UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_____________________

FORM 6-K

____________________

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16

under the Securities Exchange Act of 1934

For the Month of March 2023

Commission File Number: 001-38303

______________________

WPP plc

(Translation of registrant's name into English)

________________________

Sea Containers, 18 Upper Ground

London, United Kingdom SE1 9GL

(Address of principal executive offices)

_________________________

Indicate

by check mark whether the registrant files or will file annual

reports under cover of Form 20-F or Form 40-F:

Form

20-F X

Form 40-F ___

Indicate

by check mark if the registrant is submitting the Form 6-K in paper

as permitted by Regulation S-T Rule 101(b)(1): ___

Note: Regulation S-T Rule 101(b)(1) only permits the

submission in paper of a Form 6-K if submitted solely to provide an

attached annual report to security holders.

Indicate

by check mark if the registrant is submitting the Form 6-K in paper

as permitted by Regulation S-T Rule 101(b)(7): ___

Note: Regulation S-T Rule 101(b)(7) only permits the

submission in paper of a Form 6-K if submitted to furnish a report

or other document that the registrant foreign private issuer must

furnish and make public under the laws of the jurisdiction in which

the registrant is incorporated, domiciled or legally organized (the

registrant’s “home country”), or under the rules

of the home country exchange on which the registrant’s

securities are traded, as long as the report or other document is

not a press release, is not required to be and has not been

distributed to the registrant’s security holders, and, if

discussing a material event, has already been the subject of a Form

6-K submission or other Commission filing on EDGAR.

Forward-Looking Statements

In

connection with the provisions of the U.S. Private Securities

Litigation Reform Act of 1995 (the ‘Reform Act’), the

Company may include forward-looking statements (as defined in the

Reform Act) in oral or written public statements issued by or on

behalf of the Company. These forward-looking statements may

include, among other things, plans, objectives, beliefs,

intentions, strategies, projections and anticipated future economic

performance based on assumptions and the like that are subject to

risks and uncertainties. These statements can be identified by the

fact that they do not relate strictly to historical or current

facts. They use words such as ‘anticipate’,

‘estimate’, ‘expect’, ‘intend’,

‘will’, ‘project’, ‘plan’,

‘believe’, ‘target’, and other words and

similar references to future periods but are not the exclusive

means of identifying such statements. As such, all forward-looking

statements involve risk and uncertainty because they relate to

future events and circumstances that are beyond the control of the

Company. Actual results or outcomes may differ materially from

those discussed or implied in the forward-looking statements.

Therefore, you should not rely on such forward-looking statements,

which speak only as of the date they are made, as a prediction of

actual results or otherwise. Important factors which may cause

actual results to differ include but are not limited to: the impact

of outbreaks, epidemics or pandemics, such as the Covid-19 pandemic

and ongoing challenges and uncertainties posed by the Covid-19

pandemic for businesses and governments around the world; the

unanticipated loss of a material client or key personnel; delays or

reductions in client advertising budgets; shifts in industry rates

of compensation; regulatory compliance costs or litigation; changes

in competitive factors in the industries in which we operate and

demand for our products and services; our inability to realise the

future anticipated benefits of acquisitions; failure to realise our

assumptions regarding goodwill and indefinite lived intangible

assets; natural disasters or acts of terrorism; the Company’s

ability to attract new clients; the economic and geopolitical

impact of the Russian invasion of Ukraine; the risk of global

economic downturn; technological changes and risks to the security

of IT and operational infrastructure, systems, data and information

resulting from increased threat of cyber and other attacks; the

Company’s exposure to changes in the values of other major

currencies (because a substantial portion of its revenues are

derived and costs incurred outside of the UK); and the overall

level of economic activity in the Company’s major markets

(which varies depending on, among other things, regional, national

and international political and economic conditions and government

regulations in the world’s advertising markets). In addition,

you should consider the risks described in Item 3D, captioned

“Risk Factors,” which could also cause actual results

to differ from forward-looking information. In light of these and

other uncertainties, the forward-looking statements included in

this document should not be regarded as a representation by the

Company that the Company’s plans and objectives will be

achieved. Neither the Company, nor any of its directors, officers

or employees, provides any representation, assurance or guarantee

that the occurrence of any events anticipated, expressed or implied

in any forward-looking statements will actually occur. The Company

undertakes no obligation to update or revise any such

forward-looking statements, whether as a result of new information,

future events or otherwise.

EXHIBIT INDEX

|

Exhibit No.

|

Description

|

|

1

|

Annual Report 2022 and AGM Notice dated 23 March 2023, prepared by

WPP plc.

|

|

FOR IMMEDIATE RELEASE

|

23 March 2023

|

WPP PLC ("WPP" or "the Company")

Publication of Annual Report 2022, Sustainability Report and 2023

Notice of Annual General Meeting

WPP has today published on its website its Annual Report for

the year ended 31 December 2022 ('Annual Report

2022', www.wpp.com/investors/annual-report-2022)

together with its Sustainability Report. WPP has also today

published its 2023 Notice of Annual General Meeting (the '2023 AGM

Notice', www.wpp.com/investors/shareholder-centre/shareholder-meetings),

which will be distributed to shareholders

shortly.

The Company's AGM will be held on 17 May 2023 at 11.00am at Rose

Court, 2 Southwark Bridge Road, London SE1 9HS, with facilities to

follow the business of the AGM virtually.

In compliance with 9.6.1 of the Listing Rules, copies of the

Annual Report 2022 and 2023

AGM Notice will

be submitted to the UK Listing Authority and will shortly

be available for inspection at the National Storage

Mechanism https://data.fca.org.uk/#/nsm/nationalstoragemechanism.

A hard copy version of the Annual Report 2022 will be sent to those

shareholders who have elected to receive paper communications on or

about 3 April 2023.

The information included in the unaudited preliminary results

announcement released on 23 February 2023, together with the

information in the Appendices to this announcement which is

extracted from the Annual Report 2022, constitute the materials

required by the FCA's Disclosure Guidance and Transparency Rule

6.3.5R. This announcement is not a substitute for reading the

Annual Report 2022 in full. Page and note references in the

Appendices below refer to page and note references in the Annual

Report 2022.

Balbir Kelly-Bisla

Company Secretary

Further information

|

Chris Wade, WPP

Richard Oldworth,

Buchanan Communications

|

+44 (0)20 7282 4600

+44 (0)20 7466 5000

|

About WPP

WPP is the creative transformation company. We use the power of

creativity to build better futures for our people, planet, clients

and communities. For more information, visit www.wpp.com.

APPENDIX A: PRINCIPAL RISKS AND UNCERTAINTIES

PRINCIPAL RISKS

The Board has carried out a robust assessment of the principal

risks and uncertainties affecting the Group and the markets we

operate in and strategic decisions taken by the Board as at 31

December 2022 and up to the date of this report - including any

adverse effects of the pandemic and the geopolitical situation

following the Russian invasion of Ukraine - which are described in

the table on the following pages.

ECONOMIC RISK

Risk definition

Adverse economic conditions, including those caused by the

pandemic, the conflict in Ukraine, severe and sustained inflation

in key markets where we operate, supply chain issues affecting the

distribution of our clients' products and/or disruption in credit

markets, pose a risk our clients may reduce, suspend or cancel

spend with us or be unable to satisfy obligations.

Potential impact

Economic conditions, including inflation and increasing interest

rates, among others, have a direct impact on our business, results

of operations and financial position.

In the past, clients have responded to weak economic and financial

conditions by reducing or shifting their marketing budgets which

are easier to reduce in the short term than their other operating

expenses.

How it is managed and reflected in our strategic

priorities

Our account teams work proactively with our clients to understand

the challenges they are facing, determine general trends in

marketing spend and develop plans in advance to help us prepare,

redeploy resources and manage costs accordingly.

Our client portfolio is diverse, consisting of organisations

operating in different industry sectors and across a broad

geographical spread which further helps mitigate the impact of any

specific challenges individual clients or markets might be

facing.

GEOPOLITICAL RISK

Risk definition

Growing geopolitical tension and conflicts continue to have a

destabilising effect in our markets and across geographical

regions.

This rise in geopolitical activity continues to have an adverse

effect upon the economic outlook, the general erosion of trust and

an increasing trend of national ideology and regional convergence

over global cooperation and integration.

Such factors and economic conditions may be reflected in our

clients' confidence in making longer-term investments and

commitments in marketing spend.

Potential impact

Actual or threatened geopolitical tension and conflicts lead to

greater uncertainty, economic instability and a general lack of

confidence for many of our clients who are inclined to scale back,

delay or cancel their marketing plans and budgets.

How it is managed and reflected in our strategic

priorities

We work closely with our in-country teams, third-party advisors,

clients and other agencies in monitoring the level and nature of

geopolitical issues, events and developments across all markets and

regions.

Our primary focus is the safety and security of our people, and for

extreme events or periods of disruption we have developed a series

of crisis and response plans with clear lines of escalation to the

Board and Executive Committee that focuses upon the wellbeing of

our people and their families.

We have detailed operational and financial plans, developed through

the consideration of a range of potential scenarios and outcomes

that are continuously monitored and, if required, used to make

interventions and support decision making over our operations,

investments and advice to clients.

PANDEMIC

Risk definition

The impact of a pandemic on our business will depend on numerous

factors that we are not able to accurately predict, including the

duration and scope of a pandemic, any existing or new variants,

government actions to mitigate the effects of a pandemic and the

continuing and long-term impact of a pandemic on our clients'

spending plans.

Potential impact

A pandemic and any new variants and the measures to contain its

spread may have an adverse effect on our business, revenues,

results of operations and financial condition and

prospects.

How it is managed and reflected in our strategic

priorities

A pandemic and any new variants and the measures to contain its

spread may have an adverse effect on our business, revenues,

results of operations and financial condition and

prospects.

STRATEGIC PLAN

Risk definition

The failure to successfully complete the strategic plan updated in

December 2020 to simplify our structure, continue to introduce

market-leading products and services, identify cost savings and

successfully integrate acquisitions, may have a material adverse

effect on the Group's market share and its business revenues,

results of operations, financial condition or

prospects.

Potential impact

A failure or delay in implementing or realising the benefits from

the transformation plan and/or returning the business to sustained

growth may have a material adverse effect on our market share and

our business, revenues, results of operations, financial condition

or prospects.

How it is managed and reflected in our strategic

priorities

Board oversight of the implementation of the strategic plan and

regular briefings on the Group's response to the pandemic and the

economic and geopolitical consequences of the invasion of Ukraine

by Russia.

The Executive Committee regularly reviews progress against the

strategic plan and actions required to deliver against the plan and

convenes regularly to discuss the Group's response to and

implementation of the measures highlighted above to mitigate the

impact of the pandemic and the economic and geopolitical

consequences of the invasion of Ukraine by Russia on the Group's

operations, people, clients and financial condition.

The focus on managing cost and changes in ways of working have

accelerated aspects of the transformation as we move faster towards

a simplified company structure and enhanced use of technology by

our people as a consequence of adapting to remote

working.

IT TRANSFORMATION

Risk definition

We are undertaking a series of IT transformation programmes to

support the Group's strategic plan. The programme has been devised

so that it prioritises the most critical changes necessary to

support the overall strategic plan whilst maintaining the

operational performance and security of core systems.

The Group is reliant on third parties for the performance of a

significant portion of our worldwide information technology and

operations functions.

A failure to provide these functions could have an adverse effect

on our business.

Potential impact

Any failure or delay in implementing the IT transformation

programmes may have a material adverse effect upon the overall

strategic plan and the realisation of key targeted benefits and

savings.

Disruption and unavailability of critical system availability may

lead to disruption in our operations and client service

delivery.

How it is managed and reflected in our strategic

priorities

The Board and management team provides oversight and governance of

the most important change transformation initiatives the business

is pursuing.

Detailed plans have been prepared for each major transformation

initiative and overall progress, challenges and risks to the

initiative are monitored as part of our project management

processes and discussed in dedicated steering committees who also

agree upon any corrective action that may be required.

Progress reports are also completed as part of regular briefings

that the Board receives on the overall implementation of the

strategic plan.

CLIENT LOSS

Risk definition

We compete for clients in a highly competitive industry which has

been evolving and undergoing structural change.

Client net loss to competitors or as a consequence of client

consolidation, insolvency or a reduction in marketing budgets due

to a geopolitical change or shift in client spending would have a

material adverse effect on our market share, business, revenues,

results of operations, financial condition and

prospects.

Potential impact

The competitive landscape in our industry is constantly evolving

and the role of more traditional services and operators in our

sector who have not successfully diversified is being challenged.

Competitors include multinational advertising and marketing

communication groups, marketing services companies, database

marketing information and measurement and professional services and

consultants and consulting internet companies.

Client contracts can generally be terminated on 90 days' notice or

are on an assignment basis and clients put their business up for

competitive review from time to time.

The ability to attract new clients and to retain or increase the

amount of work from existing clients may be impacted if we fail to

react quickly enough to changes in the market and to evolve our

structure, and by loss of reputation, and may be limited by

clients' policies on conflicts of interest.

How it is managed and reflected in our strategic

priorities

The transformation plan updated in December 2020 places emphasis on

providing faster, more agile and more effectively integrated

solutions that are data and technology led for our clients as part

of a continuous improvement of our creative capability and

reputation of our businesses.

The plan is also delivering a simplification of our organisational

structure by reducing the number of legal entities in the Group,

the disposal of non-core minority holdings and more collaborative

working through the launch of further campus co-locations including

in Brazil and Canada.

The Board is focused on the importance of a positive and inclusive

culture across our business to attract and retain talent and

clients. Work continues on diversity and inclusion across the Group

including focus from the work of the WPP Global Inclusion

Council.

Continuous improvement of our creative capability and reputation of

our businesses. The development and implementation of senior

leadership incentives to align more closely with our strategy and

performance.

Business review at every Board, management and Executive Committee

meeting to identify client loss. Monthly updates to the management

team on the status of the Group's major clients and upcoming

pitches for potential new clients.

Continuous engagement with our clients and suppliers through this

period of uncertainty and reduction in economic

activity.

CLIENT CONCENTRATION

Risk definition

We receive a significant portion of our revenues from a limited

number of large clients and the net loss of one or more of these

clients could have a material adverse effect on our prospects,

business, financial condition and results of

operations.

Potential impact

A relatively small number of clients contribute a significant

percentage of our consolidated revenues. Our ten largest clients

accounted for 18% of revenue less pass-through costs in the year

ended 31 December 2022.

Clients can reduce their marketing spend, terminate contracts or

cancel projects on short notice. The loss of one or more of our

largest clients, if not replaced by new accounts or an increase in

business from existing clients, would adversely affect our

financial condition.

How it is managed and reflected in our strategic

priorities

Increased flexibility in the cost structure (including incentives,

consultants and freelancers).

Business review at every Board meeting and regular engagement at

executive level with our clients.

A monthly 'new and existing business' tracker is reviewed by the

Executive Committee on a monthly basis with regular updates

provided to the Board.

REPUTATION

Risk definition

Increased reputational risk associated with working on client

briefs perceived to be environmentally detrimental and/or

misrepresenting environmental claims.

Potential impact

As consumer consciousness around climate change rises, our sector

is seeing increased scrutiny of its role in driving consumption.

Our clients seek expert partners who can give recommendations that

take into account stakeholder concerns around climate change.

Additionally, WPP serves some clients whose business models are

under increased scrutiny, for example, energy companies or

associated industry groups. This creates both a reputational and

related financial risk for WPP if we are not rigorous in our

content standards as we grow our sustainabilityrelated

services.

How it is managed and reflected in our strategic

priorities

Our climate crisis training seeks to ensure that our people

recognise the importance of our sector's role in addressing the

climate crisis. It is part of a broader sustainability training

programme being run in multiple markets with localised content in

key regions.

We have developed internal tools to help our people identify

environmentally harmful briefs. These tools embed climate-related

issues within existing content review procedures across the

organisation. The misrepresentation of environmental issues is

governed by our Code of Conduct. We also ensure our policies reduce

the risk that any client brief undermines the implementation of the

Paris Agreement. In 2022, we introduced the revised Assignment

Acceptance Policy and Framework and the Green Claims Guide to

provide further guidance about how to conduct additional due

diligence in relation to clients and any work we are asked to

undertake.

PEOPLE, CULTURE AND SUCCESSION

Risk definition

Our performance could be adversely affected if we do not react

quickly enough to changes in our market and fail to attract,

develop and retain key creative, commercial, technology and

management talent, or are unable to retain and incentivise key and

diverse talent, or are unable to adapt to new ways of working by

balancing home and office working.

Potential impact

We are highly dependent on the talent, creative abilities and

technical skills of our people as well as their relationships with

clients.

We are vulnerable to the loss of people to competitors (traditional

and emerging) and clients, leading to disruption to the

business.

How it is managed and reflected in our strategic

priorities

Our incentive plans are structured to provide retention value, for

example, by paying part of annual incentives in shares that vest

two years after grant date.

We are working across the businesses to embed collaboration and

investing in training and development to retain and attract

talented people. The investment in co-located campus properties is

increasing the cooperation across our companies and provides

extremely attractive and motivating working

environments.

Focus on the mental health of our people by providing access to

wellbeing resources, the establishment of support networks, funded

events, discussion forums and additional time off.

All In survey completed by two-thirds of our people in 2022,

providing an opportunity for the Board, Executive Committee and

senior leaders across the business to understand the general

sentiment, views, opinions and concerns of employees.

Findings from the survey highlighted general and local views on

cultural, wellbeing and other matters, which have formed the basis

of people change projects and further plans for

remediation.

Succession planning for the Chief Executive Officer, the Chief

Financial Officer and key executives of the Company is undertaken

by the Board and Nomination and Governance Committee on a regular

basis and a pool of potential internal and external candidates is

identified in emergency and planned scenarios.

The Compensation Committee provides oversight for the Group's

incentive plans and compensation.

Our real estate teams work closely with people teams across the

business to consider how space is being utilised to support

collaboration and innovation.

CYBER AND INFORMATION SECURITY

Risk definition

The Group has in the past and may in the future experience a cyber

attack that leads to harm or disruption to our operations, systems

or services.

Such an attack may also affect suppliers and partners through the

unauthorised access, manipulation, corruption or the destruction of

data.

Potential impact

We may be subject to investigative or enforcement action or legal

claims or incur fines, damages or costs and client loss if we fail

to adequately protect data.

A system breakdown or intrusion could have a material adverse

effect on our business, revenues, results of operations, financial

condition or prospects and have an impact on long-term reputation

and lead to client loss.

The imposition of sanctions following the ongoing conflict in

Ukraine has triggered an increase in cyber attacks

generally.

How it is managed and reflected in our strategic

priorities

We monitor and log our network and systems and keep raising our

people's security awareness through our WPP Safer Data training and

mock phishing attacks.

Heightened focus on monitoring our network and systems and raising

awareness of the potential for phishing and other cyber attacks

during the period of remote working and the geopolitical situation

and an increased focus on our control environment.

CREDIT RISK

Risk definition

We are subject to credit risk through the default of a client or

other counterparty.

Challenging economic conditions, heightened geopolitical issues,

shocks to consumer confidence, disruption in credit markets and

challenges in the supply chain disrupting our client operations can

lead to a worsening of the financial strength and outlook for our

clients who may reduce, suspend or cancel spend with us, request

extended payment terms beyond 60 days or be unable to satisfy

obligations.

Potential impact

We are generally paid in arrears for our services. Invoices are

typically payable within 30 to 60 days.

We commit to media and production purchases on behalf of some of

our clients as principal or agent depending on the client and

market circumstances. If a client is unable to pay sums due, media

and production companies may look to us to pay those amounts and

there could be an adverse effect on our working capital and

operating cash flow.

How it is managed and reflected in our strategic

priorities

Evaluating and monitoring clients' ongoing creditworthiness and in

some cases requiring credit insurance or payments in

advance.

We are working closely with our clients during this period of

economic uncertainty to ensure timely payment for services in line

with contractual commitments and with vendors to maintain the

settlement flow on media.

Our treasury position and compliance with lending covenants is a

recurring agenda item for the Audit Committee and

Board.

Increased management processes to manage working capital and review

cash outflows and receipts.

INTERNAL CONTROLS

Risk definition

Our performance could be adversely impacted if we failed to ensure

adequate internal control procedures are in place.

We have previously identified material weaknesses in our internal

control over financial reporting. If we failed to properly

remediate these material weaknesses or new material weaknesses are

identified, they could adversely affect our results of operations,

investor confidence in the Group and the market price of our ADSs

and ordinary shares.

Potential impact

Failure to ensure that our businesses have robust control

environments, or that the services we provide and trading

activities within the Group are compliant with client obligations,

could adversely impact client relationships and business volumes

and revenues.

As previously disclosed, for the year ended 31 December 2020, we

identified certain material weaknesses in our internal control over

financial reporting. During 2021, we finished implementing

previously reported plans to remediate such material weaknesses and

concluded that as at 31 December 2021, such material weaknesses had

been remediated. We have also concluded that our internal control

over financial reporting is again effective as of 31 December 2022,

as disclosed in our Form 20-F.

If the remedial measures were ultimately insufficient to address

the material weaknesses, or if additional material weaknesses in

internal control are discovered or occur in the future, our ability

to accurately record, process and report financial information and,

consequently, our ability to prepare financial statements within

required time periods, could be adversely affected.

In addition, the Group may be unable to maintain compliance with

the federal securities laws and NYSE listing requirements regarding

the timely filing of periodic reports. Any of the foregoing could

cause investors to lose confidence in the reliability of our

financial reporting, which could have a negative effect on the

trading price of the Group's ADSs and ordinary shares.

How it is managed and reflected in our strategic

priorities

Transparency and contract compliance are embedded through the

networks and reinforced by audits at a WPP and network

level.

Regular monitoring of key performance indicators for trading are

undertaken to identify trends and issues.

An authorisation matrix on inventory trading is agreed with the

Company and the Audit Committee.

In 2021, our then new controls function continued to review and

enhance controls across the Group, under the direction of our

Global Director of Risk and Controls. As part of this effort, we

significantly enhanced the staffing, capabilities and resources of

our technical accounting function, which supported the

retrospective review efforts and will continue to provide ongoing

support in regards to complex accounting matters and judgment and

changes in accounting standards.

Management is committed to maintaining a strong internal control

environment, with appropriate oversight from our Audit Committee.

We have made significant enhancements to our controls through the

implementation of the remediation and continue to evaluate further

opportunities to improve our control environment. We have engaged

an independent valuation specialist, on an ongoing basis with

oversight by management, to assist us as an integral part of the

discount rate and cash flow determination process in the impairment

assessment of intangible assets and goodwill.

This has included such items as: updating our discount

determination methodology for a current market participant

approach; enhancing the level of review and controls related to the

selection of the variables underpinning the discount rate

calculation, the discount rate methodology and annual refresh; and

implementing additional validation controls and additional reviews

of the selection of cash flow periods and net working capital

assumptions.

In the case of complex accounting matters and hedging arrangements,

we performed a comprehensive retrospective review of our controls

and procedures and implemented enhanced periodic controls into our

control framework and have engaged outside advisors with specialist

expertise in the respective subject matter areas to assist with the

performance of the comprehensive retrospective review.

DATA PRIVACY

Risk definition

We are subject to strict data protection and privacy legislation in

the jurisdictions in which we operate and rely extensively on

information technology systems. We store, transmit and rely on

critical and sensitive data such as strategic plans, personally

identifiable information and trade secrets:

-

Security

of this type of data is exposed to escalating external threats that

are increasing in sophistication, as well as internal data

breaches

-

Data

transfers between our global operating companies, clients or

vendors may be interrupted due to changes in law (for example, EU

adequacy decisions, CJEU Schrems II decision)

Potential impact

We may be subject to investigative or enforcement action or legal

claims or incur fines, damages, or costs and client loss if we fail

to adequately protect data or observe privacy legislation in every

instance:

-

The

Group has in the past and may in the future experience a system

breakdown or intrusion that could have a material adverse effect on

our business, revenues, results of operations, financial condition

or prospects

-

Restrictions

or limitations on international data transfers could have an

adverse effect on our business and operations

How it is managed and reflected in our strategic

priorities

We develop principles on privacy and data protection and compliance

with local laws. We also monitor pending changes to regulations and

identify changes to our processes and policies that would need to

be implemented. In the case of data transfers, we also identify

alternative approaches, including using other permitted transfer

mechanisms, in order to limit any potential disruption (for

example, SCCs instead of Privacy Shield following the CJEU Schrems

II decision).

We implemented extensive training ahead of GDPR and CPPA

implementation and the roll-out of toolkits to assist our people to

prepare for implementation and will do the same as new legislation

is adopted in other markets.

A Chief Privacy Officer and Data Protection Officer are appointed

at the Company and Data Protection Officers are in place at a

number of our companies.

Our people must take Privacy & Data Security Awareness training

and understand the WPP Data Code of Conduct and WPP policies on

data privacy and security.

The Data Health Checker survey is performed annually to understand

the scale and breadth of data we collect so the level of risk

associated with this can be assessed.

TAXATION

Risk definition

We may be subject to regulations restricting our activities or

effecting changes in taxation.

Potential impact

Changes in local or international tax rules, for example, as a

consequence of the financial support programmes implemented by

governments during the Covid-19 pandemic, the OECD/G20 Inclusive

Framework on Base Erosion and Profit Shifting, and changes arising

from the application of existing rules, or challenges by tax or

competition authorities, may expose us to significant additional

tax liabilities or impact the carrying value of our deferred tax

assets, which would affect the future tax charge.

How it is managed and reflected in our strategic

priorities

We actively monitor any proposed regulatory or statutory changes

and consult with government agencies and regulatory bodies where

possible on such proposed changes.

Biannual briefings to the Audit Committee of significant changes in

tax laws and their application and regular briefings to executive

management. We engage advisors and legal counsel to obtain opinions

on tax legislation and principles.

REGULATORY

Risk definition

We are subject to strict anti-corruption, anti-bribery and

anti-trust legislation and enforcement in the countries in which we

operate.

Potential impact

We operate in a number of markets where the corruption risk has

been identified as high by groups such as Transparency

International.

Failure to comply or to create a culture opposed to corruption or

failing to instil business practices that prevent corruption has

previously and could expose us to civil and criminal

sanctions.

How it is managed and reflected in our strategic

priorities

Online and in-country ethics, anti-bribery, anti-corruption and

anti-trust training on a Group-wide basis to raise awareness and

seek compliance with our Code of Conduct and the Anti-Bribery &

Corruption Policy.

A continuously evolving business integrity function to ensure

compliance with our codes and policies and remediation of any

breaches of policy.

Continuous communication of the Right to Speak confidential,

independently operated helpline for our people and stakeholders to

raise any potential breaches of our Code and policies, which are

investigated and reported to the Audit Committee on a regular

basis.

Due diligence on acquisitions and on selecting and appointing

suppliers and restrictions on the use of third-party consultants in

connection with any client pitches. Rolling programme of creating

shared financial services in the markets in which we operate and

the creation of a new controls function in 2020.

Risk Committees are well established at WPP and across the networks

to monitor risk and compliance through all of our businesses and

the enhancement of our business integrity programme across our

markets.

Gift and hospitality register and approvals process.

SANCTIONS

Risk definition

We are subject to the laws of the United States, the EU, the UK and

other jurisdictions that impose sanctions and regulate the supply

of services to certain countries.

The Russian invasion of Ukraine has caused the adoption of

comprehensive sanctions by, among others, the EU, the United States

and the UK, which restrict a wide range of trade and financial

dealings with Russia and Russian persons.

Potential impact

Failure to comply with these laws could expose us to civil and

criminal penalties including fines and the imposition of economic

sanctions against us and reputational damage and withdrawal of

banking facilities which could materially impact our

results.

How it is managed and reflected in our strategic

priorities

Online training to raise awareness and seek compliance and updates

for our companies on any new sanctions.

Regular briefings to the Audit Committee and constant monitoring by

the WPP legal team with assistance from external advisors of the

sanctions regimes. Executive Committee briefed and working with the

WPP legal team to ensure compliance with escalating sanctions as a

consequence of the Russian invasion of Ukraine.

We have taken a number of actions as a consequence of the invasion.

We have announced the discontinuance of our operations in Russia

and ensured compliance with all sanctions as they impact any

clients, suppliers or financial arrangements.

ENVIRONMENT REGULATION AND REPORTING

Risk definition

The Group could be subject to increased costs to comply with the

potential future changes in environmental law and

regulations.

Potential impact

We could be subject to increased costs to comply with potential

future changes in environmental laws and regulations and increasing

carbon offset pricing to meet our net zero

commitments.

Carbon emission accounting for marketing and media is in its

infancy and methodologies continue to evolve. This is particularly

the case for emissions associated with digital media.

How it is managed and reflected in our strategic

priorities

We are developing a net zero roadmap to deliver against our net

zero commitments and aim to disclose more details of that roadmap

in 2023.

As part of this plan and through our work to decarbonise media and

media supply chains, we are exploring opportunities to improve

accounting for emissions from media.

As we seek to limit emissions, we need to reduce the total

footprint of any product or service as far as possible. To manage

the cost and quality of carbon credits purchased to offset

remaining emissions, WPP developed a new offsetting policy and we

are further developing our offsetting strategy as part of our net

zero roadmap.

EMERGING RISKS

Risk definition

The Group's operations could be disrupted by an increased frequency

of extreme weather and climate-related natural

disasters.

Potential impact

This includes storms, flooding, wildfires and water and heat stress

which can damage our buildings, jeopardise the safety and wellbeing

of our people and significantly disrupt our

operations.

How it is managed and reflected in our strategic

priorities

Co-locating our people in fewer, higher-capacity campus buildings

means we can centralise emergency preparedness procedures and

deploy climate mitigation measures more efficiently.

Climate-related risk is considered when we invest in new campus

buildings. In 2023 we will pilot a new ESG scorecard to assess

building performance across a number of climate-related

metrics.

Our hybrid working approach, which incorporates new ways of working

adopted during the pandemic, provides additional resilience by

enabling fully remote working - provided employees and their

families are in safe locations - during extreme weather

events.

The Employee Assistance Programme is activated in response to

climate-related extreme weather events.

EMERGING RISKS

Risk definition

A failure to manage the complexity in carbon emission accounting

for marketing and media or to consider scope 3 emissions in new

technology and business model innovation across the supply chain

could have an adverse effect on our business and

reputation.

Potential impact

Increased investment required in building renovation,

electrification and supplier engagement to meet targets, including

developing internal ESG capacity and capabilities.

Offset prices would likely rise, increasing the overall expenditure

to meet our net zero commitments.

How it is managed and reflected in our strategic

priorities

In 2023, we will publish our first net zero transition plan which

will outline further details on how we intend to deliver against

our net zero targets.

The Board Sustainability Committee was formed in 2019 to give

increased focus on sustainability (see page 128). In 2022, we

updated our Sustainability Policy, and released our first

Environmental Policy which included policy guidance around

offsetting.

Environment, Social and Governance KPIs are included as part of the

scorecard that determines the short-term incentive rewards for

WPP's CEO, CFO and some key members of the Executive Committee.

This includes WPP's performance against carbon reduction

targets.

APPENDIX B: DIRECTORS' RESPONSIBILITY STATEMENT

Each of the current Directors whose names and functions are listed

in the Corporate Governance section of the Annual Report 2022

confirms that, to the best of his or her knowledge:

● the

Group financial statements, which have been prepared in accordance

with IFRS, issued by the International Accounting Standards Board

(IASB) as they apply to the financial statements of the Group for

the year ended 31 December 2022, give a true and fair view of the

assets, liabilities, financial position and profit of the Group.

and

● the

Strategic report and risk sections of the Annual Report, which

represent the management report, include a fair review of the

development and performance of the business and the position of the

Company and the Group taken as a whole, together with a description

of the principal risks and uncertainties that it

faces.

APPENDIX C: RELATED PARTY TRANSACTIONS

The Group enters into transactions with its associate undertakings.

The Group has continuing transactions with Kantar, including sales,

purchases, the provision of IT services, subleases and property

related items. In the year ended 31 December 2022, revenue of

£88.3 million (2021: £117.2 million) was reported in

relation to Compas, an associate in the USA, and revenue of

£42.7 million (2021: £11.3 million) was reported in

relation to Kantar. All other transactions in the years presented

were immaterial.

The following amounts owed by related parties were outstanding at

31 December 2022:

Kantar £26.1 million

Other £62.4 million

The following amounts owed to related parties were outstanding at

31 December 2022:

Kantar £(10.5) million

Other £(65.2) million

END

SIGNATURES

Pursuant to the

requirements of the Securities Exchange Act of 1934, the registrant

has duly caused this report to be signed on its behalf by the

undersigned, thereunto duly authorized.

|

|

WPP

PLC

|

|

|

(Registrant)

|

|

Date:

23 March 2023.

|

By:

______________________

|

|

|

Balbir

Kelly-Bisla

|

|

|

Company

Secretary

|

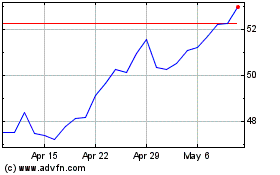

WPP (NYSE:WPP)

Historical Stock Chart

From Oct 2024 to Nov 2024

WPP (NYSE:WPP)

Historical Stock Chart

From Nov 2023 to Nov 2024