Deal comes as company reports user growth that was better than

expected

By Anne Steele

This article is being republished as part of our daily

reproduction of WSJ.com articles that also appeared in the U.S.

print edition of The Wall Street Journal (February 6, 2020).

Spotify Technology SA has agreed to buy sports and pop-culture

outlet the Ringer, the company said Wednesday, as it posted

better-than-expected growth in users and said its investment in

podcasts is helping convert people who use its free tier into

paying subscribers.

The Ringer, founded by former ESPN commentator Bill Simmons in

2016, has more than 30 podcasts, and furthers Spotify's move beyond

music into broader audio and digital media. Terms of the

transaction weren't disclosed Wednesday. The Wall Street Journal

previously reported on the takeover talks last month.

Spotify Chief Executive Daniel Ek said as consumers' listening

habits move from radio to online, sports will be a key part of

Spotify's podcast expansion efforts.

"We look at this as we just bought the next ESPN," he said

during an interview after the deal was announced.

Spotify spent much of last year building out its podcasting

business, shelling out $400 million for three podcast companies and

striking more than two dozen deals for exclusive or original

content.

The company said people who listen to both music and podcasts

are more likely to become paying subscribers than people who listen

only to music, thanks to higher engagement and retention among

those listeners. More than 16% of Spotify users now listen to

podcasts, the company said, and consumption hours nearly tripled in

the fourth quarter from a year earlier.

Mr. Ek said 2020 would be another banner year for more

deals.

"We're really encouraged by the numbers," he said. "It doesn't

make sense for us not to invest very aggressively."

At the end of the fourth quarter, Spotify had 271 million

monthly active users, topping the company's expectations. The

company had 124 million paying subscribers, its most lucrative type

of customer, which was at the high end of its guidance.

Average revenue per user for the paid-subscription business fell

5%, or 6% excluding foreign-exchange-rate effects, to EUR4.65

($5.14), mostly due to an extended free trial period in the

quarter, but also owing to new subscribers coming in via discounted

plans through family and student accounts, and lower pricing power

in international markets. Promotional activity helped reduce

monthly churn, or the number of users who end a subscription,

compared to the year earlier, the company said.

Spotify's revenue from subscriptions rose a better-than-expected

24% to EUR1.64 billion ($1.81 billion). Ad-supported revenue -- an

area of recent growth for the company as it builds out its

podcasting business -- rose 23% to EUR217 million, but fell short

of expectations. The company blamed a slow start to the period on

technical issues with a new advertising-order system.

Shares of the Stockholm-based company slid nearly 4% in morning

trading in New York.

Meanwhile, Spotify has made moves to build out its "two-sided

marketplace," selling tools and services to artists and their

teams. Late last year, the company acquired SoundBetter, a

music-production service for artists and producers, and introduced

sponsored recommendations, which let labels pay to promote new

music to specific listeners. The company said it expects that

business to help it become more profitable in the coming years.

Spotify swung to a loss of EUR209 million, or EUR1.14 a share,

for the period as it invested in podcasts and other parts of its

business. It had reported a profit of EUR442 million, or 36

European cents a share, in the prior-year quarter. Revenue jumped

24% to EUR1.86 billion, in line with guidance.

Free cash flow -- a measure of the cash a company generates from

operations, and a gauge that many investors view as a proxy for

performance -- was EUR169 million, up from EUR84 million a year

ago.

For the current quarter, the company guided for monthly active

users to grow to between 279 million and 289 million. Paying

subscribers are projected to rise to between 126 million and 131

million, and revenue is projected between EUR1.71 billion and

EUR1.91 billion.

The Ringer's podcasting network attracts more than 100 million

downloads a month. In addition to "The Bill Simmons Podcast," the

Ringer produces "The Watch," a discussion show about TV and pop

culture; "Binge Mode," which dives deep into pop-culture

franchises; and "The Rewatchables," a show that breaks down popular

movies.

The companies teamed up in September to launch a new original

podcast hosted by Mr. Simmons, "The Hottest Take," which streams

exclusively on Spotify.

Though the Ringer's website doesn't draw as many visitors as

some of its largest competitors, such as ESPN and Bleacher Report,

its podcast network generates significant revenue. The Ringer's

podcast revenues exceeded $15 million in 2018, The Wall Street

Journal reported, and the company is profitable.

The Ringer's podcast network and Mr. Simmons's following gives

Spotify a significant entree to the world of sports audio, a realm

that has long been dominated by traditional radio stations.

"Radio is dying and audio is heading online, and consumers are

getting a better experience because they can pick what content they

want on demand, on their schedule," Mr. Ek said Wednesday.

"Billions are going to start listening to audio on the internet. Is

sports going to play a big role in that? Obviously, it will."

Dow Jones & Co., publisher of the Journal, has a content

partnership with Gimlet Media, a unit of Spotify.

Write to Anne Steele at Anne.Steele@wsj.com

(END) Dow Jones Newswires

February 06, 2020 02:47 ET (07:47 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

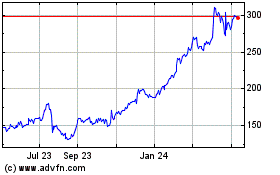

Spotify Technology (NYSE:SPOT)

Historical Stock Chart

From Jun 2024 to Jul 2024

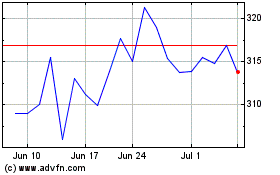

Spotify Technology (NYSE:SPOT)

Historical Stock Chart

From Jul 2023 to Jul 2024