UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-QSB

Quarterly Report Pursuant to Section 13 OR 15(d) of the Securities Exchange

Act of 1934.

For the quarterly period ended June 30, 2008

Commission file number 0-10976

MICROWAVE FILTER COMPANY, INC.

(Exact name of registrant as specified in its charter.)

New York 16-0928443

(State of Incorporation) (I.R.S. Employer Identification Number)

|

6743 Kinne Street, East Syracuse, N.Y. 13057

(Address of Principal Executive Offices) (Zip Code)

Registrant's telephone number, including area code: (315) 438-4700

Indicate by check mark whether registrant (1) has filed all reports

required to be filed by Section 13 or 15(d) of the Securities Exchange

Act of 1934 during the preceding 12 months (or for shorter period that

the registrant was required to file such reports), and (2) has been

subject to such filing requirements for the past 90 days.

YES ( X ) NO ( )

Indicate by check mark whether the registrant is an accelerated filer

(as defined in Rule 12b-2 of the Exchange Act).

YES ( ) NO ( X )

Indicate by check mark whether the registrant is a shell company (as

defined in Rule 12b-2 of the Exchange Act).

YES ( ) NO ( X )

Indicate the number of shares outstanding of each of the issuer's

classes of common stock, as of the latest practical date:

Common Stock, $.10 Par Value - 2,893,536 shares as of June 30, 2008.

PART I. - FINANCIAL INFORMATION

MICROWAVE FILTER COMPANY, INC.

CONSOLIDATED BALANCE SHEETS

(Amounts in thousands)

June 30, 2008 September 30, 2007

(Unaudited)

Assets

Current Assets:

Cash and cash equivalents $ 1,357 $ 1,267

Accounts receivable-trade, net 306 371

Inventories 678 661

Prepaid expenses and other

current assets 86 86

------- -------

Total current assets 2,427 2,385

Property, plant and equipment, net 406 441

------- -------

Total assets $ 2,833 $ 2,826

======= =======

|

Liabilities and Stockholders' Equity

Current liabilities:

Accounts payable $ 186 $ 163

Customer deposits 19 47

Accrued federal and state income

taxes payable 1 1

Accrued payroll and related

expenses 63 58

Accrued compensated absences 208 209

Other current liabilities 27 30

------- -------

Total current liabilities 504 508

------- -------

Total liabilities 504 508

------- -------

Stockholders' Equity:

Common stock,$.10 par value 432 432

Additional paid-in capital 3,249 3,249

Retained earnings 176 163

------- -------

3,857 3,844

Common stock in treasury,

at cost (1,528) (1,526)

------- -------

Total stockholders' equity 2,329 2,318

------- -------

Total liabilities and

stockholders' equity $ 2,833 $ 2,826

======= =======

|

See Accompanying Notes to Consolidated Financial Statements

MICROWAVE FILTER COMPANY, INC.

CONSOLIDATED STATEMENTS OF OPERATIONS

FOR THE THREE MONTHS AND NINE MONTHS

ENDED JUNE 30, 2008 AND 2007

(Unaudited)

(Amounts in thousands, except per share data)

Three months ended Nine months ended

June 30 June 30

2008 2007 2008 2007

Net sales $1,362 $1,123 $3,922 $3,444

Cost of goods sold 819 767 2,465 2,268

------ ------ ------ ------

Gross profit 543 356 1,457 1,176

Selling, general and

administrative expenses 500 520 1,479 1,480

------ ------ ------ ------

Income (loss) from

operations 43 (164) (22) (304)

Other income (net),

principally interest 11 15 35 49

------ ------ ------ ------

Income (loss) before

income taxes 54 (149) 13 (255)

Provision for income

taxes 0 0 0 0

------ ------ ------ ------

NET INCOME (LOSS) $54 ($149) $13 ($255)

====== ====== ====== ======

Per share data:

Basic and Diluted earnings

(loss) per share $0.02 ($0.05) $0.00 ($0.09)

====== ====== ====== ======

Shares used in computing

|

net earnings (loss) per share:

Basic and Diluted 2,894 2,898 2,895 2,901

See Accompanying Notes to Consolidated Financial Statements

MICROWAVE FILTER COMPANY, INC.

CONSOLIDATED STATEMENTS OF CASH FLOWS

FOR THE NINE MONTHS ENDED JUNE 30, 2008 AND 2007

(Unaudited)

(Amounts in thousands)

Nine months ended

June 30

2008 2007

Cash flows from operating

activities:

Net income (loss) $ 13 ($ 255)

Adjustments to reconcile

net income (loss) to net

cash provided by (used in)

operating activities:

Depreciation and amortization 58 85

Change in assets and liabilities:

Accounts receivable 65 20

Federal and state income

tax recoverable 0 138

Inventories (17) (151)

Prepaid expenses & other

assets 0 14

Accounts payable & accrued

expenses 23 (29)

Customer deposits (28) 1

----- -----

Net cash provided by (used in)

operating activities 114 (177)

----- -----

Cash flows from investing

activities:

Investments 0 20

Capital expenditures (22) (1)

----- -----

Net cash (used in) provided by

investing activities (22) 19

----- -----

Cash flows from financing

activities:

Purchase of treasury stock (2) (6)

----- -----

Net cash used in financing

activities (2) (6)

----- -----

Increase (decrease) in cash

and cash equivalents 90 (164)

Cash and cash equivalents

at beginning of period 1,267 706

----- -----

Cash and cash equivalents

at end of period $1,357 $ 542

====== =====

Supplemental disclosures of cash flows:

Cash paid (refunded) during the year

for (approximately):

Interest $0 $0

Income taxes $0 $0

|

See Accompanying Notes to Consolidated Financial Statements

MICROWAVE FILTER COMPANY, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

JUNE 30, 2008

Note 1. Summary of Significant Accounting Policies

The accompanying unaudited condensed consolidated financial statements have

been prepared in accordance with generally accepted accounting principles for

interim financial information and with the instructions to Form 10-QSB and

Regulation S-B. Accordingly, they do not include all of the information and

footnotes required by generally accepted accounting principles for complete

financial statements. In the opinion of management, all adjustments

(consisting of normal recurring accruals) considered necessary for a fair

presentation have been included. The operating results for the nine month

period ended June 30, 2008 are not necessarily indicative of the results that

may be expected for the year ended September 30, 2008. For further

information, refer to the consolidated financial statements and notes thereto

included in the Company's Annual Report on Form 10KSB for the year ended

September 30, 2007.

Note 2. Industry Segment Data

The Company's primary business segment involves the operations of Microwave

Filter Company, Inc. (MFC) which designs, develops, manufactures and sells

electronic filters, both for radio and microwave frequencies, to help process

signal distribution and to prevent unwanted signals from disrupting transmit

or receive operations. Markets served include cable television, television and

radio broadcast, satellite broadcast, mobile radio, commercial communications

and defense electronics.

Note 3. Inventories

Inventories are stated at the lower of cost determined on the first-in,

first-out method or market.

Inventories net of reserve for obsolescence consisted of the following:

(thousands of dollars) June 30, 2008 September 30, 2007

Raw materials and stock parts $548 $517

Work-in-process 51 55

Finished goods 79 89

---- ----

$678 $661

==== ====

|

The Company's reserve for obsolescence equaled $389,726 at June 30,

2008 and September 30, 2007.

Note 4. Income Taxes

The Company adopted FASB Interpretation No. 48, Accounting for Uncertainty

in Income Taxes - An Interpretation of FASB Statement No. 109 (FIN 48) as of

October 1, 2007. FIN 48 clarifies the accounting for uncertainty in income

taxes recognized in an entity's financial statements in accordance with FASB

Statement No. 109, Accounting for Income Taxes, and prescribes a recognition

threshold and measurement attributes for financial statement disclosure of tax

position taken or expected to be taken on a tax return. Additionally, FIN 48

provides guidance on derecognition, classification, interest and penalties,

accounting in interim periods, disclosure and transition. No adjustments were

required upon adoption of FIN 48. The Company has provided a full valuation

allowance against its deferred tax assets.

The Company is currently open to audit under the statute of limitations by

the Internal Revenue Service for the fiscal years 2004 through 2007. The

Company's state tax returns are open to audit under the statute of limitations

for the fiscal years 2004 through 2007.

Note 5. Stock Options

On April 9, 1998, the Board of Directors and Shareholders of Microwave

Filter Company, Inc. approved the 1998 Microwave Filter Company, Inc.

Incentive Stock Plan (the "1998 Plan"). Under the 1998 Plan, the Company may

grant incentive stock options ("ISOs"), non-qualified stock options ("NQSOs")

and stock appreciation rights to directors, officers and employees of the

Company and its affiliates. The 1998 Plan reserves 150,000 shares for

issuance. The exercise price of the ISOs and NQSOs will be 100% of the fair

market value of the Common Stock on the date the ISOs and NQSOs are granted.

On June 21, 2004, the Board of Directors granted ISOs totaling 115,000 shares

and NQSOs totaling 35,000 shares at an exercise price of $1.47. All options

were 100% vested. The 1998 Plan terminated on April 10, 2008.

We accounted for our incentive stock plan under the recognition and

measurement principles of Accounting Principles Board Opinion No. 25,

Accounting for stock issued to employees. No compensation expense has been

recognized in the accompanying financial statements relative to our stock

option plan.

The Company has adopted the provisions of SFAS No. 123R, "Share-Based

Payment", for the fiscal year beginning October 1, 2006.

A summary of all stock option activity and information related to all options

outstanding follows:

Nine months ended

June 30, 2008

------------------

ISOs NQSOs

-------- --------

Exercise Shares Exercise Shares

Price Price

-------- -------- -------- --------

Outstanding at

beginning of period $1.47 108,548 $1.47 30,000

Granted - 0 - 0

Exercised - 0 - 0

Cancelled $1.47 108,548 $1.47 30,000

------ -------- ------ --------

Outstanding at

end of period - 0 - 0

------ -------- ------ --------

|

MICROWAVE FILTER COMPANY, INC.

MANAGEMENT'S DISCUSSION AND

ANALYSIS OF FINANCIAL CONDITION AND

RESULTS OF OPERATIONS

Microwave Filter Company, Inc. operates primarily in the United States and

principally in one industry. The Company extends credit to business customers

based upon ongoing credit evaluations. Microwave Filter Company, Inc. (MFC)

designs, develops, manufactures and sells electronic filters, both for radio

and microwave frequencies, to help process signal distribution and to prevent

unwanted signals from disrupting transmit or receive operations. Markets

served include cable television, television and radio broadcast, satellite

broadcast, mobile radio, commercial communications and defense electronics.

Critical Accounting Policies

The Company's consolidated financial statements are based on the application

of generally accepted accounting principles (GAAP). GAAP requires the use of

estimates, assumptions, judgments and subjective interpretations of accounting

principles that have an impact on the assets, liabilities, revenue and expense

amounts reported. The Company believes its use of estimates and underlying

accounting assumptions adhere to GAAP and are consistently applied. Valuations

based on estimates are reviewed for reasonableness and adequacy on a

consistent basis throughout the Company. Primary areas where financial

information of the Company is subject to the use of estimates, assumptions and

the application of judgment include revenues, receivables, inventories, and

taxes. Note 1 to the consolidated financial statements in our Annual Report on

Form 10-KSB for the fiscal year ended September 30, 2007 describes the

significant accounting policies used in preparation of the consolidated

financial statements. The most significant areas involving management

judgments and estimates are described below and are considered by management

to be critical to understanding the financial condition and results of

operations of the Company.

Revenues from product sales are recorded as the products are shipped and

title and risk of loss have passed to the customer, provided that no

significant vendor or post-contract support obligations remain and the

collection of the related receivable is probable. Billings in advance of the

Company's performance of such work are reflected as customer deposits in the

accompanying consolidated balance sheet.

Allowances for doubtful accounts are based on estimates of losses related to

customer receivable balances. The establishment of reserves requires the use

of judgment and assumptions regarding the potential for losses on receivable

balances.

The Company's inventories are stated at the lower of cost determined on the

first-in, first-out method or market. The Company uses certain estimates and

judgments and considers several factors including product demand and changes

in technology to provide for excess and obsolescence reserves to properly

value inventory.

The Company established a warranty reserve which provides for the estimated

cost of product returns based upon historical experience and any known

conditions or circumstances. Our warranty obligation is affected by product

that does not meet specifications and performance requirements and any related

costs of addressing such matters.

The Company accounts for income taxes under Statement of Financial

Accounting Standards (SFAS) No. 109. Deferred tax assets and liabilities are

based on the difference between the financial statement and tax basis of

assets and liabilities as measured by the enacted tax rates which are

anticipated to be in effect when these differences reverse. The deferred tax

provision is the result of the net change in the deferred tax assets and

liabilities. A valuation allowance is established when it is necessary to

reduce deferred tax assets to amounts expected to be realized. The Company has

provided a full valuation allowance against its deferred tax assets.

RESULTS OF OPERATIONS

THREE MONTHS ENDED JUNE 30, 2008 vs. THREE MONTHS ENDED JUNE 30, 2007

The following table sets forth the Company's net sales by major product

group for the three months ended June 30, 2008 and 2007.

Product group (in thousands) Fiscal 2008 Fiscal 2007

Microwave Filter (MFC):

Cable TV $ 524 $ 484

Satellite 461 229

RF/Microwave 353 380

Broadcast TV 23 22

Niagara Scientific (NSI) 1 8

------ ------

Total $1,362 $1,123

====== ======

Sales backlog at 6/30 $ 384 $ 495

====== ======

|

Net sales for the three months ended June 30, 2008 equaled $1,362,359, an

increase of $239,399 or 21.3%, when compared to net sales of $1,122,960 for

the three months ended June 30, 2007.

MFC's Cable TV product sales increased $41,179 or 8.5% to $524,655 during

the three months ended June 30, 2008 when compared to Cable TV product sales

of $483,476 during the same period last year. Management continues to project

a decrease in demand for Cable TV products due to the shift from analog to

digital television scheduled for completion by February 17, 2009. Although the

Company has developed filters for digital television, the demand for these

types of filters is unknown at this time.

MFC's Satellite product sales increased $231,571 or 101% to $460,739 during

the three months ended June 30, 2008 when compared to sales of $229,168 during

the same period last year. The increase can be attributed to an increase in

demand for the Company's filters which suppress strong out-of-band

interference caused by military and civilian radar systems and other sources.

Management expects demand for these types of filters to continue with the

proliferation of earth stations world wide and increased sources of

interference.

MFC's RF/Microwave product sales decreased $26,291 or 6.9% to $353,444 for

the three months ended June 30, 2008 when compared to RF/Microwave product

sales of $379,735 during the same period last year. MFC's RF/Microwave

products are sold primarily to original equipment manufacturers (OEMs) that

serve the mobile radio, commercial communications and defense electronics

markets. The Company continues to invest in production engineering and

infrastructure development to penetrate OEM (Original Equipment Manufacturer)

market segments as they become popular. MFC is concentrating its technical

resources and product development efforts toward potential high volume

customers as part of a concentrated effort to provide substantial long-term

growth.

MFC's Broadcast TV/Wireless Cable product sales increased $638 or 2.9% to

$22,867 for the three months ended June 30, 2008 when compared to sales of

$22,229 during the same period last year. The increase can be attributed to an

increase in demand for UHF Broadcast products.

MFC's sales order backlog equaled $384,252 at June 30, 2008 compared to

sales order backlog of $502,760 at September 30, 2007 and $495,409 at June 30,

2007. However, backlog is not necessarily indicative of future sales.

Accordingly, the Company does not believe that its backlog as of any

particular date is representative of actual sales for any succeeding period.

Approximately 85% of the sales order backlog at June 30, 2008 is scheduled to

ship by September 30, 2008.

NSI sales for the three months ended June 30, 2008 equaled $654 compared to

sales of $8,352 for the three months ended June 30, 2007. NSI sales consist

primarily of field service and spare parts.

Gross profit for the three months ended June 30, 2008 equaled $542,854, an

increase of $186,480 or 52.3%, when compared to gross profit of $356,374 for

the three months ended June 30, 2007. As a percentage of sales, gross profit

equaled 39.8% for the three months ended June 30, 2008 compared to 31.7% for

the three months ended June 30, 2007. The increases in gross profit can

primarily be attributed to the higher sales volume this year allowing the

Company to better absorb fixed costs.

Selling, general and administrative (SGA) expenses for the three months

ended June 30, 2008 equaled $499,549, a decrease of $20,635 or 4.0%, when

compared to SG&A expenses of $520,184 for the three months ended June 30,

2007. The decrease can primarily be attributed to lower payroll costs this

year when compared to the same period last year. As a percentage of sales, SGA

expenses decreased to 36.7% for the three months ended June 30, 2008 compared

to 46.3% for the three months ended June 30, 2007 primarily due to the higher

sales volume this year when compared to the same period last year.

The Company recorded income from operations of $43,305 for the third quarter

ended June 30, 2008 compared to a loss from operations of $163,810 for the

three months ended June 30, 2007. The improvement in operating income can

primarily be attributed to the higher sales volume this year when compared to

the same period last year.

Other income for the three months ended June 30, 2008 equaled $10,951, a

decrease of $3,784 when compared to other income of $14,735 for the three

months ended June 30, 2007. Other income is primarily interest income earned

on invested cash balances. The decrease in other income can primarily be

attributed to lower market interest rates when compared to last year. Other

income may fluctuate based on market interest rates and levels of invested

cash balances.

The provision (benefit) for income taxes equaled $0 for the three months

ended June 30, 2008. The Company has provided a full valuation allowance

against its deferred tax assets since the realization of the deferred tax

benefit is not considered more likely than not.

NINE MONTHS ENDED JUNE 30, 2008 vs. NINE MONTHS ENDED JUNE 30, 2007

The following table sets forth the Company's net sales by major product

group for the nine months ended June 30, 2008 and 2007.

Product group (in thousands) Fiscal 2008 Fiscal 2007

Microwave Filter (MFC):

Cable TV $1,510 $1,438

Satellite 1,145 716

RF/Microwave 1,166 1,134

Broadcast TV 96 123

Niagara Scientific (NSI) 5 33

------ ------

Total $3,922 $3,444

====== ======

Sales backlog at 6/30 $ 384 $ 495

====== ======

|

Net sales for the nine months ended June 30, 2008 equaled $3,922,334, an

increase of $477,910 or 13.9%, when compared to net sales of $3,444,424 for

the nine months ended June 30, 2007.

MFC's Cable TV product sales increased $72,132 or 5.0% to $1,509,885 during

the nine months ended June 30, 2008 when compared to Cable TV product sales of

$1,437,753 during the nine months ended June 30, 2007. Despite the increase in

Cable TV product sales, management continues to project a decrease in demand

for Cable TV products due to the shift from analog to digital television

scheduled for completion by February 17, 2009. Although the Company has

developed filters for digital television, the demand for these types of

filters is unknown at this time.

MFC's Satellite product sales increased $428,121 OR 59.8% TO $1,144,508

during the nine months ended June 30, 2008 when compared to sales of $716,387

during the same period last year. The increase can be attributed to an

increase in demand for the Company's filters which suppress strong out-of-band

interference caused by military and civilian radar systems and other sources.

Management expects demand for these types of filters to continue with the

proliferation of earth stations world wide and increased sources of

interference.

MFC's RF/Microwave product sales increased $32,396 or 2.9% to $1,166,257

during the nine months ended June 30, 2008 when compared to RF/Microwave

product sales of $1,133,861 during the same period last year. MFC's

RF/Microwave products are sold primarily to original equipment manufacturers

(OEMs) that serve the mobile radio, commercial communications and defense

electronics markets. The Company continues to invest in production engineering

and infrastructure development to penetrate OEM (Original Equipment

Manufacturer) market segments as they become popular. MFC is concentrating its

technical resources and product development efforts toward potential high

volume customers as part of a concentrated effort to provide substantial long-

term growth.

MFC's Broadcast TV/Wireless Cable product sales decreased $26,849 or 21.8%

to $96,390 during the nine months ended June 30, 2008 when compared to sales

of $123,239 during the same period last year. The decrease can be attributed

to a decrease in demand for UHF Broadcast products.

NSI sales for the nine months ended June 30, 2008 equaled $5,294 compared to

sales of $33,184 for the nine months ended June 30, 2007. NSI sales consist

primarily of field service and spare parts.

Gross profit for the nine months ended June 30, 2008 equaled $1,457,697, an

increase of $281,026, or 23.9%, when compared to gross profit of $1,176,671

for the nine months ended June 30, 2007. As a percentage of sales, gross

profit equaled 37.2% for the nine months ended June 30, 2008 compared to 34.2%

for the nine months ended June 30, 2007. The increases in gross profit can

primarily be attributed to the higher sales volume this year allowing the

Company to better absorb fixed costs.

SG&A expenses for the nine months ended June 30, 2008 equaled $1,479,416, a

decrease of $1,211 or 0.1%, when compared to SG&A expenses of $1,480,627 for

the nine months ended June 30, 2007. As a percentage of sales, SGA expenses

decreased to 37.7% for the nine months ended June 30, 2008 compared to 43.0%

for the nine months ended June 30, 2007 due primarily to the higher sales

volume this year.

The Company recorded a loss from operations of $21,719 for the nine months

ended June 30, 2008 compared to a loss from operations of $303,956 for the

nine months ended June 30, 2007. The improvement can primarily be attributed

to the higher sales volume this year when compared to the same period last

year.

Other income for the nine months ended June 30, 2008 equaled $34,603, a

decrease of $14,506, when compared to other income of $49,109 for the nine

months ended June 30, 2007. Other income is primarily interest income earned

on invested cash balances. The decrease in other income can primarily be

attributed to lower market interest rates this year when compared to the same

period last year. Other income may fluctuate based on market interest rates

and levels of invested cash balances.

The provision (benefit) for income taxes equaled $0 for the nine months

ended June 30, 2008. The Company has provided a full valuation allowance

against its deferred tax assets since the realization of the deferred tax

benefit is not considered more likely than not.

Off-Balance Sheet Arrangements

At June 30, 2008 and 2007, the Company did not have any unconsolidated

entities or financial partnerships, such as entities often referred to as

structured finance or special purpose entities, which might have been

established for the purpose of facilitating off-balance sheet arrangements.

LIQUIDITY and CAPITAL RESOURCES

June 30, 2008 Sep. 30, 2007

Cash & cash equivalents $1,357,097 $1,266,979

Working capital $1,923,211 $1,876,807

Current ratio 4.82 to 1 4.69 to 1

Long-term debt $ 0 $ 0

|

Cash and cash equivalents increased $90,118 to $1,357,097 at June 30, 2008

when compared to cash and cash equivalents of $1,266,979 at September 30,

2007. The increase was a result of $114,532 in net cash provided by operating

activities, $22,461 in net cash used in investing activities and $1,953 in net

cash used in financing activities.

The decrease of $64,370 in accounts receivable at June 30, 2008, when

compared to September 30, 2007, can primarily be attributable to an

improvement in accounts receivable collections during the quarter ended June

30, 2008 when compared to the quarter ended September 30, 2007.

Cash used in investing activities during the nine months ended June 30, 2008

consisted of funds used for capital expenditures of $22,461.

Cash used in financing activities during the nine months ended June 30, 2008

consisted of funds used to purchase treasury stock of $1,953.

At June 30, 2008, the Company had unused aggregate lines of credit totaling

$750,000 collateralized by all inventory, equipment and accounts receivable.

Management believes that its working capital requirements for the forseeable

future will be met by its existing cash balances, future cash flows from

operations and its current credit arrangements.

RECENT PRONOUNCEMENTS

In February 2007, the Financial Accounting Standards Board ("FASB") issued

Statement of Financial Accounting Standard ("SFAS") No. 159, "The Fair Value

Option for Financial Assets and Financial Liabilities, including an amendment

of FASB Statement No. 115". SFAS 159 permits entities to choose to measure

many financial instruments and certain other items at fair value at specified

election dates. This Statement applies to all entities, including not-for-

profit organizations. SFAS 159 is effective as of the beginning of an

entity's first fiscal year that begins after November 15, 2007. As such, the

Company is required to adopt these provisions at the beginning of the fiscal

year ended September 30, 2009. The Company is currently evaluating the impact

of SFAS 159 on its consolidated financial statements.

In December 2007, the Financial Accounting Standards Board issued Statement

of Financial Accounting Standard ("SFAS") No. 160, "Noncontrolling Interests

in Consolidated Financial Statements, an amendment of ARB No. 51". SFAS 160

establishes accounting and reporting standards for the noncontrolling interest

in a subsidiary and for the deconsolidation of a subsidiary. SFAS 160 is

effective for fiscal years, and interim periods within those fiscal years,

beginning on or after December 15, 2008. As such, the Company is required to

adopt these provisions at the beginning of the fiscal year ended September 30,

2010. The Company is currently evaluating the impact of SFAS 160 on its

consolidated financial statements.

In March 2008, the Financial Accounting Standards Board ("FASB") issued

Statement of Financial Accounting Standard ("SFAS") No. 161, "Disclosures

about Derivative Instruments and Hedging Activities-an amendment of FASB

Statement No. 133". SFAS 161 requires enhanced disclosures about an entity's

derivative and hedging activities. SFAS 161 is effective for financial

statements issued for fiscal years and interim periods beginning after

November 15, 2008 with early application encouraged. As such, the Company is

required to adopt these provisions at the beginning of the fiscal year ended

September 30, 2010. The Company is currently evaluating the impact of SFAS 161

on its consolidated financial statements but does not expect it to have a

material effect.

In May 2008, the Financial Accounting Standards Board issued Statement of

Financial Accounting Standard ("SFAS") No. 162, "The Hierarchy of Generally

Accepted Accounting Principles". SFAS 162 identifies the sources of

accounting principles and the framework for selecting the principles used in

the preparation of financial statements of nongovernmental entities that are

presented in conformity with generally accepted accounting principles (GAAP)

in the United States. SFAS 162 is effective 60 days following the SEC's

approval of the Public Company Accounting Oversight Board amendments to AU

Section 411, The Meaning of Present Fairly in Conformity With Generally

Accepted Accounting Principles. The Company is currently evaluating the impact

of SFAS 162 on its consolidated financial statements but does not expect it to

have a material effect.

In May 2008, the Financial Accounting Standards Board ("FASB") issued

Statement of Financial Accounting Standard ("SFAS") No. 163, "Accounting for

Financial Guarantee Insurance Contracts-an interpretation of FASB Statement

No. 60" ("SFAS 163"). SFAS 163 interprets Statement 60 and amends existing

accounting pronouncements to clarify their application to the financial

guarantee insurance contracts included within the scope of that Statement.

SFAS 163 is effective for financial statements issued for fiscal years

beginning after December 15, 2008, and all interim periods within those fiscal

years. As such, the Company is required to adopt these provisions at the

beginning of the fiscal year ended September 30, 2010. The Company is

currently evaluating the impact of SFAS 163 on its consolidated financial

statements but does not expect it to have a material effect.

SAFE HARBOR STATEMENT UNDER THE PRIVATE SECURITIES LITIGATION REFORM ACT OF 1995

In an effort to provide investors a balanced view of the Company's current

condition and future growth opportunities, this Quarterly Report on Form 10-

QSB includes comments by the Company's management about future performance.

These statements which are not historical information are "forward-looking

statements" pursuant to the safe harbor provisions of the Private Securities

Litigation Reform Act of 1995. These, and other forward-looking statements,

are subject to business and economic risks and uncertainties that could cause

actual results to differ materially from those discussed. These risks and

uncertainties include, but are not limited to: risks associated with demand

for and market acceptance of existing and newly developed products as to which

the Company has made significant investments; general economic and industry

conditions; slower than anticipated penetration into the satellite

communications, mobile radio and commercial and defense electronics markets;

competitive products and pricing pressures; increased pricing pressure from

our customers; risks relating to governmental regulatory actions in broadcast,

communications and defense programs; as well as other risks and uncertainties,

including but not limited to those detailed from time to time in the Company's

Securities and Exchange Commission filings. These forward-looking statements

are made only as of the date hereof, and the Company undertakes no obligation

to update or revise the forward-looking statements, whether as a result of new

information, future events or otherwise. You are encouraged to review

Microwave Filter Company's 2007 Annual Report and Form 10-KSB for the fiscal

year ended September 30, 2007 and other Securities and Exchange Commission

filings. Forward looking statements may be made directly in this document or

"incorporated by reference" from other documents. You can find many of these

statements by looking for words like "believes," "expects," "anticipates,"

"estimates," or similar expressions.

ITEM 3. QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK

There has been no significant change in our exposures to market risk during

the nine months ended June 30, 2008. For a detailed discussion of market risk,

see our Annual Report on Form 10-K for the fiscal year ended September 30,

2007, Part II, Item 7A, Quantitative and Qualitative Disclosures About Market

Risk.

ITEM 4. CONTROLS AND PROCEDURES

1. Evaluation of disclosure controls and procedures. Based on their

evaluation of the Company's disclosure controls and procedures (as

defined in Rules 13a-15(e) and 15d-15(e) under the Securities

Exchange Act of 1934) as of the end of the period covered by this

Quarterly Report on Form 10-Q, the Company's chief executive officer

and chief financial officer have concluded that the Company's

disclosure controls and procedures are effective.

2. Changes in internal control over financial reporting. During the period

covered by this Quarterly Report on Form 10-Q, there were no changes in

the Company's internal control over financial reporting (as defined in

Rule 13a-15(f)) that have materially affected, or are reasonably

likely to materially affect, the Company's internal control over

financial reporting.

PART II - OTHER INFORMATION

Item 1. Legal Proceedings

The Company is unaware of any material threatened or pending

litigation against the Company.

Item 1A. The Company is exposed to certain risk factors that may effect

operations and/or financial results. The significant factors

known to the Company are described in the Company's most recently

filed annual report on Form 10-KSB. There have been no

material changes from the risk factors as previously disclosed

in the Company's annual report on Form 10-KSB.

Item 2. Changes in Securities

None during this reporting period.

Item 3. Defaults Upon Senior Securities

The Company has no senior securities.

Item 4. Submission of Matters to a Vote of Security Holders

None during this reporting period.

Item 6. Exhibits

a. Exhibits

31.1 Section 13a-14(a)/15d-14(a) Certification of Carl F. Fahrenkrug

31.2 Section 13a-14(a)/15d-14(a) Certification of Richard L. Jones

32.1 Section 1350 Certification of Carl F. Fahrenkrug

32.2 Section 1350 Certification of Richard L. Jones

Pursuant to the requirements of the Securities and Exchange Act

of 1934, the registrant has duly caused this report to be signed on

its behalf by the undersigned thereunto duly authorized.

MICROWAVE FILTER COMPANY, INC.

August 13, 2008 Carl F. Fahrenkrug

(Date) --------------------------

Carl F. Fahrenkrug

Chief Executive Officer

August 13, 2008 Richard L. Jones

(Date) --------------------------

Richard L. Jones

Chief Financial Officer

|

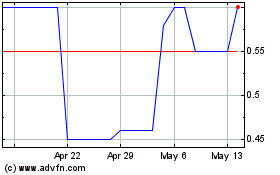

Microwave Filter (PK) (USOTC:MFCO)

Historical Stock Chart

From Jun 2024 to Jul 2024

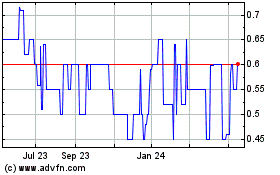

Microwave Filter (PK) (USOTC:MFCO)

Historical Stock Chart

From Jul 2023 to Jul 2024