0000217346FALSE00002173462024-01-242024-01-24

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): January 24, 2024

TEXTRON INC.

(Exact name of Registrant as specified in its charter)

| | | | | | | | |

| Delaware | 1-5480 | 05-0315468 |

(State of Incorporation) | (Commission File Number) | (IRS Employer Identification Number) |

40 Westminster Street, Providence, Rhode Island 02903

(Address of principal executive offices)

Registrant’s telephone number, including area code: (401) 421-2800

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of exchange on which registered |

| Common Stock – par value $0.125 | TXT | New York Stock Exchange |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instructions A.2. below):

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c)) under the Exchange Act (17 CFR 240.13e-4(c))

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b–2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition

On January 24, 2024, Textron Inc. (“Textron”) issued a press release announcing its financial results for the fiscal quarter and year ended December 30, 2023. This press release is attached hereto as Exhibit 99.1 and is incorporated herein by reference.

A discussion of the reasons why management believes that the presentation of non-GAAP financial measures provides useful information to investors regarding Textron’s financial condition and results of operations is attached to the press release attached hereto as Exhibit 99.1.

Item 9.01 Financial Statements and Exhibits

(d) Exhibits

The following exhibit is filed herewith:

| | | | | |

Exhibit Number | Description |

| |

| |

| |

| 104 | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

| TEXTRON INC. |

| (Registrant) |

| | |

| By: | /s/ Mark S. Bamford |

| | Mark S. Bamford |

| | Vice President and Corporate Controller |

Date: January 24, 2024

Exhibit 99.1

Corporate Communications Department

NEWS Release

Textron Reports Fourth Quarter 2023 Results; Announces 2024 Financial Outlook

•EPS of $1.01; adjusted EPS of $1.60, up 30% from a year ago

•Full-year adjusted EPS of $5.59, up from $4.45 in 2022

•Full-year share repurchases $1.168 billion

•Aviation backlog of $7.2 billion at year-end 2023, up $782 million from year-end 2022

•2024 full-year EPS outlook of $5.62 to $5.82, full year adjusted EPS outlook of $6.20 to $6.40

Providence, Rhode Island – January 24, 2024 – Textron Inc. (NYSE: TXT) today reported fourth quarter 2023 income from continuing operations of $1.01 per share, as compared to $1.07 per share in the fourth quarter of 2022. Adjusted income from continuing operations, a non-GAAP measure that is defined and reconciled to GAAP in an attachment to this release, was $1.60 per share for the fourth quarter of 2023, compared to $1.23 per share in the fourth quarter of 2022.

Full year 2023 income from continuing operations was $4.57 per share, up from $4.01 in 2022. Full year 2023 adjusted income from continuing operations was $5.59, as compared to $4.45 in 2022.

“2023 was a strong year at Textron with solid revenue and profit growth along with segment profit margin expansion,” said Textron Chairman and CEO Scott C. Donnelly. "At Aviation, we saw continued backlog growth and, at Bell, the team began executing on our transformational FLRAA program."

Cash Flow

Net cash provided by operating activities of the manufacturing group for the full year was $1.3 billion. Manufacturing cash flow before pension contributions, a non-GAAP measure that is defined and reconciled to GAAP in an attachment to this release, totaled $931 million for the full year, down from $1.178 billion in 2022.

In the quarter, Textron returned $283 million to shareholders through share repurchases. Full year 2023 share repurchases totaled $1.168 billion.

Outlook

Textron is forecasting 2024 revenues of approximately $14.6 billion, up from $13.7 billion in 2023. Textron expects full-year 2024 GAAP earnings per share from continuing operations will be in the range of $5.62 to $5.82 or $6.20 to $6.40 on an adjusted basis, which is reconciled to GAAP in an attachment to this release.

The company is estimating net cash provided by operating activities of the manufacturing group will be between $1.3 billion and $1.4 billion and manufacturing cash flow before pension contributions, a non-GAAP measure, will be between $900 million and $1.0 billion, with planned pension contributions of about $50 million.

"The 2024 outlook reflects higher revenues, increasing segment profit and operating margin expansion with a continuation of our growth strategy of ongoing investments in new products and programs to drive increases in long-term shareholder value," Donnelly concluded.

Fourth Quarter Segment Results

Textron Aviation

Revenues at Textron Aviation of $1.5 billion were down $58 million from the fourth quarter of 2022, reflecting lower volume and mix of $158 million, partially offset by higher pricing of $100 million.

Textron Aviation delivered 50 jets in the quarter, down from 52 last year, and 44 commercial turboprops, down from 47 last year.

Segment profit was $193 million in the fourth quarter, up $23 million from a year ago, reflecting a favorable impact from pricing, net of inflation, of $51 million, partially offset by lower volume and mix of $22 million.

Textron Aviation backlog at the end of the fourth quarter was $7.2 billion.

Bell

Bell revenues were $1.1 billion, up $255 million from last year's fourth quarter, reflecting higher commercial revenues of $171 million largely driven by increased deliveries and higher military revenues of $84 million related to the FLRAA program.

Bell delivered 91 commercial helicopters in the quarter, up from 71 last year.

Segment profit of $118 million was up $55 million from a year ago, primarily driven by higher volume and mix of $39 million.

Bell backlog at the end of the fourth quarter was $4.8 billion.

Textron Systems

Revenues at Textron Systems were $314 million, flat with last year's fourth quarter.

Segment profit of $35 million was equal to last year's fourth quarter.

Textron Systems’ backlog at the end of the fourth quarter was $2.0 billion.

Industrial

Industrial revenues were $961 million, up $54 million from last year's fourth quarter, largely reflecting higher volume and mix at Kautex and a favorable impact from pricing at Textron Specialized Vehicles.

Segment profit of $57 million was up $14 million from the fourth quarter of 2022, primarily due to higher pricing, net of inflation, of $18 million.

Textron eAviation

Textron eAviation segment revenues were $10 million and segment loss was $23 million in the fourth quarter of 2023, which reflected the operating results of Pipistrel along with research and development costs for initiatives related to the development of sustainable aviation solutions.

Finance

Finance segment revenues were $12 million, and profit was $4 million in the fourth quarter of 2023.

Restructuring

In November, we announced a restructuring plan that resulted in pre-tax special charges of $126 million in the fourth quarter. We anticipate the restructuring plan will be substantially completed in the first half of 2024, resulting in annualized cost savings of approximately $75 million.

Conference Call Information

Textron will host its conference call today, January 24, 2024 at 8:00 a.m. (Eastern) to discuss its results and outlook. The call will be available via webcast at www.textron.com or by direct dial at (844) 867-6169 in the U.S. or (409) 207-6975 outside of the U.S.; Access Code: 2046023.

In addition, the call will be recorded and available for playback beginning at 11:00 a.m. (Eastern) on Wednesday, January 24, 2024 by dialing (402) 970-0847; Access Code: 4065507.

A package containing key data that will be covered on today’s call can be found in the Investor Relations section of the company’s website at www.textron.com.

About Textron Inc.

Textron Inc. is a multi-industry company that leverages its global network of aircraft, defense, industrial and finance businesses to provide customers with innovative solutions and services. Textron is known around the world for its powerful brands such as Bell, Cessna, Beechcraft, Hawker, Pipistrel, Jacobsen, Kautex, Lycoming, E-Z-GO, Arctic Cat, and Textron Systems. For more information visit: www.textron.com.

###

Forward-looking Information

Certain statements in this release and other oral and written statements made by us from time to time are “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. These forward-looking statements, which may describe strategies, goals, outlook or other non-historical matters, or project revenues, income, returns or other financial measures, often include words such as “believe,” “expect,” “anticipate,” “intend,” “plan,” “estimate,” “guidance,” “project,” “target,” “potential,” “will,” “should,” “could,” “likely” or “may” and similar expressions intended to identify forward-looking statements. These statements are only predictions and involve known and unknown risks, uncertainties, and other factors that may cause our actual results to differ materially from those expressed or implied by such forward-looking statements. Given these uncertainties, you should not place undue reliance on these forward-looking statements. Forward-looking statements speak only as of the date on which they are made, and we undertake no obligation to update or revise any forward-looking statements. In addition to those factors described in our Annual Report on Form 10-K and our Quarterly Reports on Form 10-Q under “Risk Factors”, among the factors that could cause actual results to differ materially from past and projected future results are the following: Interruptions in the U.S. Government’s ability to fund its activities and/or pay its obligations; changing priorities or reductions in the U.S. Government defense budget, including those related to military operations in foreign countries; our ability to perform as anticipated and to control costs under contracts with the U.S. Government; the U.S. Government’s ability to unilaterally modify or terminate its contracts with us for the U.S. Government’s convenience or for our failure to perform, to change applicable procurement and accounting policies, or, under certain circumstances, to withhold payment or suspend or debar us as a contractor eligible to receive future contract awards; changes in foreign military funding priorities or budget constraints and determinations, or changes in government regulations or policies on the export and import of military and commercial products; volatility in the global economy or changes in worldwide political conditions that adversely impact demand for our products; volatility in interest rates or foreign exchange rates and inflationary pressures; risks related to our international business, including establishing and maintaining facilities in locations around the world and relying on joint venture partners, subcontractors, suppliers, representatives, consultants and other business partners in connection with international business, including in emerging market countries; our Finance segment’s ability to maintain portfolio credit quality or to realize full value of receivables; performance issues with key suppliers or subcontractors; legislative or regulatory actions, both domestic and foreign, impacting our operations or demand for our products;

our ability to control costs and successfully implement various cost-reduction activities; the efficacy of research and development investments to develop new products or unanticipated expenses in connection with the launching of significant new products or programs; the timing of our new product launches or certifications of our new aircraft products; our ability to keep pace with our competitors in the introduction of new products and upgrades with features and technologies desired by our customers; pension plan assumptions and future contributions; demand softness or volatility in the markets in which we do business; cybersecurity threats, including the potential misappropriation of assets or sensitive information, corruption of data or, operational disruption; difficulty or unanticipated expenses in connection with integrating acquired businesses; the risk that acquisitions do not perform as planned, including, for example, the risk that acquired businesses will not achieve revenue and profit projections; the impact of changes in tax legislation; the risk of disruptions to our business and the business of our suppliers, customers and other business partners due to unexpected events, such as pandemics, natural disasters, acts of war, strikes, terrorism, social unrest or other societal or political conditions; and the ability of our businesses to hire and retain the highly skilled personnel necessary for our businesses to succeed.

Investor Contacts:

David Rosenberg – 401-457-2288

Cameron Vollmuth – 401-457-2288

Media Contact:

Mike Maynard – 401-457-2288

TEXTRON INC.

Revenues by Segment and Reconciliation of Segment Profit to Net Income

(Dollars in millions, except per share amounts)

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended | | Twelve Months Ended |

| December 30,

2023 | December 31,

2022 | | December 30,

2023 | December 31,

2022 |

| REVENUES | | | | | | | | | | | | | |

| MANUFACTURING: | | | | | | | | | | | | | |

| Textron Aviation | | $ | 1,524 | | | | $ | 1,582 | | | | | $ | 5,373 | | | | $ | 5,073 | | |

| Bell | | 1,071 | | | | 816 | | | | | 3,147 | | | | 3,091 | | |

| Textron Systems | | 314 | | | | 314 | | | | | 1,235 | | | | 1,172 | | |

| Industrial | | 961 | | | | 907 | | | | | 3,841 | | | | 3,465 | | |

| Textron eAviation | | 10 | | | | 6 | | | | | 32 | | | | 16 | | |

| | 3,880 | | | | 3,625 | | | | | 13,628 | | | | 12,817 | | |

| FINANCE | | 12 | | | | 11 | | | | | 55 | | | | 52 | | |

| Total revenues | | $ | 3,892 | | | | $ | 3,636 | | | | | $ | 13,683 | | | | $ | 12,869 | | |

| | | | | | | | | | | | | |

| SEGMENT PROFIT | | | | | | | | | | | | | |

| MANUFACTURING: | | | | | | | | | | | | | |

| Textron Aviation | | $ | 193 | | | | $ | 170 | | | | | $ | 649 | | | | $ | 560 | | |

| Bell | | 118 | | | | 63 | | | | | 320 | | | | 282 | | |

| Textron Systems | | 35 | | | | 35 | | | | | 147 | | | | 132 | | |

| Industrial | | 57 | | | | 43 | | | | | 228 | | | | 155 | | |

| Textron eAviation | | (23) | | | | (10) | | | | | (63) | | | | (24) | | |

| | 380 | | | | 301 | | | | | 1,281 | | | | 1,105 | | |

| FINANCE | | 4 | | | | 5 | | | | | 46 | | | | 31 | | |

| Segment profit (a) | | 384 | | | | 306 | | | | | 1,327 | | | | 1,136 | | |

| | | | | | | | | | | | | |

| Corporate expenses and other, net | | (45) | | | | (50) | | | | | (143) | | | | (143) | | |

| Interest expense, net for Manufacturing group | | (13) | | | | (17) | | | | | (62) | | | | (94) | | |

| Special charges (b) | | (126) | | | | — | | | | | (126) | | | | — | | |

| LIFO inventory provision | | (21) | | | | (29) | | | | | (107) | | | | (71) | | |

| Intangible asset amortization | | (9) | | | | (13) | | | | | (39) | | | | (52) | | |

| Non-service components of pension and postretirement income, net | | 60 | | | | 60 | | | | | 237 | | | | 240 | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| Income from continuing operations before income taxes | | 230 | | | | 257 | | | | | 1,087 | | | | 1,016 | | |

| Income tax expense | | (31) | | | | (31) | | | | | (165) | | | | (154) | | |

| Income from continuing operations | | $ | 199 | | | | $ | 226 | | | | | $ | 922 | | | | $ | 862 | | |

| Discontinued operations, net of income taxes | | (1) | | | | — | | | | | (1) | | | | (1) | | |

| Net income | | $ | 198 | | | | $ | 226 | | | | | $ | 921 | | | | $ | 861 | | |

| | | | | | | | | | | | | |

| Earnings Per Share from continuing operations | | $ | 1.01 | | | | $ | 1.07 | | | | | $ | 4.57 | | | | $ | 4.01 | | |

| | | | | | | | | | | | | |

| Diluted average shares outstanding | | 197,584,000 | | | 210,488,000 | | | | 201,774,000 | | | 214,973,000 | |

| | | | | | | | | | | | | |

| Income from continuing operations and Diluted earnings per share (EPS) GAAP to Non-GAAP Reconciliation: | |

| | | | | | | | | | | | | |

| December 30,

2023 | December 31,

2022 | | December 30,

2023 | December 31,

2022 |

| Income from continuing operations - GAAP | | $ | 199 | | | | $ | 226 | | | | | $ | 922 | | | | $ | 862 | | |

| Add: Special charges, net of tax (b) | | 94 | | | | — | | | | | 94 | | | | — | | |

| LIFO inventory provision, net of tax | | 16 | | | | 22 | | | | | 81 | | | | 54 | | |

Intangible asset amortization, net of tax | | 7 | | | | 10 | | | | | 30 | | | | 40 | | |

| | | | | | | | | | | | | |

| Adjusted income from continuing operations - Non-GAAP (a) | | $ | 316 | | | | $ | 258 | | | | | $ | 1,127 | | | | $ | 956 | | |

| | | | | | | | | | | | | |

| Earnings Per Share: | | | | | | | | | | | | | |

| Income from continuing operations - GAAP | | $ | 1.01 | | | | $ | 1.07 | | | | | $ | 4.57 | | | | $ | 4.01 | | |

| Add: Special charges, net of tax (b) | | 0.47 | | | | — | | | | | 0.47 | | | | — | | |

| LIFO inventory provision, net of tax | | 0.08 | | | | 0.11 | | | | | 0.40 | | | | 0.25 | | |

| Intangible asset amortization, net of tax | | 0.04 | | | | 0.05 | | | | | 0.15 | | | | 0.19 | | |

| | | | | | | | | | | | | |

| Adjusted income from continuing operations - Non-GAAP (a) | | $ | 1.60 | | | | $ | 1.23 | | | | | $ | 5.59 | | | | $ | 4.45 | | |

| | | | | | | | | | | | | |

TEXTRON INC.

Revenues by Segment and Reconciliation of Segment Profit to Net Income (Continued)

(Dollars in millions, except per share amounts)

(Unaudited)

(a)Segment profit, adjusted income from continuing operations and adjusted diluted earnings per share are non-GAAP financial measures as defined in "Non-GAAP Financial Measures and Outlook" attached to this release.

(b)In the fourth quarter of 2023, we initiated a restructuring plan to reduce operating expenses through headcount reductions at the Industrial, Bell and Textron Systems segments. In connection with this plan, we recorded special charges of $126 million ($94 million, net of tax) for the three and twelve months ended December 30, 2023. These charges included $39 million of severance and related costs and $87 million in asset impairment charges related to both fixed and intangible assets within the powersports product line at Textron Specialized Vehicles and fixed assets at Kautex.

Textron Inc.

Condensed Consolidated Balance Sheets

(In millions)

(Unaudited)

| | | | | | | | |

| | |

| December 30,

2023 | December 31,

2022 |

| Assets | | |

| Cash and equivalents | $ | 2,121 | | $ | 1,963 | |

| Accounts receivable, net | 868 | | 855 | |

| Inventories | 3,914 | | 3,550 | |

| Other current assets | 857 | | 1,033 | |

| Net property, plant and equipment | 2,477 | | 2,523 | |

| Goodwill | 2,295 | | 2,283 | |

| Other assets | 3,663 | | 3,422 | |

| Finance group assets | 661 | | 664 | |

| Total Assets | $ | 16,856 | | $ | 16,293 | |

| | |

| | |

| Liabilities and Shareholders' Equity | | |

| Current portion of long-term debt | $ | 357 | | $ | 7 | |

| Accounts payable | 1,023 | | 1,018 | |

| Other current liabilities | 2,998 | | 2,645 | |

| Other liabilities | 1,904 | | 1,879 | |

| Long-term debt | 3,169 | | 3,175 | |

| Finance group liabilities | 418 | | 456 | |

| Total Liabilities | 9,869 | | 9,180 | |

| | |

| Total Shareholders' Equity | 6,987 | | 7,113 | |

| Total Liabilities and Shareholders' Equity | $ | 16,856 | | $ | 16,293 | |

TEXTRON INC.

MANUFACTURING GROUP

Condensed Schedule of Cash Flows

(In millions)

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | Three Months Ended | | | | Twelve Months Ended | |

| | December 30,

2023 | | | December 31,

2022 | | | | December 30,

2023 | | | December 31,

2022 | |

| Cash Flows from Operating Activities: | | | | | | | | | | | | | |

| Income from continuing operations | | $ | 194 | | | | $ | 220 | | | | | $ | 884 | | | | $ | 835 | | |

| Depreciation and amortization | | 103 | | | | 109 | | | | | 395 | | | | 396 | | |

| Deferred income taxes and income taxes receivable/payable | | (106) | | | | (56) | | | | | (183) | | | | (182) | | |

| Pension, net | | (50) | | | | (42) | | | | | (202) | | | | (165) | | |

| | | | | | | | | | | | | |

| Asset impairments | | 87 | | | | 2 | | | | | 88 | | | | 2 | | |

| Changes in assets and liabilities: | | | | | | | | | | | | | |

| Accounts receivable, net | | 36 | | | | (3) | | | | | (9) | | | | (26) | | |

| Inventories | | 300 | | | | 298 | | | | | (359) | | | | (55) | | |

| Accounts payable | | (200) | | | | 119 | | | | | 2 | | | | 235 | | |

| | | | | | | | | | | | | |

| Other, net | | 169 | | | | (131) | | | | | 654 | | | | 421 | | |

| Net cash from operating activities | | 533 | | | | 516 | | | | | 1,270 | | | | 1,461 | | |

| Cash Flows from Investing Activities: | | | | | | | | | | | | | |

| Capital expenditures | | (178) | | | | (162) | | | | | (402) | | | | (354) | | |

| Net cash used in business acquisitions | | — | | | | (1) | | | | | (1) | | | | (202) | | |

| Net proceeds from corporate-owned life insurance policies | | 1 | | | | — | | | | | 40 | | | | 23 | | |

| Proceeds from sale of property, plant and equipment | | 14 | | | | 1 | | | | | 18 | | | | 22 | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| Net cash from investing activities | | (163) | | | | (162) | | | | | (345) | | | | (511) | | |

| Cash Flows from Financing Activities: | | | | | | | | | | | | | |

| Increase/(decrease) in short-term debt | | — | | | | 1 | | | | | — | | | | (14) | | |

| Net proceeds from long-term debt | | 347 | | | | — | | | | | 348 | | | | — | | |

| Principal payments on long-term debt and nonrecourse debt | | (2) | | | | (2) | | | | | (7) | | | | (18) | | |

| | | | | | | | | | | | | |

| Purchases of Textron common stock | | (283) | | | | (228) | | | | | (1,168) | | | | (867) | | |

| Dividends paid | | (4) | | | | (4) | | | | | (16) | | | | (17) | | |

| Other financing activities, net | | 7 | | | | 8 | | | | | 67 | | | | 41 | | |

| Net cash from financing activities | | 65 | | | | (225) | | | | | (776) | | | | (875) | | |

| Total cash flows from continuing operations | | 435 | | | | 129 | | | | | 149 | | | | 75 | | |

| Total cash flows from discontinued operations | | — | | | | — | | | | | (1) | | | | (2) | | |

| Effect of exchange rate changes on cash and equivalents | | 15 | | | | 17 | | | | | 10 | | | | (32) | | |

| Net change in cash and equivalents | | 450 | | | | 146 | | | | | 158 | | | | 41 | | |

| Cash and equivalents at beginning of period | | 1,671 | | | | 1,817 | | | | | 1,963 | | | | 1,922 | | |

| Cash and equivalents at end of period | | $ | 2,121 | | | | $ | 1,963 | | | | | $ | 2,121 | | | | $ | 1,963 | | |

| | | | | | | | | | | | | |

| Manufacturing Cash Flow GAAP to Non-GAAP Reconciliation: | | | | | | | | |

| | | | | | | | | | | | | |

| | Three Months Ended | | | | Twelve Months Ended | |

| | December 30,

2023 | | | December 31,

2022 | | | | December 30,

2023 | | | December 31,

2022 | |

| Net cash from operating activities - GAAP | | $ | 533 | | | | $ | 516 | | | | | $ | 1,270 | | | | $ | 1,461 | | |

| Less: Capital expenditures | | (178) | | | | (162) | | | | | (402) | | | | (354) | | |

| | | | | | | | | | | | | |

| Plus: Total pension contribution | | 11 | | | | 13 | | | | | 45 | | | | 49 | | |

| Proceeds from sale of property, plant and equipment | | 14 | | | | 1 | | | | | 18 | | | | 22 | | |

| Manufacturing cash flow before pension contributions - Non-GAAP (a) | | $ | 380 | | | | $ | 368 | | | | | $ | 931 | | | | $ | 1,178 | | |

(a) Manufacturing cash flow before pension contributions is a non-GAAP financial measure as defined in "Non-GAAP Financial Measures and Outlook" attached to this release.

TEXTRON INC.

Condensed Consolidated Schedule of Cash Flows

(In millions)

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended | | | Twelve Months Ended |

| | December 30,

2023 | | | December 31,

2022 | | | | December 30,

2023 | | | December 31,

2022 | |

| Cash Flows from Operating Activities: | | | | | | | | | | | | | |

| Income from continuing operations | | $ | 199 | | | | $ | 226 | | | | | $ | 922 | | | | $ | 862 | | |

| Depreciation and amortization | | 103 | | | | 109 | | | | | 395 | | | | 397 | | |

| Deferred income taxes and income taxes receivable/payable | | (112) | | | | (63) | | | | | (188) | | | | (202) | | |

| Pension, net | | (50) | | | | (42) | | | | | (202) | | | | (165) | | |

| | | | | | | | | | | | | |

| Asset impairments | | 87 | | | | 2 | | | | | 88 | | | | 2 | | |

| Changes in assets and liabilities: | | | | | | | | | | | | | |

| Accounts receivable, net | | 36 | | | | (3) | | | | | (9) | | | | (26) | | |

| Inventories | | 300 | | | | 298 | | | | | (359) | | | | (55) | | |

| Accounts payable | | (200) | | | | 119 | | | | | 2 | | | | 235 | | |

| Captive finance receivables, net | | 15 | | | | 6 | | | | | (17) | | | | 35 | | |

| Other, net | | 171 | | | | (125) | | | | | 635 | | | | 407 | | |

| Net cash from operating activities | | 549 | | | | 527 | | | | | 1,267 | | | | 1,490 | | |

| Cash Flows from Investing Activities: | | | | | | | | | | | | | |

| Capital expenditures | | (178) | | | | (162) | | | | | (402) | | | | (354) | | |

| Net cash used in business acquisitions | | — | | | | (1) | | | | | (1) | | | | (202) | | |

| Net proceeds from corporate-owned life insurance policies | | 1 | | | | — | | | | | 40 | | | | 23 | | |

| Proceeds from sale of property, plant and equipment | | 14 | | | | 1 | | | | | 18 | | | | 22 | | |

| | | | | | | | | | | | | |

| Finance receivables repaid | | — | | | | (1) | | | | | 26 | | | | 20 | | |

| Other investing activities, net | | — | | | | — | | | | | 2 | | | | 44 | | |

| Net cash from investing activities | | (163) | | | | (163) | | | | | (317) | | | | (447) | | |

| Cash Flows from Financing Activities: | | | | | | | | | | | | | |

| Increase/(decrease) in short-term debt | | — | | | | 1 | | | | | — | | | | (14) | | |

| Net proceeds from long-term debt | | 347 | | | | — | | | | | 348 | | | | — | | |

| Principal payments on long-term debt and nonrecourse debt | | (3) | | | | (7) | | | | | (44) | | | | (234) | | |

| | | | | | | | | | | | | |

| Purchases of Textron common stock | | (283) | | | | (228) | | | | | (1,168) | | | | (867) | | |

| Dividends paid | | (4) | | | | (4) | | | | | (16) | | | | (17) | | |

| Other financing activities, net | | 7 | | | | 8 | | | | | 67 | | | | 41 | | |

| Net cash from financing activities | | 64 | | | | (230) | | | | | (813) | | | | (1,091) | | |

| Total cash flows from continuing operations | | 450 | | | | 134 | | | | | 137 | | | | (48) | | |

| Total cash flows from discontinued operations | | — | | | | — | | | | | (1) | | | | (2) | | |

| Effect of exchange rate changes on cash and equivalents | | 15 | | | | 17 | | | | | 10 | | | | (32) | | |

| Net change in cash and equivalents | | 465 | | | | 151 | | | | | 146 | | | | (82) | | |

| Cash and equivalents at beginning of period | | 1,716 | | | | 1,884 | | | | | 2,035 | | | | 2,117 | | |

| Cash and equivalents at end of period | | $ | 2,181 | | | | $ | 2,035 | | | | | $ | 2,181 | | | | $ | 2,035 | | |

TEXTRON INC.

Non-GAAP Financial Measures and Outlook

(Dollars in millions, except per share amounts)

We supplement the reporting of our financial information determined under U.S. generally accepted accounting principles (GAAP) with certain non-GAAP financial measures. These non-GAAP financial measures exclude certain significant items that may not be indicative of, or are unrelated to, results from our ongoing business operations. We believe that these non-GAAP measures may be useful for period-over-period comparisons of underlying business trends and our ongoing business performance, however, they should be used in conjunction with GAAP measures. Our non-GAAP measures should not be considered in isolation or as a substitute for the related GAAP measures, and other companies may define similarly named measures differently. We encourage investors to review our financial statements and publicly filed reports in their entirety and not to rely on any single financial measure. We utilize the following definitions for the non-GAAP financial measures included in this release and have provided a reconciliation of the GAAP to non-GAAP amounts for each measure:

Segment Profit

Segment profit is an important measure used by our chief operating decision maker for evaluating performance and for decision-making purposes. Beginning in 2023, we changed how we measure our manufacturing segment operating results to exclude the non-service components of pension and postretirement income, net; LIFO inventory provision; and intangible asset amortization. This measure also continues to exclude interest expense, net for Manufacturing group; certain corporate expenses; gains/losses on major business dispositions; and special charges. The prior period has been recast to conform to this presentation. The measurement for the Finance segment includes interest income and expense along with intercompany interest income and expense.

Adjusted Income from Continuing Operations, Adjusted Diluted Earnings Per Share and Outlook

Adjusted income from continuing operations and adjusted diluted earnings per share exclude special charges, net of tax and gains/losses on major business dispositions, net of tax. We consider items recorded in special charges, such as enterprise-wide restructuring, certain asset impairment charges, and acquisition-related restructuring, integration and transaction costs, to be of a non-recurring nature that is not indicative of ongoing operations.

Beginning in 2023, these measures also exclude LIFO inventory provision, net of tax and Intangible asset amortization, net of tax. LIFO inventory provision is excluded to improve comparability with other companies in our industry who have not elected to use the LIFO inventory costing method. Intangible asset amortization is excluded to improve comparability as the impact of such amortization can vary substantially from company to company depending upon the nature and extent of acquisitions and exclusion of this expense is consistent with the presentation of non-GAAP measures provided by other companies within our industry. Management believes that it is important for investors to understand that these intangible assets were recorded as part of purchase accounting and contribute to revenue generation. The prior period has been recast to conform to this presentation.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended | | Twelve Months Ended |

| December 30,

2023 | December 31,

2022 | | December 30,

2023 | December 31,

2022 |

| Income from continuing operations - GAAP | | $ | 199 | | | | $ | 226 | | | | | $ | 922 | | | | $ | 862 | | |

| Add: Special charges, net of tax | | 94 | | | | — | | | | | 94 | | | | — | | |

| LIFO inventory provision, net of tax | | 16 | | | | 22 | | | | | 81 | | | | 54 | | |

| Intangible asset amortization, net of tax | | 7 | | | | 10 | | | | | 30 | | | | 40 | | |

| | | | | | | | | | | | | |

| Adjusted income from continuing operations - Non-GAAP | | $ | 316 | | | | $ | 258 | | | | | $ | 1,127 | | | | $ | 956 | | |

| | | | | | | | | | | | | |

| Income from continuing operations - GAAP | | $ | 1.01 | | | | $ | 1.07 | | | | | $ | 4.57 | | | | $ | 4.01 | | |

| Add: Special charges, net of tax | | $ | 0.47 | | | | $ | — | | | | | $ | 0.47 | | | | $ | — | | |

| LIFO inventory provision, net of tax | | 0.08 | | | | 0.11 | | | | | 0.40 | | | | 0.25 | | |

| Intangible asset amortization, net of tax | | 0.04 | | | | 0.05 | | | | | 0.15 | | | | 0.19 | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| Adjusted income from continuing operations - Non-GAAP | | $ | 1.60 | | | | $ | 1.23 | | | | | $ | 5.59 | | | | $ | 4.45 | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| 2024 Outlook |

| | | | | | | Diluted EPS | |

| Income from continuing operations - GAAP | | $ | 1,073 | | | $ | 1,108 | | | | $ | 5.62 | | | $ | 5.82 | | |

| Add: LIFO inventory provision, net of tax | | | 85 | | | | | 0.44 | | |

| Intangible asset amortization, net of tax | | | 27 | | | | | 0.14 | | |

| Adjusted income from continuing operations - Non-GAAP | | $ | 1,185 | | — | $ | 1,220 | | | | $ | 6.20 | | — | $ | 6.40 | | |

| | | | | | | | | | |

TEXTRON INC.

Non-GAAP Financial Measures and Outlook (Continued)

(Dollars in millions, except per share amounts)

Manufacturing Cash Flow Before Pension Contributions and Outlook

Manufacturing cash flow before pension contributions adjusts net cash from operating activities (GAAP) for the following:

•Deducts capital expenditures and includes proceeds from insurance recoveries and the sale of property, plant and equipment to arrive at the net capital investment required to support ongoing manufacturing operations;

•Excludes dividends received from Textron Financial Corporation (TFC) and capital contributions to TFC provided under the Support Agreement and debt agreements as these cash flows are not representative of manufacturing operations;

•Adds back pension contributions as we consider our pension obligations to be debt-like liabilities. Additionally, these contributions can fluctuate significantly from period to period and we believe that they are not representative of cash used by our manufacturing operations during the period.

While we believe this measure provides a focus on cash generated from manufacturing operations, before pension contributions, and may be used as an additional relevant measure of liquidity, it does not necessarily provide the amount available for discretionary expenditures since we have certain non-discretionary obligations that are not deducted from the measure.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended | | | Twelve Months Ended | |

| December 30,

2023 | December 31,

2022 | December 30,

2023 | December 31,

2022 |

| Net cash from operating activities - GAAP | | $ | 533 | | | | $ | 516 | | | | $ | 1,270 | | | | $ | 1,461 | | |

| Less: Capital expenditures | | (178) | | | | (162) | | | | (402) | | | | (354) | | |

| | | | | | | | | | | | |

| Plus: Total pension contribution | | 11 | | | | 13 | | | | 45 | | | | 49 | | |

| Proceeds from sale of property, plant and equipment | | 14 | | | | 1 | | | | 18 | | | | 22 | | |

| Manufacturing cash flow before pension contributions - Non-GAAP | | $ | 380 | | | | $ | 368 | | | | $ | 931 | | | | $ | 1,178 | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | |

| 2024 Outlook |

| Net cash from operating activities - GAAP | | | $ | 1,275 | | | — | $ | 1,375 | | |

| Less: Capital expenditures | | | | | (425) | | |

| Plus: Total pension contribution | | | | | 50 | | |

| Manufacturing cash flow before pension contributions - Non-GAAP | | | $ | 900 | | | — | $ | 1,000 | | |

| | | | | | | |

| | | | | | | |

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

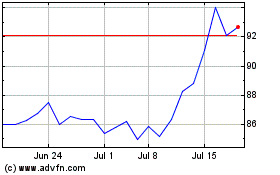

Textron (NYSE:TXT)

Historical Stock Chart

From Mar 2024 to Apr 2024

Textron (NYSE:TXT)

Historical Stock Chart

From Apr 2023 to Apr 2024