0001696195false--09-30FY2023false0.00175000000263202002632020000016961952022-10-012023-09-300001696195knit:InternationalMonetaryMember2022-10-012023-09-300001696195knit:StockCancellationAgreementsMemberknit:JoseBenjaminZapataMember2022-10-012023-09-300001696195knit:StockCancellationAgreementsMemberknit:MichelleSantiagoMember2022-10-012023-09-300001696195knit:StockCancellationAgreementsMemberknit:BroadWatersGlobalCapitalSAMember2022-10-012023-09-300001696195knit:StockCancellationAgreementsMemberknit:JackelineBullonMember2022-10-012023-09-300001696195knit:StockCancellationAgreementsMemberknit:TelcoAcquisitionPartnersLLCMember2022-10-012023-09-300001696195knit:StockCancellationAgreementsMemberknit:StevenSteinmetzMember2022-10-012023-09-300001696195knit:StockCancellationAgreementsMemberknit:MariaChristinaMendezMember2022-10-012023-09-300001696195knit:StockCancellationAgreementsMemberknit:AnaMariaMendezMember2022-10-012023-09-300001696195knit:StockCancellationAgreementsMemberknit:NewGateInvestmentsSAMember2022-10-012023-09-300001696195knit:StockCancellationAgreementsMemberknit:PartnershipCKLLVMember2022-10-012023-09-300001696195knit:StockCancellationAgreementsMemberknit:CanopiGroupSAMember2022-10-012023-09-300001696195knit:StockCancellationAgreementsMember2022-10-012023-09-300001696195knit:StockCancellationAgreementsMemberknit:InternationalMonetaryMember2022-10-012023-09-300001696195knit:StockCancellationAgreementsMemberknit:MartinJohnsonMember2022-10-012023-09-300001696195us-gaap:DebtMember2023-06-300001696195us-gaap:DebtMemberknit:CFORobertoMoraMember2023-06-300001696195us-gaap:DebtMemberknit:CanopiGroupMember2023-06-300001696195us-gaap:DebtMemberknit:DamianGriderMember2023-06-300001696195us-gaap:DebtMemberknit:AnaMariaMendezMember2023-06-300001696195knit:ChiefFinancialOfficerSecretaryAndTreasurerMember2021-10-012022-09-300001696195knit:ChiefFinancialOfficerSecretaryAndTreasurerMember2022-10-012023-09-300001696195knit:PresidentChiefExecutiveOfficerMember2021-10-012022-09-300001696195knit:PresidentChiefExecutiveOfficerMember2022-10-012023-09-300001696195us-gaap:ComputerEquipmentMember2022-09-300001696195us-gaap:ComputerEquipmentMember2023-09-300001696195us-gaap:SoftwareDevelopmentMember2022-09-300001696195us-gaap:SoftwareDevelopmentMember2023-09-300001696195us-gaap:SoftwareDevelopmentMember2022-10-012023-09-300001696195us-gaap:FurnitureAndFixturesMember2022-10-012023-09-300001696195us-gaap:ComputerEquipmentMember2022-10-012023-09-300001696195us-gaap:RetainedEarningsMember2023-09-300001696195us-gaap:AdditionalPaidInCapitalMember2023-09-300001696195us-gaap:CommonStockMember2023-09-300001696195us-gaap:RetainedEarningsMember2022-10-012023-09-300001696195us-gaap:AdditionalPaidInCapitalMember2022-10-012023-09-300001696195us-gaap:CommonStockMember2022-10-012023-09-300001696195us-gaap:RetainedEarningsMember2022-09-300001696195us-gaap:AdditionalPaidInCapitalMember2022-09-300001696195us-gaap:CommonStockMember2022-09-300001696195us-gaap:RetainedEarningsMember2021-10-012022-09-300001696195us-gaap:AdditionalPaidInCapitalMember2021-10-012022-09-300001696195us-gaap:CommonStockMember2021-10-012022-09-3000016961952021-09-300001696195us-gaap:RetainedEarningsMember2021-09-300001696195us-gaap:AdditionalPaidInCapitalMember2021-09-300001696195us-gaap:CommonStockMember2021-09-3000016961952021-10-012022-09-3000016961952022-09-3000016961952023-09-3000016961952023-09-26iso4217:USDxbrli:sharesiso4217:USDxbrli:sharesxbrli:pure

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

☒ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended September 30, 2023

or

☐ | TRANSITION REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from _____________________ to ___________________________

Commission file number 333-216047

Kinetic Group Inc. |

(Exact name of registrant as specified in its charter) |

Nevada | | 47-4685650 |

(State or other jurisdiction of Incorporation or organization) | | (I.R.S. Employer Identification No.) |

2801 NW 74TH Avenue, Miami FL 33122 | | 33122 |

(Address of principal executive offices) | | (Zip Code) |

Registrant’s telephone number, including area code (786-7126827)

Securities registered under Section 12(b) of the Exchange Act:

Title of each class | | Name of each exchange on Which registered |

Common Stock $0.001 par value | | None |

Securities registered under Section 12(g) of the Exchange Act:

None

(Title of class)

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act Yes ☐ No ☒

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No ☒

Note - Checking the box above will not relieve any registrant required to file reports pursuant to Section 13 or 15(d) of the Exchange Act from their obligations under those Sections.

SEC 1673 (05-21) | Persons who respond to the collection of information contained in this form are not required to respond unless the form displays a currently valid OMB control number. |

Indicate by check mark whether the registrant (1) filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☐ No ☒

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer | ☐ | Accelerated filer | ☐ |

Non-accelerated filer | ☐ | Smaller reporting company | ☒ |

(Do not check if a smaller reporting company) | | Emerging growth company | ☒ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C.7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☒

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ☐ No ☒

State the aggregate market value of the voting and non-voting common equity held by non-affiliates computed by reference to the price at which the common equity was sold, or the average bid and asked price of such common equity, as of the last business day of the registrant’s most recently completed second fiscal quarter.

As of September 26, 2023, last business day of period, the aggregate market value of voting stock held by non-affiliates of the registrant, based on the price at which the common equity was sold at closing, was $72,493,054

Note. —If a determination as to whether a particular person or entity is an affiliate cannot be made without involving unreasonable effort and expense, the aggregate market value of the common stock held by non-affiliates may be calculated on the basis of assumptions reasonable under the circumstances, provided that the assumptions are set forth in this Form.

As of September 30, 2023, there were 26,320,200 shares of the registrant’s common stock outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

List hereunder the following documents if incorporated by reference and the Part of the Form 10-K (e.g., Part I, Part II, etc.)into which the document is incorporated: (1) Any annual report to security holders; (2) Any proxy or information statement; and (3) Any prospectus fi led pursuant to Rule 424(b) or (c) under the Securities Act of 1933. The listed documents should be clearly described for identification purposes (e.g., annual report to security holders for fiscal year ended December 24,1980).

TABLE OF CONTENTS

KINETIC GROUP INC.

FORWARD LOOKING STATEMENTS

This Annual Report contains forward-looking statements. Forward-looking statements are projections of events, revenues, income, future economic performance or management’s plans and objectives for our future operations. In some cases, you can identify forward-looking statements by terminology such as “may”, “should”, “expects”, “plans”, “anticipates”, “believes”, “estimates”, “predicts”, “potential” or “continue” or the negative of these terms or other comparable terminology. These statements are only predictions and involve known and unknown risks, uncertainties and other factors, including the risks in the section entitled “Risk Factors” and the risks set out below, any of which may cause our or our industry’s actual results, levels of activity, performance or achievements to be materially different from any future results, levels of activity, performance or achievements expressed or implied by these forward-looking statements. These risks include, by way of example and not in limitation:

| ● | the uncertainty of profitability based upon our history of losses; |

| ● | risks related to failure to obtain adequate financing on a timely basis and on acceptable terms to continue as going concern; |

| ● | risks related to our international operations and currency exchange fluctuations; and |

| ● | other risks and uncertainties related to our business plan and business strategy. |

This list is not an exhaustive list of the factors that may affect any of our forward-looking statements. These and other factors should be considered carefully and readers should not place undue reliance on our forward-looking statements. Forward looking statements are made based on management’s beliefs, estimates and opinions on the date the statements are made and we undertake no obligation to update forward-looking statements if these beliefs, estimates and opinions or other circumstances should change. Although we believe that the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee future results, levels of activity, performance or achievements. Except as required by applicable law, including the securities laws of the United States, we do not intend to update any of the forward-looking statements to conform these statements to actual results.

Our financial statements are stated in United States dollars (US$) and are prepared in accordance with United States Generally Accepted Accounting Principles. All references to “common stock” refer to the common shares in our capital stock.

As used in this annual report, the terms “we”, “us”, “our”, the “Company” and “Kinetic Group” mean Kinetic Group Inc., unless otherwise indicated.

Our Business

Kinetic Group Inc., a Nevada corporation, (the “Company”) was formed under the laws of the State of Nevada on June 6, 2014. Kinetic Group Inc. (“KNIT” or “Company”) changed its business description and now is a technology holding company, offering digital transformation through AI technology to enterprises looking to improve strategic and operational decision making. KNIT accelerates the digital transformation of companies by converting property, plants and equipment into Smart Assets which enhance productivity. The Company will generate revenue from acquisitions and operations in Latin America and the USA.

On April 18, 2023, The Company announced that it has signed a formal Memorandum of Understanding with a profitable AI Company. As a result of this acquisition, KINETIC will own 100% of an early entrant AI company offering digital transformation to enterprises. KNIT will offer customizable AI solutions to businesses to improve their decision making, reduce risk and improve operations. Customized solutions, including Digital Twins, Smart Assets, AI predictive analytics and Metaverse engagement are designed to produce significant productivity improvements. KNIT is an early mover in offering a suite of AI business services to both the private and public sectors. This opportunity is formalized by the signing of an SPA in November 2023.

The Company also hired CIM Securities LLC as lead placement agent in a $3 million raise structured as an 8% PIK Dividend Series A Convertible Participating Preferred. The preferred offers a 1.5x liquidation preference and is priced at $1.00 per preferred share. Use of funds is to promote international sales and roll out a subscription-based revenue model. Kinetic Group Inc. is a development stage company as defined by section 915-10-20 of the FASB Accounting Standards Codification. Although the Company has recognized nominal amounts of revenue, it is still devoting substantially all of its efforts on establishing its business. All losses accumulated since Inception (June 6, 2014) have been considered as part of the Company’s development stage activities.

In June 2014, the FASB issued ASU No. 2014-10, Development Stage Entities (Topic 915): Elimination of Certain Financial Reporting Requirements, Including an Amendment to Variable Interest Entities Guidance in Topic 810, Consolidation.

The amendments in this Update remove the definition of a development stage entity from the Master Glossary of the Accounting Standards Codification, thereby removing the financial reporting distinction between development stage entities and other reporting entities from U.S. GAAP. In addition, the amendments eliminate the requirements for development stage entities to (1) present inception-to-date information in the statements of income, cash flows, and shareholder equity, (2) label the financial statements as those of a development stage entity, (3) disclose a description of the development stage activities in which the entity is engaged, and (4) disclose in the first year in which the entity is no longer a development stage entity that in prior years it had been in the development stage.

For public business entities, those amendments are effective for annual reporting periods beginning after December 15, 2014, and interim periods therein. Kinetic Group has elected to early adopt Accounting Standards Update No. 2014-10, Development Stage Entities (Topic 915): Elimination of Certain Financial Reporting Requirements. The adoption of this ASU allows the company to remove the inception to date information and all references to development stage.

Patent, Trademark, License and Franchise Restrictions and Contractual Obligations and Concessions

We do not own, either legally or beneficially, any patents or trademarks.

Research and Development Activities

Other than time spent researching our proposed business we have not spent any funds on research and development activities to date. We do not currently plan to spend any funds on research and development activities in the future.

Compliance with Environmental Laws

We are not aware of any environmental laws that have been enacted, nor are we aware of any such laws being contemplated for the future, that impact issues specific to our business.

Employees

As of September 30, 2023 we had two employees – Ana Maria Mendez, our President and Chairwoman and Roberto Mora, Chief Financial Officer. Our officers and directors are responsible for planning, developing and operational duties, and will continue to do so throughout the early stages of our growth.

Reports to Securities Holders

We provide an annual report that includes audited financial information to our shareholders. We will make our financial information equally available to any interested parties or investors through compliance with the disclosure rules for a small business issuer under the Securities Exchange Act of 1934. We are voluntarily subject to disclosure filing requirements including filing Form 10K annually and Form 10Q quarterly. In addition, we will file Form 8K and other proxy and information statements from time to time as required. The public may read and copy any materials that we file with the Securities and Exchange Commission, (“SEC”), at the SEC’s Public Reference Room at 100 F Street NE, Washington, DC 20549.

The public may obtain information on the operation of the Public Reference Room by calling the SEC on 1-800-SEC-0330. The SEC maintains an Internet site (http://www.sec.gov) that contains reports, proxy and information statements, and other information regarding issuers that file electronically with the SEC.

Kinetic Group Inc. is a “Development Stage Company”. The Company has elected to early adopt Accounting Standards Update No.2014-10, Development Stage Entities (Topic 915): Elimination of Certain Financial Reporting Requirements. The adoption of this ASU allows the Company to remove the inception to date information and all references to the development Stage from its financial statements.

Kinetic Group Inc. is a Development Stage Company as defined by section 915-10-20 of the FASB Accounting Standards Codification. Although the Company has recognized nominal amounts of revenue, it is still devoting substantially all of its efforts to establishing the business. All losses accumulated since Inception (June 6, 2014) have been considered as part of the Company’s development Stage activities.

In June 2014, the FASB issued ASU No. 2014-10, Development Stage Entities (Topic 915): Elimination of Certain Financial Reporting Requirements, Including an Amendment to Variable Interest Entities Guidance in Topic 810, Consolidation.

The amendments in this update remove the definition of Development Stage entity from the Master Glossary of the Accounting Standards Codification, thereby removing the financial reporting distinction between Development Stage entities and other reporting entities from U.S. GAAP.

In addition, the amendments eliminate the requirements for Development Stage entities to (1) present inception-to-date information in the statements of income, cash flows, and shareholder equity, (2) label the financial statements as those of a Development Stage entity, (3) disclose a description of the Development Stage activities in which the entity is engaged, and (4) disclose in the first year in which the entity is no longer a Development Stage entity that in prior years it had been in the Development Stage.

For public business entities, those amendments are effective for annual reporting periods beginning after December 15, 2014, and interim periods therein. Kinetic Group has elected to early adopt Accounting Standards Update No. 2014-10, Development Stage Entities (Topic 915): Elimination of Certain Financial Reporting Requirements. The adoption of this ASU allows the company to remove the inception to date information and all references to Development Stage.

Kinetic Group Inc. is an “emerging growth company” under the Jumpstart Our Business Startups Act. We cannot be certain if the reduced reporting requirements applicable to emerging growth companies will make our shares of common stock less attractive to investors.

Kinetic Group Inc. is and will remain an “emerging growth company” until the earliest to occur of (a) the last day of the fiscal year during which its total annual revenues equal or exceed $1 billion (subject to adjustment for inflation), (b) the last day of the fiscal year following the fifth anniversary of its initial public offering, (c) the date on which Kinetic Group has, during the previous three-year period, issued more than $1 billion in non-convertible debt securities, or (d) the date on which Kinetic Group is deemed a “large accelerated filer” (with at least $700 million in public float) under the Securities and Exchange Act of 1934.

For so long as Kinetic Group remains an “emerging growth company” as defined in the JOBS Act, it may take advantage of certain exemptions from various reporting requirements that are applicable to other public companies that are not “emerging growth companies” as described in further detail in the risk factors below. Kinetic Group cannot predict if investors will consider its shares in common stock less attractive because of our reliance on some or all of these exemptions. If some investors find Kinetic Group’s shares of common stock less attractive as a result, the trading market for its shares of common stock may be less active, and its stock price may be more volatile.

If Kinetic Group avails itself of certain exemptions from various reporting requirements, its reduced disclosure may make it more difficult for investors and securities analysts to evaluate Kinetic Group and may result in less investor confidence.

The recently enacted JOBS Act is intended to reduce the regulatory burden on “emerging growth companies”. Kinetic Group meets the definition of an “emerging growth company” and so long as it qualifies as an “emerging growth company,” it will not be required to:

| ● | have an auditor report on our internal controls over financial reporting pursuant to Section 404(b) of the Sarbanes-Oxley Act; |

| ● | comply with any requirement that may be adopted by the Public Company Accounting Oversight Board regarding mandatory audit firm rotation or a supplement to the auditor’s report providing additional information about the audit and the financial statements (i.e., an auditor discussion and analysis); |

| ● | submit certain executive compensation matters to shareholder advisory votes, such as “say-on-pay” and “say-on-frequency;” and |

| ● | disclose certain executive compensation related items such as the correlation between executive compensation and performance and comparisons of the CEO’s compensation to median employee compensation. |

In addition, Section 107 of the JOBS Act also provides that an “emerging growth company” can take advantage of the extended transition period provided in Section 7(a)(2)(B) of the Securities Act for complying with new or revised accounting standards. In other words, an “emerging growth company” can delay the adoption of certain accounting standards until those standards would otherwise apply to private companies. However, Kinetic Group is choosing to opt out of such extended transition period, and as a result, Kinetic Group will comply with new or revised accounting standards on the relevant dates on which adoption of such standards is required for non-emerging growth companies. Section 107 of the JOBS Act provides that its decision to opt out of the extended transition period for complying with new or revised accounting standards is irrevocable.

Notwithstanding the above, we are also currently a “smaller reporting company”, meaning that we are not an investment company, an asset-backed issuer, or a majority-owned subsidiary of a parent company that is not a smaller reporting company and have a public float of less than $75 million and annual revenues of less than $50 million during the most recently completed fiscal year. In the event that we are still considered a “smaller reporting company”, at such time as we cease being an “emerging growth company”, we will be required to provide additional disclosure in our SEC filings. However, similar to “emerging growth companies”, “smaller reporting companies” are able to provide simplified executive compensation disclosures in their filings; are exempt from the provisions of Section 404(b) of the Sarbanes-Oxley Act requiring that independent registered public accounting firms provide an attestation report on the effectiveness of internal control over financial reporting; are not required to conduct say-on-pay and frequency votes until annual meetings occurring on or after January 21, 2013; and have certain other decreased disclosure obligations in their SEC filings, including, among other things, only being required to provide two years of audited financial statements in annual reports.

Decreased disclosures in our SEC filings due to our status as an “emerging growth company” or “smaller reporting company” may make it harder for investors to analyze the Company’s results of operations and financial prospects.

We lack an operating history. There is no assurance our future operations will result in profitable revenues. If we cannot generate sufficient revenues to operate profitably, our business will fail.

As of September 30, 2023, we had accumulated a deficit of $-372,555. We have a limited operating history upon which an evaluation of our future success or failure can be made. Based on current plans, we expect to generate revenues in the near future. However, our revenues may not be sufficient initially to cover our operating costs. We cannot guarantee that we will be successful in generating significant revenues in the future. Failure to achieve a sustainable investment and operations level will negatively impact our business.

If we encounter unforeseen difficulties with our business or operations in the future that require us to obtain additional working capital, and we cannot obtain additional working capital on favorable terms, or at all, our business may suffer.

To date, we have relied primarily upon cash from the private sale of equity securities and operational activities and directly from our shareholders.

We may encounter unforeseen difficulties with our business or operations in the future that may deplete our capital resources more rapidly than anticipated. As a result, we may be required to obtain additional working capital in the future through bank credit facilities, public or private debt or equity financing, or otherwise. We have identified other sources for additional funding but we cannot be certain that additional funding will be available on acceptable terms, or at all. If we are required to raise additional working capital in the future, such financing may be unavailable to us on favorable terms, if at all, or may be dilutive to our existing stockholders. If we fail to obtain additional working capital as and when needed, such failure could have a material adverse impact on our business, results of operations and financial condition. Furthermore, such a lack of funds may inhibit our ability to respond to competitive pressures or unanticipated capital needs, or may force us to reduce operating expenses, which could significantly harm the business and development of operations. Similarly, our ability to borrow any such capital may be more expensive and difficult to obtain until this “going concern” uncertainty is resolved.

We are a Nevada corporation and, as such, are subject to the jurisdiction of the State of Nevada and the United States courts for purposes of any lawsuit, action or proceeding by investors herein. An investor would have the ability to effect service of process in any action on the company within the United States.

Our President resides outside the United States. She is an American citizen. Our director resides in the United States and is a United States citizen. Substantially all or a portion of their assets are located in the United States. As a result, it may be possible for investors to:

| ● | effect service of process within the United States against your officers or directors; |

| | |

| ● | enforce U.S. court judgments based upon the civil liability provisions of the U.S. federal securities laws against any of the above referenced persons in the United States; |

| | |

| ● | enforce in courts U.S. court judgments based on the civil liability provisions of the U.S. federal securities laws against the above persons; and |

| | |

| ● | Avoid bringing an original action in foreign courts to enforce liabilities based upon the U.S. federal securities laws against the above foreign persons. |

We do not have a majority of independent directors on our Board and the Company has voluntarily implemented various corporate governance measures, with which stockholders may have more protections against interested director transactions, conflicts of interest and similar matters.

Federal legislation, including the Sarbanes-Oxley Act of 2002, has resulted in the adoption of various corporate governance measures designed to promote the integrity of the corporate management and the securities markets. Some of these measures have been adopted in response to legal requirements. Others have been adopted by companies in response to the requirements of national securities exchanges, such as the NYSE or the NASDAQ Stock Market, on which their securities are listed. Among the corporate governance measures that are required under the rules of national securities exchanges are those that address the board of directors’ independence, audit committee oversight, and the adoption of a code of ethics. We have not yet adopted any of these other corporate governance measures and since our securities are not yet listed on a national securities exchange, we are not required to do so.

Our Board of Directors is comprised of three individuals, who are our CEO, one director and the CFO. We do not have independent directors on our Board of Directors.

We have not adopted corporate governance measures such as an audit or other independent committee of our board of directors, as we presently do not have independent directors on our board. If we expand our board membership in future periods to include additional independent directors, we may seek to establish an audit and other committees of our board of directors. It is possible that if our Board of Directors included independent directors and if we were to adopt some or all of these corporate governance measures, stockholders would benefit from somewhat greater assurance that internal corporate decisions were being made by disinterested directors and that policies had been implemented to define responsible conduct. For example, at present in the absence of audit, nominating and compensation committees comprised of at least a majority of independent directors, decisions concerning matters such as compensation packages or employment contracts to our senior officers are made by a majority of directors or shareholders who have an interest in the outcome of the matters being decided. However, as a general rule, the board of directors, in making its decisions, determines first that the terms of such transaction are no less favorable to us that those that would be available to us with respect to such a transaction from unaffiliated third parties. The company executes the transaction between executive officers and the company once it has been approved by the Board of Directors.

Prospective investors should bear in mind our current lack of corporate governance measures in formulating their investment decisions.

None of the members of our Board of Directors are considered audit committee financial experts. If we fail to maintain an effective system of internal control over financial reporting, we may not be able to accurately report our financial results. As a result, current and potential shareholders could lose confidence in our financial reporting, which would harm our business and the trading price of our stock.

Members of our Board of Directors are inexperienced with U.S. GAAP and the related internal control procedures required of U.S. public companies. Management has determined that our internal audit function is also significantly deficient due to insufficient qualified resources to perform internal audit functions. Finally, we have not established an Audit Committee for our Board of Directors.

We are a development stage company with limited resources. Therefore, we cannot assure investors that we will be able to maintain effective internal controls over financial reporting based on criteria set forth by the Committee of Sponsoring Organizations of the Treadway Commission (“COSO”) in Internal Control-Integrated Framework. A material weakness is a deficiency, or a combination of deficiencies, in internal control over financial reporting, such that there is a reasonable possibility that a material misstatement of the company’s annual or interim financial statements will not be prevented or detected on a timely basis. For these reasons, we are considering the costs and benefits associated with improving and documenting our disclosure controls and procedures and internal controls and procedures, which includes (i) hiring additional personnel with sufficient U.S. GAAP experience and (ii) implementing ongoing training in U.S. GAAP requirements for our CFO and accounting and other finance personnel.

If the result of these efforts are not successful, or if material weaknesses are identified in our internal control over financial reporting, our management will be unable to report favorably as to the effectiveness of our internal control over financial reporting and/or our disclosure controls and procedures, and we could be required to further implement expensive and time-consuming remedial measures and potentially lose investor confidence in the accuracy and completeness of our financial reports which could have an adverse effect on our stock price and potentially subject us to litigation.

Our current President and director own 52.92% of the outstanding shares of our common stock as of the date of this filing. Accordingly, they have a significant influence in determining the outcome of all corporate transactions or other matters, including mergers, consolidations and the sale of all or substantially all of our assets.

They are able to exercise complete control over the company and have the ability to make decisions regarding, (i) whether to issue common stock and preferred stock, including decisions to issue common and preferred stock to themselves; (ii) employment decisions, including their own compensation arrangements, (iii) the appointment of all directors; and (iv) whether to enter into material transactions with related parties. The interests of our directors may differ from the interests of the other stockholders and thus result in corporate decisions that are disadvantageous to other shareholders.

The Company is subject to the 15(d) reporting requirements under the Securities Exchange Act of 1934 which does not require a company to file all the same reports and information as a fully reporting company.

Until our common stock is registered under the Exchange Act, we will not be a fully reporting company, but only subject to the reporting obligations imposed by Section 15(d) of the Securities Exchange Act of 1934.

Pursuant to Section 15(d), we are required to file periodic reports with the SEC, such as annual reports on Form 10-K, quarterly reports on Form 10-Q, and current reports on Form 8-K, once this registration statement is declared effective, including the annual report on Form 10-K for the fiscal year during which the registration statement is declared effective. Our registration statement was declared effective on March 28, 2017, during the year ended September 30, 2017. That filing obligation will generally apply even if our reporting obligations have been suspended automatically under section 15(d) of the Exchange Act prior to the due date for the Form 10-K.

After that fiscal year and provided the Company has less than 300 shareholders, the Company is not required to file these reports. If the reports are not filed, the investors will have reduced visibility as to the Company and its financial condition.

In addition, as a filer subject to Section 15(d) of the Exchange Act, the Company is not required to prepare proxy or information statements; our common stock will not be subject to the protection of the going private regulations; the company will be subject to only limited portions of the tender offer rules; our officers, directors, and more than ten (10%) percent shareholders are not required to file beneficial ownership reports about their holdings in our company; that these persons will not be subject to the short-swing profit recovery provisions of the Exchange Act; and that more than five percent (5%) holders of classes of your equity securities will not be required to report information about their ownership positions in the securities.

We will not be required to evaluate our internal control over financial reporting under Section 404 of the Sarbanes-Oxley Act until the end of the second fiscal year reported upon in our second annual report on form 10-K.

The Sarbanes-Oxley Act of 2002 and the new rules subsequently implemented by the Securities and Exchange Commissions, the Financial Industry Regulatory Authority (“FINRA”) and the Public Company Accounting Oversight Board have imposed various new requirements on public companies, including requiring changes in corporate governance practices. We expect these rules and regulations to increase our legal and financial compliance costs and to make some activities more time-consuming and costly. These costs could affect profitability and the results of our operations.

We are in the process of determining whether our existing internal controls over financial reporting systems are compliant with Section 404. We will not be required to conduct the evaluation of the effectiveness of our internal controls until the end of the fiscal year reported upon in our second annual report on Form 10-K.

In addition, because we are a smaller reporting company, we are not required to obtain the auditor attestation of management’s evaluation of internal controls over financial reporting. If we obtain and disclose such reports, we could continue doing so at our discretion so long as we remain a smaller reporting company.

This process of internal control evaluation and attestation may divert internal resources and will take a significant amount of time, effort and expense to complete. If it is determined that we are not in compliance with Section 404, we may be required to implement new internal control procedures and re-evaluate our financial reporting. If we are unable to implement these changes effectively or efficiently, it could harm our operations, financial reporting or financial results, which could adversely affect our ability to comply with our periodic reporting obligations under the Exchange Act.

Risks Related to our Common Stock and this Offering.

Because we do not intend to pay any cash dividends on our common stock for the foreseeable future, our stockholders will not be able to receive a return on their shares unless they sell them.

We intend to retain any future earnings to finance the development and expansion of our business. We have never paid any cash dividends and currently do not intend to pay any dividends for the foreseeable future. To the extent that we require additional funding currently not provided for in our financing plan, our funding sources may likely prohibit the payment of a dividend. Because we do not intend to declare dividends, any gain on an investment in Kinetic Group Inc. will need to come through appreciation of the stock’s price.

FINRA sales practice requirements may limit a stockholder’s ability to buy and sell our stock.

In addition to the “penny stock” rules described below, FINRA has adopted rules that require that in recommending an investment to a customer, a broker-dealer must have reasonable grounds for believing that the investment is suitable for that customer. Prior to recommending speculative low-priced securities to their non-institutional customers, broker-dealers must make reasonable efforts to obtain information about the customer’s financial status, tax status, investment objectives and other information. Under interpretations of these rules, FINRA believes that there is a high probability that speculative low-priced securities will not be suitable for at least some customers. The FINRA requirements make it more difficult for broker-dealers to recommend that their customers buy our common stock, which may have the effect of reducing the level of trading activity in our common stock. As a result, fewer broker-dealers may be willing to make a market in our common stock, reducing a stockholder’s ability to resell shares of our common stock.

Our common stock was accepted for quotation on the OTC Bulletin Board and OTC Link during the year ended September 30, 2018. As a result, the application of the “Penny Stock” rules could adversely affect the market price of our common shares and increase your transaction costs to sell those shares. The Securities and Exchange Commission has adopted Rule 3A51-1, which establishes the definition of a “Penny Stock,” for the purposes relevant to us, as any equity security that has market price of less than $5.00 per share or within an exercise price of less than $5.00 per share, subject to certain exceptions. For any transaction involving a penny stock, unless exempt, Rule 15G-9 require:

| - | that a broker or dealer approve a person’s account for transactions in penny stocks; and |

| - | the broker or dealer receive from the investor a written agreement to the transaction, setting forth the identity and quantity of the penny stock to be purchased. |

In order to approve a person’s account for transactions in penny stocks, the broker or dealer must:

| - | obtain financial information and investment experience objectives of the person; and |

| - | make a reasonable determination that the transactions in penny stocks are suitable for that person and the person has sufficient knowledge and experience in financial matters to be capable of evaluating the risks of transactions in penny stocks. |

|

The broker or dealer must also deliver, prior to any transaction in a penny stock, a disclosure schedule prescribed by the SEC relating to the penny stock market, which, in highlight form: |

| - | sets forth the basis on which the broker or dealer made the suitability determination; and |

| - | that the broker or dealer received a signed, written agreement from the investor prior to the transaction. |

Generally, brokers may be less willing to execute transactions in securities subject to the “penny stock” rules. This may make it more difficult for investors to dispose of our common stock and cause a decline in the market value of our stock.

You may face significant restrictions on the resale of your shares due to state “blue sky” laws.

Each state has its own securities laws, often called “blue sky” laws, which (1) limit sales of securities to a state’s residents unless the securities are registered in that state or qualify for an exemption from registration, and (2) govern the reporting requirements for broker-dealers doing business directly or indirectly in the state. Before a security is sold in a state, there must be a registration in place to cover the transaction, or it must be exempt from registration. The applicable broker-dealer must also be registered in that state. We do not know whether our securities will be registered or exempt from registration under the laws of any state. A determination regarding registration will be made by those broker-dealers, if any, who agree to serve as market makers for our common stock. There may be significant state blue sky law restrictions on the ability of investors to sell, and on purchasers to buy, our securities. You should therefore consider the resale market for our common stock to be limited, as you may be unable to resell your shares without the significant expense of state registration or qualification.

You could be diluted by our future issuances of capital stock and derivative securities.

As of September 30, 2023, we had 26,320,200 shares of common stock outstanding and no shares of preferred stock outstanding. We are authorized to issue up to 75,000,000 shares of common stock and no shares of preferred stock. To the extent of such authorization, our Board of Directors will have the ability, without seeking stockholder approval, to issue additional shares of common stock or preferred stock in the future for such consideration as the Board of Directors may consider sufficient. The issuance of additional common stock or preferred stock in the future may reduce your proportionate ownership and voting power.

If a market develops for our shares, sales of our shares relying upon Rule 144 may depress prices in that market by a material amount.

As of September 30, 2023, a total of 2,030,000 of the outstanding shares of our Common Stock are ‘‘unrestricted securities’’ within the meaning of Rule 144 under the Securities Act of 1933, as amended. As unrestricted securities, these shares may be resold under the requirements of Rule 144 or other applicable exemptions from registration under the Act and as required under applicable state securities laws.

We intend to sell more restricted shares or securities convertible into restricted shares as part of our efforts to finance the Company’s operations. As a result of revisions to Rule 144, there is no limit on the amount of restricted securities that may be sold by a non-affiliate (i.e., a stockholder who has not been an officer, director or control person for at least 90 consecutive days) after the restricted securities have been held by the owner for a period of one year. A sale under Rule 144 or under any other exemption from the Act, if available, or pursuant to registration of shares of Common Stock of present stockholders, may have a depressive effect upon the price of the Common Stock in any market that may develop.

Item 1B. | UNRESOLVED STAFF COMMENTS |

On September 30, 2023, none.

We do not hold ownership or leasehold interest in any property.

Item 3. | LEGAL PROCEEDINGS |

We are not currently a party to any legal proceedings, and we are not aware of any pending or potential legal actions.

Item 4. | MINE SAFETY DISCLOSURES |

Not applicable to our Company.

PART II

Item 5. | MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES. |

Market Information

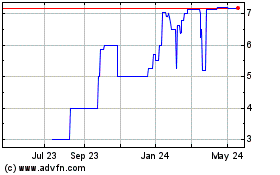

On August 27, 2018, our common stock was verified for trading on OTC Link ATS under the trading symbol KNIT. Prior to that time, there was no public market for our stock. The following table sets forth for the indicated periods the high and low intra-day sales price per share for our common stock on the OTC Link ATS for the year ended September 30, 2023.

| | 2022-2023 | |

| | High | | | Low | |

First Quarter | | $ | 4.50 | | | $ | 3.53 | |

Second Quarter | | $ | 4.75 | | | $ | 4.50 | |

Third Quarter | | $ | 4.75 | | | $ | 4.75 | |

Fourth Quarter | | $ | 5.85 | | | $ | 3.00 | |

* | There were trades 5,046 of our common stock during the relevant period. |

Holders.

As of September 30, 2023, there were 13 holders of 26,196,200 shares of the Company’s common stock (98.35%). With the balance of the Company’s common stock being trades in the open market.

Dividends.

The Company has not paid any cash dividends to date and does not anticipate or contemplate paying dividends in the foreseeable future. It is the present intention of management to utilize all available funds for the development of the Company’s business.

Securities Authorized for Issuance Under Equity Compensation Plans

None.

Recent sales of unregistered securities.

In August 2022, we sold 10,000 shares in open market transactions.

Issuer Purchases of Equity Securities

We did not repurchase any of our equity securities during the years ended September 30, 2023 and 2022.

Item 6. | SELECTED FINANCIAL DATA |

We are a smaller reporting company as defined by Rule 12b-2 of the Securities Exchange Act of 1934 and are not required to provide the information under this item.

Item 7. | MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS |

The following discussion should be read in conjunction with our audited financial statements and notes thereto included herein. In connection with, and because we desire to take advantage of, the “safe harbor” provisions of the Private Securities Litigation Reform Act of 1995, we caution readers regarding certain forward-looking statements in the following discussion and elsewhere in this report and in any other statement made by, or on our behalf, whether or not in future filings with the Securities and Exchange Commission.

Forward-looking statements are statements not based on historical information and which relate to future operations, strategies, financial results or other developments. Forward looking statements are necessarily based upon estimates and assumptions that are inherently subject to significant business, economic and competitive uncertainties and contingencies, many of which are beyond our control and many of which, with respect to future business decisions, are subject to change. These uncertainties and contingencies can affect actual results and could cause actual results to differ materially from those expressed in any forward-looking statements made by, or on our behalf. We disclaim any obligation to update forward-looking statements.

Results of operations for the years ended September 30, 2023 and 2022.

Revenue

We do not generate revenue from operations or investments. We continue with the final details of Due Diligence about our prospective AI company and hope to sign the SPA at the end of November 2023. We have initiated evaluation of other business opportunities in Panama and Colombia.

Our gross revenue for the years ended September 30, 2023 and 2022 was $0 and $0 respectively. Our cost of revenues for the year ended September 30, 2023 was $0 resulting in a gross income of $0.

Costs and Expenses

The major components of our expenses for the years ended September 30, 2023 and 2022 are outlined in the table below:

| | For the Year Ended Sept. 30, 2023 | | | For the Year Ended Sept. 30, 2022 | | | Increase (Decrease) | |

| | | | | | | | | |

Compensation - officers | | $ | 54,000 | | | $ | 20,300 | | | $ | 33,700 | |

Professional fees | | $ | 59,436 | | | $ | 10,850 | | | $ | 48,586 | |

Acquisition Fees | | $ | 0 | | | $ | 14,941 | | | $ | -14,941 | |

General and administrative | | $ | 8,339 | | | $ | 6,766 | | | $ | 1,573 | |

Total | | $ | 121,776 | | | $ | 52,857 | | | $ | 68,919 | |

Accounts Payable – Related Parties

As of September 30, 2023 and 2022 the Company owed its shareholders-directors and officers as follow:

| | For the Year Ended Sept. 30, 2023 | | | For the Year Ended Sept. 30, 2022 | | | Increase (Decrease) | |

Shareholders | | $ | 77,380 | | | $ | 24,112 | | | $ | 53,268 | |

Officers | | $ | 72,010 | | | $ | 18,000 | | | $ | 54,010 | |

Total | | $ | 149,390 | | | $ | 42,112 | | | $ | 107,278 | |

Liquidity

Our internal liquidity is provided by our shareholders and the sale of common stocks. During the years ended September 30, 2023 and 2022 the Company reported net loss from operations of -$121,776 and - $52,857, respectively.

To date we have financed our operations by cash generated from sales of shares of our common stock and cash from our shareholders.

To date we have not sold shares of common stock to our officers and directors. We sold 10,000 shares at $2.00 per share in the open market to generate cash to cover expenses.

Additional capital may be required to maintain ongoing operations.

We have explored and are continuing to explore options to provide additional financing to fund future operations as well as other possible courses of action. Such actions include, but are not limited to, securing lines of credit, sales of debt or equity securities (which may result in dilution to existing shareholders), loans and cash advances from our directors or other third parties, and other similar actions. There can be no assurance that we will be able to obtain additional funding (if needed), on acceptable terms or at all, through a sale of our common stock, loans from financial institutions, our directors, or other third parties, or any of the actions discussed above. If we cannot sustain profitable operations, and additional capital is unavailable, lack of liquidity could have a material adverse effect on our business viability, financial position, results of operations and cash flows.

Cash Flows

The table below, for the period indicated, provides selected cash flow information:

Cash Flow | | For the Year Ended Sept. 30, 2023 | | | For the Year Ended Sept. 30, 2022 | |

| | | | | | |

Net cash provided (used) by shareholders and sale common share | | $ | -13,652 | | | $ | -558,955 | |

Cash used in activities | | $ | 0 | | | $ | 0 | |

Net Cash | | $ | 100 | | | $ | 572,620 | |

Net increase (decrease) in cash | | $ | -13,552 | | | $ | 13,665 | |

We have not generated revenues during the years ended September 30, 2023 and 2022, respectively. In addition, we received proceeds of $0 and $20,000 from the sale of our common stock during the years ended September 30, 2023 and 2022. We received $53,168 during the reporting period from our shareholders. Cash flow for September 2022 was revised.

Cash Flows from Investing Activities

We did not generate any cash from investing activities during the year ended September 30, 2023.

Cash Flows from Financing Activities

Not applicable.

Recent Accounting Pronouncements

See Note 2 to the Financial Statements.

Off Balance Sheet Arrangements

As of September 30, 2023 and 2022, we did not have any significant off-balance-sheet arrangements, as defined in Item 303(a)(4)(ii) of Regulation S-K.

Item 7A. | QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK |

We are a smaller reporting company as defined by Rule 12b-2 of the Securities Exchange Act of 1934 and are not required to provide the information under this item.

Item 8. | FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA |

KINETIC GROUP INC.

Index to the Financial Statements

Report of an Independent Registered Public Accounting Firm

To the shareholders and the board of directors of Kinetic Group Inc

Opinion on the Financial Statements

We have audited the accompanying balance sheets of Kinetic Group Inc (the “Company”) as of September 30, 2023, the related consolidated statements of operations, changes in shareholders’ equity and cash flows, for each of the two years in the period ended September 30, 2023, and the related notes collectively referred to as the “financial statements.

In our opinion, the financial statements present fairly, in all material respects, the financial position of the Company as of September 30, 2023, and 2022, and the results of its operations and its cash flows for the year ended September 30, 2022, in conformity with U.S. generally accepted accounting principles.

Going Concern

The accompanying financial statements have been prepared assuming the company will continue as a going concern as disclosed in Note 3 to the financial statement, the Company has continuously incurred a net loss of $121,776 for the year ended September 30, 2023, and an accumulated deficit of $372,555 at September 30, 2023. The continuation of the Company as a going concern through September 30, 2023, is dependent upon improving the profitability and the continuing financial support from its stockholders. Management believes the existing shareholders or external financing will provide additional cash to meet the Company’s obligations as they become due.

These factors raise substantial doubt about the company’s ability to continue as a going concern. These financial statements do not include any adjustments that might result from the outcome of the uncertainty.

Basis for Opinion

These financial statements are the responsibility of the Company’s management. Our responsibility is to express an opinion on the Company’s financial statements based on our audits. We are a public accounting firm registered with the Public Company Accounting Oversight Board (United States) (“PCAOB”) and are required to be independent with respect to the Company in accordance with the U.S. federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB. We conducted our audits in accordance with the standards of the PCAOB.

Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement, whether due to error or fraud. Our audits included performing procedures to assess the risks of material misstatement of the financial statements, whether due to error or fraud, and performing procedures that respond to those risks. Such procedures included examining, on a test basis, evidence regarding the amounts and disclosures in the financial statements. Our audits also included evaluating the accounting principles used and significant estimates made by management, as well as evaluating the overall presentation of the financial statements.

We believe that our audits provide a reasonable basis for our opinion. The company is not required to have, nor were we engaged to perform, an audit of its internal control over financial reporting. As part of our audits, we are required to obtain an understanding of internal control over financial reporting but not for the purpose of expressing an opinion on the effectiveness of the Company’s internal control over financial reporting. Accordingly, we express no such opinion.

Critical Audit Matters

Critical audit matters are matters arising from the current period audit of the financial statements that were communicated or required to be communicated to the audit committee and that: (1) relate to accounts or disclosures that are material to the financial statements and (2) involved our especially challenging, subjective, or complex judgments. The communication of critical audit matters does not alter in any way our opinion on the financial statements, taken as a whole and we are not, by communicating the critical audit matters, providing separate opinions on the critical audit matter or on the accounts or disclosures to which they relate. There are no critical audit matters to be communicated.

OLAYINKA OYEBOLA & CO.

(Chartered Accountants)-PCAOB ID 5968

We have served as the Company’s auditor since September 2020.

November 13th, 2023.

Lagos Nigeria

KINETIC GROUP INC.

CONSOLIDATED BALANCE SHEETS

| | (Audited) | | | (Audited) | |

| | Year Ended 9/30/2023 | | | Year Ended 9/30/2022 | |

ASSETS |

Current Assets | | | | | | |

Cash | | $ | 113 | | | $ | 13,665 | |

Due from Related Parties | | $ | 550,000 | | | $ | 550,000 | |

| | | | | | | | |

TOTAL ASSETS | | $ | 550,113 | | | $ | 563,665 | |

| | | | | | | | |

LIABILITIES AND STOCKHOLDER'S EQUTY |

Current Liabilities | | | | | | | | |

Account payable and accrued liabilities | | $ | 152,026 | | | $ | 43,902 | |

Advance Receivables | | | | | | | | |

Total current Liabilities | | $ | 152,026 | | | $ | 43,902 | |

| | | | | | | | |

Stockholders’ Equity (Deficit): | | | | | | | | |

Common stock, par value $0.001 per share, 75,000,000 shares authorized; 26,320,200 shares issued and outstanding as of September 30, 2023 and September 30, 2022 | | $ | 26,320 | | | $ | 26,320 | |

Additional paid-in capital | | $ | 744,322 | | | $ | 744,222 | |

Accumulated deficit | | $ | (372,555 | ) | | $ | (250,779 | ) |

Total stockholders’ equity (deficit) | | $ | 398,087 | | | $ | 519,763 | |

TOTAL LIABILITIES AND STOCKHOLDER'S EQUITY (DEFICIT) | | $ | 550,113 | | | $ | 563,665 | |

The accompanying notes are an integral part of these consolidated financial statements.

KINETIC GROUP INC.

CONSOLIDATED STATEMENTS OF OPERATIONS

| | (Audited) | | | (Audited) | |

| | Year Ended 9/30/2023 | | | Year Ended 9/30/2022 | |

| | | | | | |

Revenue | | $ | - | | | $ | - | |

Cost of revenue | | $ | - | | | $ | - | |

Gross profit | | $ | - | | | $ | - | |

Operating Expenses: | | | | | | | | |

Officer Stock Base Compensation | | $ | 54,000 | | | $ | 20,300 | |

Professional Fee | | $ | 59,436 | | | $ | 14,941 | |

General and administrative | | $ | 8,339 | | | $ | 17,616 | |

Total operating expenses | | $ | 121,776 | | | $ | 52,857 | |

Income (Loss) from Operations | | $ | (121,776 | ) | | $ | (52,857 | ) |

Income tax provision | | $ | - | | | $ | - | |

Net Income (Loss) | | $ | (121,776 | ) | | $ | (52,857 | ) |

| | | | | | | | |

Net Income (Loss) Per Common Share: | | | | | | | | |

Net Income (Loss) per common share - Basic and Diluted | | $ | 0.00 | | | $ | 0.00 | |

Outstanding - Basic and Diluted | | | 26,320,200 | | | | 26,320,200 | |

The accompanying notes are an integral part of these consolidated financial statements.

KINETIC GROUP INC.

CONSOLIDATED STATEMENTS OF STOCKHOLDERS’ EQUITY

| | Common stock | | | Additional Paid-in | | | Accumulated | | | | |

Description | | Shares | | | Amount | | | Capital | | | Deficit | | | Total | |

| | | | | | | | | | | | | | | |

Balance – October 1, 2021 | | | 23,710,200 | | | $ | 23,710 | | | $ | 174,212 | | | $ | -197,922 | | | $ | - | |

Officers stock-based compensation | | | 2,300,000 | | | $ | 2,300 | | | | - | | | | - | | | $ | 2,300 | |

Additional paid in capital | | | 310,000 | | | $ | 310 | | | $ | 570,010 | | | | - | | | $ | 570,320 | |

Net Lost | | | | | | | | | | | | | | $ | -52,857 | | | $ | -52,857 | |

Balance – September 30, 2022 | | | 26,320,200 | | | $ | 26,320 | | | $ | 744,222 | | | $ | -250,779 | | | $ | 519,763 | |

| | | | | | | | | | | | | | | | | | | | |

Balance – October 1, 2022 | | | 26,320,200 | | | $ | 26,320 | | | $ | 744,222 | | | $ | -250,779 | | | $ | 519,763 | |

Common stock issued | | | 0 | | | $ | 0 | | | | - | | | | - | | | $ | 0 | |

Additional paid in capital | | | - | | | | - | | | $ | 100 | | | $ | 0 | | | $ | 100 | |

Net (loss) | | | - | | | | | | | | - | | | $ | -121,776 | | | $ | -121,776 | |

Balance – September 30, 2023 | | | 26,320,200 | | | $ | 26,320 | | | $ | 744,322 | | | $ | -372,555 | | | $ | 398,087 | |

The accompanying notes are an integral part of these consolidated financial statements.

KINETIC GROUP INC.

CONSOLIDATED STATEMENTS OF CASH FLOWS

| | Year Ended 9/30/2023 | | | Year Ended 9/30/2022 | |

Operating Activities: | | | | | | |

Net loss | | $ | -121,776 | | | $ | -52,857 | |

Adjustments to reconcile net loss to net cash used in operating activities: | | | | | | | | |

Cancelation of debt and common shares | | $ | 0 | | | $ | 0 | |

Issuance officer's stock-based compensation | | | | | | | | |

Due from related party | | $ | 53,168 | | | $ | -550,000 | |

Accounts Payable (A/P): Account Payable Vendors | | $ | 54,956 | | | | | |

Accounts payable and accrued liabilities | | $ | 0 | | | $ | 43,902 | |

Accounts payable - related party | | $ | 0 | | | | | |

Net Cash Provided (Used) by Operating Activities | | $ | -13,652 | | | $ | -558,955 | |

Investing Activities: | | | | | | | | |

Acquisition of property and equipment | | | | | | $ | 0 | |

Acquisition of software | | | | | | $ | 0 | |

Net Cash Used in Investing Activities | | $ | 0 | | | $ | 0 | |

| | | | | | | | |

Financing Activities: | | | | | | | | |

Proceeds from issuance of common stock | | | | | | $ | 0 | |

Additional Paid-in capital | | $ | 100 | | | $ | 570,010 | |

Common stock issued | | | | | | $ | 2,610 | |

Net Cash Provided by Financing Activities | | $ | 100 | | | $ | 572,620 | |

| | | | | | | - | |

Net Change in Cash | | $ | -13,552 | | | $ | 13,665 | |

Cash - Beginning of Period | | $ | 13,665 | | | $ | 0 | |

Cash - End of Period | | $ | 113 | | | $ | 13,665 | |

| | | | | | | | |

Cash paid during the period for: | | | | | | | | |

Interest | | $ | 0 | | | $ | 0 | |

Income tax paid | | $ | 0 | | | $ | 0 | |

| | | | | | | | |

Non-Cash Financing and Investing Activities: | | | | | | | | |

Restricted common stock canceled, and proceeds contributed to capital | | | | | | $ | 0 | |

Issuance of 26,320,200 shares for officer’s compensation at par | | $ | 0 | | | $ | 0 | |

The accompanying notes are an integral part of these consolidated financial statements.

KINETIC GROUP INC.

NOTES TO THE SEPTEMBER 30, 2023, AND 2022 CONSOLIDATED FINANCIAL STATEMENTS

Note 1 – Organization and Operations

Kinetic Group Inc., a Nevada corporation, (the “Company”) was formed under the laws of the State of Nevada on June 6, 2014. Kinetic Group Inc. (“KNIT” or “Company”) changed its business description and now is a technology holding company, offering digital transformation through AI technology to enterprises looking to improve strategic and operational decision making. KNIT accelerates the digital transformation of companies by converting property, plants and equipment into Smart Assets which enhance productivity. The Company will generate revenue from acquisitions and operations in Latin America and the USA.

On April 18, 2023, The Company announced that it has signed a formal Memorandum of Understanding with a profitable AI Company. As a result of the possible acquisition, KINETIC will own 100% of an early entrant AI company offering digital transformation to enterprises. KNIT will offer customizable AI solutions to businesses to improve their decision making, reduce risk and improve operations. Customized solutions, including Digital Twins, Smart Assets, AI predictive analytics and Metaverse engagement are designed to produce significant productivity improvements. KNIT is an early mover in offering a suite of AI business services to both the private and public sectors.

The Company also hired CIM Securities LLC as lead placement agent in a $3 million raise structured as an 8% PIK Dividend Series A Convertible Participating Preferred. The preferred offers a 1.5x liquidation preference and is priced at $1.00 per preferred share. Use of funds is to promote international sales and roll out a subscription-based revenue model.

Note 2 – Summary of Significant Accounting Policies

Basis of Presentation

The Company’s financial statements have been prepared in accordance with accounting principles generally accepted in the United States of America (“U.S. GAAP”).

Principle of consolidation

The accompanying consolidated financial statements include all of the accounts of the Company as of September 30, 2023 and 2022. All intercompany balances and transactions have been eliminated.

Development Stage company

Kinetic Group Inc. is a development stage company as defined by section 915-10-20 of the FASB Accounting Standards Codification. Although the Company has recognized nominal amounts of revenue, it is still devoting substantially all of its efforts to establishing the business. All losses accumulated since Inception (June 4, 2014) have been considered as part of the Company’s development stage activities.

In June 2014, the FASB issued ASU No. 2014-10, Development Stage Entities (Topic 915): Elimination of Certain Financial Reporting Requirements, Including an Amendment to Variable Interest Entities Guidance in Topic 810, Consolidation.

The amendments in this Update remove the definition of a development stage entity from the Master Glossary of the Accounting Standards Codification, thereby removing the financial reporting distinction between development stage entities and other reporting entities from U.S. GAAP. In addition, the amendments eliminate the requirements for development stage entities to (1) present inception-to-date information in the statements of income, cash flows, and shareholder equity, (2) label the financial statements as those of a development stage entity, (3) disclose a description of the development stage activities in which the entity is engaged, and (4) disclose in the first year in which the entity is no longer a development stage entity that in prior years it had been in the development stage.

For public business entities, those amendments are effective for annual reporting periods beginning after December 15, 2014, and interim periods therein. Kinetic Group has elected to early adopt Accounting Standards Update No. 2014-10, Development Stage Entities (Topic 915): Elimination of Certain Financial Reporting Requirements. The adoption of this ASU allows the company to remove the inception to date information and all references to development stage.

Use of Estimates and Assumptions and Critical Accounting Estimates and Assumptions

The preparation of financial statements in conformity with accounting principles generally accepted in the United States of America requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date(s) of the financial statements and the reported amounts of revenues and expenses during the reporting period(s).Critical accounting estimates are estimates for which (a) the nature of the estimate is material due to the levels of subjectivity and judgment necessary to account for highly uncertain matters or the susceptibility of such matters to change and (b) the impact of the estimate on financial condition or operating performance is material. The Company’s critical accounting estimates and assumptions affecting the financial statements were:

| (i) | Assumption as a going concern: Management assumes that the Company will continue as a going concern, which contemplates continuity of operations, realization of assets, and liquidation of liabilities in the normal course of business. |

| | |

| (ii) | Allowance for doubtful accounts: Management’s estimate of the allowance for doubtful accounts is based on historical sales, historical loss levels, and an analysis of the collectability of individual accounts; and general economic conditions that may affect a client’s ability to pay. The Company evaluated the key factors and assumptions used to develop the allowance in determining that it is reasonable in relation to the financial statements taken as a whole. |

| | |

| (iii) | Valuation allowance for deferred tax assets: Management assumes that the realization of the Company’s net deferred tax assets resulting from its net operating loss (“NOL”) carry–forwards for Federal income tax purposes that may be offset against future taxable income was not considered more likely than not and accordingly, the potential tax benefits of the net loss carry-forwards are offset by a full valuation allowance. Management made this assumption based on (a) the Company has incurred recurring losses, (b) general economic conditions, and (c) its ability to raise additional funds to support its daily operations by way of a public or private offering, among other factors; |

These significant accounting estimates or assumptions bear the risk of change due to the fact that there are uncertainties attached to these estimates or assumptions, and certain estimates or assumptions are difficult to measure or value.

Management bases its estimates on historical experience and on various assumptions that are believed to be reasonable in relation to the financial statements taken as a whole under the circumstances, the results of which form the basis for making judgments about the carrying values of assets and liabilities that are not readily apparent from other sources. Management regularly evaluates the key factors and assumptions used to develop the estimates utilizing currently available information, changes in facts and circumstances, historical experience and reasonable assumptions. After such evaluations, if deemed appropriate, those estimates are adjusted accordingly.

Actual results could differ from those estimates.

Fair Value of Financial Instruments

The Company follows paragraph 825-10-50-10 of the FASB Accounting Standards Codification for disclosures about fair value of its financial instruments and paragraph 820-10-35-37 of the FASB Accounting Standards Codification (“Paragraph 820-10-35-37”) to measure the fair value of its financial instruments. Paragraph 820-10-35-37 establishes a framework for measuring fair value in accounting principles generally accepted in the United States of America (U.S. GAAP) and expands disclosures about fair value measurements.

To increase consistency and comparability in fair value measurements and related disclosures, Paragraph 820-10-35-37 establishes a fair value hierarchy which prioritizes the inputs to valuation techniques used to measure fair value into three (3) broad levels. The fair value hierarchy gives the highest priority to quoted prices (unadjusted) in active markets for identical assets or liabilities and the lowest priority to unobservable inputs. The three (3) levels of fair value hierarchy defined by Paragraph 820-10-35-37 are described below:

Level 1 | | Quoted market prices available in active markets for identical assets or liabilities as of the reporting date. |

Level 2 | | Pricing inputs other than quoted prices in active markets included in Level 1, which are either directly or indirectly observable as of the reporting date. |

Level 3 | | Pricing inputs that are generally observable inputs and not corroborated by market data. |

Financial assets are considered Level 3 when their fair values are determined using pricing models, discounted cash flow methodologies or similar techniques and at least one significant model assumption or input is unobservable.

The fair value hierarchy gives the highest priority to quoted prices (unadjusted) in active markets for identical assets or liabilities and the lowest priority to unobservable inputs. If the inputs used to measure the financial assets and liabilities fall within more than one level described above, the categorization is based on the lowest level input that is significant to the fair value measurement of the instrument.

The carrying amount of the Company’s financial assets and liabilities, such as cash, prepaid expenses, accounts payable and accrued expenses, approximate their fair value because of the short maturity of those instruments.

Transactions involving related parties cannot be presumed to be carried out on an arm’s-length basis, as the requisite conditions of competitive, free-market dealings may not exist. Representations about transactions with related parties, if made, shall not imply that the related party transactions were consummated on terms equivalent to those that prevail in arm’s-length transactions unless such representations can be substantiated.

Cash Equivalents

The Company considers all highly liquid investments with a maturity of three months or less to be cash and cash equivalents.

Property and Equipment

Property and equipment are recorded at cost. Expenditures for major additions and betterments are capitalized. Maintenance and repairs are charged to operations as incurred. Depreciation is calculated using the straight-line method over the estimated useful lives, which range from five (5) years for computer equipment to seven (7) years for office furniture. Upon sale or retirement of office equipment, the related cost and accumulated depreciation are removed from the accounts and any gain or loss is reflected in statements of operations.

Related Parties

The Company follows subtopic 850-10 of the FASB Accounting Standards Codification for the identification of related parties and disclosure of related party transactions. Pursuant to Section 850-10-20 the related parties include: a. affiliates of the Company; b. entities for which investments in their equity securities would be required, absent the election of the fair value option under the Fair Value Option Subsection of Section 825–10–15, to be accounted for by the equity method by the investing entity; c. trusts for the benefit of employees, such as pension and profit-sharing trusts that are managed by or under the trusteeship of management; d. principal owners of the Company; e. management of the Company; f. other parties with which the Company may deal if one party controls or can significantly influence the management or operating policies of the other to an extent that one of the transacting parties might be prevented from fully pursuing its own separate interests; and g. other parties that can significantly influence the management or operating policies of the transacting parties or that have an ownership interest in one of the transacting parties and can significantly influence the other to an extent that one or more of the transacting parties might be prevented from fully pursuing its own separate interests.

The financial statements shall include disclosures of material related party transactions, other than compensation arrangements, expense allowances, and other similar items in the ordinary course of business. However, disclosure of transactions that are eliminated in the preparation of financial statements is not required in those statements.

The disclosures shall include: a. the nature of the relationship(s) involved; b. a description of the transactions, including transactions to which no amounts or nominal amounts were ascribed, for each of the periods for which income statements are presented, and such other information deemed necessary to an understanding of the effects of the transactions on the financial statements; c. the dollar amounts of transactions for each of the periods for which income statements are presented and the effects of any change in the method of establishing the terms from that used in the preceding period; and d. amounts due from or to related parties as of the date of each balance sheet presented and, if not otherwise apparent, the terms and manner of settlement.

Commitments and Contingencies