Tenet Healthcare Corporation (NYSE: THC) today reported Adjusted

EBITDA of $294 million for the fourth quarter ended December 31,

2011, an increase of $13 million, or 4.6 percent, compared to $281

million for the fourth quarter of 2010. The Adjusted EBITDA margin

in the quarter was 13.2 percent, compared to 13.3 percent in the

fourth quarter of 2010.

In the fourth quarter of 2011, the Company reported a net loss

attributable to common shareholders of $76 million, or a loss of

$0.17 per diluted share, compared to income of $74 million, or

$0.14 per diluted share, in the fourth quarter of 2010. These

results included a $117 million pre-tax loss from early

extinguishment of debt incurred in relation to Tenet’s strategy to

extend debt maturities and reduce future interest expense.

Excluding impairment, litigation and investigation costs, loss from

early extinguishment of debt, and valuation tax adjustments from

both fourth quarters, income from continuing operations, net of

tax, was $42 million, or $0.10 per diluted share, compared to $43

million, or $0.08 per diluted share, in the fourth quarter of

2010.

“We recorded our eighth consecutive year of growth in Adjusted

EBITDA which grew to $1.145 billion in 2011, a 9.0 percent increase

over 2010,” said Trevor Fetter, president and chief executive

officer. “The growth would have been even stronger had we been able

to close some of the favorable payer settlements we have been

working on for a number of months. Because the settlements remain

likely, we are raising our 2012 Outlook for Adjusted EBITDA to a

new range of $1.225 billion to $1.350 billion. We also recorded our

fifth consecutive quarter of growth in adjusted admissions which

grew by 1.3 percent. The favorable growth in patient volumes,

combined with strong pricing growth, enabled us to achieve a 5.4

percent increase in net operating revenues in the quarter.”

Discussion of Results (Percentage changes compare Q4’11

to Q4’10, unless otherwise noted.)

Adjusted admissions increased by 1.3 percent. Admissions

increased by 0.3 percent, and paying admissions were flat.

Emergency Departments visits increased by 3.1 percent, and there

was a 3.3 percent increase in admissions through our Emergency

Departments. Total surgeries increased by 3.2 percent with

inpatient surgeries declining by 3.1 percent and outpatient

surgeries increasing by 7.6 percent.

Net operating revenues were $2.226 billion, an increase of $115

million, or 5.4 percent, compared to net operating revenues of

$2.111 billion in the fourth quarter of 2010. As a result of the

Company’s early adoption of a new accounting standard, net

operating revenues are now reported after a deduction for the

provision for doubtful accounts. Under the Company’s prior

reporting standard, net operating revenues would have been $2.411

billion, an increase of 4.8 percent, compared to $2.301 billion in

the fourth quarter of 2010.

Net patient revenue per adjusted admission was $11,633, an

increase of 2.3 percent, compared to $11,370 in the fourth quarter

of 2010. This pricing increase reflects improved terms in our

contracts with commercial managed care payers, partially offset by

an adverse shift in payer mix.

Selected operating expenses, which is defined as the sum of

salaries, wages and benefits, supplies and other operating

expenses, increased by 6.5 percent on a per adjusted patient day

basis in the fourth quarter of 2011. The increase is primarily due

to annual merit increases, an increase in the number of physicians

we employ, and higher health benefit costs for our employees. The

comparison to last year’s fourth quarter was made more challenging

by a $10 million favorable adjustment in that quarter related to

the estimated recovery of payroll taxes paid in prior years on

behalf of medical residents. Selected operating expenses were also

adversely impacted by lower interest rates at quarter-end which

contributed $14 million of increased expense between the fourth

quarter of 2011 and 2010. Although claims experience for both

malpractice and workers’ compensation expense continue to be

favorable, lower interest rates increased the balances of these

discounted liabilities. Supply costs were well-controlled,

declining by $3 million, and were flat on a per adjusted patient

day basis. Excluding the expenses from additional physician

employment, the favorable payroll tax adjustment in the 2010

quarter, and expenses related to lower interest rates, the 6.5

percent increase in selected expenses per adjusted patient day

would have been 4.4 percent.

Bad debt expense was $185 million, a decline of 2.6 percent, as

compared to $190 million in the fourth quarter of 2010. Bad debt

expense as a percent of revenues before provision for doubtful

accounts declined to 7.7 percent, a decline of 60 basis points

compared to 8.3 percent in the fourth quarter of 2010. The

improvement in bad debt expense primarily was due to favorable

adjustments related to updates to our estimates of collection rates

in the fourth quarter of 2011 compared to unfavorable adjustments

in the fourth quarter of 2010. The change in bad debt expense also

was impacted favorably by deterioration in the age of managed care

receivables in the fourth quarter of 2010 that did not occur in the

fourth quarter of 2011.

Cash and cash equivalents were $113 million at December 31,

2011, a decrease of $72 million from $185 million at September 30,

2011. Cash used in the fourth quarter of 2011 included $178 million

to repurchase 40.3 million shares of the Company’s common stock and

$28 million for the purchase of five outpatient centers and certain

assets related to acquired physician practices. Capital

expenditures were $177 million in the fourth quarter of 2011,

compared to $196 million in the fourth quarter of 2010. As of

December 31, 2011, the Company had an outstanding balance of $80

million on its credit line.

Through December 31, 2011, the Company repurchased an aggregate

total of 75.8 million shares of common stock since announcing its

$400 million share repurchase program in May, 2011. These 75.8

million repurchased shares represent 15.5 percent of outstanding

common shares at the time the program was initiated. The average

repurchase price was $4.94 per share for a total expenditure of

approximately $374 million. At December 31, 2011, there were 415

million shares of common stock outstanding. The full $400 million

common stock repurchase program was completed in January 2012. In

total, 81.1 million shares, or 17 percent of our outstanding

shares, were repurchased at an average price of $4.94.

Outlook for Adjusted EBITDA

Tenet raised its 2012 Outlook for Adjusted EBITDA to a new range

of $1.225 billion to $1.350 billion. Other than expected outpatient

acquisitions, the Company’s 2012 Outlook represents purely organic

growth.

Adjusted EBITDA in the first quarter of 2012 is expected to

comprise approximately one-fifth of the Company’s total Adjusted

EBITDA for the year. This reflects the expectation that the

approximately $140 million in state provider fees will be

recognized in the second half of the year. In addition, the

expected ramp up of Tenet’s strategic initiatives, including cost

efficiencies related to the Medicare Performance Initiative and

incremental outpatient acquisitions, are expected to make more

significant contributions to earnings in the second half of the

year.

Tenet reconfirmed its 2013 Outlook range for Adjusted EBITDA of

$1.335 billion to $1.535 billion. The 2015 Outlook range for

Adjusted EBITDA, which includes the increased coverage of the

uninsured pursuant to the Affordable Care Act, was reconfirmed at

$1.75 billion to $2.25 billion.

Tenet’s statements on outlook constitute forward-looking

information and are subject to the qualifications set forth at the

end of this release.

Management’s Webcast Discussion of Fourth Quarter

Results

Tenet management will discuss fourth quarter 2011 results on a

webcast scheduled for 10:00 AM (ET) on February 28, 2012. This

webcast may be accessed through Tenet’s website at

www.tenethealth.com/investors. A set

of slides that management intends to refer to on the call will be

posted to the Company’s website at shortly before the start of the

webcast.

Additional information regarding Tenet’s quarterly results of

operations, including detailed tabular operational data, is

contained in its Form 10-K report, which will be filed with the

Securities and Exchange Commission and posted on the Tenet investor

relations website before today’s webcast. This press release

includes certain non-GAAP measures, such as Adjusted EBITDA. A

reconciliation of Adjusted EBITDA to net income attributable to

Tenet common shareholders is included in the financial tables at

the end of this release.

Tenet Healthcare Corporation, a premier health care services

company, operates 50 hospitals, 99 free-standing outpatient centers

and Conifer Health Solutions, a leader in business process

solutions for health care providers that serves over 250 hospital

and health care entities nationwide. Tenet’s hospitals and related

health care facilities are committed to providing high quality care

to patients in the communities they serve. For more information,

please visit www.tenethealth.com.

This document contains “forward-looking statements” – that is,

statements that relate to future, not past, events. In this

context, forward-looking statements often address our expected

future business and financial performance and financial condition,

and often contain words such as “expect,” “anticipate,” “intend,”

“plan,” “believe,” “seek,” “see,” or “will.” Forward-looking

statements by their nature address matters that are, to different

degrees, uncertain. Particular uncertainties that could cause our

actual results to be materially different than those expressed in

our forward-looking statements include the factors disclosed under

“Forward Looking Statements” and “Risk Factors” in our Form 10-K

for the year ended December 31, 2011, our quarterly reports on Form

10-Q, periodic reports on Form 8-K and other filings with the

Securities and Exchange Commission. The information contained in

this earnings release and the attachments is as of February 28,

2012. The Company assumes no obligation to update forward-looking

statements contained in this earnings release or the attachments as

a result of new information or future events or developments.

Tenet uses its company website to provide

important information to investors about the company including the

posting of important announcements regarding financial performance

and corporate developments.

TENET HEALTHCARE CORPORATION CONSOLIDATED OPERATIONS DATA

(Unaudited) (Dollars in millions except per share amounts)

Three Months Ended December 31, 2011

% 2010 % Change

Net operating revenues Revenues before provision for

doubtful accounts $ 2,411 $ 2,301 4.8 % Less provision for doubtful

accounts 185 190 (2.6

)%

Net operating revenues 2,226 100.0 %

2,111 100.0 % 5.4 % Operating

expenses: Salaries, wages and benefits 1,029 46.2 % 967 45.8 %

6.4 % Supplies 391 17.6 % 394 18.7 % (0.8

)%

Other operating expenses, net 517 23.2 % 469 22.2 % 10.2 %

Electronic Health Records Incentives (5 ) (0.2

)%

0 — % — % Depreciation and amortization 105 4.7 % 101 4.8 % 4.0 %

Impairment of long-lived assets and goodwill, and restructuring

charges, net 9 0.4 % 9 0.4 % Litigation and investigation costs

31 1.4 % 6 0.3 %

Operating

income 149 6.7 % 165 7.8

% Interest expense (100 ) (101 ) Loss from early

extinguishment of debt (117 )

(2 )

Income (loss) from continuing operations, before income

taxes (68 ) 62 Income tax benefit

(expense) 12 (2 )

Income (loss) from continuing

operations, before discontinued operations

(56 ) 60 Discontinued operations:

Income (loss) from operations (2 ) 15 Litigation and investigation

costs (17 ) — Income tax benefit 9 7

Income (loss) from discontinued operations (10

) 22 Net income (loss)

(66 ) 82 Less: Preferred stock dividends 6 6

Less: Net income attributable to noncontrolling interests 4

2

Net income (loss) attributable to Tenet

Healthcare Corporation common shareholders $ (76

) $ 74 Amounts attributable

to Tenet Healthcare Corporation common shareholders

Income (loss) from continuing operations,

net of tax

$ (66 ) $ 52 Loss from discontinued operations, net of tax

(10 ) 22

Net income (loss) attributable to Tenet

Healthcare Corporation common shareholders $ (76

) $ 74 Earnings (loss) per

share attributable to Tenet Healthcare Corporation common

shareholders Basic Continuing operations $ (0.15 ) $

0.11 Discontinued operations (0.02 ) 0.04 $

(0.17 ) $ 0.15

Diluted Continuing operations $ (0.15

) $ 0.10 Discontinued operations (0.02 ) 0.04

$ (0.17 ) $ 0.14

Weighted average shares and dilutive

securities outstanding (in thousands):

Basic 432,454 485,549 Diluted 432,454 561,921 TENET

HEALTHCARE CORPORATION CONSOLIDATED OPERATIONS DATA (Unaudited)

(Dollars in millions except per share amounts)

Year Ended December 31, 2011 %

2010 % Change Net

operating revenues

Revenues before provision for doubtful

accounts

$ 9,584 $ 9,205 4.1 % Less provision for doubtful accounts

730 738 (1.1 ) %

Net operating revenues

8,854 100.0 % 8,467 100.0

% 4.6

% Operating expenses: Salaries, wages

and benefits 4,082 46.1 % 3,900 46.1 % 4.7 % Supplies 1,582 17.9 %

1,577 18.6 % 0.3 % Other operating expenses, net 2,100 23.7 % 1,940

22.9 % 8.2 % Electronic Health Record Incentives (55 ) (0.6 ) % 0 —

% — % Depreciation and amortization 413 4.7 % 394 4.7 % 4.8 %

Impairment of long-lived assets and

goodwill, and restructuring charges, net

27 0.3 % 10 0.1 % Litigation and investigation costs 55

0.6 % 12 0.1 %

Operating income

650 7.3 % 634 7.5 %

Interest expense (375 ) (424 ) Loss from early extinguishment of

debt (117 ) (57 ) Investment earnings 3 5

Income from continuing operations,

before income taxes

161 158 Income tax benefit (expense) (61 )

977

Income from continuing operations,

before discontinued operations

100 1,135 Discontinued operations: Income

(loss) from operations (22 ) 11 Impairment of long-lived assets and

goodwill, and restructuring charges, net — (1 ) Litigation and

investigation costs (17 ) — Income tax benefit 33

7

Income (loss) from discontinued operations

(6 ) 17 Net income

94 1,152 Less: Preferred stock dividends 24 24 Less:

Net income attributable to noncontrolling interests 12

9

Net income attributable to Tenet

Healthcare Corporation common shareholders

$ 58 $ 1,119

Amounts attributable to Tenet Healthcare Corporation common

shareholders Income from continuing operations, net of tax $ 64

$ 1,102 Income (loss) from discontinued operations, net of tax

(6 ) 17

Net income attributable to Tenet

Healthcare Corporation common shareholders $ 58

$ 1,119

Earnings (loss) per share attributable

to Tenet Healthcare Corporation common shareholders

Basic Continuing operations $ 0.13 $ 2.28 Discontinued

operations (0.01 ) 0.03 $ 0.12 $ 2.31

Diluted Continuing operations $ 0.13 $ 2.01

Discontinued operations (0.01 ) 0.03 $ 0.12

$ 2.04

Weighted average shares and dilutive

securities outstanding (in thousands):

Basic 468,726 484,321 Diluted 485,181 560,631 TENET

HEALTHCARE CORPORATION CONSOLIDATED BALANCE SHEET DATA (Unaudited)

December 31, December 31,

(Dollars in millions)

2011 2010 ASSETS

Current assets: Cash and cash equivalents $ 113 $ 405

Accounts receivable, less allowance for doubtful accounts 1,278

1,143 Inventories of supplies, at cost 161 156 Income tax

receivable 7 22 Current portion of deferred income taxes 418 282

Assets held for sale 2 14 Other current assets 378

289

Total current assets 2,357

2,311 Investments and other assets 156 164 Deferred income

taxes, net of current portion 374 627 Property and equipment, at

cost, less accumulated depreciation and amortization 4,350 4,304

Goodwill 736 652 Other intangible assets, at cost, less accumulated

amortization 489 442

Total

assets $ 8,462 $ 8,500

LIABILITIES AND EQUITY Current

liabilities: Current portion of long-term debt $ 66 $ 67

Accounts payable 760 720 Accrued compensation and benefits 376 363

Professional and general liability reserves 75 84 Accrued interest

payable 112 115 Accrued legal settlement costs 64 8 Other current

liabilities 362 368

Total current

liabilities 1,815 1,725 Long-term debt, net of

current portion 4,294 3,997 Professional and general liability

reserves 337 383 Accrued legal settlement costs 2 22 Other

long-term liabilities 506 554

Total

liabilities 6,954 6,681 Commitments and

contingencies

Redeemable noncontrolling interests in

equity of consolidated subsidiaries

16 —

Equity: Shareholders’ equity: Preferred stock

334 334 Common stock 27 27 Additional paid-in capital 4,407 4,449

Accumulated other comprehensive loss (52 ) (43 ) Accumulated

deficit (1,440 ) (1,522 ) Common stock in treasury, at cost

(1,853 ) (1,479 )

Total shareholders’ equity

1,423 1,766 Noncontrolling interests

69 53 Total equity

1,492 1,819 Total liabilities

and equity $ 8,462 $ 8,500

TENET HEALTHCARE CORPORATION

CONSOLIDATED CASH FLOW DATA (Unaudited) (Dollars in millions)

Year EndedDecember 31, 2011

2010 Net income $ 94 $

1,152 Adjustments to reconcile net income to net cash

provided by operating activities: Depreciation and amortization

413 394 Provision for doubtful accounts 730 740 Deferred income tax

expense 81 (952 ) Stock-based compensation expense 24 22 Impairment

of long-lived assets and goodwill, and restructuring charges, net

27 10 Fair market value adjustments related to interest rate swap

and LIBOR cap agreements — 3 Amortization of debt discount and debt

issuance costs 30 31 Litigation and investigation costs 55 12 Loss

from early extinguishment of debt 117 57 Pre-tax loss from

discontinued operations 39 (10 ) Other items, net (15 ) (4 )

Changes in cash from operating assets and liabilities:

Accounts receivable (865 ) (744 ) Inventories and other current

assets (38 ) (17 ) Income taxes (63 ) 3 Accounts payable, accrued

expenses and other current liabilities (35 ) (84 ) Other long-term

liabilities (6 ) (58 )

Payments against reserves for

restructuring charges and litigation costs (44 )

(83 ) Net cash used in operating activities from

discontinued operations, excluding income taxes

(47 ) — Net cash provided by

operating activities 497 472 Cash flows from

investing activities: Purchases of property and

equipment—continuing operations (475 ) (450 ) Construction of new

and replacement hospitals — (13 ) Purchase of property and

equipment—discontinued operations — (13 ) Purchases of businesses

or joint venture interests (84 ) (65 ) Proceeds from sales of

facilities and other assets — discontinued operations — 19 Proceeds

from sales of marketable securities, long-term investments and

other assets 59 84 Release of escrow funds — 15 Other items, net

(3 ) 3

Net cash used in investing

activities (503 ) (420 ) Cash

flows from financing activities: Repayments of borrowings under

credit facility (365 ) — Proceeds from borrowings under credit

facility 445 — Repayments of borrowings (843 ) (886 ) Proceeds from

borrowings 900 601 Deferred debt issuance costs (21 ) (27 )

Repurchases of common stock (374 ) — Cash dividends on preferred

stock (24 ) (24 ) Distributions paid to noncontrolling interests

(11 ) (8 ) Other items, net 7 7

Net

cash used in financing activities (286 )

(337 ) Net decrease in cash and cash

equivalents (292 ) (285 ) Cash and cash equivalents at beginning of

period 405 690

Cash and cash

equivalents at end of period $ 113

$ 405 Supplemental disclosures: Interest paid,

net of capitalized interest $ (347 ) $ (402 ) Proceeds from

interest rate swap agreement $ 30 $ 0 Income tax (payments)

refunds, net $ (10 ) $ 34

TENET HEALTHCARE CORPORATION

SELECTED STATISTICS – CONTINUING HOSPITALS (Unaudited)

(Dollars in millions except per patient

day, per admission and per visit amounts)

Three Months Ended December 31, Year Ended

December 31, 2011 2010

Change 2011 2010 Change

Net inpatient revenues $ 1,536 $ 1,477 4.0 % $ 6,163 $ 5,929

3.9 % Net outpatient revenues $ 751 $ 730 2.9 % $ 2,984 $ 2,903 2.8

% Number of acute care hospitals (at end of period) (1) 50

50 — 50 50 — * Licensed beds (at end of period) 13,453 13,428 0.2 %

13,453 13,428 0.2 % Average licensed beds 13,453 13,429 0.2 %

13,449 13,430 0.1 % Utilization of licensed beds 48.5 % 49.3 % (0.8

) 50.0 % 50.4 % (0.4 ) * Patient days 599,859 608,890 (1.5 ) %

2,452,156 2,473,017 (0.8 ) % Adjusted patient days 917,798 923,219

(0.6 ) % 3,732,330 3,723,702 0.2 %

Net inpatient revenue per patient day

$ 2,561 $ 2,426 5.6 % $ 2,513 $ 2,397 4.8 % Admissions 127,321

126,977 0.3 % 515,693 512,972 0.5 % Adjusted patient admissions

196,594 194,098 1.3 % 791,919 778,505 1.7 %

Net inpatient revenue per admission

$ 12,064 $ 11,632 3.7 % $ 11,951 $ 11,558 3.4 % Average length of

stay (days) 4.7 4.8 (0.1 ) 4.8 4.8 — * Surgeries 92,691 89,859 3.2

% 367,638 360,206 2.1 % Net outpatient revenue per visit $ 749 $

730 2.6 % $ 739 $ 741 (0.3 ) % Outpatient visits 1,002,842 999,827

0.3 % 4,039,456 3,917,758 3.1 %

Sources of net patient

revenue Medicare 23.3 % 23.5 % (0.2 ) 23.2 % 23.9 % (0.7 ) *

Medicaid 8.8 % 8.6 % 0.2 9.0 % 8.7 % 0.3 * Managed care 57.8 % 56.9

% 0.9 57.0 % 56.5 % 0.6 * Indemnity, self-pay and other 10.1 % 11.0

% (0.9 ) 10.8 % 10.9 % (0.2 ) *

* This change is the difference between

the 2011 and 2010 amounts shown(1) Number of hospitals includes the

49 general hospitals and our critical access facility

TENET HEALTHCARE CORPORATION

CONSOLIDATED OPERATIONS DATA Fiscal 2011 by Calendar Quarter

(Unaudited)

Year Ended (Dollars

in millions except per share amounts)

Three Months Ended

Ended 3/31/11 6/30/11 9/30/11

12/31/11 12/31/11 Net operating

revenues Revenues before provision for doubtful accounts $

2,481 $ 2,349 $ 2,343 $ 2,411 $ 9,584 Less provision for doubtful

accounts 182 170 193

185 730

Net operating revenues

2,299 2,179 2,150 2,226 8,854

Operating expenses: Salaries, wages and benefits 1,035 999

1,019 1,029 4,082 Supplies 404 399 388 391 1,582 Other operating

expenses, net 506 529 548 517 2,100 Electronic Health Record

Incentives (25 ) (25 )

— (5 ) (55 ) Depreciation and

amortization 101 104 103 105 413

Impairment of long-lived assets and

goodwill, and restructuring charges

8 2 8 9 27 Litigation and investigation costs 11

8 5 31 55

Operating income 259 163 79 149

650 Interest expense (118 ) (98 ) (59 ) (100 ) (375 ) Loss

from early extinguishment of debt

— — — (117 )

(117 ) Investment earnings 1 1 1

— 3

Income (loss) from

continuing operations, before income taxes 142 66

21 (68 ) 161 Income tax expense

(51 ) (18 ) (4 ) 12 (61 )

Income (loss) from continuing

operations, before discontinued operations

91 48 17 (56 ) 100

Discontinued operations: Loss from operations (15 ) (3 ) (2

) (2 ) (22 ) Litigation and investigation costs — — — (17 ) (17 )

Income tax benefit 6 18 —

9 33

Income (loss) from discontinued

operations (9 ) 15

(2 ) (10 )

(6 ) Net income (loss) 82 63

15 (66 ) 94 Less: Preferred stock

dividends 6 6 6 6 24 Less: Net income attributable to

noncontrolling interests 3 2 3

4 12

Net income (loss)

attributable to Tenet Healthcare Corporation common

shareholders $ 73 $ 55

$ 6 $ (76 )

$ 58

Amounts attributable to Tenet Healthcare Corporation common

shareholders Income (loss) from continuing operations, net of

tax $ 82 $ 40 $ 8 $ (66 ) $ 64 Income (loss) from discontinued

operations, net of tax (9 ) 15 (2 )

(10 ) (6 )

Net income (loss) attributable to Tenet

Healthcare Corporation common shareholders $ 73

$ 55 $ 6 $

(76 ) $ 58

Earnings (loss) per share attributable

to Tenet Healthcare Corporation common shareholders

Basic Continuing operations $ 0.17 $ 0.08 $ 0.02 $ (0.15 ) $

0.13 Discontinued operations (0.02 ) 0.03

— (0.02 ) (0.01 ) $ 0.15 $ 0.11

$ 0.02 $ (0.17 ) $ 0.12

Diluted

Continuing operations $ 0.16 $ 0.08 $ 0.02 $ (0.15 ) $ 0.13

Discontinued operations (0.02 ) 0.03 —

(0.02 ) (0.01 ) $ 0.14 $ 0.11 $

0.02 $ (0.17 ) $ 0.12

Weighted average shares and dilutive

securities outstanding (in thousands):

Basic 486,902 486,794 468,753 432,454 468,726 Diluted 565,181

503,748 483,632 432,454 485,181

TENET HEALTHCARE CORPORATION

CONSOLIDATED OPERATIONS DATA Fiscal 2010 by Calendar Quarter

(Unaudited)

Year (Dollars in

millions except per share amounts)

Three Months Ended

Ended 3/31/10 6/30/10 9/30/10

12/31/10

12/31/10

Net operating revenues Revenues before provision for

doubtful accounts $ 2,339 $ 2,303 $ 2,262 $ 2,301 $ 9,205 Less

provision for doubtful accounts 188 173

187 190 738

Net

operating revenues $ 2,151 $ 2,130

$ 2,075 $ 2,111 $ 8,467

Operating expenses: Salaries, wages and benefits 987 969 977

967 3,900 Supplies 398 395 390 394 1,577 Other operating expenses,

net 468 498 505 469 1,940 Depreciation and amortization 95 97 101

101 394

Impairment of long-lived assets and

goodwill, and restructuring charges

— (2 ) 3 9 10 Litigation and investigation costs 2

2 2 6 12

Operating income 201 171 97 165

634 Interest expense (109 ) (107 ) (107 ) (101 ) (424 ) Loss

from early extinguishment of debt — — (55 ) (2 ) (57 ) Investment

earnings 1 1 3 —

5

Income (loss) from continuing

operations, before income taxes

93 65 (62 ) 62 158 Income

tax (expense) benefit (3 ) (20 ) 1,002

(2 ) 977

Income from continuing operations,

before discontinued operations

90 45 940 60 1,135

Discontinued operations: Income (loss) from operations 5 (5

) (4 ) 15 11

Impairment of long-lived assets and

goodwill, and restructuring charges, net

1 (3 ) 1 — (1 ) Income tax (expense) benefit (1 ) (2

) 3 7 7

Income (loss)

from discontinued operations 5

(10 ) — 22

17 Net income 95 35

940 82 1,152 Less: Preferred stock dividends 6

6 6 6 24 Less: Net income attributable to noncontrolling interests

1 4 2 2

9

Net income attributable to Tenet Healthcare

Corporation common shareholders $ 88

$ 25 $ 932 $

74 $ 1,119

Amounts attributable to Tenet

Healthcare Corporation common shareholders

Income from continuing operations, net of tax $ 83 $ 35 $ 932 $ 52

$ 1,102 Income (loss) from discontinued operations, net of tax

5 (10 ) — 22

17

Net income attributable to Tenet Healthcare

Corporation common shareholders $ 88

$ 25 $ 932 $

74 $ 1,119

Earnings (loss) per share attributable

to Tenet Healthcare Corporation common shareholders

Basic Continuing operations $ 0.17 $ 0.07 $ 1.92 $ 0.11 $

2.28 Discontinued operations 0.01 (0.02 )

— 0.04 0.03 $ 0.18

$ 0.05 $ 1.92 $ 0.15 $ 2.31

Diluted Continuing operations $ 0.16 $ 0.07 $ 1.68 $ 0.10 $

2.01 Discontinued operations 0.01 (0.02 )

— 0.04 0.03 $ 0.17

$ 0.05 $ 1.68 $ 0.14 $ 2.04

Weighted average shares and dilutive

securities outstanding (in thousands):

Basic 481,917 484,610 485,210 485,549 484,321 Diluted 559,228

502,549 559,850 561,921 560,631 TENET HEALTHCARE

CORPORATION SELECTED STATISTICS – CONTINUING HOSPITALS Fiscal 2011

by Calendar Quarter (Unaudited)

Year Ended

(Dollars in millions except per patient

day, per admission and per visit amounts)

Three Months Ended Ended 03/31/11

06/30/11 9/300/11 12/31/11 12/31/11

Net inpatient revenues $ 1,653 $ 1,497 $ 1,477 $ 1,536 $

6,163 Net outpatient revenues $ 733 $ 751 $ 749 $ 751 $ 2,984

Number of acute care hospitals (at end of

period) (1)

50 50 50 50 50 Licensed beds (at end of period) 13,457 13,420

13,453 13,453 13,453 Average licensed beds 13,457 13,445 13,440

13,453 13,449 Utilization of licensed beds 53.3 % 49.5 % 48.7 %

48.5 % 50.0 % Patient days 645,166 605,216 601,915 599,859

2,452,156 Adjusted patient days 963,039 926,328 925,165 917,798

3,732,330 Net inpatient revenue per patient day $ 2,562 $ 2,473 $

2,454 $ 2,561 $ 2,513 Admissions 133,349 127,503 127,520 127,321

515,693 Adjusted patient admissions 200,353 196,862 198,110 196,594

791,919 Net inpatient revenue per admission $ 12,396 $ 11,741 $

11,582 $ 12,064 $ 11,951 Average length of stay (days) 4.8 4.7 4.7

4.7 4.8 Surgeries 88,754 92,250 93,943 92,691 367,638 Net

outpatient revenue per visit $ 725 $ 739 $ 742 $ 749 $ 739

Outpatient visits 1,010,848 1,015,830 1,009,936 1,002,842 4,039,456

Sources of net patient revenue Medicare 23.2 % 23.6 %

22.7 % 23.3 % 23.2 % Medicaid 11.6 % 7.5 % 8.0 % 8.8 % 9.0 %

Managed care 54.4 % 58.0 % 58.0 % 57.8 % 57.0 % Indemnity, self-pay

and other 10.8 % 10.9 % 11.3 % 10.1 % 10.8 % (1) Number of

hospitals includes the 49 general hospitals and our critical access

facility

(1) Reconciliation of Adjusted EBITDA

Adjusted EBITDA, a non-GAAP term, is defined by the Company as

net income (loss) attributable to Tenet Healthcare Corporation

common shareholders before (1) cumulative effect of changes in

accounting principle, net of tax, (2) net income attributable to

noncontrolling interests, (3) preferred stock dividends, (4) income

(loss) from discontinued operations, net of tax, (5) income tax

(expense) benefit, (6) investment earnings (loss), (7) gain (loss)

from early extinguishment of debt, (8) net gain (loss) on sales of

investments, (9) interest expense, (10) litigation and

investigation (costs) benefit, net of insurance recoveries, (11)

hurricane insurance recoveries, net of costs, (12) impairment of

long-lived assets and goodwill and restructuring charges, net of

insurance recoveries, and (13) depreciation and amortization. The

Company’s Adjusted EBITDA may not be comparable to EBITDA reported

by other companies.

The Company provides this information as a supplement to GAAP

information to assist itself and investors in understanding the

impact of various items on its financial statements, some of which

are recurring or involve cash payments. The Company uses this

information in its analysis of the performance of its business

excluding items that it does not consider as relevant in the

performance of its hospitals in continuing operations. In addition,

from time to time we use this measure to define certain performance

targets under our compensation programs. Adjusted EBITDA is not a

measure of liquidity, but is a measure of operating performance

that management uses in its business as an alternative to net

income (loss) attributable to Tenet Healthcare Corporation common

shareholders. Because Adjusted EBITDA excludes many items that are

included in our financial statements, it does not provide a

complete measure of our operating performance. Accordingly,

investors are encouraged to use GAAP measures when evaluating the

Company’s financial performance.

The reconciliation of net income (loss) attributable to Tenet

Healthcare Corporation common shareholders, the most comparable

GAAP term, to Adjusted EBITDA, is set forth in the first table

below for the three and twelve months ended December 31, 2011 and

2010.

TENET HEALTHCARE CORPORATION Additional Supplemental

Non-GAAP Disclosures

Table #1 - Reconciliation of Adjusted

EBITDA to Net Income Attributable to Tenet Healthcare Corporation

Common Shareholders (Unaudited) (Dollars in millions)

Three Months EndedDecember 31, Year

EndedDecember 31, 2011 2010

2011 2010

Net income (loss) attributable to Tenet

Healthcare Corporation common shareholders

$ (76 ) $ 74 $ 58 $ 1,119 Less: Net income attributable to

noncontrolling interests (4 ) (2 ) (12 ) (9 ) Preferred stock

dividends (6 ) (6 ) (24 ) (24 ) Income (loss) from discontinued

operations, net of tax (10 ) 22 (6 )

17 Income (loss) from continuing operations (56 ) 60

100 1,135 Income tax benefit (expense) 12 (2 ) (61 ) 977 Investment

earnings — — 3 5 Loss from early extinguishment of debt (117 ) (2 )

(117 ) (57 ) Interest expense (100 ) (101 )

(375 ) (424 ) Operating income 149 165 650 634 Litigation

and investigation costs (31 ) (6 ) (55 ) (12 )

Impairment of long-lived assets and

goodwill, and restructuring charges, net

(9 ) (9 ) (27 ) (10 ) Depreciation and amortization (105 )

(101 ) (413 ) (394 )

Adjusted EBITDA

$ 294 $ 281 $

1,145 $ 1,050 Net

operating revenues $ 2,226 $

2,111 $ 8,854 $

8,467

Adjusted EBITDA as % of net operating

revenues (Adjusted EBITDA margin)

13.2 % 13.3 % 12.9 %

12.4 % Table #2 - Reconciliation of Outlook

Adjusted EBITDA to Outlook Net Income Attributable to Tenet

Healthcare Corporation Common Shareholders for Years Ending

December 31, 2012, 2013 and 2015 (Unaudited) (Dollars in

Millions)

2012 2013 2015

Low High Low High

Low High Net income attributable to common

shareholders $ 216 $ 302 $ 306 $ 451 $ 578 $ 911 Less:

Net income attributable to noncontrolling

interests

(15 ) (10 ) (15 ) (10 ) (15 ) (10 ) Preferred stock dividends (18 )

(18 ) 0 0 0 0

Loss from discontinued operations, net of

tax

(10 ) (5 ) (5 ) 0 (5 )

0 Income from continuing operations 259 335 326 461

598 921 Income tax expense (166 ) (215 ) (209

) (294 ) (382 ) (589 )

Income from continuing operations, before

income taxes

425 550 535 755 980 1,510 Interest expense (390 )

(370 ) (390 ) (340 ) (360 ) (280 )

Operating income 815 920 925 1,095 1,340 1,790 Depreciation and

amortization (410 ) (430 ) (410 ) (440

) (410 ) (460 )

Adjusted EBITDA $

1,225 $ 1,350 $

1,335 $ 1,535 $

1,750 $ 2,250 Table #3

- Reconciliation of Outlook Adjusted EBITDA to Outlook

Income From Continuing Operations for Years Ending December

31, 2012, 2013 and 2015 (Unaudited)

(Dollars in Millions except per share amounts)

2012 2013 2015 Low High

Low High Low High Adjusted EBITDA

(from Table #2) $ 1,225 $ 1,350

$ 1,335 $ 1,535 $ 1,750

$ 2,250 Depreciation and amortization (410 )

(430 ) (410 ) (440 ) (410 ) (460 ) Interest expense (390 )

(370 ) (390 ) (340 ) (360 ) (280

)

Income from continuing operations, before

income taxes

425 550 535 755 980 1,510 Income tax expense (a) (166 )

(215 ) (209 ) (294 ) (382 ) (589

)

Income from continuing operations (a)

259 335 326 461 598 921 Preferred stock dividends (18 ) (18 ) 0 0 0

0

Net income attributable to noncontrolling

interests

(15 ) (10 ) (15 ) (10 ) (15 )

(10 ) Income from continuing operations, net of tax (a) $

226 $ 307 $ 311 $ 451 $ 583 $

911

Weighted average shares outstanding (in

millions)

489 489 491 491 503 503 Diluted EPS - continuing operations (a)

$

0.46

$

0.63

$

0.63

$

0.92

$

1.16

$

1.81

(a) Uses tax rate of 39 percent

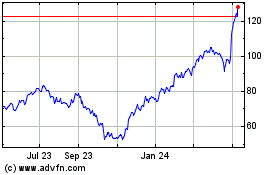

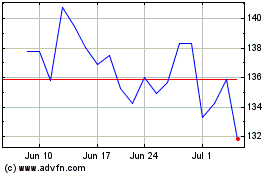

Tenet Healthcare (NYSE:THC)

Historical Stock Chart

From May 2024 to Jun 2024

Tenet Healthcare (NYSE:THC)

Historical Stock Chart

From Jun 2023 to Jun 2024