UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 13D

Under the Securities Exchange Act of 1934

(Amendment No. )*

VIPSHOP

HOLDINGS LIMITED

(Name of Issuer)

Ordinary Shares, $0.0001 par value per share

(Title of Class of Securities)

92763W103

(CUSIP Number)

Sequoia Capital China II, L.P.

Suite 2215

Two Pacific Place

88 Queensway

Hong Kong, PRC

Attention: Neil Nanpeng Shen

Telephone: 852 2501-8989

(Name, Address and Telephone Number of Person

Authorized to Receive Notices and Communications)

with copies to:

Craig Marcus

Ropes & Gray LLP

800 Boylston Street

Boston, Massachusetts 02199

(617) 951-7802

March 28, 2012

(Date of Event which Requires Filing of this Statement)

If the filing person has previously filed a statement on Schedule 13G to report the acquisition that is the subject of this Schedule 13D, and is filing

this schedule because of §§240.13d-1(e), 240.13d-1(f) or 240.13d-1(g), check the following box.

¨

Note

: Schedules filed in paper format shall include a signed original and five copies of the schedule, including all exhibits. See §240.13d-7 for other parties to whom copies are to be

sent.

|

*

|

The remainder of this cover page shall be filled out for a reporting person’s initial filing on this form with respect to the subject class of securities, and for

any subsequent amendment containing information which would alter disclosures provided in a prior cover page.

|

The information

required on the remainder of this cover page shall not be deemed to be “filed” for the purpose of Section 18 of the Securities Exchange Act of 1934 (“Act”) or otherwise subject to the liabilities of that section of the Act but

shall be subject to all other provisions of the Act (however, see the Notes).

|

|

|

|

|

|

|

|

|

|

|

Page

2

of 19

|

|

CUSIP No. 92763W103

|

|

SCHEDULE 13D

|

|

|

|

|

|

|

|

|

|

|

|

1.

|

|

Names of Reporting Persons. I.R.S. Identification Nos. of above persons (entities only)

Sequoia Capital China II, L.P.

IRS Identification No. 26-0204241

|

|

2.

|

|

Check the Appropriate Box if a

Member of a Group (See Instructions)

(a)

¨

(b)

¨

|

|

3.

|

|

SEC Use Only

|

|

4.

|

|

Source of Funds (See

Instructions)

OO

|

|

5.

|

|

Check if Disclosure of Legal

Proceedings Is Required Pursuant to Items 2(d) or 2(e)

¨

|

|

6.

|

|

Citizenship or Place of

Organization

Cayman Islands

|

|

Number of

Shares

Beneficially

Owned by

Each

Reporting

Person

With

|

|

7.

|

|

Sole Voting Power

0

|

|

|

8.

|

|

Shared Voting Power

10,373,580

|

|

|

9.

|

|

Sole Dispositive Power

0

|

|

|

10.

|

|

Shared Dispositive Power

10,373,580

|

|

11.

|

|

Aggregate Amount Beneficially

Owned by Each Reporting Person

10,373,580

|

|

12.

|

|

Check if the Aggregate Amount in

Row (11) Excludes Certain Shares (See Instructions)

¨

|

|

13.

|

|

Percent of Class Represented by

Amount in Row (11)

10.3%

|

|

14.

|

|

Type of Reporting Person (See

Instructions)

PN

|

|

|

|

|

|

|

|

|

|

|

|

Page

3

of 19

|

|

CUSIP No. 92763W103

|

|

SCHEDULE 13D

|

|

|

|

|

|

|

|

|

|

|

|

1.

|

|

Names of Reporting Persons. I.R.S. Identification Nos. of above persons (entities only)

Sequoia Capital China Partners Fund II, L.P.

IRS Identification No. 98-0577551

|

|

2.

|

|

Check the Appropriate Box if a

Member of a Group (See Instructions)

(a)

¨

(b)

¨

|

|

3.

|

|

SEC Use Only

|

|

4.

|

|

Source of Funds (See

Instructions)

OO

|

|

5.

|

|

Check if Disclosure of Legal

Proceedings Is Required Pursuant to Items 2(d) or 2(e)

¨

|

|

6.

|

|

Citizenship or Place of

Organization

Cayman Islands

|

|

Number of

Shares

Beneficially

Owned by

Each

Reporting

Person

With

|

|

7.

|

|

Sole Voting Power

0

|

|

|

8.

|

|

Shared Voting Power

219,394

|

|

|

9.

|

|

Sole Dispositive Power

0

|

|

|

10.

|

|

Shared Dispositive Power

219,394

|

|

11.

|

|

Aggregate Amount Beneficially

Owned by Each Reporting Person

219,394

|

|

12.

|

|

Check if the Aggregate Amount in

Row (11) Excludes Certain Shares (See Instructions)

¨

|

|

13.

|

|

Percent of Class Represented by

Amount in Row (11)

0.2%

|

|

14.

|

|

Type of Reporting Person (See

Instructions)

PN

|

|

|

|

|

|

|

|

|

|

|

|

Page

4

of 19

|

|

CUSIP No. 92763W103

|

|

SCHEDULE 13D

|

|

|

|

|

|

|

|

|

|

|

|

1.

|

|

Names of Reporting Persons. I.R.S. Identification Nos. of above persons (entities only)

Sequoia Capital China Principals Fund II, L.P.

IRS Identification No. 33-1190312

|

|

2.

|

|

Check the Appropriate Box if a

Member of a Group (See Instructions)

(a)

¨

(b)

¨

|

|

3.

|

|

SEC Use Only

|

|

4.

|

|

Source of Funds (See

Instructions)

OO

|

|

5.

|

|

Check if Disclosure of Legal

Proceedings Is Required Pursuant to Items 2(d) or 2(e)

¨

|

|

6.

|

|

Citizenship or Place of

Organization

Cayman Islands

|

|

Number of

Shares

Beneficially

Owned by

Each

Reporting

Person

With

|

|

7.

|

|

Sole Voting Power

0

|

|

|

8.

|

|

Shared Voting Power

1,671,446

|

|

|

9.

|

|

Sole Dispositive Power

0

|

|

|

10.

|

|

Shared Dispositive Power

1,671,446

|

|

11.

|

|

Aggregate Amount Beneficially

Owned by Each Reporting Person

1,671,446

|

|

12.

|

|

Check if the Aggregate Amount in

Row (11) Excludes Certain Shares (See Instructions)

¨

|

|

13.

|

|

Percent of Class Represented by

Amount in Row (11)

1.7%

|

|

14.

|

|

Type of Reporting Person (See

Instructions)

PN

|

|

|

|

|

|

|

|

|

|

|

|

Page

5

of 19

|

|

CUSIP No. 92763W103

|

|

SCHEDULE 13D

|

|

|

|

|

|

|

|

|

|

|

|

1.

|

|

Names of Reporting Persons. I.R.S. Identification Nos. of above persons (entities only)

Sequoia Capital China Management II, L.P.

IRS Identification No. 26-0204084

|

|

2.

|

|

Check the Appropriate Box if a

Member of a Group (See Instructions)

(a)

¨

(b)

¨

|

|

3.

|

|

SEC Use Only

|

|

4.

|

|

Source of Funds (See

Instructions)

OO

|

|

5.

|

|

Check if Disclosure of Legal

Proceedings Is Required Pursuant to Items 2(d) or 2(e)

¨

|

|

6.

|

|

Citizenship or Place of

Organization

Cayman Islands

|

|

Number of

Shares

Beneficially

Owned by

Each

Reporting

Person

With

|

|

7.

|

|

Sole Voting Power

0

|

|

|

8.

|

|

Shared Voting Power

12,264,420

|

|

|

9.

|

|

Sole Dispositive Power

0

|

|

|

10.

|

|

Shared Dispositive Power

12,264,420

|

|

11.

|

|

Aggregate Amount Beneficially

Owned by Each Reporting Person

12,264,420

|

|

12.

|

|

Check if the Aggregate Amount in

Row (11) Excludes Certain Shares (See Instructions)

¨

|

|

13.

|

|

Percent of Class Represented by

Amount in Row (11)

12.1%

|

|

14.

|

|

Type of Reporting Person (See

Instructions)

PN

|

|

|

|

|

|

|

|

|

|

|

|

Page

6

of 19

|

|

CUSIP No. 92763W103

|

|

SCHEDULE 13D

|

|

|

|

|

|

|

|

|

|

|

|

1.

|

|

Names of Reporting Persons. I.R.S. Identification Nos. of above persons (entities only)

Sequoia Capital 2010 CV Holdco, Ltd.

IRS Identification No. 98-0660286

|

|

2.

|

|

Check the Appropriate Box if a

Member of a Group (See Instructions)

(a)

¨

(b)

¨

|

|

3.

|

|

SEC Use Only

|

|

4.

|

|

Source of Funds (See

Instructions)

OO

|

|

5.

|

|

Check if Disclosure of Legal

Proceedings Is Required Pursuant to Items 2(d) or 2(e)

¨

|

|

6.

|

|

Citizenship or Place of

Organization

Cayman Islands

|

|

Number of

Shares

Beneficially

Owned by

Each

Reporting

Person

With

|

|

7.

|

|

Sole Voting Power

0

|

|

|

8.

|

|

Shared Voting Power

7,767,852

|

|

|

9.

|

|

Sole Dispositive Power

0

|

|

|

10.

|

|

Shared Dispositive Power

7,767,852

|

|

11.

|

|

Aggregate Amount Beneficially

Owned by Each Reporting Person

7,767,852

|

|

12.

|

|

Check if the Aggregate Amount in

Row (11) Excludes Certain Shares (See Instructions)

¨

|

|

13.

|

|

Percent of Class Represented by

Amount in Row (11)

7.7%

|

|

14.

|

|

Type of Reporting Person (See

Instructions)

OO

|

|

|

|

|

|

|

|

|

|

|

|

Page

7

of 19

|

|

CUSIP No. 92763W103

|

|

SCHEDULE 13D

|

|

|

|

|

|

|

|

|

|

|

|

1.

|

|

Names of Reporting Persons. I.R.S. Identification Nos. of above persons (entities only)

Sequoia Capital China Venture 2010 Fund, L.P.

IRS Identification No. 98-0678098

|

|

2.

|

|

Check the Appropriate Box if a

Member of a Group (See Instructions)

(a)

¨

(b)

¨

|

|

3.

|

|

SEC Use Only

|

|

4.

|

|

Source of Funds (See

Instructions)

OO

|

|

5.

|

|

Check if Disclosure of Legal

Proceedings Is Required Pursuant to Items 2(d) or 2(e)

¨

|

|

6.

|

|

Citizenship or Place of

Organization

Cayman Islands

|

|

Number of

Shares

Beneficially

Owned by

Each

Reporting

Person

With

|

|

7.

|

|

Sole Voting Power

0

|

|

|

8.

|

|

Shared Voting Power

7,767,852

|

|

|

9.

|

|

Sole Dispositive Power

0

|

|

|

10.

|

|

Shared Dispositive Power

7,767,852

|

|

11.

|

|

Aggregate Amount Beneficially

Owned by Each Reporting Person

7,767,852

|

|

12.

|

|

Check if the Aggregate Amount in

Row (11) Excludes Certain Shares (See Instructions)

¨

|

|

13.

|

|

Percent of Class Represented by

Amount in Row (11)

7.7%

|

|

14.

|

|

Type of Reporting Person (See

Instructions)

PN

|

|

|

|

|

|

|

|

|

|

|

|

Page

8

of 19

|

|

CUSIP No. 92763W103

|

|

SCHEDULE 13D

|

|

|

|

|

|

|

|

|

|

|

|

1.

|

|

Names of Reporting Persons. I.R.S. Identification Nos. of above persons (entities only)

Sequoia Capital China Venture 2010 Partners Fund, L.P.

IRS Identification No. 98-0705138

|

|

2.

|

|

Check the Appropriate Box if a

Member of a Group (See Instructions)

(a)

¨

(b)

¨

|

|

3.

|

|

SEC Use Only

|

|

4.

|

|

Source of Funds (See

Instructions)

OO

|

|

5.

|

|

Check if Disclosure of Legal

Proceedings Is Required Pursuant to Items 2(d) or 2(e)

¨

|

|

6.

|

|

Citizenship or Place of

Organization

Cayman Islands

|

|

Number of

Shares

Beneficially

Owned by

Each

Reporting

Person

With

|

|

7.

|

|

Sole Voting Power

0

|

|

|

8.

|

|

Shared Voting Power

7,767,852

|

|

|

9.

|

|

Sole Dispositive Power

0

|

|

|

10.

|

|

Shared Dispositive Power

7,767,852

|

|

11.

|

|

Aggregate Amount Beneficially

Owned by Each Reporting Person

7,767,852

|

|

12.

|

|

Check if the Aggregate Amount in

Row (11) Excludes Certain Shares (See Instructions)

¨

|

|

13.

|

|

Percent of Class Represented by

Amount in Row (11)

7.7%

|

|

14.

|

|

Type of Reporting Person (See

Instructions)

PN

|

|

|

|

|

|

|

|

|

|

|

|

Page

9

of 19

|

|

CUSIP No. 92763W103

|

|

SCHEDULE 13D

|

|

|

|

|

|

|

|

|

|

|

|

1.

|

|

Names of Reporting Persons. I.R.S. Identification Nos. of above persons (entities only)

Sequoia Capital China Venture 2010 Principals Fund, L.P.

IRS Identification No. 98-0705154

|

|

2.

|

|

Check the Appropriate Box if a

Member of a Group (See Instructions)

(a)

¨

(b)

¨

|

|

3.

|

|

SEC Use Only

|

|

4.

|

|

Source of Funds (See

Instructions)

OO

|

|

5.

|

|

Check if Disclosure of Legal

Proceedings Is Required Pursuant to Items 2(d) or 2(e)

¨

|

|

6.

|

|

Citizenship or Place of

Organization

Cayman Islands

|

|

Number of

Shares

Beneficially

Owned by

Each

Reporting

Person

With

|

|

7.

|

|

Sole Voting Power

0

|

|

|

8.

|

|

Shared Voting Power

7,767,852

|

|

|

9.

|

|

Sole Dispositive Power

0

|

|

|

10.

|

|

Shared Dispositive Power

7,767,852

|

|

11.

|

|

Aggregate Amount Beneficially

Owned by Each Reporting Person

7,767,852

|

|

12.

|

|

Check if the Aggregate Amount in

Row (11) Excludes Certain Shares (See Instructions)

¨

|

|

13.

|

|

Percent of Class Represented by

Amount in Row (11)

7.7%

|

|

14.

|

|

Type of Reporting Person (See

Instructions)

PN

|

|

|

|

|

|

|

|

|

|

|

|

Page

10

of 19

|

|

CUSIP No. 92763W103

|

|

SCHEDULE 13D

|

|

|

|

|

|

|

|

|

|

|

|

1.

|

|

Names of Reporting Persons. I.R.S. Identification Nos. of above persons (entities only)

SC China Venture 2010 Management, L.P.

IRS Identification No. 98-0678096

|

|

2.

|

|

Check the Appropriate Box if a

Member of a Group (See Instructions)

(a)

¨

(b)

¨

|

|

3.

|

|

SEC Use Only

|

|

4.

|

|

Source of Funds (See

Instructions)

OO

|

|

5.

|

|

Check if Disclosure of Legal

Proceedings Is Required Pursuant to Items 2(d) or 2(e)

¨

|

|

6.

|

|

Citizenship or Place of

Organization

Cayman Islands

|

|

Number of

Shares

Beneficially

Owned by

Each

Reporting

Person

With

|

|

7.

|

|

Sole Voting Power

0

|

|

|

8.

|

|

Shared Voting Power

7,767,852

|

|

|

9.

|

|

Sole Dispositive Power

0

|

|

|

10.

|

|

Shared Dispositive Power

7,767,852

|

|

11.

|

|

Aggregate Amount Beneficially

Owned by Each Reporting Person

7,767,852

|

|

12.

|

|

Check if the Aggregate Amount in

Row (11) Excludes Certain Shares (See Instructions)

¨

|

|

13.

|

|

Percent of Class Represented by

Amount in Row (11)

7.7%

|

|

14.

|

|

Type of Reporting Person (See

Instructions)

PN

|

|

|

|

|

|

|

|

|

|

|

|

Page

11

of 19

|

|

CUSIP No. 92763W103

|

|

SCHEDULE 13D

|

|

|

|

|

|

|

|

|

|

|

|

1.

|

|

Names of Reporting Persons. I.R.S. Identification Nos. of above persons (entities only)

SC China Holding Limited

IRS Identification No. – N/A

|

|

2.

|

|

Check the Appropriate Box if a

Member of a Group (See Instructions)

(a)

¨

(b)

¨

|

|

3.

|

|

SEC Use Only

|

|

4.

|

|

Source of Funds (See

Instructions)

OO

|

|

5.

|

|

Check if Disclosure of Legal

Proceedings Is Required Pursuant to Items 2(d) or 2(e)

¨

|

|

6.

|

|

Citizenship or Place of

Organization

Cayman Islands

|

|

Number of

Shares

Beneficially

Owned by

Each

Reporting

Person

With

|

|

7.

|

|

Sole Voting Power

0

|

|

|

8.

|

|

Shared Voting Power

20,032,272

|

|

|

9.

|

|

Sole Dispositive Power

0

|

|

|

10.

|

|

Shared Dispositive Power

20,032,272

|

|

11.

|

|

Aggregate Amount Beneficially

Owned by Each Reporting Person

20,032,272

|

|

12.

|

|

Check if the Aggregate Amount in

Row (11) Excludes Certain Shares (See Instructions)

¨

|

|

13.

|

|

Percent of Class Represented by

Amount in Row (11)

19.8%

|

|

14.

|

|

Type of Reporting Person (See

Instructions)

OO

|

|

|

|

|

|

|

|

|

|

|

|

Page

12

of 19

|

|

CUSIP No. 92763W103

|

|

SCHEDULE 13D

|

|

|

|

|

|

|

|

|

|

|

|

1.

|

|

Names of Reporting Persons. I.R.S. Identification Nos. of above persons (entities only)

SNP China Enterprises Limited

IRS Identification No. – N/A

|

|

2.

|

|

Check the Appropriate Box if a

Member of a Group (See Instructions)

(a)

¨

(b)

¨

|

|

3.

|

|

SEC Use Only

|

|

4.

|

|

Source of Funds (See

Instructions)

OO

|

|

5.

|

|

Check if Disclosure of Legal

Proceedings Is Required Pursuant to Items 2(d) or 2(e)

¨

|

|

6.

|

|

Citizenship or Place of

Organization

British Virgin

Islands

|

|

Number of

Shares

Beneficially

Owned by

Each

Reporting

Person

With

|

|

7.

|

|

Sole Voting Power

0

|

|

|

8.

|

|

Shared Voting Power

20,032,272

|

|

|

9.

|

|

Sole Dispositive Power

0

|

|

|

10.

|

|

Shared Dispositive Power

20,032,272

|

|

11.

|

|

Aggregate Amount Beneficially

Owned by Each Reporting Person

20,032,272

|

|

12.

|

|

Check if the Aggregate Amount in

Row (11) Excludes Certain Shares (See Instructions)

¨

|

|

13.

|

|

Percent of Class Represented by

Amount in Row (11)

19.8%

|

|

14.

|

|

Type of Reporting Person (See

Instructions)

OO

|

|

|

|

|

|

|

|

|

|

|

|

Page

13

of 19

|

|

CUSIP No. 92763W103

|

|

SCHEDULE 13D

|

|

|

|

|

|

|

|

|

|

|

|

1.

|

|

Names of Reporting Persons. I.R.S. Identification Nos. of above persons (entities only)

Neil Nanpeng Shen

|

|

2.

|

|

Check the Appropriate Box if a

Member of a Group (See Instructions)

(a)

¨

(b)

¨

|

|

3.

|

|

SEC Use Only

|

|

4.

|

|

Source of Funds (See

Instructions)

OO

|

|

5.

|

|

Check if Disclosure of Legal

Proceedings Is Required Pursuant to Items 2(d) or 2(e)

¨

|

|

6.

|

|

Citizenship or Place of

Organization

Hong Kong SAR

|

|

Number of

Shares

Beneficially

Owned by

Each

Reporting

Person

With

|

|

7.

|

|

Sole Voting Power

0

|

|

|

8.

|

|

Shared Voting Power

20,032,272

|

|

|

9.

|

|

Sole Dispositive Power

0

|

|

|

10.

|

|

Shared Dispositive Power

20,032,272

|

|

11.

|

|

Aggregate Amount Beneficially

Owned by Each Reporting Person

20,032,272

|

|

12.

|

|

Check if the Aggregate Amount in

Row (11) Excludes Certain Shares (See Instructions)

¨

|

|

13.

|

|

Percent of Class Represented by

Amount in Row (11)

19.8%

|

|

14.

|

|

Type of Reporting Person (See

Instructions)

IN

|

Page

14

of 19

|

ITEM 1.

|

SECURITY AND ISSUER.

|

This Statement on Schedule 13D (this “Statement”) relates to the Ordinary Shares, $0.0001 par value per share (“Ordinary

Shares”), of Vipshop Holdings Limited, a Cayman Islands corporation (“Vipshop”). The principal executive offices of Vipshop are located at No. 20 Huahai Street, Liwan District, Guangzhou 510370, The People’s Republic of

China (86-20) 2233-0000.

|

ITEM 2.

|

IDENTITY AND BACKGROUND.

|

(a) This Statement is being jointly filed by the following persons (each a “Reporting Person” and collectively, the

“Reporting Persons”): (1) Sequoia Capital China II, L.P., a Cayman Islands exempted limited partnership (“SCC II”); (2) Sequoia Capital China Partners Fund II, L.P., a Cayman Islands exempted limited partnership

(“SCC PTRS II”); (3) Sequoia Capital China Principals Fund II, L.P., a Cayman Islands exempted limited partnership (“SCC PF II”); (4) Sequoia Capital China Management II, L.P., a Cayman Islands exempted limited

partnership (“SCC MGMT II”); (5) Sequoia Capital 2010 CV Holdco, Ltd., a Cayman Islands limited liability company (“SC CV HOLD”); (6) Sequoia Capital China Venture 2010 Fund, L.P., a Cayman Islands exempted limited

partnership (“SCC VENTURE”); (7) Sequoia Capital China Venture 2010 Partners Fund, L.P., a Cayman Islands exempted limited partnership (“SCC VENTURE PTRS”); (8) Sequoia Capital China Venture 2010 Principals Fund, L.P.,

a Cayman Islands exempted limited partnership (“SCC VENTURE PF”); (9) SC China Venture 2010 Management, L.P., a Cayman Islands exempted limited partnership (“SCC VENTURE MGMT”); (10) SC China Holding Limited, a Cayman

Islands limited liability company (“SCC HOLD”); (10) SNP China Enterprises Limited, a British Virgin Islands limited liability company (“SNP”); and (11) Neil Nanpeng Shen, a Hong Kong SAR citizen. The agreement among

the Reporting Persons relating to the joint filing of this Statement is attached to this Statement as

Exhibit 99.1

.

Based on the transactions described herein, the Reporting Persons may be deemed to constitute a “group” for purposes of

Section 13(d)(3) of the Act. The filing of this Statement shall not be construed as an admission that the Reporting Persons are a group, or have agreed to act as a group. Each Reporting Person expressly disclaims beneficial ownership

in the securities reported herein except to the extent such Reporting Person actually exercises voting or dispositive power with respect to such securities.

(b) The business address of SCC II, SCC PTRS II, SCC PF II, SCC MGMT II, SC CV HOLD, SCC VENTURE, SCC VENTURE PTRS, SCC VENTURE PF, SCC VENTURE MGMT, SCC HOLD, SNP and Neil Nanpeng Shen is Suite 2215, Two

Pacific Place, 88 Queensway, Hong Kong, PRC.

(c) The principal occupation or employment of each of SCC II, SCC PTRS II, SCC

PF II, and SC CV HOLD is to acquire, hold and dispose of interests in various companies for investment purposes and to take all actions incident thereto. The principal occupation or employment of SCC MGMT II is to serve as general partner of SCC II,

SCC PTRS II and SCC PF II. The principal occupation or employment of each of SCC VENTURE, SCC VENTURE PTRS and SCC VENTURE PF is to serve as the joint owners of SC CV HOLD. The principal occupation or employment of SCC VENTURE MGMT is to serve as

the general partner of SCC VENTURE, SCC VENTURE PTRS and SCC VENTURE PF. The principal occupation or employment of SCC HOLD is to serve as general partner of SCC MGMT II and SCC VENTURE MGMT. The principal occupation or employment of SNP is to serve

as the parent company of SCC HOLD. The principal occupation or employment of Neil Nanpeng Shen is to serve as the founding managing partner of Sequoia Capital China and the sole owner of SNP.

(d) During the last five years, no Reporting Person has been convicted in any criminal proceeding (excluding traffic violations or

other minor offenses).

(e) During the last five years, no Reporting Person has been a party to a civil proceeding of a

judicial or administrative body of competent jurisdiction and as a result of such proceeding has been or is subject to a judgment, decree or final order enjoining future violations of, or prohibiting or mandating activities subject to, federal or

state securities laws or finding any violation with respect to such laws.

Page

15

of 19

(f) SCC II, SCC PTRS II, SCC PF II, SCC MGMT II, SC CV HOLD, SCC VENTURE, SCC VENTURE

PTRS, SCC VENTURE PF, SCC VENTURE MGMT and SCC HOLD are each organized under the laws of the Cayman Islands. SNP is organized under the laws of the British Virgin Islands. Neil Nanpeng Shen is a citizen of Hong Kong SAR.

|

ITEM 3.

|

SOURCE AND AMOUNT OF FUNDS OR OTHER CONSIDERATION.

|

The aggregate number of Ordinary Shares beneficially owned by the Reporting Persons is 20,032,272, including (a) 9,187,500 Ordinary Shares issued upon conversion of outstanding series A preferred

shares, $0.0001 par value per share (the “Class A Preferred Shares”), for which aggregate consideration of $9,187,500 has been paid, (b) 7,767,852 Ordinary Shares issued upon conversion of outstanding series B preferred shares,

$0.0001 par value per share (the “Class B Preferred Shares”), for which aggregate consideration of $25,249,636 has been paid, and (c) 3,076,920 Ordinary Shares in the form of American Depository Shares (“ADSs”), for which

aggregate consideration of approximately $10 million has been paid. The source of the funds used to purchase the Ordinary Shares, Class A Preferred Shares and Class B Preferred Shares described above is capital contributions by the partners of

such Reporting Persons and the available funds of such entities.

In January 2011, pursuant to the Share Subscription

Agreement, dated January 24, 2011, by and among SCC II, SCC PTRS II, SCC II PF II, Vipshop and certain other parties (the “Class A Share Subscription Agreement”), SCC II acquired 7,700,044 Class A Preferred Shares, SCC PTRS II

acquired 193,856 Class A Preferred Shares and SCC PF II acquired 1,293,600 Class A Preferred Shares for aggregate consideration of $9,187,500. All of the Class A Preferred Shares held by SCC II, SCC PTRS II and SCC PF II were

converted, in connection with the closing of Vipshop’s initial public offering, into an aggregate of 9,187,500 Ordinary Shares on the basis of one Ordinary Share for each Class A Preferred Share.

In April 2011, pursuant to the Share Subscription Agreement, dated April 11, 2011, by and among SC CV HOLD, Vipshop, and certain

other parties (the “Class B Share Subscription Agreement”), SC CV HOLD acquired 5,002,084 Class B Preferred Shares for aggregate consideration of $25,249,636. All of the Class B Preferred Shares held by SC CV HOLD were converted, in

connection with the closing of Vipshop’s initial public offering, into an aggregate of 7,767,852 Ordinary Shares on the basis of 1.5529 Ordinary Shares for each Class B Preferred Share.

In Vipshop’s initial public offering, SCC II, SCC PTRS II and SCC PF II acquired an aggregate of 3,076,920 Ordinary Shares in the

form of 1,538,460 ADSs, at a purchase price of $6.50 per ADS or approximately $10 million in the aggregate. Every one ADS represents two Ordinary Shares. SCC II acquired 1,336,768 ADSs representing 2,673,536 Ordinary Shares, SCC PTRS II acquired

12,769 ADSs representing 25,538 Ordinary Shares, and SCC PF II acquired 188,923 ADSs representing 377,846 Ordinary Shares.

|

ITEM 4.

|

PURPOSE OF TRANSACTION.

|

The Reporting Persons consummated the transactions described herein in order to acquire an interest in Vipshop for investment purposes.

The Reporting Persons expect to evaluate on an ongoing basis Vipshop’s financial condition and prospects and their respective interests in, and intentions with respect to, Vipshop and their respective investments in the securities of Vipshop,

which review may be based on various factors, including Vipshop’s business and financial condition, results of operations and prospects, general economic and industry conditions, the securities markets in general and those for Vipshop’s

securities in particular, as well as other developments and other investment opportunities. Accordingly, each Reporting Person reserves the right to change

Page

16

of 19

its intentions, as it deems appropriate. In particular, each Reporting Person may at any time and from time to time, in the open market, in privately negotiated transactions or otherwise,

increase its holdings in Vipshop or dispose of all or a portion of the securities of Vipshop that the Reporting Persons now own or may hereafter acquire, including sales pursuant to the exercise of the registration rights provided by the Amended and

Restated Shareholders’ Agreement by and among Vipshop, SCC II, SCC PTRS II, SCC PF II, SC CV HOLD and certain other parties thereto, dated April 11, 2011 (the “Shareholders’ Agreement”). In addition, the Reporting

Persons may engage in discussions with management and members of the Board regarding Vipshop, including, but not limited to, Vipshop’s business and financial condition, results of operations and prospects. The Reporting Persons may take

positions with respect to and seek to influence Vipshop regarding the matters discussed above. Such suggestions or positions may include one or more plans or proposals that relate to or would result in any of the actions required to be reported

herein.

Except as set forth in this Item 4, the Reporting Persons have no present plans or proposals that relate to or

would result in any of the actions described in subparagraphs (a) through (j) of Item 4 of Schedule 13D. The Reporting Persons do, however, reserve the right in the future to adopt such plans or proposals subject to compliance with

applicable regulatory requirements.

|

ITEM 5.

|

INTEREST IN SECURITIES OF THE ISSUER.

|

The information set forth and/or incorporated by reference in Items 2, 3 and 4 is hereby incorporated by reference into this Item 5.

(a) The aggregate number of Ordinary Shares and the percentage of total outstanding Ordinary Shares beneficially owned by the Reporting

Persons is set forth below. References to percentage ownerships of Ordinary Shares in this Statement are based upon the 101,138,565 Ordinary Shares stated to be outstanding as of immediately following consummation of Vipshop’s initial

public offering in Vipshop’s final prospectus filed with the Securities and Exchange Commission pursuant to Rule 424(b)(4) on March 23, 2012. The Reporting Persons may be deemed to beneficially own an aggregate of 20,032,272 Ordinary

Shares, which constitutes approximately 19.8% of Vipshop’s Ordinary Shares, calculated in accordance with Rule 13d-3 under the Act. The filing of this Statement shall not be construed as an admission that a Reporting Person beneficially owns

those shares held by any other Reporting Person.

SCC II beneficially owns 10,373,580 Ordinary Shares, which represents

approximately 10.3% of the outstanding Ordinary Shares calculated in accordance with the requirements of Rule 13d-3 under the Act.

SCC PTRS II beneficially owns 219,394 Ordinary Shares, which represents approximately 0.2% of the outstanding Ordinary Shares calculated in accordance with the requirements of Rule 13d-3 under the Act.

SCC PF II beneficially owns 1,671,446 Ordinary Shares, which represents approximately 1.7% of the outstanding Ordinary Shares

calculated in accordance with the requirements of Rule 13d-3 under the Act.

SCC MGMT II, as the general partner of each of

SCC II, SCC PTRS II and SCC PF II, may be deemed to beneficially own an aggregate of 12,264,420 Ordinary Shares, which represents approximately 12.1% of the outstanding Ordinary Shares calculated in accordance with the requirements of Rule 13d-3

under the Act.

SC CV HOLD beneficially owns 7,767,852 Ordinary Shares, which represents approximately 7.7% of the outstanding

Ordinary Shares calculated in accordance with the requirements of Rule 13d-3 under the Act.

Page

17

of 19

SCC VENTURE, as a parent company of SC CV HOLD, may be deemed to beneficially own

7,767,852 Ordinary Shares, which represents 7.7% of the outstanding Ordinary A Shares calculated in accordance with the requirements of Rule 13d-3 under the Act.

SCC VENTURE PTRS, as a parent company of SC CV HOLD, may be deemed to beneficially own 7,767,852 Ordinary Shares, which represents 7.7% of the outstanding Ordinary A Shares calculated in accordance with

the requirements of Rule 13d-3 under the Act.

SCC VENTURE PF, as a parent company of SC CV HOLD, may be deemed to

beneficially own 7,767,852 Ordinary Shares, which represents 7.7% of the outstanding Ordinary A Shares calculated in accordance with the requirements of Rule 13d-3 under the Act.

SCC VENTURE MGMT, as the general partner of SCC VENTURE, SCC VENTURE PTRS and SCC VENTURE PF, may be deemed to beneficially own 7,767,852

Ordinary Shares, which represents 7.7% of the outstanding Ordinary A Shares calculated in accordance with the requirements of Rule 13d-3 under the Act.

SCC HOLD, as the general partner of each of SCC MGMT II and SCC VENTURE MGMT, may be deemed to beneficially own an aggregate of 20,032,272 Ordinary Shares, which represents approximately 19.8% of the

outstanding Ordinary Shares calculated in accordance with the requirements of Rule 13d-3 under the Act.

SNP, which is the

parent company of SCC HOLD, may be deemed to beneficially own an aggregate of 20,032,272 Ordinary Shares, which represents approximately 19.8% of the outstanding Ordinary Shares calculated in accordance with the requirements of Rule 13d-3 under the

Act.

Neil Nanpeng Shen, who wholly owns and is the sole director of SNP, may be deemed to beneficially own an aggregate of

20,032,272 Ordinary Shares, which represents approximately 19.8% of the outstanding Ordinary Shares calculated in accordance with the requirements of Rule 13d-3 under the Act.

By virtue of the relationship described herein, the Reporting Persons may be deemed to constitute a “group” within the meaning

of Rule 13d-5 under the Act. As a member of a group, each Reporting Person may be deemed to share voting and dispositive power with respect to, and therefore beneficially own, the shares beneficially owned by members of the group as a whole. The

filing of this Statement shall not be construed as an admission that the Reporting Persons beneficially own those shares held by another member of the group. In addition, each Reporting Person expressly disclaims beneficial ownership of any

securities reported herein except to the extent such Reporting Person actually exercises voting or dispositive power with respect to such securities.

(b) The number of Ordinary Shares as to which each of the Reporting Persons has sole or shared power to vote, direct the vote, dispose or direct the disposition are as set forth in rows seven through ten

of the cover pages hereof. The information set forth in Item 2 is hereby incorporated by reference into this Item 5(b).

(c) Except with respect to the acquisition of Ordinary Shares acquired in Vipshop’s initial public offering as more fully described in Item 3, the Reporting Persons have not effected any

transactions in the Ordinary Shares during the past 60 days.

(d) No person other than the Reporting Persons is known to have

the right to receive or the power to direct the receipt of dividends from, or the proceeds from the sale of, the Ordinary Shares beneficially owned by the Reporting Persons.

(e) Not applicable.

Page

18

of 19

|

ITEM 6.

|

CONTRACTS, ARRANGEMENTS, UNDERSTANDINGS OR RELATIONSHIPS WITH RESPECT TO SECURITIES OF THE ISSUER.

|

The information set forth and/or incorporated by reference in Items 2, 3, 4 and 5 is hereby incorporated by reference into this

Item 6.

Class A Share Subscription Agreement

Pursuant to the Class A Share Subscription Agreement, dated January 24, 2011, SCC II acquired 7,700,044 Class A Preferred

Shares, SCC PTRS II acquired 193,856 Class A Preferred Shares and SCC PF II acquired 1,293,600 Class A Preferred Shares for aggregate consideration of $9,187,500. All of the Class A Preferred Shares held by SCC II, SCC PTRS II and SCC

PF II were converted, in connection with the closing of Vipshop’s initial public offering, into an aggregate of 9,187,500 Ordinary Shares on the basis of one Ordinary Share for each Class A Preferred Share.

Class B Share Subscription Agreement

Pursuant to the Class B Share Subscription Agreement, dated April 11, 2011, SC CV HOLD acquired 5,002,084 Class B Preferred Shares for aggregate consideration of $25,249,636. All of the Class B

Preferred Shares held by SC CV HOLD were converted, in connection with the closing of Vipshop’s initial public offering, into an aggregate of 7,767,752 Ordinary Shares on the basis of 1.5529 Ordinary Shares for each Class B Preferred Share.

Amended and Restated Shareholders’ Agreement

Pursuant to the Shareholders’ Agreement, dated April 11, 2011, Vipshop granted certain registration rights to SCC II, SCC PTRS

II, SCC PF II and SC CV HOLD with respect to any potential public offering of the Company’s Ordinary Shares. Set forth below is a summary description of the registration rights. This summary description does not purport to be complete, and is

qualified in its entirety by the Shareholders’ Agreement, a copy of which is filed as Exhibit 4.4 to Vipshop’s Registration Statement on Form F-1filed with the Securities and Exchange Commission on February 17, 2012 and is

incorporated herein by reference.

Piggyback Registration Rights

. If Vipshop proposes to register any of

its shares under the Securities Act of 1933, as amended, in connection with the public offering of such securities, Vipshop must offer holders of registrable securities an opportunity to include in the registration all or any part of their

registrable securities that each such holder may request to be registered.

Form S-3 or Form F-3

Registration

. Holders of at least thirty percent of Vipshop’s registrable securities then outstanding have the right to request that Vipshop files a registration statement under Form S-3 or Form F-3. Vipshop also has the right to

postpone a registration pursuant to this request up to 90 days if Vipshop’s board of directors determines in good faith that it would be materially detrimental to Vipshop and its shareholders for such Form S-3 or Form F-3

registration. Vipshop may not utilize this right more than once in any 12-month period.

Expenses of

Registration

. Vipshop will pay all expenses (other than underwriting or brokerage discounts and commissions related to shares sold by holders) incurred in connection with a Form S-3 or Form F-3 registration, including without limitation all U.S.

federal, “blue sky” and all foreign registration, filing and qualification fees, printers’ and accounting fees, and fees and disbursements of counsel and reasonable expenses of one legal counsel for the initiating holders.

Page

19

of 19

|

ITEM 7.

|

MATERIAL TO BE FILED AS EXHIBITS.

|

|

|

|

|

|

Exhibit

|

|

Description

|

|

|

|

|

1

|

|

Joint Filing Agreement dated as of April 6, 2012, by and among SCC II, SCC PTRS II, SCC PF II, SCC MGMT II, SC CV HOLD, SC VENTURE, SC VENTURE PTRS, SC VENTURE PF, SC VENTURE MGMT,

SCC HOLD, SNP and Neil Nanpeng Shen.

|

|

|

|

|

2

|

|

Amended and Restated Shareholders’ Agreement, dated as of April 11, 2011, by and among Vipshop, SCC II, SCC PTRS II, SCC PF II, SC CV HOLD and certain other parties

(incorporated by reference to Exhibit 4.4 to the Registration Statement on Form F-1 of Vipshop, filed on February 17, 2012).

|

|

|

|

|

3

|

|

Share Subscription Agreement, dated as of January 24, 2011, by and among Vipshop, SCC II, SCC PTRS II, SCC PF II and certain other parties.

|

|

|

|

|

4

|

|

Share Subscription Agreement, dated as of April 11, 2011, by and among Vipshop, SC CV HOLD and certain other parties (incorporated by reference to Exhibit 4.5 to Amendment No. 1 to

Registration Statement on Form F-1 of Vipshop, filed on March 9, 2012).

|

SIGNATURES

After reasonable inquiry and to the best of its knowledge and belief, the undersigned certifies that the information set forth in this Statement is true, complete and correct.

Dated: April 6, 2012

|

|

|

SEQUOIA CAPITAL CHINA II, L.P.

|

|

SEQUOIA CAPITAL CHINA PARTNERS FUND II, L.P.

|

|

SEQUOIA CAPITAL CHINA PRINCIPALS FUND II, L.P.

|

|

|

|

By: Sequoia Capital China Management II, L.P.

|

|

A Cayman Islands exempted limited partnership,

|

|

General Partner of Each

|

|

|

|

By: SC China Holding Limited

|

|

A Cayman Islands limited liability company

|

|

Its General Partner

|

|

|

|

/s/ Kok Wai Yee

|

|

Name: Kok Wai Yee

|

|

|

|

|

|

Title:

|

|

Authorized Signatory

|

|

|

|

|

|

SEQUOIA CAPITAL CHINA MANAGEMENT II, L.P.

|

|

|

|

By: SC China Holding Limited

A

Cayman Islands limited liability company

Its General Partner

|

|

|

|

/s/ Kok Wai Yee

|

|

Name: Kok Wai Yee

|

|

|

|

|

|

Title:

|

|

Authorized Signatory

|

|

|

|

|

|

SEQUOIA CAPITAL 2010 CV HOLDCO, LTD.

|

|

|

|

/s/ Kok Wai Yee

|

|

Name: Kok Wai Yee

|

|

Title:

|

|

Authorized Signatory

|

|

|

|

SEQUOIA CAPITAL CHINA VENTURE 2010 FUND, L.P.

|

|

SEQUOIA CAPITAL CHINA VENTURE 2010 PARTNERS FUND, L.P.

|

|

SEQUOIA CAPITAL CHINA VENTURE 2010 PRINCIPALS FUND, L.P.

|

|

|

|

By: SC China Venture 2010 Management, L.P.,

|

|

A Cayman Islands exempted limited liability company

|

|

General Partner of Each

|

|

|

|

By: SC China Holding Limited

A Cayman Islands limited liability company

Its General Partner

|

|

|

|

/s/ Kok Wai Yee

|

|

Name: Kok Wai Yee

|

|

Title:

|

|

Authorized Signatory

|

|

|

|

SC CHINA VENTURE 2010 MANAGEMENT, L.P.

|

|

|

|

By: SC China Holding Limited

A

Cayman Islands limited liability company

|

|

Its General Partner

|

|

|

|

/s/ Kok Wai Yee

|

|

Name: Kok Wai Yee

|

|

|

|

|

|

Title:

|

|

Authorized Signatory

|

|

|

|

|

|

SC CHINA HOLDING LIMITED

|

|

|

|

/s/ Kok Wai Yee

|

|

Name: Kok Wai Yee

|

|

Title: Authorized Signatory

|

|

|

|

SNP CHINA ENTERPRISES LIMITED

|

|

|

|

/s/ Neil Nanpeng Shen

|

|

Name: Neil Nanpeng Shen

|

|

|

|

|

|

Title:

|

|

Authorized Signatory

|

|

|

|

|

|

NEIL NANPENG SHEN

|

|

|

|

/s/ Neil Nanpeng Shen

|

Vipshop (NYSE:VIPS)

Historical Stock Chart

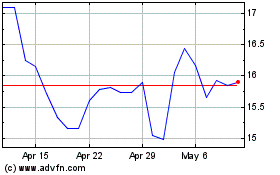

From Jun 2024 to Jul 2024

Vipshop (NYSE:VIPS)

Historical Stock Chart

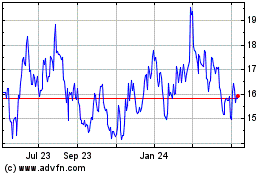

From Jul 2023 to Jul 2024