U.S. Bank Offers Options to Help Pay for Second Semester Education Expenses

December 15 2011 - 2:00PM

Business Wire

With the start of the New Year, college students and parents are

preparing for a new semester and all of the associated costs. U.S.

Bank can help students who have exhausted their federal loans,

scholarships, grants and savings and still need to cover tuition

and other educational expenses.

The following features and benefits are available to students

and parents who choose U.S. Bank as their private student loan

lender:

- Fixed and Variable Rate

Options1. U.S. Bank offers variety when it comes to

choosing a private student loan. Students can choose the option

that’s best for them, whether it’s a variable rate student loan

with low rates and no fees or the security of a true fixed rate

student loan.

- Graduation and Good Grades

Perks2. Graduating from college is a major

accomplishment, and U.S. Bank rewards students with a two percent

principal reduction on student loans. Students who graduate with a

3.30 GPA or higher will have an additional one percent principal

reduction on their student loan.

- AutoPay3 Discount.

AutoPay is the best way to repay. It's easy to set up, always on

time, paperless and also qualifies students for a 0.50 percent

interest rate reduction.

- Look-Back Feature. Students who

have a past due balance from their first semester may apply for a

loan to cover unpaid educational costs, up to six months from the

last date of the loan period.

“There’s a reason U.S. Bank is so committed to giving students

every opportunity to realize their potential,” said Lucille Conley,

senior vice president of U.S. Bank Consumer Lending. “Education

changes lives. U.S. Bank can help students finance their college

education if federal loans, scholarships and grants don’t cover all

their educational expenses.”

For more information, visit the U.S. Bank Student Loan website

at www.usbank.com/student-loans.

Students who are already thinking about next year’s tuition

bills can apply for the U.S. Bank Scholarship for a chance to win

one of 40 $1,000 scholarships for the 2012-2013 school year. No

essay is required, and applying online is fast and easy. Visit

www.usbank.com/scholarship to determine eligibility.

U.S. Bank is one of the top student banking institutions in the

nation, providing a comprehensive line of student banking products

including student loans, campus ID card programs, Internet banking,

U.S. Bank Student Checking and Savings and Visa Buxx® prepaid

spending cards.

U.S. Bancorp (NYSE: USB), with $330 billion in assets as of

September 30, 2011, is the parent company of U.S. Bank, the

fifth-largest commercial bank in the United States. The company

operates 3,089 banking offices in 25 states and 5,092 ATMs and

provides a comprehensive line of banking, brokerage, insurance,

investment, mortgage, trust and payment services products to

consumers, businesses and institutions. U.S. Bancorp and its

employees are dedicated to improving the communities they serve,

for which the company earned the 2011 Spirit of America Award, the

highest honor bestowed on a company by United Way. Visit U.S.

Bancorp on the web at www.usbank.com.

Disclosures

1. Subject to credit approval. Loan approval subject to program

guidelines. Program rules and qualification may be modified or

discontinued at any time without notice

2. To be eligible, loan application must be received on or after

August 1, 2011 and loan proceeds must be disbursed prior to

graduation date. Graduation Perk requires proof of graduation date,

and Good Grades Perk requires proof of graduation date and

cumulative GPA of 3.30 or higher, which must be submitted by the

borrower no later than 12 months after graduation date. 2%

principal reduction for Graduation Perk and 1% principal reduction

for Good Grades Perk will be credited to the student loan account

balance and are based on the original amount financed, excluding

loan fees, interest (including accrued and unpaid interest which

may be capitalized at repayment) and any loan proceeds returned by

school or not disbursed. Borrower cannot be delinquent or in

default at the time of request. Loans that are consolidated,

refinanced or paid in full prior to redeeming the perk(s) are not

eligible.

3. The automatic payment is a requirement to be qualified for

the interest rate reduction benefit. Auto-payment is set up through

the loan servicer. If the auto-payment is cancelled by the

borrower, the rate reduction benefit is lost but may be reinstated.

If the auto-payment feature is revoked, the rate reduction benefit

is lost and cannot be reinstated even if automatic payments are

re-established on the loan.

Deposit products offered by U.S. Bank, N.A. Member FDIC.

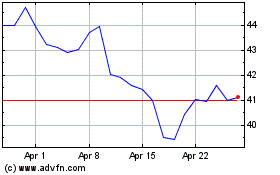

US Bancorp (NYSE:USB)

Historical Stock Chart

From May 2024 to Jun 2024

US Bancorp (NYSE:USB)

Historical Stock Chart

From Jun 2023 to Jun 2024