0001552033false00015520332024-01-062024-01-06

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

____________________

FORM 8-K

____________________

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date Earliest Event Reported): January 6, 2024

____________________

TransUnion

(Exact name of registrant as specified in its charter)

____________________

| | | | | | | | | | | | | | |

| Delaware | | 001-37470 | | 61-1678417 |

(State or other jurisdiction

of incorporation) | | (Commission File Number) | | (IRS Employer Identification No.) |

| | | | | | | | | | | | | | |

| 555 West Adams Street, | Chicago, | Illinois | | 60661 |

| (Address of Principal Executive Offices) | | (Zip Code) |

Registrant’s telephone number, including area code: (312) 985-2000

____________________

Check the appropriate box below if the Form 8−K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a−12 under the Exchange Act (17 CFR 240.14a−12)

☐ Pre−commencement communications pursuant to Rule 14d−2(b) under the Exchange Act (17 CFR 240.14d−2(b))

☐ Pre−commencement communications pursuant to Rule 13e−4(c) under the Exchange Act (17 CFR 240.13e− 4(c))

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

| Common Stock, $0.01 par value | | TRU | | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 4.02 Non-Reliance on Previously Issued Financial Statements or a Related Audit Report or Completed Interim Review.

(a) On January 6, 2024, the Audit Committee of TransUnion’s (the “Company”) Board of Directors (the “Audit Committee”), upon the recommendation of management, concluded that the previously issued unaudited consolidated financial statements of the Company as of and for the three and nine months ended September 30, 2023 (the “Q3 2023 Interim Financial Statements”), included in the Company’s Quarterly Report on Form 10-Q filed on October 24, 2023 (the “Q3 2023 10-Q”), were materially misstated and should no longer be relied upon. Similarly, any previously furnished or filed reports, related earnings releases, investor presentations or similar communications of the Company describing the Q3 2023 Interim Financial Statements should no longer be relied upon.

The error identified within the Q3 2023 Interim Financial Statements involved an overstatement of approximately $80 million to the non-cash goodwill impairment that was reported within our consolidated statements of income and balance sheet. The overstatement of the goodwill impairment was associated with our United Kingdom reporting unit and resulted primarily from a computational error in the manual translation of the U.S. Dollar equivalent value of revenue in the base year forecast upon which revenue growth rates are applied in the valuation model to calculate the reporting unit fair value. There was no impact to cash flows from operating activities as goodwill impairment is a non-cash adjustment to reconcile net income (loss) to cash provided by operating activities. The Company’s compliance with its debt covenants and performance metrics used in the calculation of executive compensation are not impacted by this adjustment.

The Company plans to file, as soon as practicable, a Form 10-Q/A for the period referenced above (the “Amended 10-Q Filing”) including restated unaudited consolidated financial statements for the three and nine months ended September 30, 2023 and related amendments to Part I, Item 2, Management’s Discussion and Analysis of Financial Condition and Results of Operations; Part I, Item 4, Controls and Procedures; Part II, Item 1A, Risk Factors; and Part II, Item 6, Exhibits.

As a result of the overstatement of goodwill impairment described above and the restatement of the Company’s unaudited consolidated financial statements, the Company identified a material weakness in the Company’s internal control over financial reporting as of September 30, 2023. The Company will provide further details on the material weakness and its plan for remediation in the Amended 10-Q Filing. In addition, management reassessed its conclusions regarding its disclosure controls and procedures as of September 30, 2023, in light of the error described above. As a result of the identification of a material weakness in internal control over financial reporting as of September 30, 2023, the Company concluded that its disclosure controls and procedures were also not effective at the reasonable assurance level as of September 30, 2023. Therefore, the Company’s previous evaluation of its disclosure controls and procedures as of September 30, 2023 should no longer be relied upon.

Management and the Audit Committee have discussed the matters described in this Item 4.02 with the Company’s independent registered public accounting firm, PricewaterhouseCoopers LLP.

Item 7.01 Regulation FD Disclosure.

Non-GAAP Measures

The Company regularly presents Consolidated Adjusted EBITDA, Consolidated Adjusted EBITDA Margin, Adjusted Net Income, Adjusted Diluted Earnings per Share, Adjusted Provision for Income Taxes, Adjusted Effective Tax Rate and Leverage Ratio for all periods presented. These are important financial measures for the Company but are not financial measures presented in accordance with GAAP. These non-GAAP financial measures should be reviewed in conjunction with the relevant GAAP financial measures and are not presented as alternative measures of GAAP. Other companies in our industry may define or calculate these measures differently than we do, limiting their usefulness as comparative measures. Because of these limitations, these non-GAAP financial measures should not be considered in isolation or as substitutes for performance measures calculated in accordance with GAAP, including operating income, operating margin, effective tax rate, net income (loss) attributable to the Company, diluted earnings per share or cash provided by operating activities.

The error described above had no impact on the Company’s Non-GAAP financial measures Consolidated Adjusted EBITDA, Consolidated Adjusted EBITDA Margin, Adjusted Net Income, Adjusted Diluted Earnings per Share, Adjusted Provision for Income Taxes, Adjusted Effective Tax Rate and Leverage Ratio as of and for the three and nine months ended September 30, 2023.

The information furnished pursuant to Item 7.01 of this Current Report on Form 8-K shall not be considered “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the "Exchange Act"), or otherwise subject to the liability of such section, nor shall it be incorporated by reference into future filings by TransUnion under the Securities Act of 1933, as amended (the "Securities Act"), or under the Exchange Act, unless TransUnion expressly sets forth in such future filing that such information is to be considered “filed” or incorporated by reference therein.

TransUnion Forward-Looking Statements

This Current Report on Form 8-K includes information that constitutes forward-looking statements within the meaning of Section 27A of the Securities Act and Section 21E of the Exchange Act. These forward-looking statements are based on the Company’s current beliefs, assumptions and expectations regarding future events, which in turn are based on information currently available to the Company. Such forward-looking statements include, without limitation, statements regarding the anticipated impact of the accounting error identified in the Company’s previously issued financial statements, the Company’s anticipated timing of the filing of the Amended 10-Q Filing and the overstatement of goodwill impairment. By their nature, forward-looking statements address matters that are subject to risks and uncertainties. A variety of factors could cause actual events and results to differ materially from those expressed in or contemplated by the forward-looking statements, including the risk that the completion and filing of the previously described periodic report will take longer than expected and that additional information may become known prior to the expected filing of the Amended 10-Q Filing with the Securities and Exchange Commission (the “SEC”). A discussion of these and other risks and uncertainties that could cause our actual results to differ materially from these forward-looking statements is included in the documents that we file with the SEC on Forms 10-K, 10-Q, 8-K, and other documents we file from time to time with the SEC. These forward-looking statements speak only as of the date of this report. We undertake no obligation to publicly release the result of any revisions to these forward-looking statements to reflect the impact of events or circumstances that may arise after the date of this report.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

| | | | | |

Exhibit No. | Description |

| 104 | Cover page Interactive Data File (embedded within the inline XBRL file). |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed by the undersigned hereunto duly authorized.

| | | | | | | | | | | |

| TRANSUNION | |

| | | |

Date: January 8, 2024 | By: | /s/ Todd M. Cello | |

| Name: | Todd M. Cello | |

| Title: | Executive Vice President, Chief Financial Officer | |

Document and Entity Information

|

Jan. 06, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Document Period End Date |

Jan. 06, 2024

|

| Entity Registrant Name |

TransUnion

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity File Number |

001-37470

|

| Entity Tax Identification Number |

61-1678417

|

| Entity Address, Address Line One |

555 West Adams Street,

|

| Entity Address, City or Town |

Chicago,

|

| Entity Address, State or Province |

IL

|

| Entity Address, Postal Zip Code |

60661

|

| City Area Code |

312

|

| Local Phone Number |

985-2000

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, $0.01 par value

|

| Trading Symbol |

TRU

|

| Security Exchange Name |

NYSE

|

| Entity Emerging Growth Company |

false

|

| Entity Central Index Key |

0001552033

|

| Amendment Flag |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

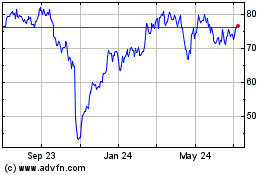

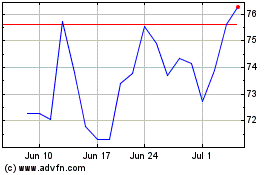

TransUnion (NYSE:TRU)

Historical Stock Chart

From Apr 2024 to May 2024

TransUnion (NYSE:TRU)

Historical Stock Chart

From May 2023 to May 2024