By Newley Purnell

NEW DELHI -- The most popular music streaming service in India,

the world's biggest untapped digital economy, isn't from Spotify

Technology SA or Apple Inc. Instead, it is a local rival little

known outside the country.

Noida, India-based Gaana, named after the Hindi word for "song,"

has used a hyperlocal approach and cut-rate pricing to beat the

competition and attract 152 million monthly users. That is more

than half of Spotify's global user base, double Apple Music's

global count and far more than YouTube Music and Amazon.com Inc.'s

music services.

Indian consumers are flocking to Gaana, analysts say, because it

has been built for them. It has a library of more than 45 million

songs, mostly from India and in more than 20 regional languages,

including auto-tuned Punjabi-language pop ballads, Hindi hip-hop

and devotional tunes for the Hindu monkey god, Hanuman.

While some of its international rivals also boast voluminous

libraries of global hits, most lack the depth of regionally

specific songs from India that Gaana offers.

"You have to understand the consumption habits by region and

even by city," Gaana Chief Executive Prashan Agarwal said.

Gaana has an edge over international rivals because, he said,

its teams have more local knowledge, conducting research across the

country to uncover emerging artists and unlikely listening

trends.

With only about half of India's 1.3 billion people online,

global tech firms have been scrambling to establish themselves in

the world's biggest pool of new internet users. Hundreds of

millions of people are sending their first WhatsApp messages,

buying their first items online -- and streaming their first songs

-- as data prices plummet and inexpensive smartphones

proliferate.

"Every global player is trying to get a share in India," said

Abhilash Kumar, an analyst at India's Counterpoint Technology

Market Research. "The market is very nascent and not at all

saturated."

Many Indians have an intense relationship with music. It is part

of celebrations, religious worship, movies and cultural traditions.

Indians spend an average of 21.5 hours a week listening to music,

some 20% higher than the global average, according to consulting

firm Deloitte.

When the internet became affordable, music was one of the first

things that many Indians consumed on their smartphones. This trend

explains why the world's most-watched YouTube channel is T-Series,

which shows Indian music videos and has racked up tens of billions

more views than any other channel.

Sweden's Spotify and YouTube Music launched in India early last

year and have been advertising on billboards and online. TikTok

parent Bytedance Inc. last year chose India as one of two markets,

along with Indonesia, to test its first-ever music streaming app,

called Resso.

Apple Music and Amazon Prime Music have been available in India

for several years but haven't been able to match Gaana's

popularity.

International growth in emerging markets is key for Spotify. The

company has been looking to boost its listener base in new

countries like India. Dow Jones & Co., publisher of The Wall

Street Journal, has a content partnership with Gimlet Media, a unit

of Spotify.

Apple is eyeing digital services such as music streaming as it

faces a maturing smartphone market at home.

Music-streaming revenue globally hit $24 billion last year,

according to Counterpoint. India so far accounts for just a sliver

of that, some $200 million in 2019. But streaming revenues in India

are projected to climb to $400 million by 2023, according to

TechSci Research, and should continue to rise as hundreds of

millions of new digital listeners turn to their mobile devices for

music.

While Gaana has a head start, it will need to continue to

innovate to stay ahead of the competition, analysts say. Another

music-streaming service popular in India is JioSaavn, which is

controlled by Reliance Industries Ltd., one of India's largest

conglomerates. Many Indian consumers shop around continuously and

will abandon services if they find a better deal or juicier

offerings elsewhere.

Gaana's global rivals don't disclose recent user counts for

India but say they are also customizing their offerings for the

country. Many have offered plans at substantially lower prices than

in developed countries. Spotify, for example, launched a light

version of its app that takes up less space on phones.

Spotify says its service is growing quickly and that it aims to

appeal to all music lovers in India. YouTube Music says India is

one of YouTube's biggest video-viewing markets, and that the

company is seeing good adoption of its music streaming service.

Apple Music has worked to localize its offerings for the country.

Representatives for Amazon Music and Bytedance's Resso declined to

comment on their user counts or India strategies.

Gaana -- which launched in 2011 and is backed by Indian media

firm Bennett Coleman & Co. and China's Tencent Holdings Ltd. --

has developed special technical features for users in India.

Customers can search for artists or songs by voice, a benefit for

those with limited literacy skills or who have difficulty typing on

smartphone keyboards in Indic languages.

Gaana also offers price advantages. There is a free version with

advertising and paid plans starting at 12 rupees (17 cents) a month

for students. Spotify also offers a free version, but its least

expensive ad-free monthly plans start at around 80 cents. Apple's

service starts at about 70 cents, while YouTube Music starts at

about $1.10.

Gaana can charge less in part because, unlike its global rivals,

the service doesn't have to worry about undermining its product if

it charges significantly less in India than in other markets.

Gaana's mostly Indian music is also less expensive to secure

rights, analysts say.

While international players are still newcomers, Gaana is

leveraging the trove of data it has collected on users' listening

preferences to recommend new tunes, Mr. Agarwal said. That is a

bonus for first-time music-streaming consumers who are unfamiliar

with the interface.

Harshit Batra, a 20-year-old university student in New Delhi,

started using Gaana's premium service last year. He listens to

artists such as Indian composer A.R. Rahman and Pakistani singer

Atif Aslam, and said he prefers Gaana because it has a wider

selection of music and a simple user interface.

"My subscription expires this month," he said. "I plan to

renew."

Write to Newley Purnell at newley.purnell@wsj.com

(END) Dow Jones Newswires

February 02, 2020 09:20 ET (14:20 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

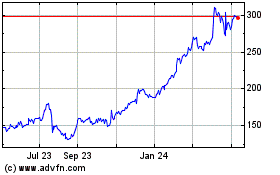

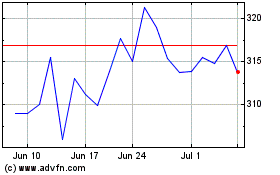

Spotify Technology (NYSE:SPOT)

Historical Stock Chart

From Oct 2024 to Nov 2024

Spotify Technology (NYSE:SPOT)

Historical Stock Chart

From Nov 2023 to Nov 2024