United Rentals Announces Final Results of Tender Offer

July 23 2008 - 12:26PM

Business Wire

United Rentals, Inc. (NYSE: URI) announced today the final results

of its previously announced �modified Dutch Auction� tender offer

to purchase up to 27,160,000 shares of its common stock, which

expired at 5:00 p.m., New York City time, on Wednesday, July 16,

2008. In accordance with the terms and conditions of the tender

offer, the company has accepted for purchase 27,160,000 shares,

representing approximately 31.4% of its outstanding common stock,

at a price of $22.00 per share, for a total cost of approximately

$597.5 million (excluding fees and expenses relating to the tender

offer). Based on the final tabulation by American Stock Transfer

& Trust Company, the depositary for the tender offer, a total

of 71,979,730 shares were validly tendered (including by guaranteed

delivery procedures) and not withdrawn at a price of $22.00 per

share. Because more than 27,160,000 shares of common stock were

validly tendered and not withdrawn, the tender offer was

oversubscribed. As a result, the depositary has informed the

company that, after giving effect to the priority for �odd lots�,

the final proration factor for the tender offer is 37.66%. Also, as

a result of this oversubscription, the company will not be

purchasing any shares issuable upon the conditional exercise of

options or warrants tendered pursuant to the tender offer. The

company will promptly deposit with the depositary funds sufficient

to pay for the shares accepted for purchase in the tender offer and

will promptly cause to be returned all shares tendered and not

accepted for purchase. After giving effect to the purchase of the

shares, the company expects to have outstanding approximately 59.3

million shares of common stock. Questions and requests for

information about the tender offer should be directed to the

information agent for the offer, D.F. King & Co., Inc., at

(800) 269-6427 or (212) 269-5550 (for banks and brokers). About

United Rentals United Rentals, Inc. is the largest equipment rental

company in the world, with an integrated network of over 670 rental

locations in 48 states, 10 Canadian provinces and Mexico. The

company�s approximately 10,400 employees serve construction and

industrial customers, utilities, municipalities, homeowners and

others. The company offers for rent over 2,900 classes of rental

equipment with a total original cost of $4.2 billion. United

Rentals is a member of the Standard & Poor�s MidCap 400 Index

and the Russell 2000 Index� and is headquartered in Greenwich,

Conn. Additional information about United Rentals is available at

www.unitedrentals.com. Forward-Looking Statements Certain

statements in this press release are forward-looking statements.

These statements can generally be identified by words such as

"believes," "expects," "plans," "intends," "projects," "forecasts,"

"may," "will," "should," "on track" or "anticipates," or the

negative thereof or comparable terminology, or by discussions of

vision, strategy or outlook. Our businesses and operations are

subject to a variety of risks and uncertainties, many of which are

beyond our control, and, consequently, actual results may differ

materially from those projected by any forward-looking statements.

Factors that could cause actual results to differ from those

projected include, but are not limited to, the following: (1)

weaker or unfavorable economic or industry conditions can reduce

demand and prices for our products and services, (2)

non-residential construction spending, or governmental funding for

infrastructure and other construction projects, may not reach

expected levels, (3) we may not always have access to capital that

our businesses or growth plans may require, (4) any companies we

acquire could have undiscovered liabilities, may strain our

management capabilities or may be difficult to integrate, (5) rates

we can charge and time utilization we can achieve may be less than

anticipated, (6) costs we incur may be more than anticipated,

including by having expected savings not be realized in the amounts

or time frames we have planned, (7) competition in our industry for

talented employees is intense, which can affect our employee costs

and retention rates, (8) we have significant debt leverage, which

leverage requires us to use a substantial portion of our cash flow

for debt service and will constrain our flexibility in responding

to unanticipated or adverse business conditions, (9) we are subject

to an ongoing inquiry by the SEC, and there can be no assurance as

to its outcome, or any other potential consequences thereof for us,

(10) we are subject to purported class action lawsuits and

derivative actions filed in light of the SEC inquiry and additional

purported class action lawsuits relating to the terminated merger

transaction with Cerberus affiliates, and there can be no assurance

as to their outcome or any other potential consequences thereof for

us, and (11) we may incur additional significant costs and expenses

(including indemnification obligations) in connection with the SEC

inquiry, the purported class action lawsuits and derivative actions

referenced above, the U.S. Attorney�s Office inquiry, or other

litigation, regulatory or investigatory matters, related to the

foregoing or otherwise. For a fuller description of these and other

possible uncertainties, please refer to our Annual Report on Form

10-K for the year ended December 31, 2007, as well as to our

subsequent filings with the SEC. Our forward-looking statements

contained herein speak only as of the date hereof, and we make no

commitment to update or publicly release any revisions to

forward-looking statements in order to reflect new information or

subsequent events, circumstances or changes in expectations.

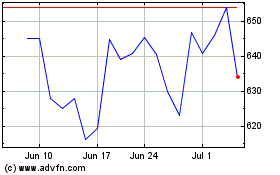

United Rentals (NYSE:URI)

Historical Stock Chart

From May 2024 to Jun 2024

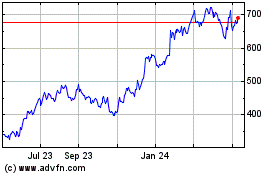

United Rentals (NYSE:URI)

Historical Stock Chart

From Jun 2023 to Jun 2024