Current Report Filing (8-k)

May 28 2019 - 6:07AM

Edgar (US Regulatory)

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

DC 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of the

Securities

Exchange Act of 1934

Date

of Report (Date of earliest event reported): April 9, 2019

2050

MOTORS, INC.

(Exact

name of Registrant as specified in its Charter)

|

California

|

|

001-13126

|

|

83-3889101

|

(State

or other jurisdiction

of incorporation)

|

|

(Commission

File No.)

|

|

(IRS

Employer

Identification No.)

|

|

25

N River Lane Suite 2050, Geneva, IL 60134

|

|

(Address

of principal executive offices)

|

|

|

|

(630)

708-0750

|

|

(Registrant’s

Telephone Number)

|

|

|

|

1340

Brook St. Unit M, St Charles, IL 60174

|

|

(Former

name or address, if changed since last report)

|

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant

under any of the following provisions (see General Instruction A.2. below):

|

[ ]

|

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

|

|

|

[ ]

|

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

|

|

|

[ ]

|

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

|

|

[ ]

|

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR

230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR 240.12b-2) [X]

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for

complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act [X]

2050

Motors, Inc. is referred to herein as “we”, “us”, or “us”

ITEM

1.01 ENTRY INTO A MATERIAL DEFINITIVE AGREEMENT

2050 Motors, Inc. has entered into material

definitive agreements with a third-party lender that has been buying and is negotiating the purchases of notes previously

owned and/or currently owned by existing lenders in order to restructure those loans, repay those loans and/or

cure events of defaults associated with those loans.

On April 9, 2019, Tri-Bridge Ventures LLC

(“TBV”), a third-party lender, purchased $13,272.60 outstanding of a loan dated October 26, 2016 ($782.07 principal,

$12,490.53 interest) from JSJ Investments Inc. The loan was converted into common shares and eliminated as disclosed in Subsequent

Events of our Form 10-Q for the three-month period ended September 30, 2018 filed on May 2, 2019. This action removed the debt

and accrued interest from the Company’s balance sheet and cured an event of default with that lender.

On May 6, 2019, TBV agreed to purchase $26,979.95

outstanding of a loan dated November 14, 2017 ($20,730.00 principal, $6,249.95 interest) from LG Capital Funding, LLC. The transaction

between TBV and LG closed on or around May 24, 2019. The loan was amended to a principal amount of $27,000.00 and all events of

default were cured with that lender.

The Company continues to work with TBV to

consolidate outstanding loans that are in default in order to strengthen its balance sheet, cure events of default with outstanding

loans, and eliminate the complexity of working with multiple third-party lenders. To this end, management has

introduced TBV to a third-party lender that previously notified the Company in writing of an event of default. Because of that

notification of default, 2050 Motors had accrued penalties of $395,369 as of September 30, 2018, and the event of

default has added liquidated damages of $2,000 per day bringing estimated total penalties to $875,369 as of May 28, 2019. The

loan had a principal balance as of May 17, 2019 of $64,377.98 with no interest outstanding. Management is optimistic

that TBV will be successful in consolidating this loan and other loans that are in default, which if completed would potentially

significantly benefit the Company and its stakeholders through balance sheet improvements, elimination of default penalties, and

access to capital, though there can be no assurances.

ITEM

8.01

Other Events

On May 22, 2019, 2050 Motors, Inc.

submitted Amended Articles of Incorporation to the Secretary of State of California to change its corporate name to “2050

Corp.” and update its mission statement. Additionally, the Company filed paperwork to amend its Certificate of Determination

for its Series A Convertible Preferred Stock to reduce the voting power of Series A Preferred Shares to one (1) vote per

share from fifty (50) votes per share in order to simplify its capital structure as directed by its majority Series A Preferred

shareholder. The Company anticipates these amendments will become effective in the next 30 days. Thereafter, the Company intends

to file for a name change and ticker change with FINRA. Any corporate action(s) filed with FINRA will require the

Company to be current with its SEC reporting requirements.

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf

by the undersigned hereunto duly authorized.

|

|

2050

MOTORS, INC.

|

|

|

|

|

|

Date:

May 28, 2019

|

By:

|

/s/

Vikram Grover

|

|

|

|

Vikram

Grover

|

|

|

|

Chief

Executive Officer

|

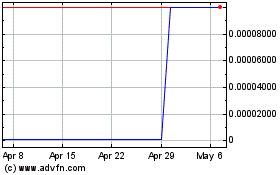

FOMO (PK) (USOTC:FOMC)

Historical Stock Chart

From May 2024 to Jun 2024

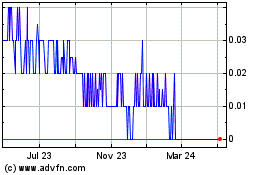

FOMO (PK) (USOTC:FOMC)

Historical Stock Chart

From Jun 2023 to Jun 2024