======

Shares used in computing net

(loss) earnings per share: 2,667 2,895

|

See Accompanying Notes to Consolidated Financial Statements

MICROWAVE FILTER COMPANY, INC.

CONSOLIDATED STATEMENTS OF CASH FLOWS

FOR THE THREE MONTHS ENDED

DECEMBER 31, 2008 AND 2007

(Unaudited)

(Amounts in thousands)

Three months ended

December 31

2008 2007

Cash flows from operating

activities:

Net (loss) income ($ 7) $ 38

Adjustments to reconcile net

(loss) income to net cash

provided by operating activities:

Depreciation and amortization 20 19

Change in assets and liabilities:

Accounts receivable - trade 4 19

Inventories (13) 23

Prepaid expenses and other

assets (8) (42)

Accounts payable and accrued

expenses 14 (12)

Customer deposits 10 3

------ ------

Net cash provided by

operating activities 20 48

------ ------

Cash flows from

investing activities:

Capital expenditures (64) (12)

------ ------

Net cash used in

investing activities (64) (12)

------ ------

Cash flows from

financing activities:

Purchase of treasury stock (154) (1)

----- -----

Net cash used in financing

activities (154) (1)

----- -----

Net (decrease) increase in

cash and cash equivalents (198) 35

Cash and cash equivalents

at beginning of period 1,417 1,267

------ ------

Cash and cash equivalents

at end of period $1,219 $1,302

====== ======

|

See Accompanying Notes to Consolidated Financial Statements

MICROWAVE FILTER COMPANY, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

DECEMBER 31, 2008

Note 1. Summary of Significant Accounting Policies

The accompanying unaudited condensed consolidated financial statements have

been prepared in accordance with generally accepted accounting principles for

interim financial information and with the instructions to Form 10-Q and

Regulation S-K. Accordingly, they do not include all of the information and

footnotes required by generally accepted accounting principles for complete

financial statements. In the opinion of management, all adjustments

(consisting of normal recurring accruals) considered necessary for a fair

presentation have been included. The operating results for the three month

period ended December 31, 2008 are not necessarily indicative of the results

that may be expected for the year ended September 30, 2009. For further

information, refer to the consolidated financial statements and notes thereto

included in the Company's Annual Report on Form 10K for the year ended

September 30, 2008.

Note 2. Industry Segment Data

The Company's primary business segment involves the operations of Microwave

Filter Company, Inc. (MFC) which designs, develops, manufactures and sells

electronic filters, both for radio and microwave frequencies, to help process

signal distribution and to prevent unwanted signals from disrupting transmit

or receive operations. Markets served include cable television, television and

radio broadcast, satellite broadcast, mobile radio, commercial communications

and defense electronics.

Note 3. Inventories

Inventories are stated at the lower of cost determined on the first-in,

first-out method or market.

Inventories net of reserve for obsolescence consisted of the following:

(thousands of dollars) December 31, 2008 September 30, 2008

Raw materials and stock parts $503 $472

Work-in-process 25 19

Finished goods 86 110

---- ----

$614 $601

==== ====

|

The Company's reserve for obsolescence equaled $404,457 at December 31,

2008 and September 30, 2008.

Note 4. Income Taxes

The Company accounts for income taxes under Statement of Financial Accounting

Standards (SFAS) No. 109. Deferred tax assets and liabilities are based on

the difference between the financial statement and tax basis of assets and

liabilities as measured by the enacted tax rates which are anticipated to be

in effect when these differences reverse. The deferred tax provision is the

result of the net change in the deferred tax assets and liabilities. A

valuation allowance is established when it is necessary to reduce deferred

tax assets to amounts expected to be realized. The Company has provided a full

valuation allowance against its deferred tax assets.

The Company adopted FASB Interpretation No. 48, Accounting for Uncertainty

in Income Taxes - An Interpretation of FASB Statement No. 109 (FIN 48) as of

October 1, 2007. FIN 48 clarifies the accounting for uncertainty in income

taxes recognized in an entity's financial statements in accordance with FASB

Statement No. 109, Accounting for Income Taxes, and prescribes a recognition

threshold and measurement attributes for financial statement disclosure of tax

position taken or expected to be taken on a tax return. Additionally, FIN 48

provides guidance on derecognition, classification, interest and penalties,

accounting in interim periods, disclosure and transition. No adjustments were

required upon adoption of FIN 48.

Note 5. Recent Pronouncements

In February 2007, the Financial Accounting Standards Board ("FASB") issued

Statement of Financial Accounting Standard ("SFAS") No. 159, "The Fair Value

Option for Financial Assets and Financial Liabilities, including an amendment

of FASB Statement No. 115". SFAS 159 permits entities to choose to measure

many financial instruments and certain other items at fair value at specified

election dates. This Statement applies to all entities, including not-for-

profit organizations. SFAS 159 is effective as of the beginning of an

entity's first fiscal year that begins after November 15, 2007. As such, the

Company is required to adopt these provisions at the beginning of the fiscal

year ended September 30, 2009. The Company is currently evaluating the impact

of SFAS 159 on its consolidated financial statements.

Fair Value Measurements. In September 2006, the FASB published Statement of

Financial Accounting No. 157, Fair Value Measurements. This Statement

establishes a single authoritative definition of fair value, sets out a

framework for measuring fair value, and requires additional disclosures about

fair-value measurements. The Statement applies only to fair-value measurements

that are already required or permitted by other accounting standards and is

expected to increase the consistency of those measurements. It will also

affect current practices by nullifying the Emerging Issues Task Force (EITF)

guidance that prohibited recognition of gains or losses at the inception of

derivative transactions whose fair value is estimated by applying a model and

by eliminating the use of "blockage" factors by brokers, dealers, and

investment companies that have been applying AICPA Guides. The Statement is

effective for fair-value measures already required or permitted by other

standards for financial statements issued for fiscal years beginning after

November 15, 2007 (the Company's fiscal 2009) and interim periods within those

fiscal years. Early application is permissible only if no annual or interim

financial statements have been issued for the earlier periods. The

requirements of the Statement are applied prospectively, except for changes in

fair value related to estimating he fair value of a large block position and

instruments measured at fair value at initial recognition based on transaction

price in accordance with EITF 02-3 or Statement 155.

In December 2007, the Financial Accounting Standards Board issued Statement

of Financial Accounting Standard ("SFAS") No. 160, "Noncontrolling Interests

in Consolidated Financial Statements, an amendment of ARB No. 51". SFAS 160

establishes accounting and reporting standards for the noncontrolling interest

in a subsidiary and for the deconsolidation of a subsidiary. SFAS 160 is

effective for fiscal years, and interim periods within those fiscal years,

beginning on or after December 15, 2008. As such, the Company is required to

adopt these provisions at the beginning of the fiscal year ended September 30,

2010. The Company is currently evaluating the impact of SFAS 160 on its

consolidated financial statements.

In December 2007, the Financial Accounting Standards Board issued Statement

of Financial Accounting Standard ("SFAS") No. 141(R), "Business Combinations".

SFAS 141(R) establishes principles and requirements for how the acquirer

recognizes and measures in its financial statements the identifiable assets

acquired, the liabilities assumed, and any noncontrolling interest in the

acquiree, recognizes and measures the goodwill acquired in the business

combination or a gain from a bargain purchase, and determines what information

to disclose to enable users of the financial statements to evaluate the nature

and financial effects of the business combination. SFAS 141(R) is effective

for fiscal years, and interim periods within those fiscal years, beginning on

or after December 15, 2008. As such, the Company is required to adopt these

provisions at the beginning of the fiscal year ended September 30, 2010. The

Company is currently evaluating the impact of SFAS 141(R) on its consolidated

financial statements but does not expect it to have a material effect.

In March 2008, the Financial Accounting Standards Board ("FASB") issued

Statement of Financial Accounting Standard ("SFAS") No. 161, "Disclosures

about Derivative Instruments and Hedging Activities-an amendment of FASB

Statement No. 133". SFAS 161 requires enhanced disclosures about an entity's

derivative and hedging activities. SFAS 161 is effective for financial

statements issued for fiscal years and interim periods beginning after

November 15, 2008 with early application encouraged. As such, the Company is

required to adopt these provisions at the beginning of the fiscal year ended

September 30, 2010. The Company is currently evaluating the impact of SFAS 161

on its consolidated financial statements but does not expect it to have a

material effect.

In May 2008, the Financial Accounting Standards Board issued Statement of

Financial Accounting Standard ("SFAS") No. 162, "The Hierarchy of Generally

Accepted Accounting Principles". SFAS 162 identifies the sources of

accounting principles and the framework for selecting the principles used in

the preparation of financial statements of nongovernmental entities that are

presented in conformity with generally accepted accounting principles (GAAP)

in the United States. SFAS 162 is effective 60 days following the SEC's

approval of the Public Company Accounting Oversight Board amendments to AU

Section 411, The Meaning of Present Fairly in Conformity With Generally

Accepted Accounting Principles. The Company is currently evaluating the impact

of SFAS 162 on its consolidated financial statements but does not expect it to

have a material effect.

In May 2008, the Financial Accounting Standards Board ("FASB") issued

Statement of Financial Accounting Standard ("SFAS") No. 163, "Accounting for

Financial Guarantee Insurance Contracts-an interpretation of FASB Statement

No. 60" ("SFAS 163"). SFAS 163 interprets Statement 60 and amends existing

accounting pronouncements to clarify their application to the financial

guarantee insurance contracts included within the scope of that Statement.

SFAS 163 is effective for financial statements issued for fiscal years

beginning after December 15, 2008, and all interim periods within those fiscal

years. As such, the Company is required to adopt these provisions at the

beginning of the fiscal year ended September 30, 2010. The Company is

currently evaluating the impact of SFAS 163 on its consolidated financial

statements but does not expect it to have a material effect.

MICROWAVE FILTER COMPANY, INC.

MANAGEMENT'S DISCUSSION AND

ANALYSIS OF FINANCIAL CONDITION AND

RESULTS OF OPERATIONS

Microwave Filter Company, Inc. operates primarily in the United States and

principally in one industry. The Company extends credit to business customers

based upon ongoing credit evaluations. Microwave Filter Company, Inc. (MFC)

designs, develops, manufactures and sells electronic filters, both for radio

and microwave frequencies, to help process signal distribution and to prevent

unwanted signals from disrupting transmit or receive operations. Markets

served include cable television, television and radio broadcast, satellite

broadcast, mobile radio, commercial communications and defense electronics.

Critical Accounting Policies

The Company's consolidated financial statements are based on the application

of generally accepted accounting principles (GAAP). GAAP requires the use of

estimates, assumptions, judgments and subjective interpretations of accounting

principles that have an impact on the assets, liabilities, revenue and expense

amounts reported. The Company believes its use of estimates and underlying

accounting assumptions adhere to GAAP and are consistently applied. Valuations

based on estimates are reviewed for reasonableness and adequacy on a

consistent basis throughout the Company. Primary areas where financial

information of the Company is subject to the use of estimates, assumptions and

the application of judgment include revenues, receivables, inventories, and

taxes. Note 1 to the consolidated financial statements in our Annual Report on

Form 10-K for the fiscal year ended September 30, 2008 describes the

significant accounting policies used in preparation of the consolidated

financial statements. The most significant areas involving management

judgments and estimates are described below and are considered by management

to be critical to understanding the financial condition and results of

operations of the Company.

Revenues from product sales are recorded as the products are shipped and

title and risk of loss have passed to the customer, provided that no

significant vendor or post-contract support obligations remain and the

collection of the related receivable is probable. Billings in advance of the

Company's performance of such work are reflected as customer deposits in the

accompanying consolidated balance sheet.

Allowances for doubtful accounts are based on estimates of losses related to

customer receivable balances. The establishment of reserves requires the use

of judgment and assumptions regarding the potential for losses on receivable

balances.

The Company's inventories are stated at the lower of cost determined on the

first-in, first-out method or market. The Company uses certain estimates and

judgments and considers several factors including product demand and changes in

technology to provide for excess and obsolescence reserves to properly value

inventory.

The Company established a warranty reserve which provides for the estimated

cost of product returns based upon historical experience and any known

conditions or circumstances. Our warranty obligation is affected by product

that does not meet specifications and performance requirements and any related

costs of addressing such matters.

The Company accounts for income taxes under Statement of Financial Accounting

Standards (SFAS) No. 109. Deferred tax assets and liabilities are based on

the difference between the financial statement and tax basis of assets and

liabilities as measured by the enacted tax rates which are anticipated to be

in effect when these differences reverse. The deferred tax provision is the

result of the net change in the deferred tax assets and liabilities. A

valuation allowance is established when it is necessary to reduce deferred

tax assets to amounts expected to be realized. The Company has provided a full

valuation allowance against its deferred tax assets.

RESULTS OF OPERATIONS

THREE MONTHS ENDED DECEMBER 31, 2008 vs. THREE MONTHS ENDED DECEMBER 31, 2007.

The following table sets forth the Company's net sales by major product

group for the three months ended December 31, 2008 and 2007.

Product group (in thousands) Fiscal 2009 Fiscal 2008

Microwave Filter (MFC):

Cable TV $ 421 $ 499

RF/Microwave 286 444

Satellite 489 372

Broadcast TV 50 26

Niagara Scientific (NSI) 4 2

------ ------

Total $1,250 $1,343

====== ======

Sales backlog at 12/31 $ 421 $ 526

====== ======

|

Net sales for the three months ended December 31, 2008 equaled $1,249,703, a

decrease of $93,608 or 7.0% when compared to net sales of $1,343,311 for the

three months ended December 31, 2007.

MFC's Cable TV product sales for the three months ended December 31, 2008

equaled $421,239, a decrease of $78,348 or 15.7%, when compared to sales of

$499,587 during the same period last year. Management continues to project a

decrease in demand for Cable TV products due to the shift from analog to

digital television. Due to the inherent nature of digital modulation versus

analog modulation, fewer filters will be required. The Company has developed

filters for digital television and there will still be requirements for analog

filters for limited applications in commercial and private cable systems. The

demand for these filters is unknown at this time but is expected to decline.

MFC's RF/Microwave product sales for the three months ended December 31,

2008 equaled $286,093, a decrease of $158,402 or 35.6%, when compared to

RF/Microwave product sales of $444,495 for the three months ended December 31,

2007. Management attributes the decrease in sales to the economy. The

Company's RF/Microwave products are primarily sold to original equipment

manufacturers (OEMs) that serve the mobile radio and commercial and defense

electronics markets. Typical customers include the U.S. Government, General

Dynamics, Motorola, Rockwell Collins, Lockheed Martin, Northrup Gruman and

Raytheon. The Company continues to invest in production engineering and

infrastructure development to penetrate OEM market segments as they become

popular. MFC is concentrating its technical resources and product development

efforts toward potential high volume customers as part of a concentrated

effort to provide substantial long-term growth.

MFC's Satellite product sales for the three months ended December 31, 2008

equaled $488,898, an increase of $117,292 or 31.6%, when compared to sales of

$371,606 during the same period last year. The increase can be attributed to

an increase in demand for the Company's filters which suppress strong out-of-

band interference caused by military and civilian radar systems and other

sources. Management expects demand for these types of filters to continue with

the proliferation of earth stations world wide and increased sources of

interference.

MFC's Broadcast TV/Wireless Cable product sales for the three months ended

December 31, 2008 equaled $49,884, an increase of $24,035 or 93.0%, when

compared to sales of $25,849 during the same period last year primarily due to

an increase in demand for UHF Broadcast products.

The Company's sales order backlog equaled $420,955 at December 31, 2008

compared to sales order backlog of $415,911 at September 30, 2008. However,

backlog is not necessarily indicative of future sales. Accordingly, the

Company does not believe that its backlog as of any particular date is

representative of actual sales for any succeeding period. The total sales

order backlog at December 31, 2008 is scheduled to ship by September 30, 2009.

The Company recorded a net loss of $7,593 for the three months ended December

31, 2008 compared to net income of $37,750, or $.01 per share, for the three

months ended December 31, 2007. The decrease can primarily be attributed to the

lower sales volume this year when compared to the same period last year.

Gross profit for the three months ended December 31, 2008 equaled $429,008,

a decrease of $85,431 or 16.6%, when compared to gross profit of $514,439 for

the three months ended December 31, 2007. As a percentage of sales, gross

profit equaled 34.3% for the three months ended December 31, 2008 compared to

38.3% for the three months ended December 31, 2007. The decreases in gross

profit can primarily be attributed to the lower sales volume this year

providing a lower base to absorb fixed expenses.

Selling, general and administrative (SGA) expenses for the three months

ended December 31, 2008 equaled $442,239, a decrease of $47,843 or 9.8%, when

compared to SG&A expenses of $490,082 for the three months ended December 31,

2007. As a percentage of sales, SGA expenses decreased to 35.4% for the three

months ended December 31, 2008 compared to 36.5% for the three months ended

December 31, 2007. The lower SG&A expenses were due to lower printing

costs, sales commissions and payroll expenses during the three months ended

December 31, 2008 when compared to the same period last year.

Other income is primarily interest income earned on invested cash balances.

Other income equaled $5,638 for the three months ended December 31, 2008

compared to $13,393 for the three months ended December 31, 2007. The decrease

is primarily due to lower invested cash balances and lower market interest

rates this year when compared to last year. Other income may fluctuate based

on market interest rates and levels of invested cash balances.

The provision (benefit) for income taxes equaled $0 for both the three months

ended December 31, 2008 and 2007. Any benefit for losses have been subject to a

valuation allowance since the realization of the deferred tax benefit is not

considered more likely than not.

Off-Balance Sheet Arrangements

At December 31, 2008 and 2007, the Company did not have any unconsolidated

entities or financial partnerships, such as entities often referred to as

structured finance or special purpose entities, which might have been

established for the purpose of facilitating off-balance sheet arrangements.

LIQUIDITY and CAPITAL RESOURCES

December 31, 2008 September 30, 2008

Cash & cash equivalents $1,219,381 $1,417,271

Working capital $1,756,143 $1,961,413

Current ratio 4.61 to 1 5.24 to 1

Long-term debt $ 0 $ 0

|

Cash and cash equivalents decreased $197,890 to $1,219,381 at December 31,

2008 when compared to cash and cash equivalents of $1,417,271 at September 30,

2008. The decrease was a result of $19,576 in net cash provided by operating

activities, $63,535 in net cash used for capital expenditures and $153,931 in

net cash used to purchase treasury stock.

During the quarter ended December 31, 2008, the Company purchased 297,219

shares of its common stock at a cost of $153,931 from two shareholders.

At December 31, 2008, the Company had unused aggregate lines of credit

totaling $750,000 collateralized by all inventory, equipment and accounts

receivable.

Management believes that its working capital requirements for the forseeable

future will be met by its existing cash balances, future cash flows from

operations and its current credit arrangements.

SAFE HARBOR STATEMENT UNDER THE PRIVATE SECURITIES LITIGATION REFORM ACT OF 1995

In an effort to provide investors a balanced view of the Company's current

condition and future growth opportunities, this Quarterly Report on Form 10-Q

may include comments by the Company's management about future performance.

These statements which are not historical information are "forward-looking

statements" pursuant to the safe harbor provisions of the Private Securities

Litigation Reform Act of 1995. These, and other forward-looking statements,

are subject to business and economic risks and uncertainties that could cause

actual results to differ materially from those discussed. These risks and

uncertainties include, but are not limited to: risks associated with demand

for and market acceptance of existing and newly developed products as to which

the Company has made significant investments; general economic and industry

conditions; slower than anticipated penetration into the satellite

communications, mobile radio and commercial and defense electronics markets;

competitive products and pricing pressures; increased pricing pressure from

our customers; risks relating to governmental regulatory actions in broadcast,

communications and defense programs; as well as other risks and uncertainties,

including but not limited to those detailed from time to time in the Company's

Securities and Exchange Commission filings. These forward-looking statements

are made only as of the date hereof, and the Company undertakes no obligation

to update or revise the forward-looking statements, whether as a result of new

information, future events or otherwise. You are encouraged to review

Microwave Filter Company's 2008 Annual Report and Form 10-K for the fiscal

year ended September 30, 2008 and other Securities and Exchange Commission

filings. Forward looking statements may be made directly in this document or

"incorporated by reference" from other documents. You can find many of these

statements by looking for words like "believes," "expects," "anticipates,"

"estimates," or similar expressions.

ITEM 3. QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK

There has been no significant change in our exposures to market risk during

the three months ended December 31, 2008. For a detailed discussion of market

risk, see our Annual Report on Form 10-K for the fiscal year ended September

30, 2008, Part II, Item 7A, Quantitative and Qualitative Disclosures About

Market Risk.

ITEM 4. CONTROLS AND PROCEDURES

1. Evaluation of disclosure controls and procedures. Based on their

evaluation of the Company's disclosure controls and procedures (as

defined in Rules 13a-15(e) and 15d-15(e) under the Securities

Exchange Act of 1934) as of the end of the period covered by this

Quarterly Report on Form 10-Q, the Company's chief executive officer

and chief financial officer have concluded that the Company's

disclosure controls and procedures are effective.

2. Changes in internal control over financial reporting. During the period

covered by this Quarterly Report on Form 10-Q, there were no changes in

the Company's internal control over financial reporting (as defined in

Rule 13a-15(f)) that have materially affected, or are reasonably

likely to materially affect, the Company's internal control over

financial reporting.

PART II - OTHER INFORMATION

Item 1. Legal Proceedings

The Company is unaware of any material threatened or pending

litigation against the Company.

Item 1A. Risk Factors

Not applicable.

Item 2. Changes in Securities

None during this reporting period.

Item 3. Defaults Upon Senior Securities

The Company has no senior securities.

Item 4. Submission of Matters to a Vote of Security Holders

None during this reporting period.

Item 6. Exhibits and Reports on Form 8-K

a. Exhibits

31.1 Section 13a-14(a)/15d-14(a) Certification of Carl F. Fahrenkrug

31.2 Section 13a-14(a)/15d-14(a) Certification of Richard L. Jones

32.1 Section 1350 Certification of Carl F. Fahrenkrug

32.2 Section 1350 Certification of Richard L. Jones

b. Reports on Form 8-K

None.

Pursuant to the requirements of the Securities and Exchange Act

of 1934, the registrant has duly caused this report to be signed on

its behalf by the undersigned thereunto duly authorized.

MICROWAVE FILTER COMPANY, INC.

February 13, 2009 Carl F. Fahrenkrug

(Date) --------------------------

Carl F. Fahrenkrug

Chief Executive Officer

February 13, 2009 Richard L. Jones

(Date) --------------------------

Richard L. Jones

Chief Financial Officer

|

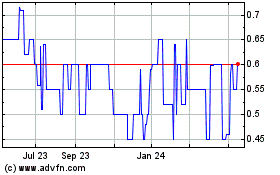

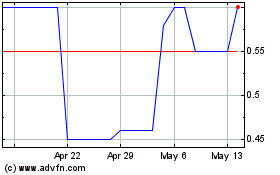

Microwave Filter (PK) (USOTC:MFCO)

Historical Stock Chart

From Jun 2024 to Jul 2024

Microwave Filter (PK) (USOTC:MFCO)

Historical Stock Chart

From Jul 2023 to Jul 2024