UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

_________________________

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of Report (date of earliest event reported):

October 31, 2014

CANNLABS, INC.

(Exact Name of Registrant as Specified in Charter)

| Nevada |

333-155318 |

20-5337455 |

| (State or other Jurisdiction |

(Commission File |

(I.R.S. Employer |

| of Incorporation or |

Number) |

Identification No.) |

| Organization) |

|

|

3888 E. Mexico Ave., Suite 202

Denver, CO 80210

(Address of principal executive offices) (Zip

Code)

(303) 309-0105

(Registrant's telephone number, including area

code)

Check the appropriate

box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the

following provisions (see General Instruction A.2. below):

|

o |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

|

o |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

|

o |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

|

o |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Item 8.01. Other Events.

On October 31, 2014, an

article appeared on Seeking Alpha, an online platform for investment research, featuring an interview with Mark Mirken, Chief Executive

Officer of CannLabs, Inc. An excerpt of the article featuring the interview with Mr. Mirken is attached hereto as Exhibit 99.1

and is incorporated by reference herein.

Forward Looking Statements

Certain statements contained herein are “forward-looking

statements.” These statements include information relating to future events, future financial performance, strategies, expectations,

competitive environment and regulation. All statements other than statements of historical facts included or incorporated by reference

in this Current Report on Form 8-K, including without limitation, statements regarding our future financial position, business

strategy, budgets, projected revenues, projected costs and plans and objective of management for future operations, are forward-looking

statements. In addition, forward-looking statements generally can be identified by the use of forward-looking terminology such

as “may,” “will,” “expects,” “intends,” “plans,” “projects,”

“estimates,” “anticipates,” or “believes” or the negative thereof or any variation there on

or similar terminology or expressions.

We have based these forward-looking statements

on our current expectations and projections about future events. These forward-looking statements are not guarantees and are subject

to known and unknown risks, uncertainties and assumptions about us that may cause our actual results, levels of activity, performance

or achievements to be materially different from any future results, levels of activity, performance or achievements expressed or

implied by such forward-looking statements. Important factors that could cause actual results to differ materially from our expectations

include, but are not limited to: our ability to raise additional capital, the absence of any operating history or revenue, our

ability to attract and retain qualified personnel, market acceptance of our platform, our limited experience in a relatively new

industry, regulatory and competitive developments, intense competition with larger companies, general economic conditions, as well

as other factors set forth under the caption “Risk Factors” in our Current Report on Form 8-K dated June 12, 2014 filed

with the Securities and Exchange Commission on June 13, 2014 and subsequently amended on August 15, 2014, September 12, 2014, and

October 10, 2014.

All subsequent written and oral forward-looking

statements attributable to us, or persons acting on our behalf, are expressly qualified in their entirety by the foregoing. Except

as required by law, we assume no duty to update or revise our forward-looking statements.

Item

9.01. Financial Statements,

Pro Forma Financial Information and Exhibit.

| (d) |

Exhibits |

| 99.1 |

Excerpt from Seeking Alpha Article, dated as of October 31, 2014 |

Signatures

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned

hereunto duly authorized.

| |

|

CANNLABS, INC. |

| |

|

|

| |

|

|

| Dated: November 3, 2014 |

|

/s/ Scott McPherson |

| |

|

Scott McPherson

Chief Financial Officer |

Exhibit 99.1

Except from Seeking Alpha Article:

Interview with CANL CEO Mark C. Mirken:

Q: With cash being the primary concern at this stage

of maturation does management have a strategy that it's made public in regards to fund raising or is it something that will happen

opportunistically and more so based on need? Typically companies in this market cap and asset space that I work with either like

to raise capital in large rounds or like to raise really slowly if the company is post-revenue. With CannLabs being post-revenue,

can you elaborate on how investors should look at the cash situation and how that will be handled going forward?

A: Cash is always something we watch. As of August 14, 2014,

we had cash resources of approximately $70,000. Also, as of August 14, 2014, we raised $500,000 through a private placement, $250,000

through the issuance of notes payable and received an additional $250,000 on September 15, 2014 and October 15, 2015.

Historically, our cash used for operating activities has

been fairly minimal (during the six months ended June 30, 2014 it was $86,315. Cash used in investing activities during the six

months ended June 30, 2014 was $174,242).

The Company's principal investor currently has a warrant

to exercise up to 3 million dollars which upon exercise would mitigate any cash needs.

Q: Staying with cash, obviously the run rate for C&CE

is going to be hard to estimate with the company being so young and maybe a growth strategy being one of more opportunity than

checkpoint standard but does management have an estimated full year run rate ex. acquisitions? I guess what I'm trying to find

out is what is the all-in C&CE number that investors are going to have to be comfortable with assuming CannLabs can raise?

A: During the six months ended June 30, 2014, the Company

was continuing to expand its space for laboratory operations to meet the new regulatory testing requirements. Beginning in November

of 2014 the capex is expected to increase which will primarily be focused on expanding capacity of the labs it manages to meet

the increase in demand for testing in the multiple jurisdictions in which it will operate.

Our cash will be used to fund our operations in anticipation

of robust growth expected over the next 12 months. The current facility that we manage in Colorado measures 4,000 square feet and

will reach full capacity in 120-180 days. We currently have 42 people working in Colorado, a headcount that has doubled in the

last 3 months. By mid-2015, we project testing revenues for the lab we manage in Colorado to be at an approximate $5M annual run

rate.

We recently opened a 4,000 square feet facility in Connecticut,

with full capacity expected to be reached in approximately 180 days. This operation is scaled based on current market (Medical

only). CannLabs has secured multiyear exclusive testing contracts with two out of only four current growers located in Connecticut.

Connecticut has some of the most stringent quality control standards in the nation and adheres to both the American Herbal Pharmacopoeia®

(AHP) and United States Pharmacopeia guidelines for permissible limits of contaminants. The guidelines include very low tolerance

limits for specified bacteria, fungi, heavy metals and pesticides, with batches being defined as 10lbs. This gives CannLabs 50%

of the grower market. Our business plan assumes that it costs $1M to build out a 4,000 sq ft lab - with $2-3M in revenues expected

in the first year after the lab reaches full capacity. We only need to spend ~$100k in additional capex during the next 120 days.

In general, we expect an approximate 12-18 month payback

on one 4k square foot lab - 6 months to ramp to full production and 12 months of netting approximately $1M. In future labs that

we manage, we believe the payback period could be less when factoring in higher margins from the addition of product formulation

and development and consulting services. We expect normalized operating margins of 40% from our labs (testing only).

One possible additional source of cash is that one of our

early investors has the right to exercise ~$3M worth of warrants-with a strike price of $0.15. Our current focus is building capacity

at the labs we manage in Colorado and Connecticut with other markets in the pipeline based on opportunity, logistics and other

determining factors. Our goal is to announce and develop the management of an additional state cert laboratory by year-end. We

would anticipate 20X revenue multiplier against current average quarterly revenue as our certified labs come on line over the next

12-18 months to be generated not only from the state mandated testing but also from proprietary analytics, new product development,

formulation, consultancy, and compliance business units.

Q: With the recent switch of ticker symbol and change

of operations investors have only had the brief update as to basic information like growth strategy, competitive advantages the

company thinks it has, barriers to entry and/or how CannLabs plans to build a defensible leadership position that were listed briefly

in the recent 10-Q and detailed a bit further in the recent PR. Can you give a few quick notes on these? Does the company plan

on putting together an "S-1 Light" on its website or distributable from IR?

A: CannLabs is recognized at the legislative level as the

gold standard of cannabis testing. We have been involved in the development of testing legislation in multiple jurisdictions, guiding

the legislation to be as efficient and effective as possible. Almost every state considering legislation will require a third-party

testing laboratory. CannLabs is the preeminent source for cannabis testing methodologies, product formulation and consulting in

the country.

In addition, CannLabs will be able to solidify our leadership

position due to the following industry-wide growth drivers:

1) COMPLIANCE - testing being mandated by new states

2) CLIENT GROWTH - Existing clients are growing to meet consumer

demand

3) NEW ENTRANTS - licensing to new growers is rapidly expanding

4) EDUCATION - consumers will be looking for tested products

they trust

As we mentioned in our Oct. 23rd press release, the new instrumentation,

the Polymerase Chain Reaction (PCR) and the Microwave Accelerated Reactor System (MARS) Extractor we discussed allow the laboratories

we manage to offer microbiological and heavy metal testing for cannabis. This, combined with an extensive range of microbial contaminant

tests, allows us to offer the most comprehensive and fasted cannabis testing that we are aware of. With this expanded cannabis

testing plus consultancy platform, we can deliver a complete service to our clients that give them the opportunity to discover

and remediate any issues before their products reach the market.

One of the barriers to entry in the testing market is the

amount of business and intellectual capital required to get an operation up and running. CannLabs has over four years experience

in setting up laboratory testing facilities, staffing and consulting services.

Q: The $112,273 in Q1 revenue and the $270,220 in

Q2 revenue, were these from already producing acquisitions or was that an uptick in activity? What I'm trying to understand is

how the uptick occurred and 1) if these were new customer wins that created the revenue or were services already being performed

to drive revenues and 2) was the growth caused by say more labs coming online or the existing labs being hired to perform more

services?

A: The growth was organic and from mandated testing. Since

potency testing was mandated we have grown our customer base, and we have seen our growth in demand from our existing customers.

Right now we work with around 50% of the addressable testing market in the state of Colorado (Keep in mind, Medical is not mandated

at this time. CannLabs also tests for growers, dispensaries and edible makers).

Q: Can you give investors some color around any existing

revenue pipeline or near-term developments that the company is excited about? Is there anything in progress or an opportunity in

particular that the company is looking to complete over the next 3-6 months? I know the recent PR stated that CannLabs will have

to expand hours to meet demand but could there be any expansion of facility capacity on the horizon to help ease this and/or meet

what are sure to be higher demands down the road?

A: See answers above. Also, to add - American

Herbal Pharmacopia

Regulations are being considered for CO, NV, WA, CT &

IL: This would increase the mandated testing from just potency to include microbial screening, Aflatoxin screening, heavy metal

screening and pesticide residue analysis. Allows for standardization of testing, making it easier to scale out to states.

We intend to scale as the market opportunity presents itself,

both here in Colorado and around the country. We have publicly said that we intend to open additional labs in other states that

have legalized marijuana which outside CO and WA are Medical.

Q: Has being the first state lab in the country provided

any benefits from a customer acquisition standpoint? Have you been able to leverage the state approval into faster negotiations

or position that as a value-add, maybe a credibility-add, with prospects?

A: I think our customers recognize that we hold ourselves

to the highest standards which we have done so since opening and becoming one of the early state licensees. We continually hear

that CannLabs is the preeminent testing laboratory and consultancy to the Marijuana Industry. See answers above as well to augment.

Q: From an IP standpoint, I know that sometimes in

other industries companies who are first to market have been able to not only protect the proprietary methods important to the

health of the business but the actual processes - things like the testing itself or a particular, very specific, function of the

testing. Is there any value to be had from an area like this that could add indefinite lived intangible assets to the balance sheet

or IP portfolio value?

A: We have patented protected-cloud based proprietary technology

involved in the search and delivery of precision based strain solutions for consumers. More about our IP strategy will be discussed

at a later date.

Q: In terms of competition and the maturation of the

general space, are we in a situation of sort of an "arms race" mentality with companies looking to acquire as much market

share as possible early and worry about profitability later down the line? More specifically, if management thought it could speed

up market share acquisition on the front-end by doing a large equity raise (assuming the demand was there) would this be something

management would do to aggregate market share in the early innings of the space? Or does management want to focus more on sticking

to "successful CAPEX" - CAPEX and the preceding raises only when a contract is in hand or an interest has been established?

A: We described our capex strategy in answer to an earlier

question. Quick revenue ramp-ups lead to short payback times on incremental facilities, and we intend to focus on "successful

CAPEX" in the future. In terms of market penetration, as noted earlier, our goal is to increase our market share from the

current 49% in Colorado to the 75% level by year-end. Of course we are focused on creating shareholder value, and will continue

to ensure that market share is added profitably and efficiently from a capital standpoint.

Q: Obviously with lab based operation capacity being

so small at this stage of growth is the company in a position where it could build a revenue backlog of sorts? I think it's important

for investors to understand if CannLabs wants to secure business and revenue prior to being able to service the demand or if the

company plans to secure business as it goes.

A: The business model executes based on our ability to successfully

build out labs to meet the demand for testing and will also serve as a conduit for other higher margin consulting services. Demand

for testing will push the demand for more labs. Failure rates on the testing level will then drive demand for the consulting services.

Timing on reaching full capacity is mentioned above.

Q: Finally, ideally what would the revenue model look

like when fully evolved? Can you give investors a sense of whether the model is going to be heavily weighted or entirely transactional

or will it have a recurring, contractually based segment? I could see the general models of the space going either way so any clarity

at least up to this point in thinking would be nice.

A: The revenue model will evolve. While it has been predominately

based on testing revenues, we will blend in consulting revenues. Within testing itself, we do have both transactional and contractual

revenue streams.

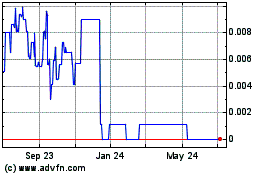

CannLabs (CE) (USOTC:CANL)

Historical Stock Chart

From Apr 2024 to May 2024

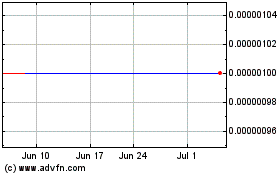

CannLabs (CE) (USOTC:CANL)

Historical Stock Chart

From May 2023 to May 2024