Spotify Technology S.A. (NYSE:SPOT):

This press release features multimedia. View

the full release here:

https://www.businesswire.com/news/home/20210728005343/en/

(Graphic: Business Wire)

Dear Shareholders,

Most of our major metrics -- Subscriber growth, Revenue, Gross

Margin, and Operating Income -- performed better than expected this

quarter. The exception was MAUs, where we fell short of our

guidance range. The quarter was led by improving ARPU, decreased

churn, a return to per user consumption growth, and significant

advertising strength. We did see a second quarter of greater MAU

variability mainly due to ongoing COVID-19 headwinds and a

temporary issue related to user intake on a third party platform.

However, trends improved in the back half of the quarter.

Additionally, we generated positive Free Cash Flow of €34

million.

MONTHLY ACTIVE USERS (“MAUs”)

Total MAUs grew 22% Y/Y to 365 million in the quarter, finishing

below our guidance range and forecast. Despite our

underperformance, we added 9 million MAUs in Q2, which drove double

digit Y/Y growth in all regions.

MAU performance was slower than expected due primarily to

lighter user intake during the first half of the quarter. COVID-19

continued to weigh on our performance in several markets, and, in

some instances, we paused marketing campaigns due to the severity

of the pandemic. Separately, a user sign-up issue associated with a

global third party platform created unexpected intake friction,

which also impacted MAU growth. This issue has since been

resolved.

Overall, we saw a return to better growth patterns in the back

half of the quarter. Although we continue to face near-term

uncertainty with respect to COVID-19, we remain confident in the

underlying health of our user funnel, and our existing user

retention activity remains consistent with historical trends.

Global consumption hours continued to grow meaningfully in Q2 on

a Y/Y basis. On a per user basis, global consumption levels

returned to Y/Y growth in the quarter, led by gains in developed

regions such as North America and Europe.

PREMIUM SUBSCRIBERS

Our Premium Subscribers grew 20% Y/Y to 165 million in the

quarter, towards the upper end of our guidance range and modestly

ahead of forecast. We added 7 million subscribers in Q2, which

drove healthy double digit Y/Y growth across all regions. We saw

strong performance of our Standard product across both Europe and

North America.

Compared with the last few years, we shortened our mid-year

promotional campaign cycle from 6 weeks to 4 weeks, and performance

exceeded expectations. Additionally, we added or expanded several

major promotional partnerships in the quarter, including a renewal

and expansion of our Samsung promotion (offering 3 month trials in

73 markets to all new and existing mobile/speaker/wearable and

appliance devices), a renewal and expansion of our Microsoft

Gamepass promotion (offering 3 or 4 month trials in 15 markets), a

new Epic/Fortnite promotion (3 month trial in 25 markets), a

renewal of our Paypal promotion (3 month trial in 10 markets), and

a renewal and expansion of our Vivo promotion (3 month trial in

Brazil). Additionally, we announced a new promotion with TikTok (3

or 4 month trial across 7 countries in EMEA) which launched in mid

July.

Our average monthly Premium churn rate for the quarter was down

23 bps Y/Y and down modestly Q/Q. The Y/Y improvement continues to

be driven by the adoption of our higher retention offerings like

Duo and Family Plans in addition to growth in high retention

regions.

FINANCIAL METRICS

Revenue

Revenue of €2,331 million grew 23% Y/Y in Q2 (or 28% Y/Y on a

constant currency basis) and was toward the top end of our guidance

range due to significant advertising strength and subscriber

outperformance. FX headwinds of 430 bps were 230 bps greater than

expected, primarily driven by US dollar weakness vs. the Euro.

Premium Revenue grew 17% Y/Y to €2,056 million (or 20% Y/Y constant

currency) while Ad-Supported Revenue was particularly strong,

growing 110% Y/Y to €275 million (or 126% Y/Y constant

currency).

Within Premium, average revenue per user (“ARPU”) of €4.29 in Q2

was down 3% Y/Y (or flat Y/Y constant currency vs. down 1% Y/Y in

Q1). Excluding the impact of FX, we saw a benefit to ARPU from our

Q1 price increases along with a marginal initial impact from Q2

price increases, offset by the impact of product mix shift.

Ad-Supported Revenue outperformed our forecast, driven by strong

underlying demand (benefiting sellout and pricing) and aided by

favorable comps vs. last year's COVID-19 lows. The strength in

Ad-Supported Revenue was led by our Direct and Podcast sales

channels, with the latter benefiting from a triple-digit Y/Y gain

at existing Spotify studios (The Ringer, Parcast, Spotify Studios,

and Gimlet) along with contributions from the Megaphone

acquisition, the exclusive licensing of the Joe Rogan Experience,

and Higher Ground. Ad Studio grew 165% Y/Y due to the success of

the video product within Ad Studio and international market

contributions.

We are very pleased with the initial performance of the Spotify

Audience Network which launched in the US in April. The rollout

allowed us to increase our monetizable podcast inventory in the US

by nearly 3x. Additionally, for opted-in podcast publishers we’ve

seen a double digit increase in fill rates, a meaningful increase

in unique advertisers, and a double digit lift in CPMs. On July 1,

we expanded the Spotify Audience Network to include Australia,

Canada, and the United Kingdom.

Gross Margin

Gross Margin finished at 28.4% in Q2, above the top end of our

guidance range and reflecting 308 bps of Y/Y expansion. While we

did benefit from the release of accruals for prior period

publishing royalty estimates, excluding the impact of these items,

Gross Margin would have been 26.5%, ahead of our expectations. The

Gross Margin improvement excluding these releases was driven by a

favorable revenue mix shift towards podcasts, marketplace activity,

and Other Cost of Revenue efficiencies (e.g. payment fees,

streaming delivery costs), which were partially offset by higher

non-music and other content costs and publishing rate

increases.

Premium Gross Margin was 30.8% in Q2, up 261 bps Y/Y and

Ad-Supported Gross Margin was 11.3% in Q2, up 2,321 bps Y/Y. As a

reminder, all content costs related to podcast investment are

included in the Ad-Supported business for the current and

historical periods.

Operating Expenses

Operating Expenses totaled €651 million in Q2, an increase of 1%

Y/Y (or 5% Y/Y constant currency) and in line with our plan.

Excluding the benefits of currency movements, Operating Expenses

were modestly higher than forecast as lower than expected marketing

expenses arising from campaign timing shifts were offset by higher

personnel costs.

Social Charges were approximately €2 million higher than

forecast due to an increase in our share price during the quarter.

Excluding the impact of Social Charges in both periods, Operating

Expenses grew roughly in line with revenue. As a reminder, Social

Charges are payroll taxes associated with employee salaries and

benefits, including share-based compensation. We are subject to

social taxes in several countries in which we operate, although

Sweden accounts for the bulk of the social costs. We don’t forecast

stock price changes in our guidance so upward or downward movements

will impact our reported operating expenses.

At the end of Q2, our workforce consisted of 7,085 FTEs

globally.

Product and Platform

During the quarter, we continued to increase the pace of our

innovation efforts. On June 16, we soft-launched Spotify Greenroom,

a redesigned version of Betty Lab’s Locker Room app, as part of our

entry into the live audio space. This mobile app allows users to

join or host live audio rooms, and optionally turn those

conversations into podcasts. Additionally, we announced a Creator

Fund bringing new exciting content to users and helping those

creators get rewarded for the content they create on the platform.

We expect to move to a full commercial launch of Spotify Greenroom

later this year, with an initial focus on sports, pop culture,

music, and entertainment.

During the quarter, we began rolling out our paid subscription

platform for podcasters in the US. Additionally, as part of our

Spotify Open Access platform strategy, we announced several new

partnerships aimed at opening our platform to third-party paywalled

content with the goal of becoming the world’s leading audio

browser. On May 20, we partnered with Storytel, one of the world’s

leading audiobook streaming services, to give Storytel subscribers

the ability to enjoy their library of audiobooks on Spotify. On

July 27, we announced more than 10 new Spotify Open Access partners

-- with more to come -- all of which will be able to activate their

subscriber base on Spotify while retaining full control over their

content.

We continue to improve our search capability expanding our

functionality to include filters and voice search making it quicker

and more efficient for users to find content. Additionally, we

rolled out a new version of Your Library to all Spotify mobile

users that creates a streamlined way for listeners to explore their

collection and find saved music and podcasts more easily.

During the quarter, we also advanced our product ubiquity

efforts in a number of key areas. We introduced a new miniplayer

experience that allows listeners to share, explore, and discover

audio from Spotify directly within Facebook, without switching

between apps. On the Apple Watch, we rolled out the capability for

users to download playlists, albums, and podcasts to their watch.

Finally, we expanded our video podcast footprint to Xbox gaming

consoles and went live with the Spotify X1 integration to Rogers

Communications customers in Canada.

Content

At the end of Q2, we had 2.9 million podcasts on the platform

(up from 2.6 million at the end of Q1). The percentage of MAUs that

engaged with podcast content on our platform improved modestly

relative to Q1. Among MAUs that engaged with podcasts in Q2,

consumption trends were strong (up 95% Y/Y in aggregate and more

than 30% Y/Y on a per user basis) while week-over-week and

month-over-month retention rates reached all-time highs. During the

quarter, podcast share of overall consumption hours on our platform

also reached an all-time high.

During the quarter, we announced exclusive licensing deals with

Call Her Daddy and Armchair Expert, both of which are now

exclusively on Spotify. The Joe Rogan Experience continues to

perform above expectations, and The Ringer shows, such as The Bill

Simmons Podcast, grew consumption significantly as the NBA headed

into the playoffs.

Internationally, we released 100 new Originals & Exclusives

(“O&E”) podcasts across markets including 5 adaptations of

existing formats. We expanded Your Daily Drive to include Mexico

(Ruta Diaria), Argentina (Ruta Diaria), and Brazil (Caminho

Diário). The launches included bespoke content from 28 partners

across the region, such as notable new organizations like Infobae

and La Nación (Argentina), W Radio (Mexico), and 123 Segundos

(Brazil), a Spotify original. One of the top podcasts in India, The

Ranveer Show, which covers topics like health, spirituality, and

lifestyle, also came exclusively to Spotify in June.

In Q2, Olivia Rodrigo’s album, SOUR, set the record for biggest

streaming debut for any album on Spotify this year with over 63

million global first day streams. Other major releases in the

quarter include BTS single, Butter, Griff’s Album, One Foot In

Front Of The Other, and Doja Cat’s album, Planet Her. Spotify also

launched a new Fresh Finds marketing program to celebrate Indie

artists in the US as well as expanding the playlist via localized

editions in 13 territories around the world. Fresh Finds, which

first launched in 2016, has playlisted over 25,000 artists and

built a reputation among users and in the industry as the go-to

destination to discover new Indie acts. In addition, of artists

whose first editorial playlist is Fresh Finds, over 44% go on to be

playlisted in another editorial property on Spotify.

Two-Sided Marketplace

We continue to test Discovery Mode with a small set of labels

and licensors including major labels, independent labels, and

independent artist distributors. Thus far, artists with tracks in

Discovery Mode have found over 40% more listeners on average

compared to pre-Discovery Mode. Additionally, 44% of those

listeners had never listened to the artist before. We are

integrating feedback from our early partners with a broader rollout

of Discovery Mode expected later this year with the main goal of

facilitating more artist to fan connections.

Sponsored Recommendations (i.e. Marquee) continued to gain

traction during the second quarter as we expanded into more

international markets including Australia, Ireland, New Zealand,

and the UK. We also rolled out new functionality for artist teams

using the self-serve platform to target specific audience segments

(casual listeners, lapsed listeners, and recently interested

listeners) with their campaigns, a functionality previously only

available to customers purchasing through our sales team.

Free Cash Flow

Free Cash Flow was €34 million in Q2, a €7 million increase Y/Y

primarily due to an increase in net income adjusted for non-cash

items, partially offset by higher working capital needs arising

from select licensor payments (delayed from Q1), podcast-related

payments, and higher ad-receivables. Capital expenditures increased

€6 million Y/Y largely due to office build outs in LA, Berlin, and

Miami.

At the end of Q2, we maintained a strong liquidity position with

€3.1 billion in cash and cash equivalents, restricted cash, and

short term investments.

Q3 & Q4 2021 OUTLOOK

The following forward-looking statements reflect Spotify’s

expectations as of July 28, 2021 and are subject to substantial

uncertainty. The estimates below utilize the same methodology we’ve

used in prior quarters with respect to our guidance and the

potential range of outcomes. Given the extraordinary operating

circumstances we currently face with respect to the impact of

COVID-19, there is a greater likelihood of variances with respect

to those ranges than typical quarters.

Q3 2021 Guidance:

- Total MAUs: 377-382 million

- Total Premium Subscribers: 170-174 million

- Total Revenue: €2.31-€2.51 billion

- Assumes approximately 60 bps tailwind to growth Y/Y due to

movements in foreign exchange rates

- Gross Margin: 24.4-26.4%

- Operating Profit/Loss: €(80)-€0 million

Q4 2021 Guidance:

- Total MAUs: 400-407 million

- Total Premium Subscribers: 177-181 million

- Total Revenue: €2.48-€2.68 billion

- Assumes approximately 175 bps tailwind to growth Y/Y due to

movements in foreign exchange rates

- Gross Margin: 24.1-26.1%

- Operating Profit/Loss: €(152)-€(72) million

EARNINGS QUESTION & ANSWER SESSION

We will host a live question and answer session starting at 8

a.m. ET today on investors.spotify.com. Daniel Ek, our Founder and

CEO, and Paul Vogel, our Chief Financial Officer, will be on hand

to answer questions submitted through slido.com using the event

code #SpotifyEarningsQ221. Participants also may join using

the listen-only conference line by registering through the

following site:

Direct Event Registration Portal:

http://www.directeventreg.com/registration/event/6039475

We use investors.spotify.com and newsroom.spotify.com websites

as well as other social media listed in the “Resources – Social

Media” tab of our Investors website to disclose material company

information.

Use of Non-IFRS Measures

To supplement our financial information presented in accordance

with IFRS, we use the following non-IFRS financial measures:

Revenue excluding foreign exchange effect, Premium revenue

excluding foreign exchange effect, Ad-Supported revenue excluding

foreign exchange effect, Gross margin excluding release of accruals

for prior period publishing royalty estimate, Operating expense

excluding foreign exchange effect, Operating expense excluding

social charge, and Free Cash Flow. Management believes that Revenue

excluding foreign exchange effect, Premium revenue excluding

foreign exchange effect, Gross margin excluding release of accruals

for prior period publishing royalty estimate, Operating expense

excluding foreign exchange effect, Operating expense excluding

social charge are useful to investors because they present measures

that facilitate comparison to our historical performance. However,

Revenue excluding foreign exchange effect, Premium revenue

excluding foreign exchange effect, Ad-Supported revenue excluding

foreign exchange effect, Gross margin excluding release of accruals

for prior period publishing royalty estimate, Operating expense

excluding foreign exchange effect, Operating expense excluding

social charge, should be considered in addition to, not as a

substitute for or superior to, Revenue, Premium revenue,

Ad-Supported revenue, Gross margin, Operating expense or other

financial measures prepared in accordance with IFRS. Management

believes that Free Cash Flow is useful to investors because it

presents a measure that approximates the amount of cash generated

that is available to repay debt obligations, to make investments,

and for certain other activities that exclude certain infrequently

occurring and/or non-cash items. However, Free Cash Flow should be

considered in addition to, not as a substitute for or superior to,

net cash flows (used in)/from operating activities or other

financial measures prepared in accordance with IFRS. For more

information on these non-IFRS financial measures, please see

“Reconciliation of IFRS to Non-IFRS Results” table.

Forward Looking Statements

This shareholder letter contains estimates and forward-looking

statements. All statements other than statements of historical fact

are forward-looking statements. The words “may,” “might,” “will,”

“could,” “would,” “should,” “expect,” “plan,” “anticipate,”

“intend,” “seek,” “believe,” “estimate,” “predict,” “potential,”

“continue,” “contemplate,” “possible,” and similar words are

intended to identify estimates and forward-looking statements.

Our estimates and forward-looking statements are mainly based on

our current expectations and estimates of future events and trends,

which affect or may affect our businesses and operations. Although

we believe that these estimates and forward-looking statements are

based upon reasonable assumptions, they are subject to numerous

risks and uncertainties and are made in light of information

currently available to us. Many important factors may adversely

affect our results as indicated in forward-looking statements.

These factors include, but are not limited to: our ability to

attract prospective users and to retain existing users; competition

for users, user listening time, and advertisers; risks associated

with our international expansion and our ability to manage our

growth; our ability to predict, recommend, and play content that

our users enjoy; our ability to effectively monetize our Service;

our ability to generate sufficient revenue to be profitable or to

generate positive cash flow and grow on a sustained basis; risks

associated with the expansion of our operations to deliver

non-music content, including podcasts, including increased

business, legal, financial, reputational, and competitive risks;

potential disputes or liabilities associated with content made

available on our Service; risks relating to the acquisition,

investment, and disposition of companies or technologies; our

dependence upon third-party licenses for most of the content we

stream; our lack of control over the providers of our content and

their effect on our access to music and other content; our ability

to comply with the many complex license agreements to which we are

a party; our ability to accurately estimate the amounts payable

under our license agreements; the limitations on our operating

flexibility due to the minimum guarantees required under certain of

our license agreements; our ability to obtain accurate and

comprehensive information about the compositions embodied in sound

recordings in order to obtain necessary licenses or perform

obligations under our existing license agreements; new copyright

legislation and related regulations that may increase the cost

and/or difficulty of music licensing; assertions by third parties

of infringement or other violations by us of their intellectual

property rights; our ability to protect our intellectual property;

the dependence of streaming on operating systems, online platforms,

hardware, networks, regulations, and standards that we do not

control; potential breaches of our security systems or systems of

third parties, including as a result of our Work From Anywhere

program; interruptions, delays, or discontinuations in service in

our systems or systems of third parties; changes in laws or

regulations affecting us; risks relating to privacy and protection

of user data; our ability to maintain, protect, and enhance our

brand; payment-related risks; our ability to hire and retain key

personnel, and challenges to productivity and integration as a

result of our Work From Anywhere program; our ability to accurately

estimate our user metrics and other estimates; risks associated

with manipulation of stream counts and user accounts and

unauthorized access to our services; tax-related risks; the

concentration of voting power among our founders who have and will

continue to have substantial control over our business; risks

related to our status as a foreign private issuer; international,

national or local economic, social or political conditions; risks

associated with accounting estimates, currency fluctuations and

foreign exchange controls; and the impact of the COVID-19 pandemic

on our business and operations, including any adverse impact on

advertising sales or subscriber revenue; risks related to our debt,

including limitations on our cash flow for operations and our

ability to satisfy our obligations under the Exchangeable Notes;

our ability to raise the funds necessary to repurchase the

Exchangeable Notes for cash, under certain circumstances, or to pay

any cash amounts due upon exchange; provisions in the indenture

governing the Exchangeable Notes delaying or preventing an

otherwise beneficial takeover of us; and any adverse impact on our

reported financial condition and results from the accounting

methods for the Exchangeable Notes. A detailed discussion of these

and other risks and uncertainties that could cause actual results

and events to differ materially from our estimates and

forward-looking statements is included in our filings with the U.S.

Securities and Exchange Commission (“SEC”), including our Annual

Report on Form 20-F filed with the SEC on February 5, 2021, as

updated by subsequently filed reports for our interim results on

Form 6-K. We undertake no obligation to update forward-looking

statements to reflect events or circumstances occurring after the

date of this shareholder letter.

Rounding

Certain monetary amounts, percentages, and other figures

included in this letter have been subject to rounding adjustments.

The sum of individual metrics may not always equal total amounts

indicated due to rounding.

Interim condensed consolidated statement of operations

(Unaudited) (in € millions, except share and per share data)

Three months ended

Six months ended

June 30, 2021

March 31, 2021

June 30, 2020

June 30, 2021

June 30, 2020

Revenue

2,331

2,147

1,889

4,478

3,737

Cost of revenue

1,668

1,599

1,410

3,267

2,786

Gross profit

663

548

479

1,211

951

Research and development

255

196

267

451

429

Sales and marketing

279

236

248

515

479

General and administrative

117

102

131

219

227

651

534

646

1,185

1,135

Operating income/(loss)

12

14

(167)

26

(184)

Finance income

21

104

6

125

76

Finance costs

(25)

(31)

(294)

(56)

(306)

Finance income/(costs) - net

(4)

73

(288)

69

(230)

Income/(loss) before tax

8

87

(455)

95

(414)

Income tax expense/(benefit)

28

64

(99)

92

(59)

Net (loss)/income attributable to

owners of the parent

(20)

23

(356)

3

(355)

(Loss)/earnings per share attributable

to owners of the parent

Basic

(0.10)

0.12

(1.91)

0.02

(1.91)

Diluted

(0.19)

(0.25)

(1.91)

(0.44)

(1.91)

Weighted-average ordinary shares

outstanding

Basic

191,172,946

190,565,397

186,552,877

190,870,850

185,799,600

Diluted

194,084,446

191,815,695

186,552,877

193,051,280

185,799,600

Condensed consolidated statement of financial position

(Unaudited) (in € millions)

June 30, 2021

December 31, 2020

Assets

Non-current assets

Lease right-of-use assets

441

444

Property and equipment

351

313

Goodwill

851

736

Intangible assets

95

97

Long term investments

1,897

2,277

Restricted cash and other non-current

assets

78

78

Deferred tax assets

17

15

3,730

3,960

Current assets

Trade and other receivables

492

464

Income tax receivable

6

4

Short term investments

612

596

Cash and cash equivalents

2,440

1,151

Other current assets

201

151

3,751

2,366

Total assets

7,481

6,326

Equity and liabilities

Equity

Share capital

—

—

Other paid in capital

4,656

4,583

Treasury shares

(171

)

(175

)

Other reserves

1,501

1,687

Accumulated deficit

(3,287

)

(3,290

)

Equity attributable to owners of the

parent

2,699

2,805

Non-current liabilities

Exchangeable Notes

1,199

—

Lease liabilities

576

577

Accrued expenses and other liabilities

36

42

Provisions

2

2

1,813

621

Current liabilities

Trade and other payables

705

638

Income tax payable

11

9

Deferred revenue

439

380

Accrued expenses and other liabilities

1,707

1,748

Provisions

20

20

Derivative liabilities

87

105

2,969

2,900

Total liabilities

4,782

3,521

Total equity and liabilities

7,481

6,326

Interim condensed consolidated statement of cash flows

(Unaudited) (in € millions)

Three months ended

Six months ended

June 30, 2021

March 31, 2021

June 30, 2020

June 30, 2021

June 30, 2020

Operating activities

Net (loss)/income

(20

)

23

(356

)

3

(355

)

Adjustments to reconcile net (loss)/income

to net cash flows

Depreciation of property and equipment and

lease right-of-use assets

23

22

23

45

44

Amortization of intangible assets

8

8

5

16

10

Share-based payments expense

68

48

50

116

87

Finance income

(21

)

(104

)

(6

)

(125

)

(76

)

Finance costs

25

31

294

56

306

Income tax expense/(benefit)

28

64

(99

)

92

(59

)

Other

3

2

2

5

6

Changes in working capital:

(Increase)/decrease in trade receivables

and other assets

(95

)

15

(39

)

(80

)

(17

)

Increase/(decrease) in trade and other

liabilities

30

(67

)

151

(37

)

88

Increase in deferred revenue

17

37

34

54

30

Decrease in provisions

—

(1

)

—

(1

)

(1

)

Interest paid on lease liabilities

(13

)

(11

)

(15

)

(24

)

(30

)

Interest received

2

—

—

2

3

Income tax paid

(1

)

(2

)

(5

)

(3

)

(6

)

Net cash flows from operating

activities

54

65

39

119

30

Investing activities

Business combinations, net of cash

acquired

(42

)

(59

)

—

(101

)

(137

)

Purchases of property and equipment

(20

)

(24

)

(14

)

(44

)

(26

)

Purchases of short term investments

(109

)

(115

)

(145

)

(224

)

(643

)

Sales and maturities of short term

investments

134

90

242

224

719

Change in restricted cash

—

—

2

—

2

Other

(2

)

(6

)

(7

)

(8

)

(21

)

Net cash flows (used in)/from investing

activities

(39

)

(114

)

78

(153

)

(106

)

Financing activities

Payments of lease liabilities

(8

)

(8

)

(6

)

(16

)

(10

)

Proceeds from exercise of stock

options

26

51

101

77

178

Proceeds from issuance of Exchangeable

Notes, net of costs

—

1,223

—

1,223

—

Payments for employee taxes withheld from

restricted

stock unit releases

(12

)

(16

)

(5

)

(28

)

(8

)

Net cash flows from financing

activities

6

1,250

90

1,256

167

Net increase in cash and cash

equivalents

21

1,201

207

1,222

91

Cash and cash equivalents at beginning of

the period

2,442

1,151

951

1,151

1,065

Net exchange (losses)/gains on cash and

cash equivalents

(23

)

90

(10

)

67

(8

)

Cash and cash equivalents at period

end

2,440

2,442

1,148

2,440

1,148

Calculation of basic and diluted (loss)/earnings per

share (Unaudited) (in € millions, except share and per share

data)

Three months ended

Six months ended

June 30, 2021

March 31, 2021

June 30, 2020

June 30, 2021

June 30, 2020

Basic (loss)/earnings per share

Net (loss)/income attributable to owners

of the parent

(20

)

23

(356

)

3

(355

)

Share used in computation:

Weighted-average ordinary shares

outstanding

191,172,946

190,565,397

186,552,877

190,870,850

185,799,600

Basic (loss)/earnings per share

attributable to owners of the parent

(0.10

)

0.12

(1.91

)

0.02

(1.91

)

Diluted loss per share

Net (loss)/income attributable to owners

of the parent

(20

)

23

(356

)

3

(355

)

Fair value gains on Exchangeable Notes

(17

)

(49

)

—

(66

)

Fair value gains on dilutive warrants

—

(22

)

—

(21

)

—

Net loss used in the computation of

diluted loss per share

(37

)

(48

)

(356

)

(84

)

(355

)

Shares used in computation:

Weighted-average ordinary shares

outstanding

191,172,946

190,565,397

186,552,877

190,870,850

185,799,600

Exchangeable Notes

2,911,500

938,150

—

1,919,670

—

Warrants

—

312,148

—

260,760

—

Diluted weighted-average ordinary

shares

194,084,446

191,815,695

186,552,877

193,051,280

185,799,600

Diluted loss per share attributable to

owners of the parent

(0.19

)

(0.25

)

(1.91

)

(0.44

)

(1.91

)

Reconciliation of IFRS to Non-IFRS Results (Unaudited)

(in € millions, except percentages)

Three months ended

Six months ended

June 30, 2021

June 30, 2020

June 30, 2021

June 30, 2020

IFRS revenue

2,331

1,889

4,478

3,737

Foreign exchange effect on 2021 revenue

using 2020 rates

(81)

(195)

Revenue excluding foreign exchange

effect

2,412

4,673

IFRS revenue year-over-year change %

23

%

20

%

Revenue excluding foreign exchange effect

year-over-year change %

28

%

25

%

IFRS Premium revenue

2,056

1,758

3,987

3,458

Foreign exchange effect on 2021 Premium

revenue using 2020 rates

(60)

(158)

Premium revenue excluding foreign exchange

effect

2,116

4,145

IFRS Premium revenue year-over-year change

%

17

%

15

%

Premium revenue excluding foreign exchange

effect year-over-year change %

20

%

20

%

IFRS Ad-Supported revenue

275

131

491

279

Foreign exchange effect on 2021

Ad-Supported revenue using 2020 rates

(21)

(37)

Ad-Supported revenue excluding foreign

exchange effect

296

528

IFRS Ad-Supported revenue year-over-year

change %

110

%

76

%

Ad-Supported revenue excluding foreign

exchange effect year-over-year change %

126

%

89

%

Gross Margin (Unaudited) (in € millions, except

percentages)

Three months ended June 30,

2021

Revenue

2,331

Cost of revenue

1,668

IFRS Gross Profit

663

IFRS Gross Margin

28.4

%

Adjustments:

Prior period publishing royalty

estimate

45

Non-IFRS Gross Profit

618

Non-IFRS Gross Margin

26.5

%

Operating Expenses (Unaudited) (in € millions, except

percentages)

Three months ended

June 30, 2021

June 30, 2020

IFRS Operating Expenses

651

646

Foreign exchange effect on 2021 operating

expenses using 2020 rates

(27)

Operating Expenses excluding foreign

exchange effect

678

IFRS Operating expense year-over-year

change %

1

%

Operating expenses excluding foreign

exchange effect year-over-year change %

5

%

Free Cash Flow (Unaudited) (in € millions)

Three months ended

Six months ended

June 30, 2021

March 31, 2021

June 30, 2020

June 30, 2021

June 30, 2020

Net cash flows from operating

activities

54

65

39

119

30

Capital expenditures

(20

)

(24

)

(14

)

(44

)

(26

)

Change in restricted cash

—

—

2

—

2

Free Cash Flow

34

41

27

75

6

1Free Cash Flow is a non-IFRS measure. See “Use of Non-IFRS

Measures” and “Reconciliation of IFRS to Non-IFRS Results” for

additional information.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20210728005343/en/

Investor Relations: Bryan Goldberg Lauren Katzen

ir@spotify.com

Public Relations: Dustee Jenkins press@spotify.com

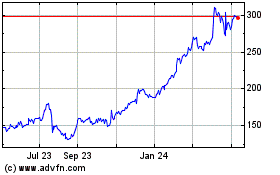

Spotify Technology (NYSE:SPOT)

Historical Stock Chart

From Oct 2024 to Nov 2024

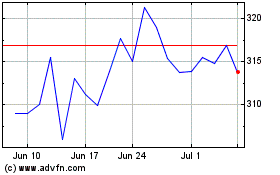

Spotify Technology (NYSE:SPOT)

Historical Stock Chart

From Nov 2023 to Nov 2024