Spotify Technology S.A. (NYSE:SPOT):

This press release features multimedia. View

the full release here:

https://www.businesswire.com/news/home/20211027005313/en/

(Graphic: Business Wire)

Dear Shareholders,

The business performed very well in the quarter. Nearly all of

our major metrics finished better than expected, including MAUs,

Revenue, Gross Margin, and Operating Income. Subscriber growth was

inline and importantly, ARPU growth increased Y/Y. Additionally, we

saw another quarter of significant advertising strength and user

engagement metrics across many markets showed encouraging signs of

growth. During the quarter, we generated positive Free Cash Flow of

€99 million.

MONTHLY ACTIVE USERS (“MAUs”)

Total MAUs grew 19% Y/Y to 381 million in the quarter, up from

365 million last quarter and near the top end of our guidance

range. We experienced double digit Y/Y growth in all regions with

particular strength in Rest of World where performance was aided by

the resumption of marketing activity in India along with above-plan

growth in the Philippines and Indonesia. We also saw improved

momentum across the 86 markets launched earlier this year, with

outperformance led by South Korea, Bangladesh, and Pakistan.

PREMIUM SUBSCRIBERS

Our Premium Subscribers grew 19% Y/Y to 172 million in the

quarter, up from 165 million last quarter and towards the midpoint

of the guidance range. We tested a Premium promotion in the third

quarter, which aided the typical seasonality of our business and

also helped offset the tough comp from the successful launch of

Russia and surrounding territories in Q3 last year.

This quarter we added several major promotional partnerships,

including HMD Global (Spotify preloads on select Nokia branded

smartphones and tablets across all 178 markets), LG U+ (offering 3

or 6 month trials in South Korea with one of the country’s largest

telcos), OnePlus (Spotify preloads on OnePlus mobile devices in

India with 3 or 6 month trials and a limited offer of 12 month

trials to OnePlus Red Cable Club members), PayMaya (supporting

pre-paid payment solutions for Spotify's daily, weekly and monthly

subscriptions and offering 7 day trials in the Philippines), and

Tinkoff (offering 3 month trials with Russia’s largest all-digital

bank). Additionally, we renewed our partnership with Spark, New

Zealand’s largest telco and digital services company, offering

bundling and reseller opportunities.

Our average monthly Premium churn rate for the quarter was down

sequentially and up Y/Y against last year’s historic low. We are

pleased with the trends in churn and continue to expect full year

2021 churn to be down versus 2020.

FINANCIAL METRICS

Revenue

Revenue of €2,501 million grew 27% Y/Y in Q3 (or 26% Y/Y on a

constant currency basis) and was at the top end of our guidance

range due to significant strength in advertising. Premium Revenue

grew 22% Y/Y to €2,178 million (or 21% Y/Y constant currency) while

Ad-Supported Revenue was particularly strong, growing 75% Y/Y to

€323 million (or 75% Y/Y constant currency).

Within Premium, average revenue per user (“ARPU”) of €4.34 in Q3

was up 4% Y/Y (or up 3% Y/Y constant currency vs. flat Y/Y in Q2).

Excluding the impact of FX, we saw a benefit to ARPU primarily from

our price increases.

Ad-Supported Revenue meaningfully outperformed, driven by higher

sold impressions, increased CPMs, and accelerated demand within the

Spotify Audience Network. The strength in advertising was

broad-based across all sales channels, with the United States and

United Kingdom meaningfully exceeding expectations. Our music

business was driven by growth in impressions, a meaningful

improvement in sell-through rate, and double-digit CPM growth. Our

Podcast business was driven by strong double-digit Y/Y growth at

existing Spotify studios (The Ringer, Parcast, Spotify Studios, and

Gimlet) along with the Megaphone acquisition and the exclusive

licensing of the Joe Rogan Experience, Armchair Expert with Dax

Shephard, and Call Her Daddy.

During Q3, the Spotify Audience Network continued to gain

traction in the United States while expanding into the United

Kingdom, Canada, and Australia. The Spotify Audience Network

continued to outperform in the quarter, driven by higher available

inventory and incremental revenue from international sales. Since

launch, the number of podcasts in our network has grown by more

than 50%, and nearly 1 in 5 Spotify advertisers are already

participating. The Spotify Audience Network will open to top

emerging podcast creators from Anchor in the coming weeks,

increasing the scale and reach for our advertisers.

Gross Margin

Gross Margin finished at 26.7% in Q3, above the top end of our

guidance range and reflecting nearly 200 bps of Y/Y expansion. The

Gross Margin improvement reflected a favorable revenue mix shift

towards podcasts, marketplace activity, improved music advertising

operating leverage, and Other Cost of Revenue efficiencies (e.g.

payment fees, streaming delivery costs), which were partially

offset by higher non-music and other content costs and publishing

rate increases.

Premium Gross Margin was 29.1% in Q3, up 182 bps Y/Y, and

Ad-Supported Gross Margin was 10.5% in Q3, up 993 bps Y/Y. As a

reminder, all content costs related to podcast investment are

included in the Ad-Supported business for the current and

historical periods.

Operating Expenses

Operating Expenses totaled €593 million in Q3, an increase of

12% Y/Y. Social Charges were below forecast given the decline in

our share price during the quarter. Additionally, personnel costs

came in lower than expected as well as certain marketing expenses.

Excluding the impact of Social Charge movements, Operating Expenses

were better than forecast and contributed to positive Operating

Income in the quarter.

As a reminder, Social Charges are payroll taxes associated with

employee salaries and benefits, including share-based compensation.

We are subject to social taxes in several countries in which we

operate, although Sweden accounts for the bulk of the social costs.

We don’t forecast stock price changes in our guidance so upward or

downward movements will impact our reported operating expenses.

At the end of Q3, our workforce consisted of 7,431 FTEs

globally.

Product and Platform

During the quarter, we continued to lean into the

personalization of our user experiences to help drive improved

intake, retention, conversion, and LTV. Key product rollouts

included: Blend (the ability for two users to merge their music

into one shared playlist), Enhance (the ability for Premium users

to add personalized recommendations to their playlists), Episodes

for You (episodic podcast level recommendations), and What’s New (a

feed that gathers all new releases from the artists and shows that

users follow).

In late August, we opened up our paid podcast subscriptions to

all US creators with intentions to expand internationally to both

more creators and users. Additionally, we announced the launch of

Q&A and polls for Anchor creators, which allows listeners to

respond to short questions posed by show creators. We also expanded

the rollout of the Music + Talk format to 15 new markets, bringing

this format to 21 markets around the world.

During the quarter, we advanced our product ubiquity efforts in

several areas. We announced a partnership with Delta Airlines that

allows passengers to discover Spotify-curated music and podcasts

within Delta’s in-flight entertainment system. Additionally, we

deepened our partnership with Roku, launching a pre-loaded playback

stack, Spotify Connect discoverability, video podcast playback, and

support for Roku’s voice assistant. In August, Spotify launched a

new smartwatch experience supporting offline and direct streaming

on Google’s new Wear OS 3 platform (deployed with key brands such

as Samsung, Fossil, and Mobvoi).

Within Two-Sided Marketplace, we continued to test Discovery

Mode with record labels and distributors, where we saw Q/Q growth

in customers and Gross Profit contribution. Sponsored

Recommendations (i.e. Marquee) also continued to gain traction

during the third quarter as we expanded into more international

markets including France, Monaco, Switzerland, Germany, Austria,

and Liechtenstein.

Content

At the end of Q3, we had 3.2 million podcasts on the platform

(up from 2.9 million at the end of Q2). The percentage of MAUs that

engaged with podcast content continued to increase throughout the

quarter, marking an acceleration relative to Q2 trends. Among MAUs

that engaged with podcasts in Q3, consumption trends remained

strong (up 20% Y/Y on a per user basis) while month-over-month

retention rates continued to trend positively. During the quarter,

podcast share of overall consumption hours on our platform also

reached an all-time high.

In the United States, we released 32 new Originals &

Exclusives (“O&E”) in the quarter, including the exclusivity

launches of Armchair Expert with Dax Sheppard and Call Her Daddy in

July. We also announced a multi-year audio content partnership

between The Ringer and WWE to develop original and exclusive audio

content, as well as live audio discussions hosted on Spotify

Greenroom after every big WWE pay-per-view event.

Internationally, we released 76 new O&E podcasts, with

notable traction in India and Latin America where Originals have

been helpful in stimulating new user acquisition. Top performing

shows in these markets include: Mythpat (India), Mano a Mano

(Brazil), Paciente 63 (Caso 63 adaptation in Brazil), and Virus

2062 (Caso 63 adaptation in India). In Sweden, we announced seven

new Spotify Originals from some of the most popular artists and

talents in the country, including Spotify’s first Swedish podcast

with video, Bakom micken med Filip Dikmen.

During the quarter, our music slate also saw significant new

release activity. In late August, Kanye West’s 10th studio album,

Donda, arrived, with 16 tracks from the album occupying the top 25

of the Spotify Global Top 50 daily chart and the entire top 10 of

the Spotify US Top 50. Drake also released his highly anticipated

6th studio album Certified Lover Boy, breaking the record for the

most-streamed album in a day in Spotify history with over 150

million streams. Spotify launched a global partnership with Drake

including an offer for fans and new users to stream the album free

on-demand for the first two weeks of release. Billie Eilish

released a long-anticipated album, Happier Than Ever, in late July

which included Spotify’s first-ever artist hub with Happier Than

Ever: The Destination. The Destination features three enhanced

albums with exclusive video and audio content from Billie across

the three playlists: Billie Mode, Lyric Mode, and Fan Mode. Other

major releases in the quarter included J Balvin’s album, JOSE,

Kacey Musgraves’ album, star-crossed, Lil Nas X’s album, Montero,

and NCT 127’s album, Sticker.

Free Cash Flow

Free Cash Flow was €99 million in Q3, a €4 million decrease Y/Y

primarily due to an increase in net income adjusted for non-cash

items, partially offset by higher working capital needs arising

from higher ad receivables, podcast-related payments, and licensor

payments. Capital expenditures decreased €8 million Y/Y largely due

to finalization of various office build outs in New York City,

Singapore, and LA.

At the end of Q3, we maintained a strong liquidity position with

€3.3 billion in cash and cash equivalents, restricted cash, and

short term investments.

Q4 2021 OUTLOOK

The following forward-looking statements reflect Spotify’s

expectations as of October 27, 2021 and are subject to substantial

uncertainty. The estimates below utilize the same methodology we’ve

used in prior quarters with respect to our guidance and the

potential range of outcomes. Given the extraordinary operating

circumstances we currently face with respect to the impact of

COVID-19, there is a greater likelihood of variances with respect

to those ranges than typical quarters.

Q4 2021 Guidance: We have maintained our prior Q4 guidance for

Total MAUs, Total Premium Subscribers, and Operating Profit/Loss,

and have increased the bottom end of the range for Total Revenue

and Gross Margin.

- ● Total MAUs: 400-407 million

- ● Total Premium Subscribers: 177-181 million

- ● Total Revenue: €2.54-€2.68 billion

- Assumes approximately 250 bps tailwind to growth Y/Y due to

movements in foreign exchange rates

- ● Gross Margin: 25.1-26.1%

- ● Operating Profit/Loss: €(152)-€(72) million

SHARE REPURCHASE PROGRAM

On August 20, 2021, Spotify announced a program to repurchase up

to $1.0 billion of its ordinary shares. The repurchase program will

expire on April 21, 2026. Through September 30, 2021, the company

repurchased 157,510 shares for €30 million under this program at an

average cost of $222.86 per share.

EARNINGS QUESTION & ANSWER SESSION

We will host a live question and answer session starting at 8

a.m. ET today on investors.spotify.com. Daniel Ek, our Founder and

CEO, and Paul Vogel, our Chief Financial Officer, will be on hand

to answer questions submitted through slido.com using the event

code #SpotifyEarningsQ321. Participants also may join using

the listen-only conference line by registering through the

following site:

Direct Event Registration Portal:

http://www.directeventreg.com/registration/event/5679825

We use investors.spotify.com and newsroom.spotify.com websites

as well as other social media listed in the “Resources – Social

Media” tab of our Investors website to disclose material company

information.

Use of Non-IFRS Measures

To supplement our financial information presented in accordance

with IFRS, we use the following non-IFRS financial measures:

Revenue excluding foreign exchange effect, Premium revenue

excluding foreign exchange effect, Ad-Supported revenue excluding

foreign exchange effect, and Free Cash Flow. Management believes

that Revenue excluding foreign exchange effect, Premium revenue

excluding foreign exchange effect, and Ad-Supported revenue

excluding foreign exchange effect are useful to investors because

they present measures that facilitate comparison to our historical

performance. However, Revenue excluding foreign exchange effect,

Premium revenue excluding foreign exchange effect, and Ad-Supported

revenue excluding foreign exchange effect should be considered in

addition to, not as a substitute for or superior to, Revenue,

Premium revenue, Ad-Supported revenue or other financial measures

prepared in accordance with IFRS. Management believes that Free

Cash Flow is useful to investors because it presents a measure that

approximates the amount of cash generated that is available to

repay debt obligations, to make investments, and for certain other

activities that exclude certain infrequently occurring and/or

non-cash items. However, Free Cash Flow should be considered in

addition to, not as a substitute for or superior to, net cash flows

(used in)/from operating activities or other financial measures

prepared in accordance with IFRS. For more information on these

non-IFRS financial measures, please see “Reconciliation of IFRS to

Non-IFRS Results” table.

Forward Looking Statements

This shareholder letter contains estimates and forward-looking

statements. All statements other than statements of historical fact

are forward-looking statements. The words “may,” “might,” “will,”

“could,” “would,” “should,” “expect,” “plan,” “anticipate,”

“intend,” “seek,” “believe,” “estimate,” “predict,” “potential,”

“continue,” “contemplate,” “possible,” and similar words are

intended to identify estimates and forward-looking statements.

Our estimates and forward-looking statements are mainly based on

our current expectations and estimates of future events and trends,

which affect or may affect our businesses and operations. Although

we believe that these estimates and forward-looking statements are

based upon reasonable assumptions, they are subject to numerous

risks and uncertainties and are made in light of information

currently available to us. Many important factors may adversely

affect our results as indicated in forward-looking statements.

These factors include, but are not limited to: our ability to

attract prospective users and to retain existing users; competition

for users, user listening time, and advertisers; risks associated

with our international expansion and our ability to manage our

growth; our ability to predict, recommend, and play content that

our users enjoy; our ability to effectively monetize our Service;

our ability to generate sufficient revenue to be profitable or to

generate positive cash flow and grow on a sustained basis; risks

associated with the expansion of our operations to deliver

non-music content, including podcasts, including increased

business, legal, financial, reputational, and competitive risks;

potential disputes or liabilities associated with content made

available on our Service; risks relating to the acquisition,

investment, and disposition of companies or technologies; our

dependence upon third-party licenses for most of the content we

stream; our lack of control over the providers of our content and

their effect on our access to music and other content; our ability

to comply with the many complex license agreements to which we are

a party; our ability to accurately estimate the amounts payable

under our license agreements; the limitations on our operating

flexibility due to the minimum guarantees required under certain of

our license agreements; our ability to obtain accurate and

comprehensive information about the compositions embodied in sound

recordings in order to obtain necessary licenses or perform

obligations under our existing license agreements; new copyright

legislation and related regulations that may increase the cost

and/or difficulty of music licensing; assertions by third parties

of infringement or other violations by us of their intellectual

property rights; our ability to protect our intellectual property;

the dependence of streaming on operating systems, online platforms,

hardware, networks, regulations, and standards that we do not

control; potential breaches of our security systems or systems of

third parties, including as a result of our Work From Anywhere

program; interruptions, delays, or discontinuations in service in

our systems or systems of third parties; changes in laws or

regulations affecting us; risks relating to privacy and protection

of user data; our ability to maintain, protect, and enhance our

brand; payment-related risks; our ability to hire and retain key

personnel, and challenges to productivity and integration as a

result of our Work From Anywhere program; our ability to accurately

estimate our user metrics and other estimates; risks associated

with manipulation of stream counts and user accounts and

unauthorized access to our services; tax-related risks; the

concentration of voting power among our founders who have and will

continue to have substantial control over our business; risks

related to our status as a foreign private issuer; international,

national or local economic, social or political conditions; risks

associated with accounting estimates, currency fluctuations and

foreign exchange controls; and the impact of the COVID-19 pandemic

on our business and operations, including any adverse impact on

advertising sales or subscriber revenue; risks related to our debt,

including limitations on our cash flow for operations and our

ability to satisfy our obligations under the Exchangeable Notes;

our ability to raise the funds necessary to repurchase the

Exchangeable Notes for cash, under certain circumstances, or to pay

any cash amounts due upon exchange; provisions in the indenture

governing the Exchangeable Notes delaying or preventing an

otherwise beneficial takeover of us; and any adverse impact on our

reported financial condition and results from the accounting

methods for the Exchangeable Notes. A detailed discussion of these

and other risks and uncertainties that could cause actual results

and events to differ materially from our estimates and

forward-looking statements is included in our filings with the U.S.

Securities and Exchange Commission (“SEC”), including our Annual

Report on Form 20-F filed with the SEC on February 5, 2021, as

updated by subsequently filed reports for our interim results on

Form 6-K. We undertake no obligation to update forward-looking

statements to reflect events or circumstances occurring after the

date of this shareholder letter.

Rounding

Certain monetary amounts, percentages, and other figures

included in this letter have been subject to rounding adjustments.

The sum of individual metrics may not always equal total amounts

indicated due to rounding.

Interim condensed consolidated

statement of operations

(Unaudited)

(in € millions, except share and per share

data)

Three months ended

Nine months ended

September 30, 2021

June 30, 2021

September 30, 2020

September 30, 2021

September 30, 2020

Revenue

2,501

2,331

1,975

6,979

5,712

Cost of revenue

1,833

1,668

1,486

5,100

4,272

Gross profit

668

663

489

1,879

1,440

Research and development

208

255

176

659

605

Sales and marketing

280

279

256

795

735

General and administrative

105

117

97

324

324

593

651

529

1,778

1,664

Operating income/(loss)

75

12

(40)

101

(224)

Finance income

101

21

14

226

90

Finance costs

(14)

(25)

(90)

(70)

(396)

Finance income/(costs) - net

87

(4)

(76)

156

(306)

Income/(loss) before tax

162

8

(116)

257

(530)

Income tax expense/(benefit)

160

28

(15)

252

(74)

Net income/(loss) attributable to

owners of the parent

2

(20)

(101)

5

(456)

Earnings/(loss) per share attributable

to owners of the parent

Basic

0.01

(0.10)

(0.53)

0.02

(2.44)

Diluted

(0.41)

(0.19)

(0.58)

(0.85)

(2.44)

Weighted-average ordinary shares

outstanding

Basic

191,485,473

191,172,946

188,842,828

191,077,975

186,821,414

Diluted

194,551,862

194,084,446

189,054,064

193,559,697

186,821,414

Condensed consolidated statement of

financial position

(Unaudited)

(in € millions)

September 30, 2021

December 31, 2020

Assets

Non-current assets

Lease right-of-use assets

443

444

Property and equipment

369

313

Goodwill

869

736

Intangible assets

91

97

Long term investments

1,090

2,277

Restricted cash and other non-current

assets

77

78

Deferred tax assets

13

15

2,952

3,960

Current assets

Trade and other receivables

571

464

Income tax receivable

5

4

Short term investments

725

596

Cash and cash equivalents

2,512

1,151

Other current assets

224

151

4,037

2,366

Total assets

6,989

6,326

Equity and liabilities

Equity

Share capital

—

—

Other paid in capital

4,681

4,583

Treasury shares

(201)

(175)

Other reserves

922

1,687

Accumulated deficit

(3,285)

(3,290)

Equity attributable to owners of the

parent

2,117

2,805

Non-current liabilities

Exchangeable Notes

1,175

—

Lease liabilities

582

577

Accrued expenses and other liabilities

37

42

Provisions

3

2

1,797

621

Current liabilities

Trade and other payables

774

638

Income tax payable

10

9

Deferred revenue

440

380

Accrued expenses and other liabilities

1,751

1,748

Provisions

16

20

Derivative liabilities

84

105

3,075

2,900

Total liabilities

4,872

3,521

Total equity and liabilities

6,989

6,326

Interim condensed consolidated

statement of cash flows

(Unaudited)

(in € millions)

Three months ended

Nine months ended

September 30, 2021

June 30, 2021

September 30, 2020

September 30, 2021

September 30, 2020

Operating activities

Net income/(loss)

2

(20)

(101)

5

(456)

Adjustments to reconcile net income/(loss)

to net cash flows

Depreciation of property and equipment and

lease right-of-use assets

24

23

21

69

65

Amortization of intangible assets

9

8

7

25

17

Share-based compensation expense

57

68

46

173

133

Finance income

(101)

(21)

(14)

(226)

(90)

Finance costs

14

25

90

70

396

Income tax expense/(benefit)

160

28

(15)

252

(74)

Other

(2)

3

(3)

3

3

Changes in working capital:

Increase in trade receivables and other

assets

(102)

(95)

(76)

(182)

(93)

Increase in trade and other

liabilities

82

30

155

45

243

(Decrease)/increase in deferred

revenue

(4)

17

20

50

50

(Decrease)/increase in provisions

(2)

—

7

(3)

6

Interest paid on lease liabilities

(13)

(13)

(13)

(37)

(43)

Interest received

1

2

—

3

3

Income tax paid

(2)

(1)

(2)

(5)

(8)

Net cash flows from operating

activities

123

54

122

242

152

Investing activities

Business combinations, net of cash

acquired

—

(42)

—

(101)

(137)

Purchases of property and equipment

(25)

(20)

(17)

(69)

(43)

Purchases of short term investments

(161)

(109)

(305)

(385)

(948)

Sales and maturities of short term

investments

63

134

197

287

916

Change in restricted cash

1

—

(2)

1

—

Other

1

(2)

(7)

(7)

(28)

Net cash flows used in investing

activities

(121)

(39)

(134)

(274)

(240)

Financing activities

Payments of lease liabilities

(9)

(8)

(6)

(25)

(16)

Lease incentives received

7

—

6

7

13

Proceeds from exercise of stock

options

26

26

96

103

274

Proceeds from issuance of Exchangeable

Notes, net of costs

—

—

—

1,223

—

Proceeds from issuance of warrants

31

—

—

31

—

Repurchases of ordinary shares

(24)

—

—

(24)

—

Payments for employee taxes withheld from

restricted

stock unit releases

(12)

(12)

(11)

(40)

(19)

Net cash flows from financing

activities

19

6

85

1,275

252

Net increase in cash and cash

equivalents

21

21

73

1,243

164

Cash and cash equivalents at beginning of

the period

2,440

2,442

1,148

1,151

1,065

Net foreign exchange gains/(losses) on

cash and cash equivalents

51

(23)

(39)

118

(47)

Cash and cash equivalents at period

end

2,512

2,440

1,182

2,512

1,182

Calculation of basic and diluted

earnings/(loss) per share

(Unaudited)

(in € millions, except share and per share

data)

Three months ended

Nine months ended

September 30, 2021

June 30, 2021

September 30, 2020

September 30, 2021

September 30, 2020

Basic earnings/(loss) per share

Net income/(loss) attributable to owners

of the parent

2

(20)

(101)

5

(456)

Share used in computation:

Weighted-average ordinary shares

outstanding

191,485,473

191,172,946

188,842,828

191,077,975

186,821,414

Basic earnings/(loss) per share

attributable to owners of the parent

0.01

(0.10)

(0.53)

0.02

(2.44)

Diluted loss per share

Net income/(loss) attributable to owners

of the parent

2

(20)

(101)

5

(456)

Fair value gains on dilutive warrants

(30)

—

(9)

(51)

Fair value gains on dilutive Exchangeable

Notes

(52)

(17)

—

(117)

—

Net loss used in the computation of

diluted loss per share

(80)

(37)

(110)

(163)

(456)

Shares used in computation:

Weighted-average ordinary shares

outstanding

191,485,473

191,172,946

188,842,828

191,077,975

186,821,414

Warrants

154,889

—

211,236

229,029

—

Exchangeable Notes

2,911,500

2,911,500

—

2,252,693

—

Diluted weighted-average ordinary

shares

194,551,862

194,084,446

189,054,064

193,559,697

186,821,414

Diluted loss per share attributable

to owners of the parent

(0.41)

(0.19)

(0.58)

(0.85)

(2.44)

Reconciliation of IFRS to Non-IFRS

Results

(Unaudited)

(in € millions, except percentages)

Three months ended

Nine months ended

September 30, 2021

September 30, 2020

September 30, 2021

September 30, 2020

IFRS revenue

2,501

1,975

6,979

5,712

Foreign exchange effect on 2021 revenue

using 2020 rates

15

(180)

Revenue excluding foreign exchange

effect

2,486

7,159

IFRS revenue year-over-year change %

27

%

22

%

Revenue excluding foreign exchange effect

year-over-year change %

26

%

25

%

IFRS Premium revenue

2,178

1,790

6,165

5,248

Foreign exchange effect on 2021 Premium

revenue using 2020 rates

16

(142)

Premium revenue excluding foreign exchange

effect

2,162

6,307

IFRS Premium revenue year-over-year change

%

22

%

17

%

Premium revenue excluding foreign exchange

effect year-over-year change %

21

%

20

%

IFRS Ad-Supported revenue

323

185

814

464

Foreign exchange effect on 2021

Ad-Supported revenue using 2020 rates

(1)

(38)

Ad-Supported revenue excluding foreign

exchange effect

324

852

IFRS Ad-Supported revenue year-over-year

change %

75

%

75

%

Ad-Supported revenue excluding foreign

exchange effect year-over-year change %

75

%

84

%

Free Cash Flow

(Unaudited)

(in € millions)

Three months ended

Nine months ended

September 30, 2021

June 30, 2021

September 30, 2020

September 30, 2021

September 30, 2020

Net cash flows from operating

activities

123

54

122

242

152

Capital expenditures

(25)

(20)

(17)

(69)

(43)

Change in restricted cash

1

—

(2)

1

—

Free Cash Flow

99

34

103

174

109

1 Free Cash Flow is a non-IFRS measure. See “Use of Non-IFRS

Measures” and “Reconciliation of IFRS to Non-IFRS Results” for

additional information.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20211027005313/en/

Investor Relations: Bryan Goldberg Lauren Katzen ir@spotify.com

Public Relations: Dustee Jenkins press@spotify.com

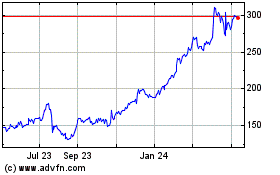

Spotify Technology (NYSE:SPOT)

Historical Stock Chart

From Oct 2024 to Nov 2024

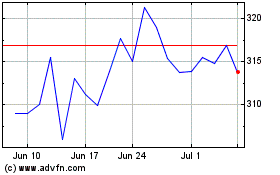

Spotify Technology (NYSE:SPOT)

Historical Stock Chart

From Nov 2023 to Nov 2024